Global Food Emulsifiers Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Mono-Glycerides, Di-Glycerides, Lecithin, Sorbitan Esters, Stearoyl Lactylates, And Polyglycerol Esters), Application (Bakery, Confectionery, Convenience & Dairy, Meat), Source (Plant & Animal), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Food Emulsifiers Market Size

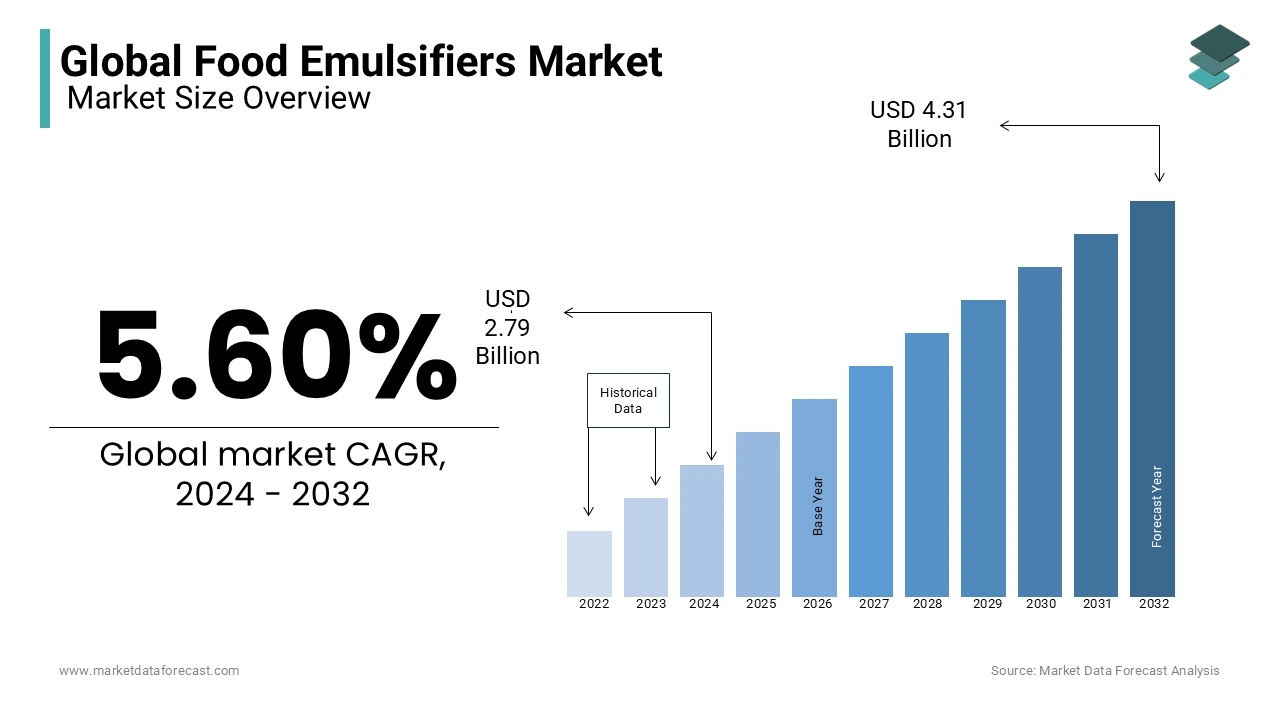

The global food emulsifiers market size was calculated to be USD 2.79 billion in 2024 and is anticipated to be worth USD 4.56 billion by 2033 from USD 2.95 billion In 2025, growing at a CAGR of 5.60% during the forecast period.

Food emulsifiers improve texture, mix ingredients well, and provide excellent flavor. It is widely used in various foods due to its multiple properties and functional advantages. The effective use of numerous emulsifiers such as lecithin, stearoyl lactylate, polyglycerol esters, and sucrose esters will contribute to market growth during the forecast period. As the preference for packaged foods increases, the obese population increases worldwide. It is expected to lead the market for food additives, such as emulsifiers, as there is a demand for high transparency for ingredients used in consumer foods, which is the market for clean-label food ingredients.

MARKET DRIVERS

The population's growing adoption of a sedentary lifestyle is leading to a decline in cooking and increasing demand for ready-to-go food products, primarily impacting the market expansion.

The growing consumer demand for processed foods like bread, cereals, frozen, and packaged food is raising the adoption of food emulsifiers among manufacturers as these emulsifiers maintain the stability and shelf-life of the products by improving the texture, driving the expansion of global market size. Food emulsifiers are expected to reduce bad cholesterol and overall fat content, fueling, and the adoption rate of food emulsifiers among manufacturers. The increasing investments by the market players in R&D to enhance the properties of the food emulsifiers and to meet consumer demand are expected to accelerate product innovations and launches, which provide growth opportunities for the food emulsifiers market. The emulsifiers are highly adopted to ensure homogenous mixing and prevent the settling of ingredients during storage, which is highly advantageous in convenience foods as they require high stability during storage. All these factors are expected to accelerate the global market value in the coming years.

The growing consumer demand for trans-fat products to use emulsifiers in products to reduce calorie and fat content is a crucial factor driving the growth of the global food emulsifier market. In addition, the extensive use of food emulsifiers in pastry and bakery products and the expansion of the frozen and processed food industry are other factors expected to accelerate the growth of the global market for food emulsifiers during the forecast period. Furthermore, as awareness of the types of emulsifiers available to consumers increases, it is expected to support the growth of the global market for food emulsifiers. Moreover, the development of new food emulsifiers for low-fat foods in the industry is a current trend that is anticipated to accelerate the growth of the world market for food emulsifiers in the next decade. Besides, increased research activities on health benefits are foreseen to create numerous opportunities for market participants in the global market.

MARKET RESTRAINTS

Due to seasonal dependence on performance, fluctuations in the prices of raw materials for the manufacture of natural emulsifiers can undermine industrial profitability, which may affect the trend in the market price of food emulsifiers.

The high costs associated with the extraction of emulsifiers from natural sources are estimated to fluctuate the raw material price, leading to the expense of the overall product and hampering the market growth.

Studies have shown that chemically synthesized emulsifiers can interfere with microbes in the human gut, such as inflammatory bowel disease and obesity, so they can act as other retraining factors. The presence of stringent regulations for approval of the food products and their development and innovation is estimated to limit the expansion of the market size.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.6% |

|

Segments Covered |

By Type, Application, Source, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company (U.S.), E. I. du Pont de Nemours and Company (U.S.), Cargill Incorporated (U.S.), Kerry Group Plc. (Ireland), Ingredion Incorporated (U.S.) |

SEGMENTAL ANALYSIS

Global Food Emulsifiers Market Analysis By Type

The mono and di-glycerides segments dominated the global food emulsifiers market as these are primarily consumed in the United States. These segments are expected to hold 70% of the global market of food emulsifiers, which will positively impact the segment's growth. Various advantages, like their ability to improve texture, stability, and shelf-life in various food products, fuel the demand for mono and di-glycerides.

The lecithin segment is estimated to grow the fastest during the forecast period due to its natural origin and multifunctional properties. Lecithin serves as an emulsifier, stabilizer, and texture enhancer in chocolates, dressings, and baked goods, which is expected to increase the adoption rate in the coming years.

Global Food Emulsifiers Market Analysis By Application

The confectionery segment dominated the global market revenue with a significant share due to their vast consumption among people. The confectionary includes chocolates and candies, which are highly consumed, and these benefit from the food emulsifiers by improving texture and shelf-life, driving the segment growth. The food emulsifiers support the confectionary in product innovations by incorporating various flavors and fillings, fueling the market growth.

The dairy segment is estimated to grow due to increasing ice cream and yogurt consumption. Food emulsifiers bring a creamy and smooth texture by preventing ice crystal formation from stabilizing, which is majorly driving the adoption of emulsifiers in dairy products and leading to the expansion of market revenue.

Global Food Emulsifiers Market Analysis By Source

The plant source segment held a significant share in the global market revenue as these are derived from natural sources like soybeans and sunflower seeds. The growing number of vegans and vegetarians is seeking alternatives in their diet, and the significant advantage of plant-based emulsifiers is sustainability, which is driving the segment's growth. The escalating demand for healthy, eco-friendly, and natural consumer choices fuels the demand for plant-based products.

The animal source segment is expected to grow steadily during the forecast period as it is sourced from egg yolks and animal fats. Rising concerns regarding allergens and sustainability are limiting the expansion of the segment.

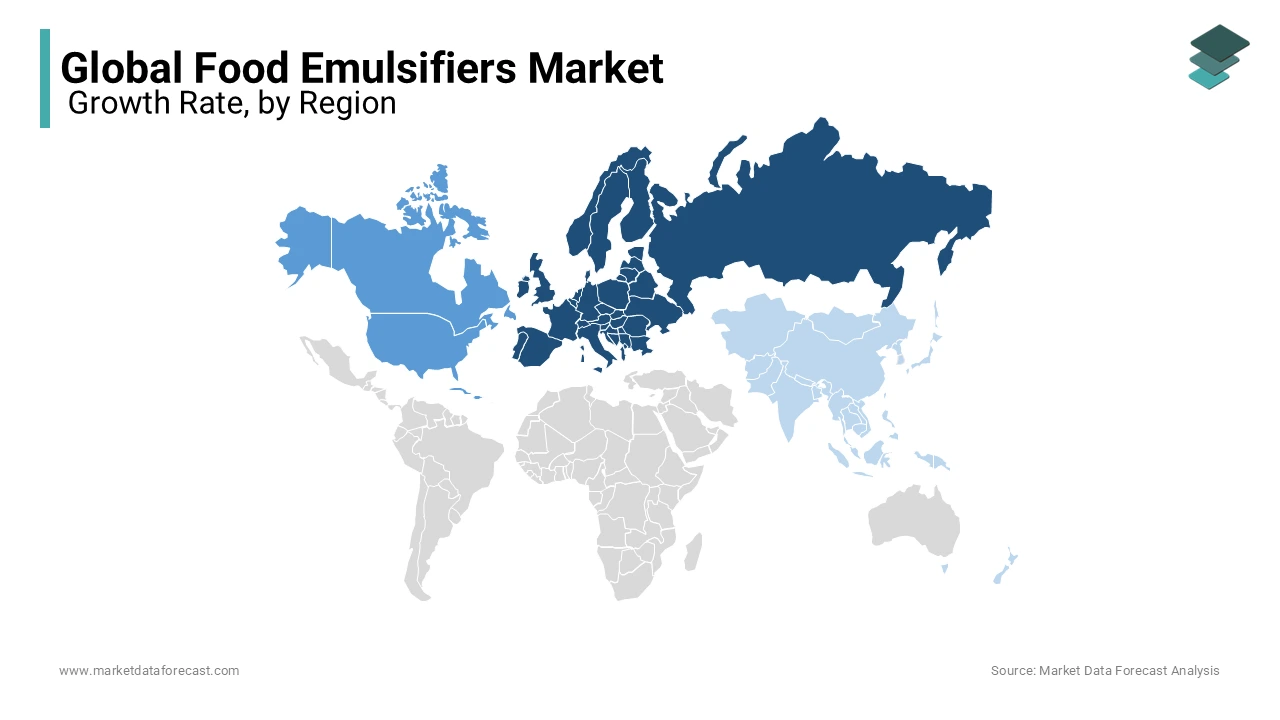

REGIONAL ANALYSIS

Europe's food emulsifiers market accounted for most of the industry, accounting for 29.5%, followed by North America and the Asia Pacific. Germany, France, and Eastern European countries are expected to impact industrial expansion in the coming years positively. Local demand for emulsifiers, including stearoyl lactylate and sorbitan esters for bakery and dairy applications, is expected to increase with a constant CAGR in the coming years. Eastern European countries, including Russia, are expected to show the fastest industrial expansion due to increased foreign investment in the manufacture of alcoholic beverages. This development is expected to provide a favorable outlook for emulsifiers.

Due to the rapid growth of the food and beverage industry and significant socioeconomic factors, including a broad consumer base, the Asia Pacific food emulsifier industry is foreseen to witness the fastest growth. This scenario will also be reflected in China, India, and other Southeast Asian countries in the coming years. The Brazilian market can have significant gains of more than 4.5% by 2025, which will facilitate the dispersion of coffee cream and improve whitening properties. As the cultural importance of coffee in Korea increases, the demand for products will increase, stimulating the growth of local industries.

KEY PLAYERS IN THE GLOBAL FOOD EMULSIFIERS MARKET

Major Key Players in the Global Food Emulsifiers Market are Archer Daniels Midland Company (U.S.), E. I. du Pont de Nemours and Company (U.S.), Cargill Incorporated (U.S.), Kerry Group Plc. (Ireland), Ingredion Incorporated (U.S.)

RECENT HAPPENINGS IN THE MARKET

- In October 2023, Ingredion launched its first functional gelling starch, designed for clean-label applications in dairy and savory products. This innovative starch product allows manufacturers to enhance texture and stability in their formulations by meeting clean-label ingredients.

- In December 2023, Archer Daniels Midland Company (ADM) expanded its global flavors capabilities through an agreement to acquire UK-based FDL. This commitment enhances the flavor and ingredient offerings and evolves preferences for innovative and diverse experiences.

- In February 2023, Corbion partnered with Belgium-based Azelis as a distribution partner for food ingredients, including emulsifiers, in Malaysia and Singapore.

- In June 2023, Kerry Group announced its purchase of a firm that focuses on developing emulsifiers for baking goods.

- In January 2017, Palsgaard acquired a significant stake in Brazilian food ingredient company Candon Food Additives, a supplier of bakery emulsifiers. The acquisition will increase the company's product range and positively impact industrial growth.

- In 2016, Cargill, Incorporated launched Canola Lecithin for use in various food applications, including chocolate and confectionery, bakery, and prepared foods.

- 2017 Clariant developed a low-foam, labelless emulsifier for metalworking fluid formulations.

- Voxon Photonics develops the world's most advanced 3D food emulsifier, Voxon VX1, to bring digital content to life and enable people to view, communicate, learn, and enjoy it collaboratively without interrupting the 3D experience.

- In 2018, Dupont Nutrition and Biosciences, a significant player in the food emulsifier market, launched the latest edition of the DIMODAN® HP 90-M emulsifier to the range of ingredients in DuPont ™ Danisco®. Naturally supplied, this new and developed monoglyceride emulsifier improves production and manages the efficiency of food manufacturers.

DETAILED SEGMENTATION OF GLOBAL FOOD EMULSIFIERS MARKET INCLUDED IN THIS REPORT

This research report on the global food emulsifiers market has been segmented and sub-segmented based on type, application, source & region.

By Type

- Mono-Glycerides

- Di-Glycerides

- Lecithin

- Sorbitan Esters

- Stearoyl Lactylates & Polyglycerol Esters

By Application

- Bakery

- Confectionery

- Convenience & Dairy

- Meat

By Source

- Plant

- Animal

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What factors are driving the growth of the food emulsifiers market?

Factors driving the growth of the food emulsifiers market include increasing demand for convenience foods, changing consumer preferences toward healthier and natural ingredients, and advancements in food processing technologies.

2. What are some key trends in the food emulsifiers market?

Critical trends in the food emulsifiers market include the growing popularity of plant-based emulsifiers, clean-label emulsifiers, and emulsifiers with functional properties such as fat reduction and improved texture.

3. What are the primary functions of food emulsifiers?

Food emulsifiers stabilize emulsions, prevent crystallization, improve texture, enhance appearance, and extend shelf life in various food products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]