Global Flow Cytometry Market Size, Share, Trends & Growth Forecast Report - By Technology (Cell-based and Bead-based), Product (Reagents & Consumables and Flow Cytometry Instruments), Application (Research, Clinical and Industrial), End-users (Commercial Organizations, Research Institutes and Clinical Testing Labs) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Flow Cytometry Market Size (2024 to 2032)

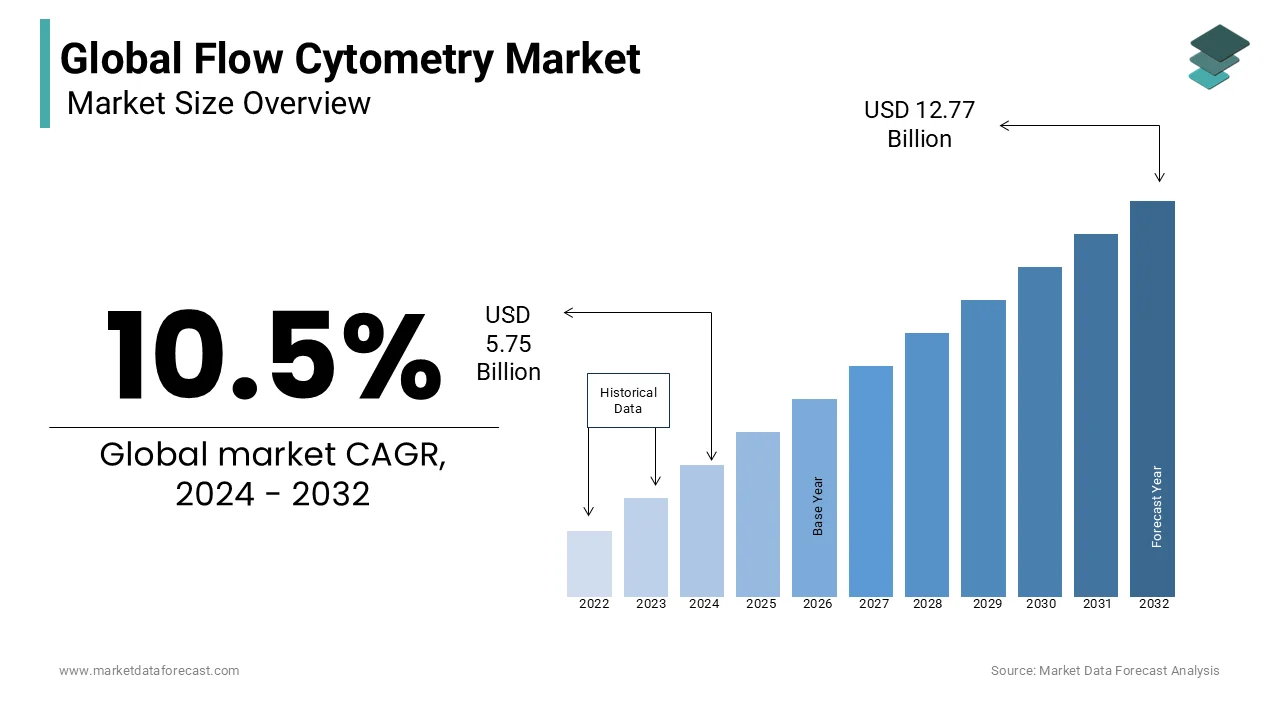

In 2023, the global flow cytometry market was valued at USD 5.2 billion and it is expected to reach USD 12.77 billion by 2032 from USD 5.75 billion in 2024, growing at a CAGR of 10.5% during the forecast period.

MARKET DRIVERS

The growing cancer patient population is majorly driving the flow cytometry market growth.

Flow cytometry is a widely used technology in biomedical research, clinical diagnostics, and drug development. Cancer has become the deadliest disease worldwide. As per the statistics published by the World Health Organization (WHO), an estimated 10 million died of cancer in 2020 and the incidence of cancer is expected to grow significantly in the coming years. It is predicted an estimated 29.7 million cancer cases are expected to be registered per year by 2040. The technology of flow cytometry has been playing a key role in cancer diagnosis, prognosis and treatment monitoring in recent years. The growing usage of flow cytometry in cancer diagnosis and monitoring and increasing R&D around developing new and advanced flow cytometry technologies are expected to boost the market growth. Apart from cancer, flow cytometry has various other applications, such as immunology, hematology, stem cell research, and others. The growth of flow cytometry is also driven by the rising demand for personalized medicine and targeted therapies.

The rising adoption of flow cytometry in research and clinical applications is boosting the market’s growth rate.

In recent years, increased usage of flow cytometry in research and clinical applications has been noticed and this trend is expected to continue in the coming years and contribute to market growth. The clinicians use flow cytometry technology to analyze the blood and other body fluids to identify the presence of abnormal cells or biomarkers that indicate the presence of disease. For instance, flow cytometry technology has been used to identify the presence of leukemia, lymphoma, and other blood cancers in human bodies. The usage of flow cytometry is also growing as researchers use this technology in various biological processes such as cell signaling, apoptosis, and protein expression to understand the complex cell populations that can be found in the immune system. The key market participants have been investing resources in the development of advanced and effective flow cytometry technologies, and these technologies are expected to analyze large numbers of cells quickly and efficiently for researchers and clinicians.

The growing demand for stem cell therapy is accelerating the growth rate of the flow cytometry market.

The adoption of stem cell therapy is growing rapidly as it is considered one of the promising treatment options for various diseases and injuries. Using flow cytometry, researchers and clinicians can detect various types of stem cells based on their physical and chemical properties. Flow cytometry is further used to evaluate the effectiveness of stem cell therapies. The rising demand for stem cell therapies is also fuelling the development of new flow cytometry technologies. Stem cell therapy is increasingly used for deadly diseases such as heart disease, diabetes, Parkinson's disease, and spinal cord injuries. The use of stem cells in regenerative medicine is also growing significantly owing to their potential to repair and regenerate damaged tissues and organs.

In addition, the growing investments in life science research, rising demand for personalized medicine, increasing adoption of cell analysis techniques, and growing number of flow cytometry applications in various fields such as microbiology and immunology are propelling the growth of the flow cytometry market. Furthermore, factors such as growing focus on drug discovery and development, increasing demand for point-of-care diagnostics, rising adoption of flow cytometry in drug screening and development, and growing adoption of flow cytometry in biotechnology and pharmaceutical industries further fuelling the market’s growth rate. Furthermore, increasing advancements in software and informatics solutions for flow cytometry analysis, rising focus on precision medicine and companion diagnostics, growing demand for multiplex assays in research and diagnostics, increasing demand for high-throughput screening in drug discovery and research, and increasing number of developments in microfluidics technology for flow cytometry analysis are favoring the growth rate of the flow cytometry market.

MARKET RESTRAINTS

The high cost of instruments used for flow cytometry is unaffordable for smaller labs are hampering the flow cytometry market growth.

Furthermore, the scarcity of skilled professionals who can handle and operate the equipment and technologies of flow cytometry is hindering the market growth in some countries. Furthermore, the availability of alternative technologies, such as single-cell RNA sequencing, is inhibiting the growth rate of the flow cytometry market. In addition, the stringent regulatory environment, lack of standardization, and limited adoption of flow cytometry in some research fields are impeding the growth of the flow cytometry market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Technology, Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Becton, Dickinson, and Company., Beckman Coulter, Inc., Thermo Fisher Scientific, Inc., Merck KGaA, Sysmex Partec GmbH, Luminex Corporation, Miltenyi Biotec GmbH, Bio-Rad Laboratories, Inc., Sony Biotechnology, Life Technologies Corporation Inc., EMD Millipore Corporation, Miltenyi Biotec, Agilent Technologies, Inc. and Affymetix Inc. |

SEGMENTAL ANALYSIS

Global Flow Cytometry Market Analysis By Technology

The bead-based technology segment had the largest share of the global market in 2023 and its domination is expected to continue during the forecast period. The segment's growth is driven by the advantages of bead-based flow cytometry technology, such as higher throughput, better sensitivity, and the ability to analyze multiple parameters simultaneously. The bead-based technology performs qualitative and quantitative analysis and due to this, it is widely adopted by researchers. The growing number of applications of bead-based flow cytometry technology, such as cell sorting, cell counting, and protein analysis, is further propelling segmental growth. In addition, the rising adoption of advanced bead-based flow cytometry technologies, such as magnetic bead-based cell sorting and multiplexed bead assays, contributes to the segment’s growth.

The cell-based segment accounted for a substantial share of the worldwide market in 2022 and is expected to grow considerably during the forecast period owing to the increasing usage of cell-based flow cytometry technologies in research and diagnostic applications such as immunophenotyping and cell cycle analysis.

Global Flow Cytometry Market Analysis By Product

The reagents & consumables segment occupied the most significant share of the global market in 2023 and is predicted to grow at a noteworthy CAGR during the forecast period. Factors such as the growing demand for personalized medicine, increasing adoption of technological developments, and the growing patient population suffering from chronic diseases contribute to segmental growth.

On the other side, the instruments segment had a considerable share of the global market in 2022 and is expected to register the fastest CAGR during the forecast period.

Global Flow Cytometry Market Analysis By Application

The clinical segment held the largest share of the global flow cytometry market in 2023 and the segment’s domination is estimated to continue throughout the forecast period. The growing usage of flow cytometry in clinical diagnostics and the increasing patient population suffering from chronic diseases are primarily propelling segmental growth.

The research segment is predicted to hold a substantial share of the global market during the forecast period owing to the growing investments in R&D by the market participants and the development of new technologies such as imaging flow cytometry and mass cytometry.

The industrial segment is estimated to grow at a healthy CAGR during the forecast period. Factors include the growing demand for food safety testing and increasing awareness of environmental monitoring.

Global Flow Cytometry Market Analysis By End-User

The commercial organization's segment captured the major share of the global flow cytometry market in 2023 and is predicted to grow at a healthy CAGR during the forecast period. Factors such as the growing demand for flow cytometry in drug discovery and development, increasing adoption of personalized medicine, and rising number of technological developments in flow cytometry are promoting the segment's growth.

The research institutes segment is predicted to hold a substantial share of the global market during the forecast period. The segment's growth is primarily driven by the rising funding for life science research and increasing demand for flow cytometry in research applications.

The clinical testing labs segment is estimated to showcase at a moderate pace during the forecast period.

REGIONAL ANALYSIS

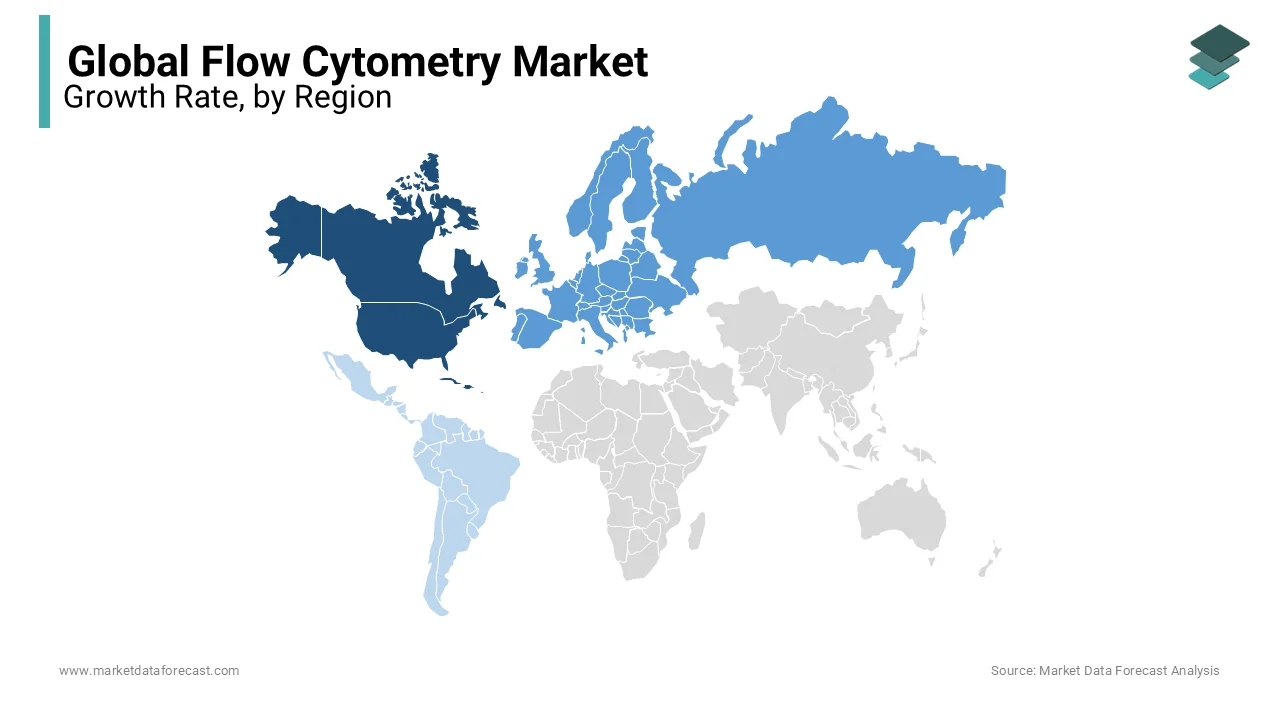

North America topped the list in the global flow cytometry market in terms of share.

North America accounted for 39.6% of the global market share in 2023 and the dominance of North America is estimated to continue throughout the forecast period. The growth of the regional market is driven by the rapid adoption of flow cytometry technologies in research and clinical applications and the presence of key market participants. As a result, the U.S. flow cytometry market held the largest share of the North American market, followed by Canada in 2023.

The European market had a substantial share of the global market in 2023.

Europe is predicted to witness a noteworthy CAGR during the forecast period. The growing R&D activities of stem cells, increasing adoption of new and advanced flow cytometry technologies, and rising applications of flow cytometry are propelling regional market growth. The growing patient population suffering from chronic diseases and the increasing availability of funding by the European governments in favor of flow cytometry promote the European market growth. The UK captured the major share of the European market in 2021 and the trend is expected to continue throughout the forecast period.

Asia-Pacific is estimated to grow at the highest CAGR during the forecast period among all the regions worldwide.

Factors such as the growing population, the presence of developing countries, increasing R&D of biologics, drugs, and vaccines and increasing patient pool of chronic diseases contribute to the APAC market growth. Furthermore, increasing investments by the major international players in the APAC region are favoring the market growth in this region. In addition, increasing investments in healthcare infrastructure, growing healthcare expenditure, and rising demand for personalized medicine are boosting the growth rate of the APAC market. India, China, and Japan are expected to hold the leading share of the APAC market during the forecast period.

Latin America is expected to grow steadily during the forecast period.

The Latin American market is anticipated to hold a considerable share of the global market during the forecast period. The growing patient population suffering from infectious diseases in Latin American countries and the growing number of initiatives by the Latin American governments to improve the healthcare infrastructure are promoting the growth of the Latin American market. The MEA is projected to grow at a steady CAGR in the coming years.

KEY PLAYERS IN THE GLOBAL FLOW CYTOMETRY MARKET

Noteworthy companies operating in the global flow cytometry market profiled in this report are Becton, Dickinson, and Company., Beckman Coulter, Inc., Thermo Fisher Scientific, Inc., Merck KGaA, Sysmex Partec GmbH, Luminex Corporation, Miltenyi Biotec GmbH, Bio-Rad Laboratories, Inc., Sony Biotechnology, Life Technologies Corporation Inc., EMD Millipore Corporation, Miltenyi Biotec, Agilent Technologies, Inc. and Affymetix Inc.

RECENT HAPPENINGS IN THE MARKET

- In January 2020, Miltenyi Biotech introduced the world's first operator with its new MACS GMP Tyto cartridge, which creates fluorescence-based, GMP-cell sorting compliant opportunities. It is used first in human trials, particularly in people with Parkinson's disease.

- In March 2020, Sony introduced its new fluorescent dyes, KIRAVIA Dyes, used as reagents for many life science applications. These are used for tissue and cells in this field, like immunology and regenerative medicine. These KIRAVIA Dyes are organic polymers with fluorescent dyes loaded on a novel organic polymer developed by Sony.

- In June 2019, Beckman Coulter Life Sciences announced that it had acquired Cytobank. This Cytobank offers a software-based platform for multi-parametric single-cell data analysis. This technology couples with Beckman's CytoFLEX LX-21-color flow to meet clinical researchers' highly complex workflow and requirements.

- In January 2019, Luminex Corporation announced the acquisition of Millipore Sigma's flow cytometry. This acquisition allows for increasing the flow-based detection systems and widening interactions based on microcapillary technologies.

- In 2018, Becton Company launched a new product called BD FACSymphony S6 high parameter cell sorter.

- IN 2018, ACEA Biosciences and Agilent Technologies entered a partnership to expand their product portfolio and increase revenues.

- In September 2017, Beckman Coulter, Inc. (United States) released its first CytoFLEX LX flow cytometry for cancer researchers, with a visible spectrum in a standard configuration. This launch allowed us to develop its activity in flow cytometry. The North America Flow Cytometry Market grows due to technological progress and high adoption in various research and diagnostic applications. In addition, the increasing incidence rates of diseases such as cancer and HIV stimulate the adoption of flow cytometric technology in diagnostic applications.

DETAILED SEGMENTATION OF THE GLOBAL FLOW CYTOMETRY MARKET INCLUDED IN THIS REPORT

This market research report on the global flow cytometry market has been segmented and sub-segmented based on technology, product, application, end-user, and region.

By Technology

- Cell-based

- Bead-based

By Product

- Reagents & Consumables

- Flow Cytometry Instruments

By Application

- Research

- Clinical

- Industrial

By End-users

- Commercial Organizations

- Research Institutes

- Clinical Testing Labs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

The Middle East and Africa

Frequently Asked Questions

How much is the global flow cytometry market going to be worth by 2032?

As per our research report, the global flow cytometry market size is projected to be USD 12.77 billion by 2032.

Which region is growing the fastest in the global flow cytometry market ?

Geographically, the North American flow cytometry market accounted for the largest share of the global market in 2023.

At What CAGR, the global flow cytometry market is expected to grow from 2024 to 2032?

The global flow cytometry market is estimated to grow at a CAGR of 10.5% from 2024 to 2032.

Which are the significant players operating in the flow cytometry market?

Thermo Fisher Scientific, Inc., Merck KGaA, Sysmex Partec GmbH, Luminex Corporation, Miltenyi Biotec GmbH, Bio-Rad Laboratories, Inc., Sony Biotechnology, Life Technologies Corporation Inc are some of the significant players operating in flow cytometry market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]