Global Fish and Fish Products Market Size, Share, Growth & Trends Forecast Report Segmented, By Product Type, Application, Distribution Channel, And By Region (North America, Asia Pacific, Europe, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Fish and Fish Products Market Size

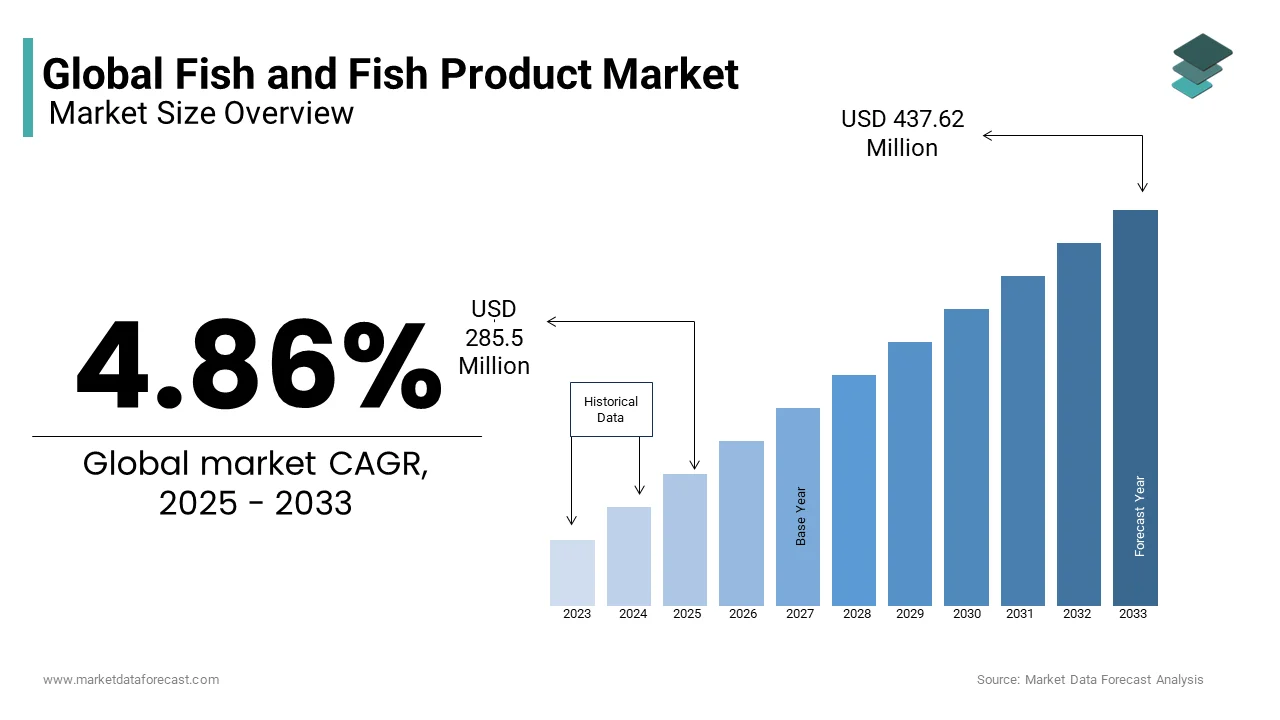

The global fish and fish products market was valued at USD 285.5 million in 2025 and is anticipated to reach USD 299.38 million in 2025 from USD 437.62 million by 2033, growing at a CAGR of 4.86% during the forecast period from 2025 to 2033.

The demand for fish and fish products has been growing exponentially from the last few years, with Asia-Pacific leading as the largest contributor. According to the Food and Agriculture Organization (FAO), the region accounted for over 70% of global fish production in 2022, driven by countries like China, India, and Vietnam. Europe follows as a significant player, with Norway and Iceland dominating exports of premium seafood like salmon and cod. North America shows steady growth, fueled by rising demand for omega-3-rich diets, with the U.S. importing over $2 billion worth of seafood annually from Canada and Ecuador. The aquaculture advancements and shifting consumer preferences are propelling the expansion of the global fish and fish products market primarily. The FAO states that aquaculture now contributes 52% of global fish supply, surpassing wild capture fisheries. However, climate change poses challenges, with warming ocean temperatures reducing fish stocks by 4% per decade since the 1930s, as per Nature Climate Change. Regulatory frameworks also vary, with the European Union enforcing strict traceability standards under its Common Fisheries Policy, while developing nations face hurdles in compliance.

MARKET DRIVERS

Rising Demand for Protein-Rich Diets

The growing global population and increasing awareness of health benefits associated with seafood are key drivers of the fish and fish products market. According to the World Health Organization (WHO), fish is one of the richest sources of high-quality protein and essential nutrients like omega-3 fatty acids, which reduce the risk of cardiovascular diseases. In 2023, Statista reported that global per capita fish consumption reached 20.5 kilograms annually, up from 14.4 kilograms in 1990. This trend is particularly strong in urban areas, where consumers prioritize nutritious and convenient food options. The rise of plant-based diets that indirectly boosts seafood consumption. A survey by Nielsen found that 60% of flexitarians incorporate fish into their meals as a sustainable alternative to red meat. Additionally, government campaigns promoting seafood as part of balanced diets have amplified demand. For instance, Japan’s “Fish Every Day” initiative increased domestic fish sales by 15% in 2022, showcasing how public policies can shape consumer behavior.

Expansion of Aquaculture Technologies

Aquaculture has revolutionized the fish and fish products market, addressing the limitations of wild catch fisheries. As per the FAO, aquaculture production grew at an annual rate of 5.3% between 2010 and 2022, outpacing traditional fishing methods. Innovations like recirculating aquaculture systems (RAS) allow producers to farm fish in controlled environments, ensuring year-round supply and minimizing environmental impact. According to studies, RAS technology adoption increased by 30% in 2023, particularly in regions like Europe and North America. These systems not only enhance yield but also improve product quality, meeting consumer expectations for freshness and sustainability. Furthermore, partnerships between governments and private players have expanded aquaculture infrastructure. For example, Vietnam invested $1 billion in shrimp farming in 2023, boosting exports by 25%. Such initiatives underscore aquaculture’s pivotal role in driving market growth.

MARKET RESTRAINTS

Overfishing and Depleting Marine Resources

Overfishing remains a key restraint in the fish and fish products market, threatening marine ecosystems and long-term supply stability. According to the FAO, over 34% of global fish stocks are exploited beyond sustainable levels, with species like Atlantic bluefin tuna facing severe depletion. This imbalance disrupts the livelihoods of over 60 million people worldwide who depend on fisheries, as per the World Bank. The economic impact is equally concerning. A study published in Marine Policy estimates that overfishing costs the global economy $83 billion annually in lost potential revenue. Illegal, unreported, and unregulated (IUU) fishing exacerbates the problem, accounting for 20% of total catches, according to the International Maritime Organization. Efforts to combat overfishing, such as implementing quotas and seasonal bans, often face resistance from local communities reliant on fishing income. Without enforceable measures, the market risks further resource depletion and price volatility.

Climate Change and Ocean Acidification

Climate change and ocean acidification are further hindering the growth of the fish and fish products market, altering marine habitats and reducing fish populations. As per Nature Climate Change, warming ocean temperatures have caused fish stocks to migrate toward cooler waters, disrupting traditional fishing zones. For example, North Atlantic cod populations declined by 30% in 2023 due to rising sea temperatures, impacting coastal economies in Canada and Greenland. Ocean acidification compounds these effects, weakening shellfish like oysters and mussels. The National Oceanic and Atmospheric Administration (NOAA) states that acidification reduces calcium carbonate availability, essential for shell formation, threatening $1 billion in U.S. shellfish sales annually. Developing nations are particularly vulnerable, lacking resources to adapt to changing conditions. These environmental shifts not only strain supply chains but also increase operational costs for fishers and processors, creating barriers to market growth.

MARKET OPPORTUNITIES

Growing Popularity of Ready-to-Eat Seafood Products

The rise of ready-to-eat seafood products is a lucrative opportunity for the fish and fish products market. The demand for convenience food is anticipated to grow significantly in the coming years, with seafood accounting for 15% of total sales. Products like smoked salmon, canned tuna, and frozen shrimp dumplings cater to busy urban consumers seeking quick, nutritious meals. This trend is amplified by e-commerce platforms, which have streamlined access to premium seafood. Amazon Fresh reported a 40% increase in seafood orders in 2023, driven by millennials prioritizing convenience. Additionally, innovations in packaging, such as vacuum-sealed pouches and biodegradable materials, enhance shelf life and appeal to eco-conscious buyers. Brands like Bumble Bee and Thai Union have capitalized on this demand, launching pre-seasoned and microwavable options. By targeting urban markets and leveraging digital channels, companies can tap into the growing appetite for convenient seafood solutions.

Sustainability Certifications and Eco-Labeling

Sustainability certifications offer another promising avenue for growth in the fish and fish products market. The Marine Stewardship Council (MSC) states that eco-labeled seafood sales grew by 25% in 2023, reflecting heightened consumer awareness of environmental issues. Certifications assure buyers that products are sourced responsibly, fostering trust and loyalty. Retailers are increasingly prioritizing certified products, with Walmart committing to source 100% of its seafood from sustainable suppliers by 2025. This shift aligns with regulatory trends, as the European Union mandates eco-labeling for all imported fish products. A study by Nielsen found that 73% of global consumers are willing to pay a premium for sustainably sourced goods, underscoring the commercial potential of certifications. By adopting sustainable practices and obtaining certifications, companies can differentiate themselves in a competitive market while contributing to marine conservation.

MARKET CHALLENGES

Supply Chain Disruptions and Logistics Costs

Supply chain disruptions across the globe is a significant challenge to the fish and fish products market, exacerbated by geopolitical tensions and rising logistics costs. According to the International Trade Centre, freight rates for perishable goods increased by 35% in 2023, impacting exporters reliant on timely deliveries. Delays in transportation compromise product quality, leading to financial losses for suppliers. For instance, disruptions caused by the Russia-Ukraine conflict reduced Black Sea fish exports by 40%, as per the FAO. Small-scale fishers in developing nations face additional hurdles, lacking resources to navigate volatile markets. The World Bank notes that logistical inefficiencies cost the global seafood industry $10 billion annually, highlighting the need for infrastructure investments. Without resilient supply chains, companies risk losing market share to competitors offering more reliable alternatives.

Regulatory Compliance and Traceability Requirements

Stringent regulatory compliance and traceability requirements is another significant hurdle for the fish and fish products market. The European Union’s Common Fisheries Policy mandates detailed documentation for all imports, including catch location and method, creating administrative burdens for exporters. Non-compliance can result in hefty fines or trade bans, as seen when Thailand faced a $1 billion export loss in 2022 due to IUU violations. The complexity of traceability systems further strains small-scale operators. A report by the Global Seafood Alliance states that 60% of fishers struggle to implement digital tracking tools, limiting their access to premium markets. While traceability enhances transparency, the high cost of adoption deters many players. Addressing these challenges requires targeted support, such as subsidies for technology upgrades and capacity-building programs, to ensure equitable participation in the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.86% |

|

Segments Covered |

By Product Type, Application, Distribution Channel and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Alpha Group Ltd, Cooke Aquaculture, Inc., Leroy Seafood Group ASA, Marine Harvest ASA, Tassal Group Limited, Marine Harvest ASA, Nippon Suisan Kaisha, P/F Bakkafrost, Cermaq Group AS, Thai Union Group PLC. |

SEGMENTAL ANALYSIS

By Product Type Insights

The marine water fish and fish oil segment dominated the market and accounted for 44.1% of the global market share in 2024. Marine fishes such as salmon, tuna, and mackerel are rich in omega-3 fatty acids, which makes them indispensable in both food and pharmaceutical applications. The World Health Organization states that omega-3 consumption reduces cardiovascular disease risk by 25%, driving demand for marine-based products. In 2023, global sales of marine fish oil supplements exceeded $4 billion, reflecting their widespread use in health-conscious populations. The growing popularity of premium seafood is also boosting the expansion of the marine water fish and fish oil segment in the global market. According to Nielsen, over 60% of consumers in North America and Europe prefer wild-caught marine fish over farmed alternatives due to perceived quality. Additionally, advancements in cold-chain logistics have expanded the availability of fresh marine fish in landlocked regions. For example, Norway exported 2.9 million metric tons of salmon in 2023, generating $12 billion in revenue.

The marine water fish and fish meal segment is anticipated to register a prominent CAGR of 7.7% over the forecast period owing to the rising demand for aquaculture feed, which relies heavily on fish meal as a protein source. The FAO states that aquaculture production grew by 5.3% annually between 2010 and 2022, directly boosting fish meal consumption. The rising adoption of sustainable practices is also boosting the growth of the marine fish and fish meal segment in the global market. As per a study by the International Fishmeal and Fish Oil Organization (IFFO), certified sustainable fish meal accounted for 30% of total production in 2023, appealing to eco-conscious buyers. Additionally, emerging markets like Vietnam and India have invested in aquaculture infrastructure, further propelling demand. For instance, Vietnam’s shrimp farming industry consumed 1.2 million metric tons of fish meal in 2023, which is contributing to the rapid expansion of marine water fish and fish meal segment in the global market.

By Application Insights

The food segment dominated the market by capturing 60.4% of the global market share in 2024. The dominating position of food segment in the global market is majorly driven by the global shift toward protein-rich diets, with fish being a staple in many cultures. The FAO notes that fish provides over 20% of animal protein intake in low-income food-deficit countries, highlighting its role in global nutrition. In 2023, China alone consumed 38.5 million metric tons of fish, accounting for 35% of global food-based fish consumption. The rise of convenience foods worldwide is also promoting the domination of food segment in the global market. According to the reports of Euromonitor International, ready-to-eat seafood products grew by 20% in 2023, catering to urban consumers seeking quick, nutritious meals. Innovations in packaging, such as vacuum-sealed pouches, have extended shelf life and boosted sales. For example, canned tuna sales in the U.S. reached $1.5 billion in 2023, driven by affordability and accessibility.

The pharmaceuticals segment is predicted to register the highest CAGR of 9.2% over the forecast period owing to the rising demand for omega-3 supplements, which are widely used to treat cardiovascular and inflammatory diseases. The World Health Organization states that omega-3 deficiency contributes to 96,000 deaths annually in the U.S., amplifying its importance in healthcare. The growing aging populationis also driving the growth of the pharmaceuticals segment in the global market. According to the United Nations, the global elderly population will reach 2.1 billion by 2050 and is creating a surge in demand for preventive healthcare solutions. In 2023, global sales of omega-3 supplements exceeded $5 billion, with North America and Europe leading adoption. Additionally, advancements in extraction technologies have improved purity and efficacy, enhancing consumer trust.

By Distribution Channel Insights

The supermarkets and hypermarkets segment led the market by holding 40.1% of the global market share in 2024. The leading position of supermarkets and hypermarkets segment in the global market is driven by its ability to offer a wide range of products under one roof, catering to diverse consumer needs. Nielsen reports that over 70% of households in developed nations purchase fish products from these outlets due to convenience and competitive pricing. The focus on quality assurance is also boosting the expansion of the supermarkets and hypermarkets segment in the global market. Major chains like Walmart and Tesco have implemented strict traceability systems, ensuring compliance with sustainability standards. For example, Tesco sourced 90% of its seafood from certified sustainable suppliers in 2023, enhancing brand credibility. Additionally, promotional campaigns and discounts have boosted sales, with frozen fish products showing a 15% increase in supermarket sales in 2023.

The E-commerce segment is anticipated to exhibit the fastest CAGR of 12.5% over the forecast period owing to the increasing penetration of online shopping platforms, particularly among millennials and Gen Z. Amazon Fresh reported a 40% increase in seafood orders in 2023, driven by urban consumers prioritizing convenience. The rise of subscription-based models is further boosting the growth of the e-commerce segment in the global market. Companies like HelloFresh and Blue Apron have integrated fresh seafood into their meal kits, generating $2 billion in revenue in 2023. Additionally, innovations in cold-chain logistics have reduced delivery times, ensuring product freshness. For instance, Alibaba’s Hema Supermarket delivers fresh fish within 30 minutes in major Chinese cities, setting a benchmark for e-commerce operations.

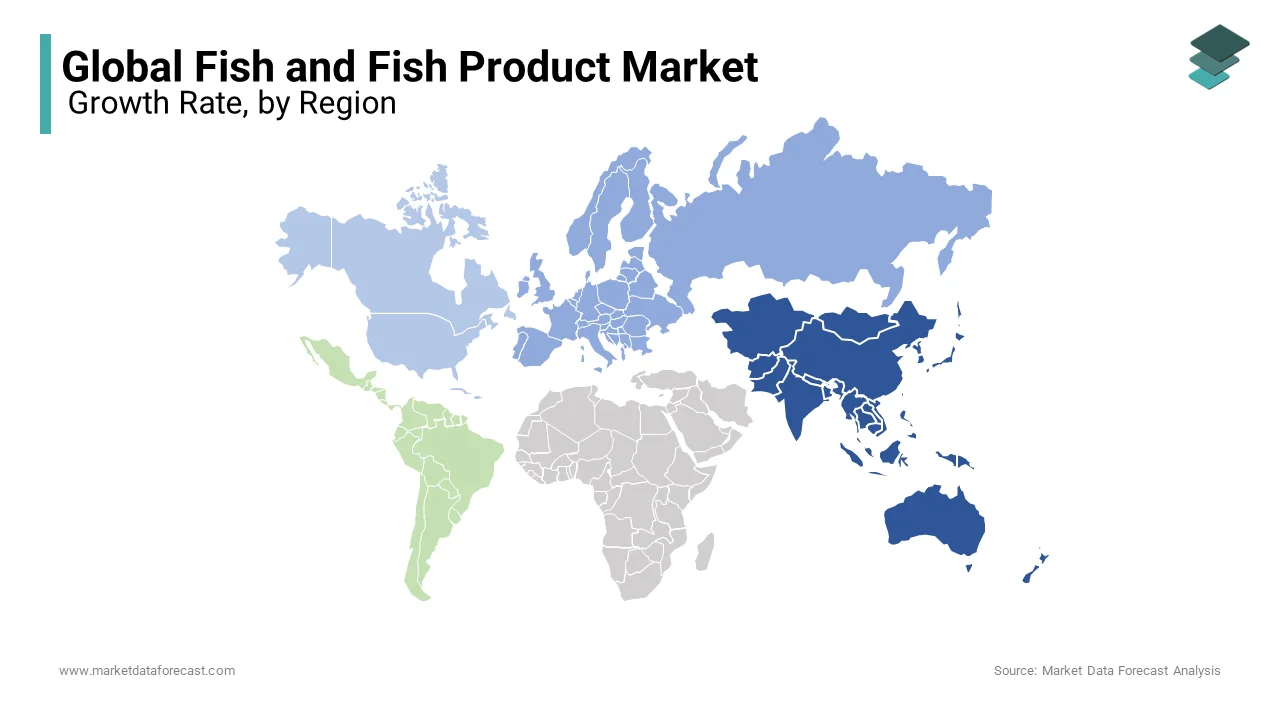

REGIONAL ANALYSIS

Asia-Pacific dominated the fish and fish products market by holding 45.5% of global market share in 2024. China leads with 38.5 million metric tons of annual consumption owing to the cultural preferences for seafood. India and Vietnam are also significant contributors, leveraging aquaculture advancements to meet domestic and export demands. The growing urbanization in this region is further propelling the fish and fish products market expansion in Asia-Pacific. As per the World Bank, 50% of Asia’s population lives in cities, increasing demand for convenient seafood options. Innovations in frozen and canned products have catered to this trend, with Thailand exporting $7 billion worth of processed seafood in 2023.

Europe accounts for a substantial share of the global fish and fish products market, with Norway and Iceland leading exports of premium seafood like salmon and cod. The European Union’s Common Fisheries Policy ensures traceability, boosting consumer confidence. According to Eurostat, seafood consumption in Europe reached 24 kilograms per capita in 2023, driven by Mediterranean diets. The rise of plant-based diets in Europe is contributing to the European market growth. Government campaigns promoting seafood as part of balanced diets have further amplified demand in Europe.

North America holds a notable share of the global fish and fish products market, driven by the U.S., which consumes over 7 million metric tons annually, as per NOAA Fisheries. The region’s growth is fueled by rising health awareness, with omega-3-rich diets gaining traction. According to the American Heart Association, over 50% of Americans consume seafood weekly, underscoring its dietary importance. The rising emphasis on sustainability in North America is also driving the regional market growth. The Marine Stewardship Council certifies 30% of U.S. seafood imports, appealing to eco-conscious buyers. Retailers like Whole Foods have capitalized on this trend, offering premium sustainable options. Additionally, collaborations between governments and private players have expanded aquaculture infrastructure, strengthening regional supply chains.

Latin America is predicted to register a healthy CAGR in the global fish and fish products market over the forecast period, with Brazil and Ecuador driving growth. The region benefits from rich marine biodiversity, supporting exports of shrimp and tilapia. According to the FAO, Ecuador exported 1.2 million metric tons of shrimp in 2023, generating $5 billion in revenue. The growing middle-class population in Latin America is also contributing to the regional market expansion. The Inter-American Development Bank notes that disposable incomes have increased by 15% since 2020, boosting seafood consumption. Retail chains like Carrefour have expanded their seafood offerings, appealing to urban consumers.

The Middle East and Africa account for a moderate share of the global market, with Egypt and Morocco leading production. The aquaculture investments and the rise of halal-certified seafood are propelling the regional market expansion. The Halal Food Authority states that halal-certified products accounted for 40% of regional sales in 2023. Additionally, government initiatives to combat malnutrition have increased fish consumption, particularly in sub-Saharan Africa.

KEY MARKET PLAYERS

Alpha Group Ltd, Cooke Aquaculture, Inc., Leroy Seafood Group ASA, Marine Harvest ASA, Tassal Group Limited, Marine Harvest ASA, Nippon Suisan Kaisha, P/F Bakkafrost, Cermaq Group AS, Thai Union Group PLC. Are the market players that are dominating the global fish and fish products market.

Top Players In The Market

Marine Harvest (Mowi ASA)

Marine Harvest, now rebranded as Mowi ASA, is a global leader in salmon farming and processing. The company operates across 25 countries, producing over 400,000 metric tons of salmon annually, according to Statista. Mowi’s commitment to sustainability has earned it Marine Stewardship Council (MSC) certification, ensuring responsible sourcing practices. Its innovations in aquaculture technology, such as recirculating aquaculture systems (RAS), have set industry benchmarks for efficiency and environmental impact. By focusing on premium-quality products, Mowi has strengthened its position in high-value markets like Europe and North America.

Thai Union Group

Thai Union Group is a key player in the processed seafood segment, renowned for brands like Chicken of the Sea and John West. As per Euromonitor International, the company supplies over 10% of canned tuna globally, making it a household name. Thai Union’s emphasis on traceability and eco-labeling aligns with consumer demand for sustainable seafood. It has also invested in digital platforms to enhance supply chain transparency. Through partnerships with retailers and e-commerce platforms, Thai Union has expanded its reach, particularly in Asia-Pacific and North America.

Nippon Suisan Kaisha (Nissui)

Nippon Suisan Kaisha (Nissui) is a diversified seafood company with operations spanning fishing, aquaculture, and processing. As per Allied Market Research, Nissui’s frozen seafood products dominate Japanese markets, while its global exports cater to diverse cuisines. The company leverages advanced freezing technologies to preserve quality, meeting stringent international standards. Nissui’s focus on research and development has led to innovations like plant-based seafood alternatives, appealing to health-conscious consumers. Its strategic acquisitions have further solidified its presence in emerging markets.

Top Strategies Used By Key Market Participants

Sustainability Certifications and Eco-Labeling

Sustainability certifications are a cornerstone strategy for companies aiming to build trust and meet regulatory demands. According to the Marine Stewardship Council, certified seafood sales grew by 25% in 2023, reflecting heightened consumer awareness. Brands like Mowi ASA and Thai Union Group have adopted eco-labeling to differentiate their products in competitive markets. These certifications not only enhance brand credibility but also open access to premium markets like the European Union, which mandates traceability. By prioritizing sustainability, companies can align with global trends and strengthen long-term market positioning.

Expansion of Aquaculture Technologies

Investing in aquaculture technologies is another critical strategy driving growth. Recirculating aquaculture systems (RAS) allow producers to farm fish in controlled environments, ensuring year-round supply and minimizing environmental impact. A report by Allied Market Research states that RAS adoption increased by 30% in 2023, particularly in regions like Europe and North America. Companies like Mowi ASA have leveraged these systems to boost yield and product quality. This strategy not only enhances market competitiveness but also addresses challenges like overfishing and climate change.

Digitalization and Supply Chain Optimization

Digitalization has revolutionized supply chain management in the fish and fish products market. Thai Union Group’s investment in blockchain technology ensures transparency, allowing consumers to trace the origin of products. According to Statista, blockchain adoption in seafood supply chains grew by 40% in 2023. Additionally, e-commerce platforms have streamlined distribution, enabling companies to reach global audiences efficiently. By optimizing logistics and enhancing customer engagement, digital tools have become indispensable for market leaders.

COMPETITION OVERVIEW

The fish and fish products market is highly competitive, characterized by a mix of multinational corporations and regional players vying for dominance. According to IBISWorld, the industry is fragmented, with small-scale producers accounting for over 60% of the market. This fragmentation creates opportunities for innovation but also intensifies rivalry. Major players like Mowi ASA and Thai Union Group dominate through premium pricing and extensive product portfolios, while smaller brands focus on niche markets like organic or halal-certified seafood.

Regulatory compliance poses a significant challenge, with stringent traceability standards enforced by bodies like the European Union’s Common Fisheries Policy. Additionally, the rise of counterfeit products threatens legitimate brands, as per the FAO. Despite these hurdles, technological advancements and shifting consumer preferences continue to shape the competitive landscape. Companies that prioritize sustainability, transparency, and innovation are likely to thrive in this evolving environment.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Mowi ASA launched its “Blue Future” initiative, investing $100 million in sustainable aquaculture projects to reduce environmental impact.

- In May 2023, Thai Union Group partnered with Alibaba’s Hema Supermarket to offer fresh seafood deliveries within 30 minutes in major Chinese cities, boosting online sales.

- In July 2023, Nippon Suisan Kaisha acquired a 51% stake in a Vietnamese aquaculture firm, expanding its production capacity for shrimp and tilapia in Southeast Asia.

- In September 2023, Mowi ASA introduced plant-based seafood alternatives under its “Mowi Zero” line, targeting health-conscious consumers in Europe and North America.

- In December 2023, Thai Union Group implemented blockchain technology across its supply chain, enabling consumers to trace the origin of its canned tuna products, enhancing transparency.

MARKET SEGMENTATION

This research report on the global fish and fish product market is segmented and sub-segmented into the following categories.

By Product Type

- Fresh water fish and fish oil

- Marine water fish and fish oil

- Diadromous fish and fish oil

- Fresh water fish and fish meal

- Marine water fish and fish meal

By Application

- Food

- Feed

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarkets

- Hypermarkets

- E-commerce websites

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global fish and fish products market?

Rising health awareness, growing demand for protein-rich foods, and the expansion of aquaculture are key drivers.

Which regions dominate the global fish market?

Asia-Pacific leads the market, especially China and India, due to high consumption and large-scale production.

What are the most traded fish products globally?

Frozen fish, canned fish (like tuna and sardines), fish fillets, and fish oil are among the top traded items.

What challenges does the fish market face today?

Overfishing, climate change, and strict import/export regulations are major challenges affecting sustainability and trade.

How is technology influencing the fish industry?

Advances in cold storage, aquaculture systems, and traceability technologies are improving efficiency and product quality.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]