Global Feed Vitamin Market Size, Share, Trends, & Growth Forecast Report By Type Of Vitamins (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E and Vitamin K.), Livestock Type (Swine, Ruminants, Poultry, Aquatic Animals and Others), Formulation (Liquid, Dry and Others (Powder, Pellet)), Function (Single Functioned and Multi Functioned) And Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Industry Analysis (2025 to 2033)

Global Feed Vitamin Market Size

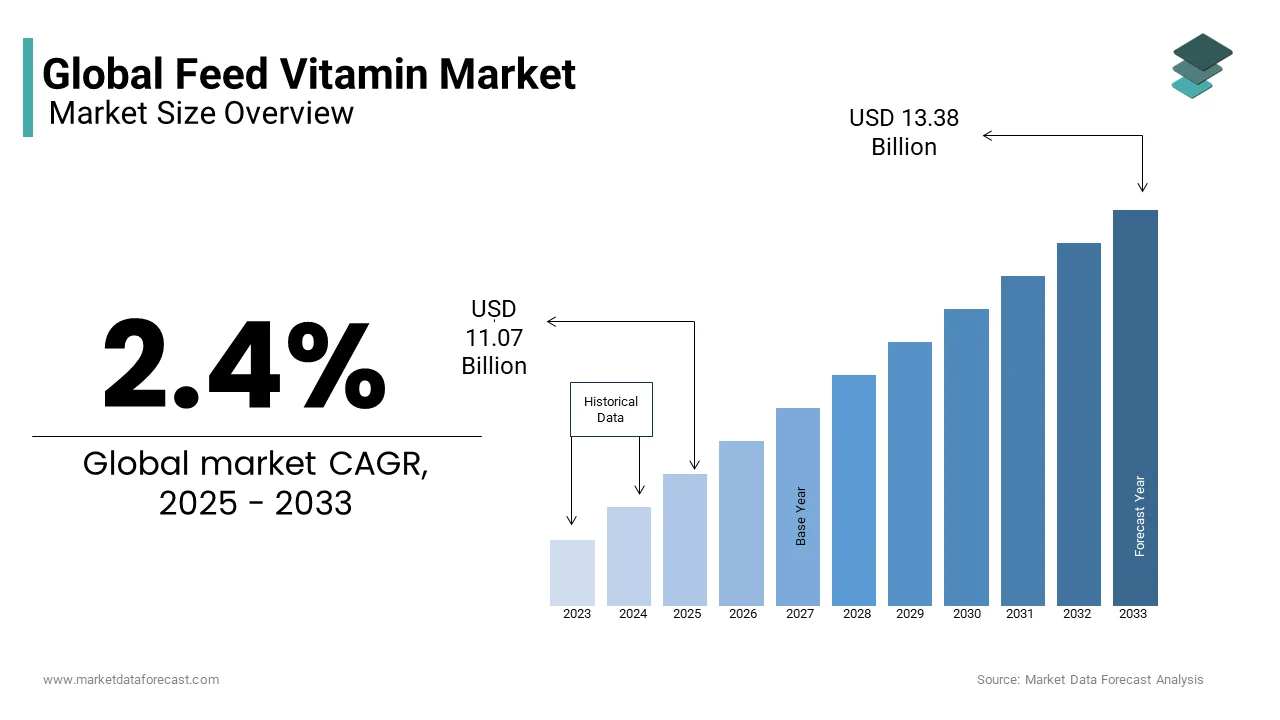

The global feed vitamin market was valued at USD 10.81 billion in 2024 and is anticipated to reach USD 11.07 billion in 2025 from USD 13.38 billion by 2033, growing at a CAGR of 2.4% during the forecast period from 2024 to 2032.

The global feed vitamin market plays a critical role in the livestock industry and contributes to animal nutrition and overall productivity. The growth of the market is primarily driven by increasing demand for animal-derived food products, awareness of animal health, and the growth of sustainable farming practices. Feed vitamins such as vitamins A, D, E, and B-complex are essential for improving immune function, growth rates, and reproductive health in livestock. Vitamin A, for instance, is crucial for vision and immunity, while vitamin D supports bone development. These nutrients are often incorporated into feed for cattle, poultry, swine, and aquaculture.

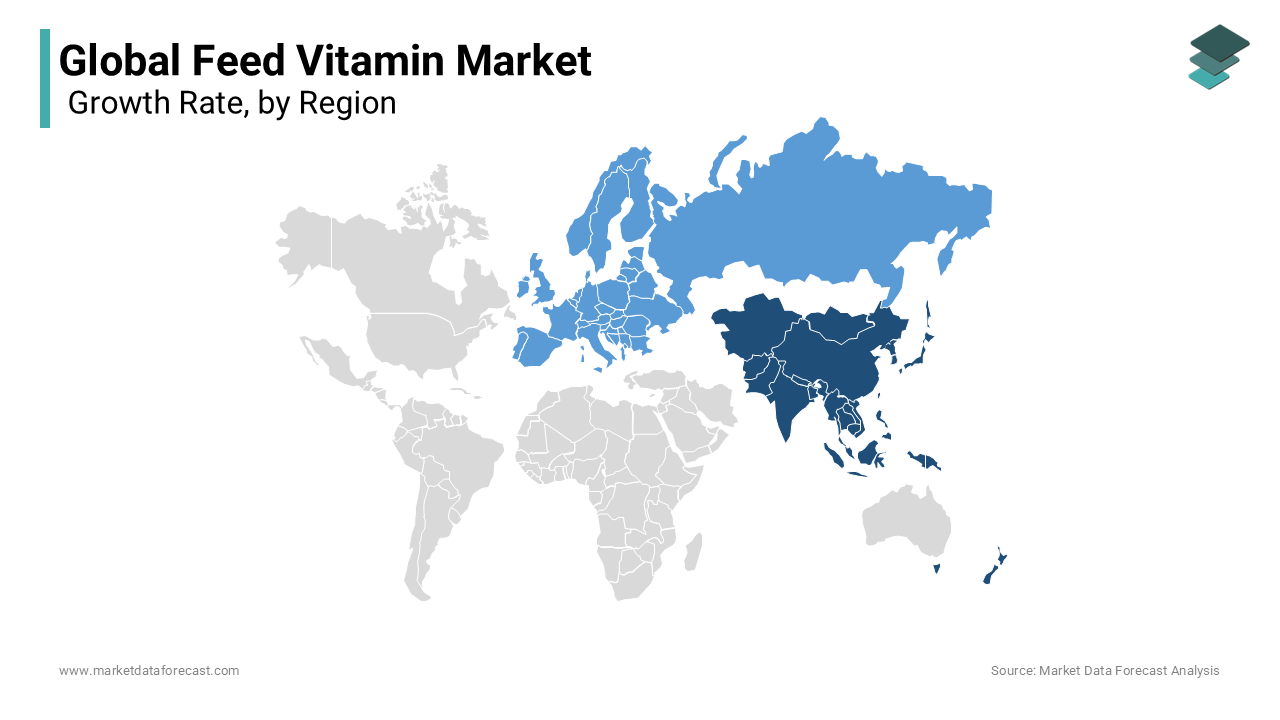

Asia-Pacific is dominating the feed vitamin market worldwide owing to the large livestock populations and high meat consumption, with China and India as primary consumers. North America and Europe also show steady growth due to stringent animal welfare regulations and the demand for quality meat products. Sustainability trends are pushing for organic and bio-based vitamin sources in feed, a shift encouraged by consumer preferences for eco-friendly meat. Major players in this sector include DSM, BASF, and ADM, who are expanding their portfolios to include innovative, high-quality feed vitamins.

MARKET DRIVERS

The demand for animal protein from the global population is rapidly increasing, particularly in developing regions. For instance, the FAO estimates that poultry production alone will grow by 24% by 2030 to meet rising consumer demand. Feed vitamins are essential in optimizing animal growth rates and product quality, with vitamins like A and D improving immune function and bone health. This demand is especially notable in China and India, where protein consumption is rising swiftly, emphasizing the need for high-quality feed additives to enhance livestock productivity and meat quality.

The rising awareness of animal welfare and stringent regulations are leading producers to prioritize nutritional standards in livestock feed. Europe, for example, has regulatory frameworks that encourage reduced antibiotic use and emphasize preventive health, partly achieved through enhanced vitamin supplementation. Feed vitamins such as E and C are known to strengthen animals’ immunity, thus minimizing reliance on antibiotics. This trend is reflected globally, with nearly 85% of livestock feed now including fortified vitamins to prevent disease and improve growth efficiency.

With nearly 40% of consumers worldwide now favoring sustainable and organic products, demand is growing for bio-based, eco-friendly vitamin sources. Organic feed vitamins, derived from natural sources, help lower the environmental impact of livestock farming. In the U.S., organic livestock feed demand has grown by about 10% annually as more producers shift away from synthetic additives. This shift is most pronounced in the poultry and dairy sectors, which increasingly adopt natural vitamins to meet consumer expectations for sustainability and quality.

MARKET RESTRAINTS

The high cost of vitamin supplements is a significant restraint to the growth of the feed vitamin market. Feed vitamins can be costly, and their prices are influenced by raw material costs and manufacturing complexities. For example, synthetic vitamin E prices spiked in recent years due to supply chain disruptions, making feed supplementation more expensive. Since vitamins account for around 2-4% of overall feed costs, price volatility can deter small- and medium-scale livestock producers from consistent use. In price-sensitive markets like Asia and Africa, this can hinder adoption, as producers prioritize cost-effective feed solutions over nutritional fortification, impacting the growth potential of the feed vitamin market.

Stringent regulatory standards are further hampering the global market growth. The feed vitamin market faces strict regulations, particularly in developed regions, where quality control and safety standards are rigorous. In the EU, for instance, each additive must be approved by the European Food Safety Authority (EFSA) before use, adding to development and compliance costs for manufacturers. Regulatory hurdles can delay the introduction of new vitamins or changes to existing formulations, slowing innovation. Moreover, the potential for regulatory changes adds uncertainty for producers, creating a restrictive environment that can limit the market's growth, especially for companies looking to expand globally.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2023 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.4% |

|

Segments Covered |

By Type of Vitamin, Type of livestock, Formulation and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

like S.A.S, Aland BASF SE, CSPC Pharmaceutical Group Ltd., Zhejiang Medicine Company Ltd., Pharmative LLC, North China Pharmaceutical Corporation, Archer Daniels Midland Company, Evonik Industries, and DSM N.V. |

SEGMENT ANALYSIS

By Vitamins Insights

The Vitamin A segment dominated the market by accounting for 33.8% of the global market share in 2023. This dominance is driven by vitamin A’s critical role in supporting immune function, reproduction, and vision in livestock, particularly cattle and poultry. It is essential for growth and development, making it indispensable in intensive animal farming, where productivity is a priority. Vitamin A deficiencies can lead to issues such as weakened immunity, impaired reproduction, and poor growth rates, prompting high demand for this supplement across all types of animal feed. In poultry, which constitutes a significant portion of global livestock, vitamin A is especially crucial for preventing diseases and enhancing egg production. This widespread utility across various livestock sectors ensures vitamin A's leadership in the market.

The Vitamin E segment is the fastest-growing segment and is expected to grow at a CAGR of 6.62% over the forecast period. This growth is fueled by rising awareness of the antioxidant benefits vitamin E provides, which help improve immune function and reduce the risk of diseases in animals. Vitamin E’s natural antioxidant properties support cell membrane integrity and reduce oxidative stress, making it critical in intensive farming conditions where animals are prone to stress. For instance, vitamin E is often used to enhance the quality and shelf life of meat by preventing oxidation. As consumer demand for high-quality animal products increases, the livestock industry is prioritizing vitamin E to enhance animal health and improve meat quality, driving its rapid growth in the feed vitamin market.

By Livestock Insights

The poultry segment led the market and had 40.2% of the global market share in 2023. The dominance of the poultry segment is attributed to its status as one of the most consumed animal protein sources worldwide, especially in rapidly growing markets like Asia and North America. Chickens and other poultry have high nutritional needs, requiring vitamins such as A, D, and E to support immune health, growth rates, and egg production. The Food and Agriculture Organization (FAO) projects that global poultry production will continue to rise by around 24% by 2030, reflecting increased demand for poultry feed vitamins. Producers prioritize vitamin-rich feed formulations to meet consumer demand for high-quality poultry products, ensuring this segment’s leadership in the market.

The aquatic animal segment is expected to be the fastest-growing and grow at a CAGR of 7.74% over the forecast period. This growth is driven by the booming aquaculture industry, as fish and seafood consumption continues to rise globally due to their health benefits and popularity as protein sources. Vitamins in aquatic feed especially vitamins C and E are essential for improving fish growth rates, immune response and resilience against waterborne diseases. The increasing focus on sustainable aquaculture, along with consumer demand for quality seafood, is driving producers to incorporate essential vitamins in fish feed. The rapid growth of aquaculture in regions such as Asia-Pacific and Europe, which are known for intensive fish farming, further propels the demand for vitamin-enriched feed, making aquatic animals the fastest-growing segment in the market.

REGIONAL ANALYSIS

Asia-Pacific led the feed vitamin market and had 36.3% of the global market share in 2023. The domination of the Asia-Pacific region in the global market is majorly due to its large livestock populations and growing meat consumption in countries like China and India. The Asia-Pacific region is likely to maintain its dominant position in the global market throughout the forecast period as rising disposable incomes and population growth drive demand for animal protein. China, the top consumer in the region, prioritizes feed vitamins for productivity gains in livestock and aquaculture. This emphasis on improving animal health and increasing livestock efficiency positions Asia-Pacific as a critical market for feed vitamins globally.

North America is a notable regional segment for feed vitamins and is expected to grow at a CAGR of 5.68% during the forecast period. The rising focus on quality and animal welfare, especially in the United States and Canada, is boosting the feed vitamin market in North America. The strict regulatory standards and strong consumer demand for high-quality meat products further propel the regional market expansion. The U.S., as the leading consumer in this region, uses feed vitamins extensively to boost livestock productivity and reduce antibiotic use, particularly in dairy and poultry industries. North America's commitment to stringent animal nutrition standards supports consistent market growth.

Europe is estimated to do well in the global market over the forecast period owing to the stringent animal welfare regulations and a demand for sustainable animal products. As sustainability initiatives and organic feed options gain traction, the market is Europe is expected to continue to grow. Germany and France are the primary consumers, and Germany also contributes significantly to aquaculture. Europe’s focus on environmental sustainability and reducing antibiotic use in animal feed ensures moderate but steady growth, positioning it as a region with high regulatory compliance and consumer awareness.

Latin America is anticipated to register steady growth over the forecast period. The feed vitamin market in Latin America is driven by rising meat exports and livestock sector expansion. Brazil, with its extensive poultry and cattle industries, leads the region, followed by Argentina’s robust beef sector. Chile’s growing aquaculture market also supports the demand for feed vitamins. With expanding livestock production and an increasing emphasis on quality animal nutrition, Latin America’s feed vitamin market is positioned for strong future growth, catering to both domestic needs and export markets.

The Middle East and Africa account for a moderate share of the global feed vitamin market. However, the regional market is expected to grow at a healthy CAGR due to the increasing demand for animal protein. Improving economic conditions and investments in livestock sectors are fueling market growth, especially in South Africa, Saudi Arabia, and Egypt. South Africa leads in the region’s poultry industry, while the Middle East countries focus on expanding their livestock sectors to meet domestic needs. The Middle East and Africa region, though smaller, is showing steady growth potential, driven by increasing consumption and a commitment to enhancing animal feed quality.

KEY MARKET PLAYERS

This market is dominated by companies like S.A.S, Aland BASF SE, CSPC Pharmaceutical Group Ltd., Zhejiang Medicine Company Ltd., Pharmative LLC, North China Pharmaceutical Corporation, Archer Daniels Midland Company, Evonik Industries, and DSM N.V.

MARKET SEGMENTATION

This research report on the global feed vitamins market has been segmented and sub-segmented based on vitamin type, livestock, formulation and region.

By Type Of Vitamin

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

By Type Of Livestock

- Swine

- Ruminants

- Poultry

- Aquatic animals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the current market size of the global feed vitamins market?

The global feed vitamin market is expected to be valued at USD 11.07 billion in 2025.

Which region dominates the Global Feed Vitamins Market?

Currently, Asia-Pacific holds the largest share of the Global Feed Vitamins Market, accounting for approximately 2.4% of the total market.

What factors contribute to the growth of the Global Feed Vitamins Market in North America?

In North America, the increasing demand for high-quality animal products and the focus on animal nutrition for improved health and productivity are key factors driving the growth of the Feed Vitamins Market.

In Europe, emerging trends include the incorporation of organic and natural feed vitamins, reducing environmental impact, and promoting sustainable and ethical farming practices.

In Europe, emerging trends include the incorporation of organic and natural feed vitamins, reducing environmental impact, and promoting sustainable and ethical farming practices.

who are the key market players involved in the Feed Vitamins Market?

S.A.S, Aland BASF SE, CSPC Pharmaceutical Group Ltd., Zhejiang Medicine Company Ltd., Pharmative LLC, North China pharmaceutical corporation, Archer Daniels Midland Company, Evonik Industries, and DSM N.V.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]