Global Feed Premix Market Size, Share, Trends and Growth Analysis Report – Segmented By Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics and Antioxidants), Livestock (Poultry, Swine, Aqua Animals, Equine and Pets), Form (Dry and Liquid) and Region (North America, Europe, Asia - Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Feed Premix Market Size

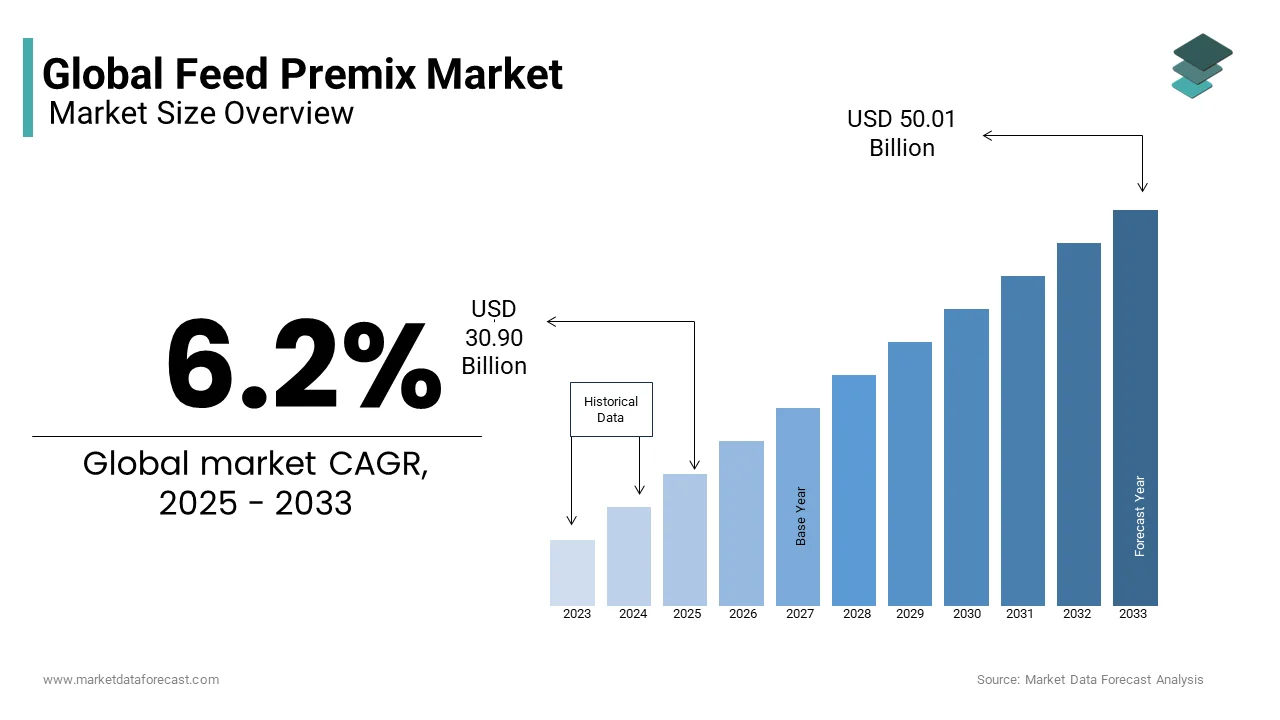

The global feed premix market was valued at USD 29.10 billion in 2024 and is anticipated to reach USD 30.90 billion in 2025 from USD 50.01 billion by 2033, growing at a CAGR of 6.2% during the forecast period from 2025 to 2033.

Current Scenario of The Global Feed Premix Market

Feed premix, also known as complex premix, trace mineral premix, and vitamin premix feed, is a type of feed additive made up of two or more types of nutritional feed additives blended with a carrier or diluents in a certain proportion. The feed premixes consist of vitamins, minerals, amino acids, antibiotics, and antioxidants and are consumed by livestock such as poultry, swine, aqua animals, equine, and pets. Feed Premix enables for more precise mixing and distribution of these additives throughout the feed, ensuring adequate homogeneity of the feed additives in the finished product. The feed premixes help in improving the immunity of the animals. For instance, amino acids play a vital role in building protein blocks in animals' bodies and also enhancing fertility in animals. Hence, the addition of such nutritional additives in the feed will lead to an increase in the demand for feed premixes in the forecast period between 2023 and 2028.

MARKET DRIVERS

The growing demand and consumption of livestock-based products such as dairy and dairy-based meats and eggs is majorly propelling the growth of the feed premix market.

Livestock farmers are using feed additives for the growth and development of farm animals. According to the FAO data, the demand for global meat production will increase by 16% by 2025. Poultry meat is the primary driver of this market due to its high demand, low-cost production and lower product prices in both developed as well as developing countries. Additionally, the modernization of livestock farms in developing regions in order to meet the demand for animal protein is driving the growth of this market.

Moreover, the demand for quality livestock protein products is increasing, which encourages livestock farmers to feed their livestock with superior-quality feed products to enhance productivity and quality output. Also, consumers across the world are becoming more conscious about the quality of the animal protein products they purchase and consume and hence, they expect a high level of transparency in the supply chain of livestock products from the point of production to consumption. As a result, it is critical to improve feed nutrition by adding vitamins, minerals, amino acids, and other nutrients in order to ensure healthy livestock animal performance, which drives the growth of the feed premix market. In addition, increased consumer awareness of healthy food and the desire for export-quality meat products are predicted to fuel robust demand for feed premixes between 2022 and 2027, according to the estimate.

MARKET RESTRAINTS

The restrictions on the use of antibiotics as a growth promoter in the feed premix I countries like EU, China, India, U.S acts as a major restraint in the growth of the feed premix market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.2% |

|

Segments Covered |

By Ingredient Type, Livestock, Form, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, RoW |

|

Market Leaders Profiled |

Koninklijke DSM N.V.(Netherlands), Nutreco N.V. (Netherlands), Cargill (US), Archer Daniels Midland Company (ADM) (US), BEC Feed Solutions (Australia), DLG Group (Denmark), Charoen Pokphand Foods PCL (Thailand), Land O’Lakes (US), AB Agri Ltd. (UK), Phibro Animal Health Corporation (US) |

SEGMENTAL ANALYSIS

Global Feed Premix Market Analysis By Ingredient Type

The amino acids segment is expected to hold the largest share of the feed premix market during the forecast period. Amino acid helps in building blocks for protein development in animals and hence increases the quality of the meat. Amino Acids are widely used in feed premixes in order to provide the required nutrients to overcome dietary deficiencies. In addition to being building blocks of body protein, amino acids play a vital role in various biochemical and metabolic processes in the cells of animals. So, from growth to production and reproduction, amino acids play a large part in the productivity of farm animals and can contribute significantly to the profitability of a farm. A variety of amino acids are fed to livestock as supplements to increase their efficiency. Owing to these benefits, amino acids drive the growth of the feed premix market in the forecast period.

Global Feed Premix Market Analysis By Livestock

The poultry segment is going to dominate the market in the forecast period. The poultry industry consists of four main areas of production broilers, eggs pullets, and breeders. Poultry is the fastest-growing industry because of the rapid increase in the demand for poultry products. In some countries, the consumption of porcine and livestock meat is projected to be low due to religious beliefs, which in turn, drives the demand for poultry meat. Moreover, there will be a rise in the demand for poultry meat in coming years due to the increased cost of other livestock meat as compared to poultry meat.

Global Feed Premix Market Analysis By Form

The dry segment is projected to hold the largest share of the feed premix market because the dry form of feed premix can be easily handled and stored and has a wide range of usages in livestock applications. The dry form is easier to mix with the feed and has a longer shelf life as compared to the liquid form. Owing to these reasons, it is mostly preferred by livestock farmers.

REGIONAL ANALYSIS

North America is the largest contributor to the feed premix market and is projected to remain the second-largest dominant region of this market in the forecast period due to the rapid adoption of efficient and technologically advanced farm management practices by livestock farmers. The United States is the major market for the feed premix industry in this region as the US is focused on innovating cost-effective production processes. Poultry is the largest consumer of the feed premix in this region. Moreover, the Companies in the North American region are committed to research, sourcing, quality and education in providing nutritional technologies that are focused on the success of the consumer.

Asia-Pacific is expected to hold the largest market share of the feed premix market during the forecast period. The key markets in the Asia-Pacific region are China, India, Japan, Australia, Thailand, New Zealand, Vietnam and others. In the Asia Pacific region, the presence of a large livestock population is driving the market of feed premixes in the near future. Additionally, the increasing number of feed mills and feed production, particularly in Japan and India, is driving the growth of the market. Moreover, the Asia-Pacific region has a large population and the demand for animal protein is increasing, which, in turn, supports the growth of livestock farming that will further increase the demand for feed premix in order to meet the demand. Furthermore, the commercialization of livestock farming in countries such as India and China is expected to fuel the feed premix market in the forecast period.

Europe is expected to have steady growth in this market during the projected period due to the increasing importance of animal health and wellness in the animal husbandry industry.

KEY MARKET PLAYERS

Some of the leading companies operating in the global feed premix market are Koninklijke DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Cargill (US), Archer Daniels Midland Company (ADM) (US), BEC Feed Solutions (Australia), DLG Group (Denmark), Charoen Pokphand Foods PCL (Thailand), Land O’Lakes (US), AB Agri Ltd. (UK), Phibro Animal Health Corporation (US) are playing a dominating role in global feed premix market. Cargill had the largest share of the world’s feed premix in terms of sales revenue in 2020.

RECENT HAPPENINGS IN THIS MARKET

- In November 2021, Royal DSM announced that it had signed an agreement to acquire Norway-based Vestkorn Milling (one of the Leading producers of pea and bean-derived ingredients for plant-based protein products. This acquisition is a significant step in DSM’s strategy to build an alternative protein business in the future and will provide synergy with DSM's innovative “Canola PRO,” which is a rapeseed protein isolate and will be commercially launched in 2022.

- BEC Feed Solutions, established in Australia, inaugurated its new premix production facility in Carole Park, Brisbane, Queensland, in April 2021. According to BEC, its new plant would feature manufacturing space equipped with integrated technology, as well as a new warehouse and two-story office block. This new plant allows BEC company to improve production capacity, accuracy, efficiency, traceability, and hygiene standards.

MARKET SEGMENTATION

This research report on the global feed premix market has been segmented & sub-segmented based on the product type, type, and region.

By Ingredient Type

- Vitamins

- Minerals

- Amino Acids

- Antibiotics

- Antioxidants

By Livestock

- Poultry

- Swine

- Aqua Animals

- Equine

- Pets

By Form

- Dry

- Liquid

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the size of global feed premix market?

The Global Feed Premix Market is expected to grow by USD 30.90 billion in 2025.

what is the growth of feed premix market?

The feed premix market is estimated to reach a valuation of USD 50.01 billion by the end of 2033.

what are key market players in feed premix players?

Koninklijke DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Cargill (US), Archer Daniels Midland Company (ADM) (US), BEC Feed Solutions (Australia), DLG Group (Denmark), Charoen Pokphand Foods PCL (Thailand), Land O’Lakes (US), AB Agri Ltd. (UK), Phibro Animal Health Corporation (US)

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]