Global Feed Phytogenics Market Research Size, Share, Trends, & Growth Forecast Report, Segmented By Ingredients (Essential Oils, Oleoresins, Herbs And Species and Others), Animal Type (Poultry, Aquaculture, Swine, Ruminant and Others), Application (Flavouring And Aroma, Organic Trace Minerals, Anti-Parasitic, Feed Intake And Digestibility and Others) and Region (North America, Europe, Aisa Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Feed Phytogenics Market Size

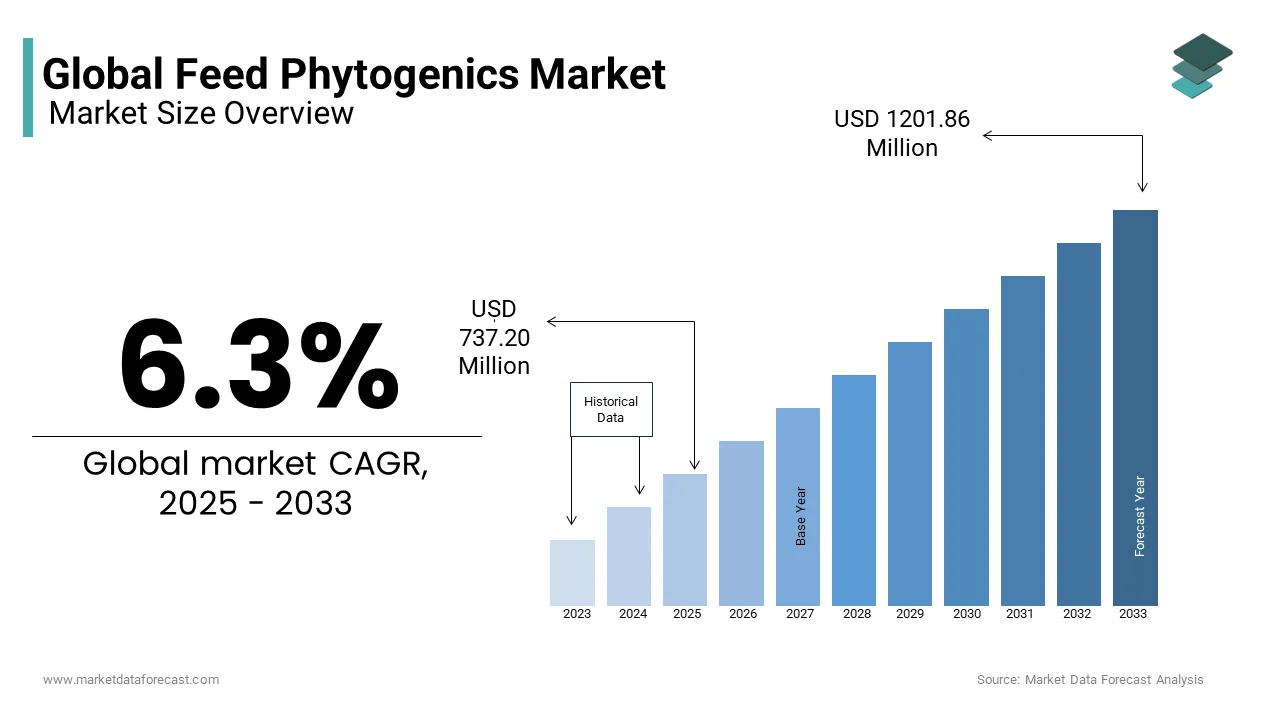

The global feed phytogenics market was valued at USD 693.51 million in 2024 and is anticipated to reach USD 737.20 million in 2025 from USD 1201.86 million by 2033, growing at a compound annual growth rate (CAGR) of 6.3% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The Feed Phytogenics Market is experiencing robust growth, largely propelled by the evolving consumer demand for natural and organic food products. With a shift towards healthier dietary choices, consumers are increasingly seeking meat and dairy products sourced from animals raised with natural and sustainable feed additives. Phytogenic feed is derived from herbs, spices, and plant-based sources that align perfectly with these consumer preferences. In a world grappling with concerns over antibiotic resistance and environmental sustainability, phytogenics offer a viable solution. Their adoption is further bolstered by regulatory support and ongoing research, resulting in innovative products. As the global livestock industry continues to expand, the Feed Phytogenics Market stands to benefit significantly, meeting the demand for healthier, more sustainable animal products.

Surging health and wellness awareness among consumers is amplifying the demand for the Feed Phytogenics Market. As people become more concerned about their dietary choices, there's also a heightened focus on the quality and safety of animal products. In response to these evolving consumer preferences, phytogenic feed additives have emerged as a natural and healthier alternative to synthetic counterparts. Perceived as a safer and more wholesome option, phytogenics align perfectly with the health-conscious trends sweeping across the globe. These botanical feed additives offer a perfect way to enhance the quality of meat and dairy products by ensuring that they meet stringent standards. The market's growth is rising by the fact that phytogenics cater to the growing demand for food products that not only taste good but also contribute to overall health.

MARKET RESTRAINTS

Cost considerations pose a significant restraint to the Feed Phytogenics Market. While these natural feed additives offer numerous benefits, including improved animal health and performance, their price tag can be a deterrent for some producers. This is particularly true in regions with stringent budget constraints or highly price-sensitive markets. Synthetic additives often come at a lower cost, making them an attractive option for budget-conscious livestock producers. The initial investment in phytogenics can strain the financial resources of some operations, especially smaller or less financially flexible ones. Additionally, as the market matures and economies of scale are realized, the cost disparity between phytogenic and synthetic alternatives may narrow, making these natural additives a more feasible choice for a broader range of producers.

Impact of COVID-19 on the Feed Phytogenics Market

The COVID-19 pandemic disrupted supply chains and created economic uncertainty, negatively affecting the feed phytogenics market. Lockdowns, reduced labor availability, and transportation restrictions disrupted the production and distribution of these products. This led to supply shortages and increased costs, making it challenging for some producers to access phytogenic feed additives when they were needed most. Additionally, the economic strain on the livestock and poultry industries during the pandemic made some producers more cost-conscious, potentially limiting their willingness to invest in these somewhat pricier natural additives. But from time on, the positive side, the pandemic underscored the importance of animal health and food safety. This heightened awareness has driven demand for natural and sustainable feed additives like phytogenics. Producers have recognized the potential benefits of using these additives to improve animal resilience and performance, making them a valuable tool in post-pandemic recovery and long-term sustainable agriculture. As the focus on health and wellness continues, the feed phytogenics market may see increased adoption in the evolving landscape of animal production.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.35% |

|

Segments Covered |

Ingredients, Animal Type, Application, Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Inc., DuPont, Biomin, Pancosma SA, and Delacon Biotechnik. |

SEGMENT ANALYSIS

By Ingredients Insighst

Essential oils are the most dominant ingredient in phytogenic feed additives due to their strong antimicrobial, anti-inflammatory, and aromatic properties. They are very effective in improving digestion and reducing the growth of harmful microorganisms in the animal's gut. Essential oils are well-researched, and their modes of action are better understood, which contributes to their widespread use in the industry.

Oleoresins hold the second largest CAGR in the market as they are natural extracts that contain both essential oil and other plant compounds. They are used as feed additives for their flavor and bioactive properties. However, the dominance of oleoresins is limited because they can be more variable in composition compared to pure essential oils.

Herbs are a third dominant and are commonly used in phytogenic feed additives. They are known for their antimicrobial and antioxidative properties. While herbs play a significant role, standardization ensures consistent results.

Species can include a wide range of botanicals and spices, each with its unique properties and can be vital components of feed additives, but their dominance is limited because of the diverse options available, and the choice of species may vary depending on specific animal nutrition requirements.

By Application Insights

Flavoring and Aroma hold the largest CAGR in the Feed Phytogenics Market due to its being particularly relevant in cases where animals exhibit reduced feed intake due to unpalatable or low-quality feeds. While enhancing feed palatability is important, this application is generally the most dominant use of phytogenic.

Organic Trace Minerals are second dominant and can be incorporated into animal diets to improve the bioavailability of essential minerals like zinc, copper, and selenium. This application is important for ensuring proper animal nutrition, growth, and reproductive performance. However, organic trace mineral supplementation may not be the most dominant use of phytogenics.

Anti-parasitic phytogenic feed additives can possess anti-parasitic properties, helping to control internal and external parasites in livestock and poultry. This application is highly valuable for animal health and welfare, as well as for reducing the need for chemical dewormers. The anti-parasitic application is significant, especially in regions where parasite infestations are a common concern.

By Animal Type Insighst

Poultry, which includes broilers, layers, and turkeys, is one of the most dominant sectors in the Feed Phytogenics Market. Poultry production demands efficient growth, improved feed conversion, and overall health. Phytogenic feed additives are widely used in poultry diets to enhance performance, control gut health, and replace antibiotic growth promoters, making this segment a dominant user.

The aquaculture industry, including fish and shrimp farming, is another significant user of phytogenic feed additives. These additives are applied to improve water quality, disease resistance, and feed conversion rates in aquaculture operations. The dominance of phytogenics in aquaculture is growing due to increasing concerns about antibiotic use and the need for sustainable practices in fish and shrimp farming.

Swine production, which includes pigs and hogs, also utilizes phytogenic feed additives to enhance growth rates, reduce stress, and improve gut health. This segment is substantial, although not as dominant as poultry, as pig farming practices can vary in different regions, and other feed additives may be used alongside phytogenics.

REGIONAL ANALYSIS

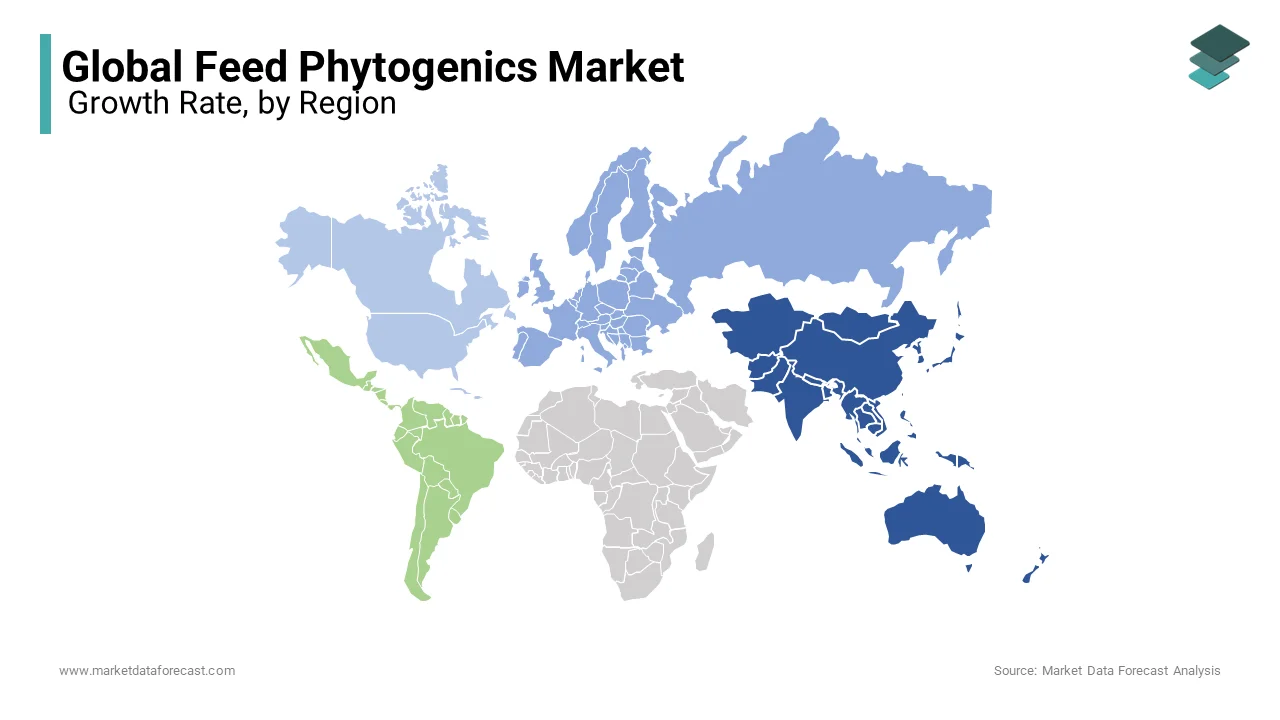

Asia Pacific is one of the most dominating regions in the Feed Phytogenics Market due to the region's substantial livestock and poultry production, including swine, poultry, and aquaculture. This rising demand for phytogenic feed additives in the Asia Pacific includes a combination of factors like a large and growing population, increasing meat consumption, and a strong push for sustainable and natural farming practices.

Europe holds the second-largest CAGR in the market, with a strong emphasis on natural and sustainable agriculture. It has been proactive in regulating and promoting the use of feed additives like phytogenics as alternatives to antibiotics. The region's strict regulations and consumer demand for clean and safe food products have bolstered the use of phytogenics in animal nutrition.

North America has a prominent growth rate due to the adoption of phytogenic feed additives, driven by a growing awareness of health and wellness among consumers. The region's livestock and poultry industries seek natural solutions to improve animal performance and address concerns about antibiotic resistance.

Latin America has been gradually increasing its usage of phytogenic feed additives, especially in poultry and swine production. The region's demand is driven by the expansion of the meat industry and a desire to improve feed efficiency and animal health. However, it may not be as dominating as Asia Pacific or Europe.

The Middle East and Africa are also showing a growing interest in phytogenic feed additives. The region's agriculture is diversifying, and there is a focus on improving livestock and poultry production efficiency. Factors such as hot and arid climates can lead to challenges in animal health, making phytogenics a valuable option.

KEY MARKET PLAYERS

DSM Nutritional Products, Delacon Biotechnik, Phytobiotics, Futterzusatzstoffe, Kemin Industries, Cargill, Pancosma, BIOMIN, Natural Remedies, Dostofarm, DuPont, Nutreco, Silvateam, Nor-Feed, A&A Pharmachem Inc., Phytosynthese, Danisco Animal Nutrition (DuPont), Bluestar Adisseo, Sensient Technologies, Zagro Asia, are playing a dominant role in the global feed phytogenic market.

RECENT HAPPENINGS IN THIS MARKET

- In 2022, Cargill expanded its portfolio of phytogenic feed additives, focusing on natural and sustainable solutions to promote animal health and performance.

- In 2023, Kemin Industries invested in research and development to create novel photogenic formulations designed to improve the digestibility of feed ingredients and boost animal growth.

- In 2023, Natural Remedies expanded its product range of phytogenic feed additives with an emphasis on organic solutions, catering to the organic farming segment.

- In 2023, DuPont developed phytogenic feed additives that enhance animal performance and reduce environmental impact by improving nutrient utilization.

MARKET SEGMENTATION

This market research report on the global feed phytogenic market is segmented and sub-segmented into the following categories

By Ingredients

- Essential oils

- Oleoresin

- Herbs

- Species

By Application

- flavoring and Aroma

- organic trace minerals

- anti-parasitic

- feed take and digestibility

By Animal Type

- poultry

- aquaculture

- swine

- ruminant

- others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the size of global feed phytogenics market?

The size of the global feed phytogenics market was predicted to grow from USD 737.20 mn in 2025.

what is the growth of feed phytogenics market?

The feed phytogenics market is estimated to be growing at a CAGR of 6.35% to reach USD 1201.86 Mn by 2033.

what are the key market players of feed phytogenics market?

The global Feed Phytogenics market includes Cargill Inc., DuPont, Biomin, Pancosma SA, and Delacon Biotechnik.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]