Global Electric Truck Market Size, Share, Growth, Trends & Forecast Research Report – Segmented By Vehicle (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks), Propulsion (BEV, PHEV, HEV), Vehicle Range (Up to 300 miles, 300-600 miles, Above 600 miles), Application (Logistics & Delivery, Construction, Waste Management, Others), And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Electric Truck Market Size

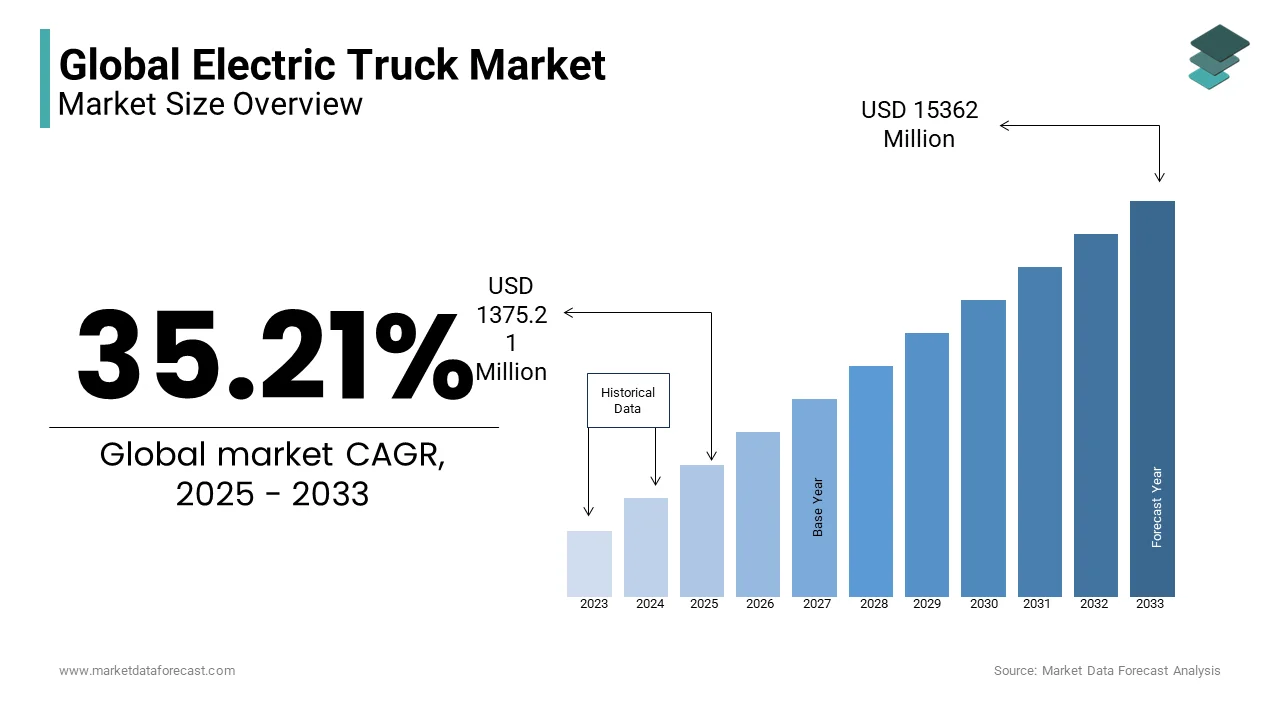

The global electric truck market size was valued at USD 1017.09 million in 2024 and is anticipated to reach USD 1375.21 million in 2025 and it is anticipated to reach USD 15362 million by 2033, growing at a CAGR of 35.21% during the forecast period 2025 to 2033.

The global electric truck market is expanding rapidly as part of the broader shift toward sustainable transportation and decarbonization of the logistics sector. Governments worldwide and particularly in the U.S. and Europe, are supporting this transition through incentives, tax breaks, and infrastructure investments. According to the U.S. Environmental Protection Agency (EPA), transportation accounts for nearly 28% of total U.S. greenhouse gas emissions making it a key focus for emissions reduction. Additionally, the International Energy Agency (IEA) projects that the global adoption of electric vehicles could reduce CO2 emissions by up to 1.5 gigatons annually by 2040. These regulatory efforts are accelerating the adoption of electric trucks in the pursuit of global climate goals.

Market Drivers

Environmental Regulations and Emission Reduction Targets

Stringent environmental regulations and emission reduction goals are major drivers of the Electric Truck Market. Governments worldwide are imposing stricter carbon emission standards to combat climate change. The U.S. Environmental Protection Agency (EPA) set new vehicle emission standards in 2022 to reduce greenhouse gas emissions by up to 60% by 2040. These regulations incentivize fleet operators to adopt zero-emission vehicles, including electric trucks, to meet compliance. The global push towards carbon neutrality by 2050 is intensifying the pressure to transition to electric-powered logistics solutions which is fueling demand for electric trucks across industries.

Advancements in Battery Technology and Cost Reduction

Advancements in battery technology are significantly driving the electric truck market. The U.S. Department of Energy reports that battery prices have fallen by 89% from 2010 to 2020 is making electric trucks increasingly affordable. In addition, innovations in battery energy density are improving vehicle range by addressing one of the primary concerns for fleet operators. Enhanced battery performance also enables faster charging times which is making electric trucks more practical for logistics. Electric trucks are becoming more competitive with traditional diesel vehicles because of these improvements and is promoting greater adoption across both short-haul and long-haul applications.

Market Restraints

High Initial Purchase Cost

A significant restraint for the Electric Truck Market is the high initial purchase cost compared to conventional diesel trucks. The upfront cost of an electric truck remains a major barrier because of the total cost of ownership may be lower due to fuel savings and reduced maintenance. As of 2023, the cost of electric trucks is still 40-60% higher than their diesel counterparts. According to the U.S. Department of Energy, the average cost of an electric truck is around $120,000 to $150,000 depending on size and specifications which is limiting affordability for many fleet operators and especially small and medium-sized businesses.

Limited Availability of Charging Infrastructure

Despite growing investments in charging infrastructure, the availability of high-capacity, fast-charging stations remains insufficient for long-haul trucking. The U.S. Department of Energy's Alternative Fuels Data Center reports that while there are over 55,000 public charging stations only about 2-3% of them cater to heavy-duty vehicles. This gap in infrastructure creates operational challenges and especially for long-distance freight because it increases range anxiety and delays due to extended charging times. A lack of widespread as well as strategically located charging stations restricts the practicality and convenience of electric trucks for fleet operators which is hindering market growth.

Market Opportunities

Government Incentives and Regulatory Support

A key opportunity in the Electric Truck Market lies in the increasing government incentives and regulatory support aimed at reducing carbon emissions. The U.S. government, for example, has committed $5 billion through the Infrastructure Investment and Jobs Act to expand EV charging infrastructure. Additionally, the Environmental Protection Agency (EPA) has introduced stricter emissions standards that encourage fleet operators to transition to zero-emission vehicles. By 2040, the Biden administration's Clean Trucks Plan aims for a 100% electric vehicle fleet in state and local government fleets and is further driving the demand for electric trucks.

Technological Advancements in Battery and Charging Solutions

Advancements in battery technology and fast-charging solutions present a significant opportunity for the electric truck market. The U.S. Department of Energy (DOE) has reported significant progress in reducing the cost of batteries, with prices falling by 89% from 2010 to 2020. This cost reduction when coupled with improvements in energy density and charging speed will increase the adoption of electric trucks. Additionally, the DOE's efforts to develop ultra-fast charging technology could drastically reduce downtime, making electric trucks more viable for long-haul logistics. Electric trucks will become more competitive with traditional diesel models as battery efficiency improves.

Market Challenges

High Battery Costs and Limited Range

One of the primary challenges in the Electric Truck Market is the high cost of batteries, which constitutes a significant portion of the overall vehicle cost. As of 2023, the global average cost of lithium-ion batteries is around $137 per kWh thereby impacting the affordability of electric trucks. The high battery costs also limit the range of electric trucks, which makes them less attractive for long-haul transportation. According to the International Energy Agency (IEA), the average range of electric trucks is still lower than that of conventional diesel trucks, and their widespread adoption in freight transport is restricted.

Charging Infrastructure and Range Anxiety

A significant hurdle for the Electric Truck Market is the lack of adequate charging infrastructure and particularly for long-haul routes. As of 2022, the U.S. had approximately 55,000 public charging stations but only a small percentage (around 2-3%) of these stations are specifically designed to support the heavy-duty electric truck market which requires higher power output for fast charging. The limited availability of these high-capacity charging points creates substantial barriers for fleet operators and long-distance truckers, leading to concerns about downtime and operational delays.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

35.21% |

|

Segments Covered |

By vehicle, propulsion, Vehicle Range, Application and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Tesla, Rivian, Volvo Group, Daimler AG, BYD, Nikola Corporation, Lordstown Motors, Scania AB, MAN SE, Freightliner (a division of Daimler Trucks North America), Competitive Landscape. |

SEGMENT ANALYSIS

Global Electric Truck Market By Vehicle

The heavy-duty trucks segment dominated the market by holding a significant share of 45.5% of the global market in 2024. Governments worldwide and particularly in North America and Europe, are implementing stringent regulations to reduce emissions from large trucks, which is driving the transition to electric heavy-duty trucks. For example, the European Union aims to reduce CO2 emissions from transport by 60% by 2040 which directly impacts the adoption of electric heavy-duty trucks. Furthermore, in the U.S., the EPA’s new emission standards for heavy-duty trucks are pushing fleet operators toward electric options. Electric heavy-duty trucks offer a lower total cost of ownership over the vehicle's lifecycle, which is driven by lower maintenance and fuel costs, making them a key driver of the global transition to electric transportation.

The light-duty trucks segment is growing significantly and is expected to witness the fastest CAGR of 22.2% over the forecast period owing to the increasing consumer demand for sustainable alternatives in urban transportation and the growing popularity of last-mile delivery services. The U.S. Department of Energy (DOE) reports that light-duty trucks account for a significant portion of transportation-related emissions, prompting regulatory efforts to accelerate their adoption. In the U.S., the Biden administration’s goal is to have 50% of all vehicle sales be electric by 2030, including light-duty trucks, which is creating strong demand. Additionally, the rise of e-commerce is boosting the need for electric light-duty trucks in urban logistics. The U.S. government’s incentives, such as tax credits for electric vehicles are also stimulating demand in this segment. Battery technology improves, and light-duty electric trucks become more affordable, making them increasingly attractive for both commercial and personal use and further propelling their rapid growth in the global market.

Global Electric Truck Market By Propulsion

The battery electric vehicles (BEV) captured 65.7% of the global market share in 2024 due to their zero-emission advantage, which aligns with global sustainability goals and stricter government regulations aimed at reducing transportation-related emissions. BEVs are powered solely by electric batteries which are eliminating the need for fossil fuels and significantly reducing carbon footprints. This makes them highly appealing to fleet operators and governments. According to the U.S. Environmental Protection Agency (EPA), BEVs are expected to play a key role in meeting the U.S. target of reducing greenhouse gas emissions from the transportation sector by 60% by 2040. Additionally, battery costs have fallen significantly over the past decade, positioning BEVs as more affordable for both commercial and private consumers. Continued advancements in battery technology and growing government incentives for zero-emission vehicles position BEVs to remain the leading propulsion segment in the electric truck market.

The plug-in hybrid electric vehicles (PHEV) segment is anticipated to witness a CAGR of 21.6% during the forecast period. The ability to switch between electric power and gasoline or diesel makes it a more versatile solution particularly in regions with limited access to fast-charging stations. According to the U.S. Department of Energy (DOE), PHEVs are becoming increasingly popular for short-range urban deliveries while maintaining the flexibility to operate longer distances when needed. The demand for PHEVs is driven by a growing preference for vehicles that can reduce emissions without compromising operational range and especially in regions where full BEV adoption may take longer. Infrastructure development and tightening fuel efficiency standards are expected to drive rapid growth in the PHEV segment.

Global Electric Truck Market By Vehicle Range

The 300-600 miles range segment occupied 41.5% of the global market share in 2024. The domination of the 300-600 miles range segment is majorly driven by its optimal balance between range, cost, and operational efficiency, making it ideal for both regional and long-haul freight transportation. Trucks in this range offer a sufficient driving distance for most commercial needs while remaining more affordable than those with ranges above 600 miles. According to the U.S. Department of Energy (DOE), the average range of electric trucks in the U.S. is around 300-400 miles which aligns well with the logistical demands of most fleet operators. This range is particularly beneficial for urban distribution and regional freight routes, which do not require the extended range of heavy-duty long-haul trucks but still offer a significant improvement over the shorter-range electric trucks. Battery technology continues to improve, and the 300-600 miles range segment is expected to remain dominant due to its practicality and cost-effectiveness.

The above 600 miles range segment is estimated to register the fastest CAGR of 16.2% over the forecast period owing to the increasing demand for long-haul trucking solutions that can operate over extended distances without frequent recharging. The U.S. Department of Energy (DOE) and the International Energy Agency (IEA) both report that long-haul trucking accounts for a significant portion of transportation emissions and is leading to a push for more capable electric trucks in this segment. Advancements in battery technology are expected to lower the cost of producing trucks with ranges above 600 miles, making them more accessible to fleet operators. Improved infrastructure for high-speed charging stations will make this segment even more attractive to operators in freight transport across regions. The long-range electric truck segment is essential for meeting decarbonization goals in long-distance freight transportation, a critical aspect of achieving global emission reduction targets.

Global Electric Truck Market By Application

The logistics & delivery segment held 55.6% of the global electric truck market share in 2024. The demand for electric trucks in logistics and delivery is primarily driven by the rise in e-commerce and the push toward reducing transportation-related emissions. According to the U.S. Environmental Protection Agency (EPA), transportation is responsible for nearly 28% of U.S. greenhouse gas emissions, and freight and delivery vehicles contribute significantly to this total. Urban centers impose stricter emissions regulations, making electric trucks the preferred choice for last-mile deliveries and regional distribution due to their zero-emission capabilities. The global shift toward sustainability and reduced operational costs, including lower fuel and maintenance expenses further strengthens the adoption of electric trucks in this application. Additionally, advancements in battery technology and growing infrastructure for fast-charging are making electric trucks more viable for logistics fleets which is contributing to their growing dominance in the market.

The waste management segment is on the rise and is expected to grow at the fastest CAGR of 19.2% over the forecast period in the global electric truck market. This segment is growing swiftly due to the increasing focus on urban sustainability, cleaner air, and reduced carbon emissions. Waste management vehicles which typically operate in dense urban areas, are subject to stringent emissions regulations, particularly in European and U.S. cities. The U.S. Department of Energy (DOE) has reported a significant rise in the adoption of electric trucks for waste collection due to their low-emission nature, which aligns with cities' goals of achieving zero-emission zones. Furthermore, governments across the globe, including in the U.S. and EU, implement more aggressive environmental policies and sustainability targets, and the waste management sector is being urged to adopt cleaner technologies. This, combined with the operational cost savings of electric trucks, including lower fuel and maintenance costs, is driving the rapid growth of the electric waste management truck market.

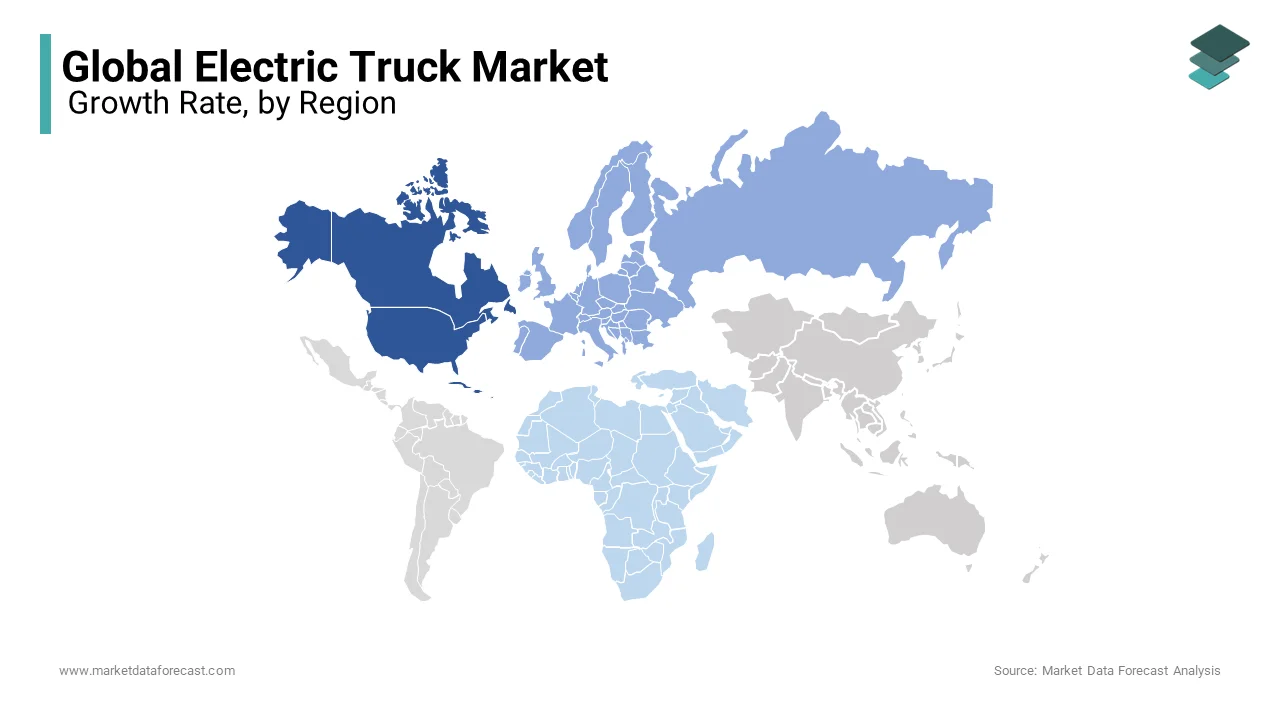

REGIONAL ANALYSIS

North America led the electric truck market by accounting for 45.4% of the global market share in 2024 owing to stringent environmental regulations, government incentives, and advancements in electric vehicle (EV) infrastructure. The U.S. leads the region with aggressive federal and state-level incentives such as the $5 billion allocated to EV charging infrastructure through the Infrastructure Investment and Jobs Act. The U.S. Environmental Protection Agency (EPA) projects that transportation emissions could be reduced by 60% by 2040, which will significantly impact the adoption of electric trucks. Canada is also witnessing increased demand due to its own EV-related policies and incentives.

Europe is predicted to grow at a CAGR of 17.1% during the forecast period. The region benefits from strong regulatory support such as the European Union’s goal to reduce carbon emissions by 55%, by 2030. Leading countries like Germany, France, and the Netherlands are actively fostering electric truck adoption through subsidies, zero-emission zones, and infrastructure investments. The EU's ambitious Green Deal and Clean Energy for All Europeans package are key drivers. By 2040, the European Commission expects nearly 30% of trucks on the road to be electric.

Asia-Pacific is expected to be the fastest-growing region for electric trucks and is expected to pose a CAGR of 20.2% over the forecast period. China being the dominant player accounts for the largest share of the global electric vehicle market, with the government setting aggressive targets for EV adoption including a goal of 20% of new vehicle sales being electric by 2025. The region benefits from strong manufacturing capabilities and government incentives for electric truck manufacturers. The Chinese Ministry of Industry and Information Technology (MIIT) is heavily investing in EV infrastructure which is making the country a key player in the electric truck segment.

Latin America is anticipated to have steady growth during the forecast period. Brazil is the key player supported by the government’s initiatives to reduce pollution in major cities and increase EV adoption. The Latin American Development Bank (CAF) has projected that the demand for electric vehicles in the region could rise as much as 30% over the next decade and is driven by stricter emissions regulations and growing environmental awareness. However, charging infrastructure remains a challenge in many parts of the region.

The market in Middle East and Africa is anticipated to have a moderate growth rate during the forecast period owing to growing interest from countries like the United Arab Emirates (UAE) and Saudi Arabia, which have set ambitious sustainability goals. The UAE's Energy Strategy 2050 aims for 50% of all vehicles to be electric by 2050, and Saudi Arabia is focusing on electric vehicle adoption as part of its Vision 2030 plan. The region's oil-rich economies are increasingly exploring green technology diversification as the adoption rate is lower which creates opportunities for future growth in the electric truck market.

KEY MARKET PLAYERS

Tesla, Rivian, Volvo Group, Daimler AG, BYD, Nikola Corporation, Lordstown Motors, Scania AB, MAN SE, Freightliner (a division of Daimler Trucks North America), Competitive Landscape. These are the market drivers that are dominating the global electric truck market.

The electric truck market is witnessing heightened competition due to the rising demand for eco-friendly transportation and rapid advancements in EV technology. Prominent industry players such as Tesla, Rivian, Volvo, and Daimler have ventured into the electric truck space, each offering innovative solutions. Tesla’s Cybertruck is set to disrupt the market with its futuristic design, while Rivian is targeting electric delivery trucks, notably for e-commerce leaders like Amazon.

In addition to these major companies, numerous startups like Nikola and Lordstown Motors are entering the arena, focusing on specialized segments such as long-distance trucking and urban logistics. The race to gain market dominance is fueled by continuous investments in battery innovation, autonomous systems, and fast-charging infrastructure, all of which are critical to ensuring mass adoption.

Government regulations aimed at curbing emissions and promoting sustainability are further intensifying competition as manufacturers work to comply with stricter standards. This dynamic environment has spurred companies to prioritize cost-effectiveness, performance, and operational efficiency in their electric truck offerings. The competitive nature of the sector is driving rapid innovation, accelerating the shift towards electric-powered freight transportation.

RECENT HAPPENINGS IN THIS MARKET

In January 2025, Blue Energy reported that it inked a contract with the government of Maharashtra to establish a factory for the production of electric trucks with a yearly roll-out capacity of 30 thousand vehicles. For this purpose, it plans to infuse a sum of 3,500 crore rupees to set up the manufacturing factory, which is scheduled to start in the fiscal year 2025-26.

In October 2024, upiter Electric Mobility (JEM), announced that it purchased Log9’s technology and business and technological assets for its Electric Truck Battery and Railway Battery Divisions.

MARKET SEGMENTATION

This research report on the global electric truck market is segmented and sub-segmented into the following categories.

By Vehicle

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

By Propulsion

- BEV

- PHEV

- HEV

By Vehicle Range

- Up to 300 miles

- 300-600 miles

- Above 600 miles

By Application

- Logistics & Delivery

- Construction

- Waste Management

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global electric truck market?

The global electric truck market size was valued at USD 1375.21 million in 2025

What are the market drivers that are driving the global electric truck market?

The Environmental Regulations and Emission Reduction Targets and Advancements in Battery Technology and Cost Reduction are main market driving factors in this market

What challenges are faced in the global electric truck market?

Challenges that are faced by the electric utility market are High Battery Costs, Limited Range, and Charging Infrastructure and Range Anxiety.

who are the market players that are dominating the global electric truck market?

Tesla, Rivian, Volvo Group, Daimler AG, BYD, Nikola Corporation, Lordstown Motors, Scania AB, MAN SE, Freightliner (a division of Daimler Trucks North America), Competitive Landscape

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]