Global Disposable Gloves Market Size, Share, Trends & Growth Forecast Report By Product, Material, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Disposable Gloves Market Size

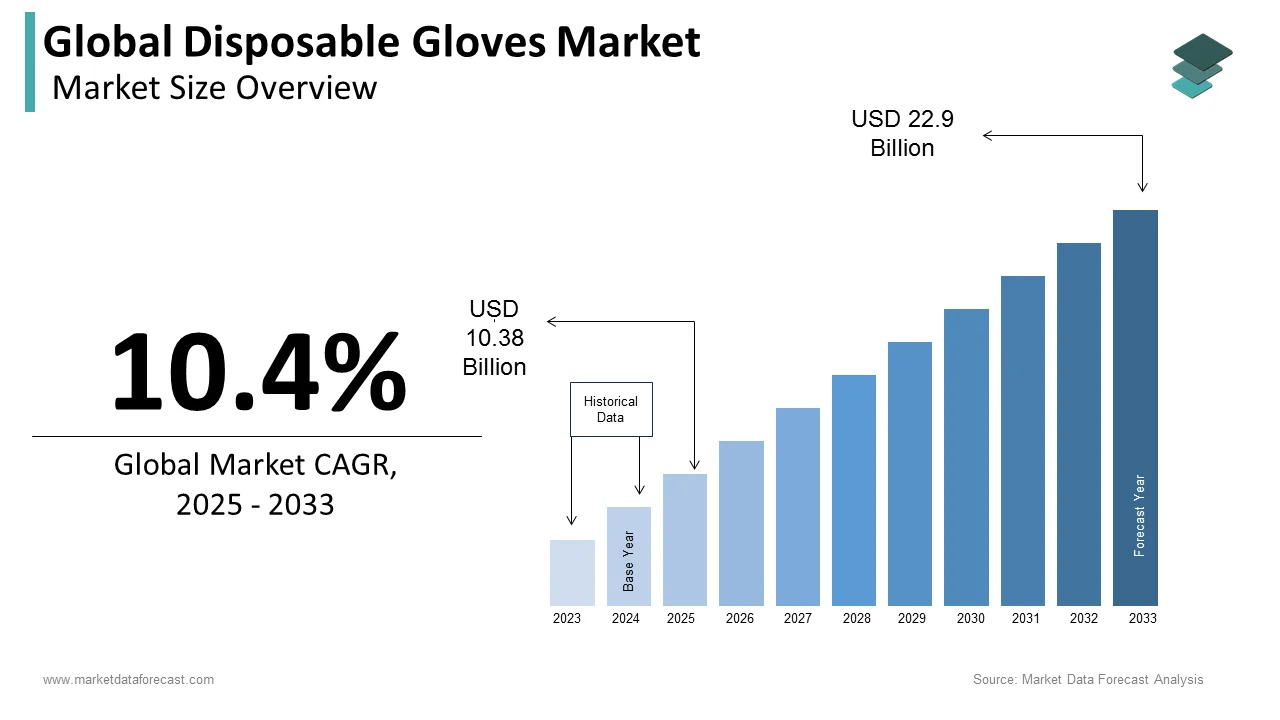

The size of the global disposable gloves market was worth USD 9.4 billion in 2024. The global market is anticipated to grow at a CAGR of 10.4% from 2025 to 2033 and be worth USD 22.9 billion by 2033 from USD 10.38 billion in 2025.

Disposable gloves are single-use gloves that decompose after being used. Disposable gloves are mainly composed of natural or synthetic rubber, and the raw materials used in their manufacture include natural rubber latex (NR gloves), nitrile butadien latex (NBR gloves), and PVC/softener paste (vinyl gloves). These gloves cover the entire hand and shield hands from debris, viruses, bacteria, chemicals, and other potentially harmful substances. Disposable gloves are useful in the workplace; they can also be worn for personal reasons. Disposable gloves are used for domestic tasks such as washing, gardening, and cooking.

MARKET DRIVERS

The growing prevalence of healthcare-associated infections primarily drives the growth of the global disposable gloves market.

Rising healthcare-associated infections are the primary driver of disposable glove market growth. Disposable gloves are increasingly becoming common in the healthcare industry as essential safety equipment for preventing cross-contamination between patients and workers. Surgeons, physicians, laboratory technicians, nurses, caregivers, dentists, and all other medical staff wear these masks, which have been checked and approved by the US Food and Drug Administration (FDA). Many infectious diseases are caused by cross-contamination, including urinary tract infections, wound infections (after surgery), and skin infections. Every year, hundreds of millions of people globally are infected by healthcare-associated infections, resulting in substantial mortality and financial costs for healthcare services. According to WHO, the prevalence of health-care-associated illness ranges from 3.5 % to 12 & in developing nations, while it ranges from 5.7 % to 19.1 % in low- and middle-income countries. Every year in Europe, the Centre reports that nearly 4,544,100 episodes of healthcare-associated infection infect 4,131,000 patients. The Centers for Disease Control (CDC) reports that HAIs cause an estimated 1.7 million illnesses and 99,000 deaths in American hospitals per year.

The growing demand for disposable gloves in various industries for health and safety also propels the disposable gloves market forward.

Industry-grade gloves are disposable protective gloves designed for use in various industries. The Occupational Safety and Health Association (OSHA) is in charge of regulating industrial glove use. Disposable gloves are mostly used in food processing, scientific labs, medical industries, and the cleaning industry, but their use has recently extended to almost every field. These gloves are used in various sectors, including agriculture/farming, auto/aviation/marine, infant care/pet care, beauty/hair/nail, dairy/ranch, industrial/manufacturing, janitorial/cleaning, plumbing/painting, and so on. To prevent infections, chefs and waiters in the food industry use disposable gloves while serving clients. Tattoo artists, spa and salon executives also use these gloves to ensure a sanitary atmosphere.

The advancement of disposable gloves has also contributed to developing the disposable gloves market.

As disposable glove technology advances, the strength, durability, and efficiency of materials improve, and as a result, the demand for disposable gloves rises. The invention of more sustainable, biodegradable, protein-free natural rubber gloves saves energy during production by 50%. The recently formulated natural rubber latex eliminates skin reactions caused by protein involvement, increasing demand. Furthermore, the thin-walled construction of disposable, chemical splash-resistant gloves usually made of latex, neoprene, or nitrile may provide an outstanding fit, comfort, dexterity, and grip whilst providing a secure, short-term barrier from low-hazard chemicals. As a result of the advantages provided by advanced gloves, the disposable gloves market is expanding.

MARKET RESTRAINTS

The high cost of the raw materials used for disposable glove production could impede the growth of the global disposable glove market.

The raw materials used to make disposable gloves play an important role in the quality of such gloves. The cost of these raw materials accounts for about half of the production expense, so the cost of gloves remains a problem for manufacturers. If the manufacturer uses less expensive raw materials, the disposable gloves' reliability, toxicity resistance, flexibility, and durability can suffer. Furthermore, the use of some raw materials may result in allergic reactions. As a result, raw materials and their prices have been a problem for manufacturers of disposable gloves.

Impact of COVID-19 on the global disposable gloves market

The contagious virus COVID-19 is spread by contacting human skin or objects, so this epidemic raises the need for personal protective equipment. Gloves, masks, and gowns are in high demand, especially in healthcare facilities. This condition also increases the use of single-use protective gloves to prevent cross-contamination. To prevent coronavirus contamination, workers of every company are currently wearing gloves. Not only in industry but even in public spaces, people are wearing gloves to prevent cross-contamination. Because of the increased demand for disposable gloves, businesses attempt to extend their processing facilities and raise output. Top Glove, for example, has had a run of record financial results. Annual earnings for the fiscal year ending August 31, 2020, increased by more than 400% from the previous year as demand for latex gloves skyrocketed due to the coronavirus pandemic. However, supply access has been disrupted by various problems, including production and travel bans imposed by some producing nations, as well as lockdowns that have caused producers to (temporarily) close down.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.4% |

|

Segments Covered |

By Product, Material, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ansell Ltd., Supermax Corporation Bhd, Medline Industries, Inc., Hartalega Holdings Berhad, Smart Glove, Semperit AG Holding, Kossan Rubber Industries Bhd, The Glove Company, 3M Company, Kimberly Clark, B. Braun Melsungen AG, Cypress Medical Products LLC, Unigloves (UK) Limited, Dynarex Corporation, Cardinal Health, Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, in 2024, the powder-free product segment dominated the global disposable glove market. Over the forecast period, stringent regulations on the usage of powdered gloves by numerous governments worldwide are projected to boost the powder-free gloves market. Powder-free products are chlorinated to make them less form-fitting, allowing for simple donning and removal without powder use. The powdered gloves, on the other hand, provide superior protection against dangerous chemicals and physical pollutants, as well as an ideal fit.

By Material Insights

Based on the material, because vinyl gloves are latex-free and produced from polyvinyl chloride and plasticizers, they are predicted to expand at the fastest CAGR throughout the forecast period. These gloves are mostly used in catering, food services, lab work, and analysis for food handling regulations. It offers the acid resistance needed for laboratory testing, minimal maintenance, and clean-up. As a result, vinyl gloves are projected to become more popular in the future.

By 2033, the nitrile material sector is expected to account for the largest revenue share. The increased acceptance of nitrile-based products in the medical, painting, chemical, laboratory, and dentistry industries can be attributed to this growth.

By End-User Insights

Based on the end-user, in 2024, the Medical & Healthcare segment dominated the market. The global COVID-19 pandemic is expected to increase glove demand in the healthcare industry. Surgical and examination gloves are two common categories of disposable gloves. Because of increased demand in hospital, veterinary, and dental applications, disposable examination gloves have seen significant expansion in the medical industry. Surgical disposable gloves are used by surgeons and operating room nurses and have higher quality standards than examination gloves.

REGIONAL ANALYSIS

Based on the region, in 2024, North America is expected to be the largest market for disposable gloves. Because of the growing number of work-related risks, local government organizations enforce strict workplace standards to safeguard worker safety. The Covid-19 outbreak has resulted in increased product demand in various industries across the region. Increasing healthcare spending and an elderly population and more awareness of HAIs are expected to boost the regional market growth. Because of the developing medical industry in the region, demand for hand protection equipment such as disposable and durable gloves is expected to increase.

Due to the significant consumption of medical disposable gloves in countries such as Germany, France, Italy, Spain, and others, Europe is expected to hold the second-largest share. Because of the expansion of the chemical, food, and equipment sectors in Germany, the disposable glove market is expected to rise rapidly. The European Union (EU) has changed several regulations relating to workers' safety and the standardization of personal protective equipment, which will likely increase the demand for disposable gloves in this region.

Over the next several years, Asia Pacific is expected to be the fastest-growing regional market. Increased product demand from medical, food & beverage, and industrial applications characterizes the Asia Pacific market. Due to the rising population, Asia-Pacific delivers lucrative opportunities for major players in the disposable gloves market. Furthermore, rising healthcare costs and the development of guidelines are projected to drive market expansion in the region. The need for disposable gloves in the medical industry has increased in key nations such as India and China, projected to boost the disposable gloves market in Asia-Pacific.

KEY MARKET PARTICIPANTS

Some of the prominent players present in the global disposable gloves market profiled in this report are Ansell Ltd., Supermax Corporation Bhd, Medline Industries, Inc., Hartalega Holdings Berhad, Smart Glove, Semperit AG Holding, Kossan Rubber Industries Bhd, The Glove Company, 3M Company, Kimberly Clark, B. Braun Melsungen AG, Cypress Medical Products LLC, Unigloves (UK) Limited, Dynarex Corporation, Cardinal Health, Inc., and many others.

These companies form the business strategies like mergers, acquisitions, product launches, joint ventures, and brand promotions to gain a strong foothold in the market.

RECENT MARKET DEVELOPMENTS

- On 3 Mar 2021, Ansell Limited, a specialist in security solutions, completed the purchase of the Primus brand and associated properties that include the Primus Gloves and Sanrea Healthcare Products Life Science company (Primus).

- On 29 April 2021, Yanimed, a Maltese manufacturer of nitrile gloves and safety masks, formed a joint venture with Guangdong Guyun Medical Technology Co., Ltd., a Chinese manufacturer of nitrile gloves. This partnership develops the new Yanimed – YaniPure brand, which will be available exclusively in the United States.

MARKET SEGMENTATION

This research report on the global disposable gloves market has been segmented and sub-segmented based on the product, material, end-user, and region.

By Product

- Powdered

- Powder-free

By Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polypropylene

- Others

By End-User

- Medical & Healthcare

- Non-Medical

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the global disposable gloves market?

The global disposable gloves market is predicted to be worth USD 9.4 billion in 2024.

What are the factors driving the growth of the disposable gloves market?

The growing demand for disposable gloves in healthcare facilities, the rising awareness regarding personal hygiene and safety, and the growing use of disposable gloves in the food and beverage industry are majorly boosting the growth of the disposable gloves market.

Which region is expected to dominate the disposable gloves market?

The Asia Pacific region is predicted to showcase dominance during the forecast period in the worldwide market.

Who are the key players in the disposable gloves market?

Top Glove Corporation Bhd, Kossan Rubber Industries Bhd, Supermax Corporation Berhad, Hartalega Holdings Berhad, Ansell Limited, Rubberex Corporation (M) Berhad, Adventa Berhad, Cardinal Health Inc., Dynarex Corporation, and Semperit AG Holding are some of the notable companies in the disposable gloves market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]