Global Diagnostic Imaging Market Size, Share, Trends & Growth Forecast Report By Type (X-Ray, Nuclear Medicine, Ultrasound, MRI, Tomography, Photoacoustic Imaging, Thermography, Tactile Imaging, Elastography, Functional Near-Infrared Spectroscopy and Echocardiography), Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Diagnostic Imaging Market Size

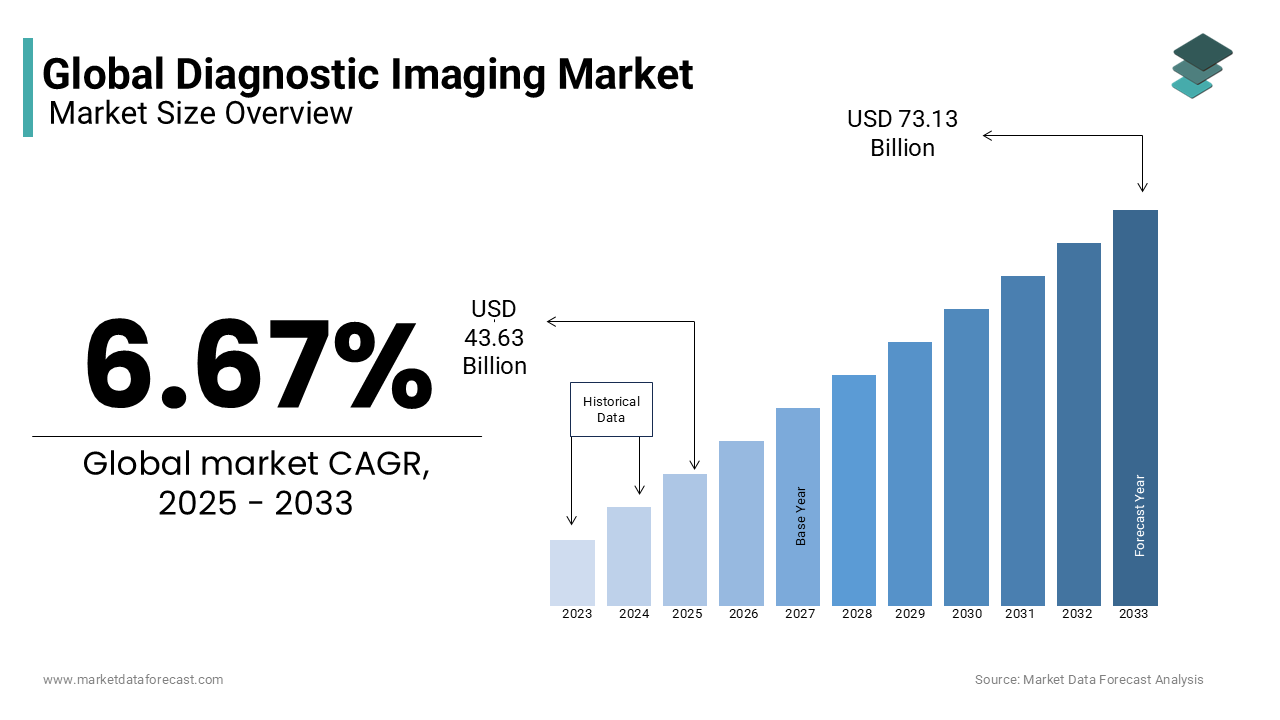

In 2024, the global diagnostic imaging market was valued at USD 40.9 billion and it is expected to reach USD 73.13 billion by 2033 from USD 43.63 billion in 2025, growing at a CAGR of 6.67% during the forecast period.

Diagnostic imaging is also called medical imaging. Medical imaging depicts information and picturization of internal organs and abnormalities. It establishes a database for anatomy and physiology to make it easy to identify abnormalities. Medical imaging draws images or visual representations of various parts of the human body with digital health to diagnose and treat underlying diseases.

MARKET DRIVERS

Growing Demand for Medical Imaging Services

The demand for medical imaging services is always at the top end and will continue to grow throughout the forecast period, boosting the growth of the digital imaging market. Then, any other market considering the healthcare sector's diagnostic imaging market holds the most considerable revenue and will continue to grow due to technological advancements, rising incidences of chronic diseases, awareness in the population of a healthy lifestyle, and early detection of diseases. R&D activities are a key factor for market growth. Government funding to healthcare sectors and, most importantly, the diagnostic imaging market is crucial for growth. In developing regions such as Asia-Pacific and LAMEA, the market is expected to grow immensely. Highly populated countries where the senior population's ratio is high also hold the most significant shares globally.

In addition, the rising preference for early detection of diseases, increasing awareness of early diagnosis and treatment, and the growing geriatric and pediatric population are contributing to the expansion of the digital imaging market. Government initiatives to create awareness of the early stages of diagnosis and treatment and investments from government and private organizations to worldwide healthcare fuel the diagnostic imaging market. Technological advances in the diagnostic imaging market led to new inventions, such as devices for various disease diagnoses. In addition, the rising demand for knowledge to be provided to students in hospitals and universities by providing training for advanced medical imaging technology influences market growth. With an increase in population and chronic diseases such as diabetes, cancers, cardiovascular issues, and organ failures, the spread of diseases and infections is expected to increase market size.

Various health monitoring systems introduced by the government, easy usage of mobile health systems, subscription plans in healthcare apps, and a rise in vulnerable diseases augment market growth factors. In addition, the rise in demand for various medical diagnostic tests such as MRI, nuclear imaging and PET scans, Ultrasound, Computed Tomography (CT) scans, and X-rays are the primary growth contributing factors for the diagnostic imaging market across the globe.

MARKET RESTRAINTS

High Costs

The high costs involved with treatment procedures and the rise in complications due to exposure to high radiation are hindering the global diagnostic imaging market growth. The preliminary reimbursement plans, high costs associated with diagnosis plans and procedures, and helium shortage are expected to hamper the market growth. Skilled workers are needed daily. Since this market lacks skilled workers and staff, operating all the procedures will cause low market growth. In addition, the risk of radiation exposure is high for patients, workers, and staff; this may create significant health issues with daily exposure. Recently, a severe helium shortage has been recorded in many countries, and stringent approval regulations restricted this market. In addition, repeated quality checks and control of medical devices are hard to process.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

GE Healthcare, Siemens Healthcare, Toshiba Medical Systems Corporation, Hitachi Medical Corporation, Hologic Inc., and Fujifilm Shimadzu Corporation |

SEGMENTAL ANALYSIS

By Type Insights

X-ray imaging dominates the global diagnostic imaging market, commanding a market share of approximately 35%, according to the World Health Organization (WHO). This leadership is attributed to its widespread adoption across healthcare facilities due to its cost-effectiveness, accessibility, and versatility in diagnosing a wide range of conditions. According to the European Society of Radiology, over 60% of diagnostic imaging procedures performed globally involve X-rays, making it an indispensable tool for preliminary diagnostics. The affordability of X-ray systems, coupled with advancements in digital radiography, has further amplified its adoption. For instance, the American College of Radiology reports that digital X-ray systems have reduced radiation exposure by up to 50% compared to traditional film-based systems, enhancing patient safety. Additionally, the growing prevalence of chronic diseases such as cardiovascular disorders and respiratory conditions has increased the demand for X-ray imaging. According to the Centers for Disease Control and Prevention (CDC), cardiovascular diseases account for nearly 30% of global deaths annually, underscoring the critical role of X-rays in early detection and management.

Functional Near-Infrared Spectroscopy (fNIRS) emerges as the fastest-growing segment, with a projected CAGR of 12.5% from 2023 to 2030, as per the National Institutes of Health (NIH). This rapid growth is driven by its non-invasive nature and ability to provide real-time monitoring of brain activity, making it highly valuable in neurology and psychiatric research. According to the NIH, fNIRS is increasingly being adopted in clinical trials and research studies to study cognitive functions and neurological disorders such as Alzheimer's disease and depression. The European Brain Council highlights that neurological disorders affect over 179 million people in Europe alone, creating a favorable environment for advanced imaging technologies like fNIRS. Furthermore, investments in neuroscience research are expected to exceed $30 billion globally by 2030, further accelerating this trend. The segment's growth underscores its critical role in enabling innovative diagnostic solutions and advancing personalized medicine.

By Application Insights

Oncology represents the largest application segment in the global diagnostic imaging market, holding a market share of approximately 28%, according to the International Agency for Research on Cancer (IARC). This dominance is attributed to the rising incidence of cancer worldwide, which necessitates advanced imaging techniques for early detection, treatment planning, and monitoring. The IARC reports that there were over 19 million new cancer cases globally in 2022, with projections indicating a 30% increase by 2030. Diagnostic imaging modalities such as MRI, CT scans, and PET scans play a pivotal role in oncology, enabling precise tumor localization and staging. The American Cancer Society highlights that early diagnosis through imaging technologies improves survival rates by up to 40% for certain cancers, underscoring their importance. Additionally, the growing emphasis on precision medicine has amplified the demand for advanced imaging solutions tailored to individual patient needs.

Neurology emerges as the fastest-growing application segment, with a projected CAGR of 11.8% from 2023 to 2030, as per the World Federation of Neurology. This rapid growth is fueled by the increasing prevalence of neurological disorders such as Alzheimer's disease, Parkinson's disease, and epilepsy, which require advanced imaging for accurate diagnosis and treatment. According to the Global Burden of Disease Study, neurological disorders account for over 16% of global deaths, creating a significant demand for diagnostic tools like MRI and fNIRS. The European Brain Council reports that investments in neurological research exceeded €10 billion in 2022, further boosting the adoption of advanced imaging technologies. Additionally, the growing focus on mental health has amplified the need for non-invasive imaging solutions to study brain activity and cognitive functions. This trend positions neurology as a key driver of innovation in the diagnostic imaging market.

REGIONAL ANALYSIS

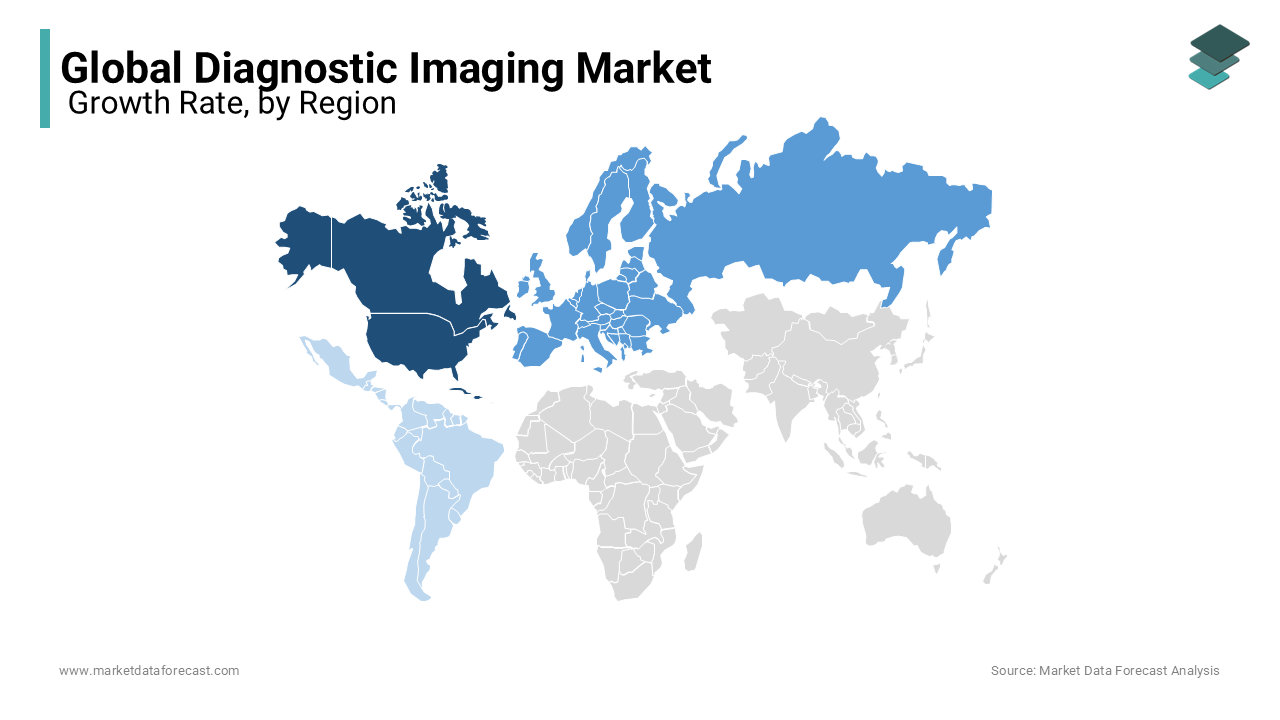

North America leads the global diagnostic imaging market, holding a market share of approximately 35%, according to the U.S. Food and Drug Administration (FDA). This prominence is attributed to the region's advanced healthcare infrastructure, high healthcare expenditure, and strong presence of key market players. The FDA reports that over 70% of hospitals in the United States are equipped with advanced imaging systems such as MRI and CT scanners, reflecting the region's commitment to cutting-edge medical technologies. Additionally, the American Medical Association highlights that diagnostic imaging accounts for approximately 10% of total healthcare spending in North America, underscoring its significance. The growing prevalence of chronic diseases, coupled with government initiatives to improve healthcare access, further drives market growth.

Europe ranks second, with a market share of approximately 25%, as per the European Society of Radiology. The region's leadership stems from its robust regulatory framework, emphasis on research and development, and widespread adoption of advanced imaging technologies. The European Commission reports that investments in healthcare infrastructure exceeded €50 billion in 2022, creating a favorable environment for diagnostic imaging solutions. Additionally, the growing aging population has increased the demand for imaging modalities such as X-rays and ultrasound. The European Brain Council highlights that neurological disorders affect over 179 million people in Europe, further amplifying the need for advanced imaging technologies.

Asia-Pacific holds a market share of approximately 20%, according to the Asian Development Bank. The region's rapid economic growth, increasing healthcare expenditure, and rising prevalence of chronic diseases drive the adoption of diagnostic imaging technologies. The Asian Development Bank reports that healthcare spending in the region grew by 8% annually over the past five years, creating opportunities for market expansion. Additionally, the growing awareness of early disease detection has amplified the demand for affordable imaging solutions such as X-rays and ultrasound. The region's large population base further ensures sustained growth in the diagnostic imaging market.

Latin America accounts for approximately 10% of the market, as per the Pan American Health Organization. The region's growing healthcare infrastructure and increasing focus on improving diagnostic capabilities drive the adoption of imaging technologies. The Pan American Health Organization reports that over 60% of hospitals in Latin America have upgraded their imaging systems in the past decade, reflecting the region's commitment to modernizing healthcare services. Additionally, the rising prevalence of infectious diseases and chronic conditions has increased the demand for diagnostic imaging solutions, ensuring steady market growth.

The Middle East and Africa hold a market share of approximately 10%, according to the African Union's Health Department. The region's growing investments in healthcare infrastructure and increasing prevalence of communicable and non-communicable diseases drive the adoption of diagnostic imaging technologies. The African Union's Health Department reports that healthcare spending in the region grew by 6% annually over the past five years, creating opportunities for market expansion. Additionally, government initiatives to improve healthcare access have amplified the demand for affordable imaging solutions such as X-rays and ultrasound, ensuring sustained growth in the diagnostic imaging market.

KEY MARKET PLAYERS

Some of the notable companies dominating the global diagnostic imaging market profiled in this report are GE Healthcare, Siemens Healthcare, Toshiba Medical Systems Corporation, Hitachi Medical Corporation, Hologic Inc., and Fujifilm Shimadzu Corporation.

RECENT HAPPENINGS IN THE MARKET

- In May 2020, RADLogics announced that it is adding software to the nuance AL Marketplace. Artificial intelligence-powered medical imaging applications are used for the detection of COVID-19.

- In May 2020, Life Image Launched the Patient Connect Portal to control longitudinal imaging records and medical data to share with care teams.

- In Feb 2019, Koninklijke Philips N.V., Netherlands, launched the EPIQ Elite ultrasound system for general imaging and obstetrics and gynecology applications.

- In Jan 2019, Core Medical Imaging Inc. was acquired by Shimadzu Medical Systems USA, a Shimadzu Corporation subsidiary, to strengthen its healthcare business in North America.

- In Nov 2018, GE Healthcare partnered with the Puget Sound Health Care System of Veterans Affairs (VA) to expand 3D imaging in healthcare. The VA used 3D technology before this partnership was not made for medical use. With this collaboration, however, the VA got access to the advanced 3D Printing Software integrated with AW Volume Share workstations of GE Healthcare.

- In Feb 2018, CurveBeam LLC launched an enhanced version of the Planmed Verity CBCT scanner with a 3D orthopedic and head and neck imaging solution.

- In Dec 2017, Shimadzu Corporation (Japan) introduced the virtual handheld X-ray system integrated with a Flat Panel Detector (FPD) version of MobileDaRt Evolution MX8.

- Hitachi Ltd. (Japan) unveiled a 1.5 T superconductive MRI system, ECHELON Smart, in 2017.

- Siemens Healthineers and a German-based launched a biograph vision PET/CT Scan system.

MARKET SEGMENTATION

This market research report on the global diagnostic imaging market has been segmented and sub-segmented based on the type, application, and region.

By Type

- X-Rays

- Portable

- Handheld

- Nuclear Medicine

- Scintigraphy

- PET Imaging

- SPECT Imaging

- Ultrasound

- 2D

- 3D

- 4D

- Doppler Imaging

- MRI

- Tomography

- Photoacoustic Imaging

- Thermography

- Tactile Imaging

- Elastography

- Functional Near-Infrared Spectroscopy

- Echocardiography

By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the diagnostic/medical Imaging market worldwide in 2025?

The global diagnostic/medical Imaging market size was valued at USD 43.63 billion in 2025.

Which region is growing the fastest in the diagnostic/medical Imaging market ?

Geographically, the North American diagnostic/medical Imaging market accounted for the largest share of the global market in 2023.

At What CAGR, the global diagnostic/medical Imaging market is expected to grow from 2025 to 2033?

The diagnostic/medical Imaging market is estimated to grow at a CAGR of 6.67% from 2025 to 2033.

Does this report include the impact of COVID-19 on the diagnostic/medical Imaging market?

Yes, we have studied and included the COVID-19 impact on the global diagnostic/medical Imaging market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]