Global Diabetes Treatment Market Size, Share, Trends & Growth Analysis Report – Segmented By Drug Class, Diabetes Type, Distribution Channel & Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Forecast (2024 to 2032)

Global Diabetes Treatment Market Size (2024 to 2032)

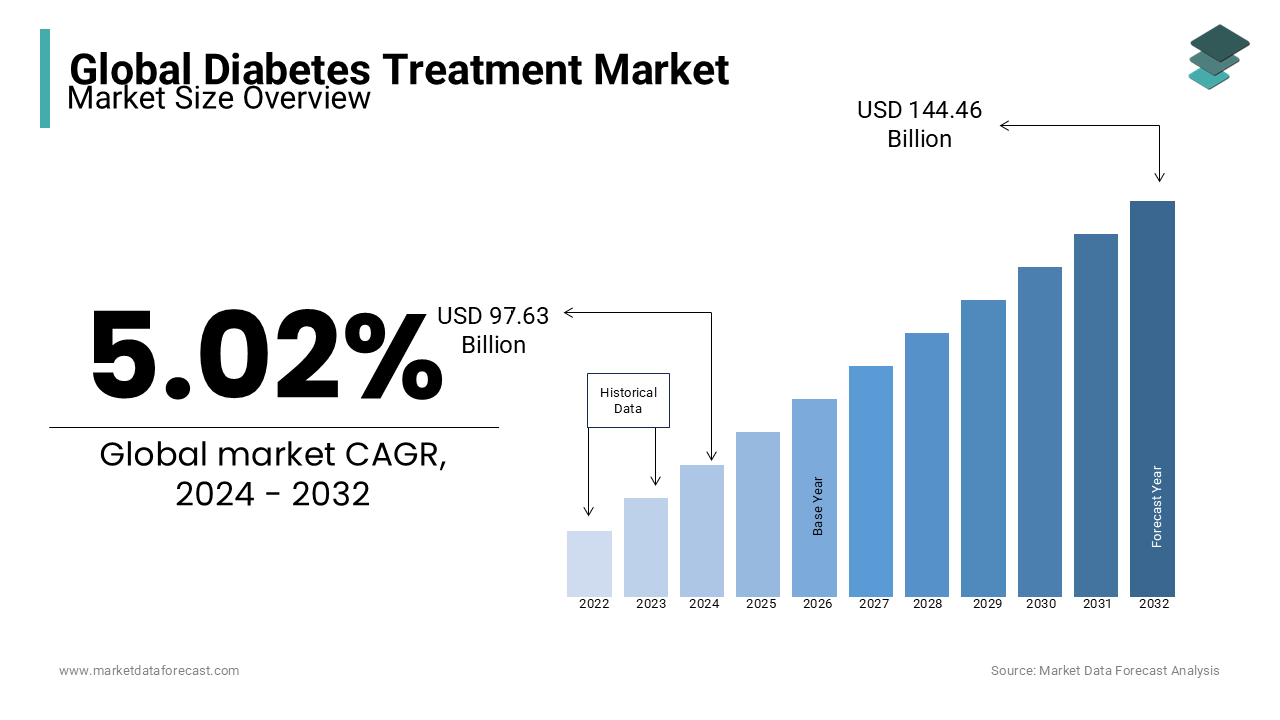

The global diabetes treatment market is forecasted to grow at a CAGR of 5.02% from 2024 to 2032 and will be worth USD 144.46 billion by 2029 from USD 97.63 billion in 2024.

Diabetes, often known as diabetes mellitus, is a collection of metabolic illnesses characterized by high blood sugar levels. Diabetes is caused by either a lack of insulin production, a failure of the body's cells to respond effectively to insulin, or both. Big pharmaceutical companies are monitoring a large number of developing diabetes medications. Drugs like Januvia and Byetta have shown efficacy and safety in treating blood glucose. To control crucial insulin therapy, blood glucose monitoring systems that are practically less painful, accurate, easy to use, and upgraded are available on the market.

MARKET DRIVERS

The development of economical and effective diabetic medicines, increased public awareness about diabetes self-management, and government support propel the growth of the global diabetes treatment market Introducing new analytical technologies and improvements in diabetes therapy is causing a considerable shift in the worldwide diabetes treatment market.

In addition, the increased prevalence of sedentary lifestyles and obesity in the global population has dramatically risen in diabetes cases. Therefore, in the overall diabetes treatment market, submarkets such as human insulin and analogs are likely to remain dominant.

The global diabetes treatment market is further predicted to grow as type-1 and type-2 diabetes rise. Increased healthcare expenditure, easy access to treatment due to an increase in the number of hospitals, rising number of diabetic patients due to unhealthy lifestyles, rising cases of diabetes in the young generation due to bad genetics, and improper dieting are other key factors driving the market growth. In addition, increased diabetes awareness and untapped market opportunities in developing regions will likely give several market development possibilities.

Y-O-Y rise in the cases of diabetes promotes the growth of the diabetes treatment market. Diabetes cases are increasing globally due to sedentary lifestyles, high levels of stress, and poor dietary habits. According to WHO figures, about 422 million people worldwide have diabetes, with most sufferers living in low-income nations. Every year, diabetes causes roughly 1.5 million fatalities. About 9 million persons were given a type 1 diabetes diagnosis in 2019; the majority of them were from high-income nations. On the other hand, type 2 diabetes predominates globally, accounting for around 95% of all cases. The market is anticipated to advance due to the excessive increase in diabetes incidences worldwide.

MARKET RESTRAINTS

However, high diabetes diagnostic and treatment costs and a strict regulatory framework are forecasted to negatively impact the e-market's growth rate; expanding the accessibility of alternative medicines and rising reimbursement disparities, among other factors, will obstruct market expansion and pose additional challenges to the diabetes treatment industry. In addition, government regulations, drug patent expiration, and trade protectionism are all factors that could slow the rate of the diabetes treatment market in the future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Drug Class, Diabetes Type, Distribution Channel & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Novo Nordisk A/S, Sanofi, Merck & Co., Inc., Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Novartis AG, Johnson & Johnson Services, Inc. |

SEGMENTAL ANALYSIS

Global Diabetes Treatment Market By Drug Class

Based on the drug class, the insulin segment is predicted to grow at a promising CAGR in the global diabetes treatment market over the forecast period, owing to rising demand from the Type-1 diabetes population, which surpassed 30 million people by the end of 2020. Some Type-2 patients also use insulin. Although Type-1 diabetes affects just 10% of the population, Type-1 diabetics have a greater insulin intake. Increased understanding of the benefits of insulin for diabetic patients is driving demand for the drug, particularly in emerging economies. Other reasons, such as the rapid development of insulin delivery methods, key firms' medication, analog research, and the rise in the geriatric and obese population, could fuel the expansion of the insulin market.

The SGLT2 segment is also expected to show newfound progress in the market revenue due to the recent research and development of the drug in treating type 1 diabetes. In addition, the Sodium-glucose cotransporter 2 is useful alongside the diet and nutrition balance to manage blood sugar levels. Moreover, it is said to have fewer side effects, further promoting its revenue in the market.

Global Diabetes Treatment Market By Diabetes Type

Type 2 diabetes affects the great majority of people with diabetes. This is because the body's ability to utilize insulin properly is impaired in type 2 diabetes. Insulin resistance is the term for this. As type 2 diabetes advances, the pancreas may generate less and less insulin.

Type-1 diabetes cases have also been rising recently, leading to revenue for the market. According to the latest reports, around 1.6 million Americans have Type 1 diabetes, including 200,000 youth, and there are approximately 64,000 new cases yearly. Therefore, the rising prevalence of the disease and the lack of sufficient research and drugs in the segment are fuelling the advancement of the segment.

Global Diabetes Treatment Market By Distribution Channel

Based on the distribution channel, the hospital pharmacies segment is projected to have the largest share in the global diabetes treatment market during the forecast period. Hospitals strive to offer the best services possible and have sophisticated infrastructure and extensive connections. Hospitals also experience a considerable increase in patients due to the confidence they gain from qualified staff and reliable medical facilities. As a result, hospital pharmacies have the widest selection of medications, contributing to the segment's dominance.

The retail segment is also expected to dominate the market due to the proliferation of new pharmacies and the increasing number of retail pharmacies worldwide. In addition, the rising retail selling diabetes care equipment and drugs are supporting the segment.

The online segment is also expected to rise due to the recent interest in personalized treatment and the increasing trend of home care equipment like diabetes machines, along with the rapid digitalization of the world.

REGIONAL ANALYSIS

In 2023, the North American diabetes treatment market accounted for a significant global market share and was predicted to grow at a promising CAGR during the forecast period. The United States dominates the market for diabetes treatment in North America. Insulin prices in the United States are among the highest in the world, forcing patients to extend the life of their insulin and opt for less expensive choices like human insulin. As a result, insulin prices are expected to fall during the next few years.

The expanding diabetic population in Europe and the growing number of patients who use various diabetes care devices daily will be the key drivers of growth. The insulin market was the most valuable, accounting for almost 45% of the total market value.

On the other hand, the APAC diabetes treatment market is expected to register the highest CAGR in the global market during the forecast period and is predicted to value USD 35.96 billion by 2032. Southeast Asian countries will likely see increased demand in the next few years, owing to local government and healthcare organizations' efforts to raise awareness about diabetes, medications, and devices. As a result, over the last decade, the diabetes population in this area has risen at an alarming rate. However, the absence of healthcare infrastructure and coordinated supply chains in Asia-Pacific rising nations is a significant barrier for the diabetic medications market, resulting in pricing discrepancies.

In 2023, China will have the largest share of the BRIC market for diabetes treatment equipment. In China, the diabetes therapeutics market will grow the highest. The high number of diabetics in the country and increased government financing for diabetes management and the diabetes care equipment business have contributed to this dominance. During the period, India is predicted to develop at the fastest rate, owing to the potential given by the country, particularly in terms of the growing use of mHealth (mobile health), which helps the diabetes management mobile applications segment.

The Latin American diabetes treatment market is predicted to accelerate at a CAGR of 5.91% during the forecast period. Among various countries of Latin America, Brazil accounted for more than half of the share of this region in 2023.

KEY MARKET PARTICIPANTS

Novo Nordisk A/S, Sanofi, Merck & Co., Inc., Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Novartis AG, Johnson & Johnson Services, Inc., and Bayer AG are a few of the prominent companies dominating the global diabetes treatment market currently and profiled in this report.

RECENT HAPPENINGS IN THIS MARKET

- In October 2022, Novo Nordisk will submit a regulatory application for once-weekly insulin icodec. According to Novo Nordisk, the results of the trials indicate that insulin Icodec may be the best insulin for persons with type 2 diabetes. The pharmaceutical company's headquarters in Denmark stated that it plans to submit a regulatory application for once-weekly insulin icodec in the US, the EU, and China in the first half of 2023. In addition, in a 52-week trial comparing once-weekly insulin icodec with once-daily basal insulin, the ONWARDS 5 phase 3a trial with once-weekly insulin icodec in adults with type 2 diabetes, the business released critical findings on Monday.

- In October 2022, Tirozepatide from Lilly was granted US FDA Fast Track status for the treatment of people who are obese or overweight and have weight-related comorbidities. The US Food and Drug Administration (FDA) has given Fast Track designation for the investigation of tirzepatide for treating people with obesity or overweight who have weight-related comorbidities, Eli Lilly & Company stated today. To facilitate the development and speed up the review of medications to treat severe disorders and meet an unmet medical need, the FDA provides the designation "Fast Track." The goal of the Fast Track designation is to give the patients potential medications more quickly. Lilly intends to start a rolling submission of a new drug application (NDA) for tirzepatide in adults with obesity or overweight based on conversations with the FDA.

- In October 2022, In India, Glenmark Pharmaceuticals introduced the drug lobeglitazone for the treatment of adult type-2 diabetes. The medication seeks to reduce diabetics' insulin resistance. For the first time, Glenmark introduced Lobeglitazone in India to address the issue of insulin resistance in people with type-2 diabetes. In addition, the medication aids in increasing insulin sensitivity in bodily cells. With this, Glenmark has made history as the first pharmaceutical company to market the insulin sensitizer Thiazolidinedione Lobeglitazone. The anti-diabetic drug will be sold under the trade name LOBG and cost 10 cents for each pill.

- In March 2019, Novo Nordisk announced to invest approximately USD 98 million to upgrade and expand its insulin medicine production facility in Kalundborg, Denmark.

- In February 2020, the FDA approved Abbott's FreeStyle Libre 14-day Flash glucose monitoring systems for hospital use.

- Insulet signed a commercialization agreement with DexCom, Inc. (US) in February 2020 to connect its present and future CGM systems to its tubeless insulin pump system, the OMNIPOD Horizon system.

DETAILED SEGMENTATION OF THE GLOBAL DIABETES TREATMENT MARKET INCLUDED IN THIS REPORT

This research report on the global diabetes treatment market has been segmented and sub-segmented based on drug class, diabetes type, distribution channel, and region.

By Drug Class

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

By Diabetes Type

- Type-1

- Type-2

By Distribution Channel

- Online pharmacies

- Hospital Pharmacies

- Retail Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

how big is the global diabetes treatment market?

The global diabetes treatment market size is estimated to grow to USD 144.46 billion by 2032.

What is the predicted value of the global diabetes treatment market in 2024?

As per our research report, the global diabetes treatment market is predicted to value USD 97.63 billion in 2024.

What is the expected growth rate of diabetes treatment market for the coming future?

The global diabetes treatment market is expected to rise at a CAGR of 5.02% from 2024 to 2032.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]