Global Copper Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Primary Copper, Secondary Copper), Form (Wire Rods, Plates, Sheets and Strips, Tubes, Bars, and Sections, Others), Mining Type (Underground Mining, Surface Mining), Application (Construction, Transportation, Appliances and Electronics, Power Generation, Distribution and Transmission, Others) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Copper Market Size

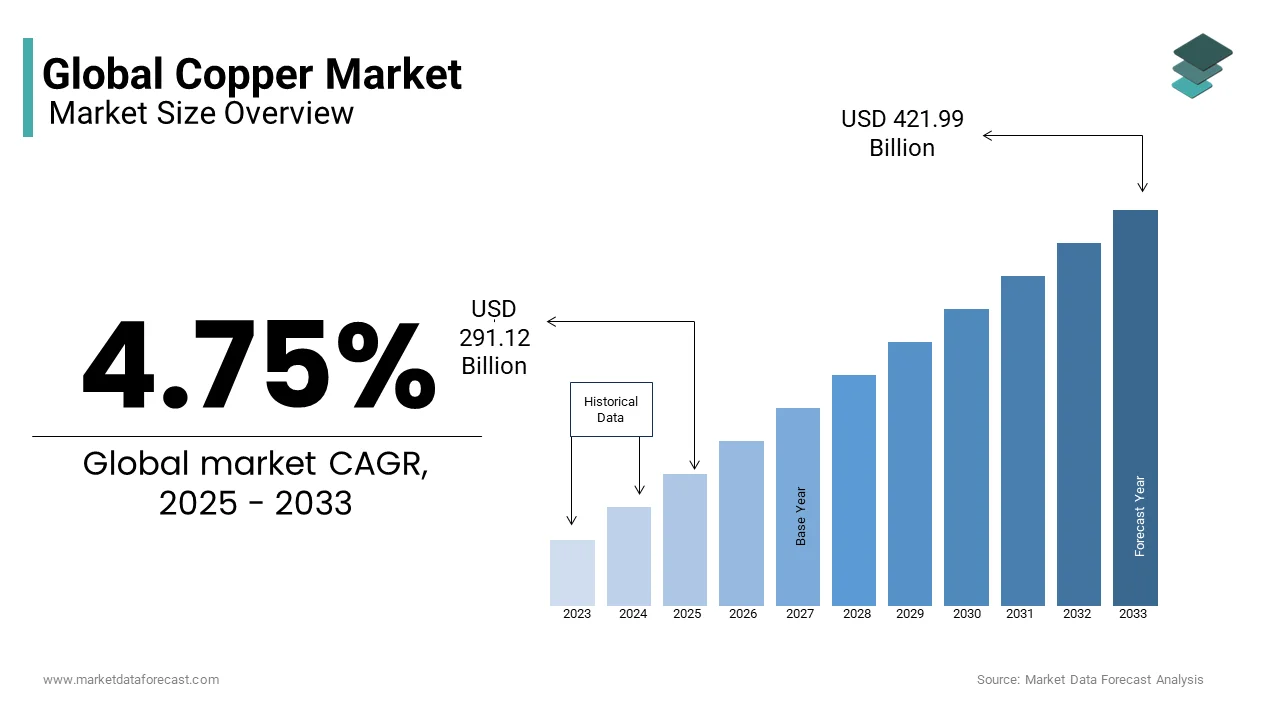

The global copper market was valued at USD 277.92 billion in 2024 and is anticipated to reach USD 291.12 billion in 2025 from USD 421.99 billion by 2033, growing at a CAGR of 4.75% during the forecast period from 2025 to 2033.

Copper is symbolized as Cu with an atomic number of 29 and is a reddish-brown metal renowned for its exceptional electrical and thermal conductivity, malleability, and resistance to corrosion. These properties make it indispensable across various industries, including electrical wiring, power generation, electronics, construction, and telecommunications. As of 2024, the global copper market has experienced notable growth due to the urbanization and industrialization, particularly in emerging economies, which escalate the demand for copper in construction, manufacturing, and infrastructure development. The metal's role in renewable energy technologies and electric vehicles further amplifies its significance in the modern economy.

In terms of production, global copper mine output in 2024 is expected to reach 22.9 million tonnes, marking a 3.2% increase from the previous year. Refined copper production is also anticipated to rise, totaling 26.71 million tonnes. However, despite these increases, the market is forecasted to experience a surplus of over 469,000 metric tons in 2024, indicating a potential oversupply amidst robust demand. The price dynamics of copper serve as a barometer for global economic health. In the second quarter of 2024, copper prices fluctuated between $9,500 and $9,800 per metric ton, reflecting favorable macroeconomic conditions, including economic stimulus measures in China. These factors, coupled with supply constraints and a resurgence in physical demand, have contributed to the upward pressure on copper prices.

Market Drivers

Global Infrastructure Development and Urbanization

The demand for copper is heavily influenced by global infrastructure development and urbanization, particularly in emerging economies. According to the International Copper Study Group (ICSG), global refined copper usage increased by approximately 1.5% in 2022, driven by infrastructure projects in regions like Asia and Africa. The U.S. Geological Survey confirms that China remains the largest consumer of copper, accounting for over 54% of global demand in 2022, as reported in its Mineral Commodity Summaries. China’s National Bureau of Statistics highlights that the country’s urbanization rate reached 65.2% in 2022, fueling demand for copper in construction, power grids, and transportation networks. Additionally, the U.S. Department of Commerce highlights that the $1 trillion Infrastructure Investment and Jobs Act will significantly increase copper usage domestically, particularly in broadband expansion and electric grid modernization.

Transition to Renewable Energy and Electrification

The transition to renewable energy and electrification is a key driver of copper demand worldwide. The International Energy Agency (IEA) reports that electric vehicles (EVs) use up to four times more copper than internal combustion engine vehicles, with global EV sales exceeding 6.6 million units in 2021 and continuing to grow rapidly. Wind and solar energy systems also rely on copper for efficient electricity transmission, with the IEA estimating that renewable energy capacity additions reached 300 gigawatts globally in 2022. The U.S. Energy Information Administration (EIA) notes that renewable energy accounted for 29% of global electricity generation in 2022, driving demand for copper-intensive technologies. Furthermore, a World Bank report titled "Minerals for Climate Action" projects that copper demand from renewable energy technologies could rise by over 50% by 2050 as countries accelerate efforts to meet net-zero emissions targets.

Market Restraints

Environmental Regulations and Mining Restrictions

Stringent environmental regulations and mining restrictions significantly hinder copper production. The U.S. Environmental Protection Agency (EPA) emphasizes that mining operations face growing scrutiny due to their ecological impacts, including water pollution and land degradation. In 2022, Chile, the world’s largest copper producer, introduced stricter environmental laws, leading to a decline in copper output compared to 2021, according to data from the Chilean Copper Commission (Cochilco). Additionally, the International Energy Agency (IEA) highlights that permitting delays for new mining projects have constrained supply growth, with global copper production increasing by less than 1% annually over the past five years. These regulatory challenges raise operational costs and limit expansion, creating supply bottlenecks. While essential for environmental protection, these measures complicate efforts to meet rising copper demand driven by urbanization and renewable energy transitions.

High Production Costs and Resource Depletion

Rising production costs and resource depletion are significant restraints on the copper market. The U.S. Geological Survey reports that the average grade of copper ore has declined by approximately 30% over the past two decades, forcing miners to process larger volumes of ore to extract the same amount of metal. This trend has increased extraction costs. Furthermore, the International Copper Study Group (ICSG) notes that aging mines in key regions like Peru and Zambia face declining yields, contributing to a projected 3% annual shortfall in supply by 2030. As higher-grade deposits become scarcer, companies must invest heavily in advanced technologies, further straining profitability and limiting market growth.

Market Opportunities

Growing Demand for Electric Vehicles and Charging Infrastructure

The rapid adoption of electric vehicles (EVs) presents a significant opportunity for the copper market. According to the International Energy Agency (IEA), global EV sales reached 10 million units in 2022, accounting for 14% of total car sales, and are projected to grow to 35% by 2030. Copper plays a critical role in EVs, with each vehicle requiring approximately 80 kilograms of copper, compared to 20 kilograms in traditional internal combustion engine vehicles, as per the U.S. Geological Survey. Additionally, the U.S. Department of Energy highlights that the expansion of EV charging infrastructure will further boost demand, as each public fast-charging station requires up to 7 kilograms of copper. With the European Union mandating a 55% reduction in carbon emissions from vehicles by 2030, the IEA estimates that copper demand from EVs alone could reach 2.3 million metric tons annually by 2030, creating substantial growth opportunities for the copper market.

Expansion of Renewable Energy Projects

The global push for renewable energy projects offers another major opportunity for the copper market. The U.S. Energy Information Administration (EIA) states that renewable energy accounted for 29% of global electricity generation in 2022, with solar and wind capacity additions reaching 295 gigawatts. Copper is essential for these technologies, with wind turbines requiring up to 4.5 tons of copper per megawatt and solar panels using about 5 kilograms per kilowatt, according to the International Copper Association. The association also notes that copper demand from renewable energy installations could grow by 50% by 2030 as countries aim to meet climate goals under the Paris Agreement. Furthermore, the World Bank predicts that the transition to clean energy technologies will drive copper demand to 22 million metric tons annually by 2050, underscoring its pivotal role in sustainable development and offering long-term growth potential for the copper market.

Market Challenges

Supply Chain Disruptions and Geopolitical Risks

Supply chain disruptions and geopolitical risks are significant challenges for the copper market. The International Copper Study Group (ICSG) reported that global copper mine production grew by only 0.5% in 2022, hindered by logistical bottlenecks and trade tensions. Peru, the second-largest copper producer, experienced political unrest in early 2023, causing a 12% decline in output during the first quarter, according to Peru’s Ministry of Energy and Mines. Additionally, the U.S. Geological Survey highlights that over 45% of global copper reserves are located in politically sensitive regions like Chile and the Democratic Republic of Congo, making supply chains vulnerable to disruptions. The World Bank warns that escalating trade disputes and export restrictions could further constrain supply chains, exacerbating price volatility. These challenges complicate planning for markets reliant on stable copper availability, creating uncertainty in the market.

Fluctuating Prices and Market Speculation

Fluctuating copper prices driven by market speculation present another major challenge. The London Metal Exchange (LME) reported that copper prices ranged between $7,600 and $9,800 per metric ton in 2022, influenced by speculative trading and macroeconomic uncertainties. The International Monetary Fund (IMF) attributes this volatility to factors such as inflationary pressures, rising interest rates, and shifting demand forecasts amid global economic slowdowns. This unpredictability undermines long-term investment in copper production, as companies hesitate to commit resources amid uncertain returns. Such instability poses risks to the growth and stability of the copper market, affecting both producers and consumers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.75% |

|

Segments Covered |

By Type, Form, Mining Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Freeport-McMoRan (USA), Codelco (Chile), Anglo American (United Kingdom), Glencore (Switzerland) Southern Copper (Peru), Rio Tinto (United Kingdom), Lundin Mining (Canada), Antofagasta (Chile), Yamana Gold (Canada), First Quantum Minerals (Canada), Teck Resources (Canada) |

SEGMENT ANALYSIS

Global Copper Market Analysis By Type

The primary copper segment dominated the market by accounting for 80.7% of global market share in 2024. The primary copper segment involves extracting copper directly from mined ores, with Chile and Peru being the largest contributors, as per the U.S. Geological Survey. The widespread use of primary copper in industries like construction, electrical wiring, and renewable energy systems is majorly contributing to the domination of the primary copper segment in the global market. Primary copper is critical due to its high purity and reliability, making it indispensable for applications requiring superior conductivity. The segment’s importance lies in its role as the backbone of global infrastructure development and electrification, ensuring steady demand despite fluctuating prices.

The secondary copper segment is another major segment and is estimated to grow at the fastest CAGR of 5.8% over the forecast period owing to the increasing environmental concerns and the push for sustainable practices. Secondary copper is derived from recycling scrap materials. The U.S. Environmental Protection Agency (EPA) highlights that recycling copper requires up to 85% less energy than primary production, significantly reducing carbon emissions. Additionally, recycled copper accounts for 41% of Europe’s copper usage, underscoring its importance in achieving circular economy goals. As global copper demand rises, secondary copper will play a vital role in mitigating supply constraints and reducing dependency on mining, making it a key contributor to resource efficiency and sustainability.

Copper Market Analysis By Form

The wire rods segment was the top performing segment of the copper market and accounted for 40.12% of global market share in 2024. The domination of the wire rods segment in the global market is majorly attributed to widespread usage of wired rods in electrical wiring, power transmission, and telecommunications due to copper’s superior conductivity and ductility. The U.S. Energy Information Administration (EIA) highlights that global electrification projects, including renewable energy systems, are driving demand for wire rods. For instance, wind turbines and solar panels require extensive copper wiring, with each megawatt of installed capacity using up to 3.5 tons of copper, as per the International Copper Association (ICA). Wire rods’ importance lies in their critical role in modern infrastructure, ensuring steady growth as urbanization and electrification expand globally.

The sheets and strips segment is anticipated to exhibit a CAGR of 6.8% over the forecast period due to the increasing demand in the automotive and construction industries, particularly for electric vehicles (EVs) and energy-efficient buildings. The International Energy Agency (IEA) reports that EV production requires significant copper for components like battery foils and heat exchangers, with sheets and strips being essential. Additionally, the European Commission emphasizes that green building standards are boosting demand for copper-based materials in HVAC systems and roofing. As sustainability initiatives gain momentum, sheets and strips will play a vital role in meeting the needs of emerging technologies, making this segment a key driver of future market growth.

Copper Market Analysis By Mining Type

The surface mining segment led the copper market by accounting for 65.5% of global copper market share in 2024. This method is preferred due to its cost-effectiveness and ability to extract large quantities of ore from shallow deposits. Major copper-producing countries like Chile and Peru rely heavily on surface mining with Chile producing 23.6% of global copper supply through open-pit operations such as the Escondida mine, as reported by the Chilean Copper Commission (Cochilco) . The International Copper Study Group (ICSG) highlights that surface mining is critical for meeting rising demand, particularly in renewable energy and infrastructure projects. Its importance lies in its scalability and efficiency, ensuring steady supply despite declining ore grades in some regions.

The underground mining segment is projected to witness a CAGR of 4.8% over the forecast period due to the depletion of surface-accessible deposits and advancements in mining technologies, enabling deeper and more efficient extraction. The International Energy Agency (IEA) notes that underground mining is essential for accessing high-grade deposits required for electric vehicles (EVs) and renewable energy systems. For instance, the Kamoa-Kakula mine in the Democratic Republic of Congo, operated by Ivanhoe Mines, is expanding underground operations to meet rising copper demand. As global copper consumption increases, underground mining will play a vital role in bridging supply gaps, making it a key contributor to sustainable resource management and long-term market stability.

Copper Market Analysis By Application

The construction segment had 25.6% of global market share in 2024. The durability, corrosion resistance, and conductivity of copper make it indispensable for plumbing, wiring, and HVAC systems in residential and commercial buildings. The U.S. Geological Survey (USGS) highlights that rapid urbanization in emerging economies like China and India is driving demand, with China consuming a substantial portion of global copper in construction-related applications. Additionally, green building initiatives, such as LEED certifications, emphasize energy-efficient systems reliant on copper. Its importance lies in supporting infrastructure development and sustainable urban growth, ensuring steady demand despite economic fluctuations.

The distribution & transmission segment is the emerging application of copper with a projected CAGR of 6.2% over the forecast period. The massive investments in upgrading aging power grids and expanding transmission networks to accommodate renewable energy sources like wind and solar are propelling the expansion of the distribution and transmission segment in the global market. The International Energy Agency (IEA) highlights that integrating renewable energy into existing grids requires significant copper, as reported in their 2022 report on materials for clean energy technologies. Additionally, the U.S. Department of Energy emphasizes that grid modernization initiatives, including smart grids and EV charging infrastructure, are further boosting demand. As nations strive to meet net-zero emissions targets, this segment will play a pivotal role in enabling sustainable energy solutions, making it a key driver of future copper consumption.

REGIONAL ANALYSIS

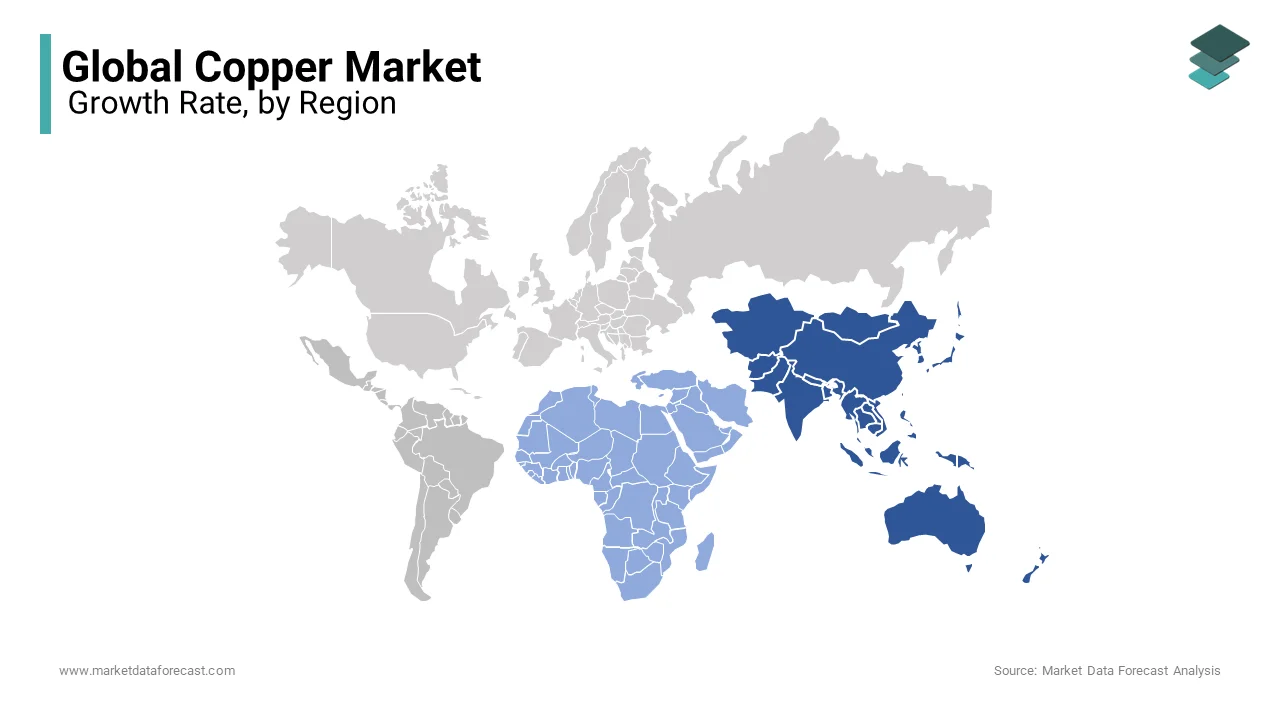

Asia-Pacific dominated the copper market by holding 55.6% of global market share in 2024. China alone contributes approximately 48% of global copper consumption, driven by rapid urbanization and industrialization. China’s refined copper consumption reached 13.9 million metric tons in 2022, fueled by infrastructure projects under its Belt and Road Initiative and renewable energy investments. This region’s dominance stems from its role as a global manufacturing hub and its large-scale electrification programs. Its importance lies in shaping global copper pricing and supply chains, with significant imports from Latin America and Africa ensuring steady material flow.

The Middle East and Africa are the expanding rapidly in the copper market with a projected CAGR of 6.5%. This growth is driven by increasing investments in renewable energy and infrastructure development. For instance, Morocco’s Noor Ouarzazate Solar Complex, one of the largest solar power plants globally, relies heavily on copper for energy transmission. Additionally, the United Nations projects that Africa’s urban population will double by 2050, boosting demand for copper in construction and power grids. The region’s rich untapped reserves further support this growth, making it a critical emerging player in the global copper market.

North America

North America is expected to witness steady growth in the copper market and is driven by renewable energy adoption and electric vehicles (EVs). Additionally, the Biden administration’s $1 trillion Infrastructure Investment and Jobs Act emphasizes investments in broadband expansion and power grid modernization, further boosting copper consumption. According to the U.S. Geological Survey, the United States accounted for approximately 8% of global copper consumption in 2022, with imports meeting over 35% of its needs. Canada, a key producer, contributed 2.4% of global mined copper supply in 2022. North America’s focus on sustainability and technological innovation positions it as a stable and growing market segment.

Europe

Europe’s copper market is driven by stringent climate goals and the push for carbon neutrality. The European Commission estimates that copper demand for renewable energy applications, such as wind and solar, will increase significantly by 2030. The region’s Green Deal initiatives aim to reduce greenhouse gas emissions by at least 55% by 2030, requiring significant copper for electrification and energy-efficient technologies. According to the International Copper Study Group (ICSG), Europe accounts for approximately 16% of global copper consumption. However, production is limited, with most supply imported from Latin America and Africa. The European Union’s focus on sustainable development ensures steady growth, although regulatory challenges may slow expansion in certain sectors like mining.

Latin America

Latin America remains the largest copper-producing region, contributing nearly 42% of global mined copper supply in 2022, according to the U.S. Geological Survey. Chile, the world’s largest producer, accounted for 27% of global output, while Peru ranked second with 11%. Despite regulatory challenges and environmental restrictions, the region remains critical to global supply chains. Latin America’s rich reserves and strategic importance ensure its dominance in copper production, though slower economic growth in some countries may temper overall regional performance in the coming years.

Top 3 Players in the market

Codelco (Corporación Nacional del Cobre de Chile)

Codelco, the world's largest copper producer, reported a production of approximately 1.328 million metric tons in 2024, a slight increase from the 1.325 million tons produced in 2023. This production accounts for about 7% of the global copper output. The company operates major mines such as Chuquicamata, El Teniente, and Andina in Chile. Despite challenges like declining ore grades and operational delays, Codelco has been investing in modernization projects to enhance efficiency and sustainability. The company plans to invest $4.727 billion in 2025, focusing on revitalizing key mines.

Freeport-McMoRan Inc.

In 2023, Freeport-McMoRan, a leading U.S.-based mining company, reported consolidated copper sales of 4.2 billion pounds (approximately 1.9 million metric tons). This positions the company with a market share of around 9%. Freeport operates significant mines, including the Grasberg Mine in Indonesia and the Morenci Mine in Arizona, USA. The company is investing in technological advancements and expansion projects to meet the growing demand for copper in electric vehicles and renewable energy applications.

BHP (BHP Group Limited)

BHP, a major global mining company, produced approximately 1.6 million metric tons of copper in 2023, accounting for about 6% of global production. The company operates the Escondida Mine in Chile, the world's largest copper-producing mine, and the Olympic Dam in Australia. BHP has been expanding its copper portfolio through acquisitions and joint ventures, including the recent acquisition of Filo Corp. The company is also focusing on sustainable mining practices to align with the global shift towards green energy.

Top strategies used by the key market participants

Expansion & Capacity Enhancement

To secure and increase copper reserves, major players in the copper market are expanding their production capacity through mine revitalization and new asset acquisitions. Codelco has committed $4.7 billion in 2025 to modernize aging mines such as Chuquicamata, El Teniente, and Andina, ensuring sustained long-term production. Freeport-McMoRan is ramping up production at its Grasberg Mine in Indonesia and Morenci Mine in the U.S., capitalizing on the rising demand for copper in electric vehicles and infrastructure projects. Meanwhile, BHP continues to increase output from the Escondida Mine in Chile, the world's largest copper-producing mine, while strengthening its South American presence through recent acquisitions like Filo Corp. in Argentina and Chile.

Mergers, Acquisitions & Joint Ventures

Leading copper companies actively engage in mergers, acquisitions, and strategic joint ventures to secure new resources and optimize operational costs. Codelco collaborates with private firms to expand copper reserves and improve efficiency in its existing mining operations. Freeport-McMoRan has entered joint ventures with the Indonesian government to maintain access to the valuable Grasberg Mine and ensure regulatory stability. BHP, on the other hand, recently completed the acquisition of Filo Corp. in 2025, forming a 50/50 joint venture with Lundin Mining, which strengthens its position in the South American copper belt.

Sustainability & Green Mining Initiatives

With global pressure to reduce environmental impact, copper mining giants are implementing sustainability initiatives to lower their carbon footprint. Codelco has set a target to reduce carbon emissions by 70% by 2030, investing in renewable energy and water conservation technologies to minimize ecological disruption. Freeport-McMoRan has committed to net-zero emissions by 2050, integrating solar and wind energy into its mining operations while adopting cleaner extraction technologies. BHP has launched its "Green Copper Initiative," which focuses on low-emission copper production and recycling programs, positioning itself as a leader in sustainable mining.

KEY MARKET PLAYERS

Freeport-McMoRan (USA), Codelco (Chile), Anglo American (United Kingdom), Glencore (Switzerland) Southern Copper (Peru), Rio Tinto (United Kingdom), Lundin Mining (Canada), Antofagasta (Chile), Yamana Gold (Canada), First Quantum Minerals (Canada), Teck Resources (Canada)

COMPETITIVE LANDSCAPE

The global copper market is highly competitive, driven by increasing demand for copper in industries such as renewable energy, electric vehicles (EVs), construction, and electronics. The competition is mainly among large mining corporations, state-owned enterprises, and emerging producers striving to secure long-term copper reserves, improve efficiency, and adopt sustainable mining practices.

Codelco, Freeport-McMoRan, and BHP are the top three players in the market, collectively controlling a significant share of global copper production. These companies compete on multiple fronts, including mine expansion, technological innovation, sustainability, and acquisitions. Other key competitors, such as Glencore, Anglo American, and Rio Tinto, are also expanding their copper portfolios through strategic investments and joint ventures.

Emerging mining firms and China-based producers add to the competition by securing new copper projects, particularly in Africa and Latin America, where copper reserves are abundant. Additionally, government policies, environmental regulations, and fluctuating commodity prices influence the competitive landscape. As the demand for low-carbon copper and recycled materials rises, companies are investing in green technologies to strengthen their positions.

With supply constraints and growing global demand, competition in the copper market will intensify, pushing companies to innovate and expand their resource bases to maintain a competitive edge.

RECENT HAPPENINGS IN THIS MARKET

- In January 2025, BHP Investments Canada Inc. and Lundin Mining Corporation completed the acquisition of Filo Corp., a Toronto Stock Exchange-listed company. This acquisition, valued at approximately C$4.0 billion, led to the formation of a 50/50 joint venture named Vicuña Corp., which now holds the Filo del Sol and Josemaria copper projects. The transaction is expected to enhance BHP and Lundin Mining’s copper asset portfolio and strengthen their presence in the Vicuña district of Argentina and Chile.

- In December 2024, India's JSW Group diversified into the non-ferrous metals sector by acquiring two copper mines in Jharkhand from Hindustan Copper. This acquisition marks JSW's strategic move to establish a presence in the copper market.

MARKET SEGMENTATION

This research report on the global copper market is segmented and sub-segmented into the following categories.

By Type

- Primary Copper

- Secondary Copper

By Form

- Wire Rods

- Plates

- Sheets and Strips

- Tubes

- Bars and Sections

- Others

By Mining Type

- Underground Mining

- Surface Mining

By Application

- Construction

- Transportation

- Appliances and Electronics

- Power Generation

- Distribution and Transmission

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]