Global Clear Aligners Market Size, Share, Trends & Growth Forecast Report By Age of the patient (Teenager and Adult), End-Users (Hospitals and Dental & Orthodontic Clinics) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Clear Aligners Market Size

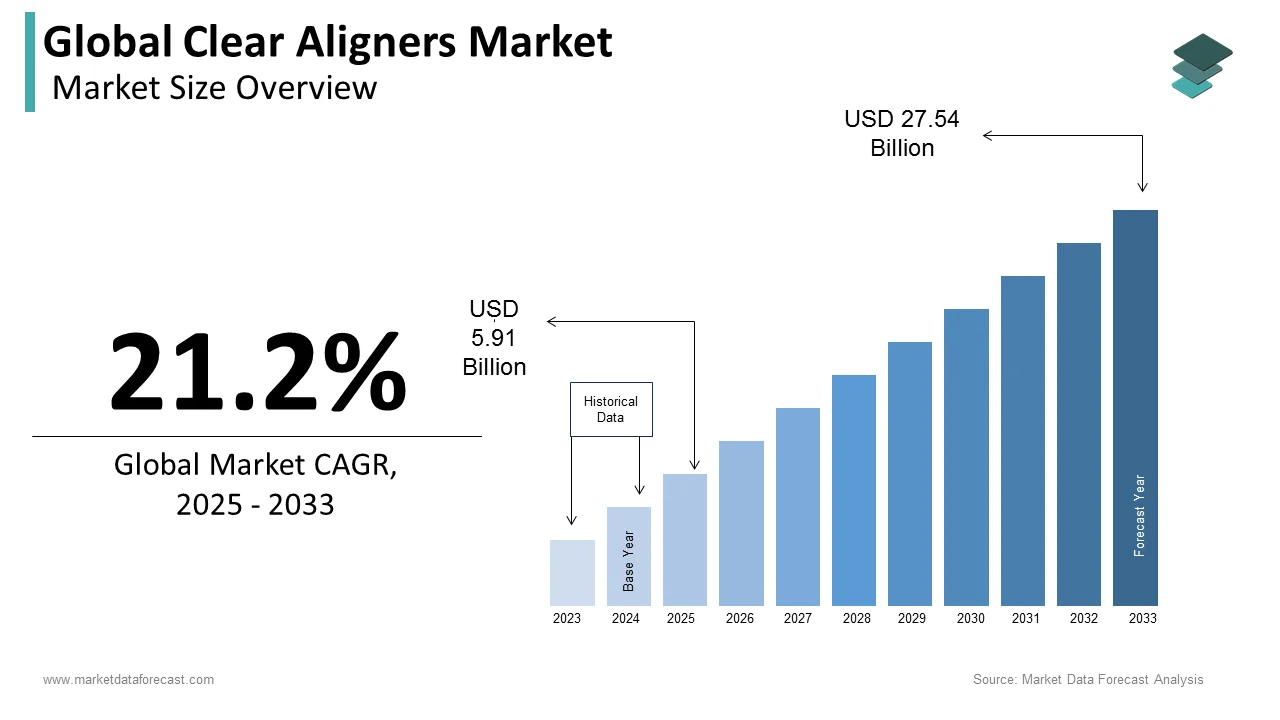

The global clear aligners market was worth US$ 4.88 billion in 2024 and is anticipated to reach a valuation of US$ 27.54 billion by 2033 from US$ 5.91 billion in 2025, and it is predicted to register a CAGR of 21.2% during the forecast period 2025-2033.

Clear aligners are one of the treatment procedures for straightening teeth and are considered the patient-friendly approach to do it compared to braces. The aesthetic appeal and the customization abilities of clear aligners are major reasons behind preferring these over the available treatment option to straighten teeth. People who suffer from various dental issues, such as crowded teeth, gapped teeth, overbites, underbites, open bites, crooked teeth, and crossbites, use clear aligners to straighten their teeth. The usage of clear aligners is high among the younger generation compared to the older population.

- Clear aligners have a success rate of 80% to 90%, and a whopping 88% of the satisfaction rate among patients who use at-home aligners has been noticed.

The removability, convenience, and flexibility of clear aligners are majorly boosting their adoption among patients, and with growing awareness, this trend is likely to spike further in the coming years.

MARKET DRIVERS

YoY growth in the patient population of malocclusions boosts the market growth.

Malocclusion is the most common dental issue worldwide, and clear aligners are the most preferred treatment approach to treat malocclusion as they are virtually invisible and discreet in nature.

- According to Dental Tribune US, close to 60% to 75% of the population worldwide suffer from malocclusion. Deep bite, which is also known as the Type 11 malocclusion is very common in the United States and affecting 15% to 20% of the U.S. population.

The number of people with malocclusion worldwide has grown considerably over the last few years and is expected to continue to grow further in the coming years. The growth in the patient population is likely to result in the increasing demand for clear aligners and this is expected to be one of the major factors of the market growth.

Technological advancements in clear aligners are contributing to the market growth.

Clear aligners have experienced several technological advancements in the last few years. To increase the strength and comfort of clean aligners, the manufacturers have been using materials that are durable, flexible and stain-resistant plastic. The demand for customized clear aligners has been on the rise. To meet the growing demand for such products, manufacturers have been using 3D printing technology to create custom-made aligners based on the scans of the patients. Likewise, other advancements such as SmartTrack, AI, Nickel, and copper-titanium wires are being actively used in the clear aligners to improve their effectiveness, efficiency, and appeal.

The growing popularity of clear aligners among adults drives the global market growth.

The awareness among people regarding the orthodontic solutions has improved significantly over the last decade and driving their attention towards aesthetic dental care. Due to their aesthetic appeal, youth are increasingly preferring the clear aligners instead of braces. On the other hand, the dental professionals can assess the treatment outcomes better with clear aligners compared to braces. These factors are eventually contributing to the popularity and adoption of clear aligners.

MARKET RESTRAINTS

High costs associated with clear aligners are the biggest restraint to the market growth.

Traditional braces comparatively cheaper than clear aligners. The cost of the traditional braces typically lies between USD 1700 to USD 6000 unless the case is severe.

- For instance, the cost of the Invisalign (which is a popular clear aligner) range from USD 2400 to USD 9000. The cost of the aligners and the treatment further goes high in severe cases.

Furthermore, factors such as clear aligners not being suitable treatment option for severe cases, lack of awareness about clear aligners and issues associated with regulatory approval and insurance coverage are hindering the clear aligners market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.2% |

|

Segments Covered |

By Age of the patient, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M, DynaFlex, Dentsply Sirona, Inc., TP Orthodontics Inc., SmileDirectClub, Clarus Company, Straumann Group, align technology, Danaher Corporation, Argen Corporation, Henry Schein, Inc., Great Lakes Dental Technologies, 3D Predict, Clear Correct LLC, Rocky Mountain Orthodontics, SmileDirectClub, and Others. |

SEGMENTAL ANALYSIS

By Age of the Patient

The adults segment occupied 64.8% of the global market share in 2024 and the adults segment is anticipated to continue to be the largest segment as the adults are the largest consumers for clear aligners worldwide. The invisibility nature of clear aligners is primarily motivating the adults to choose clear aligners over traditional braces and this has been the major factor contributing to the domination of the adults segment.

On the other hand, the teenager segment has grown substantially over the last few years and is expected to register a healthy CAGR during the forecast period. An increased number of orthodontic treatment procedures happening among the teenage age group has been noticed in recent years, and this is expected to continue in the coming years, which is one of the major factors propelling segmental growth. Furthermore, the growing teenage population suffering from malocclusion, increasing awareness among people regarding orthodontic treatment options and rising desire for aesthetic treatment options among teenagers are further anticipated to contribute to the segment’s growth rate. In addition, the recent COVID-19 pandemic has favored this segment. Furthermore, with the closure of schools and limited scope for social activities due to the lockdowns and social distancing measures, teenagers have spent more time and given an opportunity for personal hygiene, which resulted in the increasing number of clear aligner treatment procedures and boosted the demand for clear aligner products.

By End-User

The hospital segment had a slight upper hand on the dental and orthodontic clinics segment in 2024. Factors include the rising adoption of clear aligner treatments in hospital settings, the growing patient population of malocclusion visiting hospitals for treatment needs, and raising awareness of the advantages of using clear aligners. Patients believe that hospitals are the best destination for improved patient comfort, reduced treatment times, and enhanced treatment outcomes for dental issues, further contributing to the segment's growth. In addition, hospitals have better access to the equipment and medical devices required to execute the clear aligner treatment procedures, which is favoring the segment’s growth rate.

On the other hand, the dental and orthodontic clinics segment accounted for a substantial share of the global clear aligners market in 2024 and is expected to have better occupancy than the hospital segment during the forecast period. The segment’s growth is primarily driven by the increasing adoption of clear aligner treatment by dental and orthodontic clinics and the growing demand for cosmetic dentistry. People’s awareness towards visiting dental and orthodontic clinics to address their oral issues has been increasing over the last few years and the trend is expected to continue in the coming years, which is expected to boost the segment’s growth rate.

REGIONAL ANALYSIS

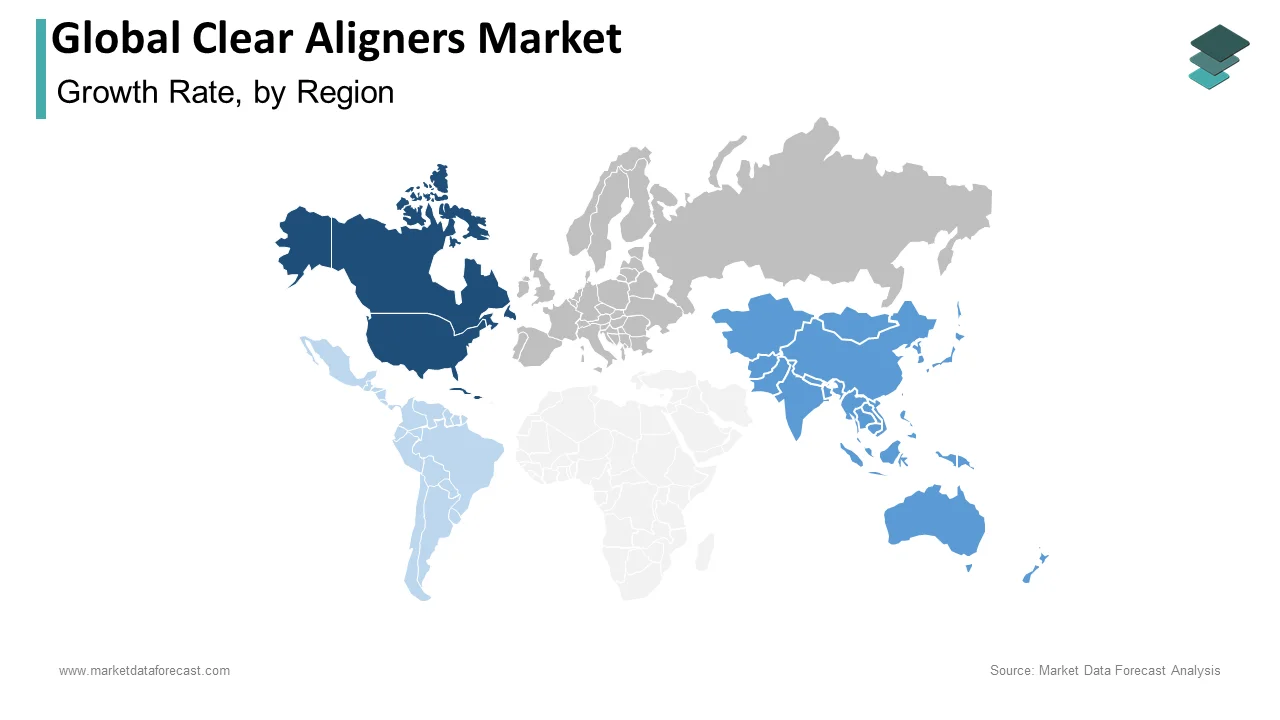

In 2024, North America accounted for around 40% of the global market. Factors such as the high prevalence of dental diseases, malocclusions, and the growing popularity of Hollywood smiles are driving the market in this region. According to a survey by the American Dental Association, 85.0% of people in the United States prioritize dental health and consider it an essential part of overall health. In the United States, four million people wear braces, 25% of whom are adults. The introduction of clear aligners is of interest to international companies due to the high demand in the U.S. and Canada and their local presence. Also, rising healthcare expenditure and the development of dental machines have boosted orthodontic treatment cases in this region.

Regions such as Asia-Pacific and Eastern Europe are expected to witness the fastest growth rate in the global market during the forecast period. Growing awareness among the population about new technologies in dentistry, high incidence of dental disorders, growing popularity of dental tourism, and increasing healthcare expenditure are the important factors that will help the market growth in these regions. For example, according to a study published in the Global Health Journal, dental prevalence in China was over 50% in all age groups. In addition, the dentist-population relationship has improved considerably over the past two decades. For example, according to an article, in 2014, in India, the dentist-to-population ratio had reached a higher number of 1:10,000 from 1:300,000 back in the 1960s.

The Latin American, Middle East, and African regional markets are anticipated to show low growth due to these regions' lack of qualified dentists and poor awareness. However, improving dental care infrastructure in emerging economies, positive dental education, and free dental camps are expected to boost the market growth.

KEY MARKET PLAYERS

Major players operating in the global clear aligners market include 3M, DynaFlex, Dentsply Sirona, Inc., TP Orthodontics Inc., SmileDirectClub, Clarus Company, Straumann Group, align technology, Danaher Corporation, Argen Corporation, Henry Schein, Inc., Great Lakes Dental Technologies, 3D Predict, Clear Correct LLC, Rocky Mountain Orthodontics, SmileDirectClub, and Others.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, With a global distribution network and more than 200 workers, Eon Dental became a market-leading supplier of clear aligner solutions. The company recently revealed its accomplishments and future expansion goals. The company, which has its headquarters in Amman, Jordan, has witnessed rapid development and just closed a $26 million Series B fundraising round to support its growth in the Middle East and North Africa (MENA), the US, Europe, and Asia.

- In December 2022, With its sponsorship of the 3rd International Saudi Orthodontic Clear Aligner Conference, Align Technology, Inc. ("Align"), a leading international medical device company that develops, produces and markets the Invisalign system of clear aligners, iTeroTM intraoral scanners, and exocadTM CAD/CAM software for digital orthodontics and restorative dentistry reaffirmed its dedication to the Middle East.

- In January 2023, Glowsmiles Dental LLP announced to purchase of the whole Klearaligner transparent aligner company. The agreement's terms weren't made public. However, the goal of the acquisition is to increase Glowsmiles' production and expand its market share in India. With the acquisition, Glowsmiles can now produce about 1500 aligners every day. By 2024, the business hopes to have reached a minimum daily capacity of 3000 aligners.

MARKET SEGMENTATION

This market research report on the global clear aligners market has been segmented and sub-segmented based on age of the patient, end-user, and region age.

By Age of the Patient

- Teenager

- Adults

By End-User

- Hospitals

- Dental & Orthodontic Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region is growing the fastest in the global clear aligners market?

Geographically, the North American clear aligners market accounted for the largest share of the global market in 2024.

At What CAGR, the global clear aligners market is expected to grow from 2025 to 2033?

The global clear aligners market is estimated to grow at a CAGR of 21.2% from 2025 to 2033.

How much is the global clear aligners market going to be worth by 2032?

As per our research report, the global clear aligners market size is projected to be USD 27.54 billion by 2033.

Which are the significant players operating in the clear aligners market?

SmileDirectClub, Clarus Company, Straumann Group, align technology, Danaher Corporation, Argen Corporation, Henry Schein, Inc., Great Lakes Dental Technologies, 3D Predict, Clear Correct LLC, Rocky Mountain Orthodontics are some of the significant players operating in the clear aligners market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]