Global Ceramic Tiles Market Size, Share, Trends & Growth Forecast Report – Segmented By Product (Glazed ceramic tiles, Porcelain tiles, Scratch free ceramic tiles, Others), Application (Wall tiles, Floor tiles, Others), End-use (Residential, Commercial) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Ceramic Tiles Market Size

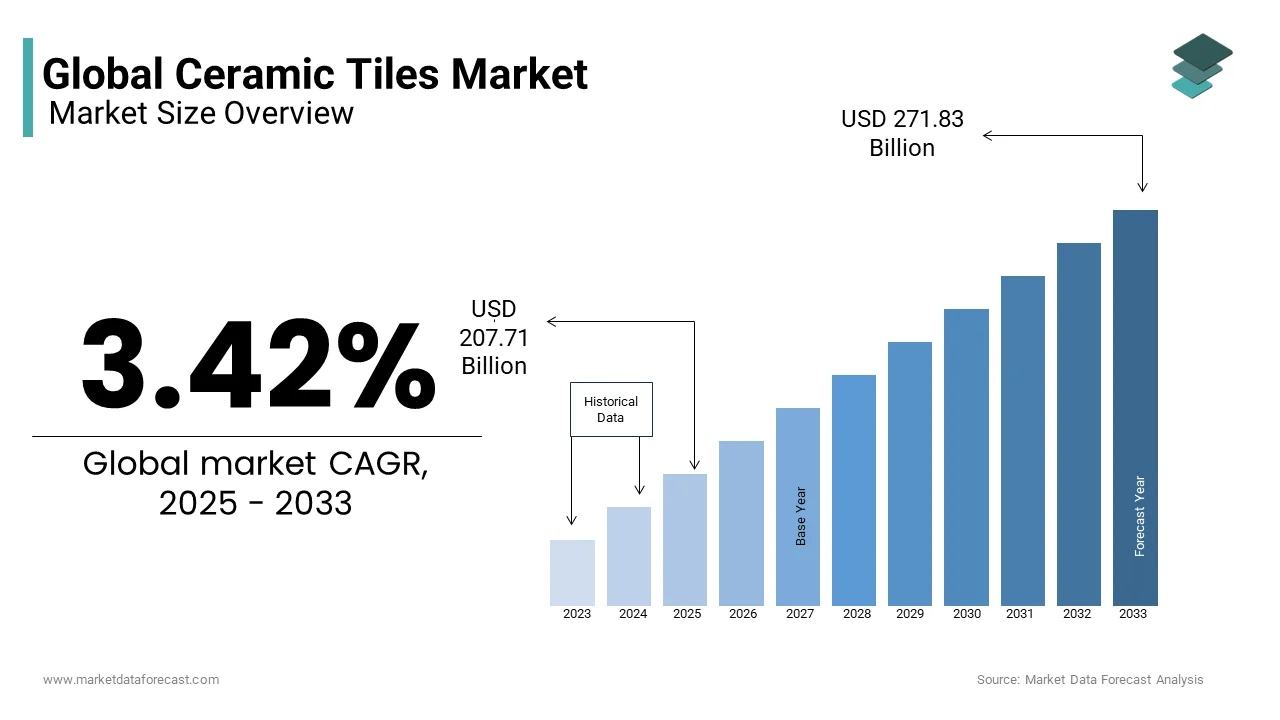

The global ceramic tiles market size was valued at USD 200.84 billion in 2024 and is anticipated to reach USD 207.71 billion in 2025 from USD 271.83 billion by 2033, growing at a CAGR of 3.42% from 2025 to 2033.

Current Scenario of the Global Ceramic Tiles Market

Ceramic tiles are among the most widely used building materials globally and valued for their durability, water resistance, and aesthetic versatility. The ceramic tile market is significantly impacted by construction and infrastructure trends. The global construction sector is projected to reach USD 15.5 trillion by 2030, according to Oxford Economics, with housing and commercial developments being key growth drivers. As urbanization accelerates, more than 68% of the world's population is expected to live in urban areas by 2050, as per the United Nations. This rapid urban growth is increasing the demand for modern housing, smart cities, and commercial complexes, where ceramic tiles are a staple due to their cost-effectiveness and design flexibility.

Environmental sustainability is also impacting the global ceramic tiles market expansion. Ceramic tile production accounts for approximately 0.8% of total global CO₂ emissions, according to the International Energy Agency (IEA). In response, manufacturers are investing in energy-efficient kilns, water recycling systems, and eco-friendly raw materials to reduce their carbon footprint. Additionally, the rise of 3D printing, digital printing, and nanotechnology coatings is revolutionizing the aesthetics and functionality of ceramic tiles, making them more antimicrobial, slip-resistant, and stain-proof for various applications.

Market Drivers

Urbanization and Infrastructure Development

Urbanization remains a key driver of the ceramic tiles market, with cities growing rapidly worldwide. According to the United Nations Department of Economic and Social Affairs, 56% of the global population lived in urban areas in 2021, and this figure is projected to reach 68% by 2050. This urban expansion drives demand for housing and commercial spaces, directly increasing ceramic tile consumption. The U.S. Census Bureau reports that housing starts in the U.S. averaged 1.5 million units annually between 2019 and 2021, reflecting steady construction activity. Ceramic tiles are widely used due to their durability, water resistance, and aesthetic versatility, making them a preferred choice for modern infrastructure projects. As governments allocate significant budgets to urban development, such as India’s Smart Cities Mission, which aims to develop 100 smart cities, the ceramic tiles market is further propelled.

Rising Disposable Incomes and Consumer Preferences

Rising disposable incomes have reshaped consumer preferences, fueling demand for premium building materials like ceramic tiles. The World Bank reports that global GDP per capita reached approximately $12,362 in 2021, reflecting improved living standards. Higher income levels allow consumers to prioritize home aesthetics and functionality, boosting ceramic tile adoption. According to the International Trade Administration, the U.S. imported $161 million worth of ceramic tiles in 2023, underscoring strong consumer demand. Homeowners increasingly prefer ceramic tiles for kitchens, bathrooms, and flooring due to their design flexibility and low maintenance. Additionally, emerging economies like China and India are witnessing rapid growth in middle-class households, further driving tile consumption. As global living standards continue to rise, this trend is expected to sustain market growth.

Market Restraints

Fluctuating Raw Material Prices

The ceramic tiles market is significantly affected by the volatility in raw material prices, which impacts production costs. Key materials such as clay, feldspar, and silica experience price fluctuations due to supply chain disruptions and geopolitical factors. According to the U.S. Geological Survey, global feldspar production was approximately 26 million metric tons in 2021, with regional price variations influenced by export restrictions and logistical challenges. These fluctuations increase manufacturing expenses, squeezing profit margins for producers. Fossil fuel subsidies reached a record high of $7 trillion in 2022, a $2 trillion increase from 2020, according to a report by the International Monetary Fund (IMF), further exacerbating costs for energy-intensive markets like ceramics. Rising raw material and energy costs disproportionately affect smaller manufacturers, limiting their ability to compete and invest in innovation. This financial strain hinders market growth and technological advancements.

Stringent Environmental Regulations

Stringent environmental regulations act as a major restraint on the ceramic tiles market by increasing compliance costs and operational complexities. The production process is energy-intensive and generates significant carbon emissions, prompting governments to impose strict emission norms. A report by the European Environment Agency found that the ceramics market contributes approximately 1% of total industrial CO2 emissions in the EU, leading to tighter regulations under the European Green Deal. Similarly, the U.S. Environmental Protection Agency mandates limits on particulate matter and greenhouse gas emissions, requiring manufacturers to adopt cleaner technologies. Compliance often necessitates costly upgrades, such as installing energy-efficient kilns or advanced waste treatment systems. These measures disproportionately impact small and medium enterprises, which struggle to absorb the additional costs, thereby limiting their ability to scale operations and remain competitive globally.

Market Opportunities

Growing Demand for Sustainable and Eco-Friendly Tiles

The increasing demand for sustainable and eco-friendly building materials presents a significant opportunity for the ceramic tiles market. Governments worldwide are promoting green building practices, driving the adoption of environmentally friendly tiles. According to the U.S. Green Building Council, green building materials accounted for 25% of the construction industry in 2021, with projections indicating steady growth as sustainability becomes a priority. Ceramic tiles, being durable, recyclable, and low-maintenance, align well with these goals. The European Commission highlights that the EU’s Renovation Wave initiative aims to renovate 35 million buildings by 2030, creating a surge in demand for sustainable tiles. Additionally, advancements in manufacturing technologies have enabled the production of tiles with reduced carbon footprints, such as those made using recycled materials. This shift towards sustainability attracts environmentally conscious consumers and opens new avenues for innovation and market expansion.

Expansion in Emerging Markets

Emerging markets offer substantial growth opportunities for the ceramic tiles market due to rapid urbanization and infrastructure development. The International Monetary Fund reports that emerging economies, such as India and China, are expected to contribute over 60% of global GDP growth by 2025. Similarly, China’s Belt and Road Initiative is driving infrastructure projects across Asia and Africa, boosting demand for ceramic tiles. These regions present untapped potential for manufacturers to expand their footprint. By investing in localized production facilities and distribution networks, companies can capitalize on the rising demand for affordable and aesthetically appealing tiles in these high-growth markets.

Market Challenges

Intense Competition from Alternative Flooring Materials

The ceramic tiles market faces significant challenges due to intense competition from alternative flooring materials such as vinyl, laminates, and engineered wood. These alternatives are gaining popularity due to their lower cost, ease of installation, and innovative designs. According to a report by the Freedonia Group, luxury vinyl tile (LVT) demand grew by 12% annually between 2019 and 2021, driven by its water-resistant properties and affordability. Additionally, the National Association of Home Builders highlights that alternative flooring materials, including carpet, hardwood, and LVT, account for a significant share of flooring installations in new U.S. home constructions, reducing the market share of ceramic tiles. The versatility and customization options offered by these substitutes make them attractive to budget-conscious consumers. This competition forces ceramic tile manufacturers to invest heavily in marketing and innovation to retain their market position, increasing operational costs and straining profitability.

Economic Uncertainty and Inflationary Pressures

Economic uncertainty and inflationary pressures pose a major challenge to the ceramic tiles market by affecting consumer purchasing power and construction activity. The International Monetary Fund projects global inflation to average 8.7% in 2022, significantly impacting construction budgets and discretionary spending on home improvement. Rising interest rates, as reported by the Federal Reserve, have increased mortgage costs, leading to a slowdown in housing starts, which saw notable fall in 2022 compared to the previous year. Additionally, the World Bank report stated that global economic growth is expected to decelerate to 1.7% in 2023, further dampening demand for non-essential building materials like premium ceramic tiles. These economic headwinds create a challenging environment for manufacturers, forcing them to navigate reduced consumer spending and delayed infrastructure projects, ultimately impacting revenue generation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.42% |

|

Segments Covered |

By Product, Application, End-user and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Atlas Concorde S.p.A., MOHAWK INDUSTRIES, INC., Crossville, Inc., RAK Ceramics, Cerámica Saloni, Florida Tile, Inc., PORCELANOSA Grupo A.I.E., Kajaria Ceramics Limited, GRUPPO CERAMICHE RICCHETTI S.p.A., China Ceramics Co., Ltd. |

SEGMENT ANALYSIS

Global Ceramic Tiles Market Analysis By Product

The porcelain tiles segment held the leading share of 40.3% of the global market in 2024. The superior durability, water resistance, and versatility of porcelain tiles is making them ideal for both residential and commercial applications, which is driving the growth of the segment in the global market. Porcelain tiles are widely used in high-traffic areas due to their scratch-resistant properties and aesthetic appeal. In 2021, U.S. ceramic tile imports surged to a 15-year peak of 207 million square meters, valued at US$2.5 billion, according to a report by the Tile Council of North America (TCNA) Their ability to mimic natural materials like wood and stone further boosts demand. As a premium product, porcelain tiles contribute significantly to market revenue, underscoring their importance in driving market growth.

The scratch-free ceramic tiles segment is a promising segment and is estimated to grow at a CAGR of 7.8% over the forecast period owing to the increasing demand for low-maintenance, durable flooring solutions, particularly in residential and institutional settings. The National Association of Home Builders highlights that scratch-resistant tiles are gaining popularity in households with pets and children, driving their adoption. Additionally, advancements in manufacturing technologies, such as digital printing and surface treatments, have improved the affordability and availability of these tiles. Their ability to retain aesthetic appeal over time makes them ideal for modern interiors. As consumer preferences shift toward functional yet stylish flooring, scratch-free tiles are expected to play a pivotal role in shaping future market trends.

Global Ceramic Tiles Market Analysis By Application

The floor tiles segment commanded the largest share of 55.4% in the global market in 2024. The durability, water resistance, and versatility of floor tiles is making them ideal for high-traffic areas in both residential and commercial spaces, which is propelling the expansion of the floor tiles segment in the global market. According to the Tile Council of North America, floor tiles account for a substantial portion of tile installations in the U.S., primarily due to their ability to withstand wear and tear while offering aesthetic appeal. Floor tiles are also preferred for their ease of maintenance and compatibility with underfloor heating systems, further solidifying their importance in modern construction and interior design. Their widespread use in sectors like hospitality and retail adds to their dominance in the market.

The wall tiles segment is the rapidly growing and is predicted to showcase a CAGR of 6.5% over the forecast period due to the increasing demand for decorative and functional wall coverings in kitchens, bathrooms, and living spaces. The National Association of Home Builders stressses that homeowners are investing more in aesthetic upgrades, driving the adoption of stylish and durable wall tiles. Advancements in digital printing technology have enabled manufacturers to produce tiles with intricate designs and textures, enhancing their appeal. Additionally, wall tiles are favored for their moisture resistance and ease of cleaning, making them ideal for humid environments. As urbanization and renovation projects rise globally, wall tiles are expected to play a pivotal role in shaping interior design trends and boosting market growth.

Global Ceramic Tiles Market Analysis By End-use

The residential segment led the ceramic tiles market by accounting for 60.3% of the global market share in 2024. The growth of the residential segment is driven by the rising demand for durable, aesthetically pleasing flooring and wall coverings in homes. Ceramic tiles are preferred in residential spaces for their affordability, water resistance, and low maintenance. The rise in urbanization and government housing projects, such as India’s Pradhan Mantri Awas Yojana, which aims to build 20 million affordable homes further fuels demand. As homeowners increasingly prioritize home aesthetics, the residential segment remains critical to the ceramic tiles market.

The commercial segment is another major segment and is likely to witness a CAGR of 6.8% over the forecast period due to the rapid urbanization, infrastructure development, and the expansion of sectors like hospitality, retail and healthcare. According to the World Bank, global urbanization is expected to reach 68% by 2050 driving demand for commercial spaces. Ceramic tiles are favored in commercial settings for their durability, ease of maintenance, and aesthetic versatility. Additionally, sustainability trends are pushing businesses to adopt eco-friendly tiles, further boosting demand. As investments in commercial real estate and public infrastructure increase, particularly in emerging economies, this segment will play a pivotal role in shaping the future of the ceramic tiles market.

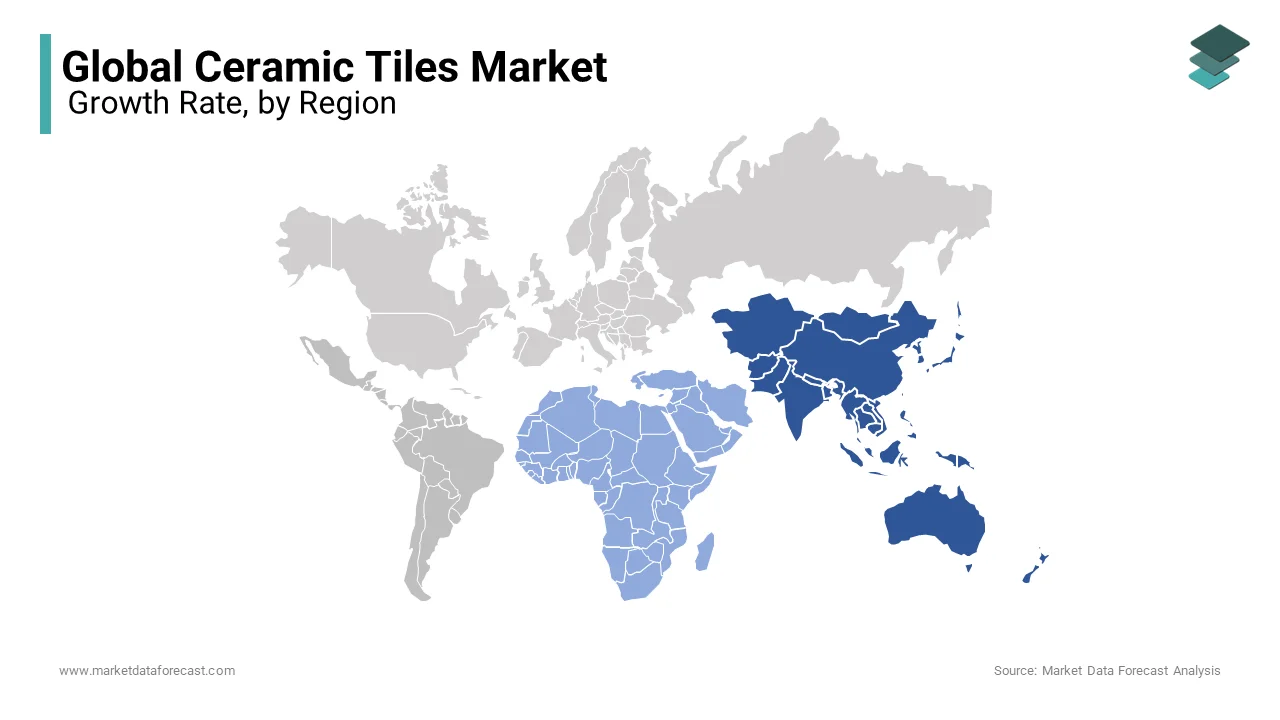

REGIONAL ANALYSIS

The Asia-Pacific outperformed other regions by holding 55.1% of the global market share in 2024. The dominance of the Asia-Pacific is primarily attributed to the rapid urbanization and infrastructure development, particularly in China and India. According to the China Building Materials Federation, China produces approximately 60% of the world’s ceramic tiles, supported by its robust manufacturing capabilities. Government initiatives like India’s Pradhan Mantri Awas Yojana, which aims to build 20 million affordable homes further boost demand. The region's leadership stems from its large population, cost-effective labor, and growing construction activities. Asia-Pacific’s prominence ensures it remains a manufacturing hub, meeting both domestic and international demand, making it critical to the global ceramic tiles market.

The Middle East and Africa region is the fastest-growing regional segment in the global ceramic tiles market with a projected CAGR of 7.2%. This growth is fueled by urbanization and large-scale infrastructure projects, such as Saudi Arabia’s Vision 2030 initiative, which aims to invest $1 trillion in construction. According to the African Development bank Group, Africa’s urban population is expected to reach 1.5 billion by 2050, driving demand for affordable housing and commercial spaces. Ceramic tiles are preferred for their durability and aesthetic appeal in harsh climates. This region’s rapid expansion underscores its importance as a future growth driver, attracting investments and boosting production capacities.

The ceramic tiles market in North America is characterized by steady growth, driven by renovation projects and a focus on sustainable building materials. The U.S. Green Building Council highlights that green building practices are increasingly adopted, favoring eco-friendly tiles. In the coming years, innovations in sustainable and low-maintenance tiles are expected to sustain demand, particularly in residential and commercial sectors.

Europe

Europe represents a mature ceramic tiles market, with a strong emphasis on sustainability and energy-efficient construction. The European Commission reports that the EU’s Green Deal has mandated stricter environmental regulations, encouraging the use of eco-friendly tiles. The region holds considerable portion of the global market share, as per the European Ceramic Tile Manufacturers' Association (ASCER). Western Europe, particularly Italy and Spain, remains a hub for high-quality tile production. Renovation projects and retrofitting older buildings to meet green standards will likely drive future demand in this region.

Latin America

Latin America shows moderate growth in the ceramic tiles market, supported by Brazil’s construction sector, which contributes notably to its GDP, as reported by the Brazilian Institute of Geography and Statistics (IBGE). Brazil is the largest producer and consumer of ceramic tiles in the region, accounting for nearly half of Latin America’s total production. The region benefits from urbanization and affordable housing projects, such as Mexico’s National Housing Program, which aims to address housing shortages. However, economic instability and inflationary pressures pose challenges. Despite these hurdles, the market is expected to grow steadily, with increasing investments in infrastructure and rising demand for durable, cost-effective flooring solutions in residential and commercial spaces.

Top 3 Players in the market

Mohawk Industries, Inc.

Mohawk Industries, headquartered in the United States, stands as the world's largest manufacturer of ceramic tiles. The company's Global Ceramics division reported revenues of approximately USD 4.3 billion in 2022. Strategic acquisitions, such as the purchase of Mexican company Vitromex and Brazilian firm Elizabeth in 2022, have expanded its production capacity to over 300 million square meters. These moves have solidified Mohawk's leading position in the market.

Grupo Lamosa

Based in Mexico, Grupo Lamosa is a prominent player in the ceramic tiles market. The company enhanced its production capacity to 215 million square meters following the acquisitions of Roca Tiles and Fanosa in 2021 and 2022, respectively. In 2022, Grupo Lamosa's tile division achieved revenues of approximately EUR 1.27 billion, reflecting a 22% increase from the previous year. These strategic expansions have reinforced its significant role in the global market.

SCG Ceramics

SCG Ceramics, a subsidiary of Thailand's Siam Cement Group, ranks among the top ceramic tile manufacturers globally. In 2022, the company maintained an installed production capacity of 152 million square meters, with actual production reaching this capacity. The tile segment's revenues saw a 24% increase, amounting to approximately EUR 667 million. SCG Ceramics' consistent performance underscores its influential presence in the ceramic tiles market.

Top strategies used by the key market participants

Strategic Acquisitions & Mergers

Acquisitions and mergers are a key strategy for major ceramic tile manufacturers to expand their market presence and strengthen their production capabilities. Companies like Mohawk Industries have acquired Vitromex (Mexico) and Elizabeth (Brazil), allowing them to penetrate key markets in Latin America and increase production efficiency. Similarly, Grupo Lamosa acquired Roca Tiles and Fanosa, boosting its overall production capacity and expanding its presence in Europe and Latin America. SCG Ceramics also actively engages in acquisitions to integrate cutting-edge manufacturing technologies, ensuring cost-efficient production and broader market access.

Expansion of Production Capacity

Increasing production capacity allows leading players to meet the growing demand for ceramic tiles, particularly in rapidly urbanizing regions. Mohawk Industries has expanded its ceramic tile manufacturing facilities across the U.S., Mexico, and Europe, ensuring a stable supply chain. Grupo Lamosa has increased its production to 215 million square meters, positioning itself as a global leader in tile manufacturing. SCG Ceramics maintains an annual production capacity of 152 million square meters, ensuring its ability to meet domestic and international demand without supply shortages.

Innovation & Technology Adoption

Continuous innovation and technological advancements enable ceramic tile manufacturers to improve product quality, durability, and aesthetics. Mohawk Industries has invested in digital printing technology, allowing it to produce highly detailed, realistic tile designs. Grupo Lamosa focuses on advanced glazing techniques and eco-friendly materials to enhance product performance. SCG Ceramics integrates automation and AI-driven quality control into its production processes, ensuring consistent quality while optimizing manufacturing efficiency.

KEY MARKET PLAYERS

Atlas Concorde S.p.A., MOHAWK INDUSTRIES, INC., Crossville, Inc., RAK Ceramics, Cerámica Saloni, Florida Tile, Inc., PORCELANOSA Grupo A.I.E., Kajaria Ceramics Limited, GRUPPO CERAMICHE RICCHETTI S.p.A., China Ceramics Co., Ltd. These are the market players that are dominating the global.

COMPETITIVE LANDSCAPE

The global ceramic tiles market is highly competitive, driven by increasing construction activities, rapid urbanization, and evolving consumer preferences. The competition is primarily shaped by market consolidation, technological advancements, and geographic expansion. Leading players such as Mohawk Industries, Grupo Lamosa, and SCG Ceramics dominate the market through strategic acquisitions, large-scale production, and innovation.

Competition intensifies as manufacturers strive to enhance product quality, design, and sustainability. Technological advancements, including digital printing, automated production, and AI-driven quality control, provide competitive advantages by improving efficiency and design flexibility. Eco-friendly production has also become a key differentiator, with companies investing in low-carbon manufacturing, water recycling, and renewable energy sources to align with sustainability trends.

Regional players in India, China, Brazil, and Spain contribute to price-based competition by offering cost-effective alternatives, challenging global giants. Additionally, rising demand for premium tiles has spurred innovation in high-end products, leading to differentiation in terms of aesthetics, durability, and performance.

Distribution networks and brand strength also play crucial roles, with retail partnerships, e-commerce, and direct-to-consumer channels influencing market reach. The market remains dynamic, with ongoing mergers, acquisitions, and capacity expansions shaping the competitive landscape. Companies that successfully adapt to evolving trends and technologies will maintain their market leadership.

RECENT HAPPENINGS IN THIS MARKET

- In June 2024, One Equity Partners, a middle-market private equity firm, acquired a significant minority stake in Gruppo Siti B&T, an Italian manufacturer specializing in turnkey plants and machinery for ceramic tile production. This investment aims to support Gruppo Siti B&T's expansion plans, both organically and through acquisitions.

- In August 2024, Topps Tiles, a leading UK tile retailer, acquired CTD Tiles for £9 million after CTD entered administration. The acquisition included CTD's brands, intellectual property, stock, 30 stores, and distribution operations, saving 92 jobs. This move aligns with Topps Tiles' strategy to diversify its business model.

MARKET SEGMENTATION

This research report on the global ceramic tiles market is segmented and sub-segmented into the following categories.

By Product

- Glazed ceramic tiles

- Porcelain tiles

- Scratch free ceramic tiles

- Others

By Application

- Wall tiles

- Floor tiles

- Others

By End-use

- Residential

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]