Global Calcium Ammonium Nitrate Market Size, Share, Trends & Growth Forecast Report – Segmented By Grade, Application, Form, Type, End-User And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Calcium Ammonium Nitrate Market Size

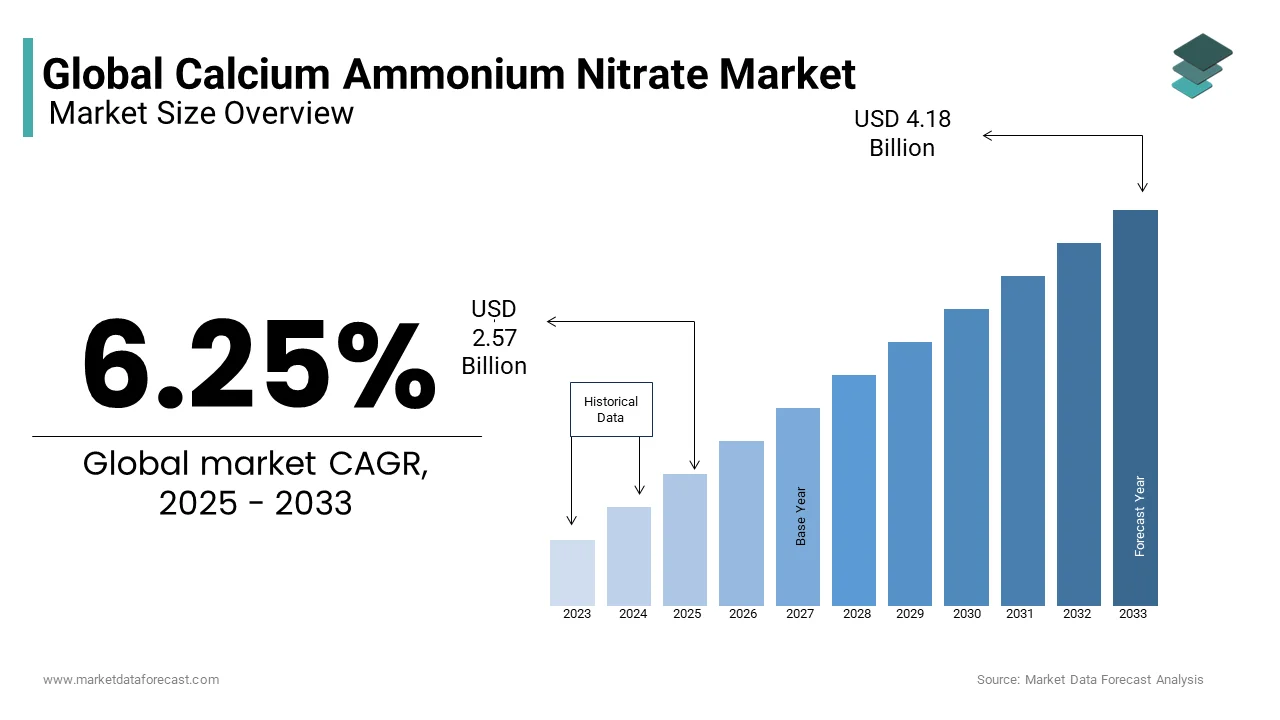

The global calcium ammonium nitrate market size was valued at USD 2.42 billion in 2024 and is anticipated to reach USD 2.57 billion in 2025 from USD 4.18 billion by 2033, growing at a CAGR of 6.25% during the forecast period from 2025 to 2033.

Calcium Ammonium Nitrate (CAN) is a widely used nitrogen-based fertilizer consisting of ammonium nitrate and calcium carbonate or dolomite. It is highly valued in agriculture for its ability to provide a balanced nitrogen supply while improving soil structure and reducing acidity. Unlike urea-based fertilizers, CAN has lower volatility, ensuring stable nutrient release, which makes it a preferred choice for various soil types and climatic conditions. Its granular composition further enhances ease of application, reducing nutrient losses and improving efficiency in crop production.

The demand for CAN is primarily driven by its application in agriculture, particularly in supporting the high-yield production of staple crops such as wheat, maize, and barley. According to the United Nations' World Population Prospects 2024, the global population is estimated to have reached 8.2 billion, which significantly increases the demand for high-efficiency fertilizers to sustain food production. Additionally, the Food and Agriculture Organization (FAO) reports that global cereal production reached a record 2.8 billion metric tons in 2023, emphasizing the need for effective fertilizers like CAN maintain soil productivity and ensure food security.

Beyond agriculture, CAN finds applications in construction as a concrete setting accelerator, which enhances durability in cold weather conditions. It is also utilized in industrial processes, including the manufacturing of certain explosives and wastewater treatment, where it aids in nitrogen balance. Regulatory frameworks, particularly in the European Union and North America, continue to influence the market due to environmental concerns surrounding ammonium nitrate, pushing for more sustainable fertilizer solutions.

Market Drivers

Growing Demand for Fertilizers in Agriculture

The global demand for fertilizers is being driven by the need to enhance agricultural productivity to feed a growing population, which the United Nations projects will reach 9.7 billion by 2050. Calcium ammonium nitrate (CAN) is gaining popularity as a nitrogenous fertilizer due to its balanced nutrient profile and low environmental impact. According to the International Fertilizer Association (IFA), nitrogen-based fertilizers accounted for approximately 58% of total fertilizer consumption in 2022, with CAN being a key contributor. In India, the Department of Fertilizers reported that fertilizer consumption reached a major mark in 2021-22, reflecting a steady increase over the past decade. CAN's ability to improve soil health while boosting crop yields has made it a preferred choice for farmers worldwide, driving market growth.

Rising Focus on Sustainable Agriculture Practices

The push for sustainable agriculture practices is reshaping the fertilizer industry, with calcium ammonium nitrate emerging as a viable solution. The European Commission’s Farm to Fork Strategy aims to reduce nutrient losses by at least 50% by 2030 while ensuring no decline in soil fertility. CAN is favored because it reduces nitrate leaching compared to other nitrogen fertilizers, as highlighted by the U.S. Department of Agriculture (USDA). The USDA notes that CAN can lower nitrate runoff, making it an environmentally friendly option. Farmers and policymakers are increasingly adopting CAN to align with sustainability goals, further propelling its demand globally.

Market Restraints

Stringent Environmental Regulations on Nitrogen-Based Fertilizers

The calcium ammonium nitrate (CAN) market is constrained by strict environmental regulations aimed at curbing nitrogen pollution. The U.S. Environmental Protection Agency (EPA) has identified nitrate contamination in water bodies as a significant environmental issue, prompting policies like the Clean Water Act, which limits fertilizer runoff. Similarly, the European Union’s Nitrates Directive requires member states to designate Nitrate Vulnerable Zones (NVZs), where fertilizer application is restricted to prevent groundwater contamination. According to the European Environment Agency (EEA), approximately 11% of Europe’s agricultural land falls under NVZs, impacting CAN usage. The Food and Agriculture Organization (FAO) reports that such regulatory measures have led to a 4% decline in nitrogenous fertilizer demand in Europe between 2018 and 2022. These restrictions increase compliance costs for manufacturers, posing a significant challenge to market growth.

Volatility in Raw Material Prices Impacting Production Costs

The production of calcium ammonium nitrate is highly sensitive to fluctuations in raw material prices, particularly ammonia and limestone. Ammonia prices surged significantly in 2022 due to geopolitical tensions and rising natural gas prices, which constitute a major part of ammonia production costs. This price volatility directly affects CAN manufacturing, squeezing profit margins for producers. Such instability discourages investments in CAN production facilities, as highlighted by the World Bank, which notes that fertilizer manufacturers face a 15-20% increase in operational costs during periods of raw material price spikes. This uncertainty restrains market expansion and availability for end-users.

Market Opportunities

Increasing Adoption of Precision Agriculture Technologies

The calcium ammonium nitrate (CAN) market stands to benefit significantly from the rising adoption of precision agriculture technologies, which enhance fertilizer efficiency and crop yields. The precision farming techniques can reduce fertilizer overuse by up to 15-20%, making CAN an ideal choice due to its slow-release nitrogen properties. As governments worldwide promote sustainable farming, CAN’s compatibility with precision tools positions it as a key growth driver in the fertilizer sector.

Rising Investments in Sustainable Fertilizer Innovations

The growing emphasis on eco-friendly agricultural solutions presents a significant opportunity for the calcium ammonium nitrate market. The European Commission’s Farm to Fork Strategy, part of the Green Deal, aims to reduce nutrient losses by at least 50% by 2030 while promoting sustainable fertilizers like CAN. Additionally, the demand for low-carbon fertilizers increased substantially around the world in 2022, driven by stricter environmental regulations. This trend is expected to drive the adoption of CAN, expanding its market share globally.

Market Challenges

Limited Awareness and Adoption in Developing Regions

One of the major challenges for the calcium ammonium nitrate (CAN) market is the limited awareness and adoption of this fertilizer in developing regions. Small-scale farmers in countries like Nigeria and Bangladesh often lack access to information about CAN’s benefits compared to traditional fertilizers. According to data, only 20% of smallholder farmers in Sub-Saharan Africa use improved fertilizers, with nitrogenous fertilizers accounting for less than 8% of total usage. In South Asia, the Indian Ministry of Agriculture & Farmers Welfare reports that despite subsidies, fertilizer literacy remains low, with only few number of farmers aware of advanced products like CAN. This knowledge gap restricts market penetration in these regions, which collectively forms a key part of the global agricultural workforce. Without targeted education campaigns and government support, expanding CAN adoption in these areas remains a significant challenge.

Competition from Alternative Nitrogen Fertilizers

The calcium ammonium nitrate market faces stiff competition from alternative nitrogen fertilizers such as urea and ammonium sulfate, which dominate due to their lower cost and widespread availability. The International Fertilizer Association (IFA) states that urea accounts for approximately 67% of global nitrogen fertilizer consumption, leaving limited room for CAN to gain market share. In China, the Ministry of Agriculture and Rural Affairs highlights that urea production reached 56 million tons in 2022, benefiting from economies of scale and government subsidies. This price disparity, coupled with established distribution networks for urea, poses a significant challenge for CAN manufacturers seeking to expand their footprint in competitive markets globally.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.25% |

|

Segments Covered |

By Grade, Application, Form, Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yara (Norway), EuroChem Group (Switzerland), HELM AG (Germany), FATIMA GROUP (Pakistan), Origin UK Operations Limited (U.K.), Barium & Chemicals, Inc. (U.S.), Agrico (U.S.), Fertinagro India Private Limited (India), AB "Achema" (Lithuania), GFS Chemicals, Inc. (U.S.). |

SEGMENT ANALYSIS

Global Calcium Ammonium Nitrate Market Analysis By Grade

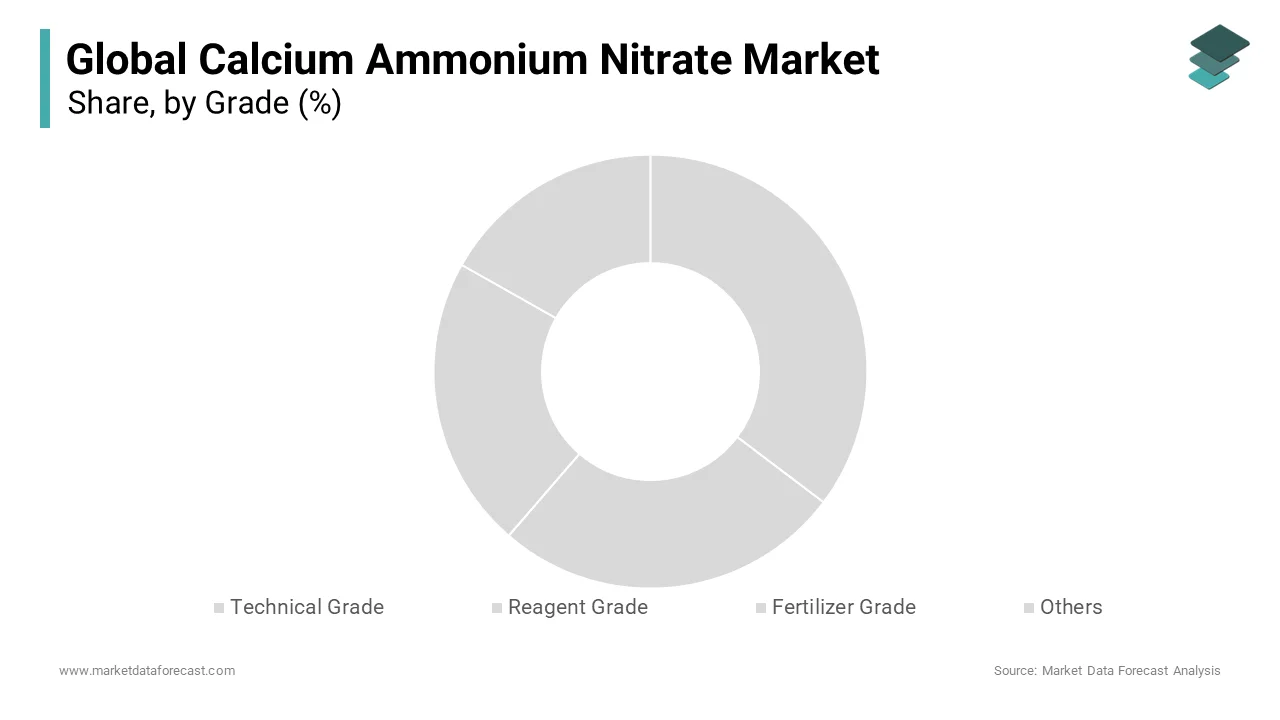

The fertilizer grade segment dominated the calcium ammonium nitrate (CAN) market by accounting for 65.5% of the global market share in 2024. The widespread use of fertilizer grade CAN in agriculture to enhance soil fertility and boost crop yields is one of the major factors propelling the segmental expansion in the worldwide market. Its cost-effectiveness, high nutrient content, and slow-release properties make it indispensable for modern farming, ensuring its dominance in the market.

The technical grade segment is anticipated to be the fastest growing segment and is likely to witness the highest CAGR of 7.8% during the forecast period owing to the increasing demand in industrial applications such as mining explosives and wastewater treatment. Additionally, Europe’s stringent environmental regulations, outlined in the European Green Deal, encourage the use of CAN in wastewater treatment to remove phosphates and reduce water pollution. The versatility and efficiency of technical-grade CAN in non-agricultural sectors underscore its rapid expansion, positioning it as a key growth driver in the coming years.

Global Calcium Ammonium Nitrate Market Analysis By Application

The inorganic fertilizer segment was the largest application in the calcium ammonium nitrate (CAN) market and held 55.6% of the global market share in 2024. This dominance is driven by CAN's role in enhancing soil fertility and improving crop yields. The Food and Agriculture Organization (FAO) highlights that nitrogen-based fertilizers like CAN are essential to meet the food demands of a growing population, projected to reach 9.7 billion by 2050. In India, the Ministry of Chemicals and Fertilizers states that fertilizer consumption witnessed a notable rise every year over the past five years, supported by subsidies under schemes like PM-KISAN. CAN’s high nutrient content and slow-release properties make it indispensable for modern agriculture, ensuring its leadership in the market.

The explosives segment is another major segment and is expected to witness a CAGR of 7.5% over the forecast period owing to the rising demand in the mining and construction industries, particularly in emerging economies. The U.S. Geological Survey (USGS) notes that the global mining industry’s reliance on CAN-based explosives has grown since 2020, driven by infrastructure development projects in regions like Asia-Pacific and Africa. Additionally, Europe’s focus on sustainable mining practices, outlined in the European Green Deal, encourages the use of CAN due to its stability and reduced environmental impact. The versatility of CAN in explosive formulations underscores its rapid expansion, making it a key growth driver in industrial applications globally.

Global Calcium Ammonium Nitrate Market Analysis By Form

The solid segment commanded the calcium ammonium nitrate (CAN) market by accounting for 70.7% of the global market share in 2024. The rising use of solid form of CAN in agriculture due to its ease of storage, transportation, and application is boosting the growth of the solid segment in the worldwide market. The Food and Agriculture Organization (FAO) highlights that solid CAN is preferred for its high nutrient content and slow-release properties, making it ideal for enhancing soil fertility. In India, the Ministry of Chemicals and Fertilizers states that solid fertilizers forms a major part of total fertilizer consumption, supported by subsidies under schemes like PM-KISAN. Its cost-effectiveness and compatibility with traditional farming practices ensure its dominance in the market.

The Liquid calcium ammonium nitrate segment is on the rise and is estimated to grow at a prominent CAGR of 6.2% over the forecast period due to the increasing adoption in precision agriculture and fertigation systems, particularly in developed regions like North America and Europe. The U.S. Department of Agriculture (USDA) notes that liquid fertilizers are gaining popularity due to their uniform nutrient distribution and compatibility with advanced farming technologies, such as GPS-guided equipment. Its ability to integrate with modern agricultural practices underscores its rapid expansion, positioning it as a key driver of innovation in the fertilizer industry globally.

Global Calcium Ammonium Nitrate Market Analysis By Type

By type, the calcium ammonium nitrate (CAN) market was ruled by the nitrogen content 27% segment by accounting for 60.7% of the global market share in 2024. The domination of the nitrogen content 27% segment is majorly attributed to its high nitrogen concentration, making it ideal for boosting crop yields and improving soil fertility. The Food and Agriculture Organization (FAO) highlights that nitrogen-rich fertilizers are critical for meeting global food demands, which are projected to grow marginally each year through 2030. In India, the Ministry of Chemicals and Fertilizers states that nitrogen-based fertilizers with higher concentrations like 27% are preferred, supported by subsidies under schemes like PM-KISAN. Its efficiency in enhancing agricultural productivity ensures its dominance in the market.

Global Calcium Ammonium Nitrate Market Analysis By End User

The agriculture segment led the calcium ammonium nitrate (CAN) market by representing for 65.7% of the global market share in 2024. The role of CAN as a nitrogen-rich fertilizer that enhances soil fertility and boosts crop yields is promoting the growth of the agriculture segment in the global market. The Food and Agriculture Organization (FAO) highlights that nitrogen-based fertilizers are critical to meet the food demands of a growing population, projected to reach 9.1 billion by 2050. In India, the Ministry of Chemicals and Fertilizers states that agricultural fertilizer consumption grew significantly each year over the past five years, supported by subsidies under schemes like PM-KISAN. CAN’s efficiency in improving agricultural productivity ensures its dominance in the market.

The mining segment is another major segment and is predicted to register a CAGR of 7.8% over the forecast period owing to the rising demand for CAN-based explosives in mining operations, particularly in emerging economies. The U.S. Geological Survey (USGS) notes that the global mining industry’s reliance on CAN-based explosives has notably grown every year since 2020, driven by infrastructure development projects in Asia-Pacific and Africa. Additionally, Europe’s focus on sustainable mining practices, outlined in the European Green Deal, encourages the use of CAN due to its stability and reduced environmental impact. Its versatility in explosive formulations underscores its rapid expansion, making it a key growth driver globally.

REGIONAL ANALYSIS

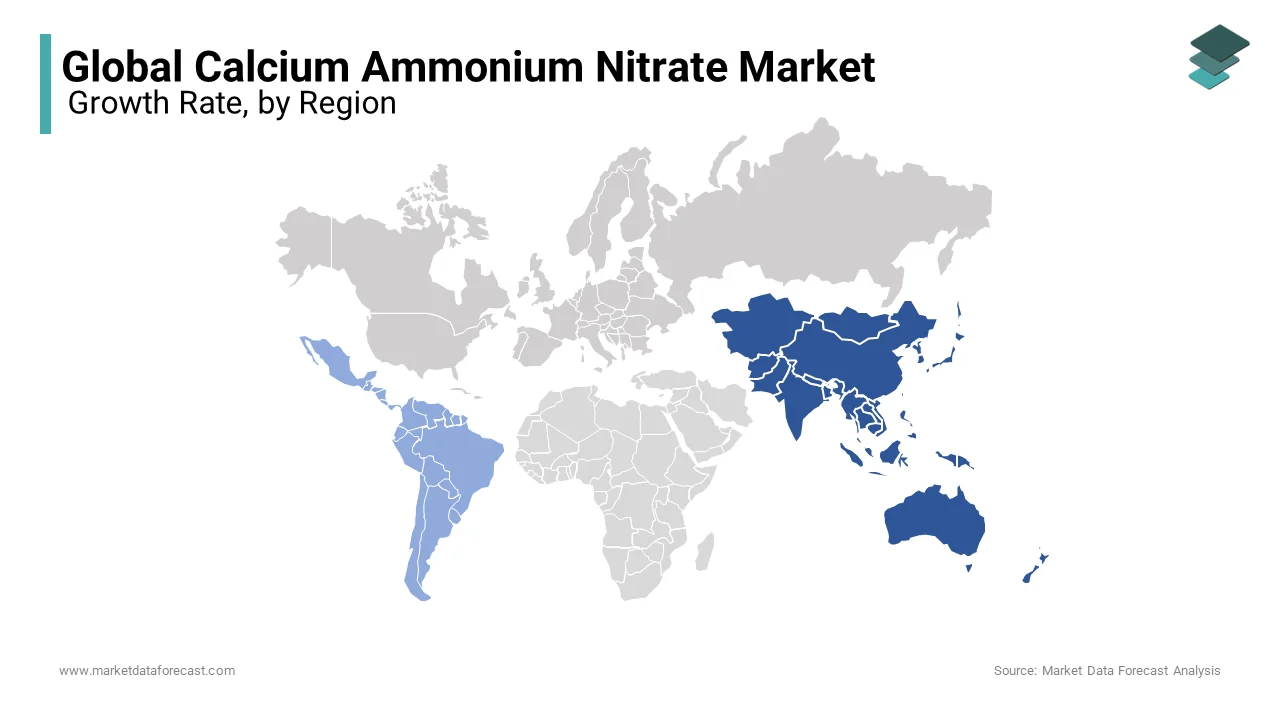

Asia-Pacific dominated the calcium ammonium nitrate (CAN) market by holding 40.3% of the global market share in 2024. This leadership is driven by the region's extensive agricultural activities, with China and India accounting for over 55% of global fertilizer consumption. The Indian Ministry of Chemicals and Fertilizers states that fertilizer demand in India grew at a notable rate over the past five years, supported by government subsidies and rising food security needs. China’s Ministry of Agriculture and Rural Affairs highlights that nitrogenous fertilizers like CAN play a critical role in meeting the country’s grain production targets, which aims to exceed annually. Asia-Pacific’s dominance underscores its pivotal role in shaping global fertilizer trends.

Latin America region quickly expanding in the calcium ammonium nitrate market with a projected CAGR of 7.2%. This growth is fueled by increasing investments in sustainable agriculture and the adoption of advanced fertilizers to improve crop yields. Brazil, the region’s largest market, reported a 10% increase in fertilizer imports in 2022, as stated by the Brazilian Ministry of Agriculture, Livestock, and Supply. The region’s focus on high-value crops such as soybeans, coffee, and sugarcane drives CAN demand, as it enhances soil fertility while minimizing environmental impact. Latin America’s rapid growth highlights its importance as an emerging hub for fertilizer innovation and adoption, supported by favorable government policies and export-oriented agriculture.

North America

North America is expected to witness steady growth in the calcium ammonium nitrate (CAN) market, driven by stringent environmental regulations promoting sustainable fertilizers. The U.S. Environmental Protection Agency (EPA) emphasizes reducing nutrient runoff under the Clean Water Act, encouraging the adoption of CAN due to its lower environmental impact. According to the United States Geological Survey (USGS), with demand projected to grow at 3-4% annually through 2030. Canada’s Agriculture and Agri-Food department highlights that CAN improves crop yields while minimizing nitrate leaching, aligning with sustainability goals.

Europe

Europe represents a mature market for calcium ammonium nitrate, with steady demand driven by advanced agricultural practices and strict environmental policies. The European Commission’s Farm to Fork Strategy aims to reduce nutrient losses by at least 50% by 2030, encouraging the use of CAN due to its controlled nutrient release properties. Eurostat reports that nitrogenous fertilizers represent a sizeable portion of total fertilizer usage in the EU, with CAN being a preferred choice for sustainable farming. Europe’s focus on sustainability and soil health ensures its continued relevance in the global CAN market, holding approximately 20% of the share by 2030.

Middle East & Africa

The Middle East and Africa are anticipated to show moderate growth in the calcium ammonium nitrate market, supported by rising agricultural modernization efforts. The African Development Bank reports that fertilizer usage in Sub-Saharan Africa is projected to grow by 4-5% annually through 2025, driven by government initiatives to boost food security. In the Middle East, Saudi Arabia’s Ministry of Environment, Water, and Agriculture highlights increased investments in high-value crops like dates and vegetables, driving CAN demand. However, limited awareness, infrastructure challenges, and reliance on imports hinder faster adoption. Collectively, these regions are expected to contribute approximately 10% to the global CAN market by 2030, with their growth largely dependent on policy support and technological advancements.

Top 3 Players in the market

Yara International ASA

Yara International, headquartered in Norway, is a prominent player in the global fertilizer industry. The company specializes in the production of nitrogen-based fertilizers, including calcium ammonium nitrate. Yara's extensive distribution network and commitment to sustainable agricultural practices have solidified its position as a market leader. Their innovative solutions aim to increase crop yields while minimizing environmental impact.

EuroChem Group AG

EuroChem, based in Switzerland, is a major global producer of nitrogen, phosphorous, and potassium fertilizers. The company produces calcium ammonium nitrate and has a significant presence in key agricultural markets worldwide. EuroChem's vertically integrated operations, from mining to fertilizer production, enable them to maintain high-quality standards and cost efficiency.

Uralchem Group

Uralchem, headquartered in Russia, is one of the largest producers of nitrogen fertilizers, including ammonium nitrate and its derivatives. The company's substantial production capacity and strategic focus on innovation have strengthened its position in the global CAN market. Uralchem's products are distributed across various regions, supporting agricultural productivity worldwide.

Top strategies used by the key market participants

Sustainability and Green Initiatives

Leading fertilizer manufacturers, such as Yara International and EuroChem, are heavily investing in eco-friendly production techniques. They aim to reduce carbon emissions and improve the environmental footprint of CAN production by incorporating cleaner energy sources, such as biomethane, into their manufacturing processes.

Vertical Integration

Companies like Uralchem have adopted a vertically integrated business model, allowing them to control the entire supply chain from raw material extraction to finished product distribution. This strategy ensures cost efficiency, quality control, and a stable supply of CAN to global markets.

Technological Advancements and R&D Investments

Key players continuously invest in research and development to improve the efficiency and effectiveness of CAN-based fertilizers. New formulations, such as enhanced nitrogen-release fertilizers, help optimize nutrient absorption in crops, reducing environmental losses and improving agricultural yields.

KEY MARKET PLAYERS

Yara (Norway), EuroChem Group (Switzerland), HELM AG (Germany), FATIMA GROUP (Pakistan), Origin UK Operations Limited (U.K.), Barium & Chemicals, Inc. (U.S.), Agrico (U.S.), Fertinagro India Private Limited (India), AB "Achema" (Lithuania), GFS Chemicals, Inc. (U.S.). These are the market players that are dominating the global calcium ammonium nitrate market.

COMPETITIVE LANDSCAPE

The calcium ammonium nitrate (CAN) market is highly competitive and driven by increasing global demand for high-efficiency fertilizers in agriculture. The market is dominated by major players such as Yara International ASA, EuroChem Group AG, and Uralchem Group, which control a significant share through large-scale production, global distribution networks, and innovative product offerings.

Competition in the market is primarily shaped by technological advancements, sustainability initiatives, and pricing strategies. Leading firms are focusing on research and development to produce fertilizers with enhanced nutrient absorption and reduced environmental impact. With growing concerns about greenhouse gas emissions, companies are investing in low-carbon and bio-based production techniques to align with global sustainability goals.

Market competition is also influenced by regional expansion and strategic acquisitions. Companies are expanding into high-growth markets in Asia-Pacific, Latin America, and Africa to capitalize on rising agricultural activities. Additionally, smaller regional players compete by offering cost-effective alternatives, leading to price-based competition.

Government regulations on fertilizer production and environmental impact also shape competitive dynamics. Companies that comply with strict regulations and innovate in sustainable fertilizers gain a competitive edge. Overall, the CAN market is poised for intense competition as global food production demands continue to rise.

RECENT HAPPENINGS IN THIS MARKET

- In December 2024, activist investor Carl Icahn, through his firm American Entertainment Properties (AEP), acquired an additional 32,348 common units of CVR Partners, a fertilizer company specializing in ammonia and urea ammonium nitrate production. This purchase, amounting to $2.4 million at an average price of $74.53 per unit, increased AEP's direct holdings to 174,192 units. Including indirect holdings through CVR Energy, in which Icahn and his affiliates hold a 66% stake, his total ownership in CVR Partners exceeds 4 million units, representing more than 38% of the company.

- In November 2024, Enaex presented advancements in "Clean Ammonium Nitrate" at the Annual Conference 2024, focusing on sustainable production methods. This initiative aims to reduce environmental impact and enhance the efficiency of ammonium nitrate-based fertilizers.

- In December 2024, Yara initiated the production of biomethane-based nitrate fertilizers at its Cubatão complex in Brazil. This innovation is expected to reduce the carbon footprint of fertilizers by up to 75%, supporting global sustainability goals.

MARKET SEGMENTATION

This research report on the global calcium ammonium nitrate market is segmented and sub-segmented into the following categories.

By Grade

- Technical Grade

- Reagent Grade

- Fertilizer Grade

- Others

By Application

- Water Treatment

- Inorganic Fertilizer

- Concrete

- Explosives

- Ice Packs

- Clear-Water Drilling

- Additive

- Others

By Form

- Liquid

- Solid

By Type

- Nitrogen Content 27%

- Nitrogen Content 15.5%

- Others

By End User

- Agriculture

- Building and Construction

- Residential

- Commercial

- Industrial

- Infrastructural

- Pharmaceutical

- Oil and Gas Industry

- On-Shore

- Off-Shore

- Mining

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the current market size of the global calcium ammonium nitrate market?

The current market size of the global calcium ammonium nitrate market size was valued at USD 2.57 billion in 2025

Who are the market drivers that re driving the global calcium ammonium nitrate market?

The Growing Demand for Fertilizers in Agriculture and the Rising Focus on Sustainable Agriculture Practices are the major market drivers in this market.

What are the market opportunities taken in the global calcium ammonium nitrate market?

The Increasing Adoption of Precision Agriculture Technologies and Rising Investments in Sustainable fertilizer innovations are the market opportunities in this market.

What are the challenges faced by the global calcium ammonium nitrate market?

The Limited Awareness and Adoption in Developing Regions and Competition from Alternative Nitrogen Fertilizers are the tough challenges faced by the global calcium ammonium nitrate market.

Who are the market players that are dominated by the global calcium ammonium nitrate market?

Yara (Norway), EuroChem Group (Switzerland), HELM AG (Germany), FATIMA GROUP (Pakistan), Origin UK Operations Limited (U.K.), Barium & Chemicals, Inc. (U.S.), Agrico (U.S.), Fertinagro India Private Limited (India), AB "Achema" (Lithuania), GFS Chemicals, Inc. (U.S.). These are the market players that are dominating the global calcium ammonium nitrate market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]