Global Building Materials Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Aggregates, Bricks, Cement, Others), Application (Residential, Commercial) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Building Materials Market Size

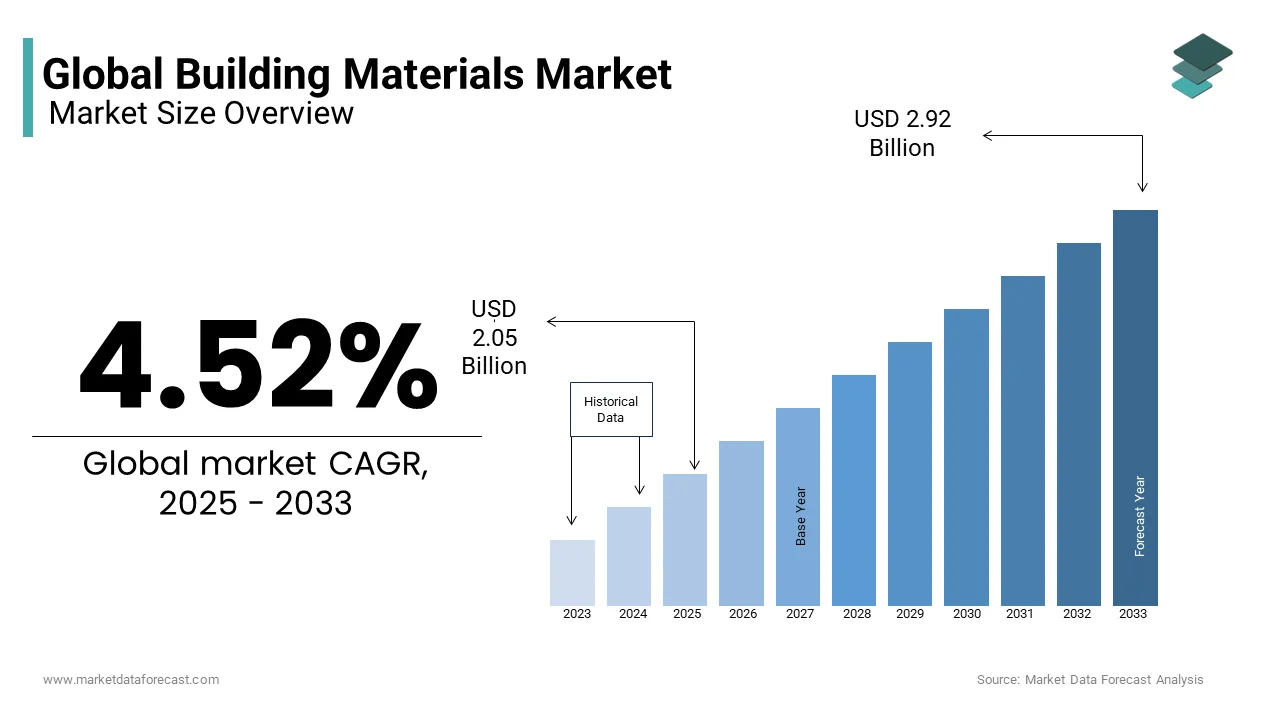

The global building materials market size was valued at USD 1.96 billion in 2024 and is anticipated to reach USD 2.05 billion in 2025 from USD 2.92 billion by 2033, growing at a CAGR of 4.52% during the forecast period from 2025 to 2033.

Building materials are integral to global infrastructure and urban development and these include a wide range of materials such as cement, steel, glass, wood, bricks, and composites. These materials are essential for constructing residential, commercial, and industrial structures. In 2021, the buildings and construction sector accounted for approximately 37% of energy and process-related CO₂ emissions, as reported by the United Nations Environment Programme (UNEP). This significant contribution underscores the importance of adopting sustainable practices within the industry.

Urbanization trends are also reshaping the demand for building materials. As of 2018, over 55% of the global population resided in urban areas, with projections indicating this figure will increase to nearly 70% by 2050, according to the World Bank. This rapid urban expansion necessitates the development of sustainable and resilient infrastructure to accommodate growing urban populations. In response to environmental concerns, there is a growing emphasis on eco-friendly materials such as low-carbon cement, engineered wood, and recycled composites. Manufacturers are investing in green building solutions to meet international standards, including LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method).

Market Drivers

Urbanization and Infrastructure Development

Urbanization is a key driver of the building materials market, as cities expand rapidly worldwide. According to the United Nations Department of Economic and Social Affairs (UN DESA), 56% of the global population lived in urban areas in 2021, and this figure is projected to rise to 68% by 2050. This trend fuels demand for infrastructure development, including housing, roads, and utilities. The U.S. Census Bureau reports that construction spending in the United States totalled $1.73 trillion in 2022, reflecting steady growth in the sector. As urban centers grow, there is an increasing need for sustainable and durable materials, driving innovation in eco-friendly solutions. Governments worldwide are prioritizing urban infrastructure projects, further boosting demand for building materials, as highlighted by the World Bank, which emphasizes infrastructure as a critical component of economic development.

Government Policies and Housing Initiatives

Government policies play a pivotal role in shaping the building materials market through housing programs and regulatory frameworks. The U.S. Department of Housing and Urban Development (HUD) has consistently supported affordable housing initiatives, infusing substantial amount of investments in fiscal year 2022 to address housing needs and stimulate construction activities. These programs increase demand for building materials while promoting sustainable practices. Additionally, regulations aimed at reducing energy consumption in buildings have gained traction globally. According to the International Energy Agency (IEA), the building sector accounted for 30% of global energy use and 27% of energy-related CO2 emissions in 2021, underscoring the importance of energy-efficient materials. Such policies not only drive demand but also align with environmental goals, fostering innovation and sustainability in the industry.

Market Restraints

Rising Raw Material Costs

One of the major restraints in the building materials market is the escalating cost of raw materials, which impacts production expenses and profit margins. The U.S. Bureau of Labor Statistics (BLS) reported that the Producer Price Index (PPI) for construction materials increased by 19.3% between January 2021 and December 2022, driven by supply chain disruptions, labor shortages, and inflationary pressures. For example, the National Association of Home Builders (NAHB) noted that lumber prices peaked at over $1,500 per thousand board feet in mid-2021 due to trade restrictions and transportation bottlenecks, significantly affecting housing affordability. These rising costs are passed on to consumers, leading to reduced affordability and delayed project timelines. Additionally, volatility in global commodity markets exacerbates uncertainties for manufacturers and contractors.

Stringent Environmental Regulations

Stringent environmental regulations pose another significant restraint on the building materials market by increasing compliance costs and limiting material choices. The Environmental Protection Agency (EPA) enforces regulations like the Toxic Substances Control Act (TSCA), which restricts hazardous substances such as asbestos and lead in construction materials. While these measures are essential for sustainability, they often require manufacturers to invest in costly alternatives or advanced technologies. According to a report published in the Science Direct, compliance with green building standards can increase upfront construction costs by 2-7%, depending on the region and project type. Furthermore, the European Commission highlights that under the EU Green Deal, cement producers face carbon emission reduction targets of 55% by 2030, driving investments in energy-efficient technologies. These regulatory pressures challenge smaller firms, potentially stifling innovation and market growth.

Market Opportunities

Growth of Smart and Sustainable Building Materials

The increasing demand for smart and sustainable building materials presents a significant opportunity for the market. The U.S. Green Building Council (USGBC) highlights that green building practices are projected to account for a notable portion of all commercial construction projects by 2025, driven by energy efficiency goals and environmental regulations. Governments are incentivizing sustainable materials; the Department of Energy (DOE) offers tax credits under the Inflation Reduction Act of 2022 for energy-efficient components like solar panels and insulation. These trends align with global climate goals, such as the Paris Agreement, encouraging innovation in eco-friendly materials and boosting market expansion.

Expansion into Emerging Markets

Emerging markets offer immense growth potential for the building materials market due to rapid urbanization and infrastructure development. The World Bank estimates that developing countries will require $1.5 trillion annually in infrastructure investments to meet Sustainable Development Goals (SDGs). For example, India’s Ministry of Housing and Urban Affairs aims to construct 20 million affordable homes under its Pradhan Mantri Awas Yojana (PMAY) initiative by 2022, creating substantial demand for cement, steel, and other materials. These regions present lucrative opportunities for manufacturers to expand their footprint, particularly by offering cost-effective and durable solutions tailored to local needs, driving long-term profitability.

Market Challenges

Fluctuating Energy Prices

Fluctuating energy prices pose a significant challenge to the building materials market, as production processes are highly energy-intensive. The U.S. Energy Information Administration (EIA) reported that industrial energy costs increased majorly in 2022 compared to 2021 due to geopolitical tensions, particularly the Russia-Ukraine conflict, and supply chain disruptions. Cement production, for example, accounts for approximately 2% of global CO2 emissions and consumes about 12-15% of industrial energy globally, according to the International Energy Agency (IEA) . These rising costs force manufacturers to either absorb expenses or pass them on to consumers, reducing affordability. Additionally, volatile energy prices hinder long-term planning and investment in sustainable technologies. The Federal Reserve Economic Data (FRED) highlights that such instability has contributed to slower growth in construction projects, further impacting demand for building materials

Labor Shortages in Construction

Labor shortages in the construction industry present another major challenge for the building materials market. The U.S. Bureau of Labor Statistics (BLS) estimates that the construction sector faced a shortfall of over 300,000 workers in 2022, driven by an aging workforce and a lack of skilled labor. This shortage delays project timelines, reduces demand for materials, and increases labor costs. According to the National Association of Home Builders (NAHB), 82% of builders reported labor shortages as a significant issue in 2022, leading to higher project costs and reduced housing starts. Furthermore, the World Economic Forum (WEF) notes that automation and digitalization could mitigate these challenges, but adoption remains slow due to high upfront costs and resistance to change. Addressing this issue is critical to sustaining growth in the building materials market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.52% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

China National Building Material Company, CEMEX, Boral Limited, Lafarge Holcim, Dyckerhoff AG, Buzzi Unicem SpA, CSR Limited, CRH Plc, Aditya Birla Group, Ambuja Cements. |

SEGMENT ANALYSIS

Global Building Materials Market Analysis By Type

The cement segment held the largest share of 31.9% of the global market share in 2024. The essential role of cement in construction, including residential, commercial, and infrastructure projects is majorly propelling the growth of the cement segment in the global market. For instance, the Global Cement and Concrete Association (GCCA) highlights that cement production reached 4 billion metric tons globally in 2022, driven by urbanization in Asia-Pacific and Africa. Cement's importance lies in its versatility, durability, and cost-effectiveness, making it indispensable for concrete production. With governments investing heavily in infrastructure such as India’s $1.4 trillion National Infrastructure Pipeline cement remains critical to global development.

The aggregates segment is growing at a brisk pace and is estimated to showcase a CAGR of 5.8% during the forecast period owing to the rising demand for sustainable construction practices and the use of recycled aggregates. Global aggregate production expanded significantly in 2022, driven by road construction and urbanization. Governments are prioritizing eco-friendly solutions, such as using recycled aggregates in green buildings, boosting demand. For example, the European Commission emphasizes circular economy principles, encouraging aggregate recycling. Aggregates' affordability and widespread application make them pivotal for meeting global infrastructure needs sustainably.

Global Building Materials Market Analysis By Application

The residential segment was the dominant segment in the building materials market by contributing 40.3% of the global market share in 2024. This dominance is driven by rapid urbanization and government initiatives to address housing shortages. For instance, India’s Pradhan Mantri Awas Yojana (PMAY). The U.S. Census Bureau highlights that single-family home construction in the U.S. grew notably in 2022, reflecting strong demand. Residential construction's importance lies in its direct impact on improving living standards and supporting economic growth through job creation and infrastructure development.

The industrial segment is currently the rapidly emerging segment with a CAGR of 6.3% over the forecast period due to the increasing investments in manufacturing facilities, warehouses, and renewable energy projects. For example, the International Energy Agency (IEA) reports that global solar and wind energy capacity additions reached 291 GW in 2022, driving demand for industrial-grade materials. Governments are prioritizing industrial modernization; China’s 14th Five-Year Plan allocates substantial amount to advanced manufacturing and technology upgrades. The industrial segment's focus on sustainability and automation makes it pivotal for meeting global economic and environmental goals, ensuring long-term growth in material demand.

REGIONAL ANALYSIS

Asia-Pacific region was at the forefront of the building materials market by accounting for 40.4% of the global market share in 2024. The dominance of the Asia-Pacific region in the global market is driven by rapid urbanization and infrastructure development, particularly in China and India. For instance, China’s construction sector contributes over 28% to its GDP, according to the National Bureau of Statistics of China. The region's importance lies in its massive population and government investments in smart cities and affordable housing projects. With urbanization rates projected to reach 68% by 2050, as per the United Nations Department of Economic and Social Affairs (UN DESA), Asia-Pacific will remain a critical hub for building materials.

The Middle East and Africa region is quickly expanding with a CAGR of 7.1% in the coming years. This growth is fueled by large-scale infrastructure projects like Saudi Arabia’s Vision 2030 and Africa’s urbanization surge. Africa’s construction landscape is expected to grow considerably supported by investments in energy, transportation, and housing. Governments are prioritizing sustainable development, driving demand for eco-friendly materials. For example, Saudi Arabia plans to invest $1 trillion in giga-projects by 2030, as stated by the Saudi Ministry of Investment. The region’s strategic focus on modernization and economic diversification makes it pivotal for future growth in the building materials market.

North America is a mature market for building materials, characterized by steady growth driven by renovation projects and green building initiatives. The US Green Building Council (USGBC) has found that the green building sector has generated hundreds of billions of dollars for the U.S. economy and millions of jobs, reflecting a strong focus on sustainability. Additionally, according to the Composite Panel Association, construction spending in the U.S. reached $1.73 trillion in 2022, with both residential and non-residential sectors contributing significantly. Government incentives, such as tax credits for energy-efficient materials under the Inflation Reduction Act of 2022, further boost demand. While growth is moderate compared to emerging markets, North America’s emphasis on innovation and sustainability ensures its continued relevance in the global building materials market.

Europe

The building materials market in Europe is expected to account for a substantial share of the global market over the forecast period due to the stringent environmental regulations and a strong push toward carbon neutrality. The European Commission emphasizes that the construction sector accounts for 36% of the EU’s CO2 emissions, driving policies like the EU Green Deal, which mandates a 55% reduction in emissions by 2030. According to Eurostat, the European construction industry grew by 3.2% in 2022, supported by investments in energy-efficient buildings and renewable energy infrastructure. Countries like Germany and France are leading this transition, with significant funding allocated to retrofitting old buildings and adopting sustainable materials. While growth is slower compared to Asia-Pacific or Africa, Europe’s focus on sustainability positions it as a leader in eco-friendly building solutions.

Latin America

Latin America’s building materials market is expected to grow at a moderate pace, driven by urbanization and government housing programs. Latin America and the Caribbean (LAC) must invest $2.22 trillion in infrastructure by 2030, according to the Inter-American Development Bank (IDB). Despite challenges like economic instability and supply chain disruptions, Latin America’s focus on affordable housing and infrastructure development will drive steady growth in the coming years.

Top 3 Players in the market

Saint-Gobain (France)

Saint-Gobain, a French multinational corporation, is one of the world's leading building materials manufacturers, specializing in glass, insulation, gypsum, mortars, and high-performance materials. The company has a global presence in over 75 countries and has been a key driver in the adoption of lightweight and energy-efficient construction solutions. Saint-Gobain is known for advanced glazing solutions, such as low-emissivity glass that enhances building insulation, helping to reduce energy consumption in residential and commercial spaces. With a strong commitment to sustainability, the company has pledged to achieve carbon neutrality by 2050 and has been investing in low-carbon cement and recyclable construction materials. In 2024, Saint-Gobain continued its expansion strategy by acquiring several insulation and specialty materials companies, further solidifying its position as a leader in green and smart construction.

China National Building Material Group (CNBM) (China)

China National Building Material Group (CNBM) is the largest cement and building materials manufacturer in China, and one of the biggest in the world, generating an estimated $67 billion in revenue in 2023. The company plays a vital role in global infrastructure development, supplying cement, concrete, gypsum board, and glass fiber products to projects across Asia, Africa, and Europe. CNBM is a major supplier for China’s Belt and Road Initiative (BRI), providing materials for large-scale highways, bridges, and urban developments. With increasing environmental concerns, CNBM has invested in carbon capture technology, waste recycling, and energy-efficient cement production to align with China’s carbon neutrality goals. The company is also leading efforts in prefabricated building solutions, helping to drive efficiency and sustainability in the construction industry.

Holcim (Switzerland)

Holcim, headquartered in Switzerland, is a global leader in cement, concrete, and aggregates, with a presence in over 70 countries. The company has been at the forefront of sustainable building solutions, pioneering low-carbon cement (ECOPlanet) and green concrete (ECOPact), which significantly reduce CO₂ emissions in construction. Holcim is actively involved in the circular economy, repurposing construction and demolition waste into new building materials, helping to reduce landfill waste. Another innovative area for Holcim is 3D-printed concrete technology, which enables faster, more cost-efficient, and environmentally friendly construction. The company’s sustainability strategy includes investing in renewable energy for production plants and developing smart urban construction solutions that contribute to energy-efficient cities. Holcim continues to lead in green building initiatives, making it a critical player in the transition towards climate-resilient infrastructure.

Top strategies used by the key market participants

Sustainability & Green Building Solutions

Sustainability has become a core strategy for leading building materials companies as they respond to strict environmental regulations and growing consumer demand for eco-friendly solutions. Companies like Saint-Gobain, CNBM, and Holcim are investing in low-carbon materials, energy-efficient products, and circular economy practices. Saint-Gobain is focusing on low-carbon cement, recyclable insulation materials, and advanced glazing solutions to reduce building energy consumption. Similarly, CNBM is integrating carbon capture technology into its cement production, aiming to minimize emissions. Holcim, on the other hand, is pioneering low-carbon concrete (ECOPact) and sustainable cement (ECOPlanet), reducing CO₂ footprints in construction. These sustainability-driven innovations not only help companies meet global climate goals but also enhance their brand reputation and market competitiveness.

Mergers & Acquisitions (M&A) for Market Expansion

Mergers and acquisitions (M&A) are a key strategy used by top building materials firms to expand market share, diversify product offerings, and strengthen supply chains. Saint-Gobain has aggressively acquired insulation and specialty materials manufacturers in Europe and North America, reinforcing its leadership in energy-efficient construction. CNBM, China’s largest cement producer, has undergone multiple mergers with state-owned enterprises (SOEs), consolidating its dominance in cement and glass fiber production. Holcim is expanding through strategic acquisitions of regional cement companies and green technology startups, allowing it to scale up sustainable construction solutions. By acquiring key players in niche markets, these companies are enhancing their global presence and operational efficiency, ensuring long-term profitability.

Digital Transformation & Smart Construction Technologies

The adoption of digital technology and automation is transforming the building materials sector, enabling companies to improve efficiency, reduce costs, and enhance product quality. Saint-Gobain is integrating AI-powered predictive analytics into its manufacturing plants, optimizing production processes and material usage. CNBM has embraced smart factory technology, automating its cement and gypsum production lines to boost productivity. Holcim is at the forefront of 3D-printed concrete technology, enabling faster, cost-effective, and sustainable building solutions. By leveraging AI, IoT, and digital sales platforms, these companies are streamlining operations and enhancing their ability to meet customer demands in a rapidly evolving construction landscape.

KEY MARKET PLAYERS

China National Building Material Company, CEMEX, Boral Limited, Lafarge Holcim, Dyckerhoff AG, Buzzi Unicem SpA, CSR Limited, CRH Plc, Aditya Birla Group, Ambuja Cements. These are the market players that are dominating the global building materials market.

COMPETITIVE LANDSCAPE

The building materials market is highly competitive, driven by innovation, sustainability trends, infrastructure development, and fluctuating raw material costs. The market consists of global giants such as Saint-Gobain, China National Building Material Group (CNBM), and Holcim, alongside regional players and specialized manufacturers. Competition is fueled by mergers and acquisitions (M&A), with companies expanding their market share through strategic partnerships and acquisitions of smaller firms.

Sustainability has become a major competitive factor, as governments and consumers demand eco-friendly, low-carbon construction materials. Companies are investing in green cement, energy-efficient insulation, and recycled materials to meet environmental regulations and market preferences. Technological advancements, such as 3D-printed concrete, AI-driven manufacturing, and smart construction materials, are further intensifying competition.

Price fluctuations in raw materials such as cement, aggregates, and steel also impact competition, with companies focusing on cost reduction and supply chain optimization. Additionally, global expansion into emerging markets, particularly in Asia, Africa, and Latin America, is a key strategy for gaining a competitive edge.

RECENT HAPPENINGS IN THIS MARKET

- In May 2024, Monomoy Capital Partners acquired Southern Exteriors, a manufacturer and installer of residential and commercial exterior building products. The acquisition was driven by the nationwide housing undersupply and population migrations to the U.S. South.

- In March 2024, Breedon Group announced the acquisition of BMC Enterprises, a U.S.-based construction materials company, for £238.1 million. This acquisition marked Breedon's expansion into the U.S. market, enhancing its product offerings and geographical reach.

- In January 2024, Kingspan Group acquired a 51% stake in Steico, a German manufacturer of wood-based insulation materials, for €250 million. This investment aligns with Kingspan's strategy to expand its sustainable building solutions portfolio.

MARKET SEGMENTATION

This research report on the global building materials market is segmented and sub-segmented into the following categories.

By Type

- Aggregates

- Bricks

- Cement

- Others

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]