Global Biofertilizers Market Size, Share, Trends & Growth Forecast Report By Type (Nitrogen Fixing, Potassium Mobilizing, Phosphate Stabilizers, Sulphur Solubilizing and Others), Microorganism (Rhizobium, Potash Mobilizing Bacteria, Azospirillium and Others), Crop Type (Cereals & Grains, Pulses & Oilseeds, Fruits & Vegetables and Others), Application (Seed Treatment, Soil Treatment, Foliar Treatment and Others) Form (Liquid and Carrier-Based) and Region (North America, Europe, Latin America, Asia-Pacific, Middle East And Africa), Industry Analysis from 2025 to 2033

Global Biofertilizers Market Size

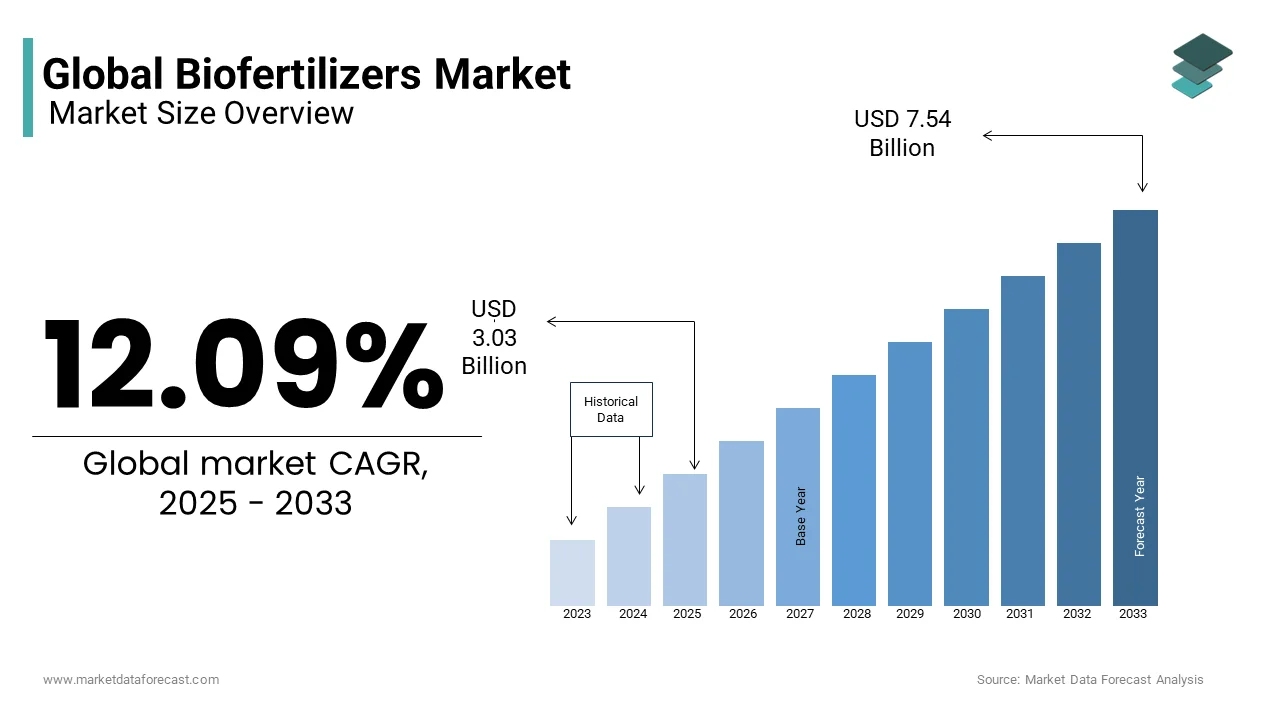

The global biofertilizers market size was valued at USD 2.70 billion in 2024 and is anticipated to reach USD 3.03 billion in 2025, from USD 7.54 billon by 2033, growing at a CAGR of 12.09% from during the forecast period 2025 to 2033.

Biofertilizers are made of living organisms like bacteria, mycorrhizal fungi, rhizobium, and pseudomonas to offer essential nutrients that promote growth in plants and trees.

Biofertilizers are associated with living organisms, most likely to be fungi or bacteria, which are not chemically synthesized, which enhances plant growth. There are various advantages of biofertilizers, such as the fact that they can stimulate plant growth by maintaining the normal fertility of the soil and that they do not contain any toxic contents. The future of farming techniques involves adopting organic and toxic-free fertilizers to limit agricultural wastage and reduce the harmful effects. Population and food demand are directly correlated, where the demand to produce food rises along with the increasing population. Stringent rules and regulations by the government closely ensure the quality of the food supply chain and encourage farmers to use only organic fertilizers like biofertilizers. It is also a known fact that biofertilizers can expand crop yield by 40% by increasing soil fertility. The need to increase the food production rate along with the randomly increasing population is surging the demand for the use of various farming techniques that induce crop yield. One step to overcoming the food shortages with the rising population across the world is to establish the growth rate of the biofertilizers market.

MARKET DRIVERS

Growing Demand for Organic Products to Maintain a Healthy Lifestyle

This need for organic products promotes organic farming, where biofertilizers play a pivotal role. Governments across the world are offering special incentives and subsidies to support sustainable agriculture, propelling the demand for biofertilizers. In addition, chemical and synthetic fertilizers result in increased pollution, water contamination, and soil degradation. Therefore, there is a rising need for alternative eco-friendly options like biofertilizers that can promote soil health and fertility, resulting in more crop yields for farmers. Also, the latest advancements in technology and improvements in microbe strains are contributing to the growth of more effective and affordable biofertilizer options.

The burgeoning demand for high-value crops and diversification of plants are creating a positive atmosphere for the biofertilizers market. Besides, the surge in global warming and deforestation is hindering the pattern of seasons and resulting in uncertain rain conditions. Therefore, there is a huge emphasis on effective solutions to ensure more crop production and high-quality foods, which is promoting the adoption of more biofertilizers. Moreover, the advantages of biofertilizers, like water conservation, integrated pest management, and increasing education about the uses of these components, will create lucrative opportunities for the biofertilizers market in the coming years.

MARKET RESTRAINTS

High Costs

The primary restraint to the global biofertilizers market is the issue of the prices of these fertilizers compared to the cheap chemical products that are available. The lack of proper awareness among farmers about the long-term benefits of these biofertilizers is also creating a negative impact on the business. Also, the uncertain functionality of these biofertilizers in harsh climates, different soil conditions, and seasoned crops is pulling the market demand down. In addition, the lack of an established infrastructure and distribution network can hamper the productivity and sales of these fertilizers. Besides, the volatility of the market due to changing commodity prices and accessibility of products is also a concern in the global biofertilizers market. The strict government regulations and compliances related to environmental safety also led to delayed approvals for manufacturers. Moreover, the shelf life and storage challenges, coupled with the intense market competition, are further supposed to restrict the developments in the global biofertilizers market.

MARKET CHALLENGES

The major challenging factor for biofertilizers is that they cost more when compared with chemical fertilizers. Also, biofertilizers have slow effects on the growth of plants, whereas chemical fertilizers show immediate results on crop production. The prominence of yielding high crop production in less time can only be successful with chemical fertilizers, which may have a negative impact on the growth rate of the market. Drastic climatic changes may not show good results for biofertilizers, which may pose severe challenges for key market players. Disruptions in the supply chain and lack of high-quality products are also likely to hinder the growth rate of the market in the coming years. Incomplete composting of the biofertilizers may elevate the potential risk for humans and animals. Biofertilizers are a type of animal manure that can be a source of weed seed where it causes hazardous disease, and one should take potential care while handling these fertilizers to avoid the risk. However, the trend toward the adoption of eco-friendly products like biofertilizers in the agriculture sector is expected to elevate the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.09% |

|

Segments Covered |

By Type, Crop Type, Microorganism, Application, Form and Region |

|

Various Analyses Covered |

Global, Regional, and country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East and Africa |

|

Market Leaders Profiled |

UPL, Novozymes, Syngenta, CHR Hansen Holding A/S, Vegalab SA, Lallemand Inc., Rizobacter Argentina, IPL Biologicals Limited, Kiwa Bio-tech Product Group Corporation, T. Stanes and Company Ltd, National Fertilizers Limited, BioWorks Inc., American Vanguard Corp, Symborg, Novozymes, Bioceres S.A., Agrilife, Gujarat State Fertilizers & Chemicals Ltd, Koppert Biological Systems Inc., and Nutramax Laboratories, Inc |

SEGMENTAL ANALYSIS

By Type Insights

The nitrogen-fixing segment recorded the highest share of the worldwide market in 2023 and is likely to have more demand over the forecast period due to their effective soil correction and high-yield benefits. In addition, nitrogen-fixing can offer advantages like improved soil health, nutrient absorption, plant growth stimulus, and increased crop production. Similarly, phosphate solubilizers are also anticipated to register significant growth with the surging need for sustainable farming techniques.

By Crop Type Insights

The cereals & grains segment dominated the biofertilizers market in 2023 and is predicted to continue its dominion in the coming years. Wheat, maize, rice, etc., are staple foods in most countries, which supports the demand in this segment. In addition, the oilseeds and pulses segment is expected to grow in the coming years because of favorable government regulations and the need for organic oils and pulses. Besides, fruits and vegetables are also estimated to witness steady growth in the future due to the consumer demand for a healthy lifestyle.

By Form Insights

The Liquid fertilizers segment held the lion’s share in the global biofertilizers market in 2023 and is predicted to continue their dominion in the outlook period. Liquid biofertilizers are easy to use and allow quick absorption of nutrients, along with improved crop yields due to high microbial density.

By Microorganism Insights

The rhizobium segment registered a majority share in the global biofertilizers market because of its advantages, such as nitrogen fixation in soils. Similarly, Rhizobium improves the crop growth and insolubilization of organic phosphates, which enhances productivity and plant health. Azotobacter, a symbiotic bacterium, is also expected to record considerable growth in the predicted period due to its support in synthesizing plant growth regulators, protection from phytopathogens, and balancing soil pH and fertility.

By Application Mode Insights

The seed treatment segment dominated the global biofertilizers market owing to the need for increased crop production and decreased utilization of synthetic fertilizers. Similarly, soil treatment applications are expected to witness higher demand because of the increasing need to reduce soil erosion and increase fertility.

REGIONAL ANALYSIS

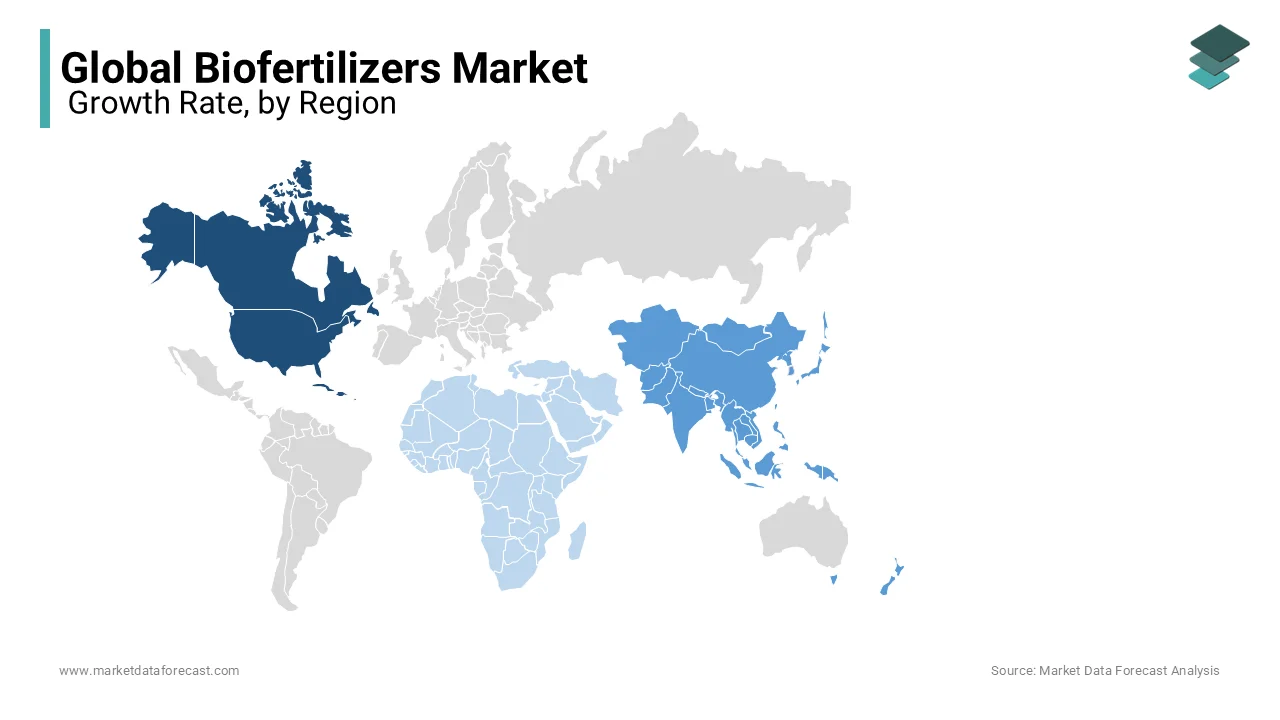

North America dominated the biofertilizers market in 2023 and is predicted to register significant growth over the forecast period. The United States is the leading contributor to this regional market because of the presence of key market players and the surging need for organic food products. In addition, the supportive government initiatives and large production of cash crops are majorly driving the adoption of biofertilizers in North America. Canada is also a prominent market in this locale and is supposed to witness more usage of biofertilizers in the coming years.

The Asia Pacific region is expected to register a notable growth rate in this market with the increasing agricultural practices in nations like India, China, Vietnam, South Korea, and Japan. The surge in the local population, along with the environmental and health challenges of using conventional fertilizers, is acting positively for the liquid fertilizers business in this locale. China and India are the leading players in the Asia Pacific due to the spike in organic food products, the adoption of technological processes in farming, and the use of biofertilizers in the place of synthetic products. Further, the supportive initiatives from local governments and economic certainty are supposed to drive the market demand in this region.

Europe is also a considerable player in this market due to the presence of the largest organic farming area. The increasing government reforms, like the ban on the use of chemical fertilizers, along with the need for environmentally friendly practices, are promoting the adoption of biofertilizers in this area.

Latin America, with nations like Brazil and Argentina, is also a promising player in the global biofertilizers market. Government-regulated cultivation and the increasing demand for sustainable agriculture are driving the business in this locale. In addition, the spike in the demand for organic food products is likely to boost the growth potential in this region.

Middle East and Africa are relatively smaller markets for biofertilizers. However, there is a huge untapped opportunity in this area because of the increasing government spending and the need for eco-friendly cultivation practices.

KEY MARKET PLAYERS

UPL, Novozymes, Syngenta, CHR Hansen Holding A/S, Vegalab SA, Lallemand Inc., Rizobacter Argentina, IPL Biologicals Limited, Kiwa Bio-tech Product Group Corporation, T. Stanes and Company Ltd, National Fertilizers Limited, BioWorks Inc., American Vanguard Corp, Symborg, Novozymes, Bioceres S.A., Agrilife, Gujarat State Fertilizers & Chemicals Ltd, Koppert Biological Systems Inc., and Nutramax Laboratories, Inc. some of the major key players involved in the biofertilizer market.

RECENT HAPPENINGS IN THIS MARKET

- In August 2023, Bionema Group Limited, a renowned biofertilizers manufacturer in the UK, introduced a range of biofertilizer products, BioNFix range, and Rhizosafe, in the country to support crop health in horticulture, forestry, farming, and sports turfs.

- In May 2023, Nutrition Technologies launched Diptia, a novel bioactive organic fertilizer extracted from Black Soldier Fly frass to address fungal infections and damage in plants.

- In July 2023, Syngenta confirmed its plans to expand its global biological footprints with the combined efforts of Syngenta Biologicals and Valagro, a biostimulants and specialty nutrients company acquired by the former in 2020.

MARKET SEGMENTATION

This market research report on the global biofertilizers market is segmented and sub-segmented based on the Type, Crop Type, Form type, Microorganism, Application mode, and Region.

By Type

- Nitrogen Fixing

- Potassium Solubilizers

- Phosphate Solubilizers

- Others

By Crop Type

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

- Others

By Form

- Liquid

- Carrier-based

By Microorganism

- Rhizobium

- Azospirillum

- Bacillus

- Azotobacter

- VAM

- Pseudomonas

- Others

By Application Mode

- Seed Treatment

- Soil Treatment

- Foliar Treatment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of global Biofertilizers Market growth?

The size of the global biofertilizers market was valued at USD 2.70 billion in 2024 and is estimated to be growing at a CAGR of 12.09% to reach USD 7.54 billion by 2033.

Which factor is primarily responsible for the global bio fertilizers market growth?

The increasing adoption of organic farming is the major factor that drives the global Biofertilizers market growth during the forecast period.

Which region has the largest global Biofertilizers Market share?

North America currently holds the highest market share in the Global Biofertilizers Market due to rising health concerns.

Is there an effect on the market because of the Covid?

The COVID-19 pandemic had an initial negative impact on the agriculture sector and biofertilizers market due to disruptions to the supply chain and restricted logistics across the globe.

What are the limiting factor in the global Biofertilizers Market growth?

The primary factor attributing to the demand in the global biofertilizers market is the rising population demand for organic products to maintain a healthy lifestyle.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]