Global Biobanks Market Size, Share, Trends & Growth Analysis Report – Segmented By Product Type, Sample Type, Application & Region – Industry Forecast (2024 to 2032)

Global Biobanks Market Size (2024 to 2032)

In 2023, the global biobanks market was valued at USD 3.3 billion and it is expected to reach USD 6.42 billion by 2032 from USD 3.55 billion in 2024, growing at a CAGR of 7.68% during the forecast period.

Current Scenario of the Global Biobanks Market

Biobanks advance biomedical and translational research by preserving and collecting biological samples. The samples, such as human tissues, blood, and nucleic acid, are collected and used to discover disease-relevant biomarkers. These samples are made helpful in the diagnosis and prediction of drug response. The collected data are analyzed and distributed biospecimens for search purposes and treating medical conditions. Regenerative medicine through stem cell technology is essential for the treatment of diseases. Alzheimer's, cancer, diabetes, and rare genetic disorders are cured using regenerative medicine. Umbilical cord cells and other stem cells are preserved to benefit from existing therapies. Stem cell practices are rising globally and influencing the expansion of new solutions for various diseases.

MARKET DRIVERS

Technological advancements and YOY growth in chronic diseases are expected to propel the global biobanks market growth.

The rising prevalence of chronic diseases is also propelling the biobanks market. Present medications are incapable of curing a wide range of chronic illnesses such as cancer, immune deficiency, cardiovascular disease, neurological disease, and genetic disease. And if they are available, they have specific side effects. As a result, new therapies to treat these diseases are needed. Biobanks play an essential role in the research for alternative therapies because they provide most of the evidence needed for developing new treatments. In addition, biobanks include many biospecimens that can be used in chronic disease studies. As a result, the use of biobanks has grown rapidly over the years. The government and non-profit organizations' support also helps set up the biobanks; subsequently, the market shows growth over the forecast period.

Increasing public awareness of genomic testing and stem cell therapies prides the opportunities for the growth of the biobanks market forward. In genetic disorders, genes and stem cells perform critical roles. They not only replace damaged cells but can also restore them with the aid of engineering. Furthermore, many people opt for cord blood banks for cord stem cell storage. Parents save their baby's cord blood in the hope that it will be helpful in the future. As a result, the number of banks has increased over the last few decades, and the stem cell transplantation process is simplified by preserving cord blood. According to WHO, about 50,000 Haematopoietic Stem Cell Transplantations are performed yearly, steadily growing.

MARKET RESTRAINTS

Strict regulations on biobanks in many countries are hampering the growth of the global biobanks market.

High costs associated with biobanks hinder the global biobanks market growth. Nonetheless, the high cost of biobanks inhibits business growth. To incorporate advanced technical biobanks, expensive machinery and other resources are needed. This raises the operational cost, and the high cost placed on consumers to store their biospecimens lowers the acceptance rate much more. Furthermore, myths about biobanks, a scarcity of trained people, and strict regulation also hinder the growth of the biobanks market. The main challenges are storage issues, regulatory issues, and inexpensive procedures. As a result, biomarker-based research is being adopted throughout the R & D process, from early detection to clinical research and data protection and confidentiality issues.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product Type, Sample Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Beckman Coulter, Tecan Group, Taylor- Wharton, Panasonic Biomedical, Teva Pharmaceuticals, Biolife Solutions. |

SEGMENTAL ANALYSIS

Global Biobanks Market Analysis By Product Type

The biobanking equipment segment was the leader in 2023 and occupied the lion's share; the segment's dominance is anticipated to continue throughout the forecast period. An increase in the new biobanks among various geographies worldwide has majorly contributed to this segment securing the top spot.

Global Biobanks Market Analysis By Sample Type

The human tissue segment had 65% of the global biobanks market share based on the sample type in 2022. The segment is expected to grow further and register dominance in the coming years. Preference for human tissue specimens increases over animal tissue samples due to the unavailability of appropriate animal models for specific neurological and psychiatric disorders.

Global Biobanks Market Analysis By Application

The regenerative medicine segment captured the leading share of the market in 2023. Factors such as increasing research and development activities on regenerative medicines and increasing demand for well-characterized and quality biosamples for research are driving the growth of this segment.

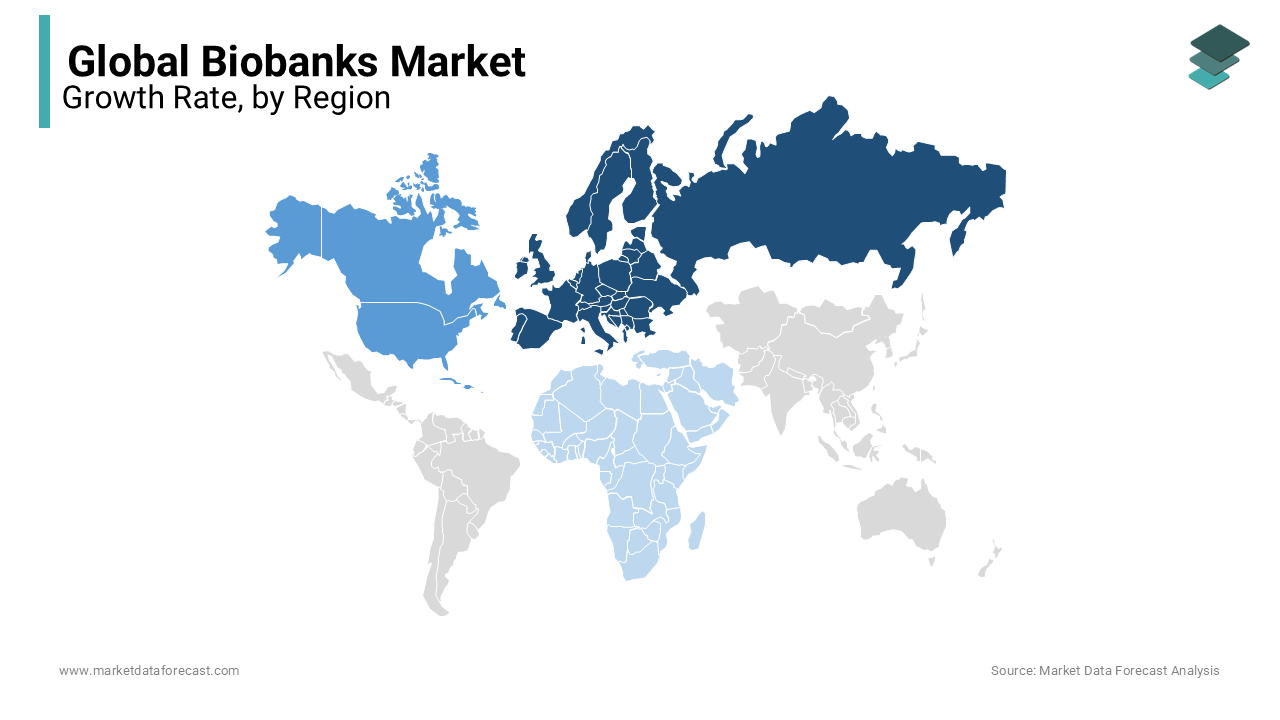

REGIONAL ANALYSIS

Europe accounted for the largest share of the global market in 2023. The European region is also expected to showcase a healthy growth rate in the coming years owing to increasing government investments in biobanks to collect biospecimen data and improve medical infrastructure.

North America captured a substantial global market share in 2023 and is anticipated to register a promising CAGR during the forecast period. The growing healthcare investments and the processing of large databases and establishments are propelling the biobanks market growth in North America. The United States biobanks market led the North American region in 2021, and the domination is likely to continue in the coming years due to the increasing expenditure on healthcare. In addition, rising disposable income in urban areas is likely to fuel the market's growth rate.

Asia Pacific is one of the promising regions worldwide and is expected to showcase the fastest CAGR during the forecast period. The rapid increase in the geriatric population and growing healthcare expenditure are primarily contributing to the growth of the APAC biobanks market. In addition, the growth of the Asia Pacific market is driven by the rise in population and increasing healthcare spending from government bodies. As a result, the Asia Pacific region shows fierce competition with the developed areas.

Latin America is forecasted to have lucrative opportunities in the near future and is expected to grow at a healthy CAGR in the coming years.

The market in MEA is expected to improve the market share during the forecast period. The increasing geriatric population, advancing technologies, and improving healthcare expenditure are anticipated to propel market growth in this region.

KEY PLAYERS IN THE GLOBAL BIOBANKS MARKET

Beckman Coulter, Thermo Fisher, Panasonic, Sigma-Aldrich, and SOL Group are industry leaders. They hold key technology and patents for high-end customers, with a market share of 32.28% formed by an industry monopoly.

Some of the promising market participants dominating the global biobanks market profiled in this report are Beckman Coulter, Tecan Group, Taylor- Wharton, Panasonic Biomedical, Teva Pharmaceuticals, Biolife Solutions, Custom Biogenic Systems, Princeton Cryo-Tech, Fluidx, Tissue Solutions, Wildcat Laboratory Solutions, Micronik, and Brooks Life Science Systems. In addition, these players focus on collaborations, mergers, and acquisitions to expand their market share.

RECENT HAPPENINGS IN THIS MARKET

- In February 2021, Cincinnati Children's Hospital Medical Center partnered with DownSyndrome Achieves (DSA) to provide a research biobank that will act as a national repository of biospecimens donated by people with Down syndrome and their families.

- In April 2020, Partners HealthCare signed a partnership to launch a COVID-19 biobank using blood samples from Biogen workers and their relatives.

- Tecan Group Ltd. Tecan's Fluent Laboratory Automation workstation improves the performance of the QFT-Plus diagnostic test by dispensing a sample of the optional lithium heparin single-tube workflow. Fluent instruments are delivered directly to the lab through Tecan's Life Sciences business.

- Becton, Dickinson, and Company launched an automated instrument for sample preparation using flow cytometry with a CE-IVD-certified BD FACSDuet in March 2019. This instrument helps to understand and count the characteristics of cells.

DETAILED SEGMENTATION OF THE GLOBAL BIOBANKS MARKET INCLUDED IN THIS REPORT

This research report on the global biobanks market has been segmented & sub-segmented based on product type, sample type, application, and region.

By Product Type

- Biobanks Equipment

- Temperature control systems

- Incubators

- Centrifuges

- Alarm and Monitoring Systems

- Accessories

- Other Equipment

- Consumables

By Sample Type

- Human Tissues

- Stem Cells

- DNA or RNA

- Bio-fluids

- Other Sample Type

By Application

- Therapeutic Applications

- Research Application

- Clinical Trials

- Regenerative Medicine

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much the global biobanks market size is going to be worth by 2032?

As per our research report, the global biobanks market size is estimated to grow to USD 6.42 billion by 2032.

Which region held the major share in the global biobanks market in 2023?

Geographically, the North American regional market held the largest share in the global biobanks market in 2023.

Which segment by product type is projected to grow rapidly in the global biobanks market in the coming future?

Based on the product type, the equipment segment is predicted to grow significantly from 2024 to 2032 in the global biobanks market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]