Global Battery Market Size, Share, Trends & Growth Forecast Report – Segmented By Material, End-Use, Application, Type, and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Battery Market Size

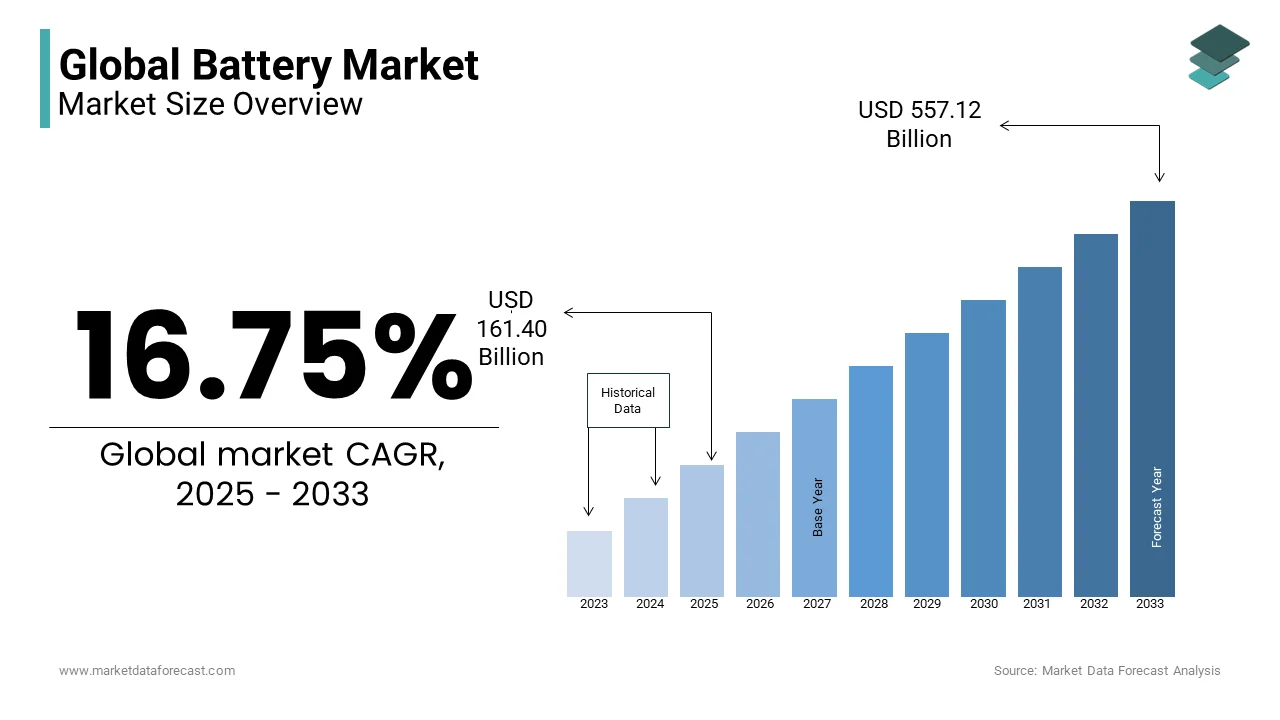

The global battery market size was valued at USD 138.24 billion in 2024 and is anticipated to reach USD 161.40 billion in 2025 from USD 557.12 billion by 2033, growing at a CAGR of 16.75% from 2025 to 2033.

Batteries are fundamental drivers of modern energy storage and facilitate advancements in various sectors, including consumer electronics, transportation, industrial applications, and renewable energy integration. Currently, lithium-ion batteries dominate the market due to their high energy density, longer lifespan, and efficiency. A typical lithium-ion battery has an energy density ranging from 150 to 300 watt-hours per kilogram (Wh/kg), significantly higher than lead-acid batteries, which offer only 30 to 50 Wh/kg, according to the U.S. Department of Energy. Additionally, lithium-ion batteries can endure around 500 to 3,000 charge cycles, whereas nickel-cadmium (NiCd) batteries typically last 1,000 cycles, and lead-acid batteries degrade after 200 to 1,000 cycles.

The efficiency of battery storage is another major factor, with lithium-ion batteries achieving a charge-discharge efficiency of approximately 95%, compared to 70-85% for lead-acid systems, as noted by the National Renewable Energy Laboratory (NREL). With growing concerns about raw material scarcity, alternative technologies such as sodium-ion batteries, which can operate efficiently in temperatures ranging from -30°C to 60°C, are gaining traction as a more sustainable and cost-effective solution.

Market Drivers

Surging Demand for Electric Vehicles (EVs)

The rising adoption of electric vehicles (EVs) is a primary driver of the battery market, significantly influencing lithium-ion battery production. As governments worldwide implement stringent emissions regulations and incentives for sustainable transportation, the EV sector continues to expand rapidly. According to the International Energy Agency (IEA), global EV sales exceeded 14 million units in 2023, accounting for approximately 18% of total vehicle sales. This surge has led to a substantial increase in battery production, with the average EV battery pack capacity reaching 60 kilowatt-hours (kWh), enabling ranges of over 250 miles per charge. Additionally, the U.S. Department of Energy states that battery costs have dropped from $1,100 per kWh in 2010 to around $132 per kWh in 2023, making EVs more affordable and accelerating mass adoption.

Growth in Renewable Energy Storage Needs

The global transition toward renewable energy sources such as solar and wind has driven demand for efficient energy storage solutions, particularly grid-scale batteries. Since renewable energy production is intermittent, large-scale battery storage systems are crucial for stabilizing power supply and ensuring reliability. According to the U.S. Energy Information Administration (EIA), utility-scale battery storage capacity in the United States reached 13.5 gigawatts (GW) by mid-2023, a significant increase from just 1 GW in 2019. Additionally, the National Renewable Energy Laboratory (NREL) reports that lithium-ion batteries, which dominate energy storage projects, achieve round-trip efficiencies of 85-95%, making them the preferred choice for integrating renewables into the grid. This trend is expected to continue as nations work toward net-zero carbon targets by 2050.

Market Restraints

Raw Material Supply Chain Constraints

The battery market faces significant challenges due to the constrained supply of critical raw materials such as lithium, cobalt, and nickel, which are essential for battery production. According to the U.S. Geological Survey (USGS), global lithium production stood at approximately 130,000 metric tons in 2022, while demand is expected to surpass 2 million metric tons by 2030. Similarly, cobalt production is concentrated in the Democratic Republic of Congo, which accounts for over 70% of the global supply, making the market highly vulnerable to geopolitical instability. The U.S. Department of Energy reports that lithium prices surged by over 500% between 2020 and 2022, directly impacting battery manufacturing costs. These supply chain limitations pose a risk to production scalability and long-term affordability.

Environmental and Recycling Challenges

The environmental impact of battery production and disposal presents a major restraint to market growth. The extraction of lithium requires immense water resources, with the World Economic Forum reporting that approximately 500,000 gallons of water are needed to mine one ton of lithium. Additionally, improper disposal of spent batteries leads to soil and water contamination due to toxic chemicals like lead and cadmium. The U.S. Environmental Protection Agency (EPA) states that less than 5% of lithium-ion batteries are recycled, exacerbating resource depletion and e-waste accumulation. Developing efficient recycling technologies remains critical, as the lack of a circular economy for battery materials limits sustainability efforts and increases reliance on newly mined resources.

Market Opportunities

Advancements in Solid-State Battery Technology

The transition from conventional lithium-ion batteries to solid-state batteries presents a significant opportunity for the battery market. Solid-state batteries offer higher energy densities, faster charging times, and improved safety compared to liquid electrolyte-based lithium-ion cells. According to the U.S. Department of Energy, solid-state batteries can achieve energy densities of over 500 watt-hours per kilogram (Wh/kg), nearly double that of traditional lithium-ion batteries, which typically range between 150-300 Wh/kg. Additionally, the National Renewable Energy Laboratory (NREL) states that solid-state batteries can withstand over 10,000 charge cycles, significantly extending battery lifespan. With major automotive manufacturers and research institutions investing in commercialization, the solid-state battery market is expected to revolutionize electric vehicles, consumer electronics, and grid storage applications.

Expansion of Battery Recycling Infrastructure

The development of large-scale battery recycling programs offers a crucial opportunity to reduce dependency on raw material mining and enhance sustainability. According to the U.S. Environmental Protection Agency (EPA), recycling lithium-ion batteries can recover up to 95% of valuable materials such as lithium, nickel, and cobalt, significantly reducing environmental impact. The U.S. Department of Energy has allocated over $200 million for battery recycling initiatives to establish a circular economy for battery materials. Additionally, the National Renewable Energy Laboratory (NREL) reports that second-life batteries from electric vehicles could be repurposed for stationary energy storage, extending their usability by an additional 5 to 10 years. Strengthening recycling infrastructure can lower production costs, reduce supply chain vulnerabilities, and support long-term industry growth.

Market Challenges

Thermal Runaway and Safety Concerns

Battery safety remains a critical challenge, particularly in lithium-ion batteries, which are prone to thermal runaway—a chain reaction that leads to overheating and potential fire hazards. According to the U.S. Consumer Product Safety Commission (CPSC), lithium-ion battery-related incidents, including fires and explosions, have resulted in over 25,000 emergency room visits in the U.S. over the past decade. The National Fire Protection Association (NFPA) states that lithium-ion battery fires burn at temperatures exceeding 1,000°F (537°C), making them difficult to extinguish. Additionally, the U.S. Department of Transportation (DOT) has implemented strict regulations for the transportation of lithium batteries due to safety risks. The need for enhanced battery management systems and safer chemistries, such as lithium iron phosphate (LFP), is growing to mitigate these hazards.

High Energy Storage Costs and Grid Integration

Despite technological advancements, the high cost of large-scale battery storage remains a significant barrier to widespread adoption. According to the U.S. Energy Information Administration (EIA), utility-scale battery storage costs averaged around $589 per kilowatt-hour (kWh) in 2022, limiting accessibility for grid applications. The National Renewable Energy Laboratory (NREL) projects that for battery storage to become a competitive alternative to fossil-fuel-based power plants, costs need to fall below $150 per kWh. Additionally, grid integration poses technical challenges, as intermittent renewable energy sources require advanced storage solutions to maintain power stability. The complexity of deploying energy storage infrastructure, including transmission upgrades and regulatory hurdles, further adds to the difficulty of scaling battery-based grid storage systems efficiently.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.75% |

|

Segments Covered |

By Material, End-User, Application, Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CATL (Contemporary Amperex Technology Co., Limited), LG Energy Solution, Ltd., Panasonic Corporation, SAMSUNG SDI Co., Ltd., BYD Company Ltd., SVOLT Energy Technology, Tesla, Toshiba Corporation, EVE Energy Co., Ltd., SK On. |

SEGMENT ANALYSIS

Global Battery Market Analysis By Material

The lead-acid batteries segment dominated the market and accounted for 40.3% of the global market share in 2024 due to widespread applications of lead-acid batteries in automotive starting, lighting, and ignition (SLI) systems, where over 250 million lead-acid batteries are sold annually in the automotive sector alone. Lead-acid batteries also play a crucial role in backup power systems for telecommunications, data centers, and uninterruptible power supplies (UPS), which are critical for maintaining business continuity. The established infrastructure for lead-acid battery recycling, which recycles approximately 95% of the components, and their lower production costs (with prices often 30-50% less than lithium-ion batteries) contribute to their continued dominance in the market.

The lithium-ion batteries segment is experiencing the rapid growth and is predicted to witness the highest CAGR of 9.2% over the forecast period owing to the increasing adoption of electric vehicles (EVs), with EV sales surpassing 10 million globally in 2023 and lithium-ion batteries representing approximately 70% of the battery market for electric vehicles. The demand for portable electronic devices, including smartphones, laptops, and wearables, is also fueling this growth, with over 1.5 billion mobile phones alone shipped worldwide in 2023. Additionally, government incentives and subsidies for electric vehicles and renewable energy solutions, such as the U.S. federal tax credit of up to $7,500 for EV buyers, further support the lithium-ion battery segment's expansion.

Global Battery Market Analysis By End Use

The automobile segment stood as the biggest end-use segment in the global battery market by capturing 31.2% of the market share in 2024. The surge in electric vehicle (EV) demand has been significant, with global EV sales reaching over 10 million units in 2023, representing a 40% year-over-year increase. Lithium-ion batteries are particularly favored in EVs, accounting for approximately 70% of the total battery market for electric vehicles. In the hybrid electric vehicle (HEV) segment, the number of HEVs on the road grew by 15% in 2023, further driving battery demand. Additionally, the automotive industry's commitment to electrification, with automakers investing billions in EV production, reinforces the critical role of advanced battery technologies.

The grid-scale energy storage segment is undergoing a rapid growth in the battery market and is expected to register a CAGR of 30.4% over the forecast period due to the increasing integration of renewable energy sources like solar and wind into power grids. The U.S. Department of Energy (DOE) has committed over $12 billion in funding through its Energy Storage Grand Challenge to accelerate the development of advanced storage technologies, including lithium-ion and solid-state batteries. In 2023, the global capacity for energy storage reached 15 gigawatt-hours (GWh), with projections to exceed 250 GWh by 2030. This surge in storage capabilities is critical to balancing grid supply and demand, especially with renewable energy's intermittent nature. In addition, U.S. utilities are investing heavily, with over $5 billion in energy storage projects expected to come online by 2025. These advancements are essential for global decarbonization goals and the reliable integration of renewable energy.

Global Battery Market Analysis By Application

The automotive batteries segment constituted the dominant position in the global market by accounting for 42.81% of the global market share in 2024. The International Energy Agency (IEA) reports that global EV sales surpassed 10 million units in 2023, with a 50% increase in EV adoption in major markets like the U.S., China, and Europe. The U.S. Department of Energy (DOE) has highlighted that over $12 billion in federal incentives and investments have been allocated to support EV manufacturing and battery production, further accelerating the transition to electric transportation. Additionally, the automotive industry has committed to a goal of 30% of global vehicle sales being electric by 2030, showcasing the pivotal role of automotive batteries in shaping the future of the sector.

The industrial batteries segment is growing promisingly and is estimated to grow at a CAGR of 15.2% from 2025 to 2033. The U.S. Department of Energy (DOE) notes that between 2020 and 2024, the number of large-scale energy storage projects in the U.S. has tripled, largely driven by the increasing integration of renewable energy sources such as solar and wind into the power grid. Additionally, the DOE's Grid Modernization Initiative emphasizes the potential for storage systems to reduce the cost of electricity by up to 30%, making energy storage solutions more cost-effective for industrial applications. In 2023, the U.S. allocated over $6 billion in funding for energy storage technologies under the Bipartisan Infrastructure Law, further accelerating growth in this sector and advancing the transition to sustainable energy.

Global Battery Market Analysis By Type

The stationary batteries segment commanded 59.6% of the market share in 2024. According to the U.S. Department of Energy (DOE), over 150 GW of battery storage projects are projected to be deployed by 2025, with a significant portion dedicated to grid stability. This demand is further supported by the increasing need for reliable backup power systems, especially in industries like healthcare and data centers, where reliability is paramount.

Conversely, the motive battery segment is witnessing rapid expansion and is projected to grow at a CAGR of 29.3% over the forecast period due to the rising adoption of electric vehicles (EVs) and advancements in battery technology. The U.S. Department of Energy (DOE) reports that over 3 million EVs were sold globally in 2023, with the figure expected to rise as government incentives and subsidies for EVs grow, such as the U.S. federal tax credit of up to $7,500 for electric vehicle purchases. Additionally, major automakers like Tesla, Ford, and General Motors have committed billions of dollars to EV production and battery research, with GM investing $35 billion through 2025 to electrify its vehicle lineup. Research from the DOE indicates that energy density improvements in batteries could lead to a 30% reduction in EV costs by 2030, further fueling growth in the motive battery sector.

REGIONAL ANALYSIS

Asia-Pacific led the battery market by accounting for 62.1% of global market share in 2024. This dominance is primarily driven by China's substantial electric vehicle (EV) production and extensive battery manufacturing infrastructure. In 2023, China's battery demand reached around 415 GWh, significantly surpassing Europe and the United States, which stood at 185 GWh and 100 GWh respectively, according to the IEA. China's leadership is further solidified by its control over critical stages of the battery supply chain, including nearly 90% of global installed cathode active material manufacturing capacity and over 97% of anode active material manufacturing capacity, as detailed by the IEA. This comprehensive integration underscores the region's pivotal role in the global battery industry.

North America is experiencing the fastest growth in the battery market, with the United States witnessing a 40% year-on-year increase in battery demand in 2023, as reported by the IEA. This rapid expansion is attributed to significant investments in battery manufacturing and supportive government policies. The U.S. Department of Energy (DOE) reports that the Inflation Reduction Act has allocated $7.5 billion to support the development of battery manufacturing facilities across the country. Additionally, the U.S. Energy Information Administration (EIA) projects that U.S. battery storage capacity could nearly double by the end of 2024, rising from 3.3 gigawatt-hours (GWh) in 2023 to approximately 6 GWh. This surge in battery production and storage capacity is vital for the growing adoption of electric vehicles (EVs) and the integration of renewable energy sources into the grid.

Europe is aggressively expanding its battery manufacturing industry, aiming to reduce dependency on Asian imports. According to the European Commission, Europe is projected to account for nearly 15% of global battery production by 2030, up from less than 5% in 2020. The European Battery Alliance has driven investments exceeding €100 billion in battery gigafactories, with major projects in Germany, Sweden, and France. Additionally, the European Union’s Green Deal mandates that at least 70% of battery materials must be recycled by 2030, promoting sustainability. As per the International Energy Agency (IEA), Europe’s battery demand surged by 30% in 2023, driven by electric vehicle adoption and energy storage solutions.

Latin America is emerging as a critical player in the global battery market due to its abundant lithium reserves. The region, particularly the "Lithium Triangle" (Argentina, Bolivia, and Chile), holds nearly 60% of the world’s lithium reserves, according to the U.S. Geological Survey (USGS). Chile alone produced 39,000 metric tons of lithium in 2022, making it the second-largest lithium producer globally. Countries like Argentina are rapidly expanding lithium mining operations, with an expected 12% annual increase in production capacity by 2025. As global demand for lithium-ion batteries grows, Latin America is likely to attract further investments in battery-grade lithium refining and cathode material production, enhancing its role in the global supply chain.

The Middle East & Africa (MEA) region is increasingly focusing on battery storage to support its renewable energy expansion. According to the International Renewable Energy Agency (IRENA), renewable energy capacity in the region grew by 13% in 2023, driving demand for grid-scale battery storage. South Africa is leading battery storage deployment, with its government committing to installing 1,400 megawatts (MW) of battery energy storage systems (BESS) by 2030. Additionally, Saudi Arabia’s Vision 2030 plan includes investments exceeding $50 billion in clean energy, with battery storage playing a crucial role. The region’s focus on energy transition, coupled with growing demand for off-grid power solutions, is expected to accelerate battery market growth in the coming years

KEY MARKET PLAYERS

CATL (Contemporary Amperex Technology Co., Limited), LG Energy Solution, Ltd., Panasonic Corporation, SAMSUNG SDI Co., Ltd., BYD Company Ltd., SVOLT Energy Technology, Tesla, Toshiba Corporation, EVE Energy Co., Ltd., SK On. These are the market players that are dominating the global battery market.

Top 3 Players in the market

The global battery market is dominated by several key players who significantly contribute to its growth and technological advancements.

Contemporary Amperex Technology Co., Limited (CATL)

As of June 2024, CATL holds a commanding position in the electric vehicle (EV) battery sector, with a market share of nearly 38%, according to data from Statista. The company's prominence is attributed to its extensive production capacity and partnerships with major automakers, including BMW, Toyota, and Honda. CATL's focus on lithium-ion battery innovation and its expansive manufacturing capabilities have solidified its leadership in the global battery market.

BYD Company Limited

BYD ranks as the second-largest EV battery manufacturer globally, capturing a market share of 15.8% as of June 2024, as reported by Statista. The company's success is driven by its vertical integration strategy, encompassing battery production and electric vehicle manufacturing. BYD's proprietary Blade Battery technology is recognized for its safety and efficiency, contributing to its substantial market presence.

LG Energy Solution

Holding the third position in the global EV battery market, LG Energy Solution accounts for a 13.6% market share as of June 2024, based on Statista's data. The South Korean company is known for its advanced battery technologies and supplies batteries to prominent automakers such as Tesla, General Motors, and Hyundai. LG Energy Solution's commitment to research and development has been pivotal in maintaining its competitive edge in the battery industry.

Top Strategies Used By the Key Market Participants

Technological Innovation and Diversification

Companies like Contemporary Amperex Technology Co., Limited (CATL) focus on advancing battery technologies to maintain a competitive edge. CATL has developed the M3P battery, which offers a 15% increase in energy density, reaching 210 Wh/kg. This innovation enhances the performance and range of electric vehicles (EVs), catering to the growing demand for efficient energy storage solutions.

Strategic Partnerships and Global Expansion

Forming alliances with international automakers and expanding manufacturing capabilities are key strategies. CATL has established partnerships with companies such as BMW, Toyota, and Honda, integrating its batteries into a wide range of EVs. Additionally, CATL announced plans to build a battery factory in Debrecen, Hungary, aiming to enhance its presence in the European market and support global supply chains.

Vertical Integration and Supply Chain Control

Companies like BYD Company Limited implement vertical integration to control various stages of production, from raw material extraction to battery manufacturing and vehicle assembly. This approach reduces reliance on external suppliers, ensures quality control, and enhances cost efficiency. BYD's proprietary Blade Battery technology exemplifies this strategy, offering improved safety and efficiency in its electric vehicles.

COMPETITIVE LANDSCAPE

The global battery market is highly competitive, driven by rapid technological advancements, increasing demand for electric vehicles (EVs), and the rising need for energy storage solutions. The industry is dominated by a few key players, including Contemporary Amperex Technology Co., Limited (CATL), BYD Company Limited, and LG Energy Solution, which collectively hold over 65% of the global EV battery market share, according to the International Energy Agency (IEA). These companies leverage their technological expertise, manufacturing scale, and supply chain control to maintain a competitive edge.

Competition is further intensified by new entrants and regional manufacturers, particularly in North America and Europe, where government incentives are fostering domestic battery production. Companies such as Panasonic, SK Innovation, and Samsung SDI are aggressively expanding their battery manufacturing capacity to capture a larger share of the growing market.

With the push for sustainable and high-performance battery technologies, firms are heavily investing in solid-state batteries, lithium iron phosphate (LFP) batteries, and sodium-ion batteries to differentiate themselves. Additionally, the race to secure raw material supply chains and develop battery recycling infrastructure is shaping market dynamics, as companies seek to lower production costs and meet environmental regulations. The competitive landscape will continue evolving as innovation and policy shifts drive the industry's future.

RECENT HAPPENINGS IN THIS MARKET

- On January 4, 2024, Plus Power was acquired by OMERS Private Equity and a consortium of financial investors in a leveraged buyout valued at $1.5 billion. This acquisition underscored the increasing interest in battery energy storage systems (BESS) driven by the rising adoption of electric vehicles and renewable energy sources.

- In late 2024, EQT and Singapore's sovereign wealth fund GIC acquired a majority stake in Calisen, a UK-based smart meter provider involved in battery technology, for approximately £4 billion. This move aimed to bolster investments in sustainable energy infrastructure.

MARKET SEGMENTATION

This research report on the global battery market is segmented and sub-segmented into the following market.

By Material

- Lead Acid

- SLI

- Stationary

- Motive

- Lithium Ion

- Nickel-based

- Sodium-ion

- Flow Battery

- Small Sealed Lead-acid Batteries

- Others

By End Use

- Aerospace

- Automobile

- ICE Engines

- Passenger vehicles

- Commercial vehicles

- Electric vehicles

- E-Bikes

- E-Cars

- E-Buses

- E-Trucks

- ICE Engines

- Consumer Electronics

- Grid-scale Energy Storage

- Telecom

- Power Tools

- Military & Defence

- Others

By Application

- Automotive Batteries

- Industrial Batteries

- Grid and Off-Grid Energy Storage Systems

- Power Backup Systems / UPS

- Marine Equipment & Machinery

- Agricultural Machinery

- Industrial Automation Systems

- Portable Batteries

By Type

- Stationary

- Motive

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global battery market?

The current market size of the global battery market size was valued at USD 161.40 billion in 2025.

What market drivers are driving the global battery market?

The market drivers are Raw Material Supply Chain Constraints and Environmental and Recycling Challenges.

What are the market restraints in the global battery market?

The market restraints, raw material supply chain constraints, and environmental and recycling challenges.

What segments are added in the global battery market?

The segments that are added to the global battery market are segmented by material, end-use, application, type, and Region.

Who are the market players dominating the global battery market?

CATL (Contemporary Amperex Technology Co., Limited), LG Energy Solution, Ltd., Panasonic Corporation, SAMSUNG SDI Co., Ltd., BYD Company Ltd., SVOLT Energy Technology, Tesla, Toshiba Corporation, EVE Energy Co., Ltd., SK On. These are the market players that are dominating the global battery market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]