Global Bathtub Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Free Standing, Alcove, Drop-in, Others) Application (Residential, Commercial), Material Type (Fiberglass, Acrylic, Cast Iron, Others), By Shape (Rectangular, Oval, Square, Others), And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Bathtub Market Size

The global bathtub market size was valued at USD 11.97 billion in 2024 and is anticipated to reach USD 12.65 billion in 2025 from USD 19.63 billion by 2033, growing at a CAGR of 5.65% during the forecast period from 2025 to 2033.

In 2023, bathtubs are increasingly seen as central elements of bathroom spaces, blending practicality with aesthetic appeal. Modern consumers prioritize designs that align with their lifestyles, whether it’s the minimalist elegance of freestanding tubs, the therapeutic benefits of soaking tubs, or the space-saving ingenuity of corner models. The growing emphasis on creating spa-like retreats within homes due to the increasing awareness of mental health and self-care practices is driving the shift towards bathtubs. For instance, a survey conducted by the National Kitchen and Bath Association revealed that over 58% of homeowners undertaking bathroom renovations prioritize upgrading their bathtubs, citing comfort and style as primary motivators. As per the American Institute of Architects, luxury bathtubs are among the top three most requested features in high-end custom homes, underscoring their status as symbols of sophistication and relaxation. These trends illustrate how bathtubs have transcended their utilitarian origins to become integral components of modern living spaces influencing both residential design and consumer behavior

Market Drivers

Urbanization and Infrastructure Development

The rapid pace of urbanization worldwide is a major force driving the bathtub market forward. The United Nations Department of Economic and Social Affairs states that 56% of the global population lives in urban areas as of 2023, and this number is projected to reach 68% by 2050. This shift toward urban living has increased the demand for modern housing and better infrastructure, including bathrooms with high-quality fixtures. In developing countries, government programs aimed at providing affordable housing have accelerated this trend. For example, India’s Ministry of Housing and Urban Affairs noted that under the Pradhan Mantri Awas Yojana, more than 12 million urban homes were approved between 2015 and 2023, many of which featured modern bathroom designs with bathtubs. As cities grow and living standards rise, homeowners are increasingly prioritizing stylish and functional bathtubs to enhance comfort and add a touch of luxury to their homes.

Growing Focus on Wellness and Self-Care

The growing focus on wellness and self-care is transforming how consumers approach bathroom design, giving a significant boost to the bathtub market. According to the Global Wellness Institute, the wellness economy was valued at $4.4 trillion in 2020, with home wellness products becoming increasingly important. Bathtubs, especially those offering hydrotherapy or deep-soaking features, are now seen as vital for relaxation and stress relief. The U.S. Centers for Disease Control and Prevention reports that over 70% of adults face stress-related challenges, fueling the demand for home solutions that support mental and physical well-being. Furthermore, a survey by the National Association of Home Builders reveals that 72% of homeowners prioritize spa-like bathrooms when renovating. This trend highlights how bathtubs have shifted from being purely functional to becoming wellness-focused fixtures that align with modern lifestyle priorities centered on health and relaxation.

Market Restraints

High Costs of Premium Bathtubs

The high cost of premium bathtubs is a major challenge in the market, especially for middle-income households. The U.S. Bureau of Labor Statistics reports that families spend about 3.5% of their total budget on home furnishings and appliances, leaving little room for luxury items like designer bathtubs. Premium options, such as cast iron tubs or those with hydrotherapy features, often cost over $2,000, putting them out of reach for many buyers. The National Association of Realtors points out that affordability issues are even more pronounced in areas with high housing costs, where homeowners are hesitant to spend on costly bathroom upgrades. This financial limitation slows market growth, particularly in price-sensitive regions. Manufacturers struggle to innovate while keeping prices affordable, which restricts their ability to reach a wider audience and meet diverse consumer needs.

Space Constraints in Urban Housing

Space limitations in urban housing present a significant challenge for the bathtub market. The U.S. Census Bureau highlights that the average size of newly built single-family homes has shrunk by 5% since 2015, signaling a shift toward smaller, more efficient living spaces. In densely populated cities, compact apartments and condominiums are the norm, leaving minimal room for large fixtures like bathtubs. The European Environment Agency reports that over 74% of urban homes in Europe are smaller than 100 square meters, underscoring the difficulty of incorporating bulky bathroom installations. Furthermore, a survey by the Canadian Mortgage and Housing Corporation found that nearly 60% of urban renters prefer showers over bathtubs due to their space-saving design. These spatial constraints significantly limit the adoption of bathtubs, especially in urban areas where compact and multifunctional layouts are highly valued.

Market Opportunities

Rising Demand for Sustainable and Eco-Friendly Products

The growing emphasis on sustainability is creating a significant opportunity for the bathtub market as consumers increasingly prioritize environmentally friendly bathroom solutions. The U.S. Environmental Protection Agency highlights that water-efficient fixtures can reduce household water usage by up to 20%, driving demand for eco-conscious designs. Bathtubs made from recycled materials or those engineered to minimize water consumption are gaining popularity among environmentally aware buyers. For instance, the European Commission reports that over 70% of EU consumers consider sustainability a key factor in their purchasing decisions by opening up a lucrative market for green innovations. Additionally, the Australian Bureau of Statistics notes that households with water-saving fixtures have increased by 35% since 2015, reflecting a broader shift toward conservation. Manufacturers investing in sustainable materials and energy-efficient production processes are well-positioned to capitalize on this trend to meet both regulatory standards and the expectations of eco-conscious consumers.

Expansion of Smart Home Integration

The integration of smart technology into home fixtures presents another promising growth avenue for the bathtub market. The U.S. Department of Energy states that smart home devices are projected to reduce energy consumption by 10-15%, encouraging homeowners to embrace technologically advanced products. Smart bathtubs, equipped with features like precise temperature control, voice activation, and automated water filling, align perfectly with the rising demand for convenience and connectivity in modern homes. These innovations not only enhance user experience but also cater to the growing preference for personalized and efficient home solutions. As smart homes become more mainstream, manufacturers who incorporate cutting-edge technology into their bathtub designs can tap into this expanding market by appealing to tech-savvy consumers seeking luxury and functionality in their living spaces.

Market Challenges

Stringent Environmental Regulations

Stringent environmental regulations are a major challenge for the bathtub market, especially for manufacturers who use traditional materials and processes. The U.S. Environmental Protection Agency has set stricter rules on volatile organic compounds (VOCs) in manufacturing, pushing companies to adopt cleaner technologies. At the same time, the European Environment Agency requires bathroom fixtures to meet specific water efficiency standards, which limits design options for manufacturers. According to a report by the Australian Department of Climate Change Energy, the Environment and Water businesses face fines of over $50,000 per violation if they fail to comply with these regulations. Transitioning to eco-friendly methods also demands significant upfront investments, which can be difficult for smaller firms to manage. These pressures force manufacturers to innovate while dealing with compliance cost,s making operations more complex.

Supply Chain Disruptions and Material Shortages

The bathtub market is facing big challenges because of ongoing supply chain problems and material shortages, which have been made worse by global uncertainties. The U.S. Bureau of Economic Analysis says that industries relying on imported raw materials like resins and metals saw a 15% rise in costs in 2022 due to logistical delays and geopolitical tensions. Labor shortages are also making things harder. The U.S. Department of Labor reports that skilled labor in construction and manufacturing has dropped by 7% since 2020. The World Trade Organization adds that global shipping delays have increased lead times for materials by an average of 30%, disrupting production schedules. Small and medium-sized businesses in Europe are feeling even more pressure, as Eurostat points out they struggle to handle rising costs because of their limited resources. Manufacturers are now trying to manage higher expenses while keeping prices affordable for consumers, which is putting the market's stability at risk.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.65% |

|

Segments Covered |

By Type, Application, Material Type, Shape, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Toto Ltd. (Japan), Royal Manufacturing (U.S.), Villeroy & Boch Group (Germany), RAK Ceramics (UAE), American Bath Group (U.S.), Geberit AG (Switzerland), Porcelanosa Group (Spain), LAUFEN Bathrooms AG (Switzerland), Jacuzzi Inc. (U.S.), Kohler Co. (U.S.) |

SEGMENT ANALYSIS

Global Bathtub Market By Type

The alcove bathtubs segment led the market by holding 45.7% of the global bathtub market share in 2024. Alcove bathtubs are cost-effective, space-saving design, and are suitable for standard bathroom layouts by making it a popular choice for residential construction. Alcove tubs are often integrated into three-wall enclosures, appealing to budget-conscious homeowners and contractors. The National Association of Home Builders highlights that over 60% of new housing projects in urban areas incorporate alcove bathtubs due to their practicality and affordability. Their widespread adoption underscores their importance in meeting the demands of compact living spaces in densely populated regions.

The free-standing segment is attributed to grow with a projected CAGR of 7.2% during the forecast period. Factors such as rising consumer interest in luxury bathroom designs and spa-like experiences at home are propelling the growth of the free-standing segment in the global market. The U.S. Department of Housing and Urban Development notes that high-end renovations by including free-standing tub installations have increased by 30% since 2020 by reflecting a shift toward wellness-focused lifestyles. Free-standing tubs, often made from materials like stone resin or cast iron, cater to affluent buyers seeking both functionality and elegance, solidifying their position as a key growth driver in the bathtub market.

Global Bathtub Market By Application

The residential segment dominated the bathtub market with a share of 65% in 2024. This dominance is driven by the rising trend of home remodeling and the increasing emphasis on creating spa-like bathrooms. As per the National Association of Home Builders, residential bathtubs remain integral to enhancing comfort and property value with over 70% of homeowners prioritizing bathroom upgrades. The segment's importance lies in its alignment with lifestyle trends, such as wellness and self-care, which fuel demand for modern, stylish designs. The residential sector will continue to lead, supported by steady housing construction rates.

The commercial segment is projected to grow at a CAGR of 5.8% from 2025 to 2033. This growth is driven by increased investments in the hospitality and healthcare sectors, where premium bathing solutions are critical. The American Hotel & Lodging Association reports that hotel renovation spending in the U.S. alone reached $6.5 billion in 2022 is reflecting a strong emphasis on upgrading facilities to meet luxury standards. Additionally, the European Commission highlights that the senior care facility sector is expanding rapidly, with over 15% annual growth in new facilities across Europe, driven by aging populations. These trends underscore the importance of bathtubs in commercial spaces as they enhance guest experiences and cater to accessibility needs by solidifying the segment’s rapid expansion.

Global Bathtub Market By Material Type

The acrylic segment held 45.5% share of the global market in 2024. Acrylic bathtubs are lightweight in design and durability and easy to maintain, which make them ideal for modern homes. Acrylic tubs are also highly customizable by allowing manufacturers to cater to diverse consumer preferences. The U.S. Census Bureau highlights that acrylic is the preferred material for over 60% of bathroom renovations due to its affordability compared to cast iron. Its thermal insulation properties, which retain heat longer further enhance user comfort. Urbanization drives demand for space-efficient and stylish designs, whereas acrylic bathtubs remain central to the market's growth.

The fiberglass segment is swiftly growing and is likely to witness a CAGR of 7.2% during the forecast period. The cost-effectiveness and lightweight nature, by making them ideal for budget-conscious consumers and large-scale housing projects, is majorly driving the segmental growth. The U.S. Department of Housing and Urban Development notes that affordable housing initiatives have increased demand for economical yet durable fixtures like fiberglass tubs. Additionally, advancements in manufacturing have improved their aesthetic appeal and durability, broadening their market reach. Fiberglass bathtubs are poised to play a pivotal role in meeting the needs of compact and cost-efficient housing solutions with rising urbanization, where the United Nations projects urban populations to grow by 500 million by 2030.

Global Bathtub Market By Shape

The rectangular bathtubs segment held the largest share of 65.3% of the global bathtub market share in 2024. Rectangular bathtubs are popular for their versatility, space efficiency, and compatibility with modern bathroom designs. Rectangular tubs are ideal for urban housing, where compact bathrooms are prevalent, and their straightforward design allows for cost-effective manufacturing. The U.S. Census Bureau highlights that over 70% of new residential constructions prioritize rectangular fixtures due to their practicality and ease of installation. This segment's leadership underscores its importance in meeting consumer demand for functional, affordable, and stylish bathing solutions.

The oval segment is expected to be the fastest growing segment and is anticipated to register a CAGR of 5.8% over the forecast period owing to the increasing consumer demand for luxury and freestanding designs that align with wellness trends. The Australian Bureau of Statistics highlights a notable rise in discretionary spending on home improvements with premium bathroom fixtures becoming a focal point for homeowners seeking to enhance their living spaces. Additionally, the Japan Ministry of Economy, Trade and Industry reports growing interest in ergonomic and aesthetically pleasing designs, particularly in urban areas where space optimization is crucial. Oval bathtubs, with their sleek curves and spa-like appeal, cater to these preferences by making them a popular choice for modern renovations. This segment's rapid expansion underscores its role in meeting the demand for both functionality and elegance.

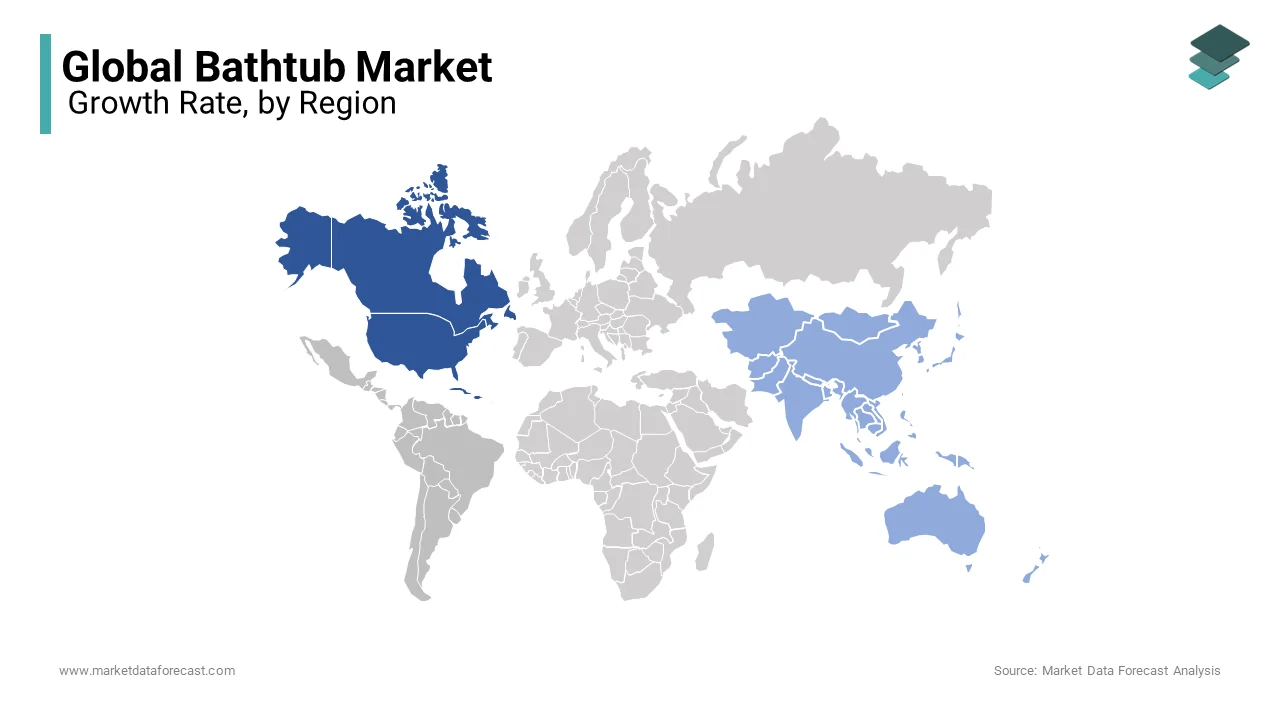

REGIONAL ANALYSIS

North America dominated the market by holding 35.4% of global market share in 2024. The domination of North America in the global market is driven by high disposable incomes, robust housing construction, and a strong preference for luxury bathroom fixtures. The National Association of Home Builders highlights that over 60% of U.S. homeowners prioritize bathroom upgrades during renovations, with bathtubs being a focal point. Additionally, Canada’s emphasis on sustainable housing has spurred demand for eco-friendly designs. North America's leadership underscores its role as a trendsetter in adopting innovative and premium products by making it a critical hub for manufacturers.

Asia-Pacific is the fastest-growing region in the global market and is estimated to expand at a CAGR of 6.2% from 2025 to 2033. The rapid urbanization, rising middle-class populations, and increased investments in real estate are fuelling the bathtub market growth in the Asia-Pacific region. The Indian Ministry of Housing and Urban Affairs reports that urban housing projects have surged by 40% since 2020 is driving demand for modern bathrooms. Similarly, China’s State Administration for Market Regulation notes a 25% rise in imports of luxury bathroom fixtures. The region's focus on affordable yet stylish designs positions it as a key growth driver by offering significant opportunities for manufacturers.

Europe, Latin America, the Middle East, and Africa are expected to witness steady growth, albeit at varying rates. The European Bathing Industry Association predicts a 3.8% annual growth for Europe, driven by sustainability trends and aging infrastructure upgrades. In Latin America, Brazil’s National Institute of Statistics highlights a 15% increase in home improvement spending since 2021, boosting demand for bathtubs. The Middle East and Africa, supported by urbanization and hospitality sector expansion, are projected to grow at 4.5%, according to the African Development Bank. These regions collectively contribute to global market diversification and resilience.

KEY MARKET PLAYERS

Toto Ltd. (Japan), Royal Manufacturing (U.S.), Villeroy & Boch Group (Germany), RAK Ceramics (UAE), American Bath Group (U.S.), Geberit AG (Switzerland), Porcelanosa Group (Spain), LAUFEN Bathrooms AG (Switzerland), Jacuzzi Inc. (U.S.), Kohler Co. (U.S.). These are the market players that are market players that are dominated to the global bathtub market.

Top 3 Players in the market

Toto Ltd. (Japan)

Toto Ltd. is a global leader in the bathroom fixtures industry, renowned for its innovative and sustainable products. The company’s focus on water-saving technologies, such as its proprietary "Eco-Technology," has set it apart in the industry. Toto’s bathtubs, often integrated with smart features like temperature control and hydrotherapy systems, cater to both residential and commercial markets. Its strong presence in Asia-Pacific and growing exports to Europe and North America underscore its leadership. By aligning with global sustainability goals, Toto continues to shape the future of the bathtub market while maintaining its reputation for quality and innovation.

Kohler Co. (U.S.)

Kohler Co. is another dominant player in the global bathtub market. Kohler’s success stems from its ability to blend luxury with functionality by offering a wide range of designs from traditional to modern freestanding tubs. The company’s emphasis on smart home integration and wellness-driven products, such as soaking tubs with chromotherapy, appeals to affluent consumers. Kohler’s strong distribution network across North America, Europe, and Asia-Pacific has solidified its position as a market leader. Additionally, its commitment to sustainability, exemplified by water-efficient designs, aligns with global environmental standards, further enhancing its brand value and contribution to the market.

Villeroy & Boch Group (Germany)

Villeroy & Boch Group is a European powerhouse in the bathtub market, known for its premium craftsmanship and timeless designs. Villeroy & Boch’s bathtubs are celebrated for their use of high-quality materials like Quaryl and acrylic, which offer durability and aesthetic appeal. The company’s focus on ergonomic designs and spa-like experiences resonates with consumers seeking luxury and comfort. With a strong foothold in Europe and expanding operations in Asia-Pacific and the Middle East, Villeroy & Boch has successfully tapped into diverse markets. Its commitment to sustainability, including eco-friendly production processes, reinforces its reputation as a key contributor to the global bathtub market.

Top strategies used by the key market participants

Product Innovation and Diversification

Leading companies like Kohler Co. and Toto Ltd. focus heavily on innovation to differentiate themselves. Kohler, for instance, has introduced smart bathtubs equipped with features such as voice control, chromotherapy, and hydrotherapy systems, aligning with the growing demand for wellness-centric products. Similarly, Toto’s development of water-efficient designs, including its Eco-Technology line, addresses global sustainability concerns while appealing to eco-conscious consumers. By diversifying their product portfolios to include luxury, compact, and multifunctional options, these players cater to a wide range of customer preferences, from urban apartments to high-end homes.

Sustainability and Eco-Friendly Solutions

Sustainability is a cornerstone strategy for many key players. Villeroy & Boch Group emphasizes eco-friendly materials and energy-efficient production processes, ensuring compliance with stringent European environmental regulations. RAK Ceramics (UAE) has also adopted sustainable practices, such as using recycled materials in its manufacturing processes, to reduce its carbon footprint. These efforts not only enhance brand reputation but also align with global green building standards, making them attractive to environmentally aware consumers and businesses.

Geographic Expansion and Market Penetration

Companies like RAK Ceramics and American Bath Group have expanded their operations into emerging markets, particularly in Asia-Pacific, Latin America, and Africa. The Asian Development Bank highlights that urbanization in these regions has created lucrative opportunities for bathroom fixture manufacturers. By establishing local manufacturing units and distribution networks, these players can reduce costs and better serve regional markets. Additionally, partnerships with local contractors and real estate developers help them tap into the growing construction and hospitality sectors.

Strategic Collaborations and Acquisitions

Strategic alliances and acquisitions are critical for strengthening market presence. For example, Geberit AG (Switzerland) has acquired smaller firms specializing in bathroom technologies to expand its product offerings and technical expertise. Such collaborations enable companies to leverage complementary strengths, access new customer bases, and enhance their technological capabilities. Similarly, Jacuzzi Inc. partners with luxury hotel chains to showcase its premium bathtubs, reinforcing its brand as a symbol of opulence and relaxation.

Digital Transformation and E-Commerce

The rise of e-commerce has prompted key players to adopt digital strategies to reach a broader audience. Porcelanosa Group (Spain) and LAUFEN Bathrooms AG (Switzerland) have invested in online platforms and virtual showrooms, allowing customers to explore products and customization options remotely. According to the U.S. Census Bureau, online sales of home improvement products grew by 25% between 2020 and 2023, underscoring the importance of digital channels. Furthermore, leveraging data analytics helps these companies understand consumer behavior and tailor marketing campaigns effectively.

COMPETITIVE LANDSCAPE

The global bathtub market is characterized by intense competition, with a mix of established multinational corporations and regional players vying for market share. Key players such as Kohler Co., Toto Ltd., and Villeroy & Boch Group dominate the industry, leveraging their strong brand recognition, extensive distribution networks, and focus on innovation to maintain their leadership. These companies consistently invest in research and development to introduce cutting-edge designs, smart features, and eco-friendly solutions, aligning with consumer trends toward sustainability and wellness. For instance, Kohler’s integration of smart home technologies and Toto’s water-saving innovations have set benchmarks in the industry.

Regional players like RAK Ceramics (UAE) and Royal Manufacturing (U.S.) also contribute significantly, particularly in emerging markets. These companies often adopt cost-effective strategies, targeting price-sensitive consumers while expanding their geographic footprint. The competitive landscape is further intensified by collaborations, mergers, and acquisitions, enabling firms to enhance their product portfolios and enter new markets. For example, Geberit AG has strengthened its position through strategic acquisitions, while Jacuzzi Inc. partners with luxury hospitality sectors to showcase its premium offerings.

RECENT HAPPENINGS IN THIS MARKET

In January 2023, Kohler Co., a leading bathroom fixtures manufacturer, launched a new line of smart bathtubs featuring voice-activated controls and chromotherapy lighting. This launch is anticipated to allow Kohler Co. to cater to the growing demand for wellness-centric bathroom solutions and strengthen its position in the luxury segment.

In March 2022, Toto Ltd., a Japanese bathroom technology leader, introduced the "Eco-Technology" series, focusing on water-efficient bathtubs. This initiative is anticipated to allow Toto Ltd. to align with global sustainability goals and strengthen its reputation as an eco-friendly innovator.

In July 2023, Villeroy & Boch Group, a German premium bathroom brand, expanded its production facilities in Spain to meet rising demand for acrylic bathtubs. This expansion is anticipated to allow Villeroy & Boch to enhance manufacturing capacity and strengthen its leadership in the European luxury market.

In November 2021, RAK Ceramics, a UAE-based manufacturer, partnered with real estate developers in India to supply eco-friendly bathtubs for urban housing projects. This partnership is anticipated to allow RAK Ceramics to tap into India’s booming real estate sector and strengthen its presence in South Asia.

In May 2022, American Bath Group, a U.S.-based company, acquired a regional manufacturer specializing in affordable acrylic tubs. This acquisition is anticipated to allow American Bath Group to expand its product range and strengthen its footprint in North America.

In September 2023, Geberit AG, a Swiss bathroom solutions provider, acquired a European bathroom technology firm known for innovative bathtub designs. This acquisition is anticipated to allow Geberit AG to enhance its product portfolio and strengthen its position as a one-stop provider for integrated bathroom systems.

In February 2023, Porcelanosa Group, a Spanish luxury bathroom brand, opened flagship showrooms in Dubai and Singapore. This move is anticipated to allow Porcelanosa Group to tap into the Asia-Pacific and Middle East markets and strengthen its global brand visibility.

In April 2022, LAUFEN Bathrooms AG, a Swiss premium bathroom manufacturer, collaborated with luxury hotel chains in Europe to install high-end freestanding bathtubs. This collaboration is anticipated to allow LAUFEN to elevate its brand image and strengthen its presence in the hospitality sector.

In August 2023, Jacuzzi Inc., a U.S.-based luxury bath brand, launched an e-commerce platform offering customizable bathtub designs. This launch is anticipated to allow Jacuzzi Inc. to target tech-savvy millennials and strengthen its online sales channels.

In June 2022, Royal Manufacturing, a U.S.-based company, introduced a budget-friendly line of compact bathtubs tailored for urban apartments. This introduction is anticipated to allow Royal Manufacturing to address space constraints in cities and strengthen its appeal to budget-conscious consumers.

MARKET SEGMENTATION

This research report on the global bathtub market is segmented and sub-segmented into the following categories.

By Type

- Free Standing

- Alcove

- Drop-in

- Others

By Application

- Residential

- Commercial

By Material Type

- Fiberglass

- Acrylic

- Cast Iron

- Others

By Shape

- Rectangular

- Oval

- Square

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com