Global Bakery Ingredients Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Emulsifier, Yeast, Enzymes, Baking Powder & Mixes, Oil, Fats & Shortenings, Colors & Flavors, Starch, Preservatives, Others), End-Use (Bread, Cakes & Pastries, Cookies & Biscuits, Rolls & Pies, Others), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Bakery Ingredients Market Size

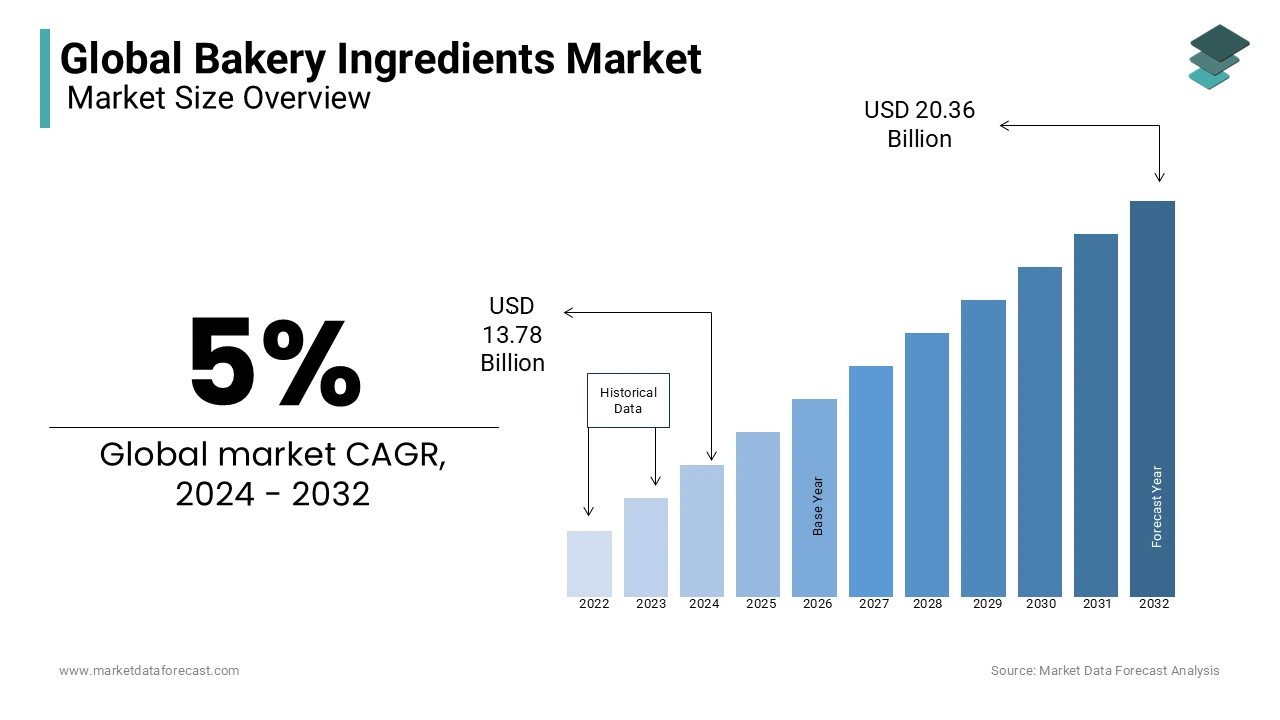

The size of the global bakery ingredients market was calculated to be USD 13.78 billion in 2024 and is anticipated to be worth USD 21.38 billion by 2033 from USD 14.47 billion In 2025, growing at a CAGR of 5% during the forecast period.The growth of the global bakery market directly increases the demand for bakery ingredients.

Current Scenario of the Global Bakery Ingredients Market

The bakery ingredients consist of flour, water, and leavening agents, primarily responsible for most products' appearance, texture, and flavor. The bakery ingredients are essential in preparing baked goods like bread, cakes, pastries, and cookies. These ingredients provide the final product structure, leavening, flavor, texture, color, and moisture retention. Some bakery ingredients like emulsifiers and leavening agents enhance the freshness, softness, and taste of baked goods, enhancing their adoption. The bakery ingredients market has witnessed significant growth in the past years and is anticipated to have prominent growth in the coming years. The increased consumer preference for bakery ingredients and the expansion of the bakery market across the food and beverage industry are majorly contributing to the bakery ingredients market worldwide. The market witnessed high consumption rates in different categories like cakes, pastries, pies, bread, and biscuits in the developed markets of North America and Europe.

MARKET DRIVERS

The increased demand for healthy food worldwide contributes to the enhanced command of bakery ingredients.

The growing urbanization is encouraging people to adopt a busy, sedentary lifestyle and busy lifestyles with no time to cook. This is mainly influencing people to adopt baking ingredients in breakfast and snacks, enhancing the global market revenue. The changing consumer preferences regarding healthier, artisanal are enhancing the exploration of baked goods, fueling the global market growth. The expanding bakery sector in the food and beverages industry, the emergence of various new specialty bakeries and cafes, and the expansion of the e-commerce platform are providing opportunities for growth in the global bakery ingredients market. Consumers are seeking bakery goods made with wholesome ingredients, reflecting the trend of healthier eating habits that propel the expansion of the market. The manufacturers are focusing on developing innovations in bakery ingredients that pose healthy and unique tastes to meet consumer demand. Using preservatives and emulsifiers enhances the texture, flavor, and shelf-life of the products; these also enhance dough development and fermentation, improving quality and uniformity. The rising consumer preferences towards unique, high-quality baked goods that offer exceptional taste and texture with good flavor are expected to favor the market growth. The growing demand for functional and health-boosting ingredients in food is expanding the market. The availability of products with longer shelf-life and accessibility to freezer storage conditions in retail bakeries is escalating the consumer's trend of one-time purchases of baked goods, which augments the bakery ingredients market's growth opportunities. The rising lifestyle-related disorders like obesity have escalated the demand for healthy baked goods among consumers, which accelerates the market share growth.

Many manufacturers are focusing on developing innovative methods to maintain the freshness of the product throughout the shelf-life, along with the baked products that combine freshness and flavor through natural ingredients and enzymes containing low sugar levels. These types of products are augmenting the consumer attention and stimulating the market expansion of bakery ingredients.

The growing demand for clean-label, gluten-free, and allergic-free products is enhancing the manufacturers' focus on developing products that meet consumer demand and will provide market growth opportunities in the coming years. The growing vegan population and increasing demand for frozen bakery products are accelerating the expansion of the global market revenue. This is accelerating consumer demand for plant-based products, like egg replacers, milk alternatives, and others, fueling market growth opportunities. In emerging economies, consumer proximity to affordable bakery products is expected to impact market growth positively. The rising technological and positive impact of digital monitoring and precision mixing enhance production efficiency, ensuring consistent product quality with minimal wastage. These technological advancements will provide market growth opportunities for manufacturers to expand their market value.

MARKET RESTRAINTS

The increased consumption of bakery foods induces the growth of trans-fatty acids, leading to various metabolic disorders.

The increasing usage of trans-fats in vegetable shortenings and margarine in baked food items to enhance the palatability, texture, and shelf-life adds to the global burden of metabolic diseases such as heart diseases, diabetes, obesity, and others. This mainly restricts bakery food product consumption and the bakery ingredients market expansion. The increasing fluctuations in the pricing of key ingredients like flour, sugar, and dairy are expected to affect the expansion of the bakery ingredients market. The rising dietary preferences among the population allow them to restrict sugar and baked items, which hinders the expansion of the market size worldwide. The frequent changes in consumer preferences are expected to limit the growth of the bakery ingredients market in the coming years.

Consistent supply of quality ingredients is challenging to the manufacturers due to various complications like crop failures, transportation disruptions, and geopolitical issues affecting the pricing of raw materials. Stringent food regulations are expected to be challenging due to delays in product launches, approvals, and financial issues; all these are expected to hamper the market growth during the forecast period. Managing the raw material pricing, labor, and energy costs are significant challenges for baking ingredient manufacturers. The presence of enormous competition affects the pricing of the products, and the manufacturers need to maintain profitability while keeping competitive prices in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5% |

|

Segments Covered |

By Type, End Use, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company, Associated British Foods, Bakels, Cargill, Dawn Food Products, E. I. du Pont de Nemours and Company, Ingredion Incorporated, Kerry Group, Koninklijke DSM N.V, Lallemand, Sdzucker, Taura Natural Ingredients Ltd, AAK AB, Tate & Lyle PLC, Corbion N.V, IFFCO Corporate, CSM Bakery Solutions, Novozymes, Puratos Group, and Others. |

SEGMENTAL ANALYSIS

Global Bakery Ingredients Market Analysis By Type

The baking powder and mixes segment held the most significant share of 28% of the global market revenue. It is a source of proteins, vitamins, and carbohydrates, widely consumed as primary ingredients in bakery products worldwide, driving the segment growth. Wheat-based baking powder is gaining popularity among consumers due to the prestige end of lower saturated fat and cholesterol content, which consumers highly prefer. The baking powder and mixes are widely recognized for their high content of vitamins, proteins, and carbohydrates, which majorly enhance the texture and quality of the baked goods and fuel the expansion of the segment revenue. Additionally, baking mixes provide pre-packaged combinations of dry ingredients for specific baking products, which include cakes and cookies.

The emulsifiers segment is estimated to grow the fastest during the forecast period due to the expanding worldwide bakery ingredients market. Various benefits of emulsifiers, such as enhancing shelf life and appealing to consumers, are enlarging the segment growth. Food acids like tartaric acid, acetic acid, and lactic acid react with the hydroxylic groups, which form emulsifiers.

Global Bakery Ingredients Market Analysis By End-Use

The bread segment dominated the global bakery ingredients market revenue with a prominent share. The bread's affordability and nutritional value are primary factors boosting the segment's growth. The convenience of bread is a quick and easy food option that suits modern, fast-paced lifestyles, making it the go-to choice for breakfast and snacks. The increased consumer demand for baked foods with premium and unique tastes is accelerating the market growth. Most manufacturers focus on developing bread with balanced nutritional and flavor content, increasing segment growth opportunities in the coming years.

The cakes and pastries segment is expected to grow prominently during the forecast period. The increasing consumption and demand for cakes and pastries, particularly among children, drives the segment expansion.

Global Bakery Ingredients Market Analysis By Distribution Channel

The supermarkets and hypermarkets segment held the dominant share in the global market and is anticipated to maintain significant growth in the coming years. The ease of availability and accessibility to consumers, where a diverse range of brands can be explored, primarily fuels the segment's growth. All product availability under the same roof is the primary factor accelerating the segment's growth.

The online retail segment is projected to grow fastest, with the highest CAGR during the forecast period. The rising adoption and accessibility of the Internet of Things to people are enhancing online shopping platforms; online retailers are focusing on offering various coupons and discounts to gain a vast customer base, which boosts segment growth. Consumers can explore various international brands, and door delivery and ease of payment are gaining traction among consumers, propelling the segment's growth.

REGIONAL ANALYSIS

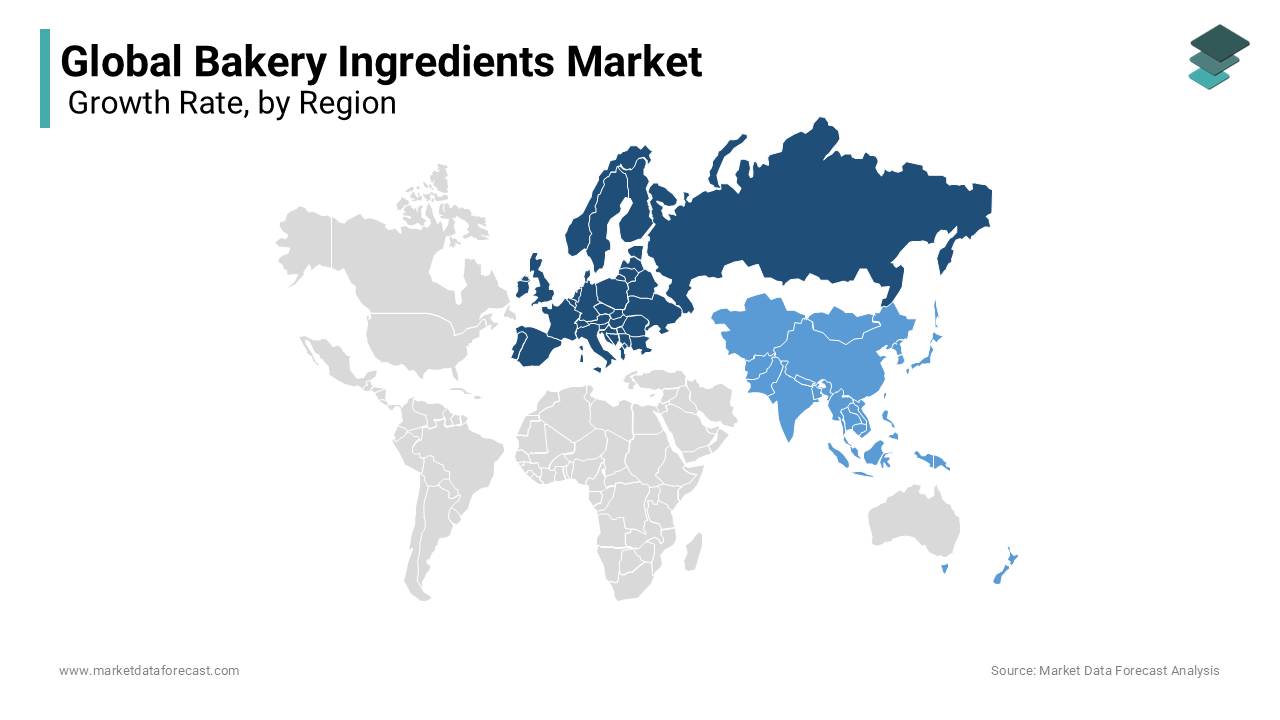

In terms of sales, Europe was the most dominant area in 2016, representing 36.2% of global sales. Due to lifestyle changes, there is a need for alternatives to regular household foods, and the demand for packaged and processed foods is increasing. However, bakery products are the most critical foods in Europe and North America. The ongoing revolution in the food processing industry is leading to the development of new packaged foods as the demand for convenient foods by European and North American consumers increases. The Asia-Pacific region is estimated to be the third-largest regional segment and is anticipated to witness the fastest growth as demand increases in China, India and Japan. India and China, with a growing population and disposable income, are expected to be the fastest-growing markets worldwide during the forecast period. Customers' propensity for western-style food is expected to stimulate demand for products in developing countries. In many countries, strict regulations on restricting the use of certain baking ingredients can challenge manufacturing methods during the forecast period. However, these are mature markets when it comes to bakery ingredients.

The Asia-Pacific region is the fastest-growing segment due to increased demand for bakery products and lifestyle changes. Europe is the most substantial business for baking ingredients, trailed by North America. In North America, the United States and Mexico are estimated to develop as the number of fast-food chains increases, and the use of baked goods and bakery ingredients rises. Germany is a significant monetization market in Europe.

KEY PLAYERS IN THE GLOBAL BAKERY INGREDIENTS MARKET

Major Key Players in the global bakery ingredients market are Archer Daniels Midland Company, Associated British Foods, Bakels, Cargill, Dawn Food Products, E. I. du Pont de Nemours and Company, Ingredion Incorporated, Kerry Group, Koninklijke DSM N.V, Lallemand, Sdzucker, Taura Natural Ingredients Ltd, AAK AB, Tate & Lyle PLC, Corbion N.V, IFFCO Corporate, CSM Bakery Solutions, Novozymes, Puratos Group, and Others.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Cargill Incorporated introduced a new line of chickpea-based flours tailored for the gluten-free and protein-rich bakery product market. These strategies are enhancing consumer demand for alternative flour options and healthier baked goods.

- In December 2023, Archer Daniels Midland Company (ADM) introduced an enticing range of organic, non-GMO flours and starches, targeting bakers searching for natural ingredients. This initiative enhances ADM's commitment to meeting the evolving preferences of health-conscious consumers and capitalizing on the growing trend toward clean-label baking methods.

- In September 2023, Moyu, a U.S.-based baking mix brand, announced the launch of a better-for-you bakery mix. The bakery features konjac-based mixes under the better-for-you baked goods category.

- In June 2023, Ardent Mills, a flour-milling and ingredient company, announced the launch of the Ardent Mills Egg Replace, Ancient Grains, plus baking flour blend. Ardent Mills Egg Replace is a gluten-free, vegan alternative to whole eggs and ancient grains, a baking flour blend, and a protein-rich, plant-based, and gluten-free flour blend.

- In June 2023, the Kerry Group announced the launch of enzyme solutions, which help the bakers reduce their egg use by 30% in different bakery products.

- In March 2023, Novozymes A/S innovated a cutting-edge enzymatic baking ingredient, Novamyl BestBite, meticulously engineered to enhance baked goods' longevity and freshness.

DETAILED SEGMENTATION OF GLOBAL BAKERY INGREDIENTS MARKET INCLUDED IN THIS REPORT

This research report on the global bakery ingredients market has been segmented and sub-segmented based on type, end use, distribution channel, & region.

By Type

- Emulsifier

- Yeast

- Enzymes

- Baking Powder & Mixes, Oil

- Fats & Shortenings

- Colors & Flavors

- Starch

- Preservatives

- Others

By End-Use

- Bread

- Cakes & Pastries

- Cookies & Biscuits

- Rolls & Pies

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Speciality Stores

- Online Retail

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. What are the current trends in the bakery ingredients market?

Current trends include a growing demand for natural and organic ingredients, the popularity of gluten-free and vegan products, the use of innovative ingredients like alternative flours (e.g., almond, coconut), and the emphasis on clean label products with fewer additives and preservatives.

2. What factors are driving the growth of the bakery ingredients market?

Key drivers include rising urbanization, increasing disposable income, growing demand for convenience foods, and the expansion of the retail bakery sector. Innovations in ingredient technology and the rising popularity of functional foods also contribute to market growth.

3. What challenges does the bakery ingredients market face?

Challenges include fluctuating raw material prices, stringent regulations regarding food safety and labeling, and the need to continually innovate to meet changing consumer preferences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]