Global Automotive Aftermarket Market Size, Share, Trends and Growth Forecast Report, Segmented By Replacement Type (Battery, Tyre, Filters, Brake Parts, Turbochargers, Body Parts, Wheels, and Others); Service Channel (DIFM, DIY, and OE); Distribution Channel (Wholesalers & Distributors and Retailers); Certification (Certified Parts, Genuine Parts, and Uncertified Parts) and Region (North America, Europe, Aisa-Pacific, Latin America, Middle East And Africa), Industry Analysis (2025 to 2033)

Global Automotive Aftermarket Market Size

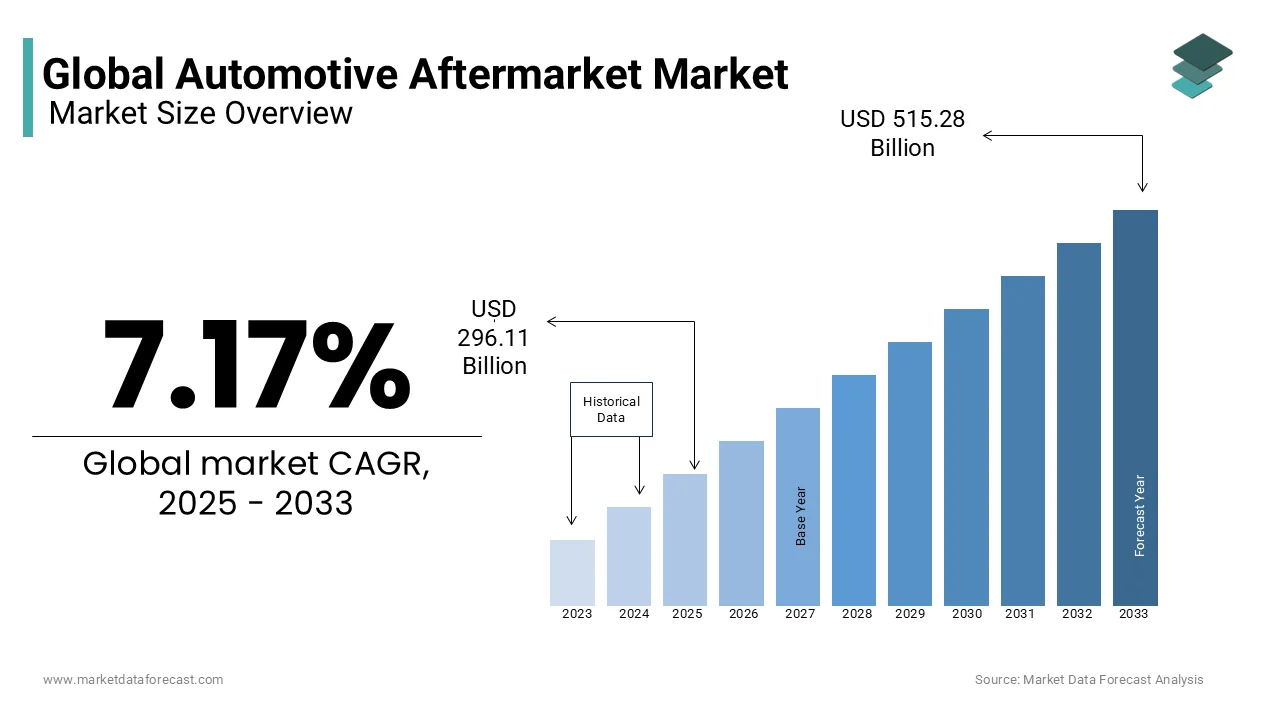

The global automotive aftermarket market was valued at USD 276.3 billion in 2024 and is anticipated to reach a valuation of USD 296.11 billion by 2025 from USD 515.28 billion by 2033, growing at a CAGR of 7.17% during the forecats period from 2025 to 2033.

The automotive aftermarket market is responsible for remanufacturing, retailing, distributing, and installing car components and equipment following the sale of a vehicle.

Current Scenario of the Global Automotive Aftermarket Market

The demand for the automotive aftermarket has been witnessing robust growth over the last few years and is estimated to accelerate further during the forecast period. The growing average age of vehicles, increasing ownership of vehicles worldwide, and rising preference from consumers for cost-effective maintenance solutions have been contributing to the expansion of the automotive aftermarket market worldwide. The U.S. is playing a major role in the global market. In the U.S., the average age of vehicle fleet is 12 years, and the U.S. has a strong culture of vehicle customization and repair, these factors strongly support the automotive aftermarket market in the U.S. Europe and China are also playing a vital role in the global market and are anticipated to witness significant demand during the forecast period as the urbanization and middle-class population are rapidly growing in these regions.

The global automotive aftermarket market is intensely competitive, with numerous market participants from various parts of the world. Key market participants such as AutoZone, Advance Auto Parts, and O'Reilly Automotive are showing dominance in North America, whereas large-sized players such as Bosch and Continental are playing a prominent role in Europe. The adoption of technological advancements such as AI-driven inventory management systems, online sales platforms, and digital marketing initiatives and focus on mergers and acquisitions are some of the key strategies adopted by the key market participants to hold and strengthen their position in the worldwide market.

MARKET DRIVERS

The growing demand for vehicles and increasing automotive production worldwide are majorly driving the global automotive aftermarket market growth.

Consumers are the lifeblood of the automotive aftermarket, which relies largely on them. The automotive aftermarket industry is constantly developing to fulfill changing consumer expectations because of rapid technological advancements in automobiles. As a result, developments in automobile technology are projected to favor the global automotive aftermarket market. In response to the desire for environmentally sustainable vehicles, the demand for aftermarket items such as catalytic converters and electronic chips to improve fuel economy on older vehicles has increased. Owners are especially keen on adding new amenities to their older vehicles, which is a major driver of the automotive aftermarket market growth.

In many countries, the government has imposed strict car emission regulations, putting pressure on manufacturers to produce environmentally friendly and high-efficiency automobile parts for both domestic and international markets, boosting demand for automotive aftermarket parts, which is expected to grow rapidly in the coming years. OEMs have offered additional accessories in vehicles that may be modified in the aftermarket to suit consumer needs for comfort and convenience in automobiles, which serves to fuel the growth of the automotive aftermarket. Aftermarket demand is driven by changing lifestyles, rising standards of living, and increased disposable income. Increased disposable money may lead to a more lavish lifestyle, necessitating the purchase of luxury vehicles. Due to the growing demand for automobile aftermarket products, an increasing number of millionaires around the world are designing or remodeling their distinctive vehicles.

The massive increase in global vehicle registrations has put pressure on OEMs to employ global platforms and modular architecture more quickly. As a result, the number of vehicles manufactured will rapidly increase, boosting the demand for spare parts and other auto-service facilities. This expands the market for automotive aftermarket companies.

MARKET RESTRAINTS

Vehicles are becoming more equipped with sensors as technology advances, resulting in better driving behavior and less wear and tear on brakes and other vehicle components. This makes component replacement difficult and hinders the growth of the automotive aftermarket. The cost of vehicle modification is excessively exorbitant for the bulk of the population. Consumers who are comparatively upper-class and prepared to pay a premium price for vehicle parts are sold as a premium option. However, if this service is used more regularly, the price will have to drop for it to be affordable to the average person. Automobiles are supplied with ecologically friendly components in various countries to reduce carbon emissions and maintain the climate. Consumers are unable to select whether to replace parts that generate more carbon and harm the environment regularly. As a result, the vehicle aftermarket is constrained by these reasons.

MARKET OPPORTUNITIES

The growing demand for electric vehicle (EV) aftermarket services is a significant opportunity in the global automotive aftermarket market.

The adoption of electric vehicles has been growing exponentially over the last few years and is expected to fuel further during the forecast period and result in the increasing need for specialized aftermarket services and parts specifically designed for electric vehicles. As per the statistics of the International Energy Agency (IEA), the global stock of electric vehicles reached 10 million in 2020 and is forecasted to reach 145 million by 2030. The increase in the sales of electric vehicles is expected to offer opportunities for aftermarket providers to develop and offer EV-specific products such as battery maintenance services, charging equipment, and software updates. In addition to that, the EV aftermarket is predicted to register a significant CAGR during the forecast period and boost the overall automotive aftermarket market expansion.

MARKET CHALLENGES

The rising complexity of modern vehicles poses a major challenge to the automotive aftermarket market.

In the current era, vehicles are being equipped with technological developments such as sophisticated electronics, complex software systems, and numerous sensors. According to a Deloitte report, the modern vehicles contain nearly 100 million lines of code, which is more than some of the modern aircraft. This growing complexity is demanding specialized diagnostic tools and expertise, which has become difficult for independent aftermarket providers to catch up. This is also resulting in higher costs for training and continuous investments in new equipment, which is deterring the smaller market participants and limiting the global market expansion considerably.

In addition to the above, high competition from OEM (original equipment manufacturer) parts, regulatory changes, and compliance requirements, supply chain disruptions, the shortage of parts, and technological advancements that require specialized knowledge and tools are a few of the major challenges to the automotive aftermarket market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.17% |

|

Segments Covered |

By Replacement, Service, Distribution, Certification and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Continental AG (Germany), ZF Friedrichshafen AG (Germany), HELLA KGaA Hueck & Co. (Germany), Denso Corp (Japan), Marelli (Japan), 3M (US), Goodyear (US), DRiV Inc (US), Federal-Mogul Corp (US), Cooper Tire (US), Delphi Tech (UK), Valeo Group (France), and Others. |

SEGMENTAL ANALYSIS

By Replacement Part Insights

Tires dominated the market and are projected to continue to do so during the forecast period due to their shorter replacement cycle than their competitors. In addition, the introduction of intelligent tires and tire monitoring systems has had a considerable impact on tire aftermarket sales to increase vehicle safety features. Rising disposable wealth in developing countries, as well as a shift in consumer desire for appealing and artistic vehicle design, are propelling the market ahead. Furthermore, as the use of electric and battery-powered vehicles grows, auto component makers are increasing including advanced safety features such as tire pressure monitoring and other control units like speed control and engine monitoring.

By Service Channel Insights

The Original Equipment (OE) sector dominated the market in 2020, with a share of 72.9 percent, and is predicted to continue to do so throughout the study period. The primary drivers of market growth in the OE sector are brand recognition and consumer loyalty. Aside from that, Do It Yourself (DIY) is expected to increase at a healthy rate over the projection period. This can be due to consumers' growing technical expertise as well as their growing desire to repair, maintain, and modify their vehicles on their own.

By Distribution Channel Insights

The retail segment dominated the market in terms of share in 2023, with a share of 57.2%. By 2029, the retail segment is expected to dominate the market in terms of size. During the forecast period, the wholesale and distribution category is expected to develop at a moderately fast rate in terms of revenue. Automotive aftermarket economies are critical components of the overall automotive manufacturing and maintenance scheme, as automotive components must be changed on a timely basis to preserve the vehicle's overall performance.

By Certification Insights

The genuine components segment dominated the market with a share of 52.2% in 2023. By the end of the forecast period, the genuine components market will have surpassed the aftermarket in terms of size. During the forecast period, the uncertified segment is expected to develop at a relatively fast rate in terms of revenue. Counterfeit components are unlawful, haven't been tested, and aren't covered by a guarantee. Genuine components are made by car manufacturers or OEMs, often known as subcontractors. Genuine replacement parts have a higher level of quality assurance, are more diverse, are easier to find, and come with a warranty. The disadvantage is that these parts are expensive and sold in exclusive outlets only.

REGIONAL ANALYSIS

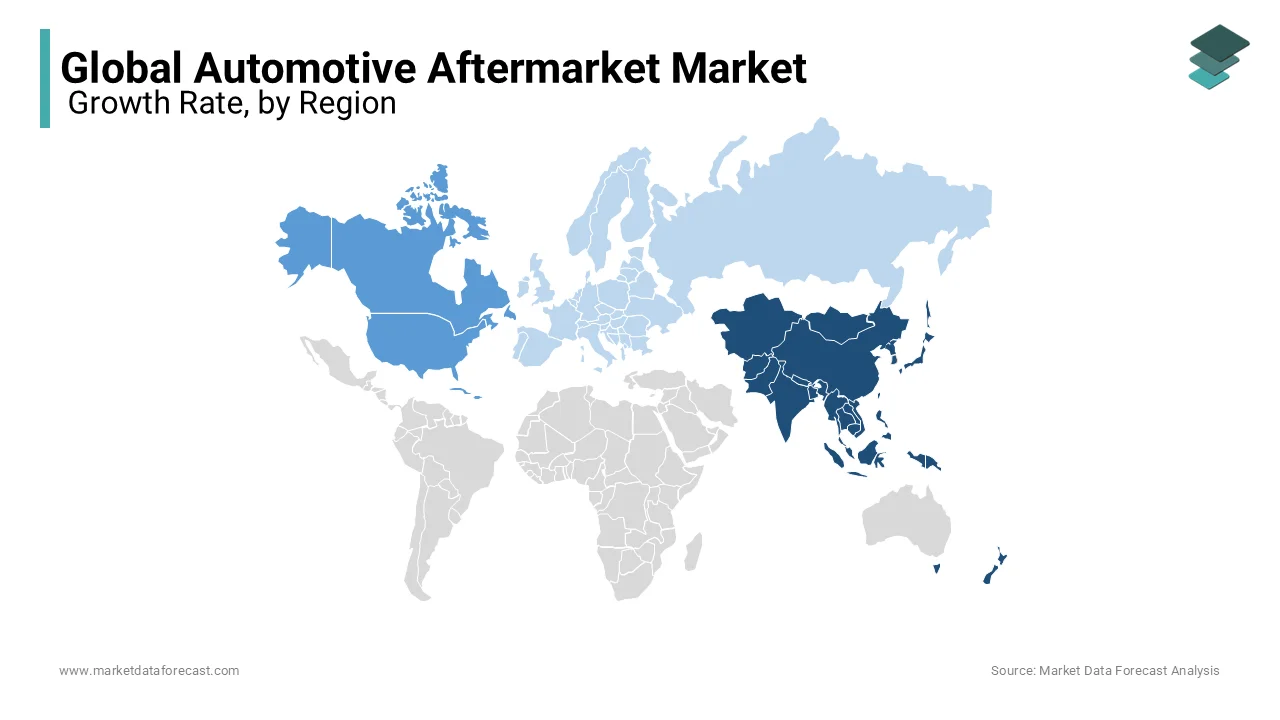

In terms of market size, Asia Pacific dominated the market in 2023, accounting for 28.0 percent of total revenue. The Asia Pacific market is predicted to increase significantly during the forecast period. The regional market penetration is being boosted by an increase in the sales of electric, hybrid, and gas-powered vehicles, leading to a shift in consumer preference toward energy-efficient automobiles. The market statistics are being driven by car digitization and personalization, as well as rising demand for Bluetooth devices and other electronic accessories.

The Asia Pacific accounts for more than 42% of total global automobile production. China is the world leader in passenger automobiles, commercial vehicles, and electric vehicles. According to China's Ministry of Commerce, China's aftermarket business was worth more than US$ 153 billion in 2020, surpassing the aftermarket sectors in the United States, Germany, France, and the United Kingdom. Automobile production is also increasing in other APAC countries such as Malaysia, Thailand, Japan, Indonesia, South Korea, and India. The Asia Pacific currently accounts for a sizable percentage of the worldwide automotive aftermarket industry.

In 2023, North America dominated the automotive aftermarket in terms of revenue. The region's market is expected to rise due to an increase in demand for passenger automobiles, the employment of modern technologies in auto part fabrication, and the digitization of component delivery services. Strict pollution regulations in the region have compelled component makers to upgrade vehicle components to comply with government regulations. The requirement for high-efficiency and environmentally friendly vehicle components for worldwide as well as domestic markets has grown dramatically as a result of the rising environmental deterioration caused by vehicular emissions.

Europe is a big revenue contributor in the global automotive aftermarket due to the presence of several automotive OEM manufacturers in the region. Additionally, strong purchasing power, combined with the green revolution's goal of making transportation more environmentally friendly, are two major factors driving the market growth. Between 2021 and 2026, the European area retained a 24.15 percent market share.

KEY MARKET PLAYERS

Continental AG (Germany), ZF Friedrichshafen AG (Germany), HELLA KGaA Hueck & Co. (Germany), Denso Corp (Japan), Marelli (Japan), 3M (US), Goodyear (US), DRiV Inc (US), Federal-Mogul Corp (US), Cooper Tire (US), Delphi Tech (UK), Valeo Group (France). Are playing a dominant role in the global automotive aftermarket. The Bosch Group is the world's largest automotive aftermarket company. The leading service provider has 400,000 employees and 440 subsidiaries in 60 countries, generating $91.8 billion in revenue.

RECENT HAPPENINGS IN THIS MARKET

- In July 2024, PRT press released the launch of 28 new full struts for pickups, SUVs, and light vehicles to broaden its product range in the North American aftermarket industry.

- In April 2024, Nippon Paint, a key paint and coating company, introduced its consumer-facing automobile body structure and color repair service brand called ‘Mastercraft’ in Gurugram, India. The Gurugram Centre will enable unique, sophisticated technology and green solutions and products with the ability to repair about 2500 cars yearly.

- In February 2024, Lumax Auto Technologies (LATL), with its Aftermarket Division, signed into a strategic collaboration with Bluechem Group of Germany, a major automotive car care solutions. LATL is a listed firm under the Lumax-DK Jain Group. The objective of this partnership is to launch class automotive car care goods for maintenance, repair, service, and cleaning throughout the area of protective and support solutions, supplements, car and bike care (detailing items, ceramic, PPF, etc.), equipment, tools and diagnostic software in India.

- In August 2024, Stellantis introduced a new vehicular component brand to operate under its Mopar brand. The new auto part brand is known as Bproauto. It will provide car components at costs lower than original equipment manufacturing prices.

MARKET SEGMENTATION

This market research report on the global automotive aftermarket market has been segmented and sub-segmented based on replacement, service, distribution channel, certification, and region.

By Replacement Part

- Battery

- Tyre

- Filters

- Brake Parts

- Turbochargers

- Body Parts

- Wheels

By Service Channel

- DIFM

- DIY

- OE

By Distribution Channel

- Wholesalers & Distributors

- Retailers

By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What Is The Size Of Global Automotive Aftermarket Market?

The size of the global automotive aftermarket market was valued at USD 296.11 billion in 2025.

What Is The Growth Of Automotive Aftermarket Market?

The size of the global automotive aftermarket market will grow at a valuation of USD 515.28 billion by 2033

What Are The Key Market Players Involved In Automotive Aftermarket Market?

Continental AG (Germany), ZF Friedrichshafen AG (Germany), HELLA KGaA Hueck & Co. (Germany), Denso Corp (Japan), Marelli (Japan), 3M (US), Goodyear (US), DRiV Inc (US), Federal-Mogul Corp (US), Cooper Tire (US), Delphi Tech (UK), Valeo Group (France). Are playing a dominant role in the global automotive aftermarket market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]