Global Anticoccidial Drugs Market Size, Share, Trends & Growth Analysis Report By Drug Type (Antibiotic Anticoccidials, Ionophore Anticoccidials & Chemical derivative Anticoccidials), Animal Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Anticoccidial Drugs Market Size

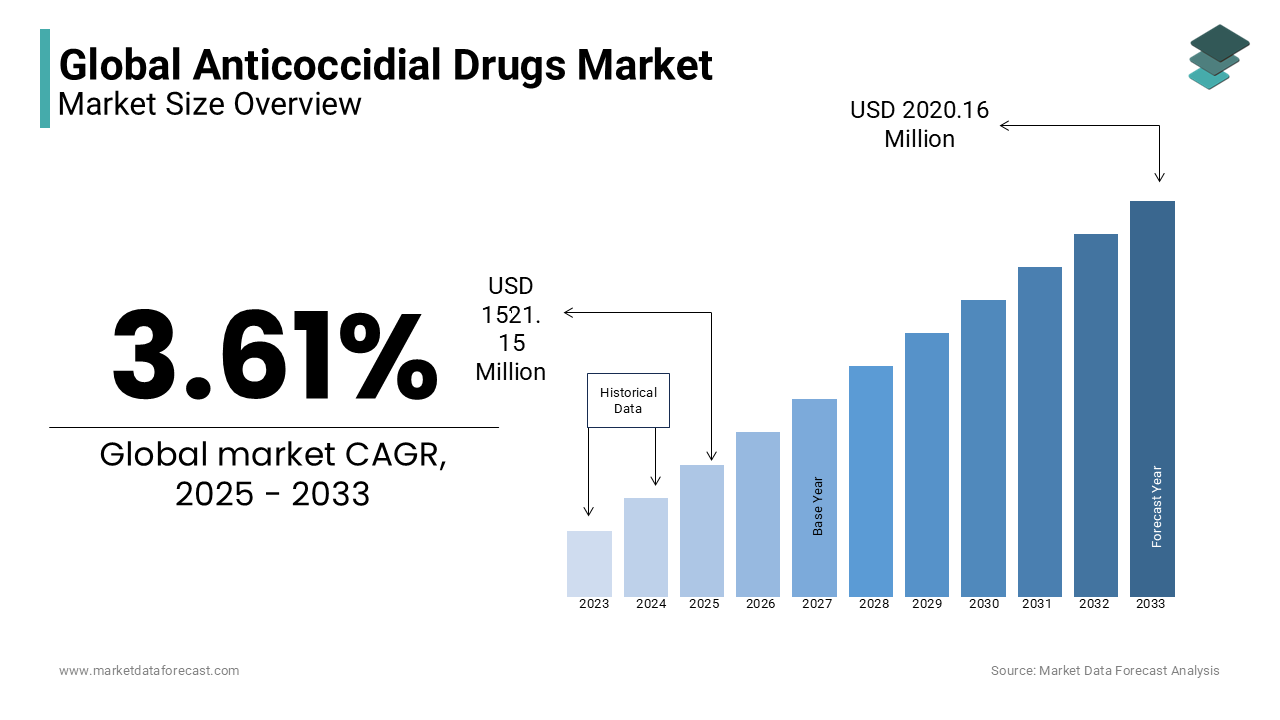

The global anticoccidial drugs market was valued at USD 1468.15 million in 2024. The global anticoccidial drugs market is expected to have a 3.61% CAGR from 2025 to 2033 and be worth USD 2020.16 Mn by 2033 from USD 1521.15 Mn in 2025.

The infections caused by the coccidia are treated with anticoccidial drugs. Gastrointestinal illness among a wide variety of birds, mammals, and reptiles is caused by a protozoan parasite. This infection mostly affects young animals as they do not have a high immune system to fight against the parasites. The drugs for the infections are widely used in poultry as the risk of fatality is very high, leading to a decreased production rate. According to the National Library of Medicine, the Institutional Animal Care and Use Committee approved all animal management and experimental protocols in 2021. The increasing prevalence of coccidiosis worldwide fuels the market’s growth rate throughout the forecast period.

MARKET DRIVERS

The growing prevalence of coccidiosis majorly propels the anticoccidial drugs market growth. The rising focus on veterinary healthcare is another notable factor contributing to the growth of the global market. Anticoccidial drugs are the agents used to treat, prevent, and control coccidial infections. However, there is a risk of increased coccidiosis due to environmental factors and other issues related to hygienic measures. Hence, there is an alarming demand for newer anticoccidial drugs in the drug market. Increasing the need to prevent the spread of diseases in animals with effective medication and the rise in the consumption rate of meat and poultry products are further propelling the global anticoccidial drugs market growth.

The growing number of veterinary hospitals, the rise in demand to improve the quality of drugs with different techniques, the growing disposable income in urban areas, and people's concern for maintaining a healthy diet further promote the growth of the global anticoccidial drugs market. According to the data published by the American Veterinary Medical Association (AVMA), an estimated 20,000 veterinary clinics, hospitals, and 90,000 veterinary practitioners were there in the United States in 2021. The growing support from the government through investments, the rising demand to increase the production rate of high-quality drugs and increasing concern towards animals' health conditions further accelerate market growth. For instance, the United States Department of Agriculture (USDA) invested an amount of USD 19 million in conducting R&D for animal health and animal diseases to prevent, control, and treat various diseases in livestock and poultry and to innovate new veterinary medical equipment, diagnostic tools, and treatment procedures via NIFA in 2019. Likewise, the Australian government announced an investment of USD 100 million for veterinary healthcare, primarily to conduct R&D to develop advanced medical devices, drugs, and treatment procedures for various animal diseases in 2020.

Furthermore, the adoption of the latest technology, the launch of valuable products, and the rising number of infectious diseases among animals and birds present growth opportunities for the global anticoccidial drugs market during the forecast period. The expanding number of companion animals and their popularity, and the rising concerns among pet owners regarding the safety and health of pets are enhancing growth opportunities among people. The enlarging expenditure on pet healthcare by pet owners, as most people are adopting health insurance for pets, augments the market growth opportunities. The escalation in the investments by the significant market players in the research and developmental activities to enhance the efficacy and safety of the drugs is creating growth opportunities to the anticoccidial drugs market. The growing meat-eating population and enlarging demand for cattle products are propelling the market growth.

MARKET RESTRAINTS

The growing number of regulatory restrictions and stringency is a major hindrance. However, the need for more skilled persons to manufacture appropriate drugs with correct dosage forms slowly restricts the global anticoccidial drug market's growth. In addition, the availability of other drugs at a lower cost and fluctuations in the prices of final products due to the less availability of raw materials limit the growth of the global anticoccidial drugs market. The rising concerns regarding drug resistance, as the continuous utilization of anticoccidial drugs lead to drug resistance in the parasites, is a significant challenge for market growth. Long-term exposure to low levels of anticoccidials may lead to chronic toxicity in humans as the ionophores may cause muscle cell necrosis, skeletal and cardiac muscle loss, and organ failure in rare cases, which is another factor impeding the market growth. The live coccidiosis vaccines are expected to lose infectivity over time, and the increased costs of production, along with the cases of dosage errors, are estimated to produce a limited immune response, which hinders the market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Drug Type, Animal type, and region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Bayer Health Care, Zoetis, Elanco, Merial, Merck Animal Healthcare, Ceva Santé Animale, Virbac, Boehringer Ingelheim Animal Health, Novartis Animal Healthcare, and Smartvet Inc. |

SEGMENTAL ANALYSIS

By Drug Type Insights

The ionophore anticoccidials segment dominated the market with 42.9% of the global market share in 2024. The growth of the ionophore segment is majorly attributed to the growing awareness regarding the advantages of ionophores, such as improved efficacy, faster action, and a lower risk of drug resistance developing among veterinary practitioners. In addition, the growing R&D activities around ionophores to bring innovative and effective drugs to the market further promote the segment's growth rate. Furthermore, ionophores are safe for animals as they contain low toxicity levels, which is why the adoption of ionophores is growing and resulting in segmental growth.

The antibiotic segment is another key segment and is likely to witness the fastest CAGR of 8.04% during the forecast period. The rise in the scale of research institutes to introduce certain types of drugs at high quality with the latest technology boosts segmental growth. Also, the growing economy in almost every region magnifies the segment's growth rate.

By Animal Type Insights

Based on animal type, the poultry animal segment led the anticoccidial drugs market with 41.8% of the global market share in 2024 and the domination of the segment is likely to continue during the forecast period. The growing adoption of anticoccidial drugs primarily drives the segment's growth by poultry producers to improve the productivity and overall health of the birds. In addition, the emergence of the latest technological developments and the growing incidence of coccidiosis, especially in food-producing animals, are fuelling the segment's growth rate.

On the other hand, the companion animal segment is another notable segment in the global market. Factors such as increasing pet ownership worldwide, rising awareness regarding veterinary healthcare, and the availability of anticoccidial drugs in several countries are promoting segmental growth. As a result, the adoption of companion animals such as cats and dogs is growing significantly worldwide. In addition, the growing incidence of coccidiosis among companion animals accelerates the segment's growth.

REGIONAL ANALYSIS

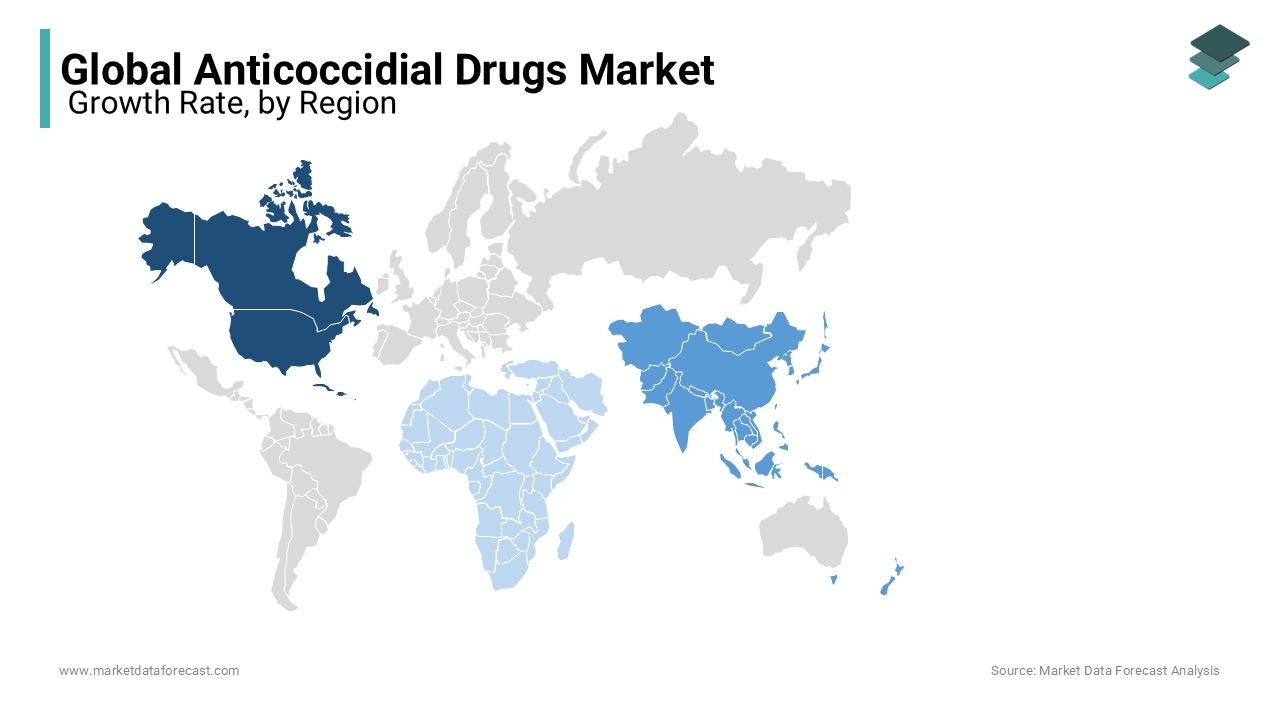

North America captured 36.3% of the global market share in 2024. The adoption of advanced manufacturing drug techniques majorly drives this regional market. In addition, launching innovative medicines that favor producing the most top-quality products significantly influences the global anticoccidial drugs market. The adoption of companion animals is increasing in North American countries, contributing to the growth of the North American market. For instance, dogs are widely adopted in the U.S., followed by cats. According to studies, 60 million households in the United States have dogs, and 47 million have cats as pets. The presence of well-organized animal healthcare systems in the North American region favors the anticoccidial drugs market in this region. The increasing accessibility of anticoccidial drugs to pet owners via veterinary hospitals and online pharmacies favors regional market growth.

Asia-Pacific is currently the fastest-growing regional segment in the global market. The Asia Pacific market accounted for the second largest global market share in 2024 owing to the growing pet population, increasing demand for poultry products, and increasing support and funding from the APAC countries. In addition, the growth rate of the APAC market is also fuelled by the increasing scale of the regional pharmaceutical industries.

Europe had a substantial share of the worldwide market in 2024 due to the growing meat consumption rate. The presence of a sophisticated pet care industry in the European region is driving the market expansion in Europe. In addition, factors such as the growing usage of anticoccidial drugs for companion animals and poultry animals in European countries and the growing availability of anticoccidial drugs via various channels are favoring the growth of the European market. As a result, the U.K. market is estimated to account for most of the share in the European market during the forecast period.

Latin America is also a noteworthy regional segment in the worldwide market. The market in Latin America has showcased steady growth over the last few years and is likely to take off in the coming years. In 2023, Brazil, followed by Mexico, led the anticoccidial drugs market in Latin America.

The Middle East and Africa market is projected to have a prominent growth rate in the coming years. The usage of anticoccidial drugs is growing substantially in the Middle East and African countries owing to the growing MEA poultry industry and increasing incidence of coccidiosis among birds. In addition, the rising consumption levels of meat and poultry products fuel the need for anticoccidial drugs in this region during the forecast period.

KEY PLAYERS IN THE GLOBAL MARKET

Noteworthy companies in the global anticoccidial drugs market profiled in this report are Bayer Health care, Zoetis, Elanco, Merial, Merck Animal Healthcare, Ceva Santé Animale, Virbac, Boehringer Ingelheim Animal Health, Novartis Animal Healthcare, and Smartvet Inc. The global anticoccidial drugs market is highly competitive, and major players have adopted product development strategies, mergers, acquisitions, and partnerships to maximize their market share.

RECENT HAPPENINGS IN THIS MARKET

- In May 2023, Amlan International announced its successful purchase of an outstanding non-controlling interest in Agromex Importaciones. By this, Amlan now possesses complete ownership of its subsidiary in Mexico, which strengthens its presence in the market.

- In April 2022, Amlan International, a U.S.-based company operating in veterinary healthcare, announced natural alternatives to anticoccidial drugs.

- In March 2022, Amlan International launched two natural alternatives to antibiotics for poultry and livestock, such as Phylox Feed and NeutraPath. Phyloxx Feed is a natural alternative to anticoccidial drugs and vaccines, which help producers increase profitability.

- In May 2020, Zoetis showed suckling calves with significant weight gain from implants. It is a considerable increase in weaning weight.

- In September 2019, Virbac launched Multimin, which is used for cattle.

- In October 2019, Ceva Sante Animale agreed with ProBioGen, the manufacturer, to represent a transformation of poultry vaccines with the help of ProBioGen's proprietary AGE1.CR technology. AGE1 is a preserved cell line that is obtained from the duck. This cell line is created as a platform to restore chicken cells to manufacture vaccines related to poultry. In addition, Ceva and ProBioGen have a long track in introducing new veterinary vaccines through additional research and development programs.

MARKET SEGMENTATION

This research report on the global anticoccidial drugs market has been segmented and sub-segmented based on the drug type, animal type, and region.

By Drug Type

- Antibiotic

- Ionophore

- Chemical Derivative

By Animal Type

- Poultry

- Swine

- Fish

- Cattle

- Companion Animal

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the growth rate for global anticoccidial drugs market?

The global anticoccidial drugs market is forecasted to grow at a CAGR of 3.61% from 2025 to 2033.

Which anticoccidial drug type is doing well?

Based on the various drug types, the Ionophore anticoccidial drugs type dominates the market and account for the leading share in the global market during the forecast period

What is the fastest growing region in the worldwide anticoccidial drugs market?

North American market led the global market in 2023. However, during the forecast period, the Asia-Pacific is likely to grow the fastest.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]