Global Aircraft Cabin Interiors Market Size, Share, Trends, & Growth Analysis Report – Segmented By Type, Aircraft Type, End-User & Region - Industry Forecast From 2024 to 2032

Global Aircraft Cabin Interiors Market Size (2024 to 2032)

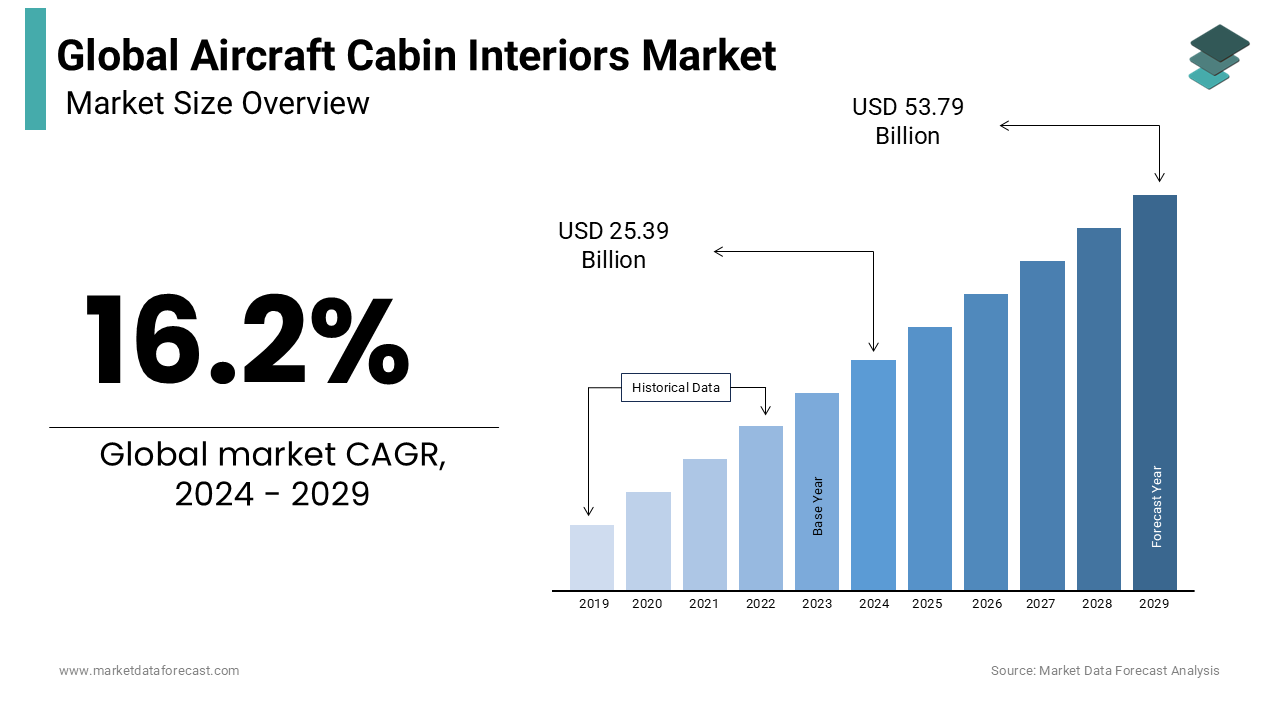

The global market size for aircraft cabin interiors is predicted to be worth USD 21.85 billion in 2023. The global market is expected at USD 25.39 billion in 2024 to USD 84.39 billion by 2032, with a CAGR of 16.2% during the foreseen period.

MARKET DRIVERS

The growth of the global aircraft cabin interiors market is primarily driven by the growing number of new aircraft orders due to increased air passenger traffic worldwide.

Additionally, airlines are very concerned with improving the customer experience and, as such, are increasingly investing in modernizing existing aircraft fleets, leading to the growth of the aircraft cabin interiors market. The aircraft cabin interior features seats, inflight entertainment connectivity, cabin lighting, a galley, a lavatory, windows, a windshield, storage compartments, and interior panels. Increasing demand for aircraft due to a surge in passenger air traffic is driving the market for aircraft cabin interiors. For example, according to the International Civil Aviation Organization, the number of air passengers is expected to increase by 34.7 billion in 2026 compared to 18.6 billion in 2021.

The domestic market for commercial airline cabins has grown significantly due to the dynamism of the aviation sector. The interior of the cabin and its environment is an essential part of the flight experience that can be used to increase passenger traffic to a particular brand of airline. The increasing number of air travelers, coupled with competitive flight rates, is one of the major factors likely to drive growth in the global aircraft cabin interiors market. In addition, the integration of inflight connectivity and entertainment systems on airplanes is driving the development of the target market, contributing to travelers' relaxation.

Another factor that is predicted to support the growth of the target market is the increasing inclination of the airline industry towards customizing cabins to meet the changing needs of travelers. Long-haul flights have a long travel time, which is expected to fuel the demand for in-flight entertainment and connectivity systems for the traveler's convenience, resulting in global market growth. Increased flight upgrade activities among significant airlines to support the competitive market increases the need for aircraft cabin interiors, resulting in target market growth. Ongoing developments in cabin-related technologies to meet passenger expectations for comfort and customization are supposed to support global market growth during the forecast period.

MARKET RESTRAINTS

The inflight entertainment and connectivity market is subject to regulations in several countries. It is becoming difficult for airlines to obtain approvals to install IFE systems onboard. The procedure of obtaining certifications for IFE systems is quite exhaustive due to the lengthy approval process and the high cost of IFE systems. Delayed aircraft deliveries affect the aviation industry, further affecting operations and cash flow and leading to losses for lessees.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

16.2% |

|

Segments Covered |

By Type, Aircraft Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

United Technologies Corporation (US), Safran (Zodiac Aerospace) (France), Astronics Corporation (US), Cobham plc (UK), Diehl Stiftung & Co. KG (Germany), Global Eagle Entertainment (US), Gogo Inc. (US), Honeywell International Inc. (US), Panasonic Avionics Corporation (US), and RECARO Aircraft Seating GmbH & Co. KG (Germany) |

SEGMENTAL ANALYSIS

Global Aircraft Cabin Interiors Market Analysis By Type

The Aircraft seat segment accounted for the largest share of the global market in 2023. To meet the expectations of the growing number of air passengers, market competitors are primarily concentrating on aircraft seating capacities. Additionally, the segment growth is aided by the seating upgrades to improve customers' travel experiences.

On the other hand, the rising demand for in-flight connectivity services, such as internet browsing, text messaging, cell phone use, and wireless streaming among passengers, particularly millennials, is credited with driving the segmented market growth. The leading companies are consistently investing in R&D coupled with sustained quick improvement in bandwidth speeds due to the increase in demand for in-flight entertainment & connectivity services, further accelerating the market expansion.

Global Aircraft Cabin Interiors Market Analysis By Aircraft Type

The narrow-body aircraft segment is expected to witness a significant share of the market during the forecast period. These factors include the rising consumer demand for visually appealing cabin interiors in short-haul aircraft and upgraded lighting systems in contemporary narrow-body aircraft platforms. Additionally, because of the lifting of limitations on domestic air travel, domestic carriers are experiencing the pandemic's fastest recovery, driving the segment's market demand at an exceptional rate.

Passengers on very large aircraft benefit greatly from the comfort and enjoyable experience that cabin illumination provides. Innovations in lighting goods, such as mood lighting systems and color-changing lights for long-haul wide-body aircraft, support market demand in the sector. Wide-body aircraft also extensively use supplementary lighting components, such as ceiling lights with high-resolution pictures and floor path strip lights.

Global Aircraft Cabin Interiors Market Analysis By End-User

The OEM (original equipment manufacturer) segment is projected to lead the market for airplane cabin interiors during the forecast period. As the commercial aviation sector grows drastically globally due to an exponential increase in air passenger traffic, the need for new aircraft is growing yearly. Therefore, due to the rising demand for new aircraft, it is estimated that the OEM sector of the market will grow more rapidly during the projected period.

REGIONAL ANALYSIS

Most of the aircraft cabin interior manufacturers are in North America. The United States and Canada are the main centers. The leading aircraft manufacturers in this region are B / E Aerospace, C&D Zodiac, Weber Aircraft, and TIMCO Aero System. The second-largest aircraft cabin interior manufacturers concentration is in Europe, the UK, Italy, France, and Germany. In Latin America, Brazil has some manufacturers of aircraft cabin interiors. However, the number of seat manufacturers is quite small compared to North America and Europe. As a result, Latin American manufacturers do not have a significant market share in the global market for aircraft cabin interiors. APAC has the lowest concentration of cabin interior manufacturers. The entry of new aircraft manufacturers, such as COMAC, into China, creates enormous opportunities for APAC cabin interior manufacturers.

KEY PLAYERS IN THE GLOBAL AIRCRAFT CABIN INTERIORS MARKET

United Technologies Corporation (US), Safran (Zodiac Aerospace) (France), Astronics Corporation (US), Cobham plc (UK), Diehl Stiftung & Co. KG (Germany), Global Eagle Entertainment (US), Gogo Inc. (US), Honeywell International Inc. (US), Panasonic Avionics Corporation (US) and RECARO Aircraft Seating GmbH & Co. KG (Germany) are some of the notable players in the global aircraft cabin interiors market. United Technologies Corporation was an American international company based in Farmington, Connecticut. It merged with the Raytheon Company in April 2021 to form Raytheon Technologies.

RECENT HAPPENINGS IN THE MARKET

- In July 2021, Panasonic Avionics Corporation partnered with Middle East Airlines Air Liban (MEA) to provide In-Flight Entertainment and Connectivity (IFEC) solutions known as the eX1 seat back for 15 of its aircraft in the Airbus A321 Family.

- In June 2021, Collins Aerospace Systems developed and introduced the High-Efficiency Particulate Air Installation Kit with Recirculating Cabin Air (HEPA) for Dash 8 (-100/-200/-300) aircraft.

DETAILED SEGMENTATION OF THE GLOBAL AIRCRAFT CABIN INTERIORS MARKET INCLUDED IN THIS REPORT

This report on the global aircraft cabin interiors market has been segmented and sub-segmented into the following categories.

By Type

- Aircraft Seats

- Inflight Entertainment and Connectivity

- Cabin Lighting

- Aircraft Galley

- Aircraft Toilets

- Aircraft Windows and Windshields

- Interior Panels Storage Compartments

By Aircraft Type

- Narrow-Body

- Wide-Body

- Very Large

- Regional and Business Jets

By End-User

- Original Equipment Manufacturer

- Aftermarket

- MRO

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key components of aircraft cabin interiors?

The key components of aircraft cabin interiors include seating, in-flight entertainment systems, lighting, galley equipment, lavatories, and storage bins. These components are crucial in enhancing passenger comfort, safety, and overall travel experience.

What are the main drivers of growth in the aircraft cabin interiors market?

The main drivers include increasing passenger traffic, particularly in emerging markets, the demand for enhanced passenger comfort, technological advancements in in-flight entertainment systems, and the trend towards lightweight and fuel-efficient cabin materials to reduce operational costs.

What role does technology play in the evolution of aircraft cabin interiors?

Technology plays a crucial role in the evolution of aircraft cabin interiors, with advancements such as smart lighting systems, touchless controls, and enhanced in-flight entertainment systems improving passenger experience. Moreover, the integration of IoT and AI is enabling predictive maintenance and personalized services in cabins.

How is sustainability influencing the aircraft cabin interiors market?

Sustainability is increasingly influencing the aircraft cabin interiors market, with airlines and manufacturers seeking eco-friendly materials, energy-efficient lighting, and lightweight components to reduce the carbon footprint. The focus on recycling and using sustainable materials is also gaining momentum in the industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]