Global Agricultural Biologicals Market Size, Share, Trends & Growth Forecast Report– Segmented By Type (Bio Pesticides, Bio Fertilizers and Bio Stimulants), Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables and Others), Sources (Microbial, Biorationals and Others), Mode Of Application (Soil Treatment, Seed Treatment and Foliar Spray) And Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Agricultural Biologicals Market Size

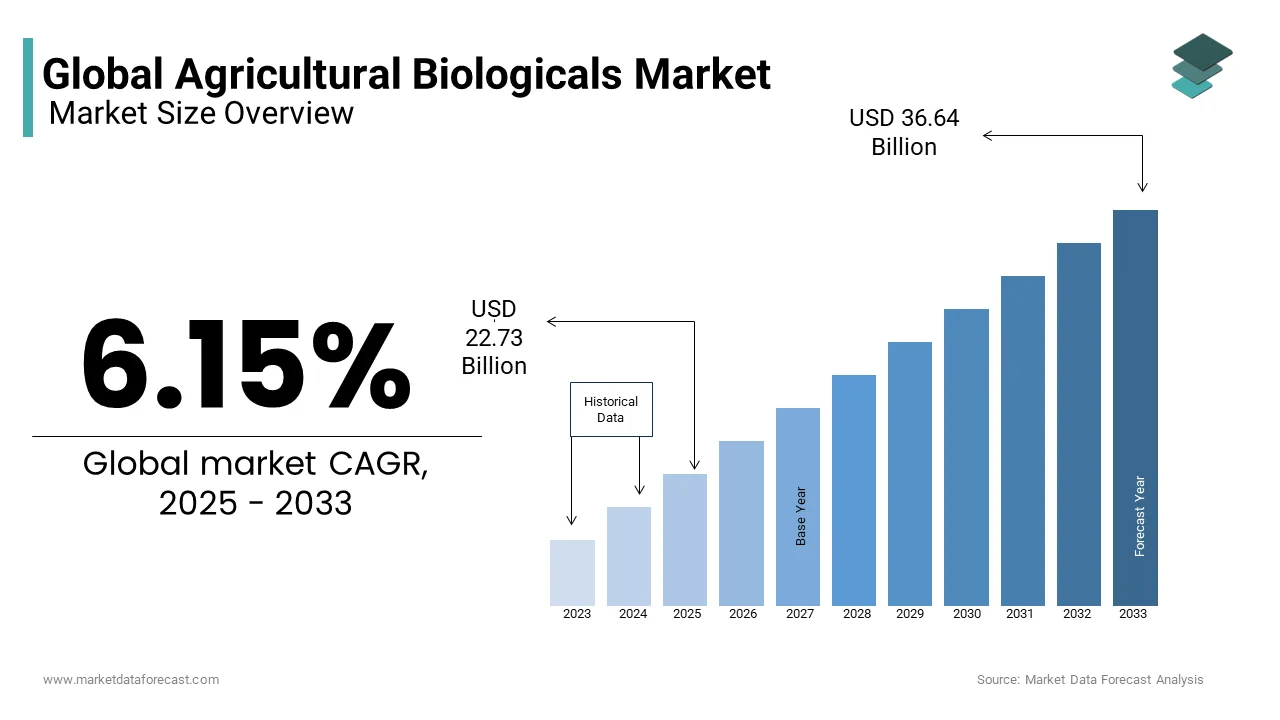

The size of the global agricultural biologicals market was valued at USD 21.41 billion in 2024, and it is anticipated to reach USD 22.73 billion in 2025 from USD 36.64 billion by 2033, growing at a CAGR of 6.15% from 2025 to 2033.

Biological agriculture is the production of crops based on crop rotation, recycling of manure and the use of biological control methods. Agricultural biological products are obtained from organic matter, such as extracts from plants and microorganisms, which improve crop health and productivity. Agricultural biologicals are primarily utilized as a part of integrated pest management (IPM) to develop innovative crop sciences. Biological agriculture is an eco-friendly production system that uses products that are safe for crop improvement.

Owing to regulatory support and increasing environmental awareness, the adoption of agricultural biologicals has increased significantly in the recent past, and this trend is expected to fuel in the coming years and boost the global market growth. Countries such as the United States, Brazil, Argentina, India, and China are currently experiencing high demand for agricultural biologics. In the U.S., the government is encouraging sustainable agriculture and organic farming practices, which is resulting in the increasing demand for agricultural biologics. In Brazil and Argentina, stringent export regulations and an increasing need to address soil degradation are promoting the usage of agricultural biologics. With the growing number of technological advancements in agricultural biologics and rising awareness around environmental concerns, the future of global agricultural biologics is estimated to be lucrative during the forecast period.

MARKET DRIVERS

The rising demand for organic food products worldwide is majorly propelling the global agricultural biologics market growth.

The demand for organic food is growing continuously, and exponential growth is expected in the coming years. Consumers have become extremely health-conscious and have been showing interest in consuming food products that have grown organically worldwide. In addition to that, consumers' concerns about food safety and environmental sustainability have boosted consumer demand for organic food products. As per the data published by the Research Institute of Organic Agriculture (FiBL) and IFOAM, the global organic food market was valued at more than 120.6 billion Euros worldwide in 2020. To address the growing demand for organic food, farmers have been increasingly using agricultural biologics while reducing their dependency on synthetic chemicals.

The growing awareness about sustainable farming practices is further contributing to the growth of the global agricultural biologics market.

The concerns around environmental degradation, soil health and the long-term viability of conventional farming methods are increasing worldwide and resulting in the adoption of sustainable alternatives. Agricultural biologics have the ability to offer a sustainable alternative to conventional chemical inputs and this can be done by harnessing natural processes and beneficial microorganisms. Farmers worldwide have been realizing the importance of using practices that minimize environmental harm while maintaining productivity in agriculture and understanding the potential of agricultural biologics in achieving these objectives.

The growing population worldwide, improving yield and productivity, increasing spending in R&D efforts, rapid growth in the use of these products in seed treatment, rising support from the government and increasing health consciousness are further boosting the growth rate of the global market.

MARKET RESTRAINTS

Factors such as lack of awareness among the farmers and reluctance to change from existing practices of chemical pesticides are restraining the growth of the market. Farmers have poor awareness of agricultural biologics or misconceptions about the effectiveness of agricultural biologics in regions where the domination of conventional farming practices is still has existence. In such regions, farmers are hesitant to use agricultural biologics, and the adoption is poor.

In addition, the high cost of agricultural biological products, the shorter shelf life of biological inputs, lack of regulatory clarity and standards, and limited availability and accessibility of agricultural biologics in rural areas are hindering the growth of the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.15% |

|

Segments Covered |

By Type, Application, Sources, Mode of Application and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF, Bayer Crop Science, Syngenta, Novozymes A/S, Isagro, Arysta Lifescience Limited, Arysta LifeScience Corporation, Valent BioScience Corporation, Marrone Bio Innovations Inc., Certis U.S.A and Koppert B.V. |

SEGMENTAL ANALYSIS

Global Agricultural Biologicals Market Analysis By Type

The biopesticides segment dominated the global agricultural biologics market with holding 39.4% of the worldwide market share in 2024, based on type. The biopesticides segment is also predicted to be the fastest growing segment in the global market. The domination of the biopesticides segment is majorly attributed to the stringent regulations on conventional pesticides and increasing awareness about the adverse effects of synthetic pesticides on human health and the environment. The key players in the global agricultural biologics market such as Bayer AG, BASF SE and Syngenta have been investing significant amounts in the R&D of biopesticides to introduce to new and effective products to the market and to increase their product portfolio, which is contributing to the expansion of the biopesticides segment.

The biofertilizers segment is another major segment and captured a substantial share of the worldwide market in 2024. The biofertilizers segment is projected to grow at a 9.88% during the forecast period. The growing focus on soil health and fertility improvement is one of the major factors propelling the growth of the biofertilizers segment in the global market. Increasing environmental concerns with chemical fertilizers, a growing number of incentives from the governments to promote organic farming, and rising awareness among farmers regarding the potential of biofertilizers in enhancing soil structure, nutrient uptake, and crop yield sustainably are further fueling the growth rate of the biofertilizers segment in the global market. Market players such as Novozymes, Rizobacter Argentina, and Lallemand Inc. have been emphasizing product innovation and strategic collaborations to promote their market presence and capture the growing demand for sustainable agricultural inputs.

Global Agricultural Biologicals Market Analysis By Application

The cereals & grains segment led the agricultural biologics market, accounting for 36.04% of the global market share in 2024. The rapid adoption of biologicals in cereal production to address soil health issues and reduce chemical inputs is primarily driving the growth of the cereals & grains segment in the global market and this trend can be seen clearly in major agricultural biologics markets such as the United States, China, and India. The introduction of innovative biological solutions targeting specific pests and diseases in cereals & grains to enhance crop productivity is further boosting the expanding the cereals and grains segment in the global market.

The oilseeds and pulses segment is predicted to be the fastest-growing segment in the global market during the forecast period. The growing cultivation of oilseeds & pulses and rising awareness among consumers regarding the nutritional benefits of plant-based proteins are majorly propelling the growth of the oilseeds and pulses segment in the global market. In Brazil, Argentina, and Canada, agricultural biologics have been increasingly used in the production of soybeans and pulses to improve crop health and yield stability.

Global Agricultural Biologicals Market Analysis By Source

The microbial segment occupied 41.9% of the global market share in 2024 and stood as the largest segment in the global market. The domination of the microbial segment in the global market is primarily credited to the rising awareness among farmers regarding the effectiveness of microbial products in improving crop yields and soil fertility and increasing investments by the key market players to innovate microbial strains that can offer enhanced efficacy and application versatility. Microbial products such as bio fungicides and bioinsecticides have gained popularity worldwide among farmers due to their eco-friendly nature and ability to combat pests and diseases effectively.

The biorational segment is predicted to witness a healthy CAGR in the global market during the forecast period. The rise in the awareness among farmers regarding the effectiveness of biorational products in integrated pest management (IPM) programs is driving the expansion of the biorational segment in the global market.

Global Agricultural Biologicals Market Analysis By Mode of Application

The soil treatment segment held 40.7% of the global market share in 2024 and is expected to grow at a steady CAGR during the forecast period. The lead of the soil treatment segment is primarily attributed to the rising awareness of soil health management among farmers worldwide. In North America and Europe, the adoption of soil treatment products is growing at a brisk pace, fueling the need for sustainable farming practices and regulatory support for organic agriculture and contributing to the expansion of the soil treatment segment in the global market.

The seed treatment segment is anticipated to register the fastest CAGR of 11.44% during the forecast period. The demand for high-yielding and disease-resistant crop varieties is continuously growing, which is majorly propelling the growth of the seed treatment segment in the global market. The advancements in seed treatment technologies are further boosting the growth rate of the seed treatment segment in the global market.

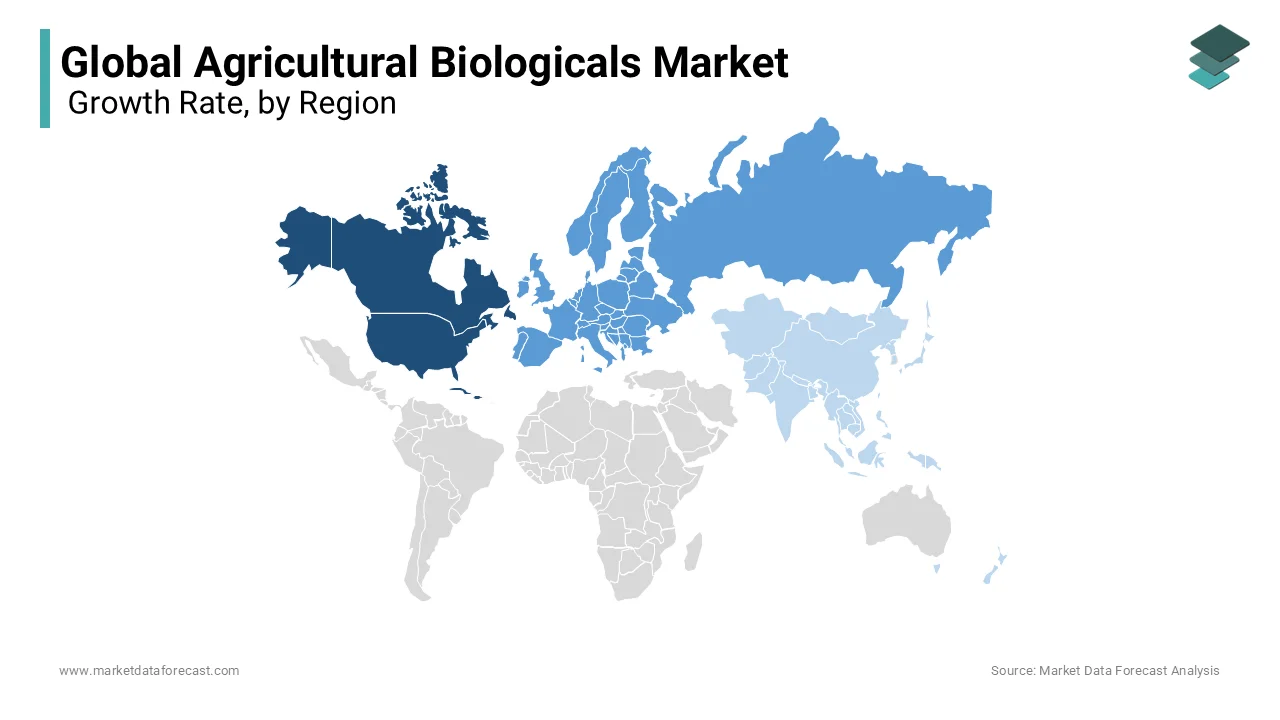

REGIONAL ANALYSIS

North America played a key role in the global agricultural biologics market and accounted for 38.8% of the worldwide market share in 2024. The strong presence of notable market participants in the North American region is significantly promoting the growth of the North American market. Market participants in the U.S. and Canada have been investing significant amounts in R&D to innovate agricultural biologics, which favors regional market growth. The rapid adoption of biological seed treatments and biopesticides to enhance crop yield and quality while minimizing environmental impact among farmers in North America is further boosting regional market growth. Furthermore, favorable regulatory frameworks, robust investments in sustainable farming practices, technological advancements, and increasing initiatives from the governments of North American countries are contributing to the expansion of the agricultural biologics market in North America.

Europe was the second biggest regional segment in the global agricultural biologics market in 2024 and is predicted to register a healthy CAGR during the forecast period. Europe has stringent regulations and bans on certain chemical pesticides, which promote the usage of agricultural biologics and drive the European market growth. The awareness regarding the health and environmental benefits of organic farming among the consumers of the European region is propelling the growth of the European market growth. In Europe, Germany, France, and Spain are at the forefront of the adoption of agricultural biologics, and governments of these countries are increasingly supporting organic farming.

The Asia-Pacific region is predicted to witness the highest CAGR among all regions in the global market during the forecast period. The population and food demand are rapidly growing in the Asia-Pacific region and fueling the adoption of agricultural biologics to enhance crop yield and productivity while ensuring food safety and security, which is one of the major factors propelling the growth of the Asia-Pacific market. China, India and Australia are expected to a promising role in the Asia-Pacific regional market.

KEY MARKET PLAYERS

BASF, Bayer Crop Science, Syngenta, Novozymes A/S, Isagro, Arysta Lifescience Limited, Arysta LifeScience Corporation, Valent BioScience Corporation, Marrone Bio Innovations Inc., Certis U.S.A, Koppert B.V. are playing a dominating role in the global agricultural biological market.

MARKET SEGMENTATIONS

This research report on the global agricultural biological market has been segmented and sub-segmented based on type, application, source, mode of application and region.

By Type

- Biopesticides

- Bioinsecticides

- Bio nematicides

- Bio Herbicides

- Biofertilizers

- Biostimulants

By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Source

- Microbial

- Microbial

- Biorationals

- Others

By Mode of Application

- Soil Treatment

- Seed Treatment

- Foliar Spray

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the size of global agricultural biological market?

The global agricultural biologicals Market is expected to be valued at USD 22.73 billion in 2025

what is the growth of global agricultural biological market?

The global agricultural biologicals Market is expected to grow at a CAGR of 6.15%, to reach USD 36.64 billion by 2033.

what are the key market players involved global agricultural biological market?

BASF, Bayer Crop Science, Syngenta, Novozymes A/S, Isagro, Arysta Lifescience Limited, Arysta LifeScience Corporation, Valent BioScience Corporation, Marrone Bio Innovations Inc., Certis U.S.A, Koppert B.V, are playing a dominating role in the global agricultural biological market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]