Global Gift Cards Market Size, Share, Trends & Growth Forecast Report By Card Type (Closed Loop Card and Open Loop Card), End User (Retail establishment and Corporate Institutions), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Gift Cards Market Size

The global gift cards market was worth USD 1,159.27 billion in 2024. The global market is projected to reach USD 5,063.98 billion by 2033 from USD 1,365.62 billion in 2025, growing at a CAGR of 17.80% from 2025 to 2033.

Gift cards serve as prepaid instruments that empower recipients to choose products or services tailored to their preferences. These cards have gained traction for their versatility, being used for employee incentives, customer loyalty programs, and even charitable donations. In recent years, the adoption of digital gift cards has surged is driven by broader societal shifts toward cashless transactions and the growing penetration of smartphones. A 2022 survey conducted by Blackhawk Network revealed that over 70% of consumers across key demographics expressed a preference for receiving gift cards as presents is citing flexibility and ease of use as primary reasons.

Interestingly, studies indicate that a significant portion of gift card users do not fully utilize their balance. According to First National Bank, approximately 10% of gift card values go unredeemed each year by amounting to billions of dollars in unused funds. This phenomenon underscores both consumer behavior patterns and opportunities for businesses to engage customers through reminders or bonus incentives. Furthermore, the rise of eco-conscious consumerism has led to increased demand for digital gift cards which eliminate the need for plastic production and reduce environmental impact. As society continues to embrace digital solutions and prioritize personalization, the role of gift cards extends beyond mere transactions, reflecting deeper cultural and behavioral trends in how people connect and exchange value.

MARKET DRIVERS

Increasing Consumer Preference for Cashless and Contactless Payments

The global shift toward cashless transactions has significantly propelled the growth of the gift card market. With the rise of digital wallets and contactless payment methods, consumers are increasingly gravitating toward prepaid instruments like gift cards for their convenience and security. According to a 2021 report by the Federal Reserve, over 75% of Americans used at least one form of digital payment during the year, with prepaid cards being a notable inclusion. This trend was further amplified during the COVID-19 pandemic, as health concerns accelerated the adoption of touch-free payment solutions. The U.S. Census Bureau highlighted that e-commerce sales surged by 32% in 2020 alone, with digital gift cards playing a pivotal role in facilitating online purchases.

Growing Role of Gift Cards in Employee Rewards and Incentives

The use of gift cards as tools for employee recognition and corporate incentives has emerged as a major driver of the market. Companies are increasingly leveraging gift cards to enhance employee satisfaction and retention with their flexibility and appeal. A study conducted by the Society for Human Resource Management (SHRM) found that organizations utilizing non-cash rewards, including gift cards, reported a 20% increase in employee engagement levels. Furthermore, the U.S. Department of Labor noted that companies investing in employee recognition programs experienced a 31% reduction in voluntary turnover rates. Gift cards are particularly effective because they allow employees to choose rewards that align with their personal preferences.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Burdens

The gift card industry faces significant hurdles due to stringent regulations imposed by government agencies which aim to protect consumers but often increase operational complexity for issuers. For instance, the U.S. Securities and Exchange Commission (SEC) enforces rules requiring transparency in terms of expiration dates and fee disclosures, which can be burdensome for smaller retailers. Furthermore, a study highlighted by the Consumer Financial Protection Bureau (CFPB) revealed that a substantial portion of consumers approximately 30% reported encountering unexpected restrictions or fees when using their gift cards. This lack of awareness often stems from unclear terms and conditions is leading to regulatory crackdowns on non-compliant issuers. These regulations, while beneficial for consumer protection, can stifle innovation and limit profitability for businesses. Additionally, state-level laws, such as those enforced by the California Department of Justice, mandate escheatment of unredeemed balances after a specific period by further complicating operations. These compliance challenges create barriers to entry for new players and strain existing participants in the market.

Increasing Consumer Preference for Cashless and Contactless Payments

The global shift toward cashless transactions has significantly propelled the growth of the gift card market. Consumers are increasingly gravitating toward prepaid instruments like gift cards for their convenience and security with the rise of digital wallets and contactless payment methods. According to a 2021 report by the Federal Reserve, over 75% of Americans used at least one form of digital payment during the year, with prepaid cards being a notable inclusion. This trend was further amplified during the COVID-19 pandemic as health concerns accelerated the adoption of touch-free payment solutions. The U.S. Census Bureau highlighted that e-commerce sales surged by 32% in 2020 alone with digital gift cards playing a pivotal role in facilitating online purchases.

MARKET OPPORTUNITIES

Integration of Gift Cards with Emerging Payment Technologies

The convergence of gift cards with emerging payment technologies presents a significant opportunity for market expansion. The rise of blockchain and digital wallets has paved the way for secure, transparent, and instantaneous transactions by enhancing the appeal of digital gift cards. According to a report by the U.S. Department of Commerce, over 60% of consumers now prefer digital payment methods with prepaid instruments like gift cards being a key beneficiary of this trend. Additionally, the Federal Reserve highlighted that real-time payment systems which align seamlessly with digital gift card usage are expected to grow by 40% annually through 2025. This technological integration not only improves user experience but also reduces operational costs for issuers. Furthermore, advancements such as biometric authentication and QR code-based redemption mechanisms are making gift cards more accessible and fraud-resistant is driving their adoption in both developed and emerging markets.

Expansion into Niche Markets and Customized Offerings

The ability to tailor gift cards for niche markets and specific consumer segments offers immense growth potential for the industry. Government agencies like the Small Business Administration (SBA) have noted that personalized and experiential gifting is on the rise, with niche gift cards catering to hobbies, wellness, and travel gaining traction. For instance, the U.S. Travel Association reported that travel-related gift cards saw a 25% increase in sales in 2022 is driven by post-pandemic demand for leisure activities. Moreover, the National Retail Federation found that 70% of millennials are more likely to purchase gift cards that support local businesses or unique experiences. Companies can create hyper-personalized offerings that resonate with diverse demographics by leveraging data analytics,. This customization not only enhances customer satisfaction but also strengthens brand loyalty by positioning gift cards as a versatile tool for targeted marketing and community engagement.

MARKET CHALLENGES

Fraud and Security Vulnerabilities in Gift Card Transactions

Gift cards have increasingly become a target for fraudsters is posing a significant challenge to the market's integrity. According to the Federal Trade Commission (FTC), gift card-related scams accounted for over $240 million in reported losses in 2022 by marking a 50% increase from the previous year. Fraudsters often exploit the anonymity of gift cards to deceive consumers through phishing schemes or counterfeit cards. The FTC also noted that nearly 25% of fraud complaints involved scammers demanding payment exclusively through gift cards, particularly targeting elderly and vulnerable populations. This growing trend undermines consumer confidence and raises concerns about the security of prepaid instruments. They are also susceptible to cyberattacks, as highlighted by the U.S. Department of Homeland Security. Strengthening encryption protocols and educating consumers about potential risks remain critical to mitigating this challenge.

Environmental Concerns with Physical Gift Cards

The environmental impact of physical gift cards represents another pressing challenge for the industry. The U.S. Environmental Protection Agency (EPA) estimates that over 100 million plastic gift cards are produced annually by contributing significantly to non-biodegradable waste. Each card, typically made from PVC takes centuries to decompose which is exacerbating landfill issues. Additionally, a study referenced by the National Oceanic and Atmospheric Administration (NOAA) revealed that improperly discarded plastic cards contribute to microplastic pollution is harming marine ecosystems. While digital gift cards offer a more sustainable alternative, their adoption is not yet universal among older demographics. The EPA emphasizes that reducing reliance on physical cards and promoting recyclable materials could mitigate environmental harm. However, achieving this shift requires significant investment in eco-friendly production methods and greater consumer awareness about sustainable gifting options.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.80% |

|

Segments Covered |

By Card Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

American Express Company, Paytronix Systems, Inc., Givex Corporation, InComm Payments LLC, Qwikcilver Solutions Pvt Ltd., Amazon.com Inc., Walmart Inc., PayPal, Inc., Fiserv, Inc., and Blackhawk Network. |

SEGMENTAL ANALYSIS

By Card Type Insights

The closed loop card segment had the dominating share of 70.7% of the global market in 2024. These cards are tied to specific retailers or brands by offering tailored shopping experiences and driving customer loyalty. Their popularity stems from their ability to lock consumers into a single ecosystem with increasing repeat purchases. According to the National Retail Federation, closed loop cards tend to have higher redemption rates compared to open loop alternatives, as they encourage spending within a specific brand's ecosystem. Additionally, data from the Federal Reserve highlights that closed loop cards often account for a significant portion of incremental sales, as unredeemed balances contribute directly to issuer revenue. This segment’s importance lies in its dual role as a revenue driver and marketing tool by fostering brand engagement while capturing residual sales through partial redemptions.

The open loop card segment is anticipated to record a CAGR of 15.04% over the forecast period. Open loop cards are usable across multiple merchants and give appeal to consumers seeking versatility and convenience. The rise of e-commerce platforms and digital wallets has accelerated their adoption among millennials and Gen Z users. A study referenced by the U.S. Department of Commerce highlights that a significant majority of open loop card transactions occur in digital environments by reflecting their alignment with cashless trends and online shopping behaviors. Additionally, government initiatives promoting financial inclusion have boosted demand for prepaid instruments like open loop cards. Their flexibility makes them ideal for employee incentives and cross-border gifting by solidifying their role as a transformative force in the evolving payment landscape.

By End User Insights

The retail establishments segment led the market by accounting for 65.3% of the global market share in 2024. The widespread adoption across industries such as apparel, electronics, and groceries where gift cards serve as both promotional tools and revenue generators is promoting the domination of retail establishment segment in the global market. The National Retail Federation highlights that retail gift card sales exceeded $160 billion in 2022 which was driven by their popularity during holiday seasons. Retailers benefit from unredeemed balances, which contribute significantly to their bottom line. Additionally, the flexibility and brand-specific nature of these cards enhance customer loyalty by making them indispensable for retailers aiming to boost repeat purchases.

The corporate institutions segment is expected to expand at a CAGR of 12.5% over the forecast period due to the increasing use of gift cards for employee recognition programs, incentives, and corporate gifting. The Society for Human Resource Management notes that organizations utilizing non-cash rewards, including gift cards, witnessed a 20% improvement in employee engagement. Furthermore, the rise of remote work has amplified demand for digital gift cards, which are easily distributed to global teams. Corporate gift card spending surpassed $20 billion in 2022, as highlighted by the National Retail Federation, underscoring their role in fostering workplace satisfaction and driving organizational success.

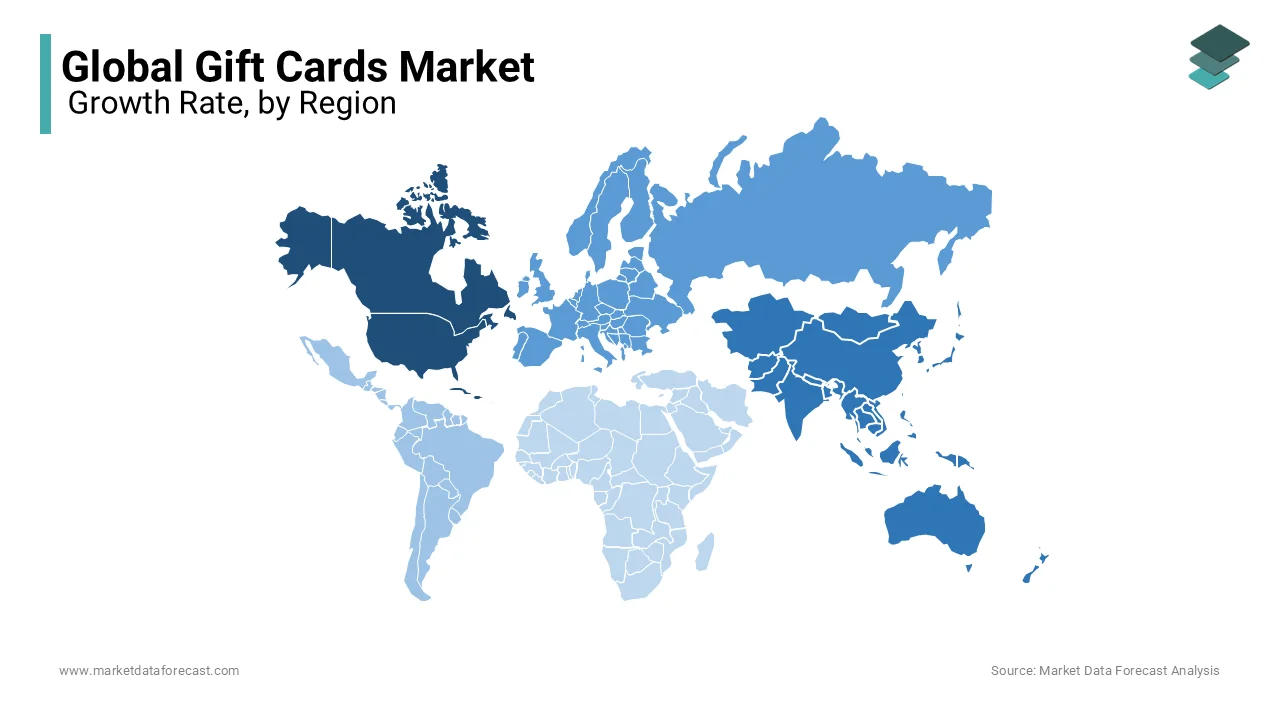

REGIONAL ANALYSIS

North America held 45.1% of global market share in 2024 owing to the robust e-commerce ecosystem of North America and high consumer preference for flexible gifting solutions. The Federal Reserve notes that over 75% of Americans use digital payment methods, with gift cards being a significant component. Additionally, the region's advanced technological infrastructure supports innovations like blockchain-enabled gift cards, enhancing security and adoption. North America's dominance is further reinforced by its strong corporate gifting culture, with businesses leveraging gift cards for employee rewards and customer loyalty programs by making it a critical hub for market innovation.

The Asia-Pacific region is experiencing unprecedented growth in the gift card market and is expected to expand at a CAGR of 15.3% during the forecast period due to the increasing internet penetration and the proliferation of mobile payment platforms like Alipay and Paytm. The Reserve Bank of India reports that digital transactions in the region grew by over 70% in 2022, with gift cards emerging as a preferred gifting solution. Governments across the region are also promoting cashless economies will further escalate the adoption of these cards. The growing middle class and rising disposable incomes have amplified demand for personalized and experiential gifting is positioning Asia-Pacific as a pivotal driver of future market dynamics.

Europe is expected to maintain steady growth which is supported by stringent consumer protection laws and the rise of sustainable gift card options, as noted by the European Central Bank. Latin America shows potential due to fintech advancements, with Mexico and Argentina witnessing a surge in digital wallet usage. In the Middle East, government-led digital transformation initiatives, such as Saudi Arabia’s Vision 2030, are propelling the adoption of prepaid instruments. Meanwhile, Africa’s burgeoning youth population and increasing smartphone penetration are driving demand for affordable and accessible gifting solutions. According to the African Development Bank, digital financial inclusion grew by 25% in 2022 by underscoring the region's untapped potential. Collectively, these regions are set to diversify and expand the global gift card landscape.

KEY MARKET PLAYERS

The major players in the global gift cards market include American Express Company, Paytronix Systems, Inc., Givex Corporation, InComm Payments LLC, Qwikcilver Solutions Pvt Ltd., Amazon.com Inc., Walmart Inc., PayPal, Inc., Fiserv, Inc., and Blackhawk Network.

COMPETITIVE LANDSCAPE

The gift card market is characterized by intense competition, driven by the presence of both global giants and regional players striving to capture market share in a rapidly evolving industry. Key players such as Blackhawk Network, InComm Payments, and Fiserv dominate the landscape, leveraging their extensive distribution networks, technological expertise, and strategic partnerships with retailers and financial institutions. These companies focus on innovation, offering solutions that cater to the growing demand for digital and customizable gift cards, while ensuring seamless integration with e-commerce platforms and mobile payment systems.

Regional players also play a significant role, particularly in emerging markets, where they capitalize on local consumer preferences and cultural nuances to differentiate themselves. The competitive environment is further intensified by fintech startups entering the space, introducing disruptive technologies like blockchain and AI-driven personalization to enhance security and user experience.

Regulatory frameworks and consumer protection laws add another layer of complexity, pushing companies to adopt transparent practices while maintaining profitability. Additionally, the rise of eco-conscious consumers has prompted businesses to explore sustainable alternatives, such as biodegradable physical cards or entirely digital options. This dynamic interplay of innovation, regulation, and shifting consumer expectations ensures that competition remains fierce, with companies continuously investing in research and development to stay ahead. As the market evolves, collaboration between traditional players and tech-driven entrants will likely shape the future competitive landscape, fostering growth while addressing challenges related to fraud, environmental impact, and consumer trust.

Top 3 Players in the Market

Blackhawk Network

Blackhawk Network is a prominent player in the global gift card market, renowned for its innovative solutions and extensive partnerships with retailers, financial institutions, and digital platforms. The company has established itself as a leader by offering a diverse portfolio of prepaid products, including both physical and digital gift cards. Blackhawk’s focus on integrating advanced technologies, such as blockchain and mobile payment systems, has enhanced the security and accessibility of its offerings. Its strong distribution network spans multiple industries, enabling it to cater to a wide range of consumer needs. By prioritizing customer convenience and brand collaboration, Blackhawk continues to shape the evolution of the gift card industry.

InComm Payments

InComm Payments is another key contributor to the global gift card market, leveraging its expertise in payment technology to deliver scalable and flexible solutions. The company specializes in creating customized gift card programs tailored to the needs of businesses and consumers alike. InComm’s emphasis on digital transformation has enabled it to offer seamless integration with e-commerce platforms, enhancing the user experience. Its ability to adapt to changing consumer preferences, such as the growing demand for contactless payments, has solidified its position as a market innovator. Through strategic partnerships and a commitment to innovation, InComm continues to drive the adoption of gift cards across various sectors.

First Data Corporation (now part of Fiserv)

First Data Corporation, now integrated into Fiserv, has played a pivotal role in advancing the gift card market through its robust payment processing capabilities and technological infrastructure. The company provides end-to-end solutions that enable businesses to design, distribute, and manage gift card programs efficiently. Its focus on data analytics and consumer insights allows brands to create personalized gifting experiences, fostering deeper customer engagement. By combining its legacy of reliability with cutting-edge innovations, Fiserv has strengthened its influence in the market. Its contributions have not only streamlined operations for retailers but also expanded the accessibility of gift cards to underserved markets, further driving global adoption.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Strategic Partnerships and Collaborations

Leading companies like Blackhawk Network and InComm Payments have forged extensive partnerships with global retailers, e-commerce platforms, and financial institutions to broaden their reach. For instance, Blackhawk’s collaboration with Amazon and Walmart has enabled it to offer branded gift cards that appeal to millions of consumers. According to the U.S. Department of Commerce, such alliances help companies tap into new customer segments and geographies, enhancing their market penetration. Additionally, partnerships with fintech firms have allowed these players to integrate advanced payment technologies, ensuring seamless user experiences.

Investment in Digital Transformation

The shift toward digitalization is a cornerstone strategy for key players. Fiserv and InComm Payments have heavily invested in blockchain, AI, and mobile wallet integrations to improve security, transparency, and convenience. The Federal Trade Commission notes that digital gift card transactions now account for over 60% of total prepaid card sales, driven by these innovations. By offering customizable, eco-friendly digital solutions, companies cater to tech-savvy consumers while reducing operational costs associated with physical cards.

Focus on Personalization and Customer Engagement

To differentiate themselves, industry leaders emphasize personalization and loyalty programs. Blackhawk Network leverages data analytics to create tailored offerings, such as experiential gift cards for travel or wellness. Similarly, InComm Payments uses AI-driven insights to design targeted marketing campaigns that resonate with specific demographics. The Society for Human Resource Management highlights that personalized gift cards increase consumer satisfaction and repeat usage, making them a vital tool for strengthening brand loyalty.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Blackhawk Network partnered with leading e-commerce platforms like Shopify and WooCommerce. This collaboration enabled retailers to integrate digital gift cards into their checkout systems, enhancing convenience for online shoppers and solidifying Blackhawk's position in the digital commerce space.

- In November 2024, InComm Payments launched a blockchain-enabled gift card solution. This innovation improved transaction security and transparency, addressing consumer concerns about fraud and positioning InComm as a leader in secure prepaid solutions.

- In October 2024, Fiserv introduced AI-driven analytics tools for personalized gift card campaigns. This technology allowed retailers to tailor offers based on consumer behavior, increasing customer engagement and strengthening Fiserv’s role in data-driven marketing solutions.

- In September 2022, Givex acquired a regional loyalty platform. This acquisition integrated gift cards with rewards programs, enabling Givex to offer dual benefits to customers and enhancing its presence in the retail and hospitality sectors.

- In April 2023, Kroger introduced eco-friendly gift cards made from biodegradable materials. This move aligned with sustainability goals, attracting environmentally conscious consumers and reinforcing Kroger’s commitment to reducing its environmental impact.

- In October 2022, PayPal integrated gift card functionalities into its mobile app. This allowed users to purchase, store, and redeem gift cards directly through their digital wallets, streamlining the process and strengthening PayPal’s market presence in prepaid solutions.

MARKET SEGMENTATION

This research report on the global gift cards market is segmented and sub-segmented based on the card type, end user, and region.

By Card Type

- Closed Loop Card

- Open Loop Card

By End User

- Retail establishment

- Corporate Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the gift cards market?

Factors include rising consumer preference for digital payments, the expansion of e-commerce, and corporate gifting trends.

How has digitalization impacted the gift cards market?

Digital gift cards have significantly increased sales, offering instant delivery, personalization options, and integration with mobile wallets.

What role do cryptocurrencies and blockchain play in the gift cards market?

Cryptocurrencies are being integrated into gift card platforms, enabling secure transactions and offering new redemption options.

What is the future outlook for the global gift cards market?

The market is expected to grow further with increased adoption of digital and mobile-based gift cards, supported by AI-driven personalization.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]