Global Geofencing Market Size, Share, Trends, Growth Forecast Report – Segmented by Component (Solution, Services), Geofencing Type (Fixed, Mobile), Organization Size (SMEs, Large Enterprises), Vertical (BFSI, Healthcare, Manufacturing, Retail, Media & Entertainment) & Region - Industry Forecast From 2024 to 2032

Global Geofencing Market Size (2024 to 2032)

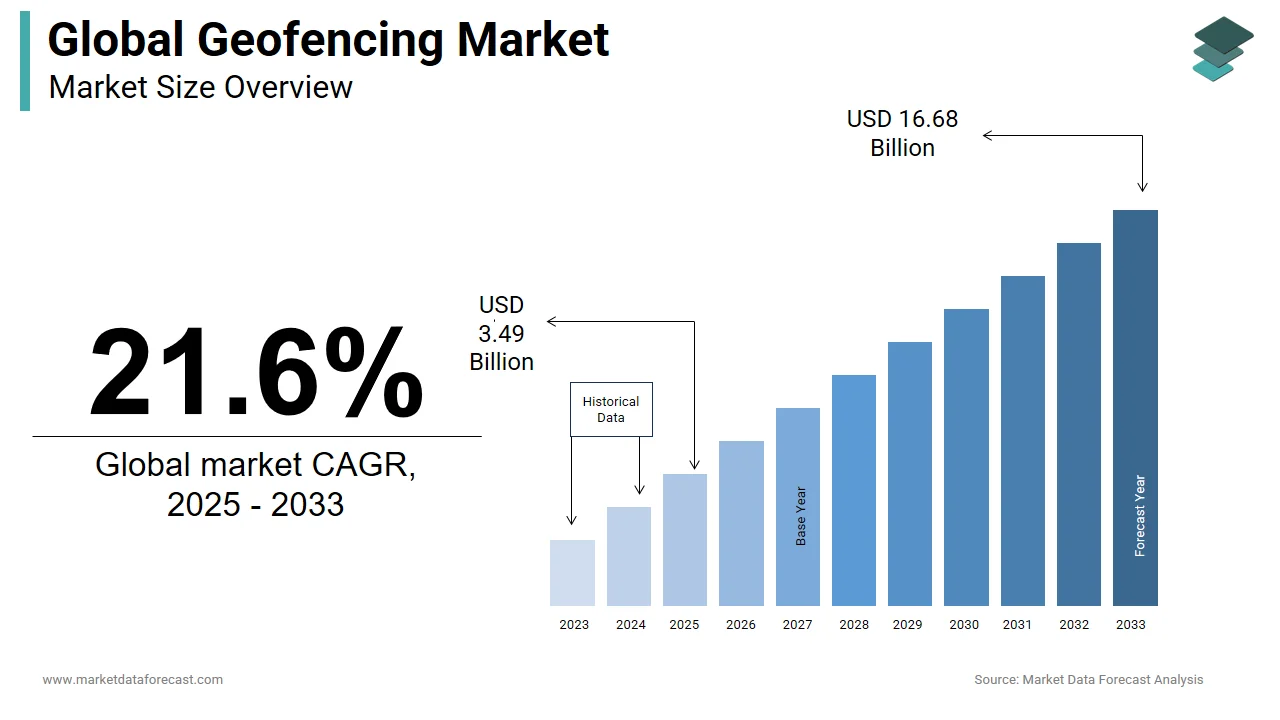

The global geofencing market was valued at USD 2.36 billion in 2023 and is predicted at USD 2.87 billion in 2024. It is expected to reach USD 13.72 billion by 2032, growing at a CAGR of 21.6% during the forecast period.

Current Scenario of the Global Geofencing Market

Major companies such as Apple, Thumbvista, Pulsate, and Bluedot Innovation are investing in the geofencing market as demand for geofencing alternatives is rising across multiple vertical industries. Increasing consumer requirement for location-based apps is a crucial variable contributing to market growth. Another significant factor driving development in the geofencing sector is the increase in the use of spatial data and analytical instruments. The facility of geofencing inclusion and implementation leads to business development.

Geofencing provides security to track the accuracy of resources such as the fleets, stocks, etc. This monitoring enables the user to optimize the price performance and increase company profit. In recent years, the spread of smartphones worldwide drives the use of effective geofenced technology.

Geofencing is a virtual fencing that is maintained around a country's intended borders. Geofencing mainly involves the use of GPS (Global Positioning Systems) or RFID (Radio Frequency Identification) information to run software programs. The data contains the localization information according to the equipment's geographical parameters. An administrator, who set up geofencing can set up the event triggering the main factor, which contributes to the growing popularity of the respective market.

Furthermore, owing to the many apps, such as Google Earth, geofencing is increasingly popular. This incorporation enables managers to define the geofencing boundaries above the satellite vision according to the specific location available to the Google Earth application, and also allows users to use longitude and latitude or user-based and web-based mapping to define the boundaries.

MARKET TRENDS

Retails are eager to digitize to achieve a faithful client base, given that digitalization enables them to more effectively and remotely participate in their clients. Retailers watch as their clients step into the geofenced region and use this effective geofencing method as advertising notifications to obtain them.

Automotive distributors use geofencing to monitor clients undergoing the tests and can achieve quick responses to prevent loss of assets if clients are trying to leave the designated region for the instant warning.

The increase in smartphones worldwide encourages retailers in their geofenced region to embrace current geofencing technology as they can monitor even more tracks. It is noted that smartphone penetration is improved in emerging nations with 82% versus 80% in advanced countries. In addition, in 2019, smartphone deliveries worldwide are anticipated to achieve 2.2 billion units. Therefore, in emerging nations, the industry for effective geofencing offers development possibilities.

MARKET DRIVERS

In the last few years, the growth of smartphone penetration worldwide has led to the use of active geofencing technology. The growing implementation bases.

MARKET RESTRAINTS

High initial setup cost. Tracking smartphone locations and consumer protection concerns due to regular cases of breach of data.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

21.6% |

|

Segments Covered |

By Component, Geofencing Type, Organization Size, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Apple Inc. (US), Bluedot Innov (US), Embitel (India), Esri (US), Factual Inc. (US), GeoMoby (Australia), Gpswox.com (UK), InVisage (US), Localytics (US), LocationSmart (US), MAPCITE (UK) and Others. |

SEGMENTAL ANALYSIS

REGIONAL ANALYSIS

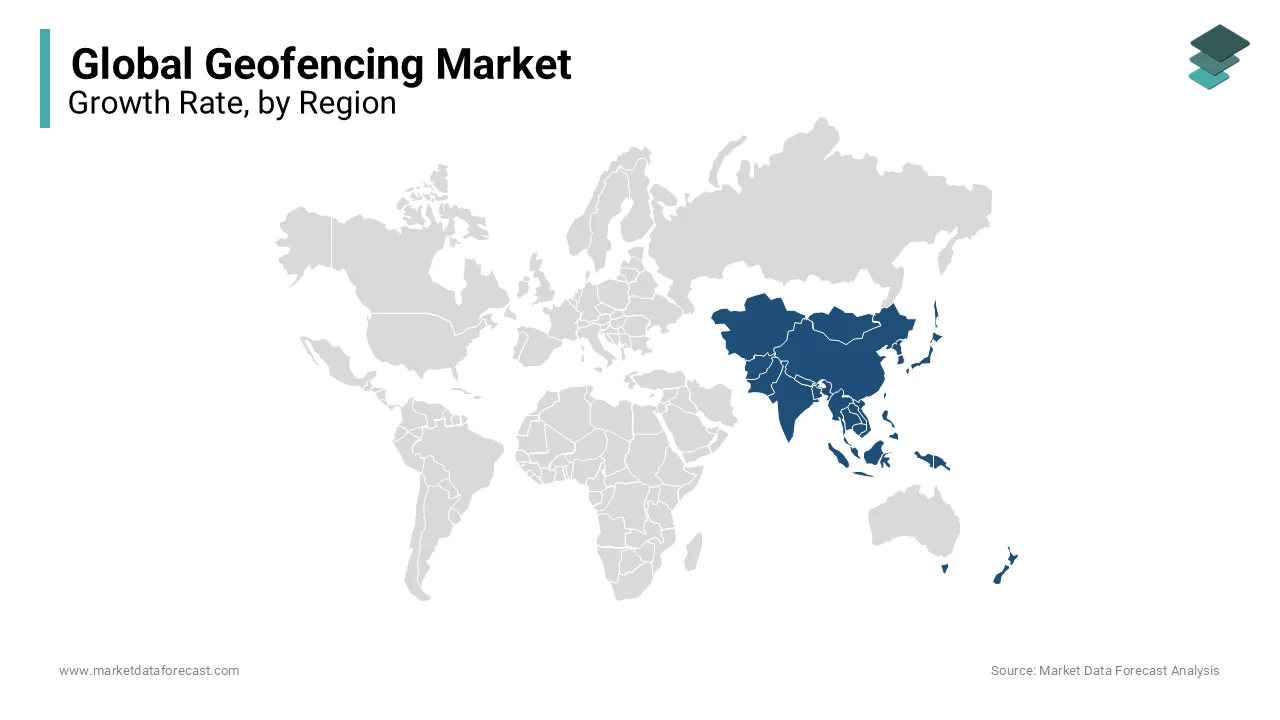

The countries such as India and China, in the Asia-Pacific region are highly growing economies. Small and medium-sized enterprises (SMBs) are enormously present in these countries. The government initiatives such as Digital India has also encouraged technology deployment in businesses.

In order to better connect its customers, SMBs adopt pharmacies and existing geofencing technologies. As there are many beacon units available under USD 20, the cost associated with this technology is negligible. We can also quickly develop the software platform required to manage the messages.

KEY PLAYERS IN THE GLOBAL GEOFENCING MARKET

- Apple Inc. (US)

- Bluedot Innov (US)

- Embitel (India)

- Esri (US)

- Factual Inc. (US)

- GeoMoby (Australia)

- Gpswox.com (UK)

- InVisage (US)

- Localytics (US)

- LocationSmart (US)

- MAPCITE (UK)

RECENT HAPPENINGS IN THE GLOBAL GEOFENCING MARKET

-

In February 2019, With the release of Geospatial Environment Online (GEO) 2.0 throughout Europe, DJI, a supplier of civil aircraft and aerial surveillance technology, has enhanced their geofencing capabilities. DJI decided to supply Altitude Angel as its fresh partner to the airports, TFRs, and other delicate sectors in 32 European nations with precise, real-time and applicable geospatial information.

-

In January 2018, Bluedot Innovation started Salesforce AppExchange Bluedot Location Marketing. This has enabled companies to communicate thoroughly newly with their clients, associates and staff. Bluedot Location Marketing provides a precise place and geofencing facilities that will allow companies to use the location authority to create individual trips.

DETAILED SEGMENTATION OF THE GLOBAL GEOFENCING MARKET INCLUDED IN THIS REPORT

This research report on the global geofencing market has been segmented and sub-segmented based on the component, geofencing type, organization size, vertical, and region.

By Component

-

Solution

-

Services

By Geofencing Type

-

Fixed

-

Mobile

By Organization Size

-

SMEs

-

Large Enterprises

By Vertical

-

BFSI

-

Healthcare

-

Manufacturing

-

Retail

-

Media & Entertainment

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

How does regulatory compliance and privacy concerns affect the adoption of geofencing solutions on a global scale?

Regulatory compliance and privacy concerns play a significant role in the adoption of geofencing solutions globally. Companies must adhere to stringent data protection regulations such as GDPR in Europe and CCPA in the United States to ensure the lawful collection and processing of location data. Failure to comply with these regulations can lead to hefty fines and damage to brand reputation, thereby impacting the adoption of geofencing technology.

What are the emerging trends in the global geofencing market that are expected to shape its trajectory in the coming years?

Emerging trends in the global geofencing market include the integration of artificial intelligence (AI) and machine learning (ML) algorithms for advanced analytics and predictive modeling, the adoption of blockchain technology for secure and transparent location data management, and the rise of indoor geofencing for enhanced indoor navigation and targeted advertising.

How does the adoption of geofencing technology vary across different regions of the world, and what factors contribute to these disparities?

The adoption of geofencing technology varies across different regions due to factors such as technological infrastructure, regulatory environment, and cultural preferences. Developed regions like North America and Europe have higher adoption rates due to advanced connectivity, favorable regulatory frameworks, and greater awareness among businesses. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid adoption driven by increasing smartphone penetration and rising demand for location-based services.

What role does geofencing play in enhancing security and safety measures in smart cities globally?

Geofencing technology plays a crucial role in enhancing security and safety measures in smart cities by enabling geographically defined virtual perimeters around sensitive areas such as government buildings, airports, and critical infrastructure. These geofences trigger alerts and notifications to authorities in case of unauthorized entry or suspicious activities, thereby improving emergency response times and overall public safety.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]