Global Generic Injectables Market Size, Share, Trends & Growth Forecast Report By Therapeutic Area (Oncology, Anesthesia, Anti-Infectives, Parenteral Nutrition and Cardiovascular Diseases), Containers (Vials, Ampoules, Premix and Prefilled Syringes), Distribution Channel and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Generic Injectables Market Size

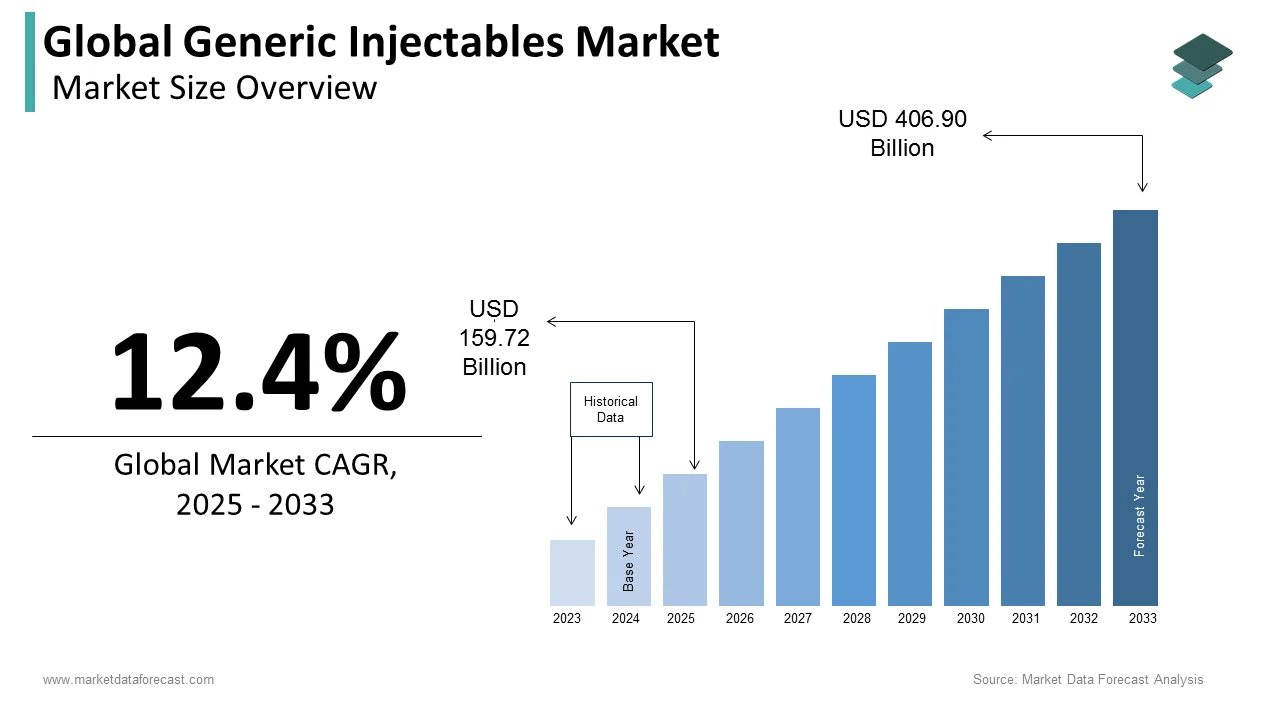

The size of the global generic injectables market was worth USD 142.10 billion in 2024. The global market is anticipated to grow at a CAGR of 12.4% from 2025 to 2033 and be worth USD 406.90 billion by 2033 from USD 159.72 billion in 2025.

Generic injectables are bioequivalent branded injectables that are not covered by patents. Because they contain the same active ingredient, dosage, strength, quality, and form as innovative medications, they are just as safe and effective. Although generic injectables are more difficult to manufacture, their R&D cycle is less expensive and quicker. Unlike branded medication companies, which must spend millions of dollars on research, development, and marketing, generic drug companies are not required to make such expenditures. Furthermore, compared to oral generics, the number of rivals in the generic injectables market is fewer, resulting in less price erosion and considerably better profit margins.

MARKET DRIVERS

The growing patient population of cancer and CVDs and increasing demand for medications that help patients undergoing chemotherapy manage side effects such as pain are propelling the generic injectables market growth.

The oncology category, among other applications, dominates the market, accounting for a substantial portion of the total. Hospitals have the greatest market share among the various distribution channels. Investments in generic injectables research and development have risen in response to the increased prevalence of chronic conditions. In addition, the popularity of intravenous (IV) and intramuscular (IM) medication delivery has grown in response to the desire for rapid therapeutic alternatives.

Governments in several nations are encouraging the production of generic injectables due to their benefits.

Other reasons driving the market's growth include an increase in medication shortages, particularly in the United States, as well as the patent expiration of several blockbuster pharmaceuticals, an aging population, and the growing incidence of chronic and lifestyle illnesses. The low costs of investments majorly drive the global generic injectables market. Additionally, factors such as safety and government regulations, high-efficiency clinical and preclinical trials, a rise in the development of generic drugs worldwide, and increasing research activities further accelerate the growth of the global generic injectables market. Moreover, the demand for affordable biological products also propels growth in the generic injectables market. Generic injectables are likewise becoming more widely acknowledged as more cost-effective therapies than their branded counterparts. As a result, adoption rates for generic injectables are increasing.

Medicine shortages, along with the USFDA's quick approvals, are likely to stimulate drug production. Furthermore, some branded injectables companies are expected to lose patient protection in the future, creating many lucrative prospects for generic injectables companies. Unlike branded medicine companies, generic drug companies do not have to invest extensively in product development and marketing. As a result, the demand for these injectables has risen sharply as total healthcare expenses have risen. In addition, the global generic injectables market is benefiting from a growing demand for generic oncology pharmaceuticals in the treatment of cancer patients. The sector is being aided even more by the expanding geriatric population and increased need for cost-effective treatment techniques, particularly in emerging nations.

MARKET RESTRAINTS

Disruptions in the supply chain and less water transportation availability are likely to disturb the market boom to a small extent in the future.

Production of sterile injectable pharmaceuticals is difficult and time-consuming due to the intricacy of manufacturing and the strictness of the procedure. As a result, drug recalls are becoming more common due to safety concerns. This may stifle the worldwide generic injectable market's expansion. Therefore, supply chain interruptions due to limited air and water transportation may prove to be a stumbling block for the genetic injectables market's growth. Inspecting syringes is one of the most challenging tasks. With the world's largest immunization campaign ever, the issues posed by syringe inspection become even more critical as the use of injectable medications grows. These discoveries have prompted the development of sophisticated inspection methods to assist manufacturers in combating the coronavirus pandemic and various other diseases. Syringes are normally moved via conveyor and then turned upside down, but other containers such as cartridges, vials, and ampoules largely stand stationary and can join the inspection process independently. As a result, robust inspection systems are required so that any concealed particulates in the funnel can fall into the liquid and be detected by the inspection system.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

Based on the therapeutic area, containers, distribution channel, and region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Hospira (Pfizer), Fresenius Kabi, Hikma, Sandoz (Novartis), Sagent, Sanofi, and Baxter. |

SEGMENTAL ANALYSIS

Global Generic Injectables Market Analysis By Therapeutic Area

The oncology segment contributes the largest share with dominant factors, such as the growth of cancer cases of different types, followed by cardiovascular, anesthesia, parenteral nutrition, and anti-infectives.

Global Generic Injectables Market Analysis By Containers

The vials segment is foreseen to account for the largest share and dominance in the generic injectables market based on the containers. Some of the attributing factors are less cost-effectiveness, flexibility, and disposability.

Global Generic Injectables Market Analysis By Distribution Channel

Due to several supporting factors, the hospital segment contributes the highest growth-share by distribution channel due to injectables for anti-infectives, anesthesia, and oncology without the need for several medication intakes.

REGIONAL ANALYSIS

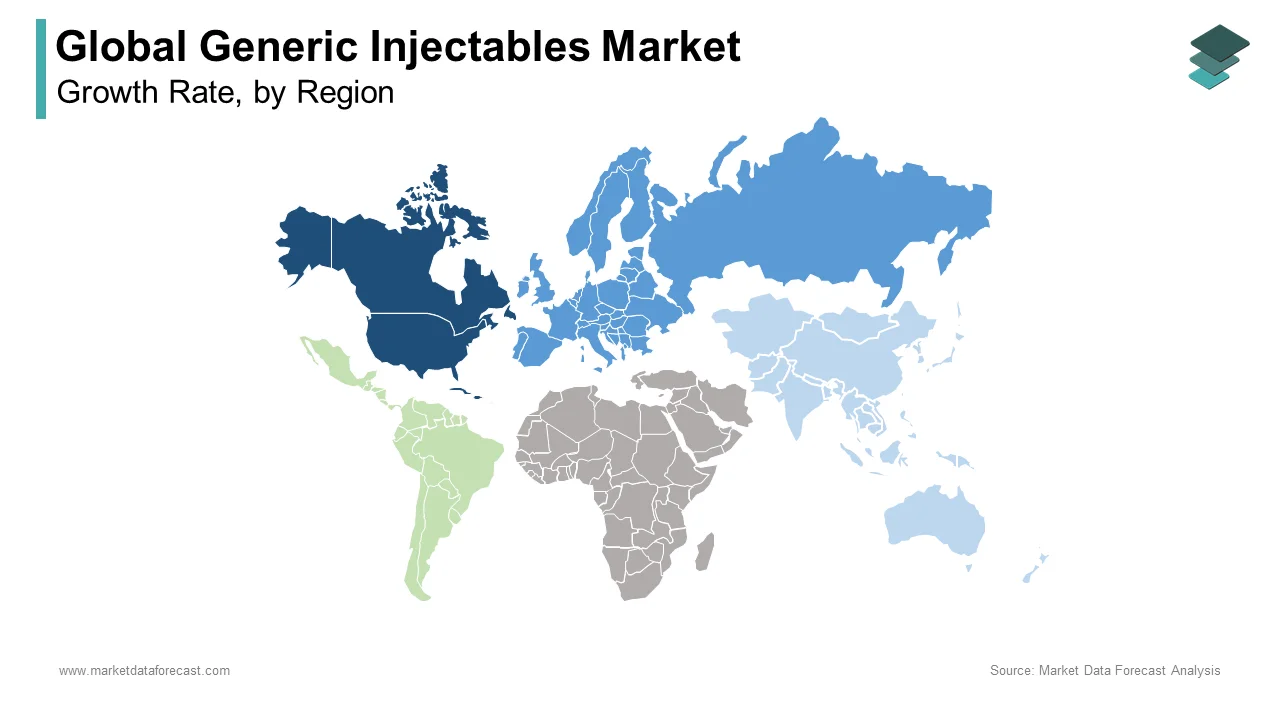

Geographically, the North American generic injectables market contributes the largest revenue share due to favorable factors like the rise of a drug shortage, especially in US countries, owning many operations across the area, and having high patent expiry of numerous blockbuster drugs. Moreover, the North American region has multiple manufacturers producing a high volume of generic injectable products in the United States.

Following North America, the European generic injectables market is expected to account for a substantial share globally during the forecast period. The European region also has many attributing factors such as government support by taking many initiatives and steps in various countries for manufacturing, having numerous market key players.

During the forecast period, the Asia-Pacific generic injectables market contributed a high growth share due to the rise of outsources, infrastructure development among market key players, and increased research activities. Moreover, low expenditure on products in the Asia-Pacific region will promote sales in the generic injectables market.

The least share was held by the Middle East and Africa region due to aspects like fewer initiatives and economically diverse countries.

KEY PLAYERS IN THE GENERIC INJECTABLES MARKET

Some noteworthy companies leading the global generic injectables market are Hospira (Pfizer), Fresenius Kabi, Hikma, Sandoz (Novartis), Sagent, Sanofi, and Baxter.

RECENT HAPPENINGS IN THE MARKET

- In 2017, an agreement was made between Baxter and Dorizoe to manufacture generic sterile injectables. It is an India-based life sciences company. This agreement further helps to develop more than 20 generic injectables products including cardiovascular and oncolytic medicines.

- In 2016, An acquisition was made by Baxter with Claris Injectables for the production of injectable medicines like analgesics, renal, anti-infective, and anesthesia, as also other critical care medications. It was established 15 years ago across the globe as a pharmaceutical company.

- Pfizer made the collaboration with Hospira in 2015. It is one of the renowned partnerships in the generic injectable market.

DETAILED SEGMENTATION OF THE GLOBAL GENERIC INJECTABLES MARKET INCLUDED IN THIS REPORT

This research report on the global generic injectables market has been segmented and sub-segmented based on the therapeutic area, containers, distribution channel, and region.

By Therapeutic Area

- Oncology

- Anesthesia

- Anti-Infectives

- Parenteral Nutrition

- Cardiovascular Diseases

By Containers

- Vials

- Ampoules

- Premix

- Prefilled Syringe

By Distribution Channel

- Hospitals

- Retail Pharmacy

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- United Kingdom

- Germany

- Spain

- France

- Italy

- Rest of EU

- Asia-Pacific

- India

- China

- Japan

- Australia

- New Zealand

- Rest of APAC

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- The Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the generic injectables market?

The growth of the generic injectables market is driven by factors such as increasing demand for cost-effective drugs, the growing geriatric population, the rising prevalence of chronic diseases, and the need for large-scale vaccination programs, which are majorly driving the growth of the generic injectables market.

What are some challenges facing the generic injectables market and how can they be overcome?

Quality concerns, complex manufacturing processes, supply chain disruptions, and the need for large investments in research and development. These challenges can be overcome through increased collaboration, innovation, and regulatory harmonization are some of the major challenges to the generic injectables market.

How are emerging markets contributing to the growth of the generic injectables market?

Emerging markets such as Asia-Pacific, Latin America, the Middle East, and Africa are contributing to the growth of the generic injectables market through their growing economies, increasing healthcare spending, and rising demand for affordable medicines.

What are the major players in the generic injectables market and what is their market share?

Teva Pharmaceutical Industries Ltd., Pfizer Inc., Novartis AG, Mylan N.V., and Hikma Pharmaceuticals PLC are the leading companies in the generic injectables market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]