Global Gene Synthesis Market Size, Share, Trends & Growth Forecast Report, Segmented By Method (Solid-phase Synthesis, Chip-based Synthesis and PCR-based Enzyme Synthesis), Service, Application, End-use and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis From 2025 to 2033

Gene Synthesis Market Size

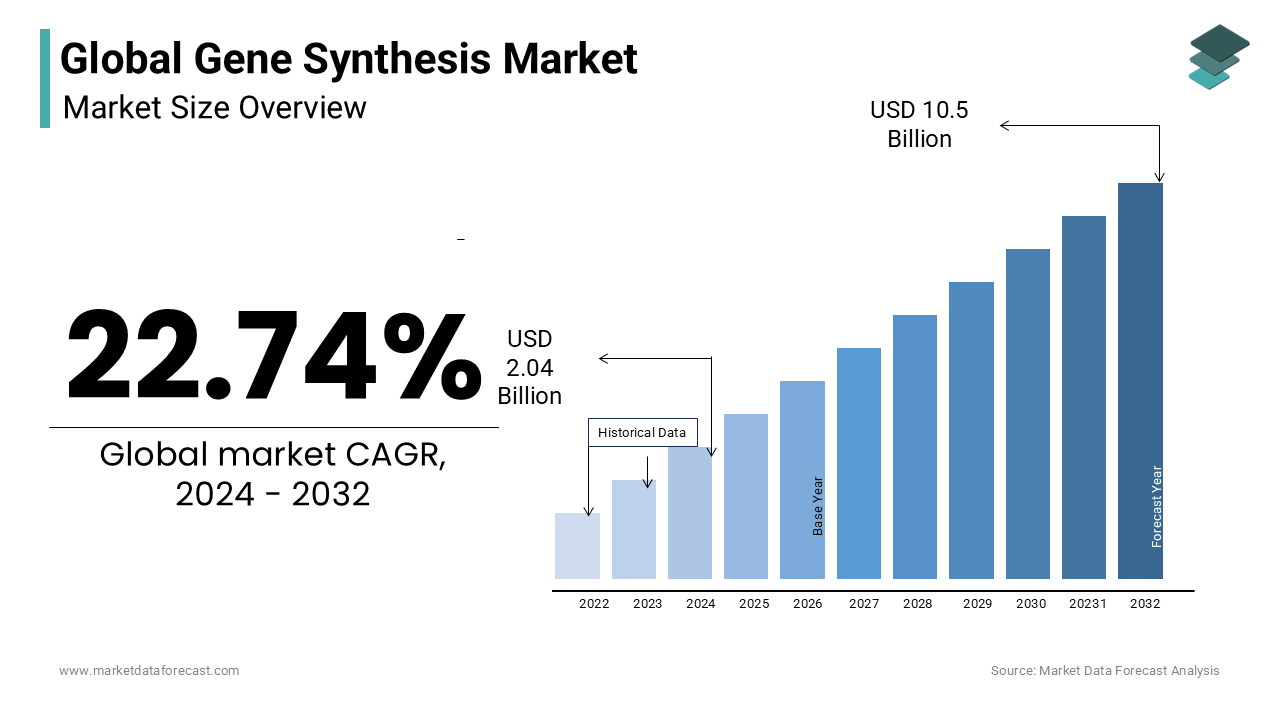

The global gene synthesis market size was valued at USD 1.66 billion in 2023. During the forecast period, the global market is expected to expand at a CAGR of 22.74% from 2024 to 2032 and be worth USD 10.5 billion by 2032 from USD 2.04 billion in 2024.

The global gene synthesis market has experienced robust growth, largely driven by advancements in synthetic biology, personalized medicine, and biopharmaceutical production. With the ability to create custom DNA sequences, gene synthesis has emerged as a pivotal tool across various industries, including pharmaceuticals, biotechnology, and agriculture. Key market players, such as Thermo Fisher Scientific, GenScript, and Integrated DNA Technologies, have been expanding their service offerings to meet rising demand. The development of mRNA vaccines during the COVID-19 pandemic underscored the essential role of gene synthesis in rapidly designing and producing vaccines. Additionally, advancements in gene-editing technologies like CRISPR have further cemented the importance of gene synthesis in therapeutic development. While regulatory challenges and ethical concerns may slow market growth, gene synthesis is expected to continue being central to breakthroughs in medical research and biotechnology.

Gene Synthesis Market Trends

Growth of CRISPR and Gene Editing Technologies

The expansion of CRISPR-based gene editing is one of the most transformative trends in the gene synthesis market. As researchers adopt CRISPR for applications like gene therapy and cancer treatments, the demand for custom DNA sequences continues to rise. CRISPR relies heavily on synthesized guide RNAs (gRNAs) and precise DNA templates, positioning gene synthesis as a critical component. The global CRISPR market was valued at USD 2.8 billion in 2023, with a projected CAGR of 24.6% from 2024 to 2032, highlighting the rapid pace of adoption.

Key companies, including CRISPR Therapeutics and Editas Medicine, are at the forefront of developing CRISPR-based therapies for conditions such as sickle cell anemia and cancers. For instance, a collaboration between CRISPR Therapeutics and Vertex Pharmaceuticals is working on a CRISPR-based treatment for beta-thalassemia, a genetic disorder requiring precise gene modifications. As more gene-editing therapies progress through clinical trials and receive regulatory approvals, gene synthesis will continue to play a pivotal role in driving market growth.

Advancements in Synthetic Biology

The rise of synthetic biology, which focuses on designing new biological systems, is also fueling demand for gene synthesis. Synthetic biology applications range from biofuels to pharmaceuticals, and the global synthetic biology market is expected to grow at a CAGR of 24.1% through 2029. Companies like Amyris use gene synthesis to engineer microorganisms to produce bio-based chemicals, highlighting the critical role of gene synthesis in the sector.

The rapid development of mRNA vaccines for COVID-19 further exemplified the importance of gene synthesis in vaccine development. These vaccines, which rely on synthesized genetic sequences to trigger immune responses, are paving the way for future innovations in synthetic biology. The ability to quickly design and synthesize genetic material will continue to drive advancements in the field.

Personalized Medicine

The growing emphasis on personalized medicine, which tailors treatments based on individual genetic profiles, is reshaping the healthcare landscape and driving growth in the gene synthesis market. Gene synthesis enables the creation of custom DNA sequences for therapeutic interventions, playing a central role in developing precision medicine solutions, particularly in oncology and genetic disorders.

For instance, CAR-T cell therapy, which involves synthesizing chimeric antigen receptors (CARs) to target specific cancer cells, showcases the importance of gene synthesis in personalized treatments. The success of Novartis' Kymriah, a CAR-T therapy approved by the U.S. FDA, highlights gene synthesis’s essential role in advancing cancer therapies. As demand for precision therapies grows, so will the need for scalable, accurate gene synthesis solutions.

MARKET DRIVERS

Increasing Demand for Biopharmaceuticals

The rising demand for biopharmaceuticals, such as monoclonal antibodies and recombinant proteins, is a key driver of the gene synthesis market. Biopharmaceutical production often involves complex proteins that require precisely synthesized genetic sequences. The global biopharmaceutical market is projected to reach USD 389.1 billion by 2029, driven by advancements in personalized treatments and biologics.

Leading companies like Amgen and Pfizer leverage gene synthesis to accelerate the development of therapeutic proteins. For example, Pfizer's biologics pipeline, including oncology drugs, heavily relies on synthesized gene sequences for efficient production. The growing reliance on biologics to treat chronic diseases such as cancer and autoimmune disorders is boosting demand for high-quality gene synthesis services, making them an integral part of the biopharma supply chain.

Expansion of Vaccine Development

The global vaccines market is expected to be valued at USD 73.36 billion by 2024, with gene synthesis playing a crucial role in driving expansion. The development of mRNA vaccines for COVID-19, pioneered by companies like Moderna and BioNTech, underscored the essential role of gene synthesis in designing rapid-response vaccines. These vaccines, which rely on synthesized genetic sequences, have marked a new era in vaccine technology.

Beyond COVID-19, gene synthesis is crucial for the development of vaccines targeting diseases like HIV and influenza. For instance, BioNTech is advancing mRNA vaccines for influenza using synthesized gene sequences to optimize viral antigen production. The ability to swiftly synthesize and modify viral genes will be key to ensuring future-proof vaccine development, particularly in response to emerging infectious diseases.

Rising Investment in Genetic Research

Increased funding for genetic research is another major driver of the gene synthesis market. Governments and private institutions are making significant investments in genomics, which pushes the boundaries of genetic manipulation and synthetic biology. Global investments in genomic research surpassed USD 20 billion in 2022, spurred by projects like the Human Genome Project-Write, which aims to synthesize entire human genomes.

Countries like the U.S. and China are leading the charge, establishing state-of-the-art laboratories focused on large-scale DNA synthesis. These initiatives are expected to foster innovation in areas like gene therapy, agriculture, and synthetic biology, with gene synthesis playing a central role in translating research into practical applications. As investment in genomics rises, gene synthesis is increasingly recognized as a critical foundation for genetic research and industrial biotech applications.

MARKET RESTRAINTS

High Cost of Gene Synthesis

The cost associated with synthesizing custom DNA sequences remains a key challenge for the gene synthesis market, particularly for smaller research institutions and biotech startups. While technological advancements and automation have driven prices down over the past decade, gene synthesis can still be prohibitively expensive, especially for large-scale or highly complex sequences. In 2023, the cost per base pair of synthesized DNA stood at approximately USD 0.09, a significant decrease from previous years, yet still a limiting factor for many. Within the pharmaceutical sector, the expenses related to producing synthetic DNA for large-scale clinical trials can add considerable overhead, affecting the economics of drug development programs. Though companies like GenScript and Integrated DNA Technologies (IDT) have made strides in lowering costs, many smaller firms continue to face financial strain, which can delay research initiatives and stifle innovation.

Regulatory and Ethical Concerns

Navigating the regulatory landscape remains a complex challenge for the gene synthesis market, especially due to ethical concerns surrounding genetic manipulation. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have established stringent guidelines for products involving synthetic DNA, particularly in areas like gene editing and synthetic biology. For example, while CRISPR-based therapies hold significant promise, they face heightened scrutiny due to potential risks, including unintended genetic changes. Companies like Editas Medicine have experienced delays in clinical trials for their CRISPR therapies due to regulatory reviews. Additionally, public concerns surrounding topics like "designer babies" and gene editing in human embryos further underscore the ethical challenges that may slow market progress. As gene editing and synthetic biology technologies advance, the need for a careful balance between innovation and regulatory oversight becomes increasingly important.

Technical Challenges in Long-Sequence Synthesis

Despite significant advancements in gene synthesis, the synthesis of long DNA sequences continues to present technical challenges. Sequences longer than 1,000 base pairs often exhibit increased error rates, reducing efficiency and complicating applications in fields such as synthetic biology and genomic medicine. For example, efforts to synthesize entire bacterial genomes have been hindered by errors that accumulate during the process. In 2022, the Synthetic Yeast Project encountered delays due to accuracy issues in long-sequence synthesis, underscoring the technical hurdles that still persist. Overcoming these challenges is critical for expanding the use of gene synthesis in areas like bioengineering and regenerative medicine. Until more reliable techniques are developed, these limitations will continue to impact the broader adoption of gene synthesis.

MARKET OPPORTUNITIES

Emerging Applications in Agriculture

The agricultural sector represents a significant growth opportunity for the gene synthesis market, particularly in the development of genetically modified crops and livestock. With the global population projected to reach 9.7 billion by 2050, enhancing agricultural productivity is crucial. Gene synthesis allows for precise modifications to plant genomes, improving resistance to pests, diseases, and environmental stresses, thereby addressing key challenges in food security. Companies like Bayer and Corteva are leveraging gene synthesis to develop crops with improved drought resistance and higher yields. In 2023, genetically modified crops accounted for 29% of global agricultural production, a figure expected to rise as gene synthesis technologies become more accessible. These advancements not only enhance productivity but also promote more sustainable agriculture by reducing the reliance on chemical inputs. The ability to rapidly prototype and implement genetic modifications positions gene synthesis as a critical tool for meeting future agricultural needs.

Advances in Regenerative Medicine

Gene synthesis is set to play a pivotal role in the rapidly expanding field of regenerative medicine, offering promising opportunities for tissue repair, organ regeneration, and stem cell research. With the global regenerative medicine market projected to reach USD 60 billion by 2030, gene synthesis will be essential in driving the development of cutting-edge therapies. In regenerative medicine, synthesized genes are used to program cells for specific functions, such as generating new tissues or repairing damaged organs. For instance, gene therapies for conditions like muscular dystrophy rely on synthesized DNA to correct faulty genes responsible for muscle degeneration. Moreover, advancements in induced pluripotent stem cells (iPSCs) highlight the potential of gene synthesis to reprogram adult cells into stem cells capable of forming any tissue type. Research institutions like the Harvard Stem Cell Institute are actively exploring these applications, positioning gene synthesis as a key enabler of next-generation medical treatments.

Expansion in Developing Markets

Developing regions, particularly in Asia-Pacific and Latin America, offer significant growth potential for the gene synthesis market. Countries such as China, India, and Brazil are making substantial investments in biotechnology, supported by government initiatives and private sector funding. China's "Made in China 2025" strategy, for example, includes significant investments in genomics and synthetic biology, positioning the country as a leader in gene synthesis. Similarly, India and Brazil are emerging as key players in biotechnology. In 2022, India’s biotechnology sector attracted approximately USD 10 billion in investments, with gene synthesis playing a critical role in drug development and agricultural research. The availability of skilled labor and cost-effective production capabilities in these regions is expected to attract global companies, further driving market expansion. As biotechnology infrastructure continues to develop in these markets, the demand for gene synthesis services will rise, creating significant opportunities in medical research, agriculture, and industrial biotechnology.

MARKET CHALLENGES

Data Privacy and Biosecurity Concerns

As gene synthesis technologies advance, concerns about data privacy and biosecurity are becoming more pronounced. The ability to synthesize any DNA sequence, including those of pathogens, has raised fears of potential misuse for bioterrorism. In response, governments and organizations are implementing stricter regulations and monitoring to mitigate these risks. For instance, in 2022, the U.S. National Institutes of Health (NIH) issued new guidelines to ensure the safe synthesis of potentially harmful biological agents, highlighting the importance of biosecurity. Companies like Twist Bioscience and IDT are working to ensure responsible use of synthetic DNA, but balancing innovation with security remains a critical challenge. The market must continue to evolve to address these concerns while fostering technological advancements.

Talent Shortage and Skill Gaps

The rapid growth of the gene synthesis market has outpaced the availability of skilled professionals with expertise in synthetic biology, genomics, and bioinformatics. This talent shortage is particularly evident in regions where the biotechnology sector is still developing, leading to bottlenecks in research and production. According to a 2022 survey by the Biotechnology Innovation Organization (BIO), nearly 47% of companies reported challenges in finding qualified personnel to support gene synthesis operations. In response, leading biotech companies are investing in workforce development. For instance, Thermo Fisher Scientific has partnered with academic institutions to offer specialized training in synthetic biology. However, bridging the talent gap will require sustained efforts in education, training, and collaboration between academia and industry. Until the skill shortage is addressed, it may hinder market growth, especially for smaller companies competing for top talent.

Intellectual Property Issues

Navigating the complexities of intellectual property (IP) in the gene synthesis market presents a significant challenge, particularly as companies seek to patent synthetic genes and related biological products. The legal landscape surrounding gene patents is both complex and contentious, with ongoing debates about the extent to which genetic sequences can be patented. In 2023, the U.S. Supreme Court ruled on several cases related to gene patenting, further complicating the IP environment for companies in synthetic biology. Firms like Agilent Technologies and GenScript are attempting to navigate these challenges by filing for broad patents on synthetic gene technologies, but disputes over patent infringement and ownership of genetic innovations remain common. These legal battles can lead to costly litigation and delays in product development. The challenge of navigating IP issues is likely to persist, particularly for companies operating in multiple jurisdictions with varying legal frameworks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

22.74% |

|

Segments Covered |

Method, Service, Application, End-use and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Brooks Automation, Inc. (GENEWIZ), Boster Biological Technology, Twist Bioscience, Thermo Fisher Scientific, Inc., GenScript, ProteoGenix, Inc., Biomatik, Integrated DNA Technologies, Inc., ProMab Biotechnologies, Inc., Codex DNA, Eurofins Scientific and OriGene Technologies, Inc. |

SEGMENTAL ANALYSIS

By Method Insights

In 2023, solid-phase synthesis emerged as the largest segment in the global gene synthesis market, accounting for 40.4% of the market share. Widely adopted for the creation of longer and more complex DNA sequences, this method involves synthesizing DNA on a solid support, allowing for high precision and throughput. Its accuracy and efficiency make it a preferred choice in pharmaceutical research and genetic engineering, especially for the production of custom DNA sequences used in biopharmaceuticals. Industry leaders such as Thermo Fisher Scientific and GenScript continue to advance solid-phase synthesis technologies, focusing on optimizing efficiency and reducing costs to meet growing market demands. The expanding need for gene therapy solutions and biologics has driven solid-phase synthesis forward, particularly with the rise of synthetic biology and CRISPR-based gene editing. For instance, the development of CAR-T cell therapies, which require precise DNA synthesis, underscores the importance of solid-phase methods in customizing gene sequences for cancer treatments, solidifying its leading position in the market.

PCR-based enzyme synthesis is projected to be the fastest-growing segment, with an expected CAGR of 20.14% from 2024 to 2032. This method leverages polymerase chain reaction (PCR) technology to amplify and synthesize DNA sequences efficiently, offering a cost-effective and scalable solution. Its ability to replicate large volumes of DNA rapidly has made it a crucial tool in diagnostics and vaccine development. During the COVID-19 pandemic, PCR-based enzyme synthesis played a pivotal role in facilitating mass production of genetic sequences for viral detection, underscoring its importance in healthcare innovation. Ongoing advancements in PCR technology are expected to accelerate its adoption across gene therapy and personalized medicine, propelling the segment’s future growth.

By Services Insights

In 2023, antibody DNA synthesis was the largest service segment, capturing 35.4% of the market share. This service is integral to the development of monoclonal antibodies and other therapeutic proteins, which are widely used to treat conditions such as cancer, autoimmune disorders, and infectious diseases. The biopharmaceutical industry's growing reliance on synthesized antibody genes for biologic drug production ensures continued demand for antibody DNA synthesis services. As the global biopharmaceutical market is projected to reach USD 389.1 billion by 2029, this service will remain critical in supporting the development of biologic therapies. Companies such as GenScript and Twist Bioscience are at the forefront of innovation in antibody synthesis, particularly for oncology and immunology applications, maintaining this segment’s dominance.

Viral DNA synthesis is projected to be the fastest-growing service segment, with a CAGR of 22.35% through 2032. This growth is driven by increasing demand for viral vectors used in gene therapy and vaccine development. Viral vectors, which require custom viral DNA sequences to deliver therapeutic genes into cells, are essential components of gene therapy research. The rapid development of mRNA vaccines during the COVID-19 pandemic underscored the critical role of viral DNA synthesis in vaccine innovation. Companies such as Moderna and BioNTech utilized synthesized viral sequences for their platforms, and the continued advancements in gene therapy for rare genetic diseases are expected to drive further demand for viral DNA synthesis services.

By Application Insights

The vaccine development segment led the gene synthesis market in 2023, accounting for 38% of the total market share. The surge in demand for gene synthesis during the COVID-19 pandemic played a pivotal role in the development of mRNA vaccines, with major companies such as Pfizer, Moderna, and BioNTech leveraging synthesized DNA sequences to fast-track vaccine production. Beyond the pandemic, gene synthesis continues to play a central role in developing vaccines for infectious diseases like influenza, HIV, and emerging viral threats. As global health organizations prioritize pandemic preparedness, the demand for gene synthesis in vaccine R&D is expected to grow, positioning this segment as a cornerstone of the market.

Gene and cell therapy development is anticipated to be the fastest-growing application segment, with a CAGR of 24.18% from 2024 to 2032. The increasing adoption of gene therapy for the treatment of rare genetic disorders and cancers is driving demand for customized gene sequences. Therapies such as CAR-T cells and gene-editing treatments require precise gene constructs, and gene synthesis plays a vital role in designing these therapeutic sequences. With advancements in CRISPR and other gene-editing technologies, companies like CRISPR Therapeutics and Editas Medicine are in charge of developing innovative treatments. Coupled with rising investments and favorable regulatory environments, this segment is positioned for robust growth, driven by demand for novel therapeutic approaches.

By End-Use Insights

Biotechnology and pharmaceutical companies dominated the gene synthesis market in 2023, holding 50.8% of the global market share. These companies are the primary consumers of gene synthesis technologies, employing them for drug discovery, biologics production, and genetic research. The biopharmaceutical industry's focus on developing innovative therapies, particularly monoclonal antibodies and gene therapies, has created significant demand for high-quality, synthesized genes. Leading firms such as Pfizer, Novartis, and Amgen continue to invest in gene synthesis to support the production of next-generation biologics and personalized medicines. As the biopharmaceutical market is projected to reach USD 526 billion by 2030, this segment will continue to dominate the gene synthesis landscape.

Contract Research Organizations (CROs) are expected to be the fastest-growing end-use segment, with a projected CAGR of 19.4% from 2024 to 2032. The increasing complexity of drug discovery and clinical trials has led to a growing reliance on CROs for outsourced gene synthesis services. CROs like Charles River and WuXi AppTec are expanding their capabilities to meet the rising demand from pharmaceutical and biotech companies seeking to optimize timelines and reduce costs. As more biotech firms look to streamline their research and development processes, CROs are set to play an increasingly critical role in the gene synthesis market, offering specialized expertise and scalable solutions for therapeutic research.

REGIONAL INSIGHTS

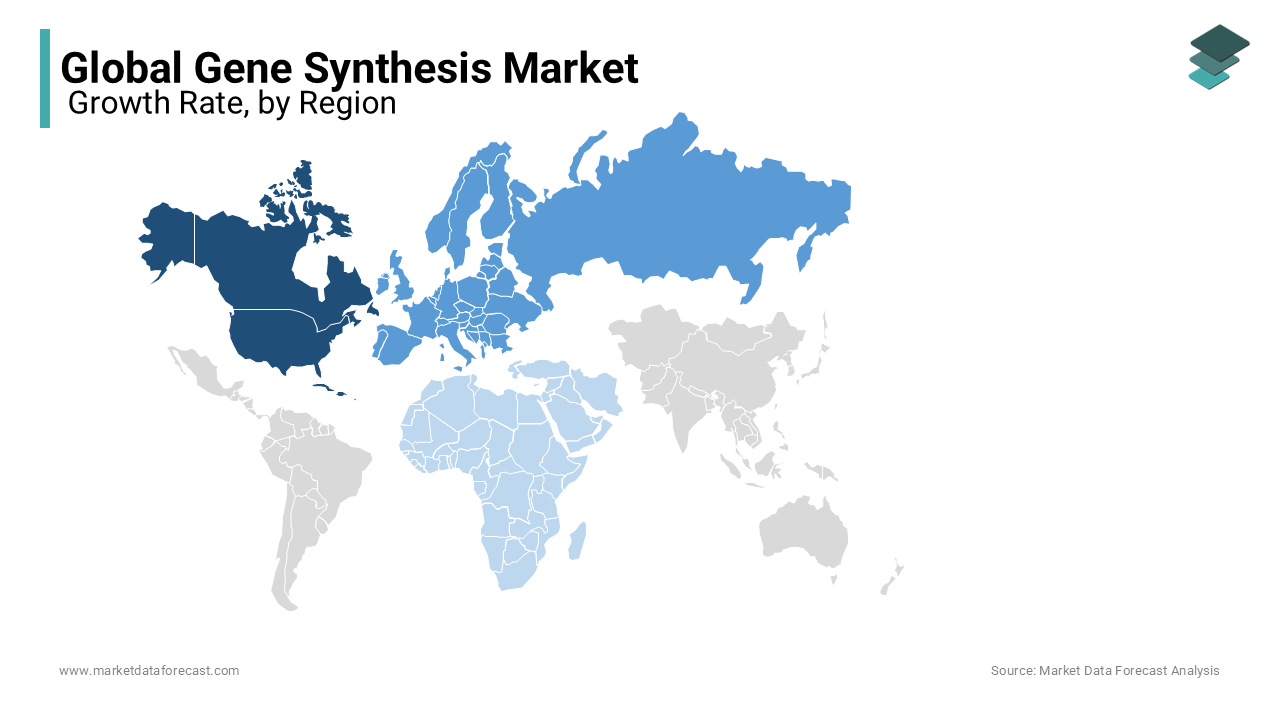

North America Leads in Innovation Through Advanced Genetic Research

North America maintained its leadership in the global gene synthesis market in 2023, capturing 40% of the market share, with a projected CAGR of 18.2% through 2032. This dominance is largely fueled by the United States, where robust investments in biotechnology, synthetic biology, and genomic research are accelerating market growth. The U.S. is supported by a well-established infrastructure for genetic research, with initiatives like those from the National Institutes of Health (NIH) contributing over USD 8 billion to genetic research in 2022. This significant funding reflects the country’s commitment to advancing gene synthesis technologies.

Key industry players, such as Thermo Fisher Scientific and Integrated DNA Technologies (IDT), continue to spearhead innovation in areas like personalized medicine, gene therapy, and vaccine development. The rapid deployment of mRNA vaccines by companies like Moderna and BioNTech during the COVID-19 pandemic showcased the critical role of gene synthesis in global healthcare advancements.

Canada is also playing a growing role in this space, with a focus on synthetic biology and increased government support for biotech startups through programs like the National Research Council of Canada (NRC). As developments in CRISPR-based gene editing advance and applications in biopharmaceuticals and academic research expand, North America is expected to maintain its leadership position as new innovations in healthcare, agriculture, and industrial biotechnology emerge.

Europe Navigates Regulation While Accelerating Biotech Growth

Europe is projected to expand at a steady CAGR of 16.3% through 2032, driven by growing government support for biotechnology research and an increase in gene therapy initiatives. Leading countries such as Germany, the U.K., and France are at the forefront of Europe’s gene synthesis advancements, supported by a strong network of academic institutions and biotech clusters that foster innovation.

Germany plays a pivotal role in the region, with companies like Eurofins Genomics and Evonik advancing synthetic biology and personalized medicine. In 2022, Germany invested over EUR 3 billion in biotechnology research, highlighting its commitment to remaining competitive in the global gene synthesis market. The U.K. continues to strengthen its biotech ecosystem, supported by government programs like the Industrial Strategy Challenge Fund, while France is enhancing its gene therapy capabilities through partnerships between public institutions and private enterprises. However, Europe’s regulatory framework, governed by bodies such as the European Medicines Agency (EMA), remains cautious, which may slow commercialization efforts compared to other regions like North America. Despite these regulatory challenges, Europe remains a key player in healthcare and academic research.

Asia-Pacific Emerges as a Powerhouse of Genetic Innovation

Asia-Pacific is the fastest-growing region in the gene synthesis market, with an impressive CAGR of 20.5% projected from 2024 to 2032. The region’s rapid ascent is underpinned by advancements in biotechnology, substantial government investments, and the increasing presence of leading gene synthesis companies. China, Japan, and South Korea are the primary drivers of this growth.

China has positioned itself as a global leader in genomics and synthetic biology, supported by government initiatives like "Made in China 2025", which emphasize biotechnology as a strategic industry. In 2022, China invested over USD 4 billion in genomics research, and companies like BGI Genomics and GenScript are expanding their global footprint, driving innovations in gene therapy, vaccine development, and agricultural biotechnology.

Japan and South Korea are also key players in the region. Japan’s focus on gene therapy and regenerative medicine is being led by companies like Takara Bio, advancing research in treatments for rare genetic diseases. South Korea’s biotech sector continues to grow rapidly, supported by government policies that promote innovation in synthetic biology and genetic research.

Latin America: An Emerging Market with Untapped Potential

Latin America represents a smaller yet rapidly expanding segment of the global gene synthesis market, with a projected CAGR of 14.8% through 2032. Brazil and Mexico are leading the region’s growth, spurred by increasing government investments in biotechnology and academic research.

Brazil has seen a significant uptick in genetic research funding, supported by institutions like the Brazilian Development Bank (BNDES) and the Ministry of Science, Technology, and Innovation. The country is focusing on utilizing gene synthesis in agriculture, particularly in the development of genetically modified crops resilient to climate change and pests. Additionally, Brazil is expanding its efforts in gene therapy research, though progress has been tempered by regulatory and infrastructure challenges.

Mexico is also expanding its focus on synthetic biology and personalized medicine. Biotech companies like Neolpharma and Probiomed are driving innovation in biopharmaceuticals and gene synthesis for therapeutic applications. While regulatory hurdles and limited funding for large-scale research remain challenges, growing government support and rising interest in biotechnology signal a promising future for gene synthesis in Latin America.

Middle East & Africa: A Growing Market Focused on Health and Agriculture

The Middle East and Africa (MEA) region, while currently holding the smallest share of the global gene synthesis market, is expected to grow at a CAGR of 13.2% through 2032, driven by increasing healthcare needs and government investments in biotechnology. Countries such as Israel and South Africa are leading the region in gene synthesis research.

Israel’s well-established biotech sector is heavily investing in genetic research, particularly in cancer therapies and personalized medicine. Companies like Evogene are pioneering innovations in agricultural biotechnology, developing drought-resistant crops to address food security challenges in the region. In 2022, Israel invested over USD 400 million in biotechnology research, with a focus on gene synthesis and synthetic biology.

South Africa is also making significant strides in healthcare applications of gene synthesis, particularly in gene therapy and vaccine development. While challenges such as infrastructure limitations and regulatory hurdles persist, government initiatives aimed at boosting biotech research are creating a more supportive environment for growth. As demand for solutions in agriculture and healthcare continues to rise, the MEA region presents notable growth potential in the global gene synthesis market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Brooks Automation, Inc. (GENEWIZ), Boster Biological Technology, Twist Bioscience, Thermo Fisher Scientific, Inc., GenScript, ProteoGenix, Inc., Biomatik, Integrated DNA Technologies, Inc., ProMab Biotechnologies, Inc., Codex DNA, Eurofins Scientific, OriGene Technologies, Inc. are some of the key market players.

The global gene synthesis market is marked by high competition, driven by advancements in synthetic biology, the growing demand for personalized medicine, and innovations in gene therapy. Leading industry players such as Thermo Fisher Scientific, GenScript, Integrated DNA Technologies (IDT), and Twist Bioscience are continuously advancing their technological capabilities, expanding product offerings, and entering strategic partnerships to maintain their competitive position. The focus on improving synthesis accuracy, reducing costs, and scaling up production is intensifying competition as companies vie for a larger share of this expanding market.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, Eurofins Genomics acquired the Indian gene synthesis start-up BioSynth Tech, strengthening its presence in the Asia-Pacific region. This acquisition will provide Eurofins with access to advanced gene synthesis technologies, helping the company address the growing demand in emerging markets like India, where biotech innovation is accelerating rapidly.

- In April 2024, Twist Bioscience launched its "TwistBio Ultra" platform, offering high-throughput, cost-effective gene synthesis solutions for large-scale projects in agricultural biotechnology and the biopharmaceutical sectors. This new platform is expected to cut synthesis costs by 20%, providing Twist with a competitive edge in price-sensitive markets.

- ATUM introduced the "Leap Synth" platform in March 2024, utilizing proprietary algorithms and machine learning to optimize gene synthesis pathways. This innovation reduces error rates by 25%, targeting synthetic biology companies and academic researchers and reinforcing ATUM's position as a leader in efficient gene assembly technologies.

- Also in March 2024, GenScript launched "GeneSynth Flex", a customizable DNA sequence service designed for research institutions and biotech companies involved in advanced synthetic biology projects. This service solidifies GenScript’s position as a top provider of custom gene synthesis solutions.

- Thermo Fisher Scientific debuted its high-throughput gene synthesis platform "GenePro" in February 2024, reducing synthesis time by 30% for large-scale projects. The platform is aimed at accelerating genetic research in drug development and personalized medicine, further strengthening Thermo Fisher’s standing in the biopharmaceutical market.

- In January 2024, IDT launched "SynSeq Pro", a next-generation sequencing (NGS) platform that combines gene synthesis with advanced sequencing technology. This innovation is designed for precision medicine applications and provides highly accurate DNA sequences, positioning IDT as a leading player in both gene synthesis and genomics.

- In September 2023, Thermo Fisher Scientific formed a strategic partnership with the Broad Institute of MIT and Harvard to advance research in gene editing and synthetic biology. This collaboration enhances Thermo Fisher's leadership in the gene synthesis market, particularly in gene therapy research.

- GenScript expanded its manufacturing facility in Suzhou, China in June 2023, doubling production capacity to meet growing global demand, especially in cancer research and vaccine development. The facility incorporates advanced automation, increasing efficiency and reducing production time.

- In October 2023, IDT signed an exclusive distribution agreement with a major biotech firm in Japan, as part of its strategy to expand its footprint in the rapidly growing Asia-Pacific market for gene synthesis services.

- In August 2023, Twist Bioscience entered a multi-year collaboration with Moderna to optimize mRNA synthesis for vaccine development. This partnership positions Twist as a key player in mRNA vaccine research, including for COVID-19 and other infectious diseases, strengthening its role in the global vaccine market.

- Eurofins Genomics launched its "GeneSynth Prime" product line in November 2023, designed for CRISPR-based applications. Targeting academic and biotech researchers, this product line offers high-fidelity gene synthesis, enhancing Eurofins’ competitive position in the gene editing research market.

- In July 2023, ATUM signed a strategic collaboration agreement with Pfizer to develop custom gene synthesis solutions for biologics production, accelerating the development of recombinant proteins and therapeutic antibodies.

- BGI Genomics expanded its service offerings in April 2023 with the launch of "GeneSynth Advanced", a platform tailored for large-scale genome engineering projects, particularly in agricultural biotechnology. This expansion strengthens BGI’s market position and diversifies its presence in the gene synthesis sector.

- In October 2023, BGI Genomics announced a joint venture with a leading European biotech firm to establish a gene synthesis R&D center in Denmark. This center will focus on developing next-generation gene synthesis technologies for synthetic biology and personalized medicine, expanding BGI's presence in the European market.

REPORT SEGMENTATION

This report on the global gene synthesis market is segmented and sub-segmented into the method, service, application, end-use, and region.

By Method

- Solid-phase Synthesis

- Chip-based Synthesis

- PCR-based Enzyme Synthesis

By Services

- Antibody DNA Synthesis

- Viral DNA Synthesis

- Others

By Application

- Gene & Cell Therapy Development

- Vaccine Development

- Disease Diagnosis

- Others

By End-use

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Contract Research Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the gene synthesis market worldwide?

The global gene synthesis market was worth USD 1.66 bn in 2023.

What are the factors driving the gene synthesis market?

An increase the developmental activities of vaccines and growing demand for biopharmaceuticals are propelling the global market growth.

Which region is growing at the fastest CAGR in the global market?

The Asia-Pacific is estimated to witness the fastest CAGR in the worldwide market.

Who are the key players in the global gene synthesis market?

Brooks Automation, Inc. (GENEWIZ), Boster Biological Technology, Twist Bioscience, Thermo Fisher Scientific, Inc., GenScript, ProteoGenix, Inc., Biomatik, Integrated DNA Technologies, Inc., ProMab Biotechnologies, Inc., Codex DNA, Eurofins Scientific and OriGene Technologies, Inc. are a few of the major players in the global market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]