Global Gemstones Market Size, Share, Trends, & Growth Forecast Report Segmented By Product Type (Diamond, Emerald Ruby, Sapphire, Alexandrite, Topaz, and Others), End User, Product Format, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Gemstones Market Size

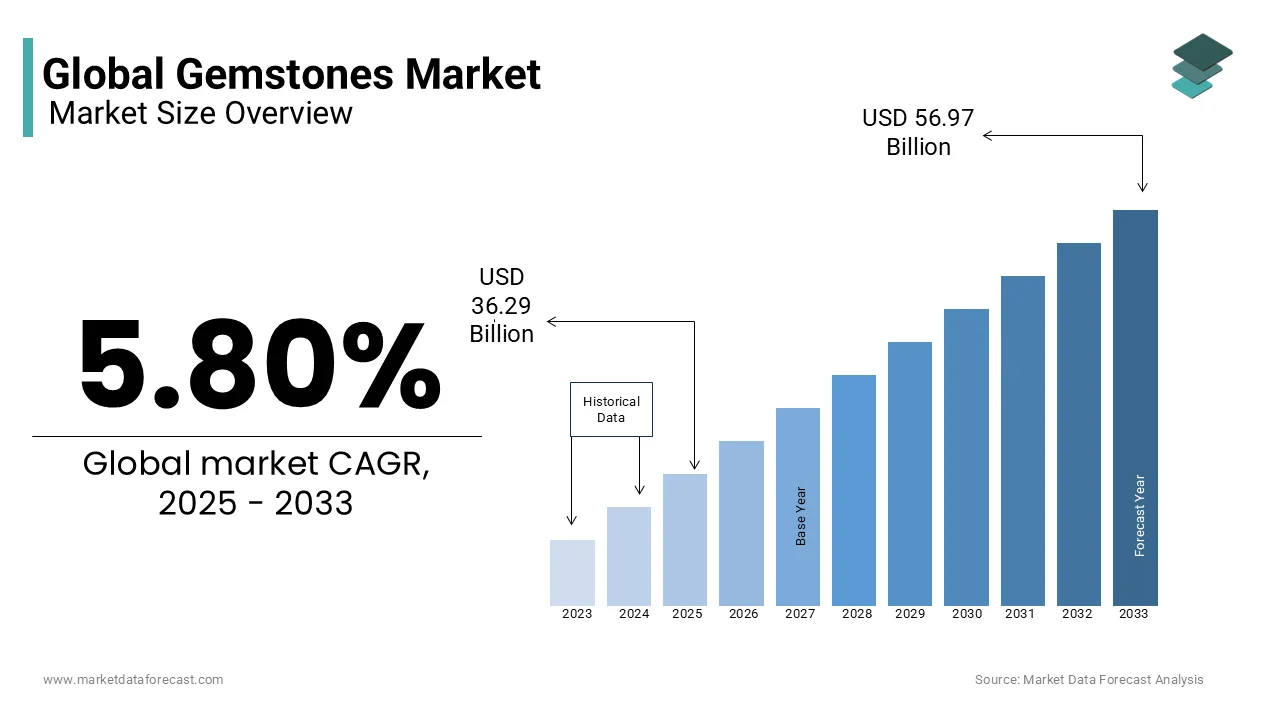

The global gemstones market was valued at USD 34.30 billion in 2024. The global market is expected to reach USD 56.97 billion by 2033 from USD 36.29 billion in 2025, rising at a CAGR of 5.80% from 2025 to 2033.

Gemstones are precious and semi-precious stones such as diamonds, rubies, sapphires, emeralds, and a diverse range of colored gemstones. These stones are prized for their rarity, aesthetic beauty, and unique physical properties, including hardness, refractive index, and color saturation. Their applications extend beyond ornamental jewelry to include industrial uses, such as in cutting, grinding, and high-precision instruments for diamonds due to their unmatched hardness on the Mohs scale. A noteworthy statistic is that over 80% of the world’s emeralds are sourced from Colombia, as per data from the Gemological Institute of America (GIA), while Myanmar is responsible for nearly 90% of the world’s rubies of gem quality. Additionally, diamonds, the most popular gemstones, are not only valued for their brilliance but also their industrial utility, with around 70% of mined diamonds being used in industrial applications according to the International Gem Society. As consumer demand grows for ethically sourced gemstones, traceability and certification have become central concerns is reshaping the industry's approach to sourcing and production.

MARKET DRIVERS

Rising Demand for Ethical and Sustainable Gemstones

The increasing consumer awareness surrounding ethical sourcing and environmental sustainability has become a pivotal driver in the gemstones market. Consumers are prioritizing transparency in the supply chain for conflict-free and responsibly mined gemstones. According to the Kimberley Process Certification Scheme (KPCS), over 99.8% of the global diamond supply is now certified as conflict-free which is impacting on industry-wide adherence to ethical sourcing practices. Furthermore, the growing popularity of lab-grown gemstones, which offer the same physical and chemical properties as natural stones but with a significantly reduced environmental footprint is reshaping market preferences. The U.S. Geological Survey reports that lab-grown diamond production rose by 15% in 2021 is highlighting this shift towards sustainable alternatives. This trend is further fueled by regulatory frameworks and consumer demand for traceability in the gemstone supply chain.

Technological Advancements in Gemstone Processing and Authentication

Innovations in gemstone cutting, treatment, and authentication technologies are significantly enhancing the value and accessibility of gemstones. Advanced techniques like laser cutting, 3D printing for custom jewelry designs, and sophisticated spectroscopic methods for gemstone verification are driving market growth. The Gemological Institute of America (GIA) has reported that over 80% of gemstones are now processed using advanced laser technology, ensuring higher precision and reducing material wastage. Additionally, blockchain technology is increasingly being employed for gemstone traceability by offering secure and transparent records of a gemstone's origin and journey through the supply chain. According to the U.S. Patent and Trademark Office, filings related to gemstone authentication technologies have increased by 20% over the past five years with ongoing innovation in the industry. These advancements not only improve gemstone quality but also reinforce consumer trust in the authenticity and ethical sourcing of their purchases.

MARKET RESTRAINTS

High Cost and Price Volatility of Natural Gemstones

The gemstones market is significantly restrained by the high costs and price volatility associated with natural gemstones. Factors such as geopolitical tensions, mining restrictions, and fluctuating demand contribute to unpredictable pricing. The U.S. Geological Survey indicates that the price of high-quality emeralds and rubies has increased by over 30% in the past decade due to limited supply from key regions like Colombia and Myanmar. Additionally, economic instability in gemstone-producing countries can disrupt supply chains is further driving price fluctuations. This volatility makes it challenging for both consumers and retailers to maintain consistent pricing strategies is limiting broader market accessibility. For investors, these unpredictable shifts can deter engagement when alternative investment assets offer more stable returns.

Environmental and Regulatory Challenges in Gemstone Mining

Environmental degradation and stringent regulatory frameworks around gemstone mining present notable constraints to market growth. Mining activities, particularly for diamonds and colored gemstones, often lead to land degradation, water pollution, and deforestation. In response, governments worldwide have imposed stricter environmental regulations to mitigate these effects. For instance, the Environmental Protection Agency (EPA) in the U.S. has implemented rigorous guidelines on mining operations with increasing operational costs for gemstone extraction. Similarly, the European Union’s Conflict Minerals Regulation mandates due diligence in sourcing is impacting the import and trade of certain gemstones. These regulations, while crucial for environmental sustainability and ethical sourcing, increase compliance costs and can slow down production is hindering the market’s expansion in regions with rich gemstone deposits.

MARKET OPPORTUNITIES

Expansion of Emerging Markets and Growing Middle-Class Affluence

The gemstones market is poised for significant growth due to rising disposable incomes and the expanding middle class in emerging economies, particularly in Asia and Africa. As per the World Bank, the middle-class population in Asia is projected to reach 3.5 billion by 2030 which is driving increased demand for luxury goods, including gemstones. Countries like China and India are witnessing a surge in consumer spending on fine jewelry, with India alone accounting for over 29% of global jewelry consumption, as reported by the Ministry of Commerce & Industry, Government of India. This rising affluence, coupled with cultural preferences for gemstones in weddings and festivals creates a robust opportunity for market expansion in these regions, especially for colored gemstones that hold traditional significance.

Technological Integration in Online Gemstone Retail

The integration of technology in online retail platforms is opening new avenues for the gemstones market by allowing broader reach and enhanced consumer engagement. The U.S. Census Bureau reports that e-commerce sales in the jewelry sector grew by over 25% in 2021, reflecting the shift toward digital purchasing behaviors. Virtual try-on technologies, AI-driven personalization, and blockchain-backed authentication systems are making it easier for consumers to buy gemstones online with confidence. Additionally, the increasing use of augmented reality (AR) tools in online jewelry stores allows customers to visualize gemstone pieces before purchase, enhancing the buying experience. This digital transformation not only expands the market’s geographical reach but also caters to tech-savvy consumers looking for convenience and transparency in their gemstone purchases.

MARKET CHALLENGES

Proliferation of Counterfeit and Synthetic Gemstones

One of the significant challenges facing the gemstones market is the increasing prevalence of counterfeit and synthetic gemstones which undermines consumer trust and market integrity. The infiltration of undisclosed lab-grown or imitation stones into the natural gemstone market poses serious risks. The Federal Trade Commission (FTC) has reported a rise in fraudulent gemstone sales, with consumer complaints related to misrepresented jewelry increasing by 18% in 2020. Additionally, advancements in synthetic gemstone production have made it more difficult for untrained buyers to distinguish between natural and artificial stones by complicating authentication processes. This challenge necessitates greater investment in certification and verification technologies which can increase operational costs for gemstone traders and retailers.

Political Instability and Supply Chain Disruptions

Political instability in key gemstone-producing regions presents a considerable challenge to the market’s stability and growth. Countries like Myanmar, the Democratic Republic of Congo, and Zimbabwe, which are major sources of rubies, sapphires, and diamonds, often experience political conflicts that disrupt mining activities and export logistics. According to the U.S. Department of State, sanctions imposed on Myanmar due to political unrest have significantly affected the global ruby supply chain is leading to delays and increased costs. Furthermore, these disruptions can result in sudden shortages, price spikes, and logistical complications by making it difficult for businesses to maintain consistent inventory levels. This instability hampers long-term planning and creates uncertainties that can deter investment in gemstone-related ventures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.80% |

|

Segments Covered |

By Product Type, End User, Product Format, and Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Anglo American PLC, Petra Diamonds Limited, Rockwell Diamonds Inc., Gem Diamonds Limited, PJSC ALROSA, Swarovski Group, Rio Tinto Diamonds, DebswanaDiamond Company (Pty) Limited, LucaraDiamond Corp., Botswana Diamonds P.L.C, Fura Gems Inc., Dominion Diamond Corporation, Mountain Province Diamonds Inc., Pangolin Diamonds Corporation, and Stornoway Diamond Corporation. |

SEGMENTAL ANALYSIS

By Product Type Insights

The diamonds segment was the biggest segment and held 50.3% of global gemstone market share in 2024. The cultural significance of diamonds in engagement rings, and their unmatched hardness ranks 10 on the Mohs scale by making them highly durable and desirable are primarily driving the domination of diamonds segment in the global market. The De Beers Group reports that global diamond jewelry sales exceeded $80 billion in 2021, driven by strong demand in the U.S., which accounts for nearly 40% of the global diamond market. Diamonds are also widely used in industrial applications, with about 70% of mined diamonds utilized for cutting and drilling tools.

The sapphires segment is anticipated to register a prominent CAGR of 7.5% during the forecast period owing to the increasing consumer interest in colored gemstones, particularly as alternatives to traditional diamonds in engagement rings and luxury jewelry. Sapphires, prized for their rich hues and durability (9 on the Mohs scale) are also gaining popularity due to their symbolic association with wisdom and loyalty. Moreover, advancements in sapphire treatments and ethical sourcing from countries like Sri Lanka and Madagascar have broadened their appeal. The U.S. Geological Survey notes that sapphire imports to the U.S. have increased by 20% over the past five years.

By End User Insights

The jewellery and ornaments segment ruled the market by accounting for 75.7% of the gemstones market share in 2024 due to the cultural and economic significance of gemstones in crafting high-value jewellery. The USGS highlights that global gemstone production reached over $23 billion in 2022, with diamonds, sapphires, and emeralds being the most sought-after stones. According to the World Trade Organization, jewellery exports from key markets like India and China exceeded $180 billion in 2022. Additionally, the International Labour Organization notes that the gemstone industry supports over 10 million jobs globally in mining and retail sectors. Rising disposable incomes in emerging economies, such as India and Southeast Asia, have further fueled demand for gemstone-adorned jewellery.

The luxury art segment is experiencing rapid growth and is projected to exhibit a promising CAGR of 8.5% over the forecast period. Factors such as the increasing incorporation of gemstones into high-end art pieces, including sculptures and mosaics which appeal to affluent collectors is fuelling the expansion of the luxury art segment in the global market. The International Council of Museums highlights that Europe and North America account for over 60% of luxury art sales, driven by rising investments in contemporary and sustainable art. Furthermore, the United Nations Conference on Trade and Development (UNCTAD) notes that ethically sourced gemstones are increasingly preferred, aligning with consumer demand for sustainability. This segment's growth reflects shifting preferences toward unique, investment-worthy art with gemstones as a symbol of exclusivity and creative innovation.

By Product Format Insights

The natural gemstones segment held the major share of 75.3% of the global market in 2024. The domination of natural segment is attributed to their rarity, historical significance, and higher perceived value compared to synthetic alternatives. Consumers continue to prefer natural stones for luxury jewelry and investment purposes due to their unique characteristics and cultural importance. High-profile auctions, such as those conducted by Sotheby’s and Christie’s, regularly feature natural gemstones fetching record-breaking prices with their market dominance. Additionally, countries like Colombia, Myanmar, and Sri Lanka continue to be leading exporters by ensuring a consistent supply of high-quality natural gemstones.

The synthetic segment is expected to register a CAGR of 7.8% over the forecast period owing to the increasing consumer demand for affordable, sustainable, and ethically sourced alternatives to natural stones. Lab-grown diamonds, for instance, have gained popularity due to their identical physical and chemical properties to natural diamonds but at a lower cost and with a significantly reduced environmental footprint. The Federal Trade Commission has noted a 15% annual increase in synthetic diamond sales in the U.S. market. Furthermore, advancements in technology have enhanced the quality and availability of synthetic gemstones by making them more accessible to a broader audience and appealing to environmentally-conscious consumers seeking conflict-free options.

REGIONAL ANALYSIS

Asia-Pacific dominated the gemstones market with 45.4% of global market share in 2024. The dominance of the Asia-Pacific region in the global market is primarily driven by the region's rich gemstone reserves, major cutting and polishing hubs, and strong cultural affinity for gemstone jewelry. Countries like India, Thailand, and China are key players, with India alone contributing nearly 29% of global jewelry consumption. Furthermore, the region benefits from lower labor costs and advanced craftsmanship which bolster its position as a global leader in gemstone processing and trade. The growing middle class and increasing disposable incomes further amplify demand for gemstones in the region.

North America is the fastest-growing region in the global gemstones market and is likely to witness a CAGR of 8.2% over the forecast period. Factors such as rising demand for ethically sourced and lab-grown gemstones in the United States and Canada are boosting the gemstones market growth in North America. The U.S. is a leading market for lab-grown diamonds with the Federal Trade Commission reporting a 15% annual increase in synthetic gemstone sales. Additionally, consumer preferences for customized and sustainable jewelry, coupled with advancements in e-commerce platforms are driving market expansion. North America also benefits from strict regulatory frameworks that ensure gemstone authenticity and ethical sourcing, which appeals to increasingly conscious consumers seeking transparency in their purchases.

Europe is expected to experience steady growth is driven by high demand for luxury jewelry and a strong emphasis on sustainability and ethical sourcing. The European Union’s stringent regulations on conflict minerals are likely to encourage growth in certified gemstones. Latin America, rich in gemstone resources like emeralds from Colombia and opals from Mexico is poised for moderate growth due to increased mining activities and export potential. The Middle East and Africa are anticipated to benefit from abundant natural resources particularly diamonds and colored gemstones, with South Africa and Botswana being key contributors. However, political instability in some regions could temper growth. The African Development Bank highlights that improved governance could significantly boost the region's gemstone market potential.

KEY MARKET PLAYERS & COMPETITIVA LANDSCAPE

The major players in the global gemstones market include Anglo American PLC, Petra Diamonds Limited, Rockwell Diamonds Inc., Gem Diamonds Limited, PJSC ALROSA, Swarovski Group, Rio Tinto Diamonds, DebswanaDiamond Company (Pty) Limited, LucaraDiamond Corp., Botswana Diamonds P.L.C, Fura Gems Inc., Dominion Diamond Corporation, Mountain Province Diamonds Inc., Pangolin Diamonds Corporation, and Stornoway Diamond Corporation.

The global gemstones market is characterized by intense competition, driven by a mix of established mining giants, specialized gemstone companies, and emerging synthetic gemstone producers. Major players like Anglo American PLC (De Beers Group), PJSC ALROSA, and Rio Tinto Diamonds dominate the natural gemstone segment, leveraging extensive mining operations, vertical integration, and strong global distribution networks. These companies maintain competitive advantages through control over the supply chain, investments in ethical sourcing, and technological innovations, such as blockchain traceability and advanced gemstone processing techniques.

Simultaneously, the rise of lab-grown and synthetic gemstones has introduced new competitors like Swarovski Group and Dominion Diamond Corporation, challenging traditional players by offering cost-effective, sustainable alternatives that appeal to environmentally-conscious consumers. The synthetic segment's rapid growth is reshaping market dynamics, creating additional pressure on natural gemstone suppliers to emphasize ethical mining practices and differentiate through rarity and heritage.

Regional players, particularly in Asia-Pacific and Africa, contribute to market fragmentation with localized expertise in cutting, polishing, and trading. Companies are increasingly focusing on product diversification, brand collaborations, and digital transformation to gain a competitive edge. The emphasis on sustainability, transparency, and technological integration remains pivotal, as consumer preferences continue to evolve towards responsible sourcing and personalized jewelry experiences.

Top 3 Players in the Market

Anglo American PLC

Anglo American PLC, through its subsidiary De Beers Group, is one of the most influential players in the global gemstones market, particularly in the diamond sector. The company operates extensive mining operations in Botswana, Namibia, South Africa, and Canada, contributing significantly to both rough and polished diamond markets. Anglo American emphasizes ethical sourcing and has pioneered initiatives like the Tracr blockchain platform for diamond traceability by enhancing transparency in the supply chain. Their investments in sustainability and marketing have reinforced their leadership will make them cornerstone of the global gemstones industry.

PJSC ALROSA

PJSC ALROSA, a Russian state-owned enterprise, is the world’s largest diamond mining company by volume. ALROSA operates primarily in Russia's Yakutia region and Arkhangelsk, with a focus on ethical mining practices and sustainable development. The company’s strategic partnerships and government-backed operations allow it to maintain a stable supply chain despite global market fluctuations. ALROSA has also invested heavily in advanced technologies for diamond exploration and production which contributes to consistent output levels and reinforcing its dominance in the international market.

Rio Tinto Diamonds

Rio Tinto Diamonds, a division of the global mining giant Rio Tinto Group, is a major player in the colored gemstones and diamond markets. The company is renowned for its Argyle Diamond Mine in Australia, which was the world’s primary source of rare pink diamonds until its closure in 2020. Despite this, Rio Tinto remains influential, focusing on operations at the Diavik Diamond Mine in Canada. The company’s emphasis on sustainability, ethical sourcing, and technological innovation ensures it remains a significant contributor to the global gemstones market.

TOP STRATEGIES USED IN THE KEY PARTICIPANTS

Vertical Integration and Supply Chain Control

Many leading companies in the gemstones market, such as De Beers Group (a subsidiary of Anglo American PLC) and PJSC ALROSA, have adopted vertical integration strategies to control every stage of the gemstone lifecycle—from mining and processing to marketing and retail. By managing the entire supply chain, these companies ensure consistent quality, secure supply, and greater profitability. This approach also allows them to implement traceability initiatives, such as De Beers' Tracr blockchain platform by enhancing consumer trust in ethically sourced gemstones.

Emphasis on Ethical Sourcing and Sustainability

Ethical sourcing has become a central strategy for key players to meet growing consumer demand for conflict-free and environmentally sustainable gemstones. Companies like Rio Tinto Diamonds and Lucara Diamond Corp. invest heavily in responsible mining practices and transparency initiatives. They follow international guidelines, such as the Kimberley Process Certification Scheme, to ensure conflict-free diamonds and minimize environmental impact. Sustainability-focused strategies also include community engagement and investments in local development near mining sites.

Expansion into Synthetic and Lab-Grown Gemstones

Recognizing the rising demand for sustainable and affordable alternatives, companies like Swarovski Group and Dominion Diamond Corporation have diversified into synthetic gemstone production. This move helps tap into new markets, particularly among environmentally-conscious consumers. These synthetic stones offer comparable quality at lower costs, allowing companies to capture a broader customer base while reducing reliance on traditional mining.

Technological Innovation and Digital Transformation

To enhance operational efficiency and customer engagement, gemstone companies are integrating advanced technologies. ALROSA and Fura Gems Inc. employ cutting-edge geological exploration techniques and AI-driven sorting technologies to improve yield quality. Simultaneously, digital platforms and e-commerce solutions are being leveraged to reach global markets. For instance, virtual try-on tools and online marketplaces have expanded consumer access to high-quality gemstones.

Strategic Partnerships and Mergers

Mergers, acquisitions, and strategic alliances are common strategies used to consolidate market positions and access new resources. Companies like Debswana Diamond Company (a joint venture between De Beers and the Government of Botswana) leverage partnerships to strengthen their market influence and resource access. Collaborations with luxury brands also help gemstone companies gain premium positioning in the jewelry market.

Diversification of Product Portfolios

Key players are diversifying their offerings beyond traditional gemstones, venturing into colored stones and bespoke jewelry. For example, Gem Diamonds Limited has expanded its focus to high-value, rare diamonds while exploring niche markets for colored gemstones. This diversification helps mitigate risks associated with fluctuating demand for specific gemstone types and caters to evolving consumer preferences.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, Gemfields Group Limited temporarily suspended operations at its Kagem emerald mine in Zambia due to market pressures and geopolitical instability. The company is focusing on completing its second ruby processing plant in Mozambique, expected to boost premium ruby production upon its mid-2025 completion.

- In June 2024, Pandora launched its lab-grown diamond collection in Denmark, marking its first introduction to the European market after successful debuts in the Americas, Australia, and the UK. These diamonds are produced using 100% renewable energy and set in recycled metals, strengthening Pandora's position in the sustainable jewelry market.

- In March 2024, Star Gems, a Georgia-based design and manufacturing company, launched three cutting-edge AI assistants—GemArt, JewelBot, and VoiceGem. These innovations are designed to help jewelers streamline operations and enhance customer engagement, positioning Star Gems as a technology leader in the gemstone industry.

- In November 2022, The House of Gübelin launched Provenance Proof Marketplace, a digital platform for trading responsibly sourced gemstones. This initiative addresses the growing consumer demand for sustainability and transparency, reinforcing the company’s reputation for ethical practices.

- In October 2022, De Beers Group implemented blockchain technology to enhance the traceability of its diamonds. This move aims to ensure ethical sourcing and bolster consumer confidence, reinforcing De Beers’ leadership in transparent diamond sourcing.

- In September 2022, Signet Jewelers expanded its digital capabilities by acquiring Rocksbox, a jewelry rental subscription service. This acquisition is anticipated to enhance Signet’s online presence and cater to evolving consumer preferences for flexible jewelry options.

- In August 2022, Chow Tai Fook Jewelry Group announced plans to open 500 new stores across China. This expansion aims to capitalize on the growing middle-class market and increasing demand for luxury jewelry, strengthening its retail footprint in Asia.

- In July 2022, Tiffany & Co. launched its "Diamond Source Initiative," providing customers with geographic sourcing information for newly sourced, individually registered diamonds. This initiative promotes transparency and ethical sourcing, enhancing Tiffany’s brand trust.

- In June 2022, Richemont invested in advanced gemstone tracing technology to enhance supply chain transparency. This investment aims to meet increasing consumer demands for ethically sourced gemstones and reinforce Richemont’s commitment to responsible sourcing.

- In May 2022, LVMH Moet Hennessy announced a partnership with a leading blockchain provider to implement a diamond traceability program. This initiative is designed to ensure the authenticity and ethical sourcing of its gemstones, solidifying LVMH’s position in the luxury market.

MARKET SEGMENTATION

This research report on the global gemstones market is segmented and sub-segmented into the following categories.

By Product Type

- Diamond

- Emerald

- Ruby

- Sapphire

- Alexandrite

- Topaz

- Others

By End User

- Jewellery & Ornaments

- Bangles

- Necklaces

- Pendants

- Earrings

- Rings

- Anklets

- Brooches

- Luxury Art

By Product Format

- Natural

- Synthetic

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors determine the price of a gemstone?

The price of a gemstone is determined by its rarity, color, clarity, cut, carat weight, and overall market demand.

What are the latest trends in the gemstone industry?

Rising trends include the demand for ethically sourced gemstones, increased interest in colored stones, and a growing preference for custom-cut gems.

Are untreated gemstones more valuable than treated ones?

Yes, untreated gemstones are generally more valuable because they maintain their natural color and clarity without artificial enhancements.

Where can I buy high-quality gemstones safely?

High-quality gemstones can be purchased from certified jewelers, reputable auction houses, or trusted online retailers with authentication and return policies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]