Global Gas Chromatography Market Size, Share, Trends & Growth Forecast Report By Instruments (Systems, Detectors, Autosamplers, and Fraction Collectors), Accessories and Consumables (Columns, Column Accessories, Autosampler Accessories, Flow Management Accessories, Consumables & Accessories, Fittings & Tubing, Pressure Regulators, Gas Generators, and Other Accessories), End User (Oil & Gas Industry, Environmental Agencies, Food & Beverage Industry, Pharma & Biotech, Academic & Government Research Institutes, and Cosmetics Industry), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Gas Chromatography Market Size

The size of the global gas chromatography market was worth USD 4.16 billion in 2024. The global market is anticipated to grow at a CAGR of 6.6% from 2025 to 2033 and be worth USD 7.39 billion by 2033 from USD 4.43 billion in 2025.

Gas chromatography (GC) is a sophisticated analytical technique used to separate, identify, and quantify volatile compounds within a mixture. The global adoption of gas chromatography is driven by its vital role in addressing contemporary challenges. For instance, in environmental monitoring, GC is extensively used to detect and quantify pollutants such as volatile organic compounds (VOCs) and greenhouse gases. According to the World Health Organization, air pollution contributes to an estimated 7 million premature deaths annually which is promoting the need for advanced analytical tools like GC to monitor and mitigate environmental hazards. Similarly, in the pharmaceutical sector, stringent regulatory requirements for drug safety and efficacy have amplified the demand for GC in drug development and quality assurance. The U.S. Food and Drug Administration emphasizes the importance of robust analytical methods, including GC to ensure compliance with Good Manufacturing Practices (GMP).

Technological advancements, such as the integration of GC with mass spectrometry (GC-MS), have further expanded its applications by enabling the detection of trace-level compounds with unparalleled precision. Gas chromatography remains a vital instrument in advancing scientific and industrial progress as industries continue to prioritize accuracy and efficiency.

MARKET DRIVERS

Increasing Demand for Environmental Monitoring and Pollution Control

The urgent need to address environmental degradation and public health risks has propelled the use of gas chromatography in pollution monitoring. According to the World Health Organization, ambient air pollution contributes to approximately 4.2 million premature deaths annually with pollutants like nitrogen oxides and volatile organic compounds (VOCs) being major culprits. Gas chromatography is extensively employed to detect and quantify these harmful substances by ensuring compliance with global environmental regulations. For example, the European Environment Agency states that over 90% of urban populations in the EU are exposed to air pollutant levels exceeding WHO guidelines. Governments worldwide, including the U.S. Environmental Protection Agency have mandated the use of GC for monitoring air and water quality which plays an efficient role in safeguarding public health and the environment.

Rising Applications in Food Safety and Quality Assurance

Gas chromatography has become indispensable in ensuring food safety and quality, particularly in detecting contaminants and adulterants. The Food and Agriculture Organization estimates that nearly 600 million people fall ill annually due to consuming contaminated food, with chemical contaminants being a significant concern. GC is widely used to analyze pesticide residues, mycotoxins, and food additives by ensuring compliance with safety standards. For instance, the European Food Safety Authority reported that in 2020, over 96% of food samples tested for pesticide residues were within legal limits, thanks to advanced analytical techniques like gas chromatography. This underscores its vital role in protecting consumer health and maintaining trust in the global food supply chain.

MARKET RESTRAINTS

High Initial and Operational Costs

The substantial financial investment required for gas chromatography systems and their upkeep remains a significant barrier. Advanced GC systems, particularly those coupled with mass spectrometry can exceed $50,000 in cost by making them prohibitive for smaller laboratories and institutions. Operational expenses, such as high-purity carrier gases and consumables add to the financial burden. According to the U.S. Bureau of Labor Statistics, the cost of laboratory equipment and supplies has risen consistently by forcing many institutions to seek more affordable alternatives. This financial challenge is particularly acute in developing regions where funding for scientific infrastructure is limited. For example, UNESCO reports that many low-income countries allocate less than 1% of their GDP to research and development which further restricting access to advanced analytical tools like gas chromatography.

Complexity and Need for Skilled Personnel

The intricate nature of gas chromatography systems and the demand for highly skilled operators present a significant hurdle. Effective operation and data interpretation require specialized training which is not always accessible. The U.S. National Science Foundation reports a persistent skills gap in STEM fields with a shortage of qualified personnel in analytical chemistry. This issue is more pronounced in developing nations, where technical training opportunities are limited. The World Bank notes that many low- and middle-income countries struggle to build technical expertise by impacting the adoption of advanced technologies. For instance, in Sub-Saharan Africa, only about 25% of higher education institutions offer advanced science and technology programs by limiting the pool of skilled operators for sophisticated instruments like gas chromatography.

MARKET OPPORTUNITIES

Expansion in Forensic Science and Crime Investigation

Gas chromatography is increasingly being utilized in forensic science to analyze evidence such as drug residues, explosives, and arson accelerants. The U.S. Department of Justice reports that forensic laboratories processed over 2.5 million drug-related cases in 2020 amplifying the need of advanced analytical tools like GC in criminal investigations. The ability of gas chromatography to provide precise and reliable results makes it indispensable for forensic experts. Additionally, the National Institute of Justice emphasizes the growing demand for faster and more accurate forensic analysis to support law enforcement agencies. This expanding application in forensic science presents a significant opportunity for the gas chromatography market as governments worldwide invest in modernizing their criminal justice systems.

Growing Focus on Renewable Energy and Biofuel Analysis

The global shift toward renewable energy sources has created new opportunities for gas chromatography in biofuel research and quality control. The International Energy Agency states that global biofuel production reached 160 billion liters in 2021 with projections indicating continued growth as countries strive to meet climate goals. Gas chromatography is essential for analyzing the composition and purity of biofuels by ensuring they meet regulatory standards. For instance, the U.S. Department of Energy mandates stringent testing protocols for biofuels, with GC being a key analytical tool. This increasing focus on renewable energy and the need for precise biofuel characterization positions gas chromatography as a vital technology in supporting the transition to sustainable energy solutions.

MARKET CHALLENGES

Regulatory Compliance and Standardization Issues

The gas chromatography market faces challenges due to the lack of global harmonization in regulatory standards, which complicates its application across industries. For instance, the European Union’s REACH regulation oversees more than 22,000 chemicals, while the U.S. Environmental Protection Agency regulates approximately 40,000 chemical substances under the Toxic Substances Control Act each with distinct testing requirements. According to the World Health Organization, inconsistent standards for environmental and pharmaceutical testing can lead to inefficiencies with over 30% of laboratories reporting delays in adopting new technologies due to regulatory hurdles. The International Organization for Standardization emphasizes the need for unified protocols as only 60% of global analytical methods are harmonized by creating barriers to seamless integration and compliance in multinational operations.

Technological Limitations in Analyzing Complex Matrices

Gas chromatography struggles with analyzing complex or non-volatile samples, such as heavy crude oils or biological macromolecules which often require extensive sample preparation. The U.S. National Institute of Standards and Technology states that matrix interferences in environmental samples, such as soil or water which can compromise the accuracy of GC analysis. For example, the Environmental Protection Agency reports that detecting trace-level contaminants in complex matrices often necessitates additional techniques like derivatization, increasing analysis time by up to 50%. Advancements like two-dimensional gas chromatography (GCxGC) offer improved resolution whereas their high operational complexity and expense limit widespread adoption. Only 20% of laboratories globally have adopted GCxGC due to cost and technical barriers is restricting its application in critical areas like environmental monitoring and life sciences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Instruments, Accessories and Consumables, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Agilent Technologies, Inc. (US), Thermo Fisher Scientific, Inc. (US), Shimadzu Corporation (Japan), PerkinElmer, Inc. (US), Restek Corporation (US), Dani Instruments S.P.A. (Italy), Chromatotec (France), Merck KGAA (Germany), Leco Corporation (US), Scion Instruments (US), Phenomenex (US), GL Sciences (Japan), OI Analytical (US), Valco Company Instruments Inc. (US), Centurion Scientific (India), SRI Instruments (US), Skyray Instruments (US), E ChromTech Co. Ltd. (Taiwan), Trajan Scientific (Australia), Falcon Analytical (US), and Others. |

SEGMENT ANALYSIS

By Instruments Insights

The systems segment captured 45.3% of the global market share in 2024. The critical role of systems as the core component of GC setups, integrating columns, detectors, and injectors for comprehensive analysis is primarily driving the domination of the systems segment in the global market. The U.S. National Institute of Standards and Technology reported that GC systems are indispensable in environmental monitoring, with over 70% of air quality testing laboratories relying on them for detecting pollutants like VOCs. Their versatility and ability to handle diverse applications, from pharmaceuticals to food safety, make them the backbone of the gas chromatography market, ensuring their widespread adoption across industries.

The detectors segment is projected to grow at a CAGR of 7.5% over the forecast period owing to the advancements in detector technologies, such as mass spectrometry (MS) and flame ionization detectors (FID) which enhance sensitivity and accuracy. The U.S. Environmental Protection Agency emphasizes the importance of advanced detectors in identifying trace-level contaminants with over 90% of environmental laboratories upgrading to high-performance detectors for compliance with stringent regulations. Additionally, the Food and Drug Administration mandates the use of advanced detectors for pharmaceutical quality control is fueling demand. Their ability to deliver precise and reliable results makes detectors a critical and rapidly expanding segment in the gas chromatography market.

By Accessories and Consumables Insights

The columns segment led the market by holding 35.7% of the global market share in 2024. The growth of the columns segment is primarily driven by their critical role in the separation process, which is the core function of gas chromatography. Columns are essential for achieving high-resolution separation of complex mixtures, making them indispensable in applications like environmental monitoring, pharmaceuticals, and food safety. The U.S. Environmental Protection Agency mandates the use of specific column types for detecting pollutants, such as volatile organic compounds, which are linked to over 4.2 million premature deaths annually, as reported by the World Health Organization. This regulatory emphasis underscores their importance.

The gas generators segment is anticipated to exhibit a promising CAGR of 7.5% over the forecast period owing to the increasing demand for reliable and cost-effective carrier gases, such as nitrogen and hydrogen, which are essential for GC operations. The U.S. National Institute of Standards and Technology reported that gas generators reduce operational costs by up to 50% compared to traditional gas cylinders while also ensuring consistent purity levels. Additionally, the European Environment Agency reports that stricter regulations on greenhouse gas emissions are pushing laboratories to adopt sustainable alternatives is boosting the demand for gas generators. Their efficiency and environmental benefits make them a key growth driver in the GC market.

By End User Insights

The pharmaceutical and biotechnology segment dominated the market by accounting for 30.6% of global market share in 2024. The stringent regulatory requirements for drug safety and quality control are propelling the expansion of this segment in the global market. The U.S. Food and Drug Administration mandates rigorous testing of pharmaceuticals with GC being a critical tool for analyzing raw materials and finished products. According to the World Health Organization, the global pharmaceutical market produces over 4 trillion doses annually is necessitating advanced analytical techniques like gas chromatography to ensure compliance with Good Manufacturing Practices (GMP) and to detect impurities at trace levels.

The environmental agencies segment is estimated to witness the highest CAGR of 8.5% over the forecast period due to the increasing global concerns over pollution and climate change. The European Environment Agency reports that over 90% of urban populations in the EU are exposed to air pollutant levels exceeding WHO guidelines is driving demand for advanced monitoring tools like gas chromatography. Additionally, the U.S. Environmental Protection Agency emphasizes the need for precise detection of pollutants such as VOCs and PAHs to comply with the Clean Air Act. These factors underscore the critical role of GC in safeguarding public health and the environment.

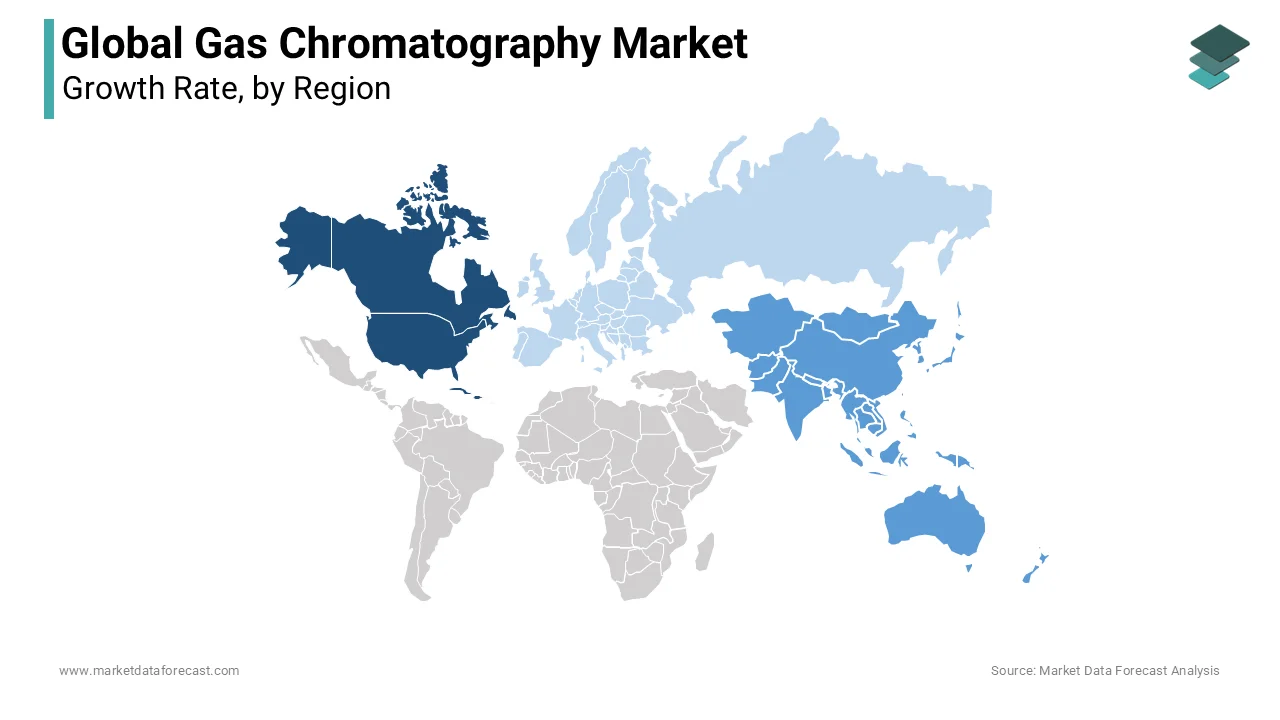

REGIONAL ANALYSIS

North America dominated the gas chromatography market with 35% of the global market share in 2024. The domination of North America in the global market is primarily driven by stringent regulatory frameworks and advanced research infrastructure. The U.S. Environmental Protection Agency mandates rigorous environmental monitoring, with GC being a key tool for detecting pollutants like VOCs and PAHs. Additionally, the U.S. Food and Drug Administration requires precise analytical methods for pharmaceutical quality control, further boosting GC adoption. According to the National Institutes of Health, the U.S. accounts for nearly 45% of global pharmaceutical R&D spending which is ensuring the region’s reliance on advanced analytical technologies like gas chromatography to maintain compliance and innovation.

The Asia-Pacific regional market is estimated to progress at the fastest CAGR of 9.2% over the forecast period owing to the rapid industrialization, increasing environmental concerns, and expanding pharmaceutical and food safety regulations. The World Health Organization reports that air pollution in Asia contributes to over 4 million premature deaths annually is driving demand for advanced monitoring tools. Additionally, the Indian government’s National Green Tribunal has implemented stricter pollution control measures while China’s Ministry of Ecology and Environment emphasizes the need for precise pollutant detection.

Europe follows North America in market share is driven by stringent EU regulations like REACH and the European Environment Agency’s focus on pollution control. Latin America is witnessing steady growth which is supported by increasing environmental awareness and pharmaceutical investments, with Brazil’s National Health Surveillance Agency playing a key role. The Middle East and Africa are emerging markets with growth driven by oil and gas industries and rising environmental regulations. The World Bank studies stated that Middle Eastern countries are investing in environmental monitoring to combat air pollution while Africa’s expanding pharmaceutical sector with the support from the African Union’s Agenda 2063 that is creating new opportunities for gas chromatography adoption.

KEY MARKET PLAYERS

Some of the notable companies dominating the global gas chromatography market profiled in this report are Agilent Technologies, Inc. (US), Thermo Fisher Scientific, Inc. (US), Shimadzu Corporation (Japan), PerkinElmer, Inc. (US), Restek Corporation (US), Dani Instruments S.P.A. (Italy), Chromatotec (France), Merck KGAA (Germany), Leco Corporation (US), Scion Instruments (US), Phenomenex (US), GL Sciences (Japan), OI Analytical (US), Valco Company Instruments Inc. (US), Centurion Scientific (India), SRI Instruments (US), Skyray Instruments (US), E ChromTech Co. Ltd. (Taiwan), Trajan Scientific (Australia), Falcon Analytical (US), and Others.

TOP 3 PLAYERS IN THE MARKET

Agilent Technologies, Inc. (US)

Agilent Technologies is a global leader in the gas chromatography market, widely recognized for its innovative and high-performance GC systems. The company’s flagship products, such as the 7890B Gas Chromatograph and the Intuvo 9000 , have set industry benchmarks for precision, sensitivity, and ease of use. Agilent has been at the forefront of integrating advanced technologies like artificial intelligence (AI) and machine learning into its GC systems, enabling predictive maintenance and real-time data analysis. This has significantly improved operational efficiency and reliability for end-users across industries such as pharmaceuticals, food safety, and environmental testing. Additionally, Agilent’s focus on sustainability is evident in its development of eco-friendly consumables and efforts to minimize the environmental impact of its manufacturing processes. With a robust global distribution network and customer-centric support services, Agilent has established itself as a trusted partner for laboratories worldwide, contributing immensely to the growth and credibility of the global gas chromatography market.

Thermo Fisher Scientific, Inc. (US)

as made substantial contributions to the gas chromatography market through its advanced GC and GC-MS (Gas Chromatography-Mass Spectrometry) systems. The company’s TRACE 1300 Series and ISQ Series GC-MS systems are widely used for trace-level analysis in applications such as environmental monitoring, forensics, and pharmaceutical research. These systems are known for their modularity, high sensitivity, and ability to handle complex samples with ease. Thermo Fisher places a strong emphasis on sustainability, developing energy-efficient instruments and eco-friendly consumables to reduce the environmental footprint of its products. Furthermore, the company’s commitment to regulatory compliance ensures that its solutions meet stringent international standards, making them a preferred choice for regulated industries. By continuously innovating and expanding its product portfolio, Thermo Fisher has engraved its position as a leader in the global gas chromatography market.

Shimadzu Corporation (Japan)

Shimadzu Corporation is a prominent player in the gas chromatography market, particularly in Asia, and has a growing global presence. The company’s Nexis GC-2030 gas chromatograph exemplifies its commitment to innovation, offering superior accuracy, user-friendly interfaces, and advanced automation features. Shimadzu’s GC systems are widely used in industries such as life sciences, environmental monitoring, and petrochemicals, where high performance and reliability are critical. One of Shimadzu’s key strengths lies in its collaborative approach, working closely with academic institutions and research organizations to develop tailored solutions for emerging applications. This has enabled the company to address unique analytical challenges and stay ahead of market trends. Additionally, Shimadzu emphasizes quality and durability in its products, ensuring long-term value for customers. Through its technological advancements and strategic collaborations, Shimadzu has made significant contributions to the evolution of the global gas chromatography market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Technological Advancements

Companies like Agilent Technologies and Thermo Fisher Scientific consistently invest in research and development (R&D) to introduce cutting-edge gas chromatography systems with enhanced sensitivity, speed, and automation. For instance, the integration of artificial intelligence (AI) and machine learning into GC systems has been a focus area to improve data analysis and operational efficiency.

Strategic Collaborations and Partnerships

Key players often collaborate with academic institutions, research organizations, and industry stakeholders to co-develop innovative solutions. For example, Shimadzu Corporation has partnered with universities to advance applications of GC in environmental monitoring and pharmaceutical analysis.

Mergers and Acquisitions

Acquiring smaller firms or niche technology providers is a common strategy to expand product offerings and enter new markets. PerkinElmer, for instance, has acquired several companies specializing in chromatography consumables and software to bolster its portfolio.

Geographic Expansion

To tap into emerging markets, companies such as Merck KGaA and GL Sciences have established subsidiaries or distribution networks in regions like Asia-Pacific, Latin America, and Africa. This helps them cater to the growing demand for analytical instruments in developing economies.

Focus on Sustainability

With increasing emphasis on green chemistry, companies like Restek Corporation and Phenomenex have developed eco-friendly columns and solvents that minimize environmental impact while maintaining high performance.

Customer-Centric Approaches

Offering tailored solutions, training programs, and after-sales support has become a priority for firms like Dani Instruments and Chromatotec. These initiatives help build long-term customer relationships and brand loyalty.

Regulatory Compliance and Certifications

Players such as Leco Corporation and SRI Instruments ensure their products comply with international standards (e.g., ISO, EPA guidelines) to gain trust and credibility among regulated industries like pharmaceuticals and food safety.

COMPETITIVE LANDSCAPE

The gas chromatography (GC) market is characterized by intense competition, driven by technological advancements, increasing demand for analytical solutions, and the presence of both established players and emerging challengers. The market is highly consolidated, with key players such as Agilent Technologies, Thermo Fisher Scientific, and Shimadzu Corporation dominating the landscape due to their extensive product portfolios, global reach, and continuous innovation. These companies invest heavily in research and development to introduce cutting-edge GC systems that offer superior sensitivity, automation, and integration capabilities, enabling them to maintain their leadership positions.

However, the market also witnesses competition from mid-sized and regional players like Restek Corporation, Merck KGaA, and GL Sciences, which focus on niche segments and cost-effective solutions. These companies often leverage strategic collaborations, partnerships, and geographic expansion to strengthen their foothold. For instance, firms in emerging markets are increasingly targeting regions like Asia-Pacific, Latin America, and Africa, where demand for analytical tools is rising due to industrialization and stricter regulatory frameworks.

Additionally, the growing emphasis on sustainability and green chemistry has intensified competition, with companies striving to develop eco-friendly products. Mergers and acquisitions are another critical aspect of competitive dynamics, as larger firms acquire smaller innovators to enhance their offerings. Overall, the GC market remains dynamic, with players vying for market share through innovation, customer-centric strategies, and adaptability to evolving industry needs. This competitive environment ensures continuous technological progress and benefits end-users with advanced, reliable, and diverse solutions.

RECENT MARKET DEVELOPMENTS

- In February 2022, Agilent Technologies Inc., a leader in life sciences and applied chemical markets, acquired advanced artificial intelligence technology developed by Virtual Control, an AI and machine learning software developer. This acquisition is anticipated to enable Agilent to integrate the AI technology, known as ACIES, into its gas chromatography and mass spectrometry platforms, thereby automating data analysis and enhancing laboratory productivity.

- In January 2025, Shimadzu Corporation unveiled the Brevis GC-2050, the world's first gas chromatograph system equipped with a CO₂ reduction visualization function. This innovative feature allows users to monitor and quantify the system's energy savings, thereby promoting eco-friendly laboratory practices. The Brevis GC-2050 is designed to support the Green Transformation industry by providing advanced analytical capabilities while minimizing environmental impact.

- In 2025, LECO Corporation introduced the Pegasus® BT 4D, a GCxGC Time-of-Flight Mass Spectrometer that integrates their benchtop Pegasus BT with a high-performance GCxGC modulation system. This innovation is anticipated to enhance sensitivity for complex sample analysis, streamline data processing through ChromaTOF® software, and reduce maintenance downtime with the StayClean® ion source, strengthening LECO's position in the analytical instrumentation market.

- In 2025, Phenomenex expanded its Zebron Gas Chromatography (GC) column portfolio to include the Zebron ZB-624PLUS, a GC column designed for the analysis of volatile compounds in environmental, pharmaceutical, food, cannabis, and specialty chemical applications. This development is anticipated to enhance the accuracy and reproducibility of GC-MS analyses, offering low bleed, excellent retention, high sensitivity, and extended column lifetime, thereby strengthening Phenomenex's position in the analytical chemistry market.

MARKET SEGMENTATION

This research report on the global gas chromatography market has been segmented and sub-segmented based on the instruments, accessories and consumables, end-user, and region.

By Instruments

- Systems

- Detectors

- Autosamplers

- Fraction Collectors

By Accessories and Consumables

- Columns

- Columns Accessories

- Autosampler Accessories

- Flow Management Accessories

- Consumables & Accessories

- Fittings & Tubing

- Pressure Regulators

- Gas Generators

- Other Accessories

By End User

- Oil & Gas Industry

- Environmental Agencies

- Food & Beverage Industry

- Pharma & Biotech

- Academic & Government Research Institutes

- Cosmetics Industry

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the gas chromatography market?

The gas chromatography market is expected to grow from USD 4.43 billion in 2025 to USD 7.39 billion by 2033, at a CAGR of 6.6%.

2. What drives the demand for gas chromatography?

Increased environmental monitoring, food safety standards, and drug quality regulations.

3. What challenges does the gas chromatography market face?

High costs of systems and the need for skilled personnel.

5. What opportunities exist for gas chromatography?

Applications in biofuel analysis and renewable energy sectors.

4. What role does gas chromatography play in forensics?

Essential for analyzing drug residues, explosives, and crime scene evidence.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]