Global Gaming PC Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Desktop, Laptop, and Peripherals), Price Range (Mid-range, Low-range, and High-end), End User (Professional Gamers, Casual Gamers, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Gaming PC Market Size

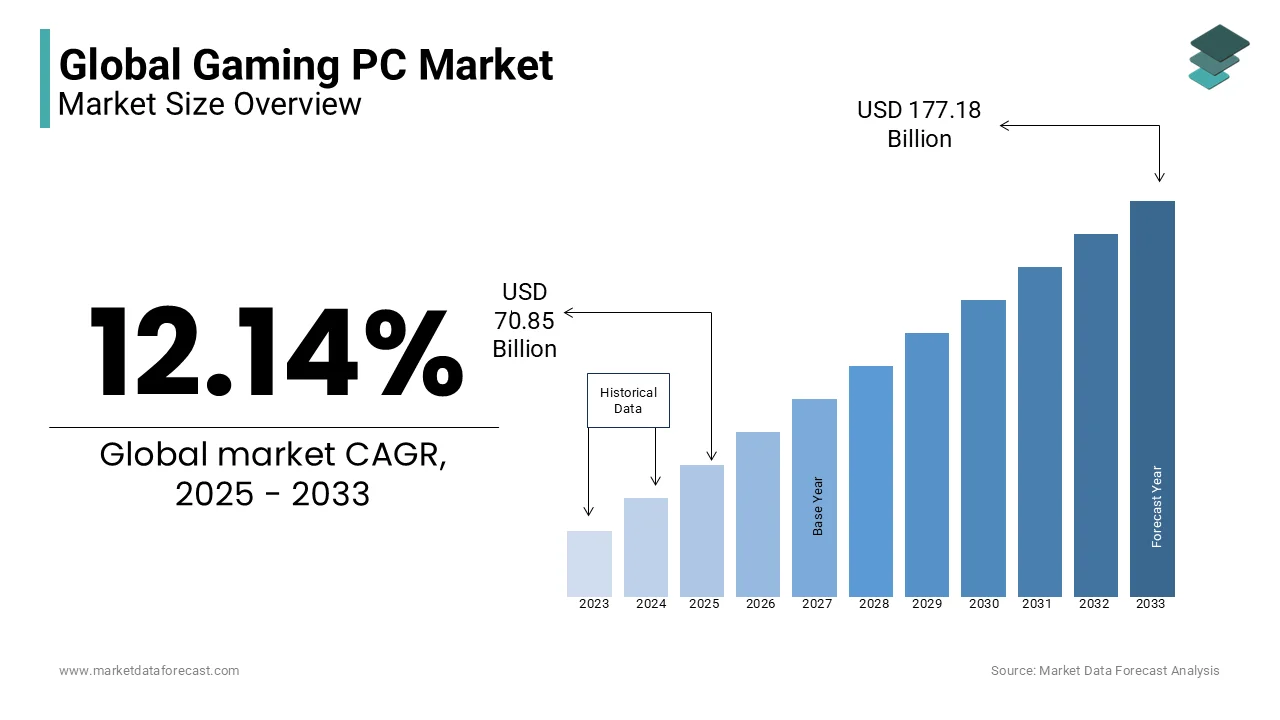

The global gaming pc market was worth USD 63.18 billion in 2024. The global market is projected to reach USD 177.18 billion by 2033 from USD 70.85 billion in 2025, growing at a CAGR of 12.14% from 2025 to 2033.

The gaming PC systems include advanced hardware components like powerful GPUs, high-speed processors, enhanced cooling systems, and customizable RGB features to meet the demands of modern as well as graphically intensive games. The market encompasses pre-built desktops, laptops, and custom-built systems tailored for gamers. Approximately 1.8 billion gamers globally prefer PCs which is highlighting a significant user base. Key players such as Dell (Alienware), ASUS, MSI, HP (OMEN), and Lenovo Legion drive innovation with laptops accounting for 60% of gaming PC sales in 2022 due to portability. The growth of 4K gaming and technologies like ray tracing and VR further fuels the demand.

MARKET DRIVERS

Government Recognition and Support for Esports

Official recognition of esports by governments has significantly boosted its legitimacy and investment opportunities. For instance, according to the Indian Ministry of Electronics and IT, the online gaming sector in India is expected to grow rapidly and is driven by esports and gaming tournaments. Furthermore, as of 2023, countries like South Korea, China, and Indonesia have integrated esports into their education and sports programs and South Korea is leading by establishing dedicated esports stadiums and training facilities. The Asian Games 2022 included esports as a medal event for the first time is attracting over 3,000 participants.

Inclusion of Esports in International Sporting Events

Esports is increasingly being included in prestigious global events. The Olympic Virtual Series in 2021 which is a precursor to esports in the Olympics attracted over 250,000 participants across 100+ countries, as reported by the International Olympic Committee. Similarly, the Asian Games 2022 featured eight esports medal events with approximately 5 million live spectators during key matches. This demonstrates the potential reach of esports as a competitive discipline. The Saudi government’s Vision 2030 plan allocated $1.1 billion to develop esports infrastructure there by cementing the nation’s role in hosting international tournaments.

MARKET RESTRAINTS

Competition from Mobile and Console Gaming

The rise of mobile and console gaming presents a substantial challenge to the Gaming PC market. Mobile games, in particular, accounted for 49% of the global market, followed by console games at 28% and PC games at 23%, as per the data published by the International Trade Administration (ITA). This shift indicates a growing preference for more accessible and portable gaming options, potentially limiting the growth of the Gaming PC sector.

High Cost of Gaming PCs

Gaming PCs are often priced significantly higher than consoles or mobile devices, making them less accessible to a broader audience. The average cost of a high-performance gaming PC ranges from $1,200 to $3,000 when compared to gaming consoles like PlayStation 5 or Xbox Series X which are priced at $500-$600. In emerging markets, this price disparity is particularly impactful because the median disposable income is often below $5,000 annually (World Bank). Furthermore, peripheral costs, including gaming monitors, mechanical keyboards, and GPUs, have risen by nearly 30% since 2020 and are driven by semiconductor shortages and inflation, as per the U.S. Bureau of Labor Statistics.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

Emerging markets, particularly in regions like Southeast Asia, offer substantial growth potential for the Gaming PC industry. For instance, Singapore's gaming sector, though currently modest, is on an upward trajectory. In 2019, players in Singapore spent approximately USD 327 million on games, which highlights the market's potential, according to ITA. As disposable incomes rise and internet infrastructure improves in these regions, the demand for high-performance gaming PCs is expected to increase due to the rise in disposable incomes and improvement in internet infrastructure in these regions and is providing a lucrative opportunity for market expansion.

Integration of Advanced Technologies

The integration of advanced technologies such as Virtual Reality (VR) and Augmented Reality (AR) into gaming experiences offers a promising avenue for the Gaming PC market. These technologies require robust hardware capabilities, positioning gaming PCs as the preferred platform for immersive gaming. The U.S. Department of Commerce notes that VR and AR have emerged with futuristic programs for entertainment, shopping, and healthcare, indicating a broadening scope for gaming applications. The Gaming PC market can attract tech-savvy consumers seeking cutting-edge experiences by capitalizing on these advancements.

MARKET CHALLENGES

High Energy Consumption

According to the Energy Technologies Area, Gaming PCs, while representing only 2.5% of the global PC base, account for approximately 20% of computer energy usage. This disproportionate consumption raises concerns about environmental impact and operational costs for users. Research by the Berkeley Lab News Center indicates that energy demand from gaming could rise by 114% or decrease by 28%, which depends on user behavior and equipment choices. Implementing energy-efficient components and promoting responsible gaming habits are essential to mitigate this challenge.

Supply Chain Disruptions

The Gaming PC industry is vulnerable to supply chain disruptions, particularly in the semiconductor sector. The U.S. International Trade Commission highlights that the global semiconductor shortage caused a 20-30% increase in GPU prices in 2021. Additionally, the shortage resulted in production backlogs, with delivery lead times for chips extending from an average of 14 weeks to over 26 weeks during peak disruptions, as per the U.S. Department of Commerce. Semiconductors remain critical for gaming PC production, but limited capacity has amplified challenges. Strategies such as onshore semiconductor manufacturing could help mitigate these issues, as reported by the U.S. Census Bureau.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.14% |

|

Segments Covered |

By Product, Price Range, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The major players in the global gaming pc market include Dell (Alienware), HP (OMEN), Lenovo (Legion), ASUS (ROG - Republic of Gamers), MSI (Micro-Star International), Acer (Predator), Razer Inc., CyberPowerPC, Corsair Gaming, and NZXT. |

SEGMENTAL ANALYSIS

By Product Insights

The desktops segment ruled the market by capturing 73.4% of global market share in 2024. These are capable of housing more powerful hardware. High-end gaming desktops typically feature NVIDIA RTX 30 series or AMD Radeon RX 6000 series GPUs with advanced cooling systems (like liquid cooling). This enables them to support more intensive games and high-quality graphics settings, enhancing overall gaming performance. Studies show that 70% of esports players choose desktops due to their better hardware performance and upgradability, according to Statista 2023.

The laptop segment is growing considerably and is expected to register a CAGR of 15.4% from 2025 to 2033. The rise in demand for portable gaming systems is a key factor. According to a 2023 survey by Statista, 45% of gamers prefer laptops due to their portability which is enabling them to game on-the-go. Gaming laptops are now available with similar specs to desktops but with the advantage of portability, making them perfect for those who need performance while traveling or living in tight spaces.

By Price Range Insights

The Mid-range gaming PCs segment led the market and accounted for 43.4% of the global market share in 2024. These PCs offer a compelling price-to-performance ratio. They provide good performance at a reasonable cost, which appeals to a broad spectrum of consumers. According to Statista, approximately 40% of gaming PC buyers prefer systems priced within this range because they offer solid gaming performance without the steep price tag of high-end PCs.

On the other hand, the low-range gaming PC segment is estimated to grow at the fastest CAGR of 18.2% from 2025 to 2033. It is the Quickest rising category under this segment. The growth of eSports in low-budget sectors is also contributing to the increased demand for entry-level gaming systems. According to Statista, 25-30% of gamers worldwide opt for low-range gaming PCs due to the price advantage. The growth of low-range gaming PCs is especially pronounced in developing markets such as India, Brazil, and Southeast Asia, where gaming is rapidly becoming a popular form of entertainment and affordable systems are crucial to penetration.

By End User Insights

The casual gamers segment dominated the market and captured the major share of the 64.6% of global market in 2024. Casual games that include a wide range of players who engage in gaming as a hobby or for occasional entertainment and rather than as a professional pursuit. The casual gaming segment benefits from the availability of affordable mid-range gaming PCs. These systems priced between USD 600 to 1,000 provide sufficient performance for most modern titles at reasonable settings. The demand for these systems is growing rapidly and especially with the increasing affordability and enhanced specs of mid-range gaming PCs.

The professional gamers segment is anticipated to witness the highest CAGR of 15.7% by end-user over the forecast period. More players are aspiring to turn professional with the growing prize pools in esports tournaments (e.g., The International Dota 2 Championship offering over USD 40 million in 2023). This creates a direct need for specialized gaming PCs capable of providing high performance under competitive pressure.

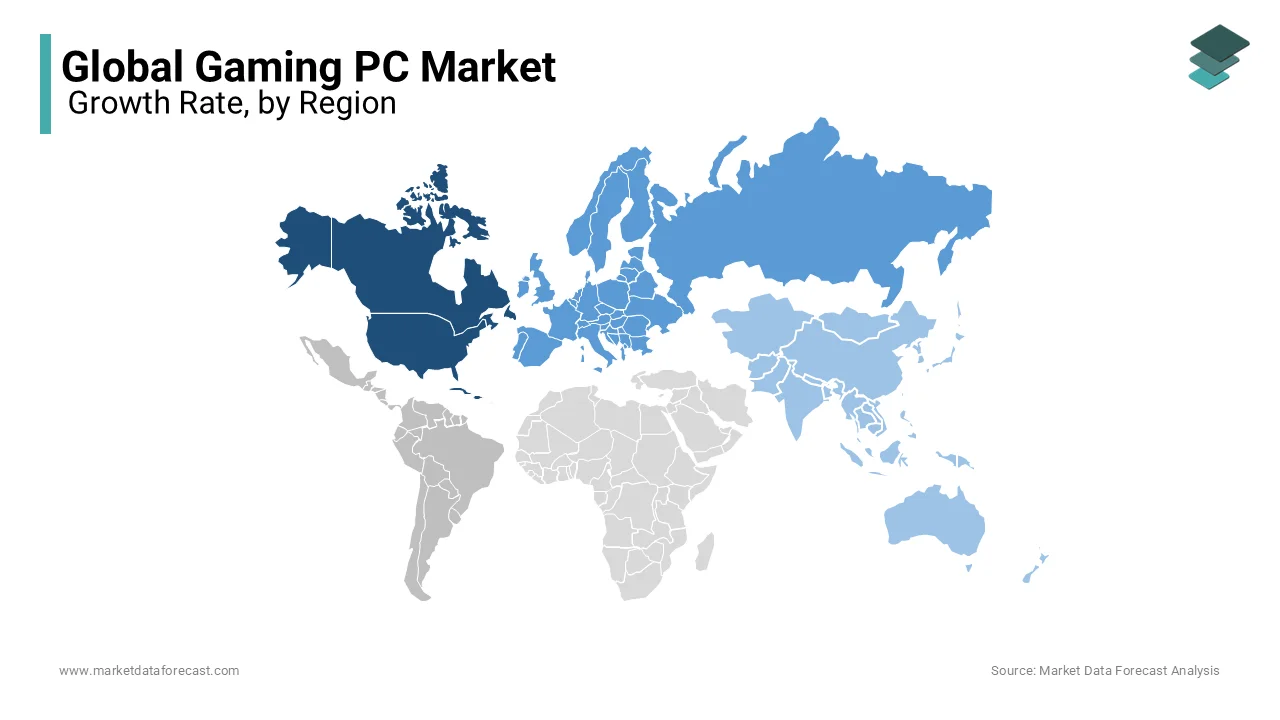

REGIONAL ANALYSIS

North America accounted for the most significant share of 29.4% of the global gaming PC market in 2024. In 2023, 35% of U.S. households owned gaming PCs with hardware and accessory sales contributing significantly. Canada also plays a role, with its gaming market projected to reach $6.8 billion by 2030, as per the Entertainment Software Association of Canada. E-sports is a growing segment and generated $205 million in the U.S. in 2023, as stated by Statista.

The market in Europe held a substantial share of the global market in 2024 and is expected to play a prominent role in the global market throughout the forecast period. Germany leads with 34% of European gaming hardware sales, while the U.K. ranks second, where gaming PCs accounted for 15% of PC sales in 2023, according to UK Interactive Entertainment (UKIE). France also showed growth, with its gaming market exceeding $6.5 billion in 2023, as per the European Gaming and Betting Association.

Asia-Pacific is rapidly growing and is predicted to witness the highest CAGR of 12.1% over the forecast period. The gaming PC penetration in China stands at 58% among gamers, with e-sports contributing $360 million in revenue in 2023, as per the National Bureau of Statistics of China. India is a rapidly growing country and is propelled by affordable internet and government-backed e-sports initiatives according to the NITI Aayog.

The gaming PC market in Latin America is growing steadily. Brazil commands 50% of the regional market, and Mexico's gaming population is expected to surpass 80 million by 2025, as stated by the World Bank. The growing middle class and increasing penetration of gaming cafés are key drivers.

The market in Middle East and Africa is anticipated to register moderate growth over the forecast period. Saudi Arabia’s Vision 2030 aims to make it a global gaming hub with investments of $38 billion announced in 2023. The UAE has seen a 22% increase in gaming PC sales year-over-year due to rising interest in e-sports (GCC Statistics). South Africa is representing the African market and expects gaming PC adoption to rise 30% by 2026, according to the World Economic Forum.

KEY MARKET PLAYERS

The major players in the global gaming pc market include Dell (Alienware), HP (OMEN), Lenovo (Legion), ASUS (ROG - Republic of Gamers), MSI (Micro-Star International), Acer (Predator), Razer Inc., CyberPowerPC, Corsair Gaming, and NZXT.

COMPETITIVE LANDSCAPE

The Gaming PC market is highly competitive and is driven by innovation, performance differentiation, and branding. The market comprises key players including Dell (Alienware), HP (OMEN), Lenovo (Legion), ASUS (ROG - Republic of Gamers), and MSI all competing to capture a share of the rapidly growing segment. These brands focus on providing high-performance devices with cutting-edge processors, GPUs, and immersive features like RGB lighting and advanced cooling systems.

In addition to established brands, custom-built gaming PCs play a significant role, with enthusiasts often preferring tailored configurations. Companies like NZXT and CyberPowerPC cater to this demand, further intensifying competition.

Emerging markets, particularly in Asia-Pacific and Latin America, are driving the expansion, with local manufacturers like Hasee in China and Avell in Brazil entering the fray.

The e-sports boom has amplified demand, prompting gaming peripheral companies like Razer and Corsair to enter the market with bundled solutions. However, challenges such as fluctuating GPU prices and semiconductor shortages affect competitiveness.

Key strategies include collaborations with e-sports teams, launching exclusive hardware for competitive gaming, and offering financing options to attract budget-conscious gamers. As the market grows, innovation, customer loyalty, and aggressive pricing will define competitive advantages.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Swedish private equity firm EQT announced its intention to acquire Keywords Studios, a prominent provider of services to video game developers, for approximately £2 billion. The Keywords board supported the takeover bid of £24.50 per share. This move reflects EQT's strategy to capitalize on the growing demand for gaming services.

- On December 15, 2024, NVIDIA unveiled "Project Digits," a high-performance desktop computer featuring the GB10 Grace Blackwell Superchip. Priced at $3,000, Digits aims to revolutionize AI computing for developers and data scientists, potentially impacting the gaming PC landscape.

MARKET SEGMENTATION

This research report on the global gaming pc market is segmented and sub-segmented into the following categories.

By Product

- Desktop

- Laptop

- Peripherals

By Price Range

- Mid-range

- Low-range

- High-end

By End User

- Professional Gamers

- Casual Gamers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors to consider when buying a gaming PC?

The most important factors include the GPU, CPU, RAM, storage type (SSD vs. HDD), cooling system, power supply, and upgradeability. Choosing the right balance between these components ensures optimal performance for gaming needs.

How often should a gaming PC be upgraded?

A well-built gaming PC can last around five years before needing significant upgrades. However, upgrading the GPU every two to three years and increasing RAM or storage as needed can help keep up with modern game requirements.

What are the best storage options for gaming PCs?

SSDs, especially NVMe SSDs, are the best choice for gaming PCs due to faster load times and improved system responsiveness. A combination of an NVMe SSD for the operating system and an HDD for extra storage is a common setup.

What are the emerging trends in the gaming PC market?

Key trends include AI-powered GPUs, increasing adoption of ray tracing, compact high-performance PCs, cloud gaming compatibility, and a growing focus on energy-efficient components.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]