Global Gaming Market Size, Share, Trends & Growth Forecast Report By Game Type (Shooter, Action, Sports, Role Playing, and Others), Device Type, End-User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Gaming Market Size

The global gaming market was valued at USD 319.80 billion in 2024. The global market is estimated at USD 991.74 billion by 2033 from USD 362.65 billion in 2025, rising at a CAGR of 13.40% from 2025 to 2033.

Gaming has become a cultural phenomenon, engaging diverse audiences across age groups, genders, and geographies, while also intersecting with fields such as education, healthcare, and social interaction. According to the Entertainment Software Association (ESA), 76% of Americans aged 18 and older play video games with the average age of a gamer being 34 years old, reflecting the broad demographic reach of gaming. Additionally, 48% of gamers are female which is challenging outdated stereotypes about the industry's audience.

The impact of gaming on mental health and cognitive development has been increasingly studied. The American Psychological Association (APA) highlights that strategic video games, such as real-time strategy titles have been shown to improve problem-solving skills and enhance cognitive flexibility. Furthermore, a study conducted by the National Institutes of Health (NIH) found that 65% of children aged 8-12 who engage in moderate gaming exhibit improved hand-eye coordination and spatial reasoning compared to non-gamers. These findings underscore the potential of gaming as an educational tool and its role in fostering critical thinking and adaptability.

MARKET DRIVERS

Advancements in Gaming Accessibility and Inclusivity

The global gaming market has been significantly propelled by advancements in accessibility and inclusivity, ensuring broader participation across diverse demographics. The U.S. Census Bureau reports that 13% of the U.S. population lives with a disability, and gaming companies have increasingly prioritized features such as customizable controls, screen readers, and colourblind modes to accommodate these players. For instance, Microsoft’s Xbox Adaptive Controller, designed for gamers with limited mobility which has been lauded for its innovative design by enabling disabled gamers to engage more fully in gaming activities, according to the National Institutes of Health (NIH). Additionally, the rise of multilingual support and culturally relevant content has expanded gaming's global appeal. These inclusivity initiatives not only enhance user experiences but also foster a sense of community among underrepresented groups.

Integration of Gaming into Education and Skill Development

Gaming’s integration into education and skill development has emerged as a transformative driver, reshaping how individuals learn and grow. The National Center for Education Statistics (NCES) reveals that 70% of teachers in the U.S. incorporate digital games into their curriculum to enhance student engagement and retention. Furthermore, the U.S. Department of Labor highlights that simulation-based training, often rooted in gaming technologies, is used in workforce development programs, particularly in industries like healthcare and aviation. Gaming has become a powerful medium by blending entertainment with education for fostering creativity, critical thinking, and professional growth.

MARKET RESTRAINTS

Concerns Over Screen Time and Mental Health

One significant restraint on the gaming market is the growing concern over excessive screen time and its impact on mental health, particularly among younger audiences. The Centers for Disease Control and Prevention (CDC) survey found that around 50% of American teens, ages 12 to 17, spend at least four hours daily in front of screens which is raising concerns about potential adverse effects on sleep patterns and academic performance. Additionally, the National Institutes of Health (NIH) highlights that prolonged gaming sessions can contribute to anxiety and depression in vulnerable individuals, with studies showing a correlation between excessive gaming and a 20% increase in reported mental health issues among teens. These findings have prompted regulatory scrutiny, with some governments imposing restrictions on gaming hours for minors. For instance, China has implemented policies limiting minors to three hours of gaming per week. While gaming offers numerous benefits, these health-related concerns have led to increased public debate and calls for moderation by restraining market growth.

Regulatory Challenges and Content Restrictions

Another major restraint on the gaming industry is the increasing regulatory scrutiny over content and data privacy. The Federal Trade Commission (FTC) has flagged concerns about inappropriate content and microtransactions targeting children with reports indicating that 60% of parents are worried about their children's exposure to violent or explicit material in games. Furthermore, the General Services Administration (GSA) highlights that data privacy remains a critical issue, as gaming platforms often collect sensitive user information by including geolocation and behavioural data. In response, regulations like the Children’s Online Privacy Protection Act (COPPA) impose strict guidelines on data collection practices by creating compliance challenges for developers. Additionally, countries like South Korea have enacted laws banning in-game purchases for minors by impacting revenue models. These regulatory hurdles not only increase operational costs but also limit creative freedom with significant barriers to innovation and market expansion in the gaming industry.

MARKET OPPORTUNITIES

Expansion of Gaming in Healthcare and Therapeutic Applications

The gaming market is poised to benefit significantly from its growing integration into healthcare and therapeutic applications. The National Institutes of Health (NIH) highlights that video games are increasingly being used as tools for mental health treatment with studies showing a 30% reduction in symptoms of anxiety and depression among patients using game-based therapies. For instance, the FDA-approved game EndeavorRx has demonstrated efficacy in improving attention function in children with ADHD. Additionally, the Centers for Disease Control and Prevention (CDC) notes that virtual reality gaming is being utilized in physical rehabilitation programs. These innovations not only expand gaming's societal value but also open new revenue streams. The industry stands to gain from partnerships with medical institutions is creating opportunities for growth in both commercial and social impact domains.

Growth of Gaming as an Educational and Workforce Training Tool

Gaming presents a significant opportunity through its application in education and workforce training is transforming traditional learning methods. For example, pilots trained using flight simulators have shown a 25% improvement in decision-making under pressure. Similarly, the National Center for Education Statistics (NCES) reveals that there are 3.8 million educators in the U.S. incorporate educational games like "Minecraft: Education Edition" into their teaching by citing increased student engagement and retention. These platforms foster critical thinking, collaboration, and technical skills, preparing learners for future careers. The market is well-positioned to capitalize on this demand is driving innovation and expanding its influence beyond entertainment.

MARKET CHALLENGES

Cybersecurity Threats and Data Privacy Concerns

The gaming industry faces significant challenges due to rising cybersecurity threats and data privacy concerns which undermine user trust and operational stability. The Federal Bureau of Investigation (FBI) reports that cyberattacks targeting gaming platforms have increased by 160% since 2020, with hackers exploiting vulnerabilities to steal sensitive user data by including payment information and personal identifiers. Additionally, the Federal Trade Commission (FTC) has highlighted concerns over inadequate data protection practices for younger users. A report by the Pew Research Center found that 81% of parents are concerned about how companies use their children’s data online with gaming platforms being a specific area of worry due to their widespread adoption among youth. The FTC does not provide a specific percentage tied to gaming alone due to issued warnings about the risks of unauthorized data collection and misuse which is urging companies to adopt stricter safeguards. These vulnerabilities underscore the urgent need for enhanced cybersecurity measures and transparent data-handling practices to protect users and maintain trust in the gaming ecosystem.

Environmental Impact of Gaming Hardware Production

The gaming market faces significant environmental challenges due to the growing issue of electronic waste (e-waste) generated by outdated hardware, including consoles, gaming PCs, and peripherals. According to the U.S. Environmental Protection Agency (EPA) , e-waste is one of the fastest-growing waste streams globally, with approximately 5.1 million tons of electronics discarded annually in the United States as of 2023. However, only about 15% of this e-waste is recycled properly is leaving the majority to end up in landfills where hazardous materials like lead and mercury can leach into the environment. The rapid pace of technological advancements in the gaming industry contributes significantly to this problem. For instance, the average lifespan of a gaming console is just 5-6 years is leading to frequent upgrades and disposals. Addressing these sustainability challenges is critical for the gaming industry to reduce its environmental footprint and align with global efforts to combat climate change.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.40% |

|

Segments Covered |

By Game Type, Device Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Microsoft Corporation (U.S.), Nintendo Co., Ltd (Japan), Rovio Entertainment Corporation (Finland), Nvidia Corporation (U.S.), Valve Corporation (U.S.), PlayJam Ltd (U.K.), Electronic Arts Inc (U.S.), Sony Group Corporation (Japan), Bandai Namco Holdings Inc. (Japan), Tencent Holdings Ltd. (China), and Activision Blizzard, Inc. (U.S.). |

SEGMENTAL ANALYSIS

By Game Type Insights

The shooter games segment led the gaming market with a 20.8% global market share in 2024. The immersive gameplay of shooter games, high replay ability, and widespread appeal across demographics have led the domination of this segment in the global market. Titles like "Call of Duty" and "Fortnite" have become cultural phenomena, with the ESA reporting that in 2024, U.S. consumers spent $58.7 billion on video games. The genre's competitive multiplayer modes and integration with esports further boost its popularity. Its dominance underscores the importance of engaging, adrenaline-driven experiences in shaping the gaming industry's growth.

The role-playing games (RPGs) segment is anticipated register the fastest CAGR of 12.5% from 2025 to 2033. This rapid growth is fueled by advancements in storytelling, open-world design, and player customization which resonate with modern gamers seeking immersive experiences. Additionally, the rise of mobile RPGs has expanded accessibility is contributing to the segment's growth. The National Institutes of Health (NIH) emphasizes RPGs' cognitive benefits such as improved decision-making and strategic thinking is further boosting their appeal. The ability to blend entertainment with skill development solidifies their importance in the evolving gaming landscape.

By Device Type Insights

The mobile phone segment accounted for the dominating share of 45.7% of global market in 2024. The widespread adoption of smartphones with over 78% of global population owning at least one mobile phone, as reported by the International Telecommunication Union (ITU), is one of the major factors propelling the growth of the mobile phone segment in the global market. Mobile gaming’s accessibility, affordability, and diverse genres attract a broad audience, including casual gamers. The Asia-Pacific region contributes significantly, with countries like China and India driving growth due to affordable internet and devices. This segment’s importance lies in its ability to democratize gaming is making it accessible to non-traditional gamers and fostering innovation through microtransactions and free-to-play models.

The PC/MMO segment is anticipated to register the fastest growth in the global gaming market ovr the forecast period. This rapid growth is fueled by advancements in cloud infrastructure and high-speed internet, with 90% of Americans now having access to broadband is enabling seamless streaming. Platforms like Xbox Cloud Gaming and NVIDIA GeForce Now are expanding their subscriber base which is expected to have 3.6 million subscribers, according to the National Telecommunications and Information Administration (NTIA). The segment’s importance lies in its potential to disrupt traditional hardware-dependent gaming by offering high-quality experiences on low-spec devices. This shift not only lowers entry barriers but also aligns with the growing demand for on-demand entertainment by positioning cloud gaming as a transformative force in the industry.

By End-User Insights

The male segment held 42% share of the gaming market in 2024. This dominance is driven by higher engagement rates in competitive and AAA titles, such as first-person shooters and sports games, which traditionally appeal more to male players. The Pew Research Center highlights that 81% of men aged 18-29 play video games regularly, compared to 50% of women in the same age group. This segment's importance lies in its strong purchasing power, with males being more likely to invest in high-end consoles, PCs, and in-game purchases. As a result, game developers often prioritize creating content tailored to this demographic by ensuring sustained market leadership.

The female gamers segment is estimated to progress at a 10.5% from 2025 to 2033. This rapid growth is fueled by increased accessibility through mobile gaming, which accounts for 44% of female gamers' preferred platforms, according to the U.S. Census Bureau. Additionally, the rise of inclusive and narrative-driven games has attracted more women to the industry. Women aged 30-49, in particular, have shown notable growth in gaming engagement due to the popularity of casual and social games. This segment's importance lies in its influence on diversifying content and expanding the industry’s reach by making gaming a more inclusive and universal form of entertainment.

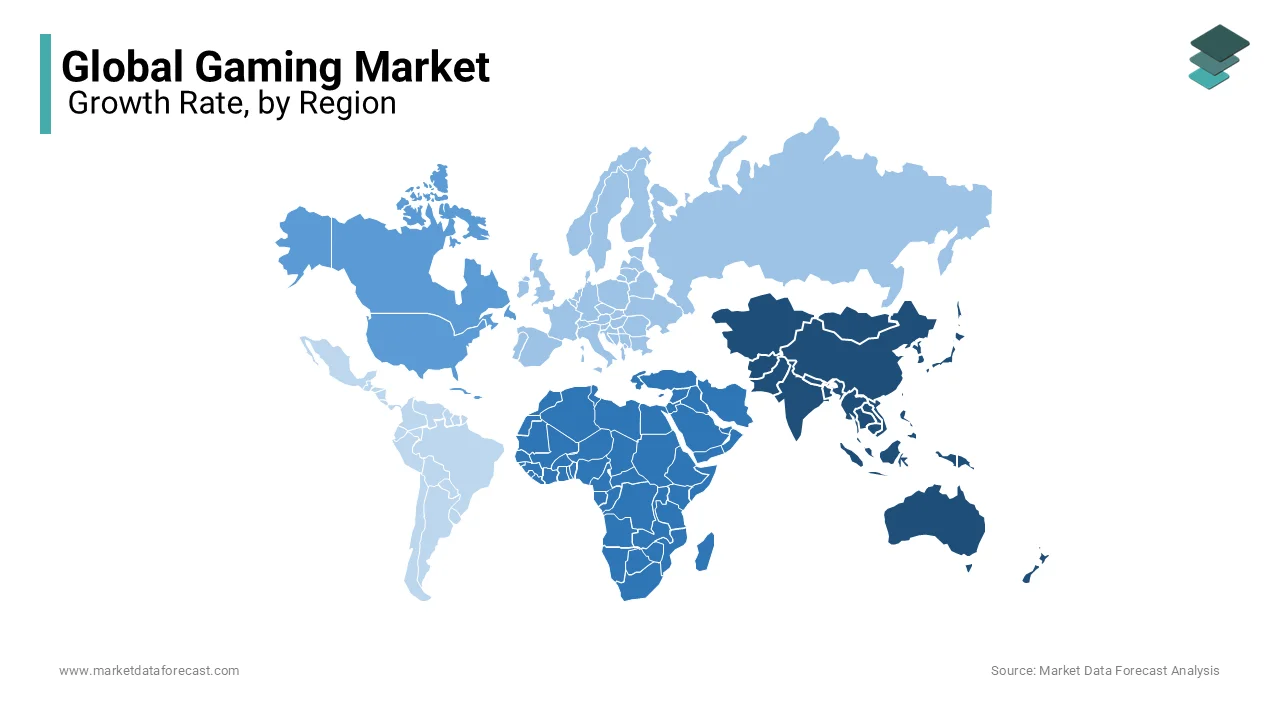

REGIONAL ANALYSIS

The Asia-Pacific region dominating the gaming market worldwide in 2024 by capturing 51.7% of the global market share. Countries like China and Japan, where mobile gaming thrives due to high smartphone penetration and affordable internet access. The International Telecommunication Union (ITU) reports that the Asia-Pacific region accounts for over 50% of global mobile broadband subscriptions, with widespread adoption of smartphones enabling millions to engage in mobile gaming. Additionally, government support for esports and gaming innovation in South Korea and China has bolstered growth. Asia-Pacific's importance lies in its massive consumer base and technological advancements is positioning it as a key driver of global gaming trends.

The Middle East and Africa (MEA) region is the fastest-growing gaming market with a projected Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033. This growth is fueled by rising internet penetration, with the World Bank noting that internet access in Sub-Saharan Africa increased by 40% over the past five years. Mobile gaming dominates with 70% of the region’s gaming revenue due to affordable smartphones and localized content. Governments in the UAE and Saudi Arabia are investing heavily in esports infrastructure by hosting international tournaments that attract global audiences. MEA's rapid growth underscores its potential to become a significant gaming hub by offering untapped opportunities for developers and investors.

North America remains a leader in technological adoption with the U.S. Census Bureau reporting that over 85% of households have access to high-speed internet by enabling widespread engagement in gaming and esports. Europe follows closely, with the European Commission highlighting that 60% of Europeans aged 16-74 engage in digital activities by including gaming with the region’s strong PC gaming culture. Latin America shows significant social and economic progress with fostering greater participation in digital entertainment. The rapid urbanization and digital transformation are creating new opportunities for community building through gaming. These regions collectively demonstrate how advancements in connectivity and digital literacy are shaping diverse societal interactions and cultural exchanges.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global gaming market include Microsoft Corporation (U.S.), Nintendo Co., Ltd (Japan), Rovio Entertainment Corporation (Finland), Nvidia Corporation (U.S.), Valve Corporation (U.S.), PlayJam Ltd (U.K.), Electronic Arts Inc (U.S.), Sony Group Corporation (Japan), Bandai Namco Holdings Inc. (Japan), Tencent Holdings Ltd. (China), and Activision Blizzard, Inc. (U.S.).

The gaming market is characterized by intense competition, driven by rapid technological advancements, shifting consumer preferences, and the growing globalization of entertainment. Key players such as Tencent, Sony, Microsoft, and Nintendo dominate the industry, each leveraging unique strengths to maintain their positions. Tencent leads through its mobile-first strategy and strategic investments in major studios, while Sony and Microsoft compete fiercely in the console space, with Sony excelling in exclusive, narrative-driven titles and Microsoft pioneering cloud gaming through Xbox Cloud Gaming. Nintendo differentiates itself with innovative hardware and family-friendly content, appealing to a broad demographic.

Emerging technologies like virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) have further intensified competition, as companies race to integrate these innovations into their offerings. Cloud gaming has become a battleground, with platforms like NVIDIA’s GeForce Now and Google Stadia challenging traditional hardware-dependent models. Meanwhile, the rise of esports and live-streaming platforms has created new arenas for engagement, attracting significant investment from both established players and startups.

Regional dynamics also shape competition, with Asia-Pacific dominating due to its massive mobile gaming audience, while North America and Europe lead in premium gaming experiences. Smaller companies and indie developers contribute to the competitive landscape by delivering niche, creative content that resonates with specific audiences. This combination of technological innovation, diverse content strategies, and regional focus ensures that the gaming market remains highly dynamic and fiercely contested, offering opportunities for both incumbents and newcomers to carve out their niches.

Top 3 Players in the Market

Tencent Holdings Ltd. (China)

Tencent is the largest player in the global gaming market, with a focus on mobile gaming and strategic investments in major studios. According to the U.S. Department of Commerce, Tencent owns stakes in industry giants like Riot Games ("League of Legends") and Epic Games ("Fortnite"), enabling it to dominate both publishing and distribution. The company’s mobile gaming portfolio includes hits like "Honor of Kings" and "PUBG Mobile”. Tencent’s emphasis on free-to-play models with in-game monetization has set industry standards, generating billions in revenue annually. Tencent’s influence extends beyond gaming into adjacent sectors like esports and live-streaming platforms, making it a cornerstone of the digital entertainment ecosystem.

Sony Group Corporation (Japan)

Sony has cemented its position as a leader in console gaming through its PlayStation brand, which has redefined premium gaming experiences. Sony’s exclusive titles, such as "God of War: Ragnarök" and "Spider-Man: Miles Morales," have received critical acclaim, driving hardware sales and user engagement. Beyond hardware, Sony has embraced subscription-based services like PlayStation Plus, which offers access to a library of games and cloud streaming features. The Federal Communications Commission (FCC) notes that high-speed broadband adoption in developed regions has enabled seamless online gaming experiences, benefiting Sony’s multiplayer and live-service offerings. Additionally, Sony’s investment in virtual reality (VR) through PlayStation VR has positioned it as a pioneer in immersive technologies, further solidifying its role in shaping the future of gaming.

Microsoft Corporation (U.S.)

Microsoft has emerged as a key innovator in both console gaming and cloud-based gaming services. The Federal Communications Commission (FCC) highlights that Xbox Cloud Gaming has expanded accessibility by allowing gamers to stream AAA titles on devices without requiring expensive hardware. Microsoft’s acquisition of Activision Blizzard in 2023, valued at $68.7 billion, underscores its ambition to strengthen its content library and compete in the esports arena. The company’s Game Pass subscription service, which boasts over 25 million subscribers globally, has revolutionized how gamers consume content, offering a Netflix-like model for gaming. By integrating gaming with its broader ecosystem, including Windows PCs and Azure cloud infrastructure, Microsoft continues to push technological boundaries and drive innovation in the gaming industry.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Strategic Acquisitions and Partnerships

Acquisitions and partnerships have been critical for companies seeking to expand their content libraries and strengthen their ecosystems. For example, Microsoft has made significant moves by acquiring major studios like Activision Blizzard, adding iconic franchises to its portfolio and positioning itself as a leader in both gaming and esports. Similarly, Tencent has invested in globally recognized developers such as Riot Games and Epic Games, leveraging their intellectual property to dominate both publishing and distribution. These collaborations allow companies to create synergies across platforms, ensuring they remain competitive in a crowded market.

Technological Innovation and Cloud Gaming

Technological advancements, particularly in cloud gaming, have become a cornerstone for industry leaders. Microsoft has been a pioneer in this space with Xbox Cloud Gaming, enabling users to stream high-quality games on various devices without the need for expensive hardware. Sony has also embraced cloud technology through PlayStation Now, offering gamers access to a vast library of titles via subscription. NVIDIA’s GeForce Now platform further exemplifies this trend, providing low-latency streaming experiences that appeal to gamers in regions with limited access to advanced hardware. By reducing barriers to entry, these innovations attract new audiences and enhance accessibility.

Subscription-Based Models and Monetization

Subscription-based services have emerged as a key strategy for fostering recurring revenue and long-term user retention. Microsoft’s Game Pass and Sony’s PlayStation Plus offer gamers access to extensive libraries of titles for a fixed monthly fee, creating a Netflix-like model for gaming. Tencent has excelled in monetizing free-to-play games through microtransactions and in-game purchases, generating consistent revenue streams while keeping players engaged. These models not only ensure steady cash flow but also encourage deeper integration into the gaming ecosystem.

Expansion into Esports and Live Streaming

Esports and live-streaming platforms have become integral to the gaming landscape, with companies investing heavily in competitive gaming and community-building initiatives. Tencent has capitalized on the popularity of titles like "League of Legends" and "PUBG Mobile," hosting large-scale tournaments that attract millions of viewers. Activision Blizzard has developed the Overwatch League, establishing itself as a leader in professional gaming. Platforms like Twitch and YouTube Gaming have further amplified the reach of live-streamed content, enabling companies to engage with audiences in real-time and build loyal community.

Localization and Regional Focus

To tap into emerging markets, companies have prioritized localization and culturally relevant content. Nintendo has successfully adapted its games for diverse audiences, ensuring widespread appeal across regions. Similarly, Electronic Arts has localized its sports franchises, such as "FIFA," to resonate with regional preferences, driving engagement and sales. By tailoring their offerings to local tastes and preferences, these companies have expanded their global footprint and strengthened their presence in untapped markets

Integration of Virtual Reality (VR) and Augmented Reality (AR)

The integration of VR and AR technologies has allowed companies to differentiate themselves by offering immersive and innovative gaming experiences. Sony has been a leader in VR gaming with PlayStation VR, providing players with highly engaging and interactive gameplay. Valve has also contributed to this space with the Valve Index, catering to enthusiasts seeking cutting-edge VR experiences. By embracing these technologies, companies position themselves at the forefront of next-generation gaming, appealing to tech-savvy audiences and setting new standards for immersion.

RECENT HAPPENINGS IN THE MARKET

- In January 2022, Microsoft Corporation acquired Activision Blizzard, a leading game developer and publisher. This acquisition is anticipated to allow Microsoft to expand its content library with iconic franchises like "Call of Duty" and "World of Warcraft," strengthening its position in the gaming and esports markets.

- In November 2020, Sony Group Corporation launched the PlayStation 5 (PS5), its next-generation gaming console. This launch is anticipated to solidify Sony’s dominance in premium gaming hardware and exclusive titles, enhancing its market presence.

- In December 2015, Tencent Holdings Ltd. acquired full ownership of Riot Games, the developer of "League of Legends." This move is anticipated to strengthen Tencent’s foothold in esports and global gaming markets through control over one of the most popular gaming franchises.

- In February 2020, NVIDIA Corporation launched GeForce Now, its cloud gaming service. This launch is anticipated to democratize access to AAA games by enabling streaming on low-end devices, positioning NVIDIA as a key player in cloud gaming.

- In March 2017, Nintendo Co., Ltd. released the Nintendo Switch, a hybrid gaming console. This release is anticipated to revitalize Nintendo’s market position by offering innovative portability and appealing to a broad audience.

- In April 2022, Epic Games partnered with LEGO Group to create a child-friendly metaverse. This partnership is anticipated to position Epic Games as a leader in safe, family-oriented virtual experiences, expanding its user base beyond "Fortnite."

- In February 2022, Valve Corporation launched the Steam Deck, a handheld gaming PC. This launch is anticipated to challenge traditional consoles by offering gamers flexibility and access to a vast library of PC games, enhancing Valve’s ecosystem.

- In August 2020, Electronic Arts Inc. rebranded and expanded its subscription service to EA Play, offering more titles and platforms. This expansion is anticipated to increase user retention and recurring revenue, aligning with industry trends toward subscription-based models.

- In September 2021, Bandai Namco Holdings Inc. collaborated with ILCA to release remakes of classic titles like "Tales of Arise." This collaboration is anticipated to revitalize interest in Bandai Namco’s legacy franchises, appealing to both nostalgic fans and new players.

- In November 2020, Ubisoft Entertainment launched Ubisoft+ , its subscription service offering access to its entire game library. This launch is anticipated to strengthen Ubisoft’s direct-to-consumer strategy, driving recurring revenue and deeper engagement with its fanbase.

MARKET SEGMENTATION

This research report on the global gaming market is segmented and sub-segmented based on game type, device type, end-user, and region.

By Game Type

- Shooter

- Action

- Sports

- Role Playing

- Others

By Device Type

- PC/MMO

- Tablet

- Mobile Phone

- TV/Console

By End-User

- Male

- Female

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the main platforms driving gaming revenue?

Consoles, PCs, and mobile devices contribute significantly, with mobile gaming generating the highest revenue due to accessibility and free-to-play models.

What is the biggest trend shaping the gaming industry?

Cloud gaming, blockchain-based gaming, and artificial intelligence are major trends, alongside the rise of virtual reality and augmented reality experiences.

What is the future of gaming hardware?

Next-gen consoles, high-performance PCs, and cloud gaming services are evolving, focusing on better graphics, faster load times, and immersive experiences.

What impact does artificial intelligence have on gaming?

AI enhances game development, NPC behavior, procedural content generation, and personalized player experiences, making games more immersive and adaptive.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]