Global Gaming Accessories Market Size, Share, Trends & Growth Forecast Report By Product (Gamepads, Keyboards, Mice, Headsets, Surfaces, Controllers/ Joysticks, Virtual Reality [VR] Devices, Cooling Fans, Web Camera and others), Device Type (PC [Desktop and Laptop], Smartphones and Gaming Consoles), End-Use (Casual Gaming and Professional Gaming), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Gaming Accessories Market Size

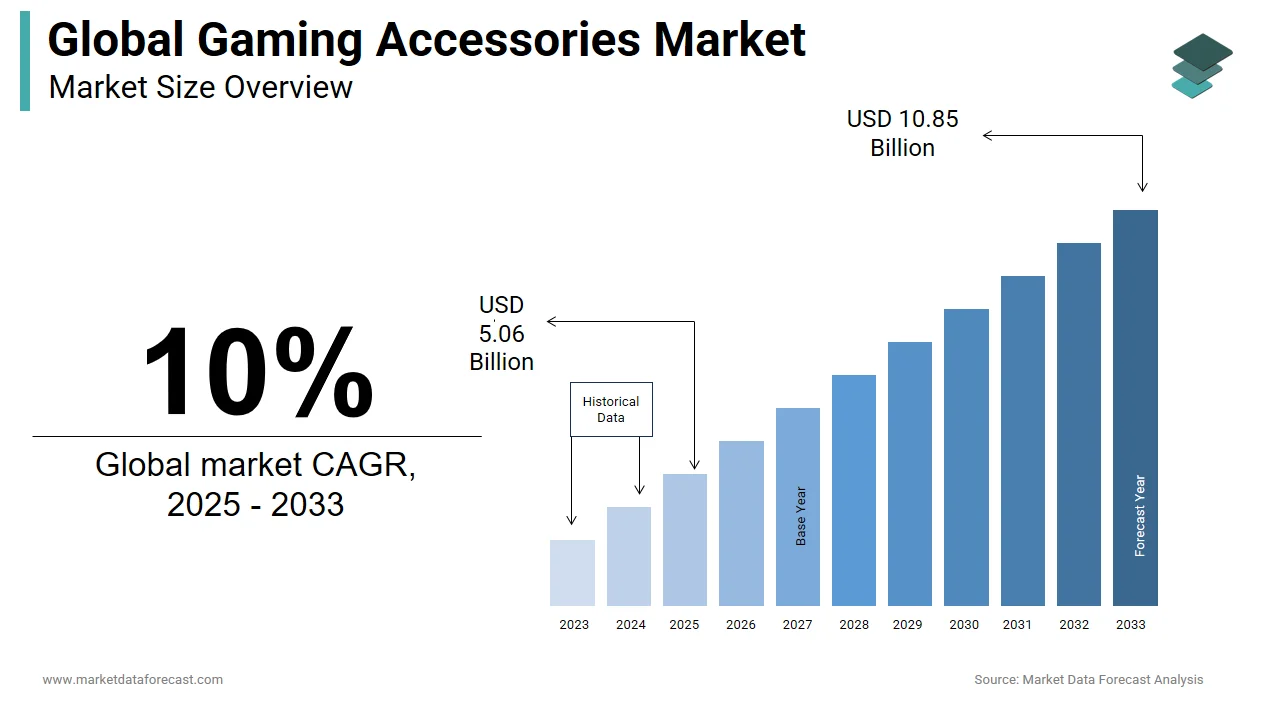

The global gaming accessories market was worth USD 4.6 billion in 2024. The global market is predicted to be USD 5.06 billion in 2025 and is determined to reach USD 10.85 billion by 2033 with a compound annual growth rate (CAGR) of about 10% over the forecast period.

The gaming accessories market has been growing rapidly over the past few years. In the last few years, the Asia Pacific, with its surging population and spending heavily on the production of power, has positioned itself as a crucial region for market players. The emergence of eSports in nations like South Korea and China further accelerated this demand. Moreover, developments in streaming and cloud technology for indie and AAA games, digital distribution, and expanding variety have pushed forward the cloud-based multiplayer gaming industry along with professional Esports tournaments. Presently, games like The Lies of P with 7 million players, Rollerdome with sales of over 1 million, Dragonflight expansion for World of Warcraft with 7.25 million subscribers, etc., have significantly benefited the market.

However, the rise of the market in the first half of 2024 is rather moderate despite the larger quantity of key releases in 2023. This is because of the lack of sufficient usage time. Main buy-to-play launches deflected the customers and broke down the GAAS projects.

MARKET DRIVERS

The gaming accessories market growth is driven by the rising smartphone adoption and the growing demand for VR gaming.

Moreover, developments in Artificial Intelligence (AI) technology are expected to propel the industry forward. Also, the rapid expansion of e-commerce platforms and websites and the surging popularity of online shopping are mainly boosting the expansion of this market. This helps gamers buy a wide range of brands, features, and versions, facilitating their easy finding of accessories as per their gaming requirements and preferences. Another factor contributing to the rising trajectory of the gaming accessories market is the rise of mobile gaming. According to a survey, over 41 billion dollars were spent by mobile gamers in the first half of 2022, and of these, Google Play earned 15.6 billion dollars.

Apart from this, social media platforms have also added to the rise of mobile gaming, providing easy access irrespective of time and place. Additionally, the AR/VR headsets to wireless gamepads have also fuelled the demand for gaming accessories.

MARKET RESTRAINTS

The gaming accessories market growth is derailed by the rising competition for attention, greater capital requirements, high volatility, shortage of skilled laborers, and swift pace of developments that have led to the obsolescence of existing technology. The market growth is hampered by the slump of post-COVID-19 revenue growth in the game sector as customers have headed back to music, TV, movies, books, and other types of in-person and live entertainment. The extremely hyped game launched in 2023 has also been compensated by major cancellations and record-high layoffs in the game accessories market in 2023 and into 2024.

MARKET OPPORTUNITIES

The gaming accessories market is predicted to expand significantly due to the growing Asia Pacific industry and advancements in blockchain and artificial intelligence. In addition, according to industry experts, the market can benefit from investments in gaming-adjacent technology requiring stakeholder support and the development of potential use cases. For instance, Nvidia initiated the development of dedicated graphics processors and AI computing. Apart from this, hyper-casual gaming is rapidly becoming popular and is predicted to provide potential opportunities for market players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Device Type, End Use, and Region, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Alienware (US), Logitech International SA (Switzerland), Razer Inc. (US), Mad Catz (US), Turtle Beach (US), Corsair (US) , Cooler Master (China), Sennheiser (Germany), HyperX (USA), Anker (China), Reddragon (USA), SADES Technological Corporation (China), Plantronics (USA), Google Inc. (USA) and Nintendo Co., Ltd (Japan),Oculus VR, LLC (US), HP Inc. (US), Xiaomi Corporation (China), Dell Inc. (US), AsusTek Computer Inc. (Taiwan) ), Acer Inc. (Taiwan), Sony Corporation (Japan), SteelSeries (Denmark) and Nvidia Corporation (United States) and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The controllers/joysticks segment held the biggest portion of the gaming accessories market share. These have become the common and preferred input devices for online games. Also, Controllers have an extensive appeal across several gaming platforms. Moreover, the market benefited due to its adaptability. Whether connected with gaming consoles, PCs, or even smartphone devices, they offer a similar and standardized way of interaction for gamers. This prevalence adds to their greater adoption and makes sure they satisfy a varied audience, including professional players, casual gamers, and enthusiasts.

On the other hand, the headsets segment is expected to record a higher CAGR in the coming years owing to the immersive audio experience, which will give gamers improved background music, sound effects, and dialogues. Additionally, the keyboard segment captured notable traction and market share. This rise is because of the development of compact-sized keyboards with enhanced response, strength, and foldability, which are less prone to damage caused by extensive use and other factors.

By Device Type Insights

The smartphone segment is anticipated to propel at a faster pace during the estimation period. The growth of mobile gaming has been one of the most substantial trends in the whole gaming industry in the last ten years. Moreover, the segment’s market share grew tremendously because of its accessibility, particularly in developing countries. In the past few years, smartphone ownership has gone up exponentially, especially in India, Brazil, and Indonesia, which are in the top 5 smartphone markets across the world. So, the growth of the segment’s market size can be credited to its extensive availability. Further, as per the study, there are more than 3 billion new gamers as of July 2022, i.e., an increase of 5.3 percent over 2021.

The PC segment is not far behind and is quickly gaining market share. According to industry experts, the combined market revenue in 2024 for gaming laptops and PCs was forecasted to climb to 52 billion US dollars. Moreover, the market size of gaming laptops is bigger than that of PCs. This can be attributed to the developments in processors, graphics cards, and other components that provide high-end gaming performance and experience. Also, the number of PC gamers has steadily surged to around 1855 million or 1.8 billion in 2024.

By End-use Insights

The casual gaming sub-segment dominated this category of the gaming accessories market owing to the rise of hyper-casual games. It is forecasted that hyper-casual gaming will achieve an even higher CAGR in the coming years, providing loads of opportunities for gamers and developers. Moreover, casual games generated the maximum revenue volumes in North America at 60 percent and Europe at 52 percent of all the gaming types. Furthermore, it is highly appropriate for a broad range of platforms, each satisfying varied preferences and lifestyles. Currently, the main audience of casual gaming is people of all age groups and genders.

Meanwhile, the professional gaming segment, or Esports, is a significant challenge for casual gaming. It is believed to continue its growth rate and will not decrease soon. Interestingly, it is estimated that more than 856 million people are communicating with the industry in some way, ultimately making the market healthier than ever before. In addition, its market share is surging due to several factors, from seeing live competitions through Twitch streams to incoming open tournaments between fans and gamers from all sectors of society. Also, hardware producers, technology giants, traveling esports tours worldwide, and more broadcast streams are major growth elements.

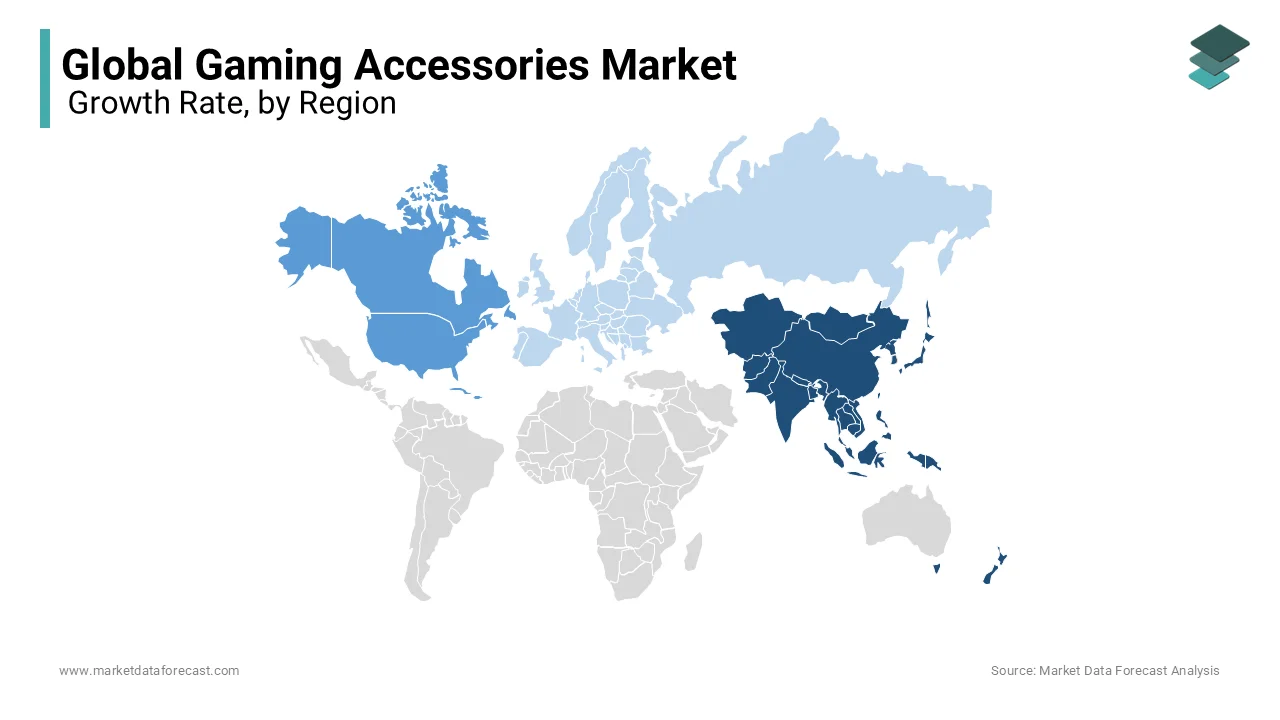

REGIONAL ANALYSIS

Asia Pacific's gaming accessories market is the biggest and fastest-growing industry. The prominent countries that are leading the regional market growth rate are China, India, South Korea, and Japan. The APAC industry is believed to be the largest contributor to the world market during the forecast period. This can be due to the rapidly increasing number of gamers or customer base, frequent technological advancements and product launches, surging collaborations and partnerships, etc. For instance, in December 2023, Vertux, a Taiwan-based lifestyle brand, formally entered the Indian market in collaboration with Amazon to launch gaming headphones, mice, keyboards, mousepads, and other accessories. Besides this, China is one of the major nations, and India is an emerging market due to the rising technological usage.

North America is the most important stakeholder in the gaming accessories market. The region’s market growth is linked to the increasing popularity of Esports and gaming culture, which is leading to greater demand for robust gaming systems and a surge in the sale of PCs. Moreover, technological developments, like superior-performance processors and graphics cards, have enhanced gaming experiences, creating more gamers on the continent. In addition, the modification and personalization choices present in gaming PCs also influence their demand. Besides this, the expansion of online gaming groups and social contact via gaming also boosts this trend.

Europe witnessed significant growth in the gaming accessories market, with approximately 182 billion PC and console games sold in 2023. The regional market also witnessed a rise in the revenue from mobile games of about 7 per cent,t and the leading countries in revenue growth are Lithuania at 29 per cent, Ukraine at 27 per cent, Turkey at 25 per cent, Poland at 21 per cent, and Romania at 18 per cent.

KEY MARKET PLAYERS

Alienware (US), Logitech International SA (Switzerland), Razer Inc. (US), Mad Catz (US), Turtle Beach (US), Corsair (US) , Cooler Master (China), Sennheiser (Germany), HyperX (USA), Anker (China), Reddragon (USA), SADES Technological Corporation (China), Plantronics (USA), Google Inc. (USA) and Nintendo Co., Ltd (Japan). These companies are analyzed based on their geographic presence, origin, product portfolio, key developments, and expertise in laser projection technology.

In addition to the above-mentioned players, Oculus VR, LLC (US), HP Inc. (US), Xiaomi Corporation (China), Dell Inc. (US), AsusTek Computer Inc. (Taiwan) ), Acer Inc. (Taiwan), Sony Corporation (Japan), SteelSeries (Denmark) and Nvidia Corporation (United States) have a significant presence in the global gaming accessories market.

RECENT MARKET HAPPENINGS

- In June 2024, Razer introduced its Razer Viper V3 Pro, which is a high-end wireless gaming mouse. The objective is to provide further enhanced performance in comparison to non-pro versions. Moreover, the company has priced it on the high side at 159.99 dollars, giving head-on competition to the Logitech G PRO X Superlight 2. Apart from this, the Viper V3 comes with Razer Focus Pro 35K Gen 2, a new optical sensor capable of delivering a resolution accuracy of 99.8 percent.

- In January 2024, Vertux introduced a new gaming headset called Sirius in India with a spatial audio experience. It comes with 10 customisable modes for RGB lighting, a high-resolution microphone, and 360-degree surround sound. Further, it also reported that it will be introducing over thirty new gaming products in the coming months to expand its market share and position itself distinctly in India.

- In October 2023, Logitech G, a brand of Logitech, launched the Adaptive Gaming Kit for the Access controller for PS5.

MARKET SEGMENTATION

This research report on the global gaming accessories market has been segmented and sub-segmented based on the product, device type, end-use, and region.

By Product

- gamepads

- keyboards

- mice

- headsets

- surfaces

- controllers/joysticks

- virtual reality (VR) devices

- cooling fans

- webcams

- and others

By Device Type

- PCs (desktops and laptops)

- smartphones

- game consoles

By End-use

- casual games

- professional games

By Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

What are the current trends driving the global gaming accessories market?

The rise of esports, the demand for immersive gaming experiences, and technological advancements like VR and AR are major trends fueling growth in the gaming accessories market.

How are gaming accessory manufacturers addressing sustainability concerns?

Many companies are incorporating eco-friendly materials, reducing packaging waste, and implementing recycling programs to mitigate environmental impact.

What impact does the integration of AI and machine learning have on gaming accessories?

AI-powered features such as adaptive lighting, predictive analytics for gameplay optimization, and personalized settings are enhancing the user experience.

What are the challenges faced by the global gaming accessories market?

Intense competition, counterfeit products, and compatibility issues with rapidly evolving gaming platforms pose challenges for manufacturers and retailers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]