Global Galacto-Oligosaccharides (GOS) Market Size, Share, Trends & Growth Forecast Report - Segmented By Application (Food & Beverages, Dietary Supplements), Product (Syrup, Powder), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Galacto-Oligosaccharides (GOS) Market Size

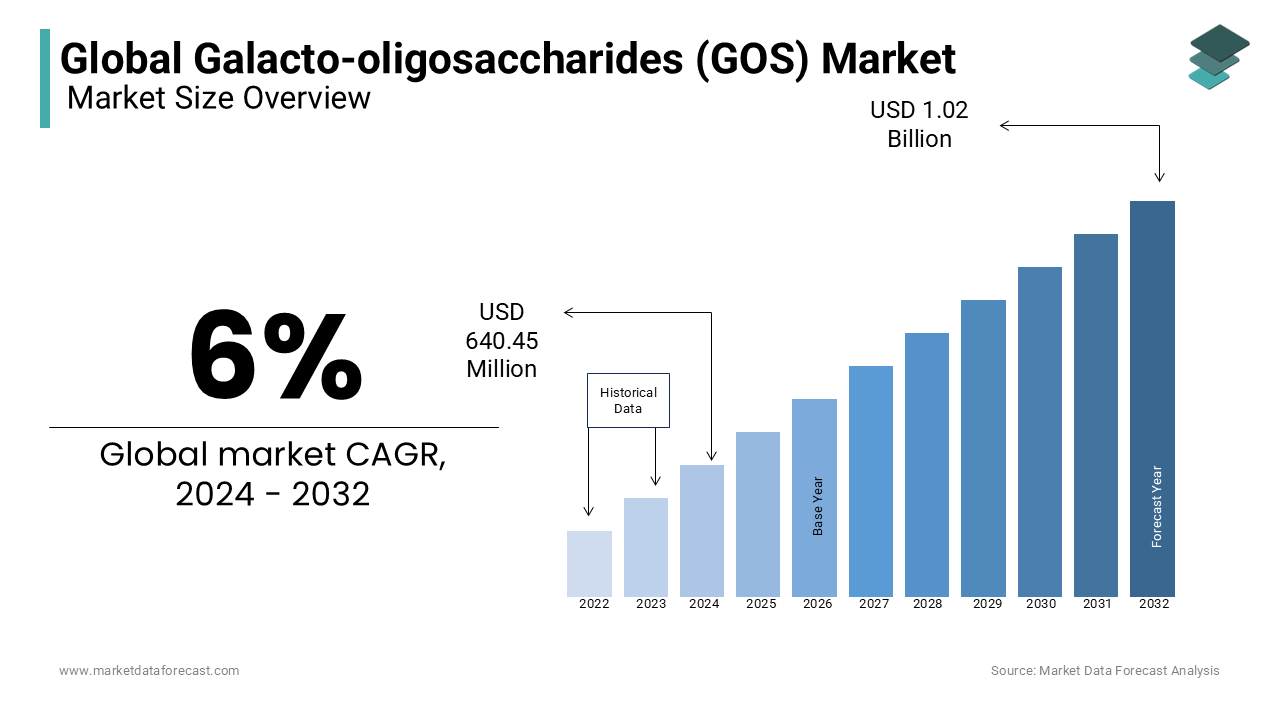

The size of the global galacto-oligosaccharides (GOS) market was expected to be worth USD 640.45 million in 2024 and is anticipated to be worth USD 1.08 billion by 2033 from USD 678.88 million In 2025, growing at a CAGR of 6% during the forecast period.The size of the galacto-oligosaccharide (GOS) market may show significant growth during the same time.

Galacto-oligosaccharides (GOS), also termed as oligo-galactose or trans-galacto-oligosaccharides (TOS) that belong to the group of prebiotics and are non-digestible. It helps hydrolysis by saliva and intestinal digestive enzymes. As the incidence of chronic disease increases worldwide, the rate of Galacto-oligosaccharides consumption has increased. GOS is very stable over a wide temperature range, making it easy to use in a variety of applications. Furthermore, it is suitable for use in diabetics due to the low calorific value of the product. Galacto-oligosaccharides (GOS) is gaining significant absorption in the infant nutrition industry due to its positive perception of the therapeutic effects on gut health and immune development. The increase in lactose intolerance populations continues to challenge policy makers. The availability of plant galacto oligosaccharides have been shown to be highly beneficial in meeting the nutritional requirements of lactose intolerant populations. The infant nutrition industry will strive to take advantage of the opportunities offered by the marketing of Galacto-oligosaccharides (GOS).

MARKET DRIVERS

The market for galacto oligosaccharides (GOS) is expected to grow significantly during the forecast period as interest in the quality of food and beverages increases.

It is a colorless, water soluble substance that prolongs shelf life by reducing microbial contamination. Market growth increased as product demand and consumer awareness of healthy eating habits increased. The tremendous benefits GOS offers include improving digestive health for middle-aged and older consumers and increasing consumption of low-fat products that increase demand during the prediction period. The growth of the food and beverage industry due to changes in eating habits, taste preferences and increased consumption of fast food may promote the overall growth of the market. The increased use of galacto oligosaccharides in processed and functional foods can lead to increased demand for products. GOS is increasingly used as a low-calorie sweetener in confectionery, beverages, dairy products, and bread. The presence of nutrients similar to breast milk allows them to be used in infant formulas, which ultimately drives growth.

However, market growth slows due to a variety of factors. Among them, the presence and preference of ingredients is increasing. For example, prebiotics like oligosaccharide isomalt (IMO), which exhibit similar functionality, can be used as a substitute for GOS. Isomalt Oligosaccharides (IMO) are digestion resistant oligosaccharides present in grains such as wheat, barley, corn, pulse, oats, tapioca, rice, potatoes, and other sources of starch. IMO can also be artificially derived with starch. Galacto-oligosaccharides are rapidly increasing in terms of adoption rates in the infant nutrition sector worldwide due to awareness of the therapeutic effects on immunity and intestinal health. Consequently, the development of plant-based Galacto-oligosaccharides has been shown to be effective in meeting the nutritional requirements of lactose-intolerant populations. This trend is also further anticipated to improve the marketing of infant nutrition items. Also, the rise in demand for liquid and powdered GOS is determined to support growth in the foreseen years. New entrants in the market are expected to rise as large R&D investments expand. Leading companies in this industry have improved their production capabilities to fulfill the augmenting demand. However, continued investment from developing countries and plans to expand the GOS market, adoption of galacto oligosaccharides (GOS) in food, and consumer awareness of healthy eating are expected to strengthen the market for galacto oligosaccharides (GOS) during the anticipated period.

MARKET RESTRAINTS

On the other hand, as the incidence of lactose intolerance increases, the use of galacto-oligosaccharides is limited. Expensive GOS products and excessive consumption can limit market growth by causing health problems such as intestinal gas and noise, stomach cramps, bloating, and diarrhea.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6% |

|

Segments Covered |

By Application, Product, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yakult Pharmaceutical Industry Co. Ltd., Samyang Genex Co, Nissin Sugar Production Co. Ltd, Taiwan Fructose Co. Ltd, Friesland Campina and Others. |

SEGMENTAL ANALYSIS

Global Galacto-Oligosaccharides (GOS) Market By Application

The food and beverages segment holds the highest share of the galacto-oligosaccharides (GOS) market. The launch of various food products according to people’s preference for dietary options is solely responsible for the use of this in various recipes. Adding high-fiber content food products to a regular diet is highly important to maintain balanced health, which is substantially leveraging the growth rate of the market. Consumers have preferred convenience foods like pastries, soups, and others in recent times, and companies are taking advantage of this by promoting the use of dietary ingredients like galacto-oligosaccharides. This attribute shall quietly surge the growth rate of the market.

The dietary supplements segment is solely to hit the highest CAGR by the end of 2032. Stringent rules and regulations by the government to only launch high-standard dietary supplements using these ingredients are all set to elevate the growth rate of the market. For instance, the Chinese Food and Drug Administration posed stringent rules and regulations to follow standards in dietary supplements to ensure the safety of the public. The rising awareness among people over the benefits of taking supplements is additionally to boost the growth rate of the market.

Global Galacto-Oligosaccharides (GOS) Market By Product

The syrup segment is dominating the highest share of the market, whereas the powder segment is esteemed to have significant growth opportunities throughout the forecast period. The rising number of research and development activities in the F&B industry, along with the rapid expansion of the scale in many countries, is anticipated to elevate the growth rate of the market. In addition to these factors, the constantly rising number of lactose intolerant people and the trend towards plant-based dietary options are set to fuel the growth rate of the market.

REGIONAL ANALYSIS

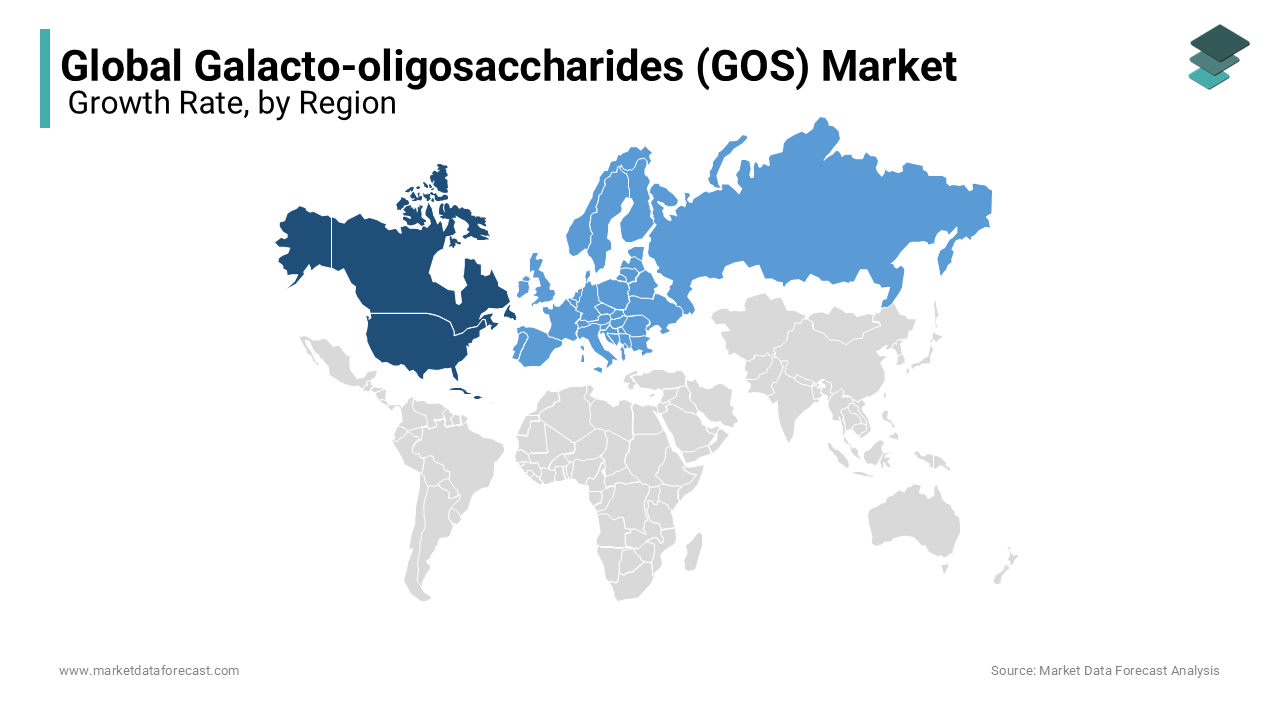

North America, fueled by market demand for galacto-oligosaccharides in Canada, Mexico, and the United States, will record significant growth by 2025. Increased health awareness and increased disposable incomes are driving increased demand for infant formula and baby food. The increasing number of women working in regions that prefer ready-made formulas and have an increasing tendency to adopt organic baby food is a major driver of growth in the regional market. The size of the European galacto-oligosaccharides market, led by Spain, the United Kingdom, Italy, France and Germany, will show significant growth during the predictable period. Increased consumer health awareness and a willingness to increase dietary supplements can promote product growth.

The European dietary supplement market may exceed $ 25 billion by 2025. In addition, an increase in the elderly population in the region leads to a regional demand for GOS, which may increase the demand for various dietary supplements because it suffers from a variety of age-related diseases and suffers from malnutrition due to a dietary disorder that occurs in old age. The Asia Pacific region, driven by the size of the galacto-oligosaccharides market in India, Japan and China, will show significant growth during the outlook period. Increased consumer awareness of the nutritional value of dairy products and the high consumption of dairy products may lead to further growth in local markets as demand for dairy products increases. India's dairy sector is expected to exceed $150 billion by 2025. Additionally, consumers, especially the younger generation for new flavors and their preference for dairy protein, can influence dairy innovation, fueling the growth of the local business.

KEY PLAYERS IN THE GLOBAL GALACTO-OLIGOSACCHARIDES (GOS) MARKET

Major key players in the global galacto-oligosaccharides (gos) market are Yakult Pharmaceutical Industry Co. Ltd., Samyang Genex Co, Nissin Sugar Production Co. Ltd, Taiwan Fructose Co. Ltd, Friesland Campina and Others.

RECENT HAPPENINGS IN THE MARKET

- King-Prebiotics recently introduced GOS-570-S, a galacto-oligosaccharide (GAC) product with 57% liquid syrup. It can be used in the food and beverage industry to produce liquid milk, dairy products, powdered formulas, dietary supplements, and beverages.

- Yakult Pharmaceutical industry Co., a market leader in galacto-oligosaccharides, competes to expand its services in a variety of countries such as China, Vietnam, the United States, Brazil, India, Mexico, Myanmar and the Middle East.

- Royal Friesland Campina N.V., a leading player in the Galacto oligosaccharide market, has started a new unit for Vivinal GOS in Borculo, The Netherlands, to respond to the increasing demand for high-quality ingredients in infant nutrition.

DETAILED SEGMENTATION OF THE GLOBAL GALACTO-OLIGOSACCHARIDES (GOS) MARKET INCLUDED IN THIS REPORT

This research report on the global galacto-oligosaccharides (GOS) market has been segmented and sub-segmented based on application, Product and region.

By Application

- Food & Beverages

- Dietary Supplements

By Product

- Syrup

- Powder

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the main drivers of the GOS Market?

Key drivers include increasing consumer awareness of gut health and prebiotics, rising demand for functional foods and beverages, growing use of GOS in infant nutrition, and expanding research on the health benefits of prebiotics.

2. What challenges does the GOS Market face?

Challenges include high production costs, competition from other prebiotics and dietary fibers, regulatory hurdles, and potential supply chain disruptions.

3. What are the current trends in the GOS Market?

Current trends include the increasing use of GOS in personalized nutrition, the rise of clean-label and natural products, growing incorporation of GOS in plant-based and vegan foods, and the development of GOS-enriched products targeting specific health issues like digestive health and immunity.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]