Global Functional Mushrooms Market Size, Share, Trends & Growth Forecast Report Segmented By Ingredient (Carotenoids, Dietary Fibers, Fatty Acids, Minerals, Prebiotics & Probiotics, Vitamins, Others), Product, Application, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Functional Mushrooms Market Size

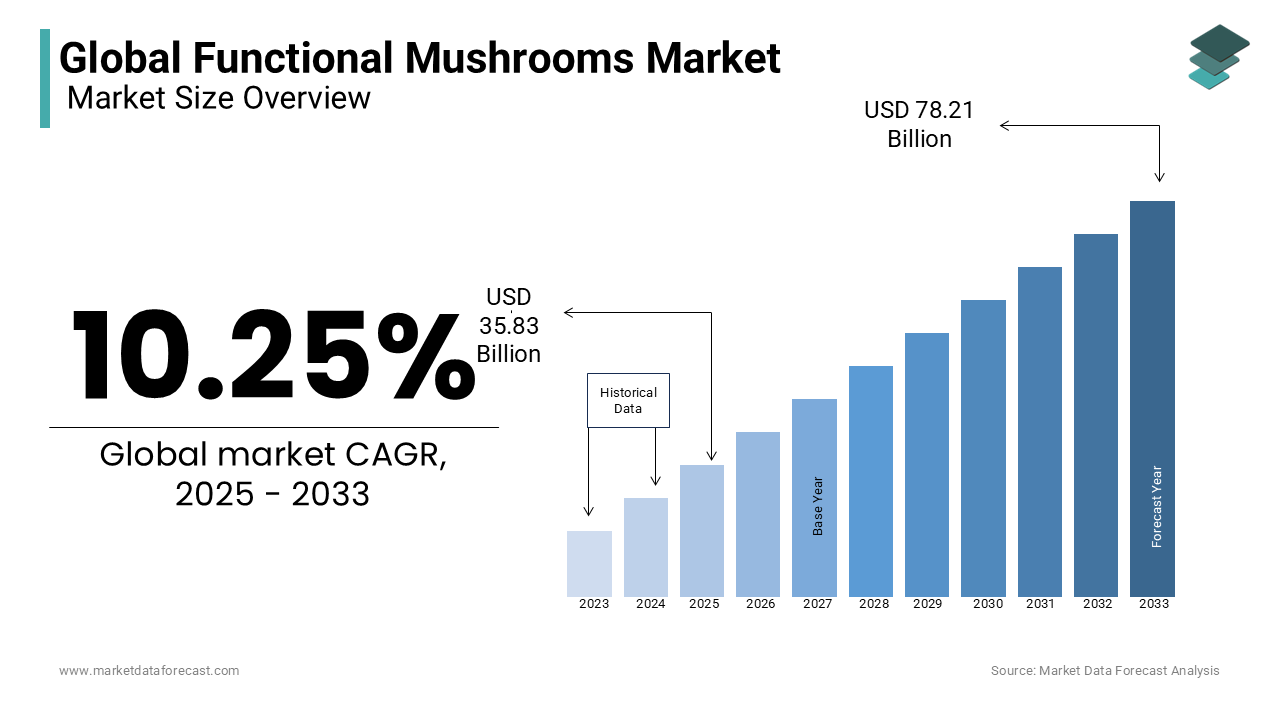

The global functional mushrooms market size was calculated to be USD 32.50 billion in 2024 and is anticipated to be worth USD 78.21 billion by 2033 from USD 35.83 billion In 2025, growing at a CAGR of 10.25% during the forecast period.

Functional mushrooms are increasingly recognized for their adaptogenic properties, enhancing immunity, cognitive function, and stress management. According to the National Institutes of Health, lion’s mane can stimulate the production of nerve growth factor (NGF) which supports brain health and may aid in preventing neurodegenerative diseases. The global demand for functional mushrooms is bolstered by the rise of holistic wellness trends and plant-based nutrition. For example, cordyceps are popular for their role in boosting energy and endurance by making them a preferred supplement among athletes. Functional mushrooms are incorporated into dietary supplements, coffee blends, and skincare products, reflecting their versatility. According to Nutrition Business Journal in 2024, 37% of consumers reported consuming functional mushroom-infused foods and beverages, while 27% used functional mushroom supplements.

MARKET DRIVERS

Increasing Consumer Focus on Holistic Wellness

The rising demand for holistic health solutions significantly drives the functional mushrooms market. Consumers are increasingly seeking natural remedies to enhance immunity, mental clarity, and energy levels. According to a 2023 survey by the Global Wellness Institute, 68% of respondents preferred plant-based supplements over synthetic ones. Functional mushrooms such as reishi and chaga are prized for their adaptogenic properties which help the body manage stress and inflammation. Their integration into products like teas, coffees, and powders reflects their growing popularity as accessible wellness enhancers, supporting preventative healthcare trends.

Growth of Plant-Based and Sustainable Nutrition

The plant-based nutrition trend bolsters the adoption of functional mushrooms, which are eco-friendly and nutrient-dense. Mushrooms can be cultivated on agricultural by-products by reducing food waste and environmental impact. Cordyceps, for instance, are popular among athletes for enhancing stamina, while shiitake mushrooms provide a natural source of vitamin D. Research shows that mushrooms require 80% less water and emit significantly fewer greenhouse gases compared to conventional protein sources by aligning with sustainability goals. This dual benefit of health and eco-friendliness strengthens their appeal across consumer segments.

MARKET RESTRAINTS

Lack of Consumer Awareness and Misconceptions

Despite growing interest, limited consumer awareness about the benefits and applications of functional mushrooms remains a significant restraint. A 2023 survey by the Nutrition Business Journal revealed that 34% of consumers were unfamiliar with functional mushrooms like lion’s mane and cordyceps. Additionally, some consumers associate mushrooms solely with culinary use or psychedelic varieties which creates misconceptions. This knowledge gap hinders adoption, especially in emerging markets. Effective educational campaigns and transparent labeling are necessary to build trust and familiarity by allowing the market to reach its full potential.

High Costs and Limited Supply Chain Infrastructure

The cultivation and processing of functional mushrooms involve specialized techniques are leading to higher production costs. Mushrooms like reishi and cordyceps require controlled environments for optimal growth. For instance, cordyceps cultivation costs are 20–30% higher than conventional crops due to labor-intensive farming practices. Additionally, limited supply chain infrastructure in developing regions hampers the availability of premium-quality mushrooms which affects market penetration. These challenges make functional mushrooms less accessible to cost-sensitive consumers by restricting broader adoption.

MARKET OPPORTUNITIES

Integration into the Skincare Industry

Functional mushrooms are gaining traction in the beauty sector due to their anti-inflammatory and antioxidant properties. Ingredients like chaga and reishi are being incorporated into skincare formulations to combat aging and enhance skin hydration. Studies in 2023 revealed that 40% of consumers prefer natural ingredients in their skincare products which drives demand for mushroom-based solutions. For instance, chaga is rich in melanin and helps protect the skin from UV damage, while reishi supports collagen production. The expanding natural cosmetics provides a significant growth opportunity for functional mushroom-based innovations in beauty and personal care products.

Advancements in Extraction and Processing Technologies

Emerging technologies in mushroom extraction, such as dual extraction and fermentation are enabling the production of highly concentrated and bioavailable compounds. These advancements enhance the efficacy of mushroom-based supplements and functional foods. For example, polysaccharide and beta-glucan extraction techniques improve the immune-boosting properties of mushrooms like turkey tail. A 2023 report by the Food Technology Institute found that advanced extraction methods increased active ingredient yield by 35% to reduce production waste. Such innovations provide opportunities for manufacturers to create premium products that meet consumer demands for potency and sustainability.

MARKET CHALLENGES

Regulatory Complexity Across Regions

The functional mushrooms market faces challenges due to varying regulations across countries. While some regions classify mushrooms like reishi as food supplements, others consider them as herbal medicines which require additional approvals. For example, the European Food Safety Authority (EFSA) mandates rigorous testing for health claims that delays product launches by 12–18 months on average. These regulatory inconsistencies increase compliance costs for manufacturers and complicate global market entry. Ensuring uniform standards and clear labeling practices is critical for overcoming this barrier and fostering market growth.

Sustainability and Overharvesting Concerns

The rising demand for wild-harvested mushrooms like chaga and cordyceps is raising concerns about sustainability. Overharvesting disrupts natural ecosystems, threatening the long-term availability of these resources. A 2023 environmental study highlighted that 20% of wild mushroom species face habitat degradation due to unsustainable harvesting practices. Cultivating functional mushrooms in controlled environments offers a solution but requires significant investment in infrastructure. Balancing market demand with environmental preservation poses an ongoing challenge, necessitating responsible sourcing and innovative farming methods.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.25% |

|

Segments Covered |

By Ingredient, Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hokkaido Reishi Co., Ltd., Half Hill Farm, Inc., MONAGHAN MUSHROOMS LTD., Nammex (North American Medicinal Mushroom Extracts), Real Mushrooms, New Roots Herbal, Inc., Hawlik Gesundheitsprodukte GmbH, Organic Mushroom Nutrition (OM Mushroom Superfood), Aloha Medicinals, Inc., M2 Ingredients |

SEGMENTAL ANALYSIS

By Ingredient Insights

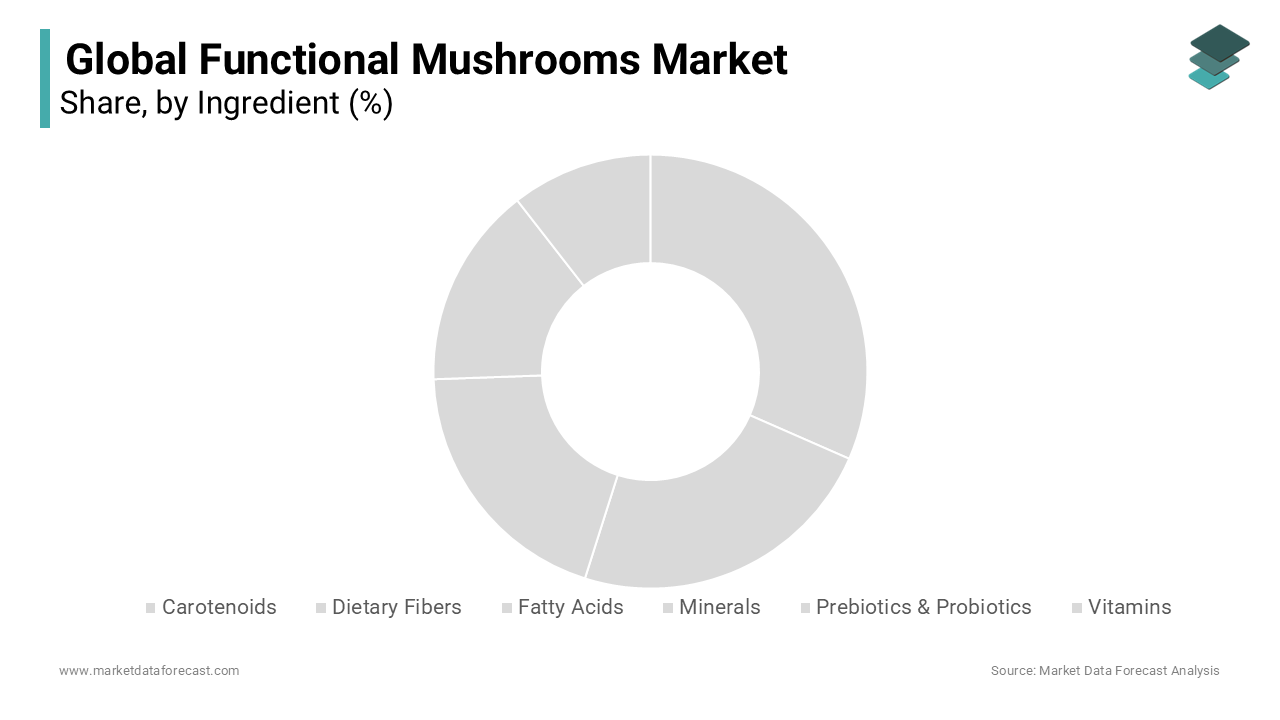

The prebiotics and probiotics segment dominated the functional foods market by holding 61.5% of share in 2024. Probiotics, defined as live microorganisms that, when consumed in adequate amounts, provide health advantages, are vital for maintaining gut health, supporting digestion, and improving nutrient absorption. According to the National Institutes of Health (NIH), probiotics also help prevent antibiotic-related diarrhea and enhance immune responses, potentially reducing respiratory infections.

On the other hand, the vitamins segment is steadily growing with an expected CAGR of 7.5% during the forecast period. Increasing health awareness and the shift toward preventive healthcare are accounted in fostering the growth rate of this segment. In 2020, U.S. dietary supplement sales reached USD 55.7 billion, with vitamins accounting for a significant share. Multivitamins remain the most commonly used dietary supplements among adults, as noted by the NIH, helping to address nutritional deficiencies and prevent chronic diseases. Product innovation, such as vitamin gummies and fortified foods, caters to consumer demand for convenient and palatable options.

By Product Insights

The bakery & cereals segment holds 38% of share in the functional food products market which is driven by their widespread consumption as staple items and the increasing demand for fortified products. Functional bakery products, such as whole grain bread enriched with omega-3 fatty acids or cereals fortified with vitamins and minerals, cater to health-conscious consumers seeking better nutrition. According to National Institute of Health, 45% of consumers prefer fortified cereals for breakfast due to their convenience and nutritional benefits. The versatility of bakery and cereal products for functional ingredient incorporation ensures their dominance in the market.

The dairy products segment is likely to witness a compound annual growth rate (CAGR) of 6.8% from 2025 to 2033. This growth is fueled by the increasing popularity of functional dairy items such as probiotics-rich yogurt, calcium-fortified milk, and protein-enriched cheese. According to Frontiers in Microbiology, 60% of consumers associate yogurt with gut health benefits, driving demand for probiotics-enriched options. The rise in lactose-free and plant-based alternatives, incorporating functional ingredients like prebiotics and vitamins that further accelerates the segment’s growth by catering to diverse dietary preferences and health trends.

By Application Insights

The digestive health segment held 40.6% of global market share in 2024. Increasing consumer awareness of gut health's importance to overall wellness is specifically to enhance the growth rate of the market. Functional ingredients like prebiotics, probiotics, and fiber-rich mushrooms such as chaga and turkey tail play a key role in improving gut microbiota. A 2023 survey by the International Probiotics Association indicated that 60% of consumers prioritize digestive health when choosing functional foods. The integration of functional mushrooms into teas, powders, and supplements addressing gut health solidifies this segment's dominance due to their effectiveness in improving nutrient absorption and reducing gastrointestinal issues.

The immunity segment is projected to grow at the fastest rate, with a compound annual growth rate (CAGR) of 7.5% from 2025 to 2033. This growth is fueled by the increasing demand for natural immune-boosting solutions, particularly following the COVID-19 pandemic. Functional mushrooms like reishi, cordyceps, and shiitake are rich in beta-glucans, which enhance immune system function. The regular consumption of beta-glucans can reduce infection rates by 25%, driving consumer trust in these products. The rise in fortified foods and supplements targeting immune health further propels this segment's rapid expansion.

REGIONAL ANALYSIS

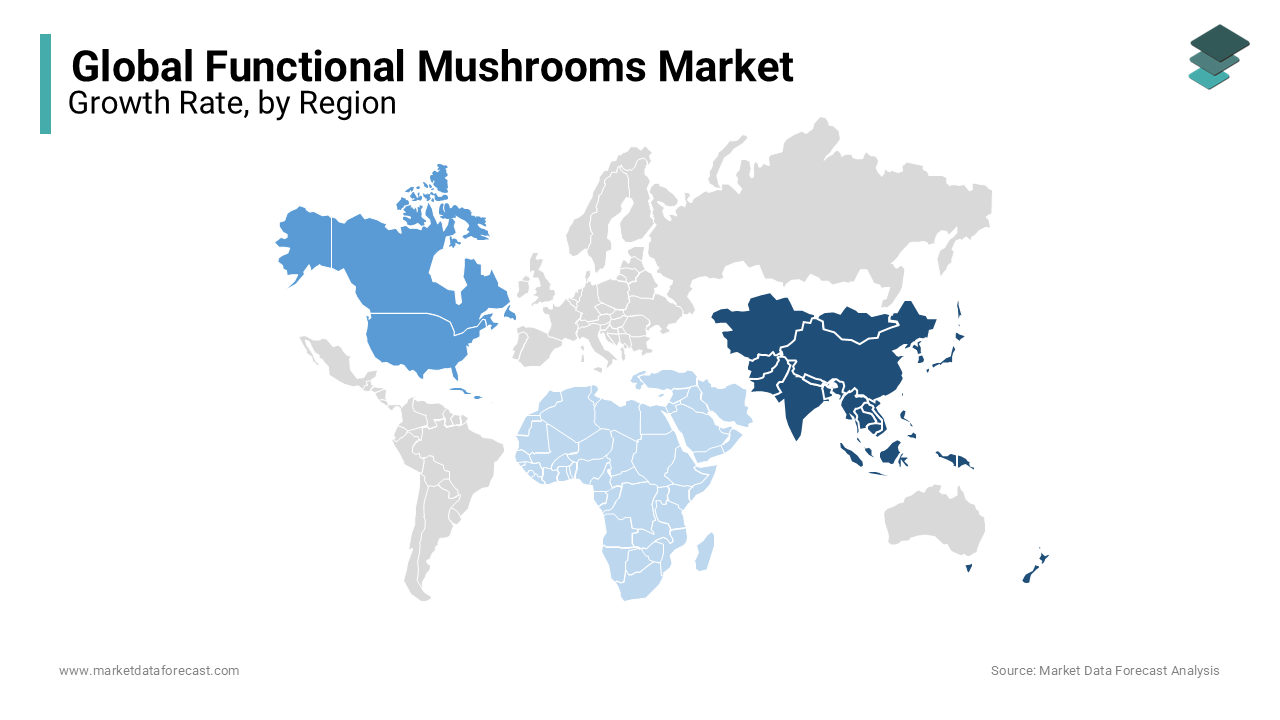

Asia-Pacific is dominating the market with substantial share of 51.66% in 2024. This region’s dominance is primarily due to China's significant production capacity. According to the Food and Agriculture Organization (FAO) of the United Nations, China is the world's largest producer of mushrooms, accounting for over 75% of global output. The widespread consumption of functional mushrooms in traditional diets and medicine contributes to the region's leading market share. The market is expected to continue its robust growth, driven by increasing consumer awareness of health benefits associated with functional mushrooms.

North America: The market is projected to grow at a compound annual growth rate (CAGR) exceeding 12% from 2025 to 2033. Rising health consciousness and a preference for natural supplements is majorly propelling the growth rate of the market in this region. The U.S. Department of Agriculture (USDA) reports that mushroom production in the United States was approximately 375 million kilograms in 2019. Although production has seen a decline, demand remains strong, leading to increased imports and higher market prices.

Europe is emerging to exhibit a CAGR of 8.7% during the forecast period. The region has witnessed increasing adoption of mushroom-based health products, especially in countries like Germany and the United Kingdom, where consumers show strong interest in sustainable and natural remedies. Functional mushrooms are becoming increasingly popular in dietary supplements, beverages, and skincare products, driven by a focus on holistic health and environmental consciousness. Germany’s preference for high-quality, natural supplements and the UK's embrace of mushroom-infused coffee and tea products underline Europe’s growing role in the market.

Latin America functional mushroom market is attributed in holding a CAGR of 11.4% during the forecast period with growing consumer awareness and adoption. The region shows steady growth with the rising disposable incomes and an expanding middle class. Brazil and Argentina are leading the way with increasing demand for Reishi and Cordyceps mushrooms in health and wellness applications. The region’s potential lies in the growing inclination toward natural and plant-based health solutions by positioning it as a future growth area within the global functional mushroom market.

Middle East and Africa: The Middle East and Africa region is expected to witness a CAGR of 8% in the functional mushrooms market. Urbanization, increasing disposable incomes, and a rising focus on health and wellness are driving demand for these products. While the region currently holds a small share of the global market, countries like South Africa and the UAE are emerging as key contributors. South Africa, in particular, shows growing interest in natural remedies and wellness products, while the UAE's emphasis on premium health products is expected to drive further growth. The region is positioned for gradual expansion in the coming years as consumer awareness increases.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the global functional mushrooms market include Hokkaido Reishi Co., Ltd., Half Hill Farm, Inc., MONAGHAN MUSHROOMS LTD., Nammex (North American Medicinal Mushroom Extracts), Real Mushrooms, New Roots Herbal, Inc., Hawlik Gesundheitsprodukte GmbH, Organic Mushroom Nutrition (OM Mushroom Superfood), Aloha Medicinals, Inc., M2 Ingredients

The functional mushrooms market is highly competitive, driven by increasing consumer demand for natural health supplements and food products. Key players such as Nammex, Hokkaido Reishi Co., and MONAGHAN MUSHROOMS dominate the market with extensive product portfolios and global distribution networks. These companies focus on leveraging traditional knowledge of mushrooms like reishi, lion’s mane, and chaga, while integrating modern extraction and processing technologies to ensure high-quality offerings.

Innovation is a key competitive strategy. Companies like Real Mushrooms and OM Mushroom Superfood are expanding their product lines to include functional beverages, dietary supplements, and skincare products. The use of advanced extraction techniques, such as dual-extraction methods, enhances the bioavailability of active compounds, providing a competitive edge.

The market also sees significant activity from regional and niche players who focus on organic and sustainable cultivation practices to appeal to environmentally conscious consumers. For instance, Aloha Medicinals emphasizes eco-friendly production and traceability, addressing rising concerns over sustainability.

Collaboration with research institutions for clinical trials and product development further strengthens market positions. With rising demand and growing consumer awareness, competition is expected to intensify, particularly in the dietary supplements and functional beverages sectors, where innovation and branding play critical roles.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, Mushrooms Inc. filed a non-provisional patent titled "METHOD OF GENERATING MULTIFUNCTIONAL MYCELIUM PRODUCTS." This patent marks a significant advancement in bacterial detection and nutrient delivery, strengthening Mushrooms Inc.'s position in the functional mushrooms market.

- In February 2022, Optima Health Corp. launched an e-commerce platform to offer functional mushroom supplements to Canadian consumers. This initiative aimed to meet growing demand by providing greater accessibility to their products online.

MARKET SEGMENTATION

This research report on the global functional mushrooms market has been segmented and sub-segmented based on ingredient, product, application, and region.

By Ingredient

- Carotenoids

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Vitamins

- Others

By Product

- Bakery & Cereals

- Dairy Products

- Meat, Fish & Eggs

- Soy Products

- Fats & Oils

- Others

By Application

- Sports Nutrition

- Weight Management

- Immunity

- Digestive Health

- Clinical Nutrition

- Cardio Health

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the major applications of functional mushrooms?

They are used in dietary supplements, beverages (tea, coffee), food products, cosmetics, and pharmaceuticals.

2. How is the demand for functional mushrooms growing globally?

Increasing consumer interest in natural health solutions, plant-based nutrition, and immune-boosting foods is driving market expansion.

3. Which industries are driving the functional mushrooms market?

The food and beverage, nutraceuticals, pharmaceuticals, and cosmetics industries are key players in market growth.

4. Who are the key consumers of functional mushrooms?

Health-conscious individuals, athletes, wellness enthusiasts, and people seeking natural remedies for immunity and cognitive health.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]