Global Fruits and Vegetables Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Fruits, Vegetables), Type, Distribution Channel, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Fruits and Vegetables Market Size

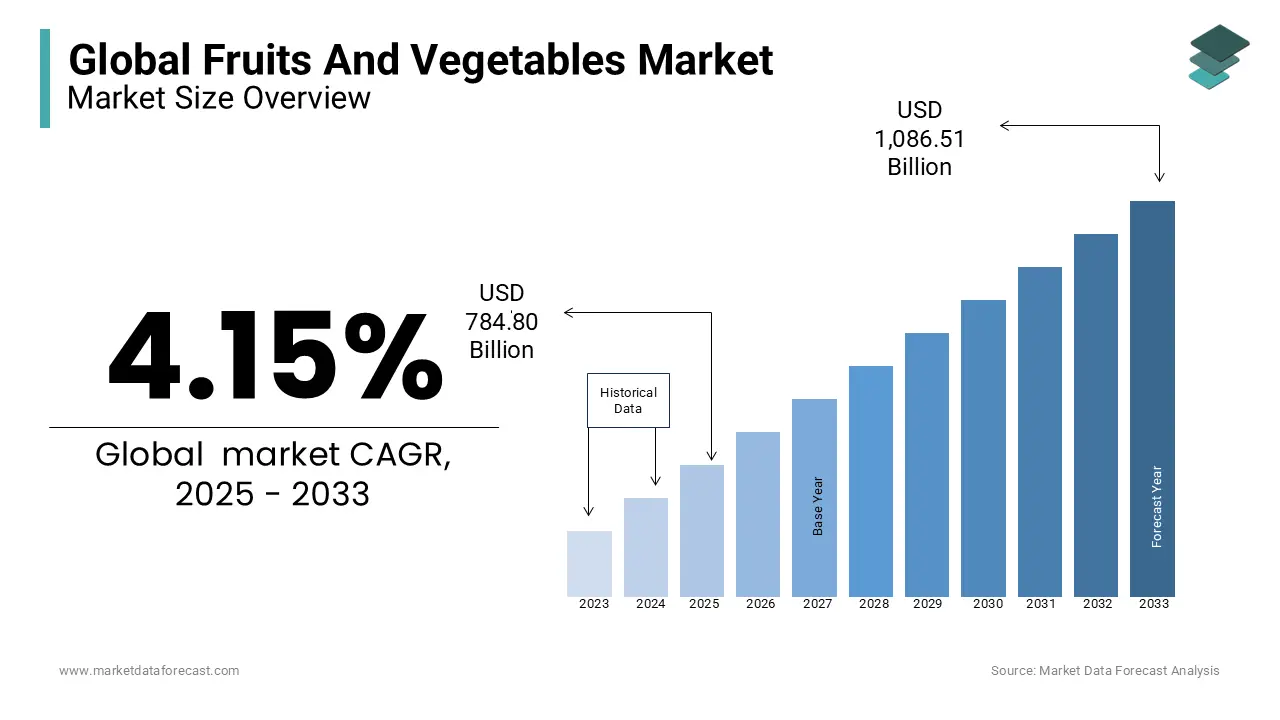

The global fruits and vegetables market size was calculated to be USD 753.53 billion in 2024 and is anticipated to be worth USD 1,086.51 billion by 2033 from USD 784.80 billion In 2025, growing at a CAGR of 4.15% during the forecast period.

In the United States, sales of organic food products reached $52.0 billion in 2021. Fresh fruits and vegetables accounted for $19.2 billion of these sales representing 40% of the total organic food market, as reported by the USDA's Economic Research Service. Technological advancements are playing a critical role in improving supply chain efficiency. For example, the U.S. Department of Agriculture (USDA) has expanded the availability of market information on organic products including production and marketing data to aid industry growth. This initiative is supported by AMS USDA ensures better access to resources for stakeholders. Online grocery platforms are reshaping consumer access to fresh produce. The USDA's Economic Research Service reports that 55.6% of organic food sales in 2021 were facilitated through conventional grocery retailers including online vendors, signaling a shift in purchasing behaviors.

MARKET DRIVERS

Rising Consumer Demand for Health and Wellness

Consumers are increasingly prioritizing health and wellness which has resulted in a growing demand for fresh produce. In the United States, per capita availability of vegetables and pulses averaged 414 pounds from 2017 to 2022. While this shows a slight decrease compared to the previous decade it demonstrates the continued importance of fresh produce in the American diet. The USDA Economic Research Service underscores that this trend reflects a sustained emphasis on fruits and vegetables as essential components of a balanced diet contributing to overall health and wellness.

Expansion of International Trade

Global trade has profoundly influenced the fruits and vegetables market expanding opportunities for producers and consumers alike. In 2021, U.S. fresh fruit and vegetable exports totaled $7.2 billion representing a 4% increase from the prior year. Canada emerged as the leading export destination accounting for 52% of these exports valued at $3.7 billion. This growth highlights the increasing globalization of the market and the rising demand for year-round access to diverse and high-quality produce. The USDA Foreign Agricultural Service emphasizes that such trade dynamics strengthen international market linkages and drive the sector's growth.

MARKET RESTRAINTS

Price Volatility and Economic Uncertainty

The fruits and vegetables market experiences significant price fluctuations driven by factors such as unpredictable weather patterns pest outbreaks and shifts in consumer preferences. According to the USDA's, Economic Research Service vegetables show a price variation over 20 times higher than grains used for feed. This level of volatility creates financial instability for producers making it difficult to plan and invest in future production effectively. When market prices drop below production costs growers often face losses and may choose not to harvest their crops entirely. This situation contributes to increased food waste at the farm level affecting overall supply chain stability and market sustainability. Addressing this challenge requires implementing risk mitigation strategies such as improved crop insurance and enhanced predictive models for market trends. These measures can help stabilize incomes for producers and reduce waste ensuring a more consistent supply of fresh produce for consumers.

Labour Costs and Availability

Labor costs and availability are essential factors in the cultivation and harvesting of fruits and vegetables. The U.S. Department of Agriculture (USDA) highlights that labor expenses represent a significant portion of production costs that accounted for up to 38% in fruit and tree nut farms and 29% in vegetable and melon farms. These high costs underscore the dependency of these operations on a reliable workforce.

In recent years, farm wages have risen more rapidly than non-farm wages, indicating a tightening labor market. The USDA Economic Research Service reports that average hourly earnings of U.S. field and livestock workers, adjusted for inflation, increased by 16% from 2001 to 2019, further amplifying production costs and putting pressure on profitability for growers.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging economies, particularly in Asia, present significant growth opportunities for U.S. fruits and vegetables exports. South Korea, for instance, imported $1.5 billion worth of frozen and processed vegetables in 2022 which represented a 15% increase from the prior year. The potential for U.S. exporters to expand their presence is notable, while China leads as the primary supplier with a 57% market share. According to the USDA Foreign Agricultural Service, successful entry into these markets requires an understanding of local consumer preferences and the establishment of robust trade relationships by ensuring long-term competitiveness and market penetration.

Adoption of Controlled Environment Agriculture (CEA)

Controlled Environment Agriculture includes greenhouse and vertical farming techniques, facilitates year-round production and reduces the risks associated with climate variability. The USDA Economic Research Service reports that the number of CEA operations in the United States grew from 1,476 in 2009 to 2,994 in 2019 with production volumes rising by 56% during the same period. Crops like tomatoes, lettuce, and cucumbers dominates with r 60% to 70% of total CEA output. This rapid growth demonstrates the increasing demand for locally grown, high-quality produce while emphasizing CEA's pivotal role in enhancing supply chain resilience in urban and peri-urban areas.

MARKET CHALLENGES

Food Loss and Waste

Significant amounts of fruits and vegetables are lost at various points along the supply chain, from production to retail. The U.S. Department of Agriculture estimates that over $161 billion worth of food at the retail and consumer levels is wasted annually. Furthermore, the Food and Agriculture Organization states that approximately 30% of fruit and vegetable losses occur during the earlier stages of the supply chain. Contributing factors include price volatility, labor shortages, and aesthetic standards imposed by retailers. For instance, the Economic Research Service highlights that vegetables show a price variation over 20 times greater than grains used for feed. This makes it financially unviable for growers to move their produce through the supply chain when prices drop below production costs, exacerbating food waste.

Climate Change and Environmental Stressors

Climate change poses a significant challenge to the fruits and vegetables market by impacting crop yields and quality. Increasing temperatures, shifting rainfall patterns, and extreme weather events such as droughts, floods, and storms disrupt growing cycles and reduce overall agricultural productivity. According to the USDA, weather-related crop losses in the U.S. averaged $8 billion annually between 2016 and 2020. Fruits and vegetables, being highly sensitive to climate conditions are particularly vulnerable. Additionally, rising temperatures increase the prevalence of pests and diseases that further straining production. This underscores the urgent need for climate-resilient farming practices and investment in drought-tolerant crop varieties to mitigate these risks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.15% |

|

Segments Covered |

By Product, Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dole Food Company, Fresh Del Monte Produce Inc., Chiquita Brands International, Total Produce PLC (part of Dole plc), Greenyard NV, Driscoll's Inc., Sunkist Growers, Inc., Nature's Touch Frozen Foods, Bonduelle Group, and The Kraft Heinz Company (in processed vegetables) |

SEGMENTAL ANALYSIS

By Product Insights

The vegetable segment held a significant share of 62.3% of the global market in 2024. According to the Food and Agriculture Organization (FAO), global vegetable production exceeds 1.1 billion metric tons annually with vegetables like potatoes, tomatoes and onions being among the most widely cultivated crops. This high production reflects their essential role in diets worldwide. Moreover, this segment also leads due to its extensive use in fresh consumption as well as processed forms like frozen vegetables, canned goods and vegetable-based products. The FAO highlights that vegetables are critical for food security in both developed and developing nations.

On the other hand, the fruit segment is likely to witness a projected CAGR of 9.3% during the forecast period in fruits and vegetables market. The FAO highlights that fruits like bananas, apples, citrus fruits, and berries are among the most traded agricultural commodities globally. Additionally, its production has been on a steady upward trend having an overall growth rate of 63% from 2000 to 2022. This growth is driven by increasing consumer demand for fresh produce, health awareness and the popularity of plant-based diets, as per the Food and Agricultural Organization (FAO).

By Type Insights

The fresh segment captured 70.4% of the global fruits and vegetables market share in 2024. Moreover, fresh ones are staples in diets worldwide due to their nutritional value. According to the Food and Agriculture Organization (FAO), global production of fresh fruits and vegetables exceeded 2 billion metric tons in 2022 with fresh produce dominating consumption patterns across all regions. Consumers prefer fresh produce over processed alternatives because of its natural taste, lack of preservatives, and perceived health benefits. According to the USDA, fresh fruits like apples, bananas, and oranges are among the most consumed food items in the United States.

In contrast, the frozen segment is forecasted to have the prominent growth rate in the global fruits and vegetables market with a projected CAGR of approximately 5.5% in the coming years. The trend towards plant-based diets has led to increased consumption of frozen fruits as part of smoothies and vegan recipes which is further fueling demand in this segment. The USDA reports that the U.S. exported approximately USD 1.6 billion worth of frozen fruits in 2022, indicating strong demand for these products in international markets.

By Distribution Channel Insights

The supermarkets/hypermarkets segment is solely leading the dominant share of the market which represented 60% of the total market share in 2024. Supermarkets and hypermarkets make it easy for consumers to shop for fresh fruits and vegetables alongside other products. According to the USDA, they are the leading retail outlets for fresh produce in the United States, catering to nearly 90% of consumers. Further, these retail formats offer a large variety of fresh produce, including organic and exotic choices. Supermarkets also have strict quality control processes to maintain freshness which helps build consumer trust.

The online segment is seeing the swift growth rate within the fruits and vegetables market with a projected CAGR of 11.5% for the estimation period. Increased internet access globally has made online shopping more accessible to diverse populations. According to the International Telecommunication Union (ITU), global internet penetration reached nearly 66% in 2023, facilitating e-commerce growth. The COVID-19 pandemic drastically shifted consumer behavior toward online grocery shopping as people sought safer alternatives to in-store shopping. The USDA reported that online grocery sales surged by over 50% during 2020, with many consumers continuing this habit post-pandemic.

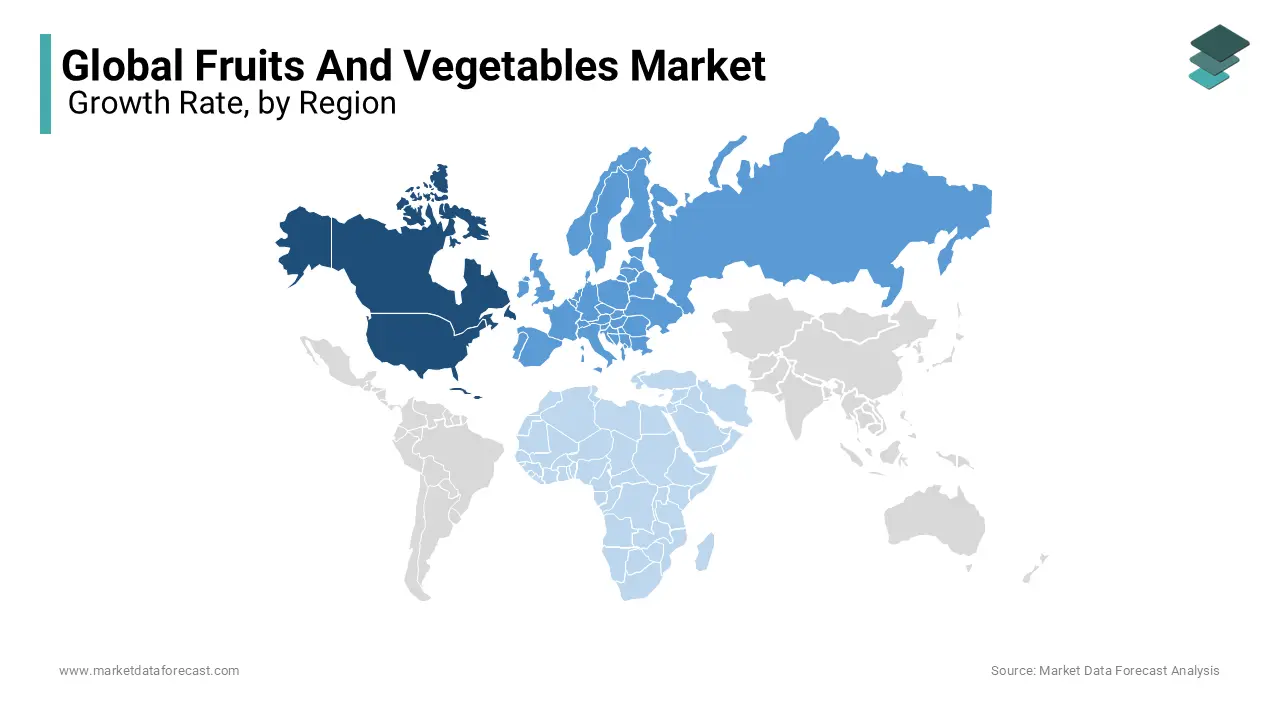

REGIONAL ANALYSIS

North America holds a dominating position in the global fruits and vegetables market and accounted for 40.4% of the global market share in 2024. The region's dominance is driven by a combination of factors such as high disposable incomes with a preference for organic and locally sourced produce and well-established supply chain networks. The United States is the largest contributor to the market, with California alone producing nearly 70% of the nation’s fruits and vegetables. Additionally, there is increasing consumer awareness about healthy eating, leading to higher demand for fresh, exotic, and functional fruits and vegetables. Organic produce is particularly popular with 55% of households in the U.S. purchasing organic fruits and vegetables regularly in 2024. Canada also plays a key role in the market by focusing on importing exotic produce to cater to its diverse population.

Europe is projected to grow at a CAGR of 3.8% over the forecast period. Europe is characterized by a strong emphasis on sustainable agriculture and organic farming practices. Countries like Germany, France, and the United Kingdom are at the forefront which are driven by stringent food safety regulations and rising demand for high-quality, locally produced goods. In 2023, nearly 20% of total farmland in Europe was dedicated to organic farming by making it the world’s largest organic producer by area. European consumers are also highly health-conscious and willing to pay premium prices for fresh, nutritious fruits and vegetables. Countries like Italy and Spain dominate exports by supplying fresh produce like citrus fruits, olives, and grapes to global markets.

The Asia-Pacific region is expected to grow at the fastest CAGR of 7.3% over the forecast period. This rapid growth is fueled by factors such as urbanization, an expanding middle class, and a shift in dietary preferences toward healthier food options. Countries like China, India, and Japan are the primary drivers of this growth. China is the largest producer of fruits and vegetables globally, accounting for 35% of the world’s vegetable production. India, on the other hand, is one of the top producers of fruits such as bananas, mangoes, and guavas. Rising disposable incomes and increased awareness about the nutritional benefits of fruits and vegetables are key trends shaping the market. The emergence of organized retail, coupled with advancements in cold chain infrastructure, has made fresh produce more accessible to consumers across urban and rural areas.

Latin America accounted for a considerable share of the worldwide market in 2024. Brazil and Mexico are the leading countries in this region, benefiting from favorable climates that allow year-round cultivation of fruits and vegetables. Brazil is a significant exporter of tropical fruits such as bananas and papayas, while Mexico leads in the production and export of avocados and tomatoes. The domestic market is also growing, as regional governments promote the consumption of fresh produce to combat rising obesity rates and other health issues. Initiatives like "5-a-day" campaigns in these countries encourage higher daily fruit and vegetable consumption. Additionally, advancements in sustainable farming practices and an increased focus on organic certification are strengthening the region’s position in the global market.

The market in Middle East and Africa is projected to grow at a healthy CAGR during the forecast period. South Africa and Egypt are among the top contributors to the market with favorable climates and strong agricultural traditions. Egypt is a major exporter of citrus fruits, particularly to European and Middle Eastern markets. The growth in the region is supported by investments in modern farming techniques alongwith expanded irrigation systems, and government-backed initiatives to ensure food security. However, challenges such as water scarcity and political instability hinder the full potential of the market. Despite these challenges, the growing population and urbanization in countries like Nigeria and Kenya are driving demand for fresh and affordable produce.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the global fruits and vegetables market include Dole Food Company, Fresh Del Monte Produce Inc., Chiquita Brands International, Total Produce PLC (part of Dole plc), Greenyard NV, Driscoll's Inc., Sunkist Growers, Inc., Nature's Touch Frozen Foods, Bonduelle Group, and The Kraft Heinz Company (in processed vegetables)

The fruits and vegetables market is marked by intense competition driven by a wide range of global players including multinational corporations regional producers and local farmers. Key market participants focus on staying competitive by prioritizing product quality sustainability initiatives technological innovation and supply chain efficiency. The fragmented nature of the market creates opportunities for both large and small-scale producers to address specific consumer demands such as organic exotic or minimally processed produce.

Leading companies like Dole Food Company Fresh Del Monte and Chiquita Brands International hold a significant position through their expansive distribution networks and strong brand reputation. They focus on innovation including controlled environment agriculture and smart logistics to ensure consistent product availability. Regional players in Asia-Pacific and Latin America utilize local climatic advantages and cost-effective labor to supply fresh and processed produce globally.

Increasing consumer preference for organic and sustainably sourced products has intensified market competition. Producers are adopting eco-friendly farming techniques and obtaining certifications to appeal to environmentally conscious customers. Technological advancements such as blockchain for traceability and AI for optimizing supply chains are becoming critical industry tools. The market faces challenges like price volatility labor shortages and climate-related issues compelling competitors to innovate continuously. Strategic partnerships and mergers are frequently employed to expand market presence and geographic reach.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, U.S. vertical farming startup Plenty entered into a $680 million joint venture with Mawarid, a subsidiary of Alpha Dhabi Holding, to construct five indoor farms in the Middle East over the next five years. The first farm in Abu Dhabi is expected to produce over 4.5 million pounds of premium strawberries annually for local consumption and export to Gulf Cooperation Council countries.

- In November 2024, Amazon announced an ambitious plan to integrate physical and online stores into a one-stop shopping experience, aiming to dominate the grocery market. This initiative includes trials at Whole Foods locations, allowing customers to purchase organic groceries and order additional items via their phones for quick pick-up.

MARKET SEGMENTATION

This research report on the global fruits and vegetables market has been segmented and sub-segmented based on product, type, distribution channel, and region.

By Product

- Fruits

- Vegetables

By Type

- Fresh

- Dried

- Frozen

By Distribution Channel

- Supermarkets/Hypermarkets

- Grocery Stores

- Online

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Who are the major players in the global fruits and vegetables market?

Major players include Dole Food Company, Fresh Del Monte Produce, Chiquita Brands International, Green yard, and Total Produce. These companies dominate the supply chain, from farming to distribution.

2. Which fruits and vegetables are most in demand globally?

The most in-demand fruits include bananas, apples, and citrus fruits, while popular vegetables include potatoes, tomatoes, and onions. The demand varies based on regional consumption patterns and seasonal availability.

3. How is climate change affecting the fruits and vegetables market?

Climate change impacts crop yields, quality, and supply chains. Extreme weather events, droughts, and temperature fluctuations affect production, leading to price volatility and changes in farming practices.

4. What are the key trends driving the fruits and vegetables market?

Key trends include growing demand for organic produce, advancements in cold storage and logistics, increased consumer preference for fresh and minimally processed food, and rising popularity of plant-based diets

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]