Global Fruit Beer Market Size, Share, Trends & Growth Forecast Report - Segmented By Flavour (Peach, Raspberry, Cherries, Blueberry, Plums And Others), Distribution Channel (Departmental Stores, Bars And Restaurants, Supermarkets, Speciality Stores And Online Retailers) , And Region(North America, Europe, APAC, Latin America, Middle East And Africa) - Industry Analysis 2024 To 2032

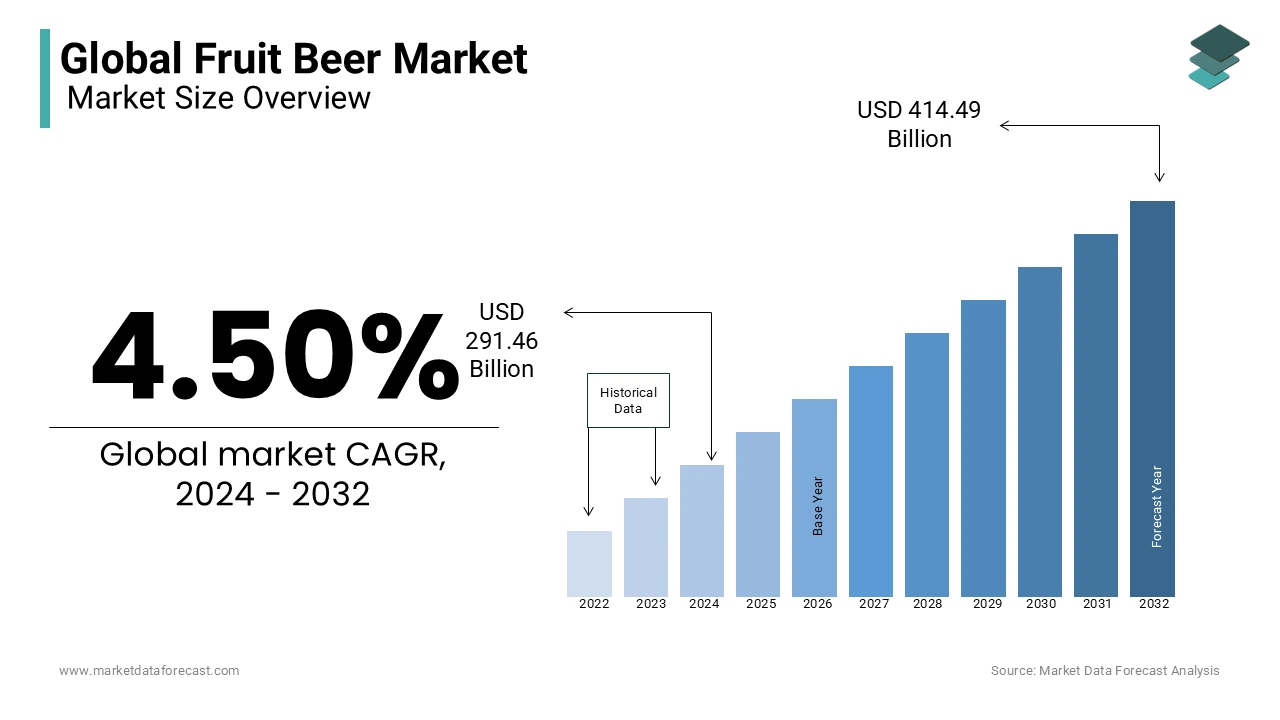

Global Fruit Beer Market Size (2024 to 2032)

The global fruit beer market size is estimated to be USD 291.46 billion in 2024 and is predicted to reach around USD 414.49 billion by 2032 at a CAGR of 4.50% over the calculated time period. As fruit beer grows in popularity with women as an intermittent beverage, it is expected to benefit the market in the coming years.

Fruit beer is a type of beer that has been modified by adding fruit flavors or extracts and is served in the form of large, strong beer by adding fruit as a supplement in the form of fruit. Fruits like plums, cherries, and raspberries have a malt or hop aroma that is used as the base for making fruit beer. In the current scenario, many breweries have been shown to add processed extracts, syrups, or spices to the finished product without going through the fermentation process. Fruit beer is low in alcohol content from scratch and does not harm an individual's kidneys. They blend well with the sweet flavor of traditional malt and fruit. It is served in a variety of fruit flavors including raspberry, peach, blueberry, cherry, plum, apple, and apricot. Fruit beer consists of fruits that serve as supplements or spices. Fruit beer, although introduced in Belgium, is now available in many countries around the world. Fruit beer with reduced alcohol content does not harm the liver or kidneys or cause poisoning. These health benefits provided by a low-alcohol fruit beer with a fruity and tasty flavor will accelerate the expansion of the market in the coming years. As awareness of the inherent health benefits associated with fruit beer increases, demand for products is supposed to increase as consumer preference for non-alcoholic beer rises.

MARKET DRIVERS

The global fruit beer market is fueled by the female population's love of soft drinks.

The flavor of fruit beer strikes a good balance between traditional malt beer and the sweetness of the fruit. Fruit beer is served with a different flavor than traditional beer. Additionally, the unique flavor of fruit beer has made it one of the most popular drinks for Western consumers. Like the fragrance, the flavor must have a characteristic that is noticeable in the fruits. The sugar in the selected fruit is generally fully fermented, making the dryer lighter and lighter in flavor; the amount of sugar added to this beer is considerably less, which makes the fruit more noticeable. The rules and regulations related to the operation of the fruit beer industry, the acceptance of Western cultures, an increase in population, an increase in the number of bars and restaurants, an increase in disposable income, and some of the main driving forces of fruit beer. Increasing disposable income among the working-class population allows consumers to socialize more in bars and restaurants and spend more money on alcoholic beverages. Additionally, consumers are willing to spend more on premium segments. All of these combinations will be driving the growth of the global fruit beer market throughout the foreseen period.

To avoid headaches and drowsiness, some factors, such as increased consumer awareness associated with the long-term effects of alcohol along with consumer preferences, will promote the growth of the fruit beer market. The growing demand for fruit beer for teens, due to the strict alcohol law between the ages of 16 and 18, will support industrial growth. In addition, higher disposable income, increased adoption of Western culture, more restaurants and bars, and breakpoints are assumed to drive growth in target markets. Furthermore, the popularity of these drinks has increased over time, promoting the growth of target markets. Furthermore, the expansion of the fruit beer industry will accelerate as the number of bars and restaurants increases. The unique flavor and rich popularity of fruit beer are some of the main growth factors in the industry. Manufacturers' approach to selling fruit beers online will optimally capitalize on market progress. However, as the number of campaigns to drink alcoholic beverages increases, you may not be able to consume fruit beer.

MARKET RESTRAINTS

The high cost of fruit beer hinders the growth of this market.

The increase in the number of campaigns against alcohol consumption, highlighting the side effects of a lack of consumer confidence in the alleged benefits of fruit beer, is expected to have a negative impact on business growth. It is presumed to play a role in slowing market growth, with concerns over the availability of low-cost counterfeit products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.5% |

|

Segments Covered |

By Flavor, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Joseph James Brewing Company, Inc. New Belgium Brewing Company, Brewery Ommegang, All Saints’ Brewery, Lindemans Brewery, Lost Coast Brewery, Magic Hat Brewing Company, Shipyard Brewing Company, Unibroue, Wells & Young's Ltd., Brouwerij Van Honsebrouck N.V., Abita Brewing Co., and Pyramid Breweries, Inc. |

SEGMENTAL ANALYSIS

Global Fruit Beer Market Analysis By Flavour

The blueberry segment is leading with the largest share due to people’s interest in the innovative flavors. This beer is produced by fermenting blueberry instead of grains with very little alcohol, which accounts for enhancing the growth rate of the market. The trend towards maintaining a healthy diet by strictly avoiding high alcoholic beverages is likely to hinder the growth rate of the market. The rising concern of obesity and diabetes-related issues among many people these days is ascribed to bolstering the growth rate of the market.

The Raspberry segment is anticipated to hit the highest CAGR by the end of the year 2032. The easy availability of fruit beer at affordable prices and the rising preference to drink these beverages from the women population are major factors in the growth rate of the market.

Global Fruit Beer Market Analysis By Distribution Channel

The bar and restaurant segment has the highest share of the fruit beer market. The people’s preference to drink alcohol during weekend parties and others is contributing to the expansion of the fruit beer market. There are increasing numbers of bars and restaurants on every corner of the street, especially in urban cities, which is favored to amplify the growth rate of the market.

The online retailers segment has substantially had huge growth opportunities in recent years. The rapid adoption of advanced technologies and the launch of innovative applications where allow consumers to order their preferred products that will be delivered to their doorstep. Increasing internet access, even in rural areas, is greatly influencing the growth rate of the market.

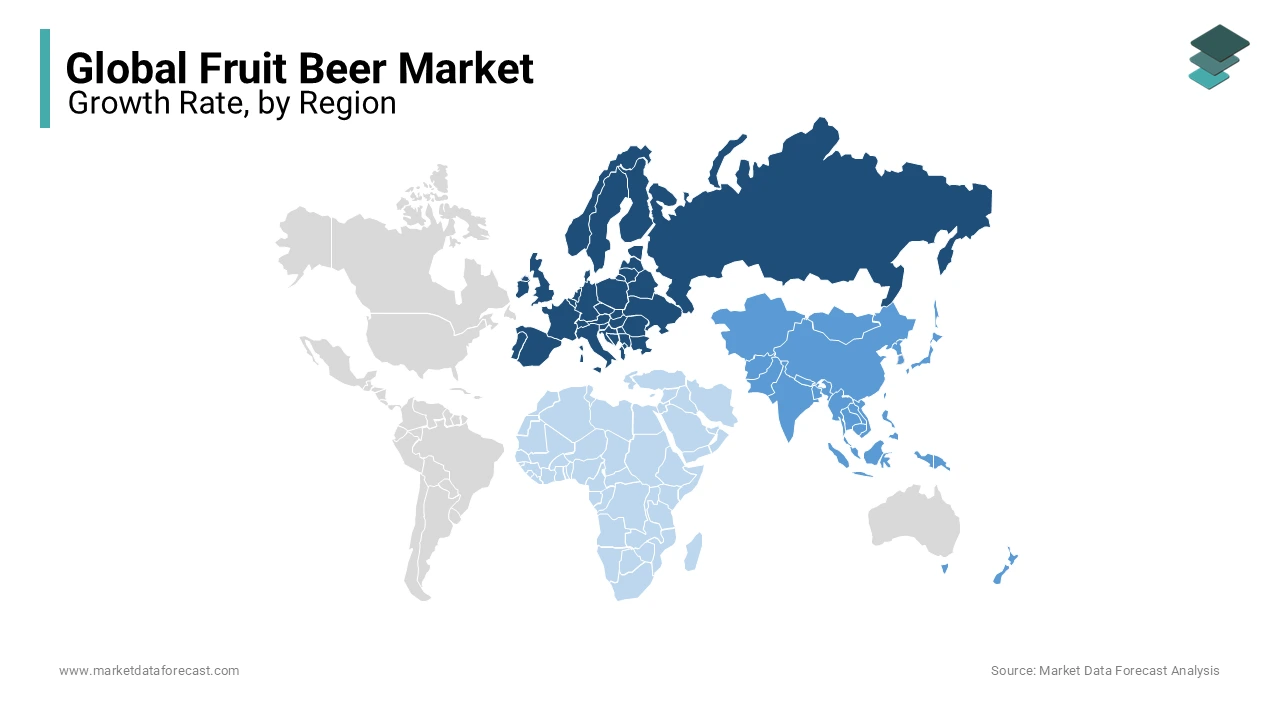

REGIONAL ANALYSIS

The regional segment of the fruit beer market is divided into North America, Latin America, Europe, APAC, and MEA. Europe dominated the market in 2019, occupying a 40.0% share. Among consumers in countries like France and the UK, many breweries and current demand for non-alcoholic beverages are expected to continue to be a favorable factor for the region's industrial growth. Brewing is considered a high-value industry and traditionally supported in Europe and is expected to open the way for new players to make national investments. As the fruit beer industry is growing in popularity with beer in countries like India, China, and Japan, where significant business opportunities and strong growth prospects are expected, Asia Pacific will expand at the fastest annual growth rate of 6.3% during the outlook period. Increased consumer awareness of the harmful effects of alcohol on the human body is anticipated to be a major factor in increasing demand for non-alcoholic beer in the coming years.

Furthermore, due to changes in eating habits and socialization trends in bars, pubs and liquor bars, the number of fast-service restaurants in India and China is expected to increase, opening the way for fruit beer in the next years. Furthermore, Latin American and North American markets have shown great growth potential and are foreseen to make a significant contribution to the overall size of the market in the future. The Middle East and Africa have the lowest market share due to poor economic conditions in Africa and alcohol production regulations in some countries in the Middle East.

KEY PLAYERS IN THE GLOBAL FRUIT BEER MARKET

Major Key Players in the Global Fruit Beer Market are Joseph James Brewing Company, Inc. New Belgium Brewing Company, Brewery Ommegang, All Saints’ Brewery, Lindemans Brewery, Lost Coast Brewery, Magic Hat Brewing Company, Shipyard Brewing Company, Unibroue, Wells & Young's Ltd., Brouwerij Van Honsebrouck N.V., Abita Brewing Co., and Pyramid Breweries, Inc.

RECENT HAPPENINGS IN THE MARKET

- In October 2018, Miller Coors launched a completely new type of natural, light fruit beer to attract the attention of the young Millennium generation. This is a cheap fruit beer that encourages people to go from cocktails to new fruit beers.

- In May 2019, St Peter's launched a new fruit beer, "Elderberry and Raspberry Free," a 0.0% alcohol to meet the needs of health-conscious people. This new fruit beer is completely natural, alcohol-free, and nutritious.

- In June 2019, Anheuser-Busch InBev and Heineken launched a non-alcoholic beer in India, which will compete in physical stores and restaurants with beverage manufacturers, including Coca-Cola Company and PepsiCo Inc.

DETAILED SEGMENTATION OF GLOBAL FRUIT BEER MARKET INCLUDED IN THIS REPORT

This research report on the global fruit beer market has been segmented and sub-segmented based on flavor, distribution channel, & region.

By Flavor

- Peach

- Raspberry

- Cherries

- Blueberry

- Plums

- Other flavors

By Distribution Channel

- Departmental Stores

- Bars and Restaurants

- Supermarkets

- Specialty Stores

- Online Retailers

By Region

- North America

- Europe

- Asia Pacifica

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the most popular fruit flavors used in fruit beers?

Familiar fruit flavors in fruit beers include raspberry, cherry, peach, strawberry, mango, pineapple, and citrus fruits like orange and lemon. Brewers often experiment with various fruit combinations to create unique flavors.

2. What types of consumers are driving the demand for fruit beers?

Fruit beers appeal to a wide range of consumers, including craft beer enthusiasts looking for unique flavors, individuals who enjoy fruity and refreshing beverages, and those interested in exploring diverse beer styles and offerings.

3. What food pairings complement fruit beers?

Fruit beers pair well with a variety of foods, including grilled chicken or fish, salads with fruity dressings, cheese platters (especially with tangy cheeses), spicy dishes like barbecue or curry, and desserts like fruit tarts or sorbets.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]