Global Frozen Seafood Market Size, Share, Trends, & Growth Forecast Report - Segmented By Distribution Channel (Supermarkets And Hypermarkets, Independent Retailers, Convenience Stores, Specialty Retailers And Others), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Frozen Seafood Market Size

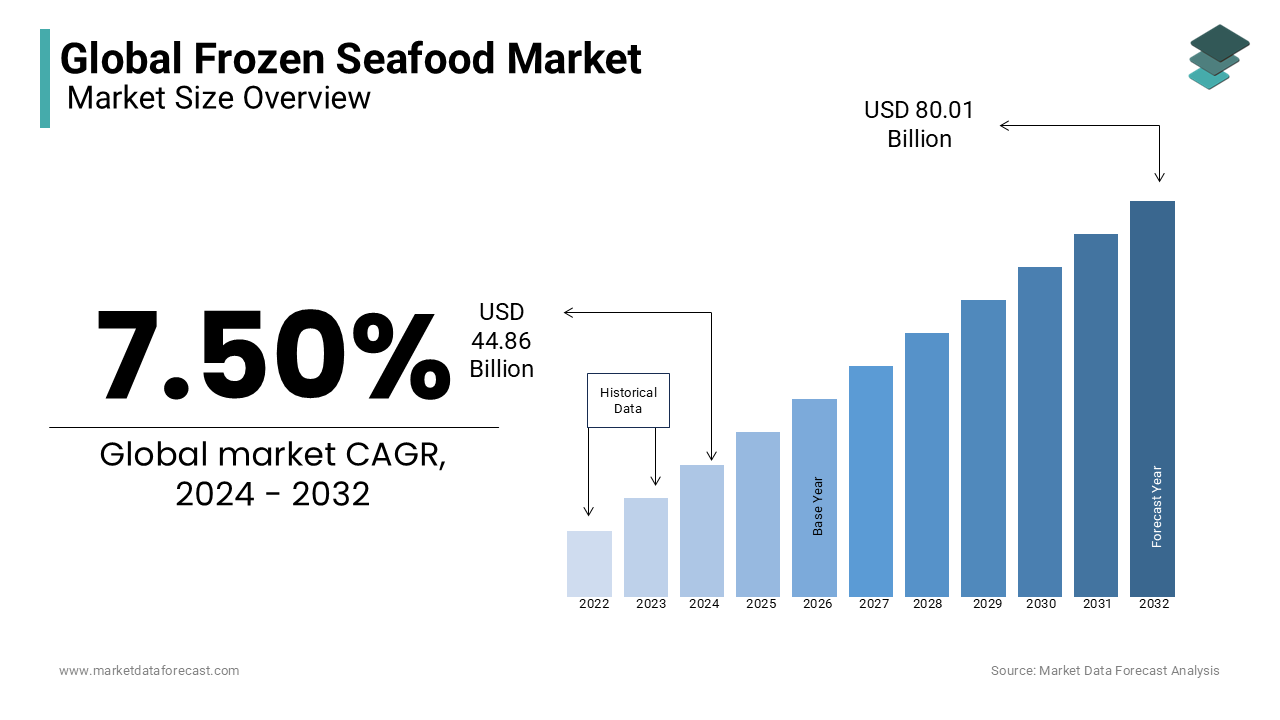

The size of the global frozen seafood market was expected to be worth USD 44.86 billion in 2024 and is anticipated to be worth USD 86 billion by 2033 from USD 48.22 billion In 2025, growing at a CAGR of 7.50% during the forecast period. Frozen seafood does not affect nutritional values like A and D, fats and proteins. Market growth increases as it is not affected by the freeze.

Seafood is one of the most perishable foods, so special attention should be paid to freezing until it reaches the consumer. Seafood contains high-quality protein and other essential nutrients. Shellfish protein is simpler to process since shellfish have less connective tissue than red meat and poultry. Fish contains polyunsaturated fats like omega-3 unsaturated fats that are not delivered by the human body. It is gainful for human coronary illness and is basic for the improvement of the mind and vision in babies. Fish is a characteristic wellspring of nutrients D and A, and the B complex is valuable for the best possible improvement of the sensory system and bones and for sound vision and skin. Fish gives minerals, for example, calcium and iron, selenium, iodine, and zinc. Selenium goes about as a cancer prevention agent and ensures against cell harm. Zinc assists with cell development and improves the safe framework. Iron is important for the production of red blood cells. Therefore, seafood is an important part of a healthy and balanced diet. Frozen seafood is processed by two processes like rapid freezing and cryogenics known as machines. Frozen seafood products are mainly frozen using the most popular refrigeration techniques due to the presence of ultra-low liquid nitrogen at -196 degrees Celsius. The odorless stabilizer, carboxymethyl cellulose, is mainly used for frozen seafood products that do not harm the quality of frozen seafood products. Many frozen seafood manufacturers are implementing cryogenic freezing to keep temperatures low, including carbon dioxide or liquid nitrogen, which is used to freeze seafood. Using modern refrigeration technology, frozen seafood products can be stored for a long time. Frozen seafood products are processed to suppress the formation of bacteria in food and extend the shelf life of food, which is likely to improve its demand in the coming years.

MARKET DRIVERS

The demand for frozen seafood products is increasing worldwide as leading manufacturers are focusing on providing healthier products.

Frozen seafood products are chilled with cryogenic technology to inhibit bacterial growth in products. Using modern refrigeration technology, frozen seafood products can be stored for a long time. Many consumers are changing their preference for frozen foods over canned foods because nutrients are not destroyed in frozen foods, and foods are consumed worldwide. These frozen seafood products are consumed worldwide as they maintain the quality of the product. Therefore, the global frozen seafood market is expected to experience strong growth during the forecast period. Expanded interest for fishery items in remote regions has quickened the creation of solidified fishery items.

Companies that produce frozen fish products actively depend on cold storage areas, which is a major obstacle to the market. A solid cold chain infrastructure has become essential for the distribution of frozen fish products, but the shortage of such services may cause some problems for the company. The world leader for frozen seafood is adopting advanced processing technology to increase product durability against external factors such as weather changes, mechanical damage, and freezing temperature fluctuations. Multinational retail food chains like Red Lobster make up a significant part of the frozen seafood market. This large chain continues to demand frozen food instead of fresh seafood. Therefore, despite the growing demand for fresh produce, the frozen seafood market is expected to grow. Additionally, fresh seafood can open up new opportunities as advanced storage facilities can hold a wide variety of fresh and seafood for a long time. Growth in disposable income in developing countries, increased awareness of the health benefits of shellfish, and the development of processing and storage capacities are supposed to help cultivate fresh shellfish products in the near future. Furthermore, since the large retail seafood chains represent a significant part of the overall market share, a strategic collaboration in the frozen seafood market is expected during the forecast period.

MARKET RESTRAINTS

The main challenge for the frozen seafood market is the limited storage options of the new market.

To overcome these challenges, the company is investing in processing to improve the life cycle of its products and maintain its flavor. Advances toward this path are relied upon to see sound development for the solidified fish advertise soon.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.50% |

|

Segments Covered |

By Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Clearwater Seafood, AquaChile, Leroy Seafood, High Liner Foods, Marine Harvest, Iglo Group, Beijing Princess Seafood International Trading, Austevoll Seafood, Fishery Products International, Sajo Industries and Others. |

SEGMENTAL ANALYSIS

Global Frozen Seafood Market Analysis By Distribution Channel

The supermarkets/hypermarkets segment holds a significant share of the market. The innovative strategies by this channel to attract customers are greatly influencing the market’s growth rate. People’s willingness to purchase high-quality products from the stores with the increasing awareness of clean label ingredients shall widely promote the demand for eating frozen sea foods. Huge support from the government over the import and export of animal-based food products due to escalating demand from the population shall amplify the growth rate of the market to the extent.

The convenience stores segment is likely to have the dominant growth rate of the market during the forecast period. Frozen seafood is easy to store and more convenient to prepare in minimal time, which is attracting a huge number of customers. Convenience stores offer huge flexibility for customers to shop for food and even offer discounts.

The specialty retailers segment is likely to have a steady growth rate in the frozen seafood market.

REGIONAL ANALYSIS

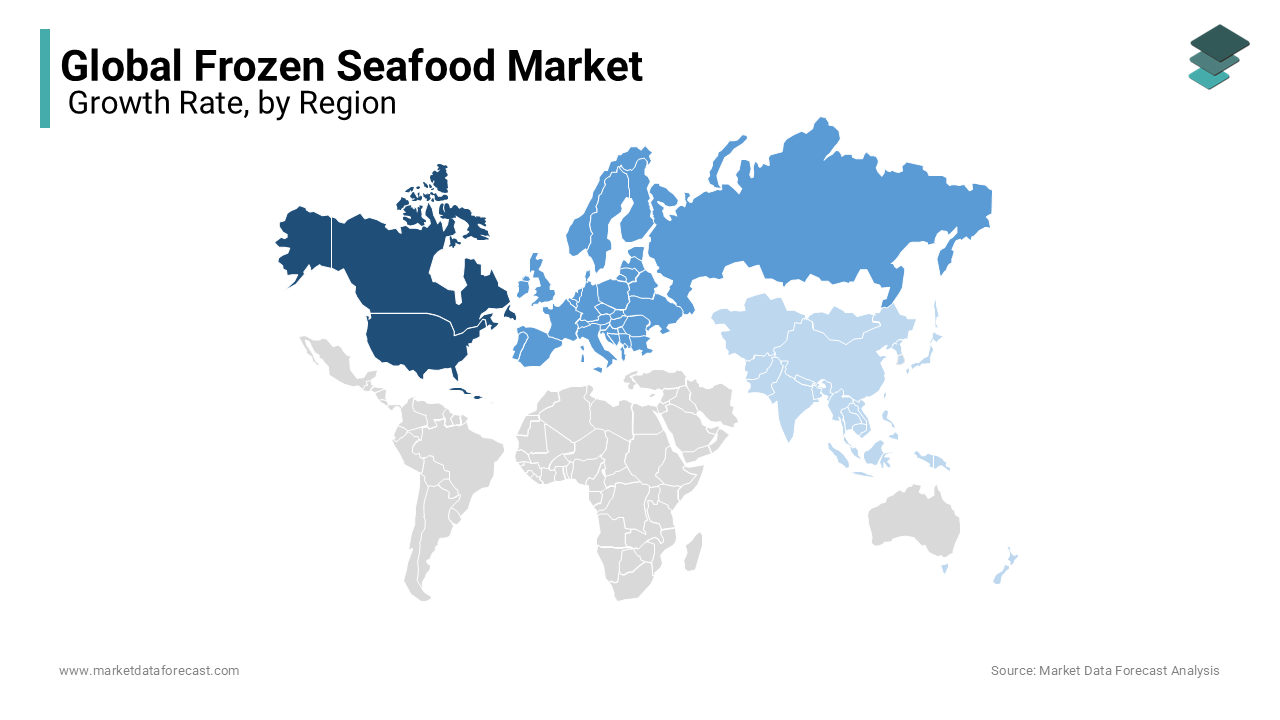

The market frozen seafood industry is geographically segmented as North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa. Of all the regions in the world, North America has become a dominant locale followed by Europe and Asia Pacific in the global market. As the demand for frozen seafood as a variety of end-use thickeners increases, the global frozen seafood market is supposed to intensify its growth, greatly increasing the contribution of market revenue during the outlook period. Europe had the largest share based on sales in 2017. The industry is supposed to lead due to the rising call for seafood and the increase in refrigeration chains in the region. Europe was followed by North America and Asia Pacific in terms of imports. The Asia Pacific region is determined to grow significantly in the coming years mainly due to regional population growth, urbanization, and cold chain networks.

KEY PLAYERS IN THE GLOBAL FROZEN SEAFOOD MARKET

Major Key Players in the global frozen seafood market are Clearwater Seafood, AquaChile, Leroy Seafood, High Liner Foods, Marine Harvest, Iglo Group, Beijing Princess Seafood International Trading, Austevoll Seafood, Fishery Products International, Sajo Industries and Others.

DETAILED SEGMENTATION OF THE GLOBAL FROZEN SEAFOOD MARKET INCLUDED IN THIS REPORT

This research report on the global frozen seafood market has been segmented and sub-segmented based on distribution channel, and region.

By Distribution Channel

- Supermarkets and Hypermarkets

- Independent Retailers

- Convenience Stores

- Specialty Retailers

- Others

By Region

- North America

- Asia and Pacific

- Europe

- Middle East and Africa

- Latin America

Frequently Asked Questions

1. What factors are driving the growth of the frozen seafood market?

Key drivers include rising consumer demand for convenience foods, growing awareness of the health benefits of seafood, improved freezing and packaging technologies, and expanding distribution networks.

2. What are the latest trends in the frozen seafood market?

Current trends include a growing demand for sustainably sourced seafood, the popularity of ready-to-cook and value-added products, advancements in freezing technology to improve quality, and increased availability of exotic and lesser-known seafood varieties.

3. How is technology impacting the frozen seafood market?

Technological advancements are enhancing the efficiency of freezing processes, improving the quality and shelf life of products, enabling better traceability and transparency in the supply chain, and facilitating the development of new product innovations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]