Global Fresh Apple Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Red, Green, And Others), Distribution Channel (Online, Offline, And Others), Industry Vertical(Food & Beverages And Others), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2024 To 2032

Global Fresh Apple Market Size (2024 To 2032)

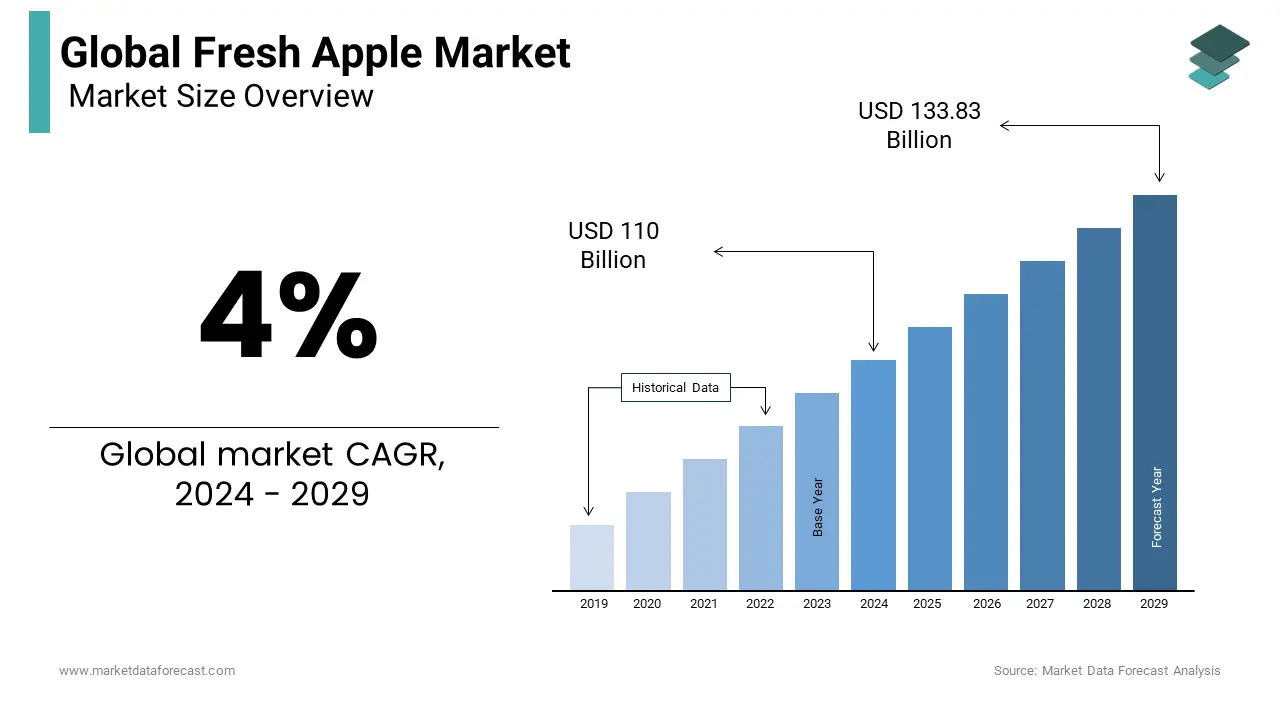

The size of the global fresh apple market is expected to be worth USD 110 billion in 2024 and grow at a CAGR of 4% from 2024 to 2032 to achieve USD 150.54 billion by 2032.

An apple is an edible fruit produced by an apple tree (Malus Domestica). Apple trees are grown throughout the world and are the most widely cultivated species of the genus Malus. The tree is native to Central Asia, where its wild ancestor, Malus sieversii, is still found today. Apples have been grown for thousands of years in Asia and Europe and were brought to North America by European settlers. Apples have religious and mythological significance in many cultures, including the Nordic, Greek, and European Christian tradition. Apple trees are great when grown from seed. Generally, apple cultivars are propagated by rootstock grafting, which controls the size of the resulting tree.

There are more than 7,500 known apple cultivars, providing a range of desired characteristics. Different cultivars are selected for different tastes and uses, including cooking, raw consumption, and cider production. Trees and fruits are subject to a number of fungal, bacterial, and pest problems, which can be controlled by various biological and non-organic means. In 2010, the fruit's genome was sequenced as part of research on disease control and selective breeding in apple production.

MARKET DRIVERS

The increase in the population that chooses healthy foods is driving the growth of the fresh apple market globally.

Increased consumer awareness of healthy foods and changes in their eating habits are driving the consumption of organic fruits, which is driving the growth of the market. The easy availability of fresh apples and the myriad benefits are the key factors increasing its consumption among health-conscious consumers. Consumers prefer to eat fresh apples rather than drink their juice because whole fruit contains more fiber than its juice, which has driven demand for fresh apples. The increase in the number of health-conscious consumers around the world has increased the consumption of healthy foods in their daily routine, which has encouraged market players to launch something healthy and convenient to keep them healthy and fit, for which they released fresh produce.

MARKET RESTRAINTS

Fruit Juices with Advanced Tetra Packaging for consumers with a busy routine who cannot allow time to eat fruit instead, they can easily obtain healthy and nutritious fruit juices that can replace whole fruit to some extent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4% |

|

Segments Covered |

By Type, Transaction, Distributions, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Washington Fruit & Produce Co., Auvil Fruit Co. Inc., Symms Fruit Ranch Inc., Stemilt Growers LLC, Jewel Apple Ltd., Gilbert Orchards, Gebbers Farms, Fruit Hill Orchard, Evans Fruit Co., and Borton & Sons. |

SEGMENTAL ANALYSIS

By Type Insights

The red apple segment dominated the market by type by accounting for the leading share of the global fresh apple market in 2024. Red apples, such as the popular Red Delicious, Gala, and Fuji varieties, are widely consumed due to their sweet flavor, crisp texture, and appealing color. These varieties dominate global sales and are favored for fresh consumption, as well as in processed products like juices, sauces, and desserts. Their strong consumer preference and versatile use in a wide range of applications contribute to the red apple segment’s position as the largest in the fresh apple market.

The green apple segment is another major segment in the global market and is expected to witness a notable CAGR during the forecast period. Green apple varieties, such as Granny Smith, are gaining popularity due to their tart flavor, high antioxidant content, and health benefits. As consumers become more health-conscious and seek low-calorie, nutrient-dense options, green apples, with their higher fiber content and distinct taste, are becoming a top choice. This growing demand for green apples, particularly in health-focused and culinary applications, is driving the rapid growth of this segment.

By Transaction Insights

The offline segment had the largest share of the global market in 2024. Traditional brick-and-mortar stores, including supermarkets, grocery stores, and farmers' markets, continue to dominate fresh apple sales. Consumers typically prefer purchasing fresh apples in person to inspect their quality and freshness. The established distribution channels and convenience of physical shopping contribute to the offline segment’s dominance in the market.

The online segment is growing rapidly and is estimated to witness a promising CAGR over the forecast period. With the rise of e-commerce platforms and delivery services, more consumers are opting to purchase fresh produce, including apples, online for convenience. The ability to shop from home and the increasing popularity of subscription services for fresh fruits are fueling the growth of online transactions. As consumer behavior shifts toward digital purchasing, the online segment is expanding rapidly, particularly in urban areas.

By Distributions Insights

The food & beverages distribution segment accounted for the largest share of the global market in 2024. Fresh apples are widely distributed in the food and beverage sector, where they are sold through grocery stores, supermarkets, and specialized produce retailers. Apples are a popular, healthy snack and are frequently used in various culinary applications, such as salads, pies, juices, and smoothies. This broad usage across the food industry makes Food & Beverages the dominant distribution channel for fresh apples.

The Others distribution segment is predicted to account for a considerable share of the global market over the forecast period. This category includes alternative distribution channels like farmers' markets, direct-to-consumer sales through online platforms, and subscription-based delivery services for fresh produce. With the increasing demand for locally sourced and organic produce, more consumers are turning to these alternative channels for fresh apples. The convenience and personalized service offered by these distribution methods are driving the rapid growth of the "Others" segment.

REGIONAL ANALYSIS

Asia-Pacific leads the world consumption of fresh apples, with a 62% share of the world market. China is the world's largest apple producer. Apples are the most consumed fruit in China. China remains the world's largest apple consumer, with a consumption rate of 40 million metric tons, which is about 48% of the total volume. In addition, the consumption of apples in China has increased tenfold compared to the figures recorded by the United States. China was the second-largest consumer, with 4 million tons of apples. In 2019, South Korea's per capita consumption increased 12% due to increased domestic supply and high consumer preference for apples due to various health benefits over other domestic fruits. According to the Ministry of Agriculture, Food and Rural Affairs (MAFRA), in 2019, the consumption of apples per capita is 10.3 kg, the second-highest after citrus.

KEY PLAYERS IN THE GLOBAL APPLE MARKET

The Fresh Apple Market is concentrated with well-established players. Key players in the Fresh Apple Market include Washington Fruit & Produce Co., Auvil Fruit Co. Inc., Symms Fruit Ranch Inc., Stemilt Growers LLC, Jewel Apple Ltd., Gilbert Orchards, Gebbers Farms, Fruit Hill Orchard, Evans Fruit Co., and Borton & Sons.

RECENT HAPPENINGS IN THE MARKET

- Apple doesn't always tell the world when it buys another business, but in reality, it quietly traps startups all the time. Over the weekend, CEO Tim Cook told CNBC that Apple is buying a new business every two to three weeks on average and has bought between 20 and 25 companies in the last six months alone.

- Apple acquired Xnor.ai, a Seattle-based startup specializing in low-power edge-based artificial intelligence tools, sources familiar with the deal told GeekWire. The acquisition echoes Apple's high-profile purchase of Seattle-based startup AI Turi in 2016. Speaking on condition of anonymity, sources said Apple paid an amount similar to what it paid for Turi, on the order of $ 200 million. The fix suggests that Xnor's AI-enabled image recognition tools may become standard features on future iPhones and webcams.

- GrubMarket announced today that it had completed the acquisition of Leo's Apples Inc, a recognized and established supplier of a wide range of fresh fruits, with a long-standing customer base in the metropolitan and suburban areas of the Mid-Atlantic and New England. New York-based Leo's Apples was founded in 1991 by Leo Rotstein. It partners directly with growers in the Mid-Atlantic and New England and the West Coast to provide high-quality fruit.

- Apple has confirmed that it has acquired British imaging technology company Spectral Edge for an undisclosed amount. As we reported yesterday, all of the Spectral Edge directors had resigned to be replaced by a California-based Apple Legal Eagle. The tech industry in the United States confirmed our story today but declined to reveal details about how much was paid for Spectral Edge or its plans for the future.

- Dialog Semiconductor said it completed the previously announced transaction with Apple to license its Power Management Integrated Circuit (PMIC) technologies and transfer assets to Apple. This involves the transition of more than 300 Dialog employees to Apple employees, becoming part of Apple's hardware technology team under Johny Srouji. The dialog will receive a total of $ 600 million, including $ 300 million in cash from Apple for the transaction and a prepayment of $ 300 million for Dialog products to be delivered over the next three years.

DETAILED SEGMENTATION OF THE GLOBAL APPLE MARKET INCLUDED IN THIS REPORT

This research report on the global apple market has been segmented and sub-segmented based on type, transaction, distributions, and region.

By Type

- Red

- Green

- and Others

By Transaction

- Online

- Offline

- Others

By Distributions

- Food & Beverages

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the major trends in the fresh apple market?

Organic Apples growing consumer preference for organic apples due to increasing health consciousness, varietal diversity new apple varieties, like Honeycrisp and Cosmic Crisp, are gaining popularity, and Sustainable farming practices are becoming more prevalent as consumers demand environmentally friendly products.

2. What are the key drivers for growth in the fresh apple market?

Increasing awareness about the health benefits of apples, such as their nutritional value and role in preventing chronic diseases, and the popularity of plant-based diets and snacking trends supports the consumption of fresh fruits like apples.

3. What challenges does the fresh apple market face?

Adverse weather conditions can impact apple production, affecting supply and prices, Ongoing challenges in managing pests and diseases that affect apple crops, and Competition from other fruits and processed snacks can affect apple sales.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]