Global Freighter Aircraft Market Size, Share, Trends, & Growth Forecast Report – Segmented by type (Dedicated Cargo Aircraft, Derivative of Non-Cargo Aircraft), Application (Turboprop Aircraft, Turbofan Aircraft), & Region - Industry Forecast From 2024 to 2032

Global Freighter Aircraft Market Size (2024 to 2032)

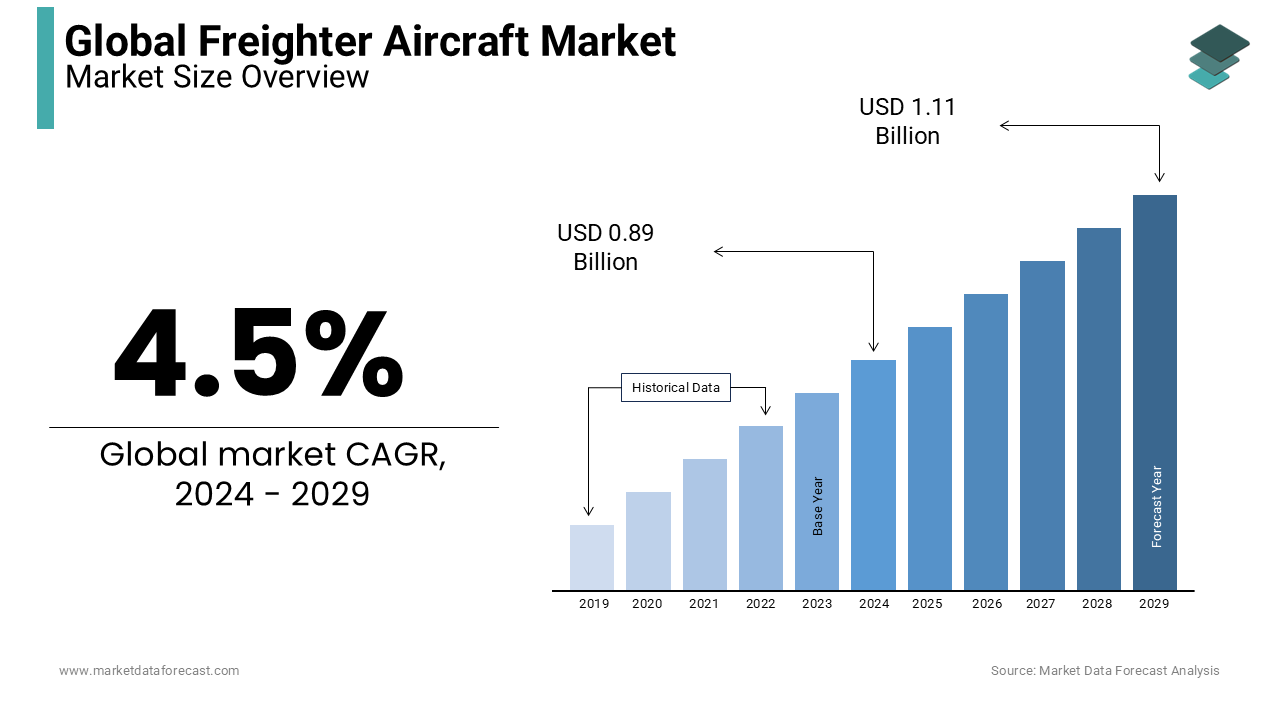

The global freighter aircraft market was worth USD 0.85 billion in 2023. The global market is predicted to reach USD 0.89 billion in 2024 and USD 1.27 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

The freight Aircraft is sometimes known as a cargo Aircraft. It's a fixed-wing aircraft that's been constructed or retrofitted to transport goods instead of people. These planes don't have any passenger facilities and usually have one or more big cargo doors. Freighter aircraft systems or freight systems are examples of aircraft freight systems that are used to transfer cargo into or out of planes and are also capable of resolving cargo in the reserved place of the cabin. Commercial transport or cargo airlines, private persons, or particular countries' military forces may all operate Freighter aircraft. The freighter aircraft has various advantages, including being the quickest means of transportation and hence appropriate for long-distance freight delivery, providing quick service, and being simple to access.

MARKET DRIVERS

The global demand for freighter aircraft is expected to develop since no infrastructural investment is required, making it a cost-effective service. It is also accessible at any time and is used by numerous countries for national defense.

Freighter aircraft can also carry greater weight and provide the fastest service of all kinds of transportation. It also provides effective and pleasant freight transportation services. The growing usage of Aircraft Freight Systems in Fixed-Wing Aircraft and Rota planes is propelling the global Aircraft Freight System market.

The delivery of time-sensitive & elevated cargo, such as medical equipment, perishable items, and medications, is yet another growth driver in the Global Freighter aircraft market. As the worldwide PPE shortage worsened, a handful of mostly passenger airlines began to fly exclusively Freighter aircraft, enabling them to reactivate a portion of their idle aircraft and recoup the money. To satisfy the rise in demand, certain mixed passenger and freight carriers, such as Emirates & Iceland air, temporarily turned passenger planes into freighters. Approximately half of all freighter aircraft carried on passenger planes is transported via belly cargo. Generally, cargo-only airlines such as FedEx and Cargolux have not seen revenue growth equal to the total rise in market capacity. This is most likely because passenger airlines have increased their belly cargo space or operate a small fleet of specialized freighters.

MARKET RESTRAINTS

The global Freighter Aircraft market for freighter aircraft is restrained by a wide range of restraining factors such as weather conditions, specific skills and a high level of training are necessary for operation, and legislative constraints imposed by various governments. Because of these major factors, the Global Freighter Aircraft market has been hampered.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The Boeing Company, Airbus SE, (NASA) National Aeronautics & Space Administration, Textron Inc., Aviation Industry Corporation of China, ATR, KF Aerospace, Singapore Technologies Engineering Ltd, Aeronautical Engineers, Inc., Precision Aircraft Solution, Israel Aerospace Industries Ltd., and others |

SEGMENTAL ANALYSIS

Global Freighter Aircraft Market Analysis By Type

Based on type, the global Freighter Aircraft market of type is divided into dedicated Cargo Aircraft and Derivative of non- Cargo Aircraft. The Dedicated Cargo Aircraft is a specialized freighter Aircraft as it is be built expressly for air freight needs, including loading or unloading, flooring, fuselage layout, and pressurization that are suited for the task. Moreover, this can make proper the use of NASA's ACEE results, thereby cutting operational costs and fuel consumption dramatically. Such a high overhead raises the airplane's price and direct operating costs (due to depreciation and insurance costs), and the investment risk to investment firms, notably even though it would have been competing with derivatives with much-reduced development unit costs and which have integrated some of the cost-cutting technology themselves.

Global Freighter Aircraft Market Analysis By Application

By Application, the Global Freighter Aircraft market in the application is divided into Turboprop Aircraft and Turbofan Aircraft. The Turboprop Aircraft's category is dominated in the global Freighter Aircraft market. A turboprop Aircraft is a turbine engine that drives the propeller of an airplane. An intake, compressor, combustor, reduction gearbox, turbine, & propelling nozzle make up a turboprop. The compressor compresses the air that enters the intake. The fuel is then mixed with pressurized gas inside the combustor, in which the combination combusts. Because propellers are becoming less efficient as an aircraft's speed increases, turboprops are only utilized for low-speed aircraft such as cargo Aircraft or so-called Freighter Aircraft.

REGIONAL ANALYSIS

In APAC, Well over 30% of aviation freight demand is generated in the Asia-Pacific area. The growing demand for air freight is mostly due to the growing popularity of e-commerce. The air cargo business is being driven by a rising desire for shopping online and the existence of electronics as well as other commercial products manufacturing facilities in countries such as China, Japan, India, Vietnam & Cambodia.

North America holds a larger share in the Global Freighter Aircraft market. As Major manufacturers are from this region and there is a significant amount of growth coming from this region.

KEY MARKET PARTICIPANTS

- The Boeing Company

- Airbus SE

- (NASA) National Aeronautics & Space Administration

- Textron Inc.

- Aviation Industry Corporation of China

- ATR

- KF Aerospace

- Singapore Technologies Engineering Ltd

- Aeronautical Engineers, Inc.

- Precision Aircraft Solution

- Israel Aerospace Industries Ltd.

RECENT HAPPENINGS IN THE MARKET

In February 2022, After Textron Aviation finished the very first product line of a freight turboprop at its manufacturing site in Wichita, Kansas, FedEx Express might take ownership including the Cessna Sky Courier by mid-year. Following approval by Federal Aviation, which is expected in the first quarter of 2022, it'll be delivered to debut customer FedEx. FedEx has committed to buy up to 100 planes, with the first order of 50 planes and options for another 50.

In November 2021, According to Airbus, demand for air transportation will gradually move away from fleet expansion and toward the faster retiring of old, lesser gas airplanes, resulting in a requirement for 39,000 new passengers and cargo aircraft, 15,250 of which will be replacements. As a result, by 2040, the great number of commercial airplanes in operation, up from around 13% now, will be of the newest generation, significantly boosting the CO2 efficiency of the world's commercial aviation fleets. Aviation's economic advantages transcend beyond the sector, with the industry generating roughly 4% of yearly global GDP and supporting almost 90 million employments globally.

DETAILED SEGMENTATION OF THE GLOBAL FREIGHTER AIRCRAFT MARKET INCLUDED IN THIS REPORT

This research report on the global freighter aircraft market has been segmented and sub-segmented based on the type, application, and region.

By Type

- Dedicated Cargo Aircraft

- Derivative of Non-Cargo Aircraft

By Application

- Turboprop Aircraft

- Turbofan Aircraft

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the freighter aircraft market?

Key factors include the rise in e-commerce, increased demand for express shipping services, globalization of trade, and the need for efficient transportation of goods. Additionally, the growth of emerging markets and advancements in aircraft technology contribute to market expansion.

What are the major types of freighter aircraft available in the market?

The major types of freighter aircraft include narrow-body freighters, wide-body freighters, and regional freighters. Narrow-body freighters are commonly used for short-haul routes, while wide-body freighters are preferred for long-haul international routes. Regional freighters are used for intra-regional transportation.

How does the freighter aircraft market address the issue of aging fleets?

To address aging fleets, many operators are investing in newer, more efficient aircraft. Additionally, there is a trend of converting older passenger aircraft into freighters, which extends the lifespan of these aircraft and provides a cost-effective solution for increasing cargo capacity.

What role does technology play in the freighter aircraft market?

Technology plays a crucial role in improving efficiency, safety, and sustainability in the freighter aircraft market. Innovations such as advanced avionics, real-time tracking systems, automation, and the use of big data for predictive maintenance are enhancing operational efficiency and reliability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]