France Butter Powder and Oil Powder Market Research Report - Segmented By Distribution Channel, Nature, Flavor, And Region – Analysis On Size, Share, Trends, Growth Forecast Analysis Report 2025 To 2033

France Butter Powder and Oil Powder Market Size

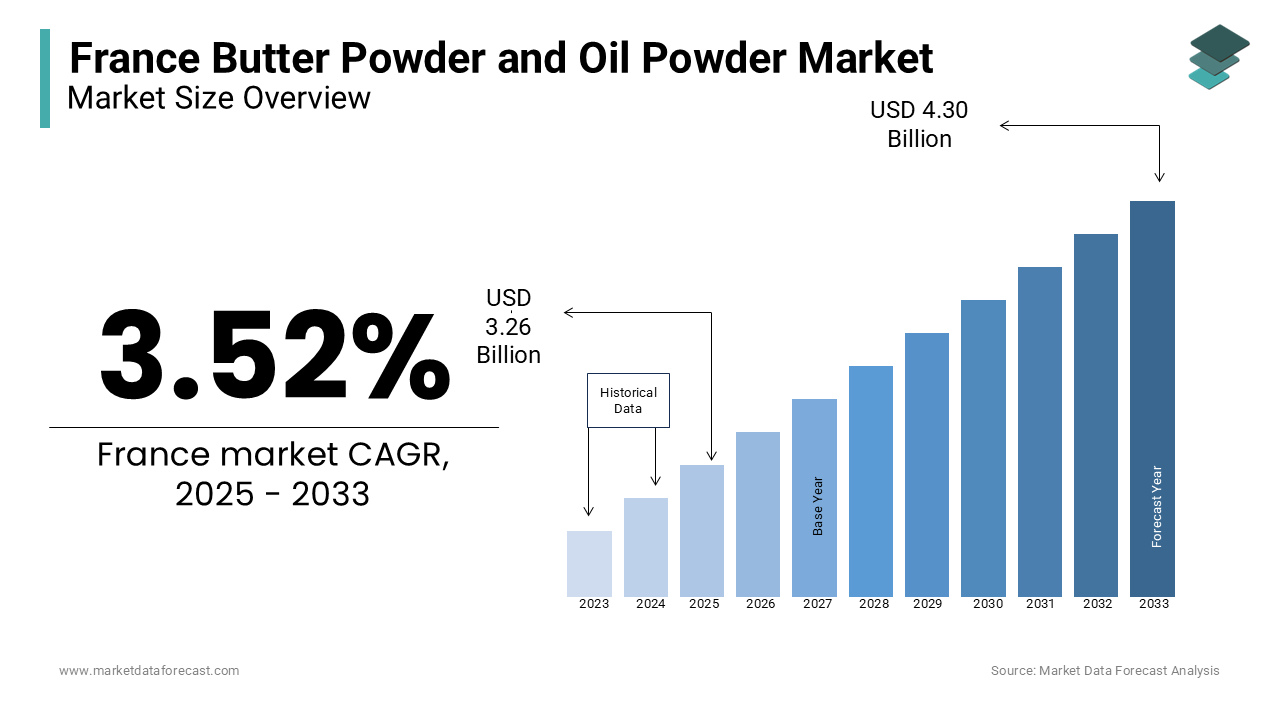

The france butter powder and oil powder market size was calculated to be USD 3.15 billion in 2024 and is anticipated to be worth USD 4.30 billion by 2033 from USD 3.26 billion In 2025, growing at a CAGR of 3.52% during the forecast period.

The French butter powder and oil powder market is integral to the nation's esteemed culinary and food processing sectors. According to the National Institute of Statistics and Economic Studies (INSEE), the manufacture of butter, classified under NAF code 10.51B, is a significant component of France's dairy industry. While specific data on butter powder production is limited, the broader butter manufacturing sector has shown resilience, adapting to evolving consumer preferences. The development of oil powders, which involves converting liquid oils into powdered form through processes like microencapsulation, caters to the demand for convenient and stable ingredients in food processing. France's commitment to innovation in food technology supports the growth of this niche market, aligning with trends in convenience and quality within the food industry. The demand for convenience foods, which has grown by 15% annually in France shall increase the adoption of these products. Additionally, the lightweight nature of powders reduces transportation costs and supports sustainability which is a key purchasing criterion as 74% of French consumers prioritize eco-friendly products.

MARKET DRIVERS

Growth in the Processed Food Industry

The increasing demand for processed and ready-to-eat foods is a key driver of the butter powder and oil powder market in France. According to INSEE, the processed food sector contributed approximately 15% of total manufacturing turnover in France in 2022. Butter and oil powders, valued for their long shelf life, ease of storage, and ability to enhance flavor, are widely used in bakery, confectionery, and instant food products. With the rising popularity of convenience foods, these powders are becoming indispensable ingredients, allowing manufacturers to maintain product consistency and meet consumer demand for high-quality, easy-to-use components.

Sustainability and Reduced Waste in Food Production

The adoption of butter and oil powders is driven by sustainability goals and the need to minimize food waste. Unlike traditional liquid oils or fresh butter, these powders have a longer shelf life and lower refrigeration requirements, reducing energy use and spoilage. France's focus on sustainable food practices is reflected in the French National Low-Carbon Strategy, which emphasizes reducing carbon emissions across the food supply chain. By using powdered formats, manufacturers can align with these goals while meeting the growing consumer preference for environmentally conscious food products.

MARKET RESTRAINTS

High Production Costs

The production of butter and oil powders involves advanced spray-drying or encapsulation processes which are energy-intensive and expensive. This makes the end products costlier than liquid counterparts, limiting their adoption, particularly among small-scale food producers. The average energy cost in France increased by 15% in 2022 that further exacerbating production costs. Additionally, sourcing high-quality raw materials, such as organic butter or premium oils, adds to the expense, making it challenging for manufacturers to offer competitively priced products. These higher costs can deter price-sensitive consumers and restrict market growth despite the increasing demand for convenience and sustainability.

Limited Consumer Awareness

Despite growing demand in B2B applications, consumer awareness about butter and oil powders remains limited in France. Many end-users are unfamiliar with their benefits, such as extended shelf life and versatility, which hinders adoption in emerging product segments like DIY meal kits. 35% of French consumers are aware of powdered dairy products that suggests a need for education and marketing efforts. This lack of awareness also limits the incorporation of oil powders in health-conscious applications, such as protein snacks, where they could serve as clean-label fat sources by slowing the market’s overall growth potential.

MARKET OPPORTUNITIES

Rising Demand for Health-Forward Snacks

The health-forward snack segment in France is growing rapidly by creating an opportunity for butter and oil powders as functional and clean-label ingredients. In 2023, the French snack industry saw a 21% rise in demand for healthier alternatives by including low-fat and high-protein options. Butter powder is used for its flavor enhancement and natural fat content, can be included in premium snack bars and cookies, while oil powders support fat control in savory snacks like chips and crackers. These powders enable manufacturers to innovate while addressing nutritional preferences with 34% of French consumers actively seeking products with added health benefits.

Increased Focus on Exporting Shelf-Stable Ingredients

France’s food export sector is flourishing with a 15% year-on-year increase in demand for shelf-stable food products in 2022 from markets in Asia and the Middle East. Butter and oil powders offer excellent storage and transportation advantages by reducing the reliance on refrigeration in regions with limited infrastructure. For example, butter powder’s use in exported pastries and confectioneries supports the global trend toward convenience foods which is expected to grow at 5.4% CAGR globally by 2030. These powders also meet the stringent EU food quality standards by giving French producers a competitive edge in premium export markets.

MARKET CHALLENGES

Supply Chain Volatility

Supply chain disruptions due to fluctuations in raw material availability and rising energy costs is posing a significant challenge for the butter powder and oil powder market in France. France experienced a 15% increase in dairy input costs in 2023, driven by lower milk yields and increasing feed prices. Additionally, the reliance on imported oils like coconut or palm increases vulnerability to global trade disruptions. Production and logistics expenses are further impacted pressuring profit margins and pricing competitiveness for both domestic and export markets with energy costs also rising by 25% in the past two years.

Regulatory Compliance and Labeling Challenges

Stricter EU food safety regulations and labeling requirements challenge manufacturers to ensure transparency and compliance. The 2022 EU Green Deal initiatives push for more sustainable sourcing and production which adds complexity and cost to supply chains for butter and oil powders. Producers must also meet evolving clean-label standards, with 63% of French consumers demanding clear and natural ingredient lists. Non-compliance risks include market exclusion and damaged consumer trust by forcing companies to invest heavily in reformulations and certifications which can slow innovation and delay product launches in an increasingly competitive market.

SEGMENTAL ANALYSIS

By Distribution Channel Insights

The Supermarket/Hypermarket segment holds 40% of the France butter powder and oil powder market share. This dominance is due to the widespread presence of these retail outlets across the country by offering consumers convenient access to a variety of butter powder products. Supermarkets and hypermarkets provide a one-stop shopping experience which appeals to the busy lifestyles of many French consumers. Additionally, these stores often offer competitive pricing and promotions which further attracting a large customer base.

The Online Store segment is experiencing the fastest growth in France's butter powder market with a projected compound annual growth rate (CAGR) of 5.6% from 2024 to 2032. This rapid expansion is driven by increasing consumer preference for the convenience of online shopping, the availability of a wider product range, and the rise of e-commerce platforms. The COVID-19 pandemic has further accelerated this trend, as consumers increasingly turn to online channels for their purchases. The growth of the online segment reflects a broader shift towards digital retailing in the food industry.

By Nature Insights

The Conventional segment is accounted in holding 85% share of the market in 2024. This dominance is due to the widespread availability and cost-effectiveness of conventionally produced butter powder by making it a preferred choice among manufacturers and consumers. Conventional butter powder is extensively used in various applications by including bakery products, confectioneries, and ready-to-eat meals due to its consistent quality and affordability. The large-scale production and established supply chains further reinforce its leading position in the market.

Conversely, the Organic segment is experiencing the fastest growth in France's butter powder market, with a projected compound annual growth rate (CAGR) of 6.5% from 2024 to 2032. This rapid expansion is driven by increasing consumer awareness and demand for organic and clean-label products by reflecting a broader shift towards health-conscious consumption patterns. The growing preference for organic products is influencing manufacturers to expand their organic product lines by contributing to the segment's accelerated growth.

By Flavor Insights

The Cocoa flavor segment holds the largest share by accounting for 45% of the market. This dominance is attributed to French consumers' strong preference for chocolate-infused products, leading to widespread use of cocoa butter powder in bakery items, confectioneries, and desserts. The rich flavor and versatility of cocoa butter powder make it a staple ingredient in many traditional and modern French recipes by reinforcing its leading position in the market.

Conversely, the Almond flavor segment is experiencing the fastest growth, with a projected compound annual growth rate (CAGR) of 7.3% from 2024 to 2032. This rapid expansion is driven by increasing consumer demand for nut-based flavors and health-conscious consumption patterns. Almond butter powder is gaining popularity due to its nutritional benefits, including being a source of healthy fats and proteins, and its versatility in various culinary applications. Manufacturers are responding to this trend by expanding their almond-flavored product lines, contributing to the segment's accelerated growth.

REGIONAL ANALYSIS

The France Butter Powder Market is witnessing consistent growth driven by its widespread application in food manufacturing and processing sectors. The market is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2032. This growth is fueled by increasing consumer demand for shelf-stable, high-quality ingredients that cater to convenience foods, bakery products, and ready-to-eat meals. The bakery industry alone accounts for 60% of France’s food and beverage exports by making butter powder a crucial ingredient in maintaining consistency and quality for both domestic consumption and export.

Butter powder's advantages include its extended shelf life, ease of transportation, and ability to retain flavor and texture in recipes without refrigeration. With the convenience food segment growing by 15% annually in France, butter powder continues to be a preferred ingredient for manufacturers aiming to meet modern consumer preferences.

France's robust position as a global exporter of gourmet food products ensures that butter powder remains a staple ingredient in its culinary offerings. Moreover, the increasing focus on clean-label and natural ingredients has further propelled the adoption of butter powder by aligning with the 34% rise in demand for natural and organic food ingredients in recent years.

The market's future performance is expected to remain strong, supported by advancements in food technology and increasing investments in sustainable production practices which resonate with the preferences of 74% of French consumers prioritizing eco-friendly products. The combination of these factors solidifies France's standing as a key player in the butter powder market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the French butter powder and oil powder market include Lactalis Ingredients, Laïta, Isigny Sainte-Mère, Société Fromagère de Bouvron, Coopérative Laitière de la Sèvre, Beurre Bordier, Lescure Butter, Echiré Cooperative, Beillevaire, Fromagerie Gillot

The France Butter Powder Market is characterized by intense competition, with a mix of global and regional players vying for market dominance. Leading companies such as Lactalis Ingredients, Laïta, and Isigny Sainte-Mère leverage their established reputations and expansive product portfolios to maintain a competitive edge. These players focus on innovation, sustainability, and meeting the demand for high-quality, shelf-stable products to address the needs of diverse industries like bakery, confectionery, and ready-to-eat meals.

Artisanal producers like Beurre Bordier and Echiré Cooperative bring a unique advantage to the market, emphasizing traditional production methods and premium offerings. This appeals to consumers seeking authentic, high-quality products, particularly for use in gourmet and luxury food items.

Competitive differentiation often revolves around product quality, consistency, and the ability to meet clean-label and sustainability standards. As 74% of French consumers prioritize eco-friendly products, companies are increasingly investing in sustainable practices to gain consumer trust and loyalty.

Global competition also plays a role, as France faces challenges from international dairy exporters in meeting rising demand for butter powder in global markets. Companies must balance cost efficiency with innovation to retain their position in both domestic and export markets, making the market dynamic and highly competitive.

RECENT HAPPENINGS IN THE MARKET

- May 2024, Epi Ingredients introduced an additive-free butter powder. This launch is expected to capture market share in the clean-label segment, addressing growing consumer demand for natural and preservative-free products.

- September 2024, Lactalis Ingredients reduced its milk processing by 450 million liters annually to focus on high-margin products like butter powder, cheese, and yogurt. This strategic move aims to stabilize revenues and mitigate risks from fluctuating commodity prices.

- March 2023, Isigny Sainte-Mère commissioned a new drying tower to expand its butter powder production capacity. This development is anticipated to meet rising domestic and international demand for premium butter powders and strengthen the company’s market position.

- July 2023, Laïta partnered with a packaging solutions company to introduce recyclable packaging for butter powders. This initiative aligns with sustainability trends and enhances the brand’s appeal to eco-conscious consumers.

- August 2022, Beurre Bordier launched artisan butter powders tailored for gourmet markets. This move aims to solidify its position in the premium segment by catering to high-end food service providers.

- November 2023, Lescure Butter introduced a plant-based butter powder alternative. This launch is designed to tap into the growing plant-based market and expand the company’s product portfolio.

- April 2023, Echiré Cooperative secured an export agreement with Asian distributors. This deal strengthens Echiré’s presence in high-demand markets like Japan and South Korea, supporting global expansion.

- February 2024, Lactalis Ingredients launched a nutritional butter powder enriched with vitamins and minerals. This product aims to attract health-conscious consumers and expand the company’s reach into the functional food sector.

- January 2023, Société Fromagère de Bouvron adopted AI-driven production technologies for butter powder manufacturing. This initiative is expected to improve efficiency, reduce costs, and ensure consistent product quality.

- December 2023, Coopérative Laitière de la Sèvre invested in renewable energy for its production facilities. This shift is anticipated to reduce carbon emissions and align the company with sustainability-focused consumer preferences.

MARKET SEGMENTATION

This research report on the france butter powder and oil powder market is segmented and sub-segmented into the following categories.

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Store

- B2B

- Specialty Store

- Online Store

By Nature

- Conventional

- Organic

By Flavor

- Cocoa

- Almond

- Peanut

- Others

Frequently Asked Questions

1. What are the key applications of butter powder and oil powder?

They are widely used in baking, confectionery, dairy products, instant food, and food service industries.

2. How is the demand for butter powder and oil powder changing in France?

The market is witnessing steady growth due to increasing use in food processing industries, rising health-conscious consumer preferences, and demand for non-refrigerated dairy alternatives.

3. Which companies are the leading players in the France butter powder and oil powder market?

Some major players include dairy manufacturers, food ingredient suppliers, and multinational companies specializing in powdered food products.

4. Who are the target consumers for butter powder and oil powder?

Food manufacturers, bakers, restaurants, and health-conscious individuals looking for convenient dairy alternatives.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]