Global Forestry Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Logging, Timber Tract Operations, Forest Nurseries, Gathering of Forest Products) Application (Construction, Industrial Goods, Others) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) - Industry Analysis Forecast (2025 to 2033)

Global Forestry Market Size

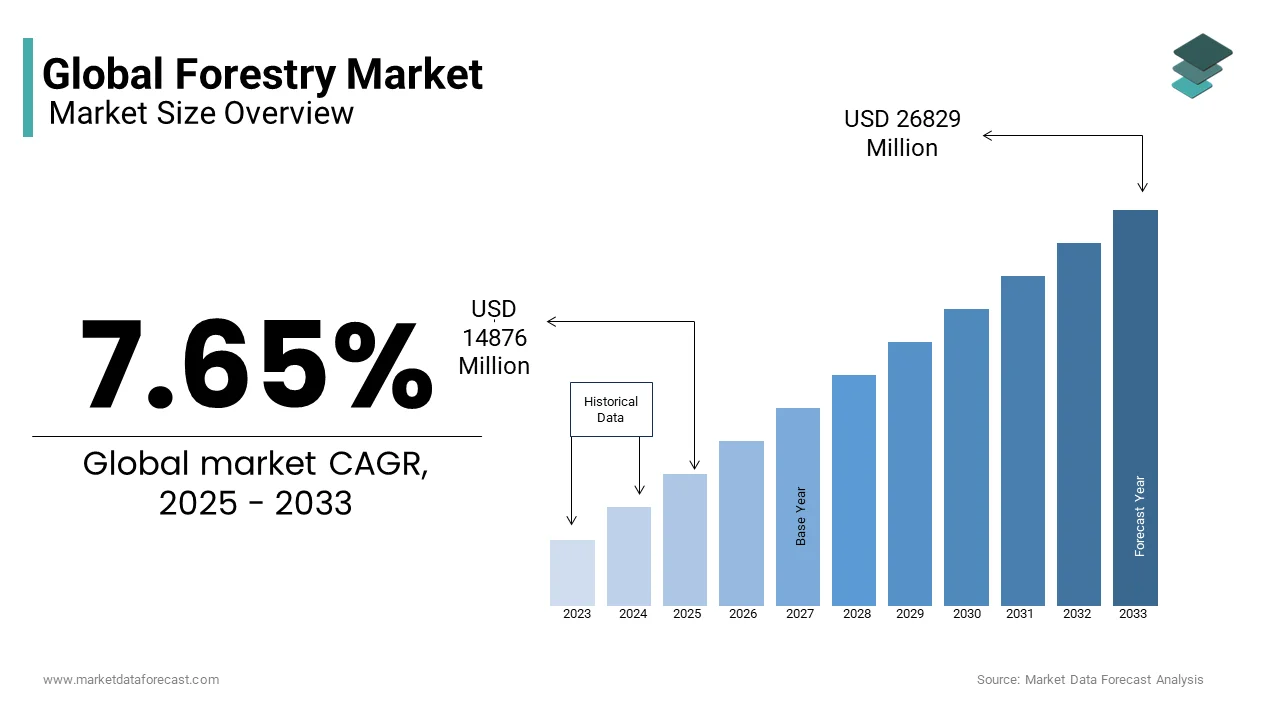

The global forestry market size was valued at USD 13819.19 million in 2024 and is anticipated to reach USD 14876 million in 2025 from USD 26829 million by 2033 growing at a CAGR of 7.65% during the forecast period from 2025 to 2033.

Forestry includes all activities related to the planting, care, and protection of forests and these provide essential materials such as wood for construction, paper products, and fuel. Additionally, forests play a crucial role in controlling the Earth's climate and providing income for millions of people. According to the Food and Agriculture Organization (FAO), forests cover about 4.06 billion hectares, which is 31% of the Earth's total land area. However, from 1990 to 2020, the world lost around 178 million hectares of forest. This loss mainly happened because trees were cleared for farming, building projects, and other land uses. Despite this decline, the speed of forest loss has slowed down over the last 30 years. This improvement is due to efforts to reduce deforestation in some areas and plant more trees in others.

Forests also help fight climate change by capturing and storing 7.6 billion metric tonnes of CO₂ each year, which is twice as much carbon as they release, according to the World Resources Institute. In addition, forests are home to a large share of the world's land-based biodiversity, providing shelter to many species and helping to keep ecosystems balanced. Factors such as government policies, sustainable forest management, new technology, and the rising demand for eco-friendly products are propelling the growth of the forestry market. As more people and businesses become aware of environmental issues, there is a greater focus on managing forests responsibly. This balance ensures that forests continue to support both the economy and the environment.

Market Drivers

Climate Change Mitigation Initiatives

Efforts to reduce the impact of climate change have helped the forestry market grow. Forests absorb 7.6 billion metric tonnes of CO₂ every year, making them essential in controlling greenhouse gases, according to the World Resources Institute. Recognizing their importance, the European Union has launched the "3 Billion Tree Planting Pledge by 2030" to increase tree planting. Similarly, India’s National Mission for a Green India focuses on restoring and expanding forests by using strategies that adapt to and reduce climate change effects. These programs support carbon storage, biodiversity, and forest conservation, which encourage investment and long-term growth in the forestry market.

Technological Advancements in Sustainable Forestry

New technology has improved the way forests are managed, making forestry more sustainable and efficient. Modern equipment, such as advanced harvesters, can cut down trees quickly while reducing harm to the environment. Remote sensing, Geographic Information Systems (GIS), and blockchain technology have also improved how forests are monitored, allowing for better tracking of tree health and timber supply. These innovations help prevent illegal logging, improve resource management, and ensure forests are used responsibly. As a result, forestry companies attract more investment and can grow while keeping forests protected for the future.

Market Restraints

Deforestation

Deforestation remains one of the biggest problems for the forestry market. Since 1990, about 420 million hectares of forest have been lost, and between 2015 and 2020, trees were cut down at a rate of 10 million hectares per year, as reported by the Food and Agriculture Organization (FAO). This loss reduces the amount of wood available for industries and threatens the stability of the forestry market. Deforestation also leads to habitat destruction and climate change, which can result in stricter environmental laws, limiting the expansion of the forestry market and increasing operational costs.

Illegal Logging

The illegal cutting of trees harms sustainable forest management and disrupts the forestry market. The World Wildlife Fund (WWF) states that 15% to 30% of global timber production comes from illegal sources, with illegal wood trade valued between $50 billion and $150 billion annually. This causes governments to lose revenue and leads to forest degradation, the loss of biodiversity, and more greenhouse gas emissions. To stop illegal logging, international organizations and governments have introduced laws and agreements to ensure timber is harvested legally and sustainably, but enforcement remains a challenge.

Market Opportunities

Expansion of Forest Cover through Afforestation Initiatives

Planting new trees provides a great opportunity for the forestry market, increasing forest areas and benefiting the environment. In the United Kingdom, new woodland creation increased significantly, from 12,960 hectares in 2022-23 to 20,660 hectares in 2023-24, as per Forest Research. More forests mean more carbon storage, better biodiversity, and a greater supply of raw materials for different industries. Governments around the world are offering financial support and incentives for planting trees, which is helping the forestry market grow while also improving environmental conditions.

Integration of Natural Capital Projects

Natural capital projects focus on protecting forests while generating revenue through ecosystem services and carbon credits. The UK Forest Market Report 2024 states that the demand for high-quality forests is increasing due to stable timber prices and growing natural capital projects. Investments in these projects support sustainable forestry, helping companies earn money from biodiversity conservation and climate initiatives. These projects also encourage businesses to invest in environment-friendly forestry operations, strengthening the market and ensuring long-term sustainability.

Market Challenges

Climate Change and Extreme Weather Events

Forestry is facing increasing risks due to climate change and extreme weather events. The Forestry Commission’s 2023-2024 report stated that 1,300 hectares of woodland were affected by storms, droughts, and pest infestations. These events damage forests, making it difficult to manage and restore them. Additionally, extreme weather leads to higher costs and unpredictable timber supply, making forestry operations more challenging. To handle these risks, companies must adopt climate-resilient forest management strategies, which require additional investment and long-term planning.

Regulatory and Policy Uncertainties

Changing environmental laws and policies make it difficult for forestry businesses to plan for the future. The Forestry Commission’s 2022-2023 report explains that new biodiversity offsetting requirements have changed how forestry companies operate. Delays in government decisions and differences between national and regional laws create confusion, making businesses hesitant to invest. These policy changes affect forest management, timber production, and land use, slowing down market growth. To overcome these challenges, governments and businesses must work together to create clear and stable regulations for the forestry market.

REPORT COVERAGE

-

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.65% |

|

Segments Covered |

By Type, Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

West Fraser Timber Co Ltd, Canfor, Weyerhaeuser Company, Hancock Victorian Plantations, Forestry Corporation of NSW, Rayonier Inc., China Forestry Group Corporation, Potlatch Deltaic Corporation. |

SEGMENT ANALYSIS

Global Forestry Market Analysis By Type

The logging segment was the most dominating segment in the global market by holding the most promising share of the global market in 2024 owing to the critical role of logging in supplying raw materials for various industries, including construction, paper manufacturing, and furniture production. According to the Food and Agriculture Organization (FAO), global industrial roundwood production reached 2.02 billion cubic meters in 2020, highlighting the substantial scale of logging activities worldwide. The consistent demand for timber underscores logging's importance in meeting global needs for wood-based products.

The timber tract operations segment is estimated to register the highest CAGR of 12.6% during the forecast period due to factors such as the increasing investments in sustainable forest management and the rising demand for certified timber. The FAO reports that the area of certified forest worldwide has been expanding, reflecting a global commitment to responsible forestry practices. Timber tract operations focus on the management and cultivation of forested lands for long-term timber production, playing a crucial role in ensuring a sustainable supply of wood resources while maintaining ecological balance.

Global Forestry Market Analysis By Application

The construction segment led the market by accounting for a 73.1% of the global market share in 2024. The growth of the construction segment in the global market is attributed to the extensive use of timber in building frameworks, flooring, and finishes. The Food and Agriculture Organization (FAO) reported that global industrial roundwood production reached 2.02 billion cubic meters in 2020, with a substantial portion utilized in construction. The increasing adoption of wood in sustainable building practices further underscores its importance in this sector.

The industrial goods segment is anticipated to witness the fastest CAGR of 8.3% over the forecast period. The growth of the industrial goods segment is driven by the rising demand for wood-based products in various industries, including paper manufacturing, furniture production, and bioenergy. The FAO notes that global paper and paperboard production was approximately 419 million tonnes in 2020, reflecting the substantial utilization of forest resources in industrial applications. The versatility and renewability of wood make it a preferred material across these industries, contributing to the segment's accelerated growth.

REGIONAL ANALYSIS

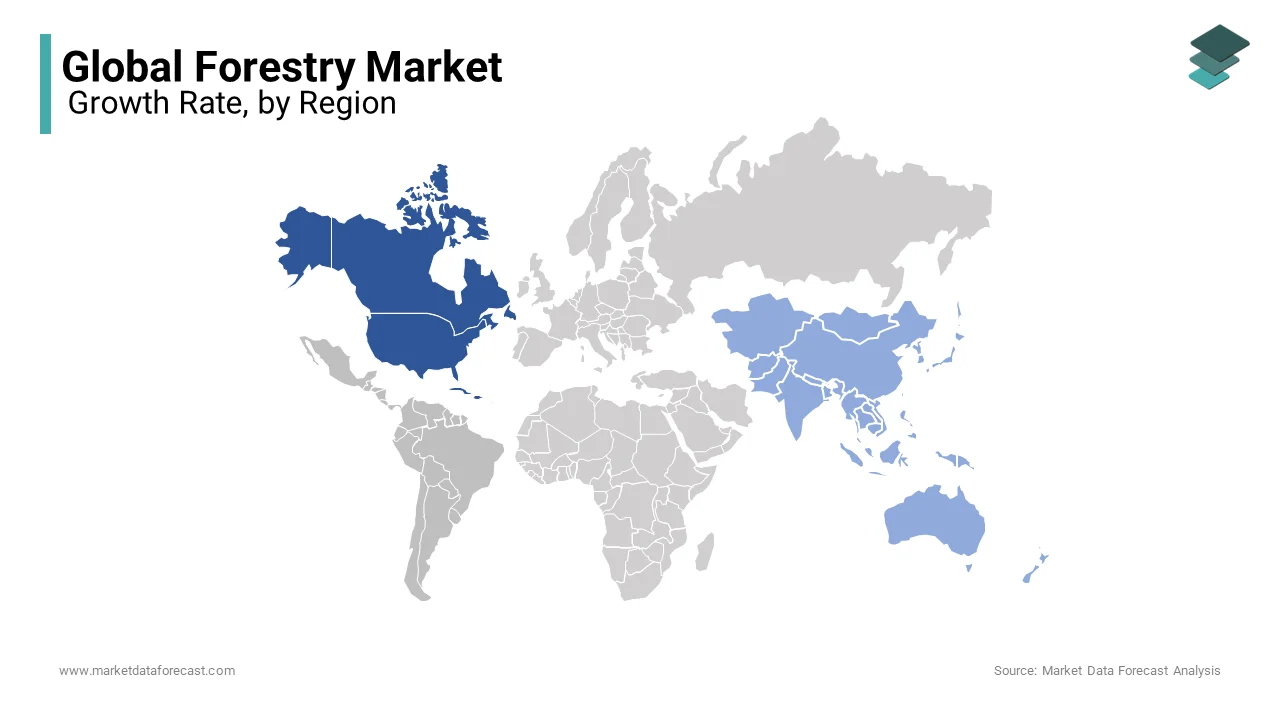

North America dominated the forestry market in 2024 and held the largest share of 40.4% of the global in 2024. This dominance of North America in the global market is attributed to the region's extensive forest resources, particularly in Canada and the United States, which support a robust logging and timber business. According to the Food and Agriculture Organization (FAO), North America has a forest area of about 751 million hectares, representing 16% of the world's total forest area. The region's well-established infrastructure and sustainable forest management practices further bolster its leading position in the market.

The Asia-Pacific region is witnessing the fastest growth in the forestry market with a projected CAGR of 10.5% over the forecast period. This rapid expansion is driven by increasing demand for timber and wood products in countries such as China and India, fueled by urbanization and industrialization. The FAO reports that Asia's forest area has been expanding, with significant afforestation efforts contributing to this growth. Government initiatives promoting sustainable forestry practices and investments in forest plantations are also key factors propelling the market in this region.

Europe possesses a significant position in the global forestry market. This prominence is attributed to the region's extensive forest resources and advanced forest management practices. According to the Food and Agriculture Organization (FAO), Europe, including the Russian Federation, encompasses about 1.02 billion hectares of forest, representing 25% of the world's total forest area. The region's commitment to sustainable forestry is evident through policies like the European Union's Forest Strategy, which aims to enhance forest protection and biodiversity. However, recent regulations, such as the EU Deforestation Regulation set to be enforced from December 30, 2024, may impact trade dynamics by restricting imports linked to deforestation, as highlighted by Reuters.

Latin America, particularly Brazil, is a major contributor to the global forestry market due to its vast forest resources, including the Amazon rainforest. In 2024, the region held a smaller market share . Initiatives to restore degraded lands are underway, with plans to restore 40 million hectares of degraded pastures into productive systems for food, biofuels, and forests through commercial forestry, as reported by Reuters. However, challenges such as deforestation and regulatory uncertainties may affect the market's growth trajectory.

The Middle East and Africa region is anticipated to grow at a steady rate. The region faces challenges due to limited forest cover and arid climates. However, afforestation initiatives and sustainable forest management practices are gradually gaining momentum. For instance, the Great Green Wall initiative aims to combat desertification and restore degraded lands across the Sahel region. These efforts are expected to enhance the region's market presence in the coming years.

Top 3 Players in the market

Oji Holdings Corporation

Oji Holdings Corporation, headquartered in Tokyo, Japan, is one of the largest players in the global forestry market. The company manages over 4 million acres of forest land across multiple countries, including Australia, Canada, and Brazil. Oji Holdings specializes in producing paper for writing, printing, and packaging, as well as chemicals derived from the paper manufacturing process. The company is known for its extensive sustainability efforts, ensuring a continuous supply of raw materials while preserving ecological balance. With over 36,000 employees across 156 subsidiaries, Oji Holdings plays a crucial role in global employment within the forestry sector. Its commitment to responsible forestry practices and innovative paper and packaging solutions makes it a key driver in the market’s future growth.

Stora Enso Oyj

Stora Enso Oyj, a Finnish-Swedish multinational company, is a leading provider of renewable solutions in packaging, biomaterials, wooden construction, and paper. Formed through a merger between Finland's Enso Oyj and Sweden’s Stora in 1998, the company operates globally, with major operations in Europe, Asia, and South America. Stora Enso is at the forefront of sustainable forestry management, producing innovative materials designed to replace non-renewable resources. The company's product portfolio includes recyclable packaging solutions, engineered wood products for sustainable construction, and biomaterials derived from wood. With approximately 20,000 employees, Stora Enso continues to push boundaries in forestry-based solutions while maintaining a strong commitment to sustainability and environmental responsibility.

Weyerhaeuser Company

Weyerhaeuser Company, based in Seattle, Washington, is one of the largest private owners of timberlands in the world, managing over 11 million acres in the United States and an additional 14 million acres under long-term licenses in Canada. The company operates across multiple sectors, including timberland management, wood products manufacturing, and real estate development. Weyerhaeuser is dedicated to sustainable forestry practices, ensuring that its timberlands are responsibly managed to maintain biodiversity and water quality while supplying high-quality wood products. The company's wood products, including lumber, plywood, and engineered wood, are widely used in residential, commercial, and industrial construction. With a long-standing reputation for sustainability, Weyerhaeuser plays a pivotal role in maintaining a balance between economic growth and environmental stewardship in the forestry market.

Top strategies used by the key market participants

Sustainable Forest Management – Oji Holdings Corporation

Oji Holdings Corporation prioritizes sustainable forest management to ensure a steady supply of raw materials while preserving environmental integrity. The company actively engages in afforestation and reforestation projects across its vast landholdings in Japan, Australia, Brazil, and Canada. By implementing responsible logging practices and investing in biodiversity conservation, Oji Holdings minimizes the ecological impact of its operations. The company also utilizes advanced monitoring technologies such as satellite imaging and drone surveillance to track forest health and optimize harvesting cycles. This commitment to sustainability strengthens its reputation as an environmentally responsible forestry leader, giving it a competitive edge in a market increasingly driven by eco-conscious consumers and regulatory requirements.

Innovation in Renewable Materials – Stora Enso Oyj

Stora Enso has focused heavily on innovation in renewable materials to position itself as a leader in sustainable forestry solutions. The company is developing bio-based alternatives to fossil-fuel-based materials, such as lignin-based adhesives, bioplastics, and fiber-based packaging. By investing in research and development, Stora Enso is shifting towards a circular economy, where forest resources are used efficiently and sustainably. Additionally, the company is expanding its presence in the engineered wood construction sector, promoting wooden buildings as a sustainable alternative to traditional steel and concrete structures. These innovations allow Stora Enso to differentiate itself from competitors while addressing growing consumer and regulatory demand for environmentally friendly products.

Vertical Integration and Diversification – Weyerhaeuser Company

Weyerhaeuser has implemented a vertical integration strategy to strengthen its market position by controlling various stages of the forestry supply chain. The company owns vast timberlands, operates sawmills and processing facilities, and is actively engaged in real estate development. This approach allows Weyerhaeuser to maintain cost efficiency, quality control, and supply chain stability, reducing reliance on third-party suppliers. Additionally, the company has diversified its revenue streams by expanding into carbon credit markets, where it generates income by preserving forests that sequester carbon dioxide. This strategic move aligns with global climate action efforts while providing an additional financial advantage in an evolving regulatory landscape.

KEY MARKET PLAYERS

West Fraser Timber Co Ltd, Canfor, Weyerhaeuser Company, Hancock Victorian Plantations, Forestry Corporation of NSW, Rayonier Inc., China Forestry Group Corporation, Potlatch Deltaic Corporation. These are the market players that are dominating the global forestry market.

COMPETITIVE LANDSCAPE

The global forestry market is highly competitive, driven by demand for timber, paper, wood-based products, and bioenergy. Key players, including Oji Holdings Corporation, Stora Enso Oyj, and Weyerhaeuser Company, compete through strategies such as sustainable forest management, vertical integration, and digitalization. The competition is influenced by several factors, including resource availability, regulatory frameworks, environmental concerns, and evolving consumer preferences for sustainable products.

Sustainability and responsible forestry practices have become key differentiators in the market. Companies that integrate reforestation, biodiversity conservation, and carbon credit trading into their operations gain a competitive edge as global climate regulations tighten. Additionally, the shift towards renewable and bio-based materials has intensified innovation, with firms investing in alternative packaging, engineered wood, and biomass energy solutions.

Geographic expansion and supply chain efficiency are also crucial in this competitive landscape. Companies with access to vast, well-managed timberlands and advanced processing facilities maintain cost advantages. Digitalization is reshaping competition, with AI-driven forest monitoring, blockchain-based traceability, and predictive analytics enhancing operational efficiency.

The forestry market is further influenced by economic cycles, trade policies, and climate-related disruptions. As consumer demand shifts toward sustainable wood products, the ability to adapt to market trends and regulatory changes remains critical for long-term success.

RECENT HAPPENINGS IN THIS MARKET

- In December 2024, the European Union agreed to delay the implementation of its regulation banning imports of commodities linked to deforestation by one year, moving the enforcement date to December 30, 2025. This decision came after concerns from multiple EU countries, businesses, and nations like Brazil and Indonesia.

- In November 2024, the Integrity Council for the Voluntary Carbon Market approved new methodologies for forestry projects aimed at avoiding deforestation, known as REDD+. This approval introduces the Core Carbon Principles (CCP) label, serving as a quality assurance guarantee for carbon credits generated under these methodologies.

MARKET SEGMENTATION

This research report on the global forestry market is segmented and sub-segmented into the following categories.

By Type

- Logging

- Timber Tract Operations

- Forest Nurseries

- Gathering of Forest Products

By Application

- Construction

- Industrial Goods

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com