Global Foreign Exchange Market Size, Share, Trends, Growth Forecast Report By Counterparty (Reporting Dealers, Non-financial Customers and Other Financial Institutions), Trade Finance Instrument (Currency Swap, Outright Forward, FX Swaps, FX Options, Spot Forex and Others), End User (Individuals, Retailers, Corporates, Government and Other End Users) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Foreign Exchange Market Size

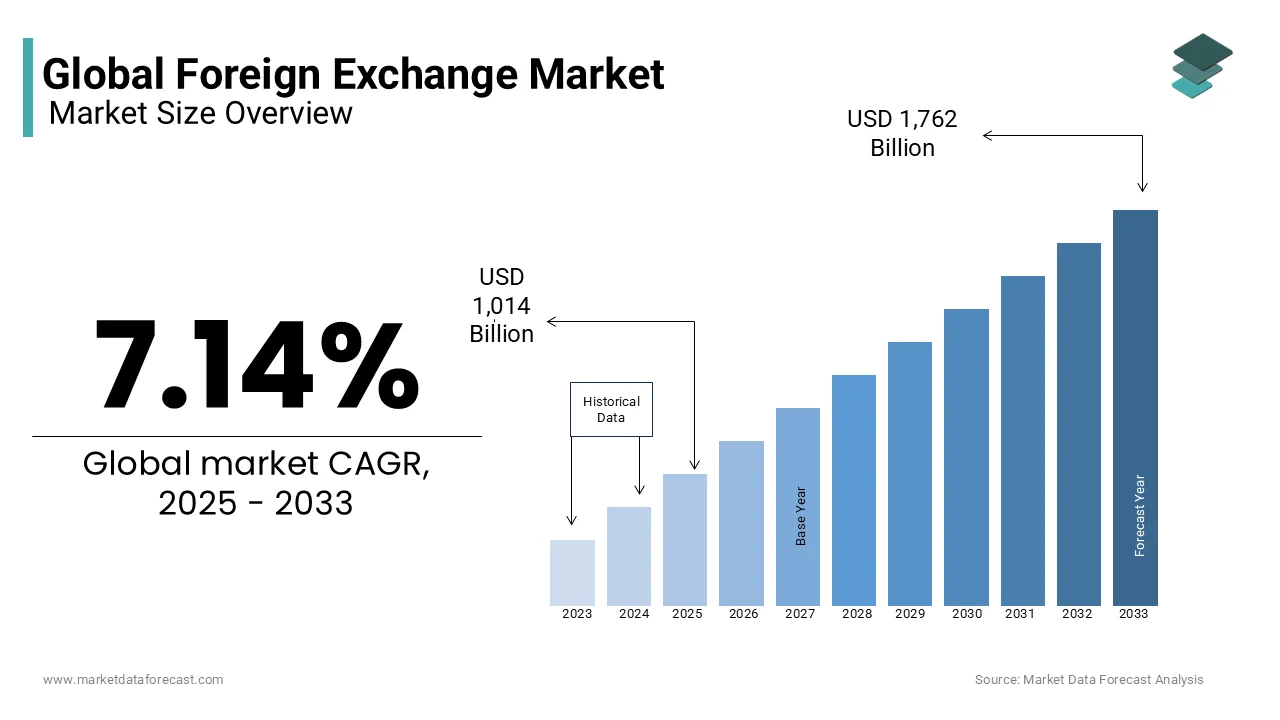

The size of the global foreign exchange market was valued at USD 947.33 billion in 2024. The global market is expected to grow at a CAGR of 7.14% from 2025 to 2033 and be worth USD 1,762.24 billion by 2033 from USD 1,014.97 billion in 2025.

The growth of the global foreign exchange market is driven by an increased introduction of the latest technologies such as blockchain. In January 2024, R3, an enterprise blockchain firm, revealed a new product suite called “R3 Digital Market”. It uses its Corda distributed ledger technology (DLT) for capital markets. This is the perfect time for Europe as it gives two significant capital market initiatives. Moreover, the United Kingdom also introduced its Digital Securities Sandbox in January 2024. Furthermore, in mainland Europe, the trials are about to commence by the European Central Bank using federal bank money for DLT settlement. In the Asia Pacific, the Reserve Bank of India is planning and designing a new segment of money changers for the smooth functioning of money-changing businesses via an agency model. Additionally, governments and banks worldwide have begun shifting their focus towards utilizing digital assets in their economies and operations.

MARKET DRIVERS

Growing Integration of Modern Technology into Trading Locations, Sites and Marketplaces

This, therefore, enhances its effectiveness and openness. Consequently, the proliferation of businesses requires implementing foreign exchange services to promote multinational operations. In addition, the variable nature of monetary policy and legal frameworks by governments and central or federal banks continuously influences the global market dynamics. Additionally, the expansion of digital payment platforms and networks, along with the deregulation of financial markets, are fuelling the growth trajectory of the market. Further, the easy availability of news, updates and pricing offers foreign exchange players real-time analysis and data that are taking the global foreign exchange forward.

Advancements in Smart Order Routing (SOR) Technologies

The automated process, simultaneous selection of trading venues, and analysis of multiple factors of smart order routing technologies have fuelled its adoption rate across asset classes. Currently, artificial intelligence and machine learning are regularly being incorporated to enhance SOR performance via adaptive learning, predictive analysis and dynamic strategy adjustments.

MARKET RESTRAINTS

Growing Intensity and Scale of Cybersecurity Threats

In the last few years, online attacks have increased in both sophistication and frequency, which significantly impacts traders, companies, and governments. This has caused substantial financial losses for the market players. Moreover, the foreign exchange market is increasingly experiencing cases of fraud and scams through Voice over Internet Protocol (VOIP) calls to target customers for foreign exchange trading. Creating fake company profiles, websites or employee details and showing false market trends are some of the ways to scam people. This resulted in a huge lack of confidence in existing as well as first-time users, ultimately decreasing the foreign exchange market growth rate.

MARKET OPPORTUNITIES

Artificial intelligence for improving liquidity, central bank digital currency (CBDC), and the application of blockchain present potential opportunities for the foreign exchange market. The purpose of CBDC is to enhance the productivity of settlements or transactions and lower the cost of transporting, storing and printing physical cash. This will create significant demand because governments and banks are actively looking into this as a better secure substitute to crypto. Blockchain, additionally, is viewed as an optimistic technology for better transparency, decreasing fraud and offering secure peer-to-peer transactions without the requirement for intermediaries.

MARKET CHALLENGES

The foreign exchange market faces the challenge of counterparty risks. It is the threat related to the other party to a financial agreement not obliging its commitments. Since it is an international market, forex regulation is a tough subject owing to the involvement of authority of the currencies of various nations. This results in a state in which the world industry becomes mostly unregulated. Geopolitical tensions are another significant challenge in the foreign exchange market. These events often have a severe impact on the principal amount invested by the investors in the hope of good returns, affecting the expansion of the market in remote or rural areas in emerging countries.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.14% |

|

Segments Covered |

By Counterparty, Trade Finance Instrument, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Barclays, XTX Markets Limited, BNP Paribas, State Street Corporation, Citibank, Standard Chartered PLC, Deutsche Bank, UBS AG, Goldman Sachs, The Royal Bank of Scotland, HSBC Holdings plc and JPMorgan Chase & Co. |

SEGMENTAL ANALYSIS

By Counterparty Insights

The reporting dealer segment is the leading category in the foreign currency market. These facilitate intraday liquidity in this industry by continuously buying and selling foreign exchange at their bid prices and providing quotes during the entire trading day. They are one of the main drivers for this market, and the substantial intraday liquidity in a single system is economically important. For example, in the US market, the routine amount put in is around 630 billion dollars and a maximum of 1 trillion dollars in payment value. Moreover, their greater trading operation over the volatile periods and adoption of risk management methods offer more effective market circulation and growth.

By Trade Finance Instruments Insights

The FX Swaps segment continues to hold its position with a major portion of the foreign exchange market share. Customers perceive this as a source of global funding, so relationship banks are extremely popular in furnishing liquidity throughout the several currencies and tenors. Besides this, the segment’s market share was also propelled by the shift away from the traditional RFQ or RFS basis to electronic means coupled with higher demand for price transparency.

The spot forex segment holds a decent market share and is used by many emerging countries. For instance, in March 2024, Deutsche Borse Group introduced the Deutsche Borse Digital Exchange (DBDX). It is a crypto spot platform for institutional customers. Moreover, DBDX provides a completely governed and secure ecosystem for trading, settlement, custody or possession of crypto assets. This launch bridges a void in the industry and places Deutsche Borse at the center of the expanding institutional digital assets market.

By End-Users Insights

The corporate segment is the fastest-growing end-user category of the foreign exchange market. This growth is mainly driven by the global proliferation of trade and commerce and growing free trade agreements for better bilateral cooperation. Further, the expanding imports and exports of goods and services since post-COVID-19 also contribute to the segment’s market share. Additionally, the rapid expansion of e-commerce services and platforms due to technological advancement has accelerated the segmental expansion.

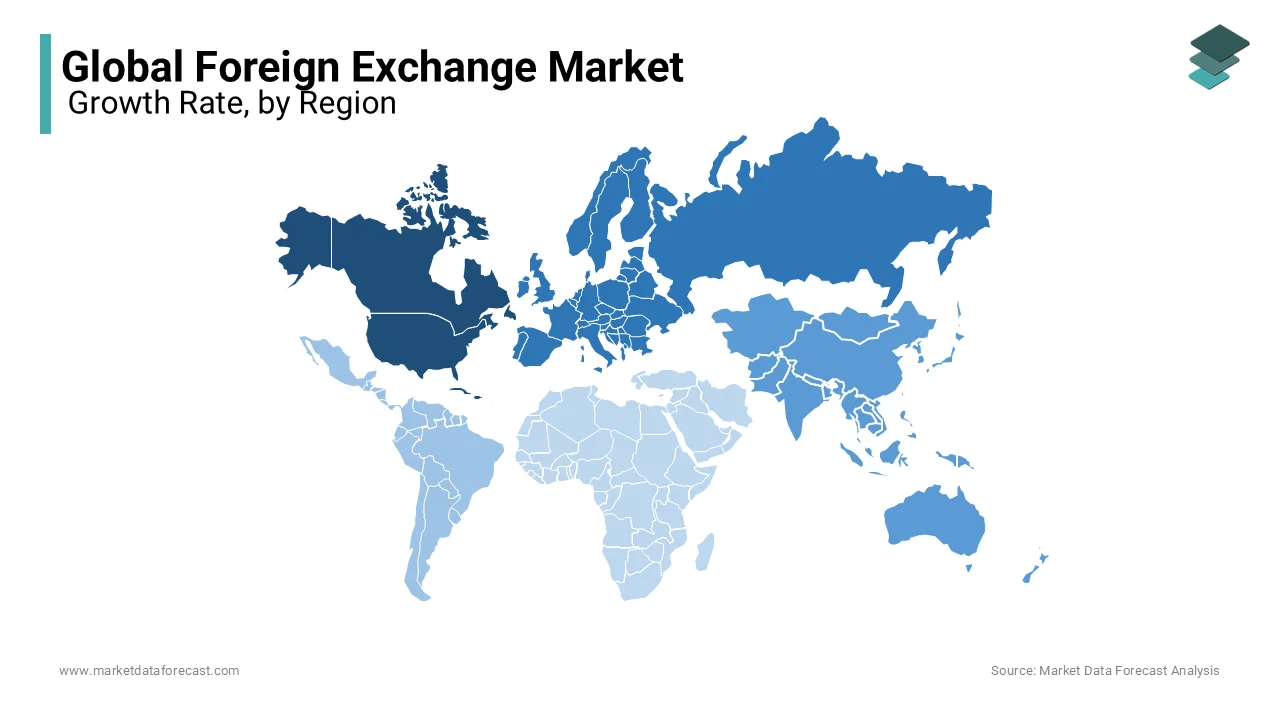

REGIONAL ANALYSIS

North America is commanding the foreign exchange market. The regional industry is marked by a high degree of trade exchange volume between market stakeholders. In addition, the market is fuelled by several factors, like the establishment of the US dollar as a global currency. Apart from this, the United States trading shifted to a shorter settlement in May 2024, which is expected to mitigate risk and improve efficiency. This will further evolve the country’s forex market because the regulators wanted the new guidelines, which are normally known as T+1, to lower counterparty dangers and enhance capital effectiveness and liquidity in security dealings. Considering this, Canada, Mexico and Argentina will accelerate their industry transactions one day ago.

Europe is a major player in the foreign exchange market, though it has recently registered some major lows. However, this growth over the years is linked to consistent trade monitoring and surveillance in the regional forex industry. The strict compliance review of top companies was required in the wake of the latest collusive operations and benchmark manipulations in currency markets. Hence, more trading players will disclose real-time data on trading activity. However, the European market share slumped because of the increase in cyberattacks. According to the German Digital Industry Association, approximately 80% of the targeted businesses suffered from espionage, sabotage or data theft.

KEY MARKET PLAYERS

Companies playing a key role in the global foreign exchange market include Barclays, XTX Markets Limited, BNP Paribas, State Street Corporation, Citibank, Standard Chartered PLC, Deutsche Bank, UBS AG, Goldman Sachs, The Royal Bank of Scotland, HSBC Holdings plc and JPMorgan Chase & Co.

RECENT HAPPENINGS IN THE GLOBAL MARKET

- In April 2024, Zimbabwe introduced ZiG, which stands for “Zimbabwe Gold,” which replaces the Zimbabwe dollar. It is a new gold-backed Currency launched to stabilize the economy.

- In March 2024, Digital Asset, a blue-chip financial blockchain company, concluded a test of the Canton Network pilot with 155 participants from 45 major organizations. They performed more than 350 simulated transactions across 22 permitted blockchains linked on Canton, during which time it held controls demanded by regulated capital markets. It connects several financial institutions and banks.

MARKET SEGMENTATION

This research report on the global foreign exchange market has been segmented and sub-segmented based on counterparty, trade finance instrument, end-user and region.

By Counterparty

- Reporting Dealers

- Non-financial Customers

- Other Financial Institutions

By Trade Finance Instruments

- Currency Swap

- Outright Forward

- FX Swaps

- FX Options

- Spot Forex

- Others

By End User

- Individuals

- Retailers

- Corporates

- Government

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global foreign exchange market?

The global foreign exchange market was worth USD 947.33 billion in 2024.

Which segment by end-user led the foreign exchange market in 2024?

The corporate segment had the major share of the global market.

Which region dominated the foreign exchange market in 2024?

North America captured the major share of the global foreign exchange market in 2024.

Who are the key players in the foreign exchange market?

Barclays, XTX Markets Limited, BNP Paribas, State Street Corporation, Citibank, Standard Chartered PLC, Deutsche Bank, UBS AG, Goldman Sachs, The Royal Bank of Scotland, HSBC Holdings plc and JPMorgan Chase & Co. are some of the notable companies in the global market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]