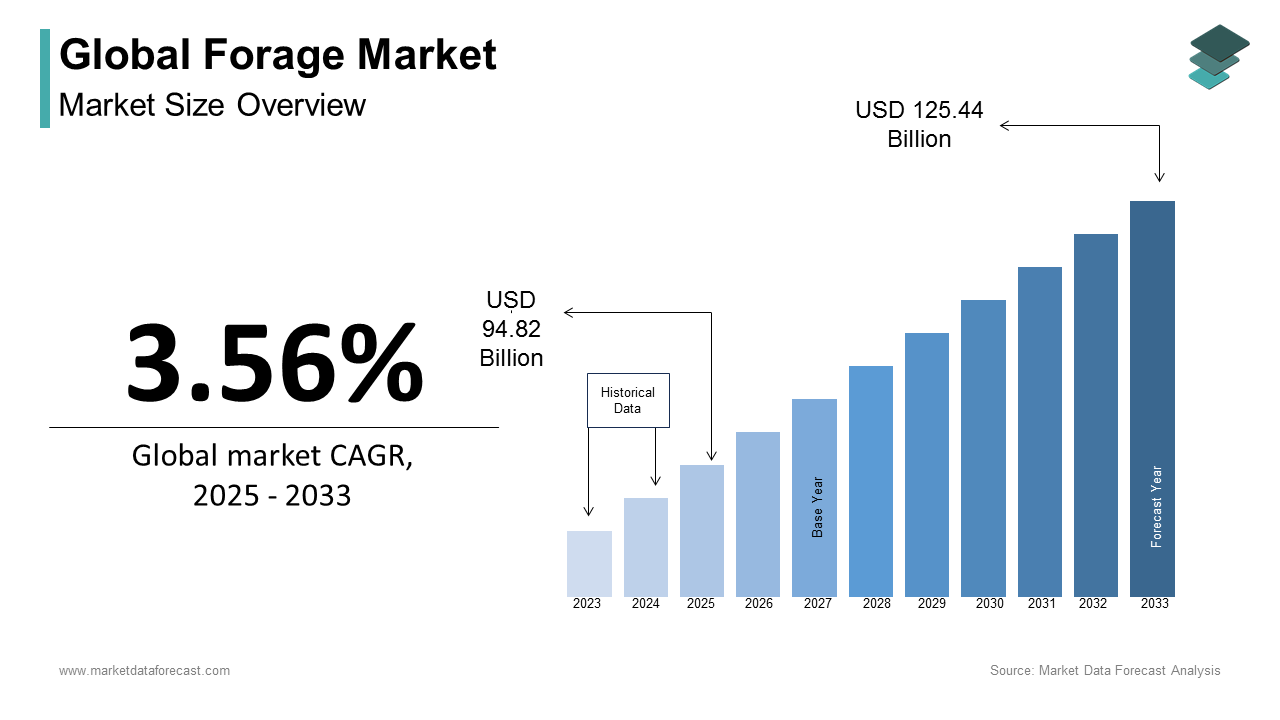

Global Forage Market Size, Share, Trends & Growth Forecast Report Segmented By Crop Type (Cereals, Legumes, Grasses), Product Type, Animal Type, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Forage Market Size

The global forage market size was calculated to be USD 91.56 billion in 2024 and is anticipated to be worth USD 125.44 billion by 2033 from USD 94.82 billion In 2025, growing at a CAGR of 3.56% during the forecast period.

Forage crops are essential for farming because they provide food for animals such as cows, sheep, and chickens. These crops include grasses, legumes, and silage, which supply animals with fiber, protein, and minerals. Forage farming also helps the environment by keeping the soil healthy, preventing erosion, and supporting plant and animal life. The Food and Agriculture Organization (FAO) reported that in 2023, global crop production reached 9.9 billion tonnes, a 3% increase from 2022 and 27% more than in 2010. This shows that forage crops are becoming more important. However, climate change is affecting farming. The International Livestock Research Institute (ILRI) states that pasture yields have dropped by 10–20% in some areas. However, better management of forage crops has increased soil carbon storage by 15–30%, helping reduce climate change. Forage production is vital for livestock farming, as it affects both animal health and environmental sustainability.

MARKET DRIVERS

Rising Global Livestock Population

The increasing number of farm animals is driving the demand for forage crops. The Food and Agriculture Organization (FAO) reports that in 2023, the world had 1.57 billion cattle, up from 1.51 billion in 2021. As more animals are raised, more forage is needed. In the United Kingdom, the Department for Environment, Food & Rural Affairs recorded 9.6 million cattle and calves in 2023. This shows how essential forage is for livestock farming. With the global livestock population rising, farmers need more high-quality forage to keep animals healthy and improve milk and meat production.

Emphasis on Sustainable Agriculture Practices

The shift toward sustainable farming is helping the forage market grow. Forage crops improve soil fertility, prevent erosion, and promote biodiversity. The Department for Environment, Food & Rural Affairs states that in England, 38% of all agricultural land in 2024 was permanent grassland, highlighting the importance of forage crops. Forage crops also help store carbon in the soil, reducing climate change effects. By improving soil and cutting greenhouse gas emissions, sustainable forage practices support long-term farming success. More farmers are adopting these practices to ensure a steady and eco-friendly food supply.

MARKET RESTRAINTS

Climate Change and Weather Variability

Climate change is making it harder to grow forage crops. The U.S. Department of Agriculture (USDA) reports that extreme weather, such as droughts, floods, and heatwaves, is reducing forage crop yields and quality. During a drought, less forage grows, forcing farmers to buy additional feed, which increases costs. Too much rain can cause flooding, which damages crops and washes away soil. These unpredictable weather conditions make it hard for farmers to plan their planting and harvesting. To fix this, scientists are developing new forage crops that can survive extreme weather to ensure a steady food supply for animals.

Land Use Competition

The amount of land available for growing forage crops is shrinking. The USDA Economic Research Service states that urban expansion, industrial growth, and biofuel crops are reducing farmland for forage. In the U.S., farmland is being converted into houses and businesses, limiting space for growing forage crops. This forces farmers to produce more forage on less land, sometimes leading to unsustainable farming practices. To solve this, better land management and new farming methods are needed to ensure livestock continue to get the nutrition they need.

MARKET OPPORTUNITIES

Technological Advancements in Forage Production

New farming technology is improving forage crop production. The U.S. Department of Agriculture (USDA) reports that precision agriculture tools like GPS-guided tractors and remote sensing help farmers plant, fertilize, and harvest more efficiently. These technologies lead to higher yields and better-quality forage. The USDA also states that scientists are developing drought-resistant forage crops to ensure reliable production, even in changing climates. Using technology reduces waste, boosts efficiency, and promotes sustainable farming, making it a major opportunity for the forage market.

Growing Demand for Organic and Non-GMO Forage

Consumers are looking for organic and non-GMO animal products, increasing the demand for organic forage. The U.S. Department of Agriculture (USDA) reports that organic livestock farming is growing, leading to higher demand for organic forage crops. The USDA’s National Organic Program states that organic forage must be free from synthetic fertilizers and pesticides. As consumers become more concerned about health and sustainability, more farmers are switching to organic farming, creating a fast-growing market for organic forage. This shift benefits both animal nutrition and the environment.

MARKET CHALLENGES

Labor Shortages in Forage Production

Finding enough workers to plant and harvest forage crops is becoming harder. The U.S. Department of Agriculture’s Economic Research Service reports that labour costs for U.S. farms reached $42.09 billion in 2023, an increase of $1.78 billion (4.4%) from 2022. Even though the number of farmworkers has stayed the same since 1990, the demand for labor is still high, especially during harvesting seasons. While machines and automation can help, they require big investments and special training, which not all farmers can afford.

International Trade and Supply Chain Disruptions

The forage market depends on international trade, but supply chain disruptions can create shortages. The U.S. Department of Agriculture’s Foreign Agricultural Service states that Japan imports around 2.6 million metric tons of forage annually from countries like the United States, Australia, China, and Canada. However, shipping delays, rising transportation costs, and trade restrictions are making it harder for countries to get enough forage. This causes higher prices and shortages, affecting both farmers and consumers. As trade policies change, forage producers and importers must find new ways to ensure a stable supply.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.56% |

|

Segments Covered |

By Crop Type, Product Type, Animal Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Allied Seed LLC, Barenbrug USA, BrettYoung, Cargill Incorporated, Corteva Inc., DLF Seeds A/S, Forage Genetics International LLC (Land O'Lakes Inc.), King's Agriseeds Inc., Rivard's Turf & Forage, and Standlee Premium Products LLC |

SEGMENTAL ANALYSIS

By Crop Type Insights

The cereals segment of the forage market by representing a global market share of 44.7% in 2024. It includes crops such as corn, barley, and oats, constitute the largest segment in the forage market. The cereals dominate the market due to their widespread cultivation and high nutritional value, providing essential carbohydrates and energy for livestock. The U.S. Department of Agriculture (USDA) reports that in 2023, corn silage production in the United States alone reached approximately 130 million tons, underscoring its prominence in forage applications. The adaptability of cereals to various climates and their high yield potential makes them a preferred choice among farmers, thereby solidifying their leading position in the forage market.

The legumes segment is projected to expand at a CAGR of 5.2% from 2025 to 2033 due to the ability of legumes to fix atmospheric nitrogen, enhancing soil fertility and reducing the need for synthetic fertilizers. According to the Food and Agriculture Organization (FAO), alfalfa, a key forage legume, offers high protein content, improving livestock nutrition and productivity. Additionally, legumes contribute to sustainable agriculture by promoting biodiversity and soil health. Their environmental benefits and nutritional advantages are driving their rapid adoption in forage systems worldwide.

By Product Type Insights

The stored forage segment occupied 60.5% of the global market share in 2024. The dominance of stored forage segment is attributed to its critical role in providing a consistent and reliable feed supply for livestock throughout the year, especially during periods when fresh forage is scarce due to seasonal variations. The U.S. Department of Agriculture (USDA) stated that silage, particularly corn silage, is a prevalent stored forage in the United States, valued for its high energy content and digestibility, which are essential for dairy and beef cattle productivity. The ability to preserve the nutritional quality of forage through storage methods like ensiling and haymaking ensures that livestock receive adequate nutrition regardless of external conditions, thereby supporting stable animal performance and farm operations.

The fresh forage segment is anticipated to witness a prominent CAGR of 4.5% over the forecast period owing to the increasing adoption of sustainable grazing practices and the rising awareness of the benefits of fresh forage in enhancing livestock health and productivity. The Food and Agriculture Organization (FAO) emphasizes that fresh forage provides essential nutrients, including proteins, vitamins, and minerals, which are vital for optimal animal growth and milk production. Moreover, fresh grazing reduces the need for mechanical harvesting and feed processing, leading to lower operational costs and a reduced environmental footprint. The emphasis on natural feeding regimes aligns with consumer preferences for organically produced animal products, further propelling the demand for fresh forage in livestock diets.

By Animal Type Insights

The ruminants segment of the forage market secured a share of 57.7% of the global market in 2024. It includes cattle, sheep, and goats, represent the largest segment in the forage market. According to the Food and Agriculture Organization (FAO), the global cattle population was approximately 1.5 billion in 2021. This substantial number underscores the significant demand for forage, as ruminants rely heavily on high-fiber diets derived from forage crops. Forage provides essential nutrients necessary for milk production, growth, and overall health in ruminants, making it indispensable in ruminant husbandry.

The poultry segment is projected to progress at a notable CAGR of 4.8% over the forecast period owing to the increasing consumer demand for organic and free-range poultry products, which necessitates the inclusion of forage in poultry diets. The United States Department of Agriculture (USDA) said that integrating forage into poultry feeding regimes enhances gut health, provides natural vitamins and minerals, and reduces feed costs. Additionally, forage consumption promotes natural foraging behaviors in poultry, leading to improved welfare and product quality. As consumer preferences shift towards sustainably raised poultry, the incorporation of forage becomes increasingly significant, fueling the rapid expansion of this segment.

REGIONAL ANALYSIS

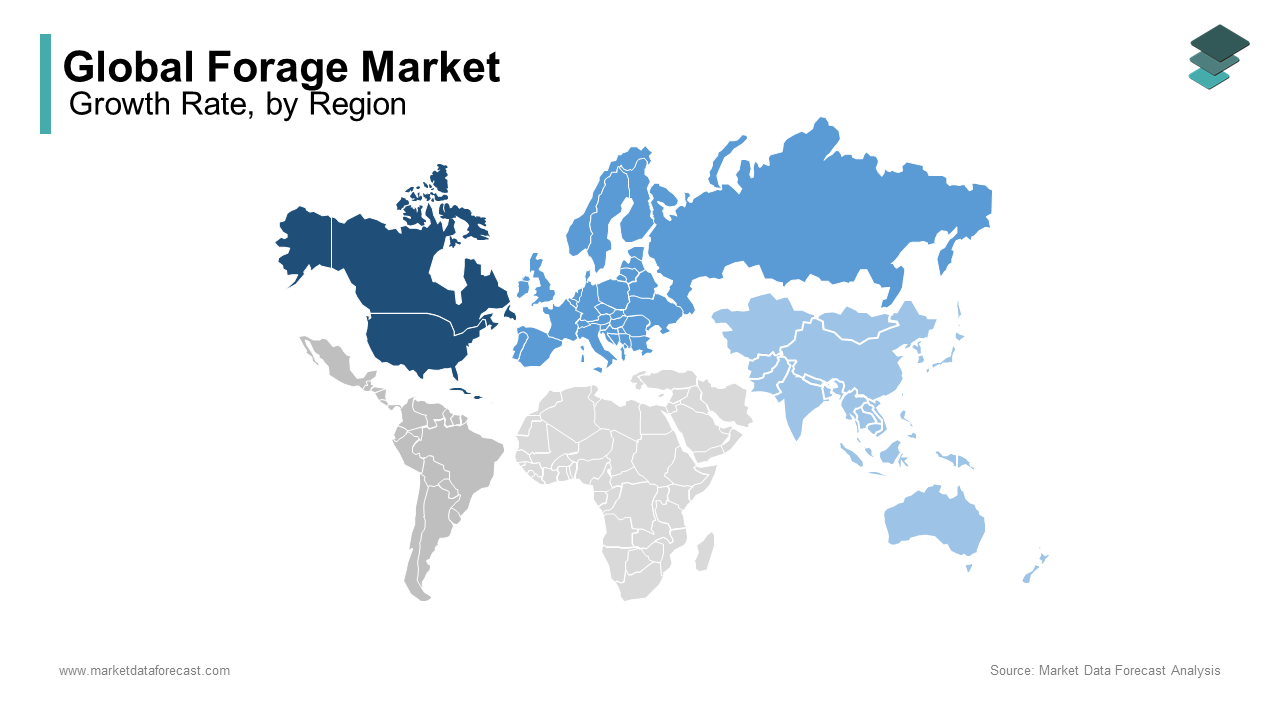

North America dominated the forage market by accounting for a 64.5% global market share in 2024 due to its extensive livestock industry and advanced agricultural practices. The United States Department of Agriculture (USDA) reports that in 2012, U.S. hay exports reached a record $1.25 billion, driven by rising global demand for premium forage products. This significant export volume underscores North America's robust forage production capacity. The region's emphasis on high-quality forage cultivation supports its leading position in the market.

The Asia-Pacific region is experiencing the fastest growth in the forage market having a CAGR of 5.7% and is driven by increasing livestock populations and rising demand for dairy and meat products in countries such as China and India. The Food and Agriculture Organization (FAO) notes that China's cattle inventory has been steadily increasing, necessitating substantial forage imports to meet feed requirements. Additionally, government initiatives promoting sustainable agriculture and improved animal nutrition contribute to the burgeoning forage market in the Asia-Pacific region.

Europe maintains a significant position in the forage market, supported by its well-established dairy and beef industries. The European Commission's Agri-Food Data Portal indicates that the region has a strong focus on sustainable farming practices, including the cultivation of high-quality forage crops. The Common Agricultural Policy (CAP) further incentivizes forage production through subsidies and support programs aimed at environmental stewardship and rural development. These factors are expected to sustain Europe's steady performance in the forage market in the coming years.

Latin America is poised for moderate growth in the forage market, driven by expanding livestock sectors in countries like Brazil and Argentina. The Food and Agriculture Organization (FAO) revealed that Brazil's beef production has been on the rise, leading to increased demand for quality forage. However, challenges such as deforestation and land-use changes may impact sustainable forage production. Efforts to implement integrated crop-livestock systems and sustainable pasture management are crucial for the region's forage market development.

The Middle East and Africa region is anticipated to experience gradual growth in the forage market. The United States Department of Agriculture (USDA) notes that countries in the Middle East, such as Saudi Arabia and the United Arab Emirates, have been increasing forage imports to support their dairy and livestock industries due to limited domestic production capabilities. In Africa, growing livestock populations and initiatives to improve animal nutrition are expected to drive demand for forage. However, factors like arid climates and limited infrastructure may pose challenges to forage production and distribution in these regions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the global forage market include Allied Seed LLC, Barenbrug USA, BrettYoung, Cargill Incorporated, Corteva Inc., DLF Seeds A/S, Forage Genetics International LLC (Land O'Lakes Inc.), King's Agriseeds Inc., Rivard's Turf & Forage, and Standlee Premium Products LLC

The global forage market is highly competitive, with several key players striving for market dominance through innovation, mergers and acquisitions, and strategic partnerships. Companies such as DLF Seeds A/S, AGCO Corporation, and KWS SAAT SE & Co. KGaA lead the market by leveraging advanced research and development (R&D) to produce high-yield, disease-resistant forage crops and efficient harvesting machinery. Competition is driven by the growing demand for high-quality animal feed to support the expanding livestock industry, increasing awareness of sustainable farming practices, and advancements in precision agriculture technologies.

Regional and international players compete based on product quality, pricing, technological advancements, and distribution networks. Companies with strong R&D capabilities and advanced agricultural technologies gain a competitive edge by introducing climate-resilient and nutrient-rich forage seeds. Additionally, technological integration in harvesting and processing equipment, such as automation and IoT-based monitoring, further intensifies competition.

Market consolidation through acquisitions and collaborations continues to reshape the industry, with larger firms acquiring smaller, specialized companies to strengthen their global footprint. Emerging players entering the market with sustainable and organic forage solutions also add to the competition. As sustainability and efficiency become top priorities, companies must continuously innovate to maintain and expand their market share.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Mergers and Acquisitions (M&A)

Mergers and acquisitions (M&A) are essential strategies for forage companies to expand their market presence, diversify product portfolios, and enhance research and development (R&D) capabilities. By acquiring complementary businesses, companies can integrate their supply chains, reduce operational costs, and eliminate competitors. A key example is Oxbo International's acquisition of H&S Manufacturing in 2023, which allowed Oxbo to broaden its hay and forage equipment offerings, reinforcing its leadership in the sector. M&A strategies also help companies penetrate new geographic markets, ensuring greater control over supply chains and enabling large-scale production. As competition in the forage market intensifies, companies continue to leverage acquisitions to strengthen their position, gain technological expertise, and enhance profitability.

Partnerships and Collaborations

Strategic partnerships and collaborations play a crucial role in the forage market by enabling companies to leverage shared expertise, expand market reach, and accelerate innovation. By collaborating with research institutions, agribusiness companies, and technology firms, forage market leaders can develop new seed varieties, optimize harvesting methods, and enhance precision farming techniques. For instance, DLF Seeds A/S partners with agricultural universities and biotech firms to develop high-yield, disease-resistant forage seed varieties that help farmers increase livestock productivity. Similarly, John Deere and AGCO Corporation collaborate with technology firms to integrate digital solutions into their forage harvesting equipment, improving efficiency and sustainability. Such partnerships not only reduce R&D costs but also help companies adapt to changing consumer demands, regulatory policies, and environmental challenges.

Product Innovation and Development

Product innovation is a key strategy for forage companies to remain competitive by meeting the evolving needs of livestock farmers. The development of high-nutrition, climate-resilient forage crops allows companies to enhance animal health and increase yields while ensuring sustainability. Germinal’s 2025 launch of the "Climate Smart" forage seed range is a prime example of how innovation is shaping the market. The new product line focuses on improving soil health, reducing greenhouse gas emissions, and increasing biodiversity, aligning with modern agricultural sustainability goals. Similarly, KWS SAAT SE & Co. KGaA invests heavily in breeding high-quality forage crops, prioritizing digestibility and resilience to climate change. Through ongoing innovation, forage companies can address critical market challenges such as fluctuating climate conditions, growing demand for sustainable feed, and the need for improved efficiency in livestock farming.

TOP 3 PLAYERS IN THE MARKET

DLF Seeds A/S

DLF Seeds A/S, headquartered in Roskilde, Denmark, is a global leader in the seed industry, specializing in forage and turf seeds, as well as other crops like clovers, alfalfa, forage brassicas, herbs, fodder, sugar beets, cover crops, seed potatoes, vegetable seeds, and flower seeds. The company operates in over 100 countries, providing grass and clover seeds for various applications, including agriculture, sports fields, and home lawns. DLF is owned by a cooperative of Danish grass-seed farmers, emphasizing its strong agricultural roots. With a workforce exceeding 2,000 employees across more than 20 countries, DLF maintains a significant focus on research and development, dedicating approximately 10% of its staff to these efforts. This commitment has led to the development of high-yielding, disease-resistant forage varieties that enhance livestock nutrition and farm productivity.

AGCO Corporation

AGCO Corporation, based in Duluth, Georgia, USA, is a prominent manufacturer and distributor of agricultural equipment and related replacement parts. The company's product portfolio includes high-horsepower tractors for row crop production, utility tractors for small- and medium-sized farms, and compact tractors for specialized agricultural industries. AGCO also offers grain storage bins, seed-processing systems, and a range of harvesting equipment such as combines, hay tools, and forage harvesters. The company markets its products under well-known brands like Challenger, Fendt, GSI, Massey Ferguson, and Valtra. AGCO's commitment to innovation is evident in its development of smart farming solutions, including telemetry-based fleet management tools that enhance machine and yield optimization. As of 2023, AGCO employs approximately 27,900 individuals worldwide and reported revenues of $14.41 billion.

KWS SAAT SE & Co. KGaA

KWS SAAT SE & Co. KGaA, headquartered in Einbeck, Germany, is one of the world's leading seed producers, specializing in the breeding, production, and distribution of high-quality seeds for agriculture. Founded in 1856, the company has evolved into an innovative, international supplier with a broad portfolio of crops, including sugar beet, corn, cereals, oil and protein plants, sorghum, catch crops, and vegetables. KWS operates in more than 70 countries and employs over 4,900 people, with approximately 1,866 dedicated to research and development. The company invests around 17% of its annual turnover in R&D to develop new seed varieties adapted to various agricultural requirements and climatic conditions. In the fiscal year 2023/2024, KWS reported revenues of €1.678 billion and an operating income of €302 million.

RECENT MARKET DEVELOPMENTS

- In February 4, 2025, Germinal introduced a new line of grass seed products designed to aid farmers in reducing emissions and meeting environmental targets. The range includes five products—Clean, Thrive, Adapt, Capture, and Restore—each offering unique benefits such as reducing greenhouse gas emissions, enhancing soil health, and improving biodiversity.

- In November 2024, significant legal changes were highlighted for the agriculture sector, focusing on sustainability regulations, environmental standards, technology-driven practices, and trade agreements. These changes are expected to impact the forage market by promoting eco-friendly practices and integrating advanced technologies in farming operations.

MARKET SEGMENTATION

This research report on the global forage market has been segmented and sub-segmented based on crop type, product type, animal type, and region.

By Crop Type

- Cereals

- Legumes

- Grasses

By Product Type

- Stored Forage

- Silage

- Hay

- Fresh Forage

By Animal Type

- Ruminants

- Swine

- Poultry

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which crops are commonly used for forage production?

Common forage crops include alfalfa, clover, ryegrass, timothy grass, sorghum, and legumes. These crops are primarily used for feeding livestock due to their high nutritional value.

2. Who are the key players in the global forage market?

Major companies in the forage market include Cargill, Inc., ADM (Archer Daniels Midland Company), BASF SE, Corteva Agriscience, and Land O'Lakes, Inc., among others. These companies focus on forage seed production, processing, and distribution.

3. What are the main factors driving the growth of the forage market?

The market is driven by increasing demand for livestock feed, the rise in dairy and meat consumption, advancements in forage seed technology, and the shift towards sustainable animal nutrition practices.

4. How is the forage market segmented?

The forage market is segmented based on crop type (cereals, legumes, grasses), product type (fresh, stored, dried), animal type (ruminants, poultry, swine, equine), and region (North America, Europe, APAC, Latin America, Middle East & Africa).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]