Global Food Testing Market Size, Share, Trends, & Growth Forecast Report - Segmented By Food Tested (Meat & Poultry, Dairy, Processed Foods, And Fruits & Vegetables), Target Tested (Pathogens, Pesticides, GMOS, And Toxins), Technology (Traditional And Rapid), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2024 To 2032

Global Food Testing Market Size (2024 to 2032)

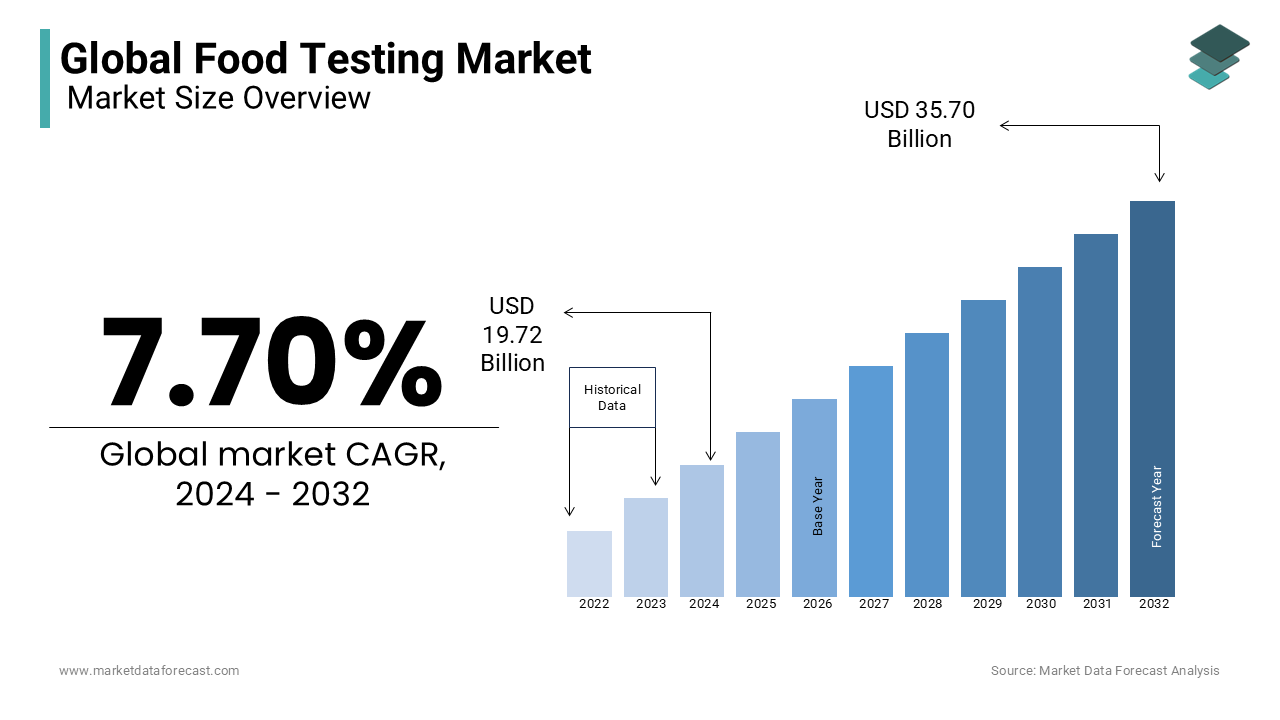

The size of the global food testing market is expected to be worth USD 19.72 billion in 2024 and grow at a CAGR of 7.70% from 2024 to 2032 to achieve USD 35.70 billion by 2032. Increased convenience and demand for packaged foods, the incidence of chemical contamination in the food processing industry, and the rise in consumer awareness of food safety are promoting this business growth.

Food testing helps in identifying disease-causing germs, chemicals, and other harmful substances in foods, offering safety from foodborne illness and limiting the risks related to contamination. Food testing is an essential aspect of preserving food quality in terms of ingredients, flavor, and appearance. Food analysis techniques like microbial contamination and chemical analysis ensure the safe production, processing, and delivery of food. The global outbreak of food poisoning diseases is increasing and the globalization of the food trade is driving demand for food safety testing services.

CURRENT SCENARIO OF THE GLOBAL FOOD TESTING MARKET

The increased pace of the development and application of rapid testing methods are some of the leading trends in laboratories for food testing. The rise in food poisoning and related risks, coupled with the rise of avian influenza in animals, are fuelling the demand for food testing. Recently, in May 2024, the popularity of the Label Padhega India campaign, with more than 25 influencers, gold medallists, actors, and actors coming together in the country can increase its application in the coming years.

Moreover, the use of blockchain and sensor-based technologies, Nanotechnology, and big data analytics will elevate the growth rate of the food testing market. The traceability and transparency in the food industry’s supply chain are revolutionized by blockchain technology.

MARKET DRIVERS

The global food safety testing market is growing as food-related issues increase due to the rising incidence of foodborne illness.

Business growth is fueled by increased consumer awareness of food safety, increased chemical contamination, and rapid inspection. Additionally, product quality is improving by modifying regulations to reduce the number of people affected by foodborne illnesses such as nausea, food poisoning, and diarrhea. The food and beverage sector has developed in a significant way because of urbanization, rising disposable income, and economic progressions. As imports and exports increase, the levels of pollutants increase due to incorrect control and monitoring, which supports the participation of the industry. Also, as the demand for pesticide residues and other contaminants for fruits and vegetables increases, along with the increase in global fruit and vegetable trades, industrial development will improve during the forecast period. The increasing level of contamination to increase the shelf life of the product is one of the key aspects of adjusting your testing needs on import. The prominent contributors to the global food testing market are seafood, fruits and vegetables, meat, and processed products. Emerging economic trends for processed foods and convenience foods will drive product development along with government initiatives to reduce foodborne illness and business expansion. Intensified competition among service providers has resulted in patent applications for new contaminant detection technologies. Technological developments for implementing reliable and rapid testing technologies are promoting the expansion of the global food testing business.

Numerous licenses for quick innovations, for example, ongoing PCR and immunosorbent measures, show extraordinary development potential in the coming years. The industry said the innovation focused on reducing the time it takes to get test results and improving accuracy. Food supply and quality are at risk across the globe, which is resulting in a surge in the call for food testing. This is because food processors are obstructing industrial growth by skipping routine food inspections to reduce operational food. Also, generous food contamination laws and penalties in developing countries can limit industrial growth. However, as consumer concerns increase, the government has urged actions such as increasing the level of evidence to reduce food contamination and disease outbreaks. Furthermore, the high costs of technology may affect adoption rates in the coming years. Technological innovations and new technological developments have been made in spectroscopy and chromatography, with a focus on reducing delivery times, sample utilization, testing costs, and deficiencies associated with multiple technologies. The increasing implementation of these technologies is supposed to create an opportunity for the services in small and medium laboratories and compete with large players in the industry. These technologies also have other advantages, including high sensitivity, the accuracy of results, reliability, non-target detection with multiple contaminants, and short processing times.

MARKET RESTRAINTS

According to a study conducted in 2022, the acquisition and upgradation of machinery and equipment, accreditation and regulatory measures, and optimum utilization of facilities and abilities for the sample inflow are some of the key obstacles for the foods testing market.

Apart from this, consumer awareness of food hygiene and testing, availability and retention of skilled people, and functional issues and maintenance are other constraints faced by companies around the world. Still, Europe has superior performance in food tests as compared to North America and Asia Pacific.

The instability in the meat and meat products industry is also derailing the food testing market growth rate. This comprises post-COVID-19 slowdown due to the negative perception of customers, more susceptible to illicit activities such as substituting meat ingredients with another animal type, and meat safety-related problems. The traditional coupled with emerging, new, and evolved pathogenic microbes have more resistance against antibiotics. Also, food safety programs at the farm, meat animal manure disposal issues, cross-contamination of foods, and foodborne illness are other pathological constraints. Additionally, correct animal identification food additives, safety and quality-related challenges in natural and organic items, chemical residues, and traceability issues are other sets of obstacles to companies' operation in this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.70% |

|

Segments Covered |

By Target Tested, Technology, Food Tested, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M Company, Biocontrol Systems Incorporated, Roka Bioscience, Agilent Technologies Incorporate, Bio-Rad Laboratories Incorporated, IDDEX Laboratories INC, Douglas Scientific, Ecolab Incorporated, and Intertek Group Plc |

SEGMENTAL ANALYSIS

Global Food Testing Market Analysis By Target Tested

The pathogens segment is expected to lead the category under the food testing market in the forecast period. Nowadays growing health problems due to harmful microorganisms such as viruses and bacteria have increased the demand for pathogen tests for identification. This frequently uses PCR, immunoassays, and ELISA for fast and precise detection of food samples. In addition, the rising consumer awareness and demand for rapid testing methods are driving the segment’s market share. However, more research is required to validate markers for several populations and distinguish among different meat sources for accurate pathogen discovery. Besides this, the lack of resources and infrastructure in emerging economies, as well as the low level of collaboration with international bodies and the absence of harmonization in laws and regulations, are hindering the segment’s expansion.

Global Food Testing Market Analysis By Technology

The rapid segment is gaining more traction and support from private and public entities and is projected to register a higher growth rate for the food testing market in the coming years. PCR, Enzyme-Linked Immunosorbent Assay (ELISA), Instrument-based Rapid Microbiological Methods, Immunoassay, and Automated Bioburden Testing are the most widely conducted tests for ensuring food safety. Also, DNA-based technology, ambient ionization mass spectrometry (AIMS), Spectroscopic techniques and electronic sensors have been steadily put to use for food authentication because of the benefits like simple operation and quick analysis. Apart from this, the function and responsibilities of commercial laboratories, particularly those associated with pathogens, have greatly increased, and this pattern is anticipated to continue worldwide.

Global Food Testing Market Analysis By Food Tested

The meat, poultry & seafood segment is expected to remain on top of this category during the forecast period of the food testing market. The industry is emphasizing improving testing methodologies to counter the challenge of quality issues, regulatory requirements, and food fraud. Also, for testing microorganisms like E. coli, Salmonella, and Listeria monocytogenes, pathogen testing is preferred and frequently used. This involves process validation, challenge testing, and shelf life examination. For instance, in May 2024, the U.S. Department of Agriculture's Food Safety and Inspection Service (FSIS) reported that Cargill Meat Solutions had called back about 16243 pounds of raw ground beef items because of E. coli O157:H7 contamination. Moreover, the FSIS in August 2022 started measuring the amount of Salmonella in fresh poultry rinses. But, this shift came after a decade of delay. Even the existing Salmonella Performance Standards metrics are performed with limited attention to substitutes until now.

REGIONAL ANALYSIS

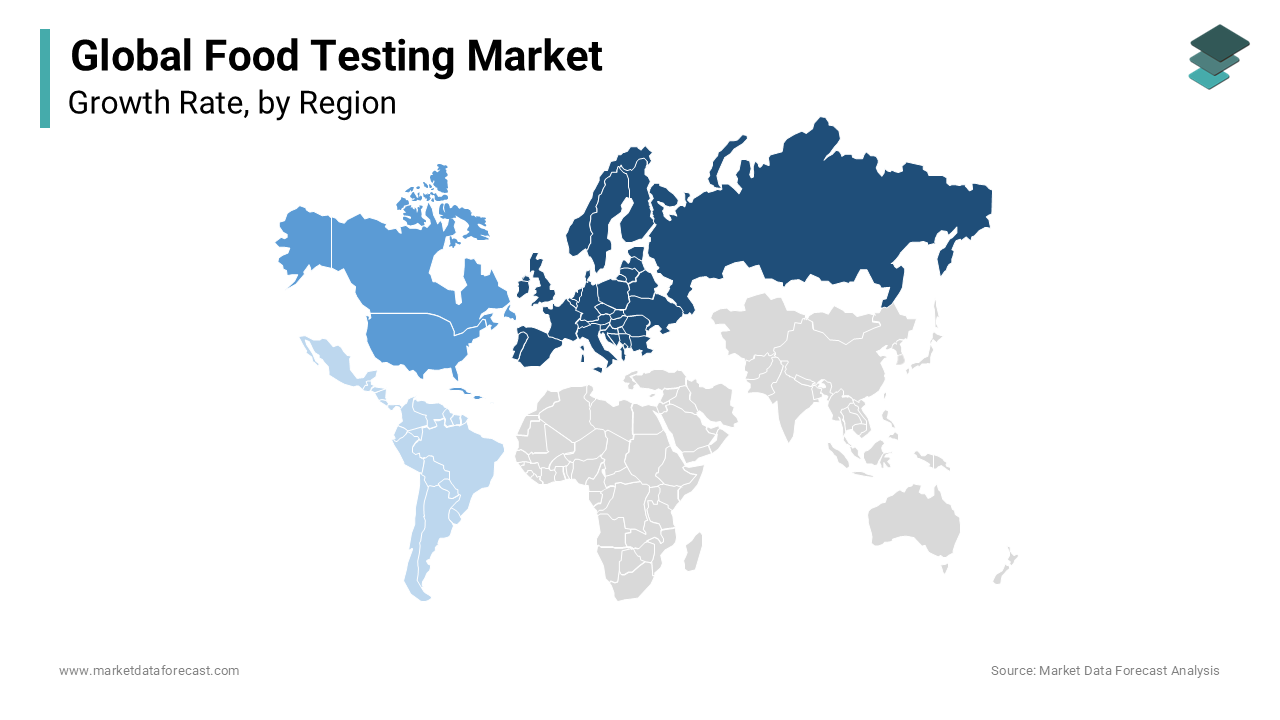

Europe has accounted for a leading portion of the worldwide industry, accounting for almost one-third of the overall revenue in 2018. The increasing food-related ailments among consumers are supposed to fuel the dependence on food testing processes. Also, the implementation of strict regulatory standards in the region is expected to increase the size of the market in the locale. North America has a significant share of the global food safety testing market. A key factor driving the growth of the North American market is strict regulations by governing agencies. The market is also driven by increased production in the North American food sector. The large market in North America is also due to the outbreak of foodborne illness. Food safety testing is essential at all stages of production and processing, ensuring consumers’ food safety and market supply. Microbial testing and GMO testing are the main types of tests conducted in North America. In the North American food testing market, there are several companies like Eurofins Scientific, Intertek, NSF International, etc. Industries in the Asia-Pacific region are expected to record notable benefits from related agency efforts regarding the safety of edible products. The Latin American market is thriving because of the increased call for packaged and processed products. The region was seriously affected by JBS's meat scandals in Brazil, which are expected to further reinforce market growth by implementing strict regulations in the country.

KEY MARKET PLAYERS

Major Key Players in the Global Food Testing Market are 3M Company, Biocontrol Systems Incorporated, Roka Bioscience, Agilent Technologies Incorporate, Bio-Rad Laboratories Incorporated, IDDEX Laboratories INC, Douglas Scientific, Ecolab Incorporated, Intertek Group Plc.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, the Strengthening of Food Testing Laboratory (SOFTeL) System or scheme was implemented by the Food Safety and Standards Authority of India (FSSAI) which is under the Ministry of Health & Family Welfare of the Indian government. This contains provisions for Mobile Food Testing Labs and also provides financial support for establishing laboratories for this purpose. It gives a 100 percent grant to government organizations and 50 to 70 percent to private companies.

- In September 2023, a group of experts from the Osaka Metropolitan University devised a measurement technology for swift and precise determination of the number of viable bacteria in food items electrochemically lowering the period to just 1 hour from 2 days. For this, they utilised tetrazolium salt (MTT) which is a water-soluble molecule. Another benefit is it can ensure the safety of food even before delivery from factories.

DETAILED SEGMENTATION OF GLOBAL FOOD TESTING MARKET INCLUDED IN THIS REPORT

This research report on the global food testing market has been segmented and sub-segmented based on target tested, technology, food tested, & region.

By Target Tested

- Pathogens

- Pesticides

- GMOs

- Toxins

By Technology

- Traditional

- Rapid

By Food Tested

- Meat, Poultry, & Seafood

- Dairy

- Processed Food

- Fruits & Vegetables

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the emerging trends in the food testing market?

Emerging trends include the adoption of rapid testing methods for faster results, advancements in technology such as biosensors and blockchain for traceability, increased focus on testing for authenticity and GMOs (Genetically Modified Organisms), and the growing demand for testing services due to globalization and increased awareness of food safety.

2. What are the challenges facing the food testing market?

Challenges include the need for continuous innovation to keep pace with evolving food safety threats, ensuring the reliability and accuracy of testing methods, addressing regulatory complexities across different markets, and balancing the demand for rigorous testing with the need for timely product release.

3. What factors are driving the growth of the food testing market?

Increasing concerns about food safety and quality, stringent regulatory standards, globalization of the food supply chain, rising consumer awareness, and the prevalence of foodborne illnesses primarily drive the growth of the food testing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]