Global Food Service Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Full-Service Restaurants, Quick Service Restaurants, Institutes, Others), Service Type (Commercial, Institutional), And Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa And Rest Of The Region) – Industry Analysis (2025 To 2033)

Global Food Service Market Size

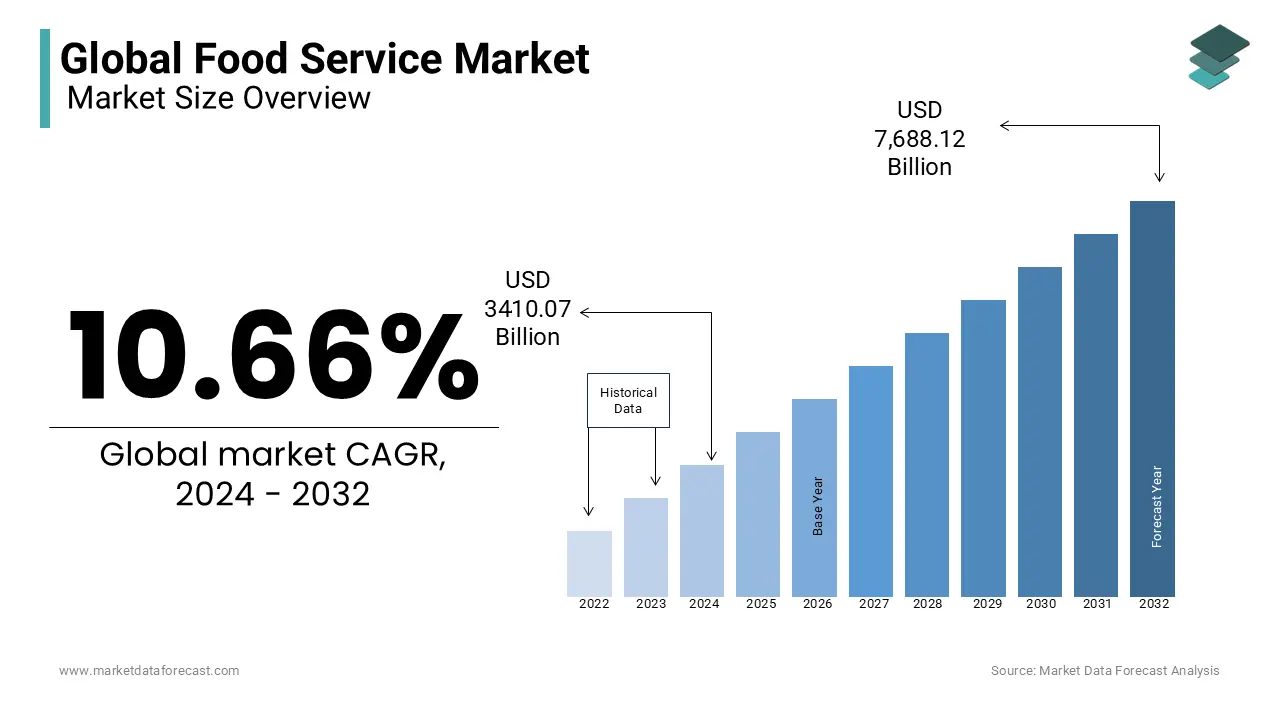

The global food service market size was calculated to be USD 3,410.07 billion in 2024 and is anticipated to be worth USD 8,485.53 billion by 2033 from USD 3,773.58 billion In 2025, growing at a CAGR of 10.66% during the forecast period.

The term "food service" describes the provision of meals to the public, including catering services. Such services are offered by numerous businesses in the catering industry. Meal services, commonly known as the catering sector or business, offer both packaged and on-demand food services. Restaurants of all types, including fast food/quick service, full-service, limited-service, and special food service restaurants, are included in the food service sector. Due to the growing working class, which is made up of the millennial population, commercial venues like cafés and restaurants have become more popular as places to mingle and spend time with varied and innovative food consumption. The acceptance of a fast lifestyle and the elimination of home cooking as a routine household activity has raised demand for ready-to-eat dishes that are unconventional and a combination of many components with various flavors. The development of home delivery services, along with the rise in the number of food dishes and menu options, has considerably accelerated the growth of the food service industry.

Current Scenario of the Global Food Service Market

Foodservice prepares, serves, and delivers customers food and beverages. It covers various businesses, including restaurants, cafes, catering companies, food trucks, and institutional cafeterias. Menu planning, food preparation, cooking, plating, and customer service are all part of the food service process. Its primary purpose is to deliver high-quality cuisine to consumers on time and efficiently. The global food service market has witnessed considerable growth in the past years and is anticipated to grow significantly during the forecast period. Due to the growing working class, filled with the millennial population, commercial venues like cafés and restaurants have become more popular as places to mingle and spend time with varied and innovative food consumption. The acceptance of a sedentary lifestyle and the elimination of home cooking as a routine household activity has raised demand for unconventional ready-to-eat dishes and a combination of many components with various flavors. The development of home delivery services, along with the rise in the number of food dishes and menu options, has considerably accelerated the growth of the food service industry.

MARKET DRIVERS

The growing presence of food service institutions worldwide is one of the major factors propelling the global market.

The rise in the tendency to eat out has led to changes in the food service business. Employing cutting-edge methods and tools has also aided food service businesses in raising production and streamlining operations to improve overall effectiveness. Rapid urbanization and migration have exposed consumers to a wide variety of cuisines. Additionally, this industry has expanded because of the rise in ethnic cuisine ads and consumer interest in other cuisines. The creation of new business types that cater to the food needs of institutions, including corporate offices, nursing homes, orphanages, and hospitals, is further aided by the emergence of these businesses. Additionally, institutional catering is essential in developing countries like India, Singapore, and Qatar. As a result, the food service industry is growing as food service and catering are increasingly used in institutions.

The increasing expenditure on dining out is further fuelling the growth rate of the global foodservice market.

Increased dual-income households and rising restaurant spending have expanded the global food service market. Developing and developed regions have also become more popular with the quick spread of diverse food service establishments. The millennial generation's increasing propensity for fast food consumption habits has increased spending on the quick service restaurant business, especially franchises. Along with rising domestic consumer spending, tourists' lodging and dining expenditures also help fuel the expansion of numerous regional economies. To draw tourists from countries, hotels and restaurants are introducing various new cuisine types in local markets as the tourism industry has grown over the past few years. This contributes to their ability to draw domestic and foreign tourists interested in trying out different cuisine styles. As a result, the rising expenditure on eating out will probably spur the development of this food service business.

The growing number of online delivery platforms across the globe propels the market size growth. The rising technological advancements and incorporation of IoT, wide smartphones usage is making easier for the consumers to place orders and make reservations for dining is fueling the market growth opportunities. The increase in the social gatherings, parties and other entertainment purposes, food plays crucial role in these gatherings. This impacts positively on the market share expansion. The adoption of food services in theme parks, theatres, malls and in other public places where more people gather is creating substantial growth to the food service market.

MARKET RESTRAINTS

The rapid growth of online food delivery platforms is hampering the growth of the food service market.

Customers are reluctant to adopt online food ordering because of its drawbacks. There are some difficulties with meal delivery in addition to all the other advantages. One issue, for instance, is that when ordering meals online, the quality of the food delivered is frequently poorer than the quality of the meal in a restaurant. Home delivery apps also struggle when there is a lot of network load. Additionally, food from delivery services is frequently bundled in packaging, which is typically less appetizing than food that is appropriately arranged on your plate in a restaurant. The fact that using these services can incur additional customer costs is yet another drawback of Meals on Wheels. While most countries offer free meal delivery, if an order's value is below a specific threshold, clients may still be required to pay for delivery even if the food they purchased is quite affordable.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.66% |

|

Segments Covered |

By Type, Service Type, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Aramark Corporation, Compass Group North America, Doctor’s Associates Inc., Domino’s, Restaurant Brands International, Seven & I Holdings Co. Ltd, Sodexo, Starbucks Corporation, Yum! Brands Inc. |

SEGMENTAL ANALYSIS

Global Food Service Market Analysis By Type

The full-service restaurant segment is predicted to account for a substantial global foodservice market share during the forecast period. Full-service restaurants include sit-down venues with a full meal menu and provide clients with table service in a physical location. They offer various food options, including breakfast, lunch, and dinner. Restaurants specializing in fine dining and casual eating make up most of this group.

The quick-service restaurants segment is estimated to grow the fastest during the forecast period. Rising demand for online food orders and growing online food service platforms are augmenting the market growth opportunities in this segment.

Global Food Service Market Analysis By Service Type

The commercial segment tends to dominate the growth of the global food service market during the forecast period. The eating-out/takeaway edible service systems, quick-service restaurants, and full-service restaurants are all included in the commercial section. Examples of commercial edible services include eateries, cafes, fast food chains, food trucks, and online food ordering. Compared to commercial food service, which has existed in the business since its inception, institutional food service is a relatively recent idea that was established in the 20th century. Families have more discretionary income; thus, customers are spending more money at hotels, restaurants, cafes, and other establishments. Major fast food chains like Domino's, Pizza Hut, KFC, Starbucks, Burger King, Taco Bell, Subway, McDonald's, Wendy's, Papa John's Pizza, and Chipotle Mexican Grill are using this opportunity to mark their presence in the international market. This trend is further propelling the growth of the global food service market.

REGIONAL ANALYSIS

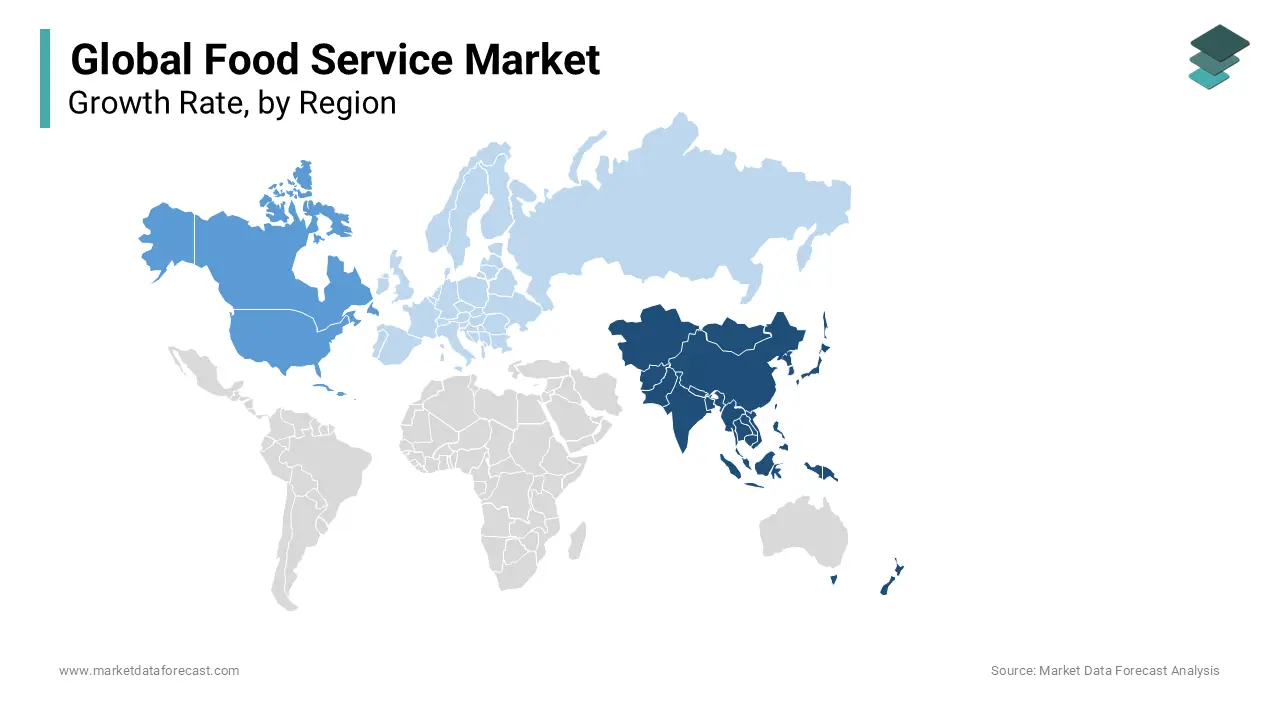

The Asia Pacific region dominated the global food service market with a prominent market share due to rising demand for a wide range of food products among the growing population. Most people from countries like Australia, Japan, China, and South Korea prefer to dine in full-service restaurants. The escalating demand for online food services is majorly boosting the regional market growth. In India, the average orders were highest among full-service restaurants in 2022 compared to other food service types, with a price of USD 6.03. The increased demand for Chinese, Indian, and Japanese food among the people drives the food services market growth across the Asia Pacific region. Rapid urbanization, increasing population, and changing lifestyles are primary factors escalating the market expansion in the region. The increasing consumer interest in trying innovative, unique, flavorful cuisines is enhancing the food service providers' focus on developing consumer demand for food products, boosting the market size growth.

The North American region is estimated to have considerable growth during the forecast period due to the well-established food and beverages industry in the United States and Canada. The costs of food service companies are rapidly rising across these countries, enhancing the region's market revenue. The growing demand for healthy and organic food products and the diversified demographic structure of North America enhance the demand for exotic food choices among the people, leading to regional market growth.

The European region is expected to have moderate growth in the coming years due to rising demand for outside food. People's busy lifestyles are escalating their desire for outside eating habits. The cultural shift towards sociable dining experiences and the rising trend of these social gatherings are accelerating the demand for casual and expensive eateries, which propels the European foodservice market.

KEY PLAYERS IN THE GLOBAL FOOD SERVICE MARKET

Key Players In The Global Food Service Market Are Aramark Corporation, Compass Group North America, Doctor’s Associates Inc., Domino’s, Restaurant Brands International, Seven & I Holdings Co. Ltd, Sodexo, Starbucks Corporation and Yum! Brands Inc. are some of the major players in the global food service market.

RECENT HAPPENINGS IN THIS MARKET

-

In February 2024, Chipotle Mexican Grill announced a partnership with Apeel Sciences to increase the shelf life of avocados used in guacamole to reduce food waste.

-

In February 2024, Domino's test drone delivery in New Zealand, looking into the possibility of faster and more efficient deliveries. This initiative could pave the way for more widespread use of drone technology in the food service industry.

-

In February 2024, Sodexo and Compass Group, two large contract food service providers, announced a partnership to provide sustainable food solutions to their clients. This initiative aims to eliminate food waste and encourage responsible sourcing.

-

In January 2024, US Foods completed its acquisition of Chef's Banquets, a prominent distributor of frozen and refrigerated food to restaurants.

-

In January 2024, Tyson Foods, a major food service supplier, plans to concentrate on rebuilding its business following setbacks during the epidemic. It is investing in new products, marketing campaigns, and operational improvements.

-

In January 2024, Starbucks plans to trail plant-based meat options in selective Chinese outlets to meet the growing demand for sustainable alternatives.

-

In September 2023, McDonald's introduced four new vegetarian options to its Netherlands menu, placing them ahead of beef to encourage plant-forward eating.

-

New Outback Steakhouse locations with a more contemporary design for the dining area were planned to open. The business opened three new eateries, one each in Fort Worth, Steele Creek, and Polaris.

DETAILED SEGMENTATION OF THE GLOBAL FOOD SERVICE MARKET INCLUDED IN THIS REPORT

This research report on the global food service market has been segmented and sub-segmented based on type, service type, and region.

By Type

- Full-service restaurants

- Quick service restaurants

- Institutes

- Others

By Service Type

- Commercial

- Institutional

By Region

- Asia Pacific

- Middle East and Africa

- Latin America

- Europe

- North America

Frequently Asked Questions

1. What is the food service industry, and what does it encompass?

The food service industry refers to businesses and establishments that prepare, serve, and deliver food and beverages to customers for immediate consumption. It encompasses a wide range of establishments, including restaurants, cafes, bars, food trucks, catering services, institutional cafeterias, and other food-related businesses. The food service industry plays a crucial role in providing convenient dining options and culinary experiences to consumers across various settings, from casual dining to fine dining, and from quick-service to full-service establishments.

2.What are the current trends shaping the food service industry?

Health and wellness: Increasing consumer demand for healthier menu options, plant-based alternatives, and transparent sourcing practices, reflecting a growing focus on nutrition, sustainability, and well-being.

Technology integration: Adoption of digital ordering platforms, mobile apps, self-service kiosks, and contactless payment systems to enhance convenience, streamline operations, and improve the overall dining experience.

3.What are the challenges facing the food service market?

Labor shortages and workforce issues: Difficulty in recruiting and retaining skilled labor, rising labor costs, and compliance with labor regulations pose challenges for food service businesses, impacting staffing levels, service quality, and operational efficiency.

Supply chain disruptions: Disruptions in the global supply chain, including ingredient shortages, transportation delays, and price fluctuations, affect food availability, menu planning, and cost

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]