Global Food Packaging Market Size, Share, Trends & Growth Forecast Report – Segmented By Materials (Glass, Metal, Paper & Paperboard, Wood and Plastics), Product (Rigid, Semi-Rigid and Flexible), Application (Fruits & Vegetables, Bakery & Confectionery, Dairy Products, Meat, Poultry & Seafood, Sauces, Dressings and Condiments and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

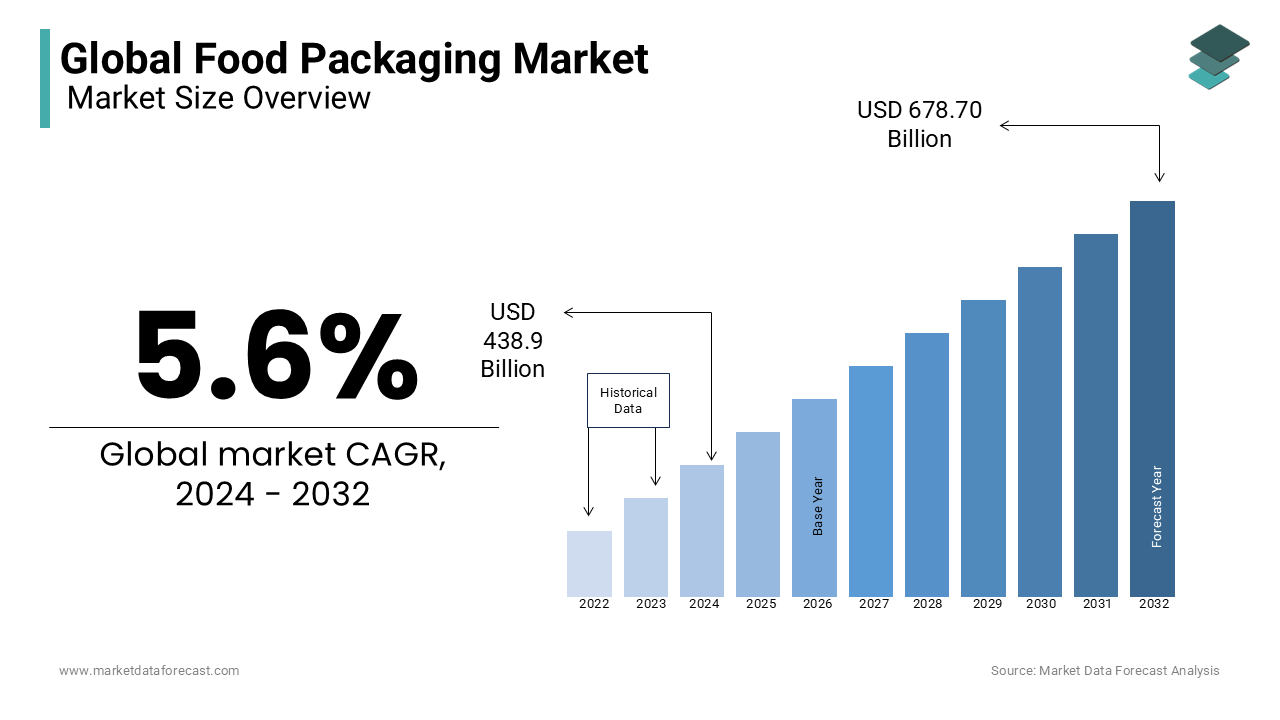

Global Food Packaging Market Size (2024 to 2032)

The size of the global food packaging market was worth USD 415.64 billion in 2023. The global market is anticipated to grow at a CAGR of 5.6% from 2024 to 2032 and be worth USD 678.70 billion by 2032 from USD 438.9 billion in 2024.

Food packaging is the bundling of food for security from harm, sullying, decay, bug assaults, and altering during transport, stockpiling, and local dealers. Bundling types incorporate jugs, sacks, plates, jars, and containers. Packaged food is utilized for different purposes, such as boundary and sullying security, accommodation, and bit control. Manageable packaging tends to reduce food waste and misfortune and decreases well-being issues by forestalling nourishment-borne ailments and substance pollution and protecting food quality. Food packaging is produced using different materials that explicitly don't respond to the food and drinks put away inside, in this manner giving excellent quality items and a timeframe of realistic usability. There is a developing interest in typical high-quality food, which is insignificantly processed or non-prepared, doesn't contain additives, and offers a longer shelf-life. Food packaging is utilized for different applications, such as bundling natural products and vegetables, dairy items, meat, poultry and fish, sauces, dressings, and toppings.

MARKET DRIVERS

The growing interest from consumers in ready-to-eat snacks is propelling the growth of the food packaging market.

Comfort food is significantly utilized because of its simple versatility, the extended timeframe of realistic usability, and ease of making. These food items comprise snacks, frozen food, finger food, candy, drinks, and others. These items, as a rule, require less planning time and are served hot in prepared-to-eat holders.

The growing disposable income among people and the increasing working population worldwide is further boosting the global food packaging market growth.

Most shoppers exchange for palatable nourishment promptly, which will prompt the growth of the global food packaging market. These days, because of the quick-moving way of life of shoppers, there has been expanding interest in fast food items. This popularity has caused comfort food creators to concoct items containing better health benefits and with less unsafe impacts on the body. This popularity for comfort foods is straightforwardly expanding the interest in food packaging, hence supporting the development of this market. To achieve manageability, there has been an expanding utilization of green packaging arrangements. They help diminish natural contamination and offer a wide assortment of advantages that incorporate a decrease in plastic use, expanding reusing, vitality protection, and productive vehicles, prompting an upsurge in the growth of the global market.

MARKET RESTRAINTS

The growing awareness of environmental concerns about single-use packaging is restraining the global food packaging market.

Furthermore, factors such as stringent regulations on packaging materials, increasing raw material costs, growing preference from consumers for eco-friendly packaging options and limited shelf life of certain packaged foods are inhibiting the growth of the global market. The rising awareness of health concerns related to certain packaging materials, the growing popularity of fresh and unpackaged foods, supply chain disruptions affecting packaging production and competition from alternative packaging solutions are impeding the global market for food packaging.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.6% |

|

Segments Covered |

By Materials, Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Mondi Group, Crown Holdings Inc, DS Smith Plc, Amcor plc, Berry Global Inc, Orora Ltd, Owens-Illinois Inc, Ardagh Group S.A, Ball Corporation, CPMC Holdings Ltd, International Paper Co, Sealed Air Corp and Others. |

SEGMENTAL ANALYSIS

Global Food Packaging Market By Material

Based on material, the Paper & Paperboard segment is anticipated to account for the largest share of the global market during the forecast period. Increasing adoption of paper in food packaging of various edible foods, fresh vegetables, and beverages is the primary factor driving the demand in this business. Glass bottles are usually used for storage and packaging of food products for an extended period or reusable items. However, plastic in food packaging is considered a feasible option as it is flexible, lightweight, and cost-effective, does not cause splintering, and protects food from damage.

Global Food Packaging Market Analysis By Product

Based on the product, the rigid packaging segment is likely to dominate the worldwide market during the forecast period. Rigid packaging accounted for the most substantial market portion due to its increased usage in vegetables, fruits, and other easily crushable food products. Semi-rigid packaging comprises plastics and cardboard, which is majorly used to protect food products from humid, rot, and harsh environments. In addition, flexible packaging is gaining more prominence demand due to increasing technological advancements and the launch of an innovative solution for product packaging.

Global Food Packaging Market Analysis By Application

Based on application, the bakery & confectionery segment is estimated to exhibit a notable CAGR during the forecast period. The food packaging industry is witnessing massive demand with the unique and attractive packaging launched recently for a different type of products. Fruits and vegetables have perishable properties and spoil when coming in contact with moisture and, therefore, require flexible packaging. Growth in the meat, poultry & seafood sectors can be linked to the augmenting demand for these products from consumers around the world. Sauces and dressings are often available in rigid packaging as they are non-perishable.

REGIONAL ANALYSIS

Of these, the Asia Pacific food packaging market registered the highest share in 2023 and is likely to continue its demand in the foreseen years. The increasing population in nations like China, India, etc., is creating a massive demand for food products, which is supporting the growth in the packaging sector. The rise in consumer disposable income, along with the increase in the middle-class section, is accelerating the demand for the food packaging sector. Major players in the global food packaging market are present in North America and Europe.

KEY PLAYERS IN THE GLOBAL FOOD PACKAGING MARKET

Mondi Group, Crown Holdings Inc, DS Smith Plc, Amcor plc, Berry Global Inc, Orora Ltd, Owens-Illinois Inc, Ardagh Group S.A, Ball Corporation, CPMC Holdings Ltd, International Paper Co and Sealed Air Corp are playing a significant role in the global food packaging market.

RECENT HAPPENINGS IN THE MARKET

- In June 2019, Mondi Group built up a fully recyclable polypropylene for thermoforming applications that will lessen carbon impression by 23% for packaging. This item holds all the usefulness and offers fantastic optical and gas obstruction properties that expand the timeframe of the realistic usability of stuffed food items.

- In August 2019, Amcor planned lightweight PET jugs for the purified brew in Brazil. These PET compartments are a trade for glass that withstands high-heat conditions and inward weight during the sanitization process. This packaging permits the organization to build up a superior swap for glass which will convey to an expansive scope of customers all through Latin America.

- In October 2019, Ball Corporation constructed another assembling plant of aluminum cups in Georgia with a speculation of USD 200 million. This plant will serve the developing interest of U.S. clients and customers for maintainable drink packaging.

DETAILED SEGMENTATION OF THE GLOBAL FOOD PACKAGING MARKET INCLUDED IN THIS REPORT

This research report on the global food packaging market has been segmented and sub-segmented based on material, product, application, & region.

By Material

- Glass

- Metal

- Paper & Paperboard

- Wood

- Plastics

- Polypropylene,

- Polyethylene

- PET

- Others

By Product

- Rigid

- Semi-Rigid

- Flexible

By Application

- Fruits & Vegetables

- Bakery & Confectionery

- Dairy Products

- Meat

- Poultry & Seafood

- Sauces

- Dressings and Condiments

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What are the key drivers of growth in the food packaging market?

Factors driving growth in the food packaging market include increasing demand for convenience foods, growing awareness about food safety, advancements in packaging technologies, and sustainability concerns leading to eco-friendly packaging solutions.

2. What are some innovations in food packaging technology?

Innovations in food packaging technology include active packaging (e.g., antimicrobial packaging), intelligent packaging (e.g., RFID tags for tracking and monitoring), modified atmosphere packaging (MAP), and nanotechnology-based packaging materials.

3. What are the current trends in food packaging design?

Current trends in food packaging design include minimalist and sustainable designs, biodegradable and compostable materials, interactive packaging (e.g., QR codes for product information), and customized packaging for e-commerce.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]