Global Food Enzymes Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Carbohydrase, Protease, Lipase), Application (Beverage, Processed Food, Dairy, Bakery, Confectionery), Source (Plant, Microorganism, Animal), Form (Lyophilized Powder, Liquid), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Food Enzymes Market Size

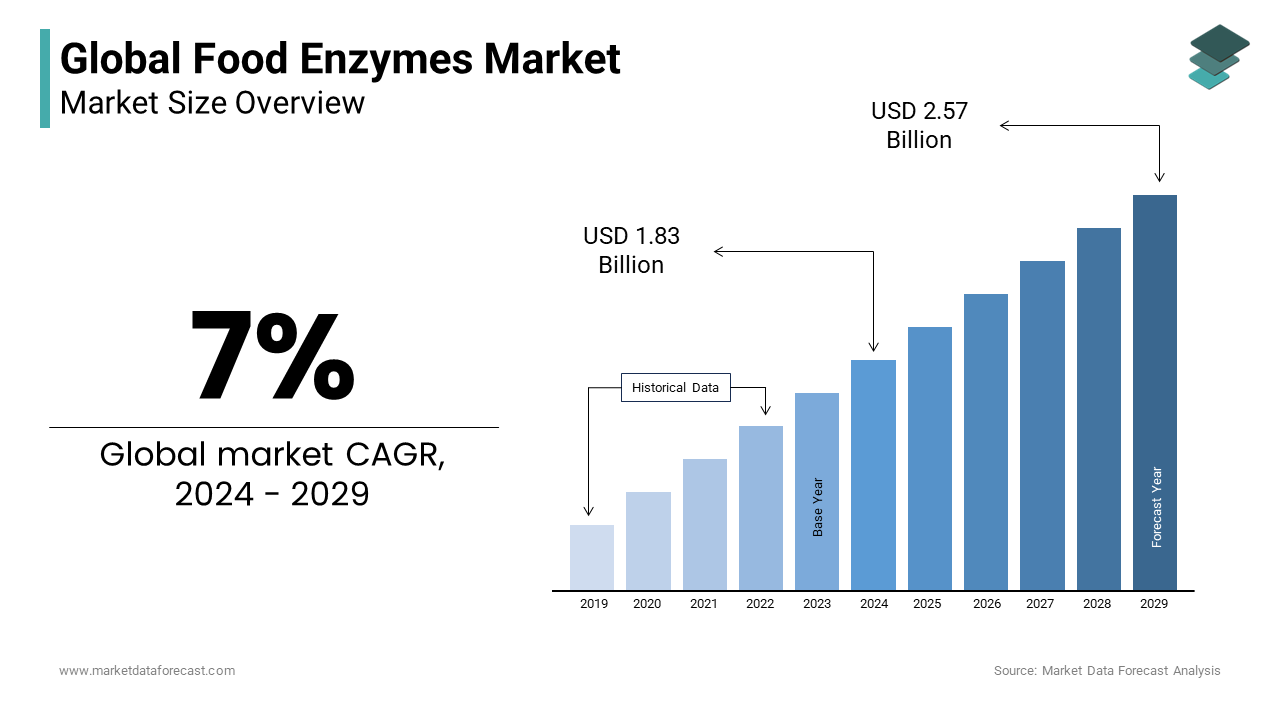

The global Food Enzymes Market size was expected to be worth USD 1.83 Billion in 2024 and is anticipated to be worth USD 3.37 billion by 2033 from USD 1.96 billion In 2025, growing at a CAGR of 7% during the forecast period.

As the demand for prepared foods increased, the F&B sector further strengthened its product portfolio with the advent of frozen foods, packaged foods, and processed foods. Food enzymes are biological catalysts. Food enzymes speed up biochemical reactions within human cells and affect all body functions. They promote cellular response by lowering the energy threshold required for the reaction. This enzyme helps improve the quality of food by simplifying food processing steps. Enzymes are widely used in food processing to mitigate potential health risks. Using advanced technology, new enzymes have been developed in a wide range of applications. Packaged foods consist of complex molecules that are difficult to digest naturally. As the intake of packaged foods increases worldwide, the application of food enzymes has inevitably developed for F&B companies. Food enzymes are often used as additives to improve the overall texture, sustenance, and shelf life of the products.

MARKET DRIVERS

The improving food quality, increasing demand for processed foods, and growing awareness of healthy and nutritional foods are primarily driving the growth of the food enzymes market.

The world market for food enzymes is supposed to experience growth during the forecast period. Due to its environmentally friendly properties, the increasing global application of food enzymes in end-use markets such as beverages, dairy products, and confectionery is deemed to be a significant driver of market growth in the next seven years. The bakery is assumed to remain the largest end-use industry in food enzyme applications due to its improved shelf life, dough stability, and dairy and beverage properties. Food and beverage enzymes are mainly produced from microbial sources due to their low cost and high productivity. The increasing application of food enzymes in various end-user industries around the world is contributing to the growth of the global food enzyme market.

The growth of the global food enzyme market is presumed to accelerate during the outlook period as the slope of prepared foods increases along with the rise in the workforce in emerging countries. The trend of developing food processing technology and the rapid development of the beverage industry are expected to increase the demand for food enzymes in each sector. With the increasing consumer awareness of the nutritional and health advantages, the demand for these food enzymes is snowballing. This has led to increased adoption of food enzymes in many food applications, such as the frozen food manufacturing industry and packaged food units. The use of food enzymes in food manufacturing equipment makes the process more environmentally friendly, reducing the waste of raw materials and greenhouse gas emissions. The properties of food enzymes, such as digestion, softening, and stem prevention, are expected to fuel the growth of the food enzyme business. The reduction in carbon emissions and waste of raw materials is anticipated to accelerate the growth of the food enzyme market during the projection period.

Along with increased productivity, the change in the trend toward healthy foods is also expected to increase the growth of the food enzyme market. The increase in per capita income, together with the penetration of the product is foreseen to have a positive effect on the demand for food enzymes, increasing the growth of the global market. Technological innovations and updates are supposed to be the main drivers of market growth during the forecast period. The latest trends, like protein fortification, are foreseen to propel the demand in the global food enzymes industry, along with the creation of immense growth potential for market players. It is assumed to work in adverse conditions and improve efficiency to promote the growth of the food enzyme business and provide opportunities for industry players.

MARKET RESTRAINTS

The health risks associated with consuming excess food enzymes will hinder market growth and challenge industry participants during the projection period.

Furthermore, growth in the food enzyme market is limited due to factors such as high R&D costs, counterfeiting of food packaging, unclear and irregular regulatory processes, restrictions related to temperature ranges and pH, and limitations in the brewing industry. Recent legislation to address the risks associated with the use of food enzymes in the food industry is expected to hamper growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7% |

|

Segments Covered |

By Type, Application, Source, Form, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nagase Chemtex Corporation, AB Enzymes GMBH, Advanced Enzymes Technologies Limited, AUM Enzymes, Dyadic International Inc, E.I. DUPONT DE Nemours & Company, Jiangsu Boli Bio Products Co. Ltd, Novozymes A/S and Puratos Group NV |

SEGMENTAL ANALYSIS

By Type Insights

The carbohydrase segment held the largest share of the global market by type in 2024. Carbohydrases are used to break down carbohydrates into simpler sugars and are widely utilized in the production of baked goods, beverages, dairy products, and sweeteners. They help improve texture, flavor, and digestibility, as well as enhance the shelf life of food products. The high demand for carbohydrases in various food processing applications, such as in the brewing and baking industries, contributes to its dominance in the market.

The lipase segment is anticipated to be the fastest growing segment in the global market during the forecast period. Lipase enzymes are involved in the breakdown of fats and oils, and they are used to improve the flavor, texture, and nutritional profile of various food products, including dairy, cheese, and snack foods. The increasing demand for low-fat and healthy food options, along with the growing interest in functional foods, is driving the rapid growth of lipase in food applications. As consumers seek more tailored and health-focused food choices, the lipase segment is experiencing significant growth in the food enzymes market.

By Application Insights

The processed food segment captured the leading share of the global food enzymes market in 2024. Enzymes are extensively used in the processed food industry to improve texture, flavor, nutritional value, and shelf life. They play a key role in applications such as meat processing, cheese production, and the production of sauces and dressings. The rising demand for convenience foods and the increasing use of enzyme technology to meet consumer preferences for healthier and more efficient food processing have contributed to the dominance of this segment in the market.

The dairy segment is estimated to be the most lucrative segment in the global market in the coming years. Enzymes are used in dairy production to enhance the texture, consistency, and taste of products like cheese, yogurt, and milk. The increasing consumer demand for specialty dairy products, such as low-fat or lactose-free options, along with the growing popularity of functional foods, is driving the rapid growth of enzymes in the dairy sector. Additionally, enzymes play a crucial role in improving the efficiency and cost-effectiveness of dairy manufacturing processes, contributing to the segment's rapid expansion.

By Source Insights

The microorganism segment held the largest share of the global market by source in 2024. Enzymes derived from microorganisms, such as bacteria, fungi, and yeast, are widely used in the food industry due to their ability to catalyze a wide range of reactions and their cost-effectiveness. Microbial enzymes are particularly used in dairy, baking, brewing, and meat processing applications. They are favored for their efficiency, ease of production, and versatility in various food processing methods. The high demand for microbial-based enzymes, particularly in mass production, contributes to its dominance in the market.

The plant segment is projected to exhibit a prominent CAGR in the global market during the forecast period. Enzymes derived from plants, such as papain (from papaya), bromelain (from pineapple), and amylases, are gaining popularity due to their natural origin and clean-label appeal. The increasing consumer demand for natural and plant-based ingredients in food products is driving the growth of plant-derived enzymes. These enzymes are used in various applications, such as in fruit processing, meat tenderizing, and baking. The growing trend for plant-based foods and cleaner, more sustainable ingredients is fueling the rapid expansion of the plant-derived enzymes segment.

By Form Insights

The Lyophilized powder segment occupied the leading share of the global market in 2024. Powdered enzymes, created through the lyophilization (freeze-drying) process, are highly preferred due to their extended shelf life, stability, and ease of handling. They are widely used in the food industry for applications such as baking, brewing, dairy processing, and meat production. Powdered enzymes offer convenience in transportation and storage, contributing to their dominance in the market. Additionally, they can be easily incorporated into food formulations, making them a preferred form for large-scale food production.

The lyophilized Liquid segment is projected to grow at a noteworthy CAGR during the forecast period. Liquid enzymes are gaining popularity due to their rapid dissolution in water, which makes them ideal for certain food processing applications. The growing demand for liquid enzymes is driven by their superior efficiency in processes where quick activation is required, such as in beverages, dairy products, and functional foods. Additionally, liquid enzyme formulations are gaining traction in clean-label products due to their natural and less processed form, contributing to their fast growth in the market.

REGIONAL ANALYSIS

North America is anticipated to remain a significant local market with a notable market share, followed by Europe as demand for processed foods increases in countries such as the United States and Canada. The growing demand for processed foods in the European food industry is expected to lead the market for food enzymes in the region. Europe is predicted to grow below-average growth for the reasons mentioned above. The Asia-Pacific region is presumed to have the fastest-growing emerging economies in countries such as China, India, and Japan as end-use applications and demand for processed foods increase. Rapid urbanization, coupled with an increasing standard of living, is demanded to be a significant driver for changing consumer tastes and preferences in Asia Pacific countries, including China and India. As awareness of healthy food increases, demand for food enzymes is expected to increase in developing countries, and growth in the food enzyme market is expected to increase. Manufacturers are aware of the potential markets in the Asia Pacific and Latin America and are well-versed in the global shift toward new and exotic flavors. South Africa and Brazil are also expected to witness changes in eating habits and show significant market growth during the outlook period.

KEY PLAYERS IN THE GLOBAL FOOD ENZYMES MARKET

Nagase Chemtex Corporation, AB Enzymes GMBH, Advanced Enzymes Technologies Limited, AUM Enzymes, Dyadic International Inc, E.I. DUPONT DE Nemours & Company, Jiangsu Boli Bio Products Co. Ltd, Novozymes A/S and Puratos Group NV are some of the major companies in the global food enzymes market. DuPont invests in marketing and branding to develop product promotion and increase sales.

RECENT HAPPENINGS IN THE MARKET

- In February 2017, Novozymes introduced a new Spirizyme enzyme into its family of sugar-processing enzymes.

- In June 2018, DSM released a new product called BakeZyme AAA for various baking enzymes to improve product delivery.

- In June 2018, DowDuPont launched a new range of POWERBake 8000 bakery enzyme products in South America, expanding the scope of product offerings in the region.

- In July 2018, DSM launched PreventASe, a variety of baking enzymes used as acrylamide reduction solutions for snacks and baked goods.

DETAILED SEGMENTATION OF THE GLOBAL FOOD ENZYMES MARKET INCLUDED IN THIS REPORT

This research report on the global food enzymes market has been segmented and sub-segmented based on type, application, source, form, and region.

By Type

- Carbohydrase

- Protease

- Lipase

By Application

- Beverage

- Processed Food

- Dairy

- Bakery

- Confectionery

By Source

- Plant

- Microorganism

- Animals

By Form

- Lyophilized Powder

- Lyophilized Liquid

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. What is the impact of food enzymes on food allergens and intolerances?

Food enzymes are generally considered safe and can benefit individuals with specific food intolerances. For example, enzyme preparations may be used to reduce gluten content in wheat-based products.

2. What challenges does the food enzymes market face?

Challenges include stability issues during processing, cost considerations, and the need for extensive research to develop enzymes with specific functionalities. Regulatory compliance is also a key consideration.

3. How is the food enzymes market expected to evolve in the future?

The market is expected to grow as demand for processed and convenience foods increases. Ongoing research in biotechnology and enzyme engineering will likely lead to innovations and expanded applications in the food industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]