Global Food and Agriculture Technology and Products Market Size, Share, Trends, & Growth Forecast Report By Industry (Animal, Agriculture, Cold Chain, Food & Beverage and Cannabis), And Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) Industry Analysis From 2025 To 2033

Global Food and Agriculture Technology and Products Market Size

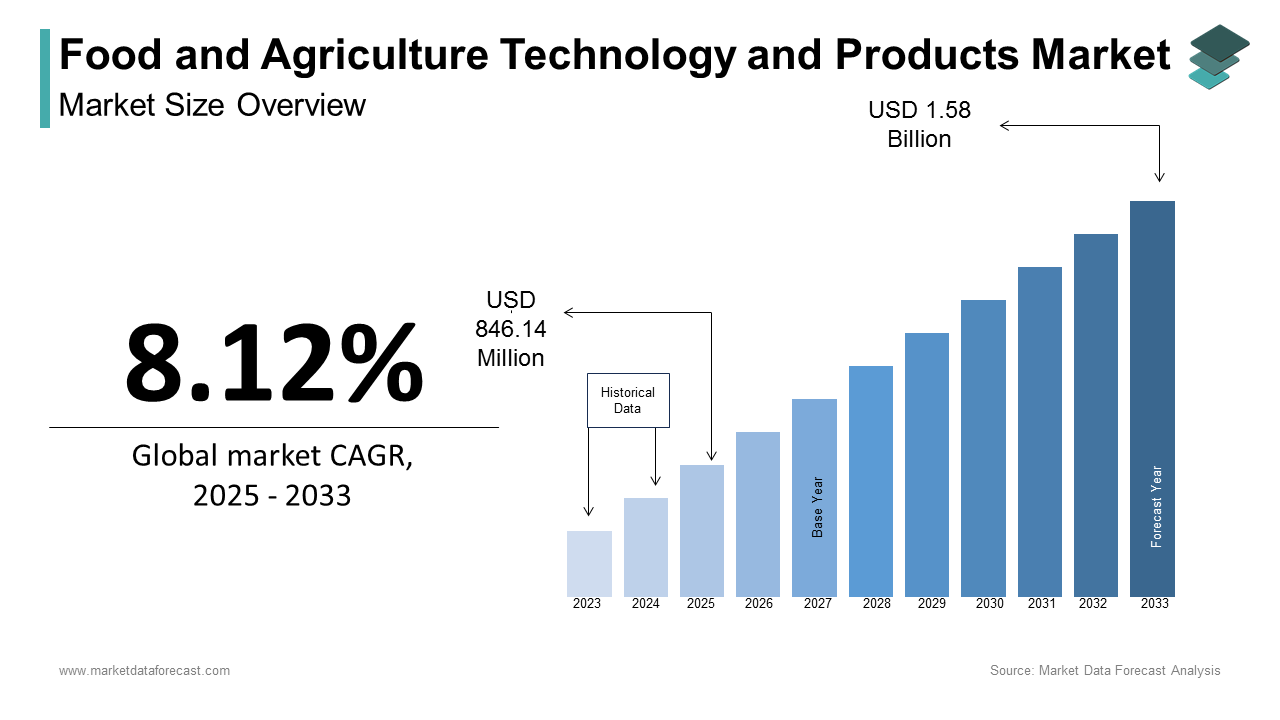

The size of the global food and agriculture technology and products market was valued at USD 782.59 million in 2024 and is expected to be worth USD 846.14 billion in 2025 and grow at a CAGR of 8.12% from 2025 to 2033 to achieve USD 1.58 billion by 2033.

Food and agricultural technology and products are used in food formation and the production of machinery used in agriculture. Food and agricultural technologies and products protect crops from increased production, efficient use of resources and harsh weather conditions. Various technologies are used in the food and agriculture industry, such as humidity and temperature sensors, robotics, aerial imaging, GPS technology, and more. Robot systems and advanced devices provide efficient, green, safe and profitable businesses. The adoption of modern technology by farmers to increase crop yields and meet growing food demand is expected to be a key driver of the global food and agriculture technology market. The emergence of Al and blockchain technology may reveal new avenues for the food and agricultural technology and products market in the near future.

MARKET SCENARIO

Presently, the food and agriculture technology and products market is growing rapidly owing to the giant strides made by smart farming in recent years. The shift towards greater integration of advanced technology in this field is because of the necessity and has developed for various reasons, involving increasing food production, overconsumption, and air pollution. The most consumed crops in the world are sugarcane, maize, rice, and wheat. As per the United Nations Food and Agriculture Organization (FAO), approximately three-fourths of the food consumed by humans around the world originates from 5 animal and 12 plant sources, with corn, rice, and wheat just 3 holding 51% of the calories present in the diet. Moreover, the world's population is expanding at a rate of around 1%, and it is believed to surpass the mark of 8.5 billion people by 2030, which will need more infrastructure. Consequently, this will decrease the farmlands. Currently, there is an urgent requirement to devise new methods to reap greater food quantities with smaller agricultural land.

Another trend influencing market growth is gut-health-friendly foods which are packed with nutrients. Consumers nowadays are prioritizing nutrition as the fundamental idea of a balanced life, broadening their emphasis to involve protein, cognitive health, immunity, gut health, and probiotics. Also, with protein being the world’s quickest-up surging macronutrient, market players are engaged in the exploration and development of bio-based processes to improve animals' and people’s gut health, coupled with personalized nutrition persistent in taking forward the innovation in this field. On the technology front, the Internet of Things (IoT) and smart sensors, artificial intelligence, Unmanned Aerial Vehicles, autonomous farm equipment, advanced analytics, precision farming, regenerative agriculture, and biotechnology are the key trends transforming agriculture worldwide.

MARKET DRIVERS

The demand for food-growing technologies and products is increasing as the world population grows, and the demand for increased food production increases, depending less on weather conditions. The increased demand for processed food and livestock products is a key factor that is expected to drive growth in the food and agricultural technology and products market in the coming years. Food and agricultural technology and products market is improving as food security, government support for the adoption of modern agricultural technologies, and increased awareness about intake for products derived from livestock and seafood. In addition, government initiatives and investments to adopt modern agricultural technology, increasing population, rising consumer capacity, and increased consumer awareness of food safety are some of the other factors expected to drive the Food and Agriculture Technology and Products market in the next years. Also, market growth is accelerating as the demand for packaged and processed foods increases. Besides, the increasing use of various agricultural technologies for smart agriculture is another factor supporting the growth of the global market for agricultural and food products and technology. The demand for food-growing technologies and products is increasing as the world population grows, and the demand for food production increases with less dependence on weather conditions. This is one of the main reasons for the increased demand and consumption of livestock and shellfish, increased consumer awareness of food security, government support for adopting modern agricultural technologies, and demand for agricultural production due to the population growth market growth engine.

Growth in the agriculture industry, energy and cost savings, government support and increased yields and profitability are some of the driving forces in the food and agriculture technology market. Lack of technical knowledge and high initial investment are some of the limiting factors for broadband market penetration and mobile technologies such as precision web-based agriculture and drone applications are opportunities in the food and agriculture technology market. The agricultural industry has grown into a technologically powerful and data-rich industry with the advent of advanced technologies such as mapping systems, variable speed technology, the Internet of Things (IoT), artificial intelligence (AI), remote sensing, and lighting. In addition, the busy lifestyle has led to the growth of the food and agricultural technology market, as consumer awareness of the importance and desirability of food security and increased demand for packaged and processed foods increases. The growth of this market is due to the increased demand and consumption of products derived from livestock, such as dairy products, meat, eggs and seafood. Growth in R&D in the agriculture industry and the adoption of cloud computing platforms and big data analysis of smart farming practices are expected to create favorable opportunities for manufacturers operating in the food and agriculture technology and products market.

MARKET RESTRAINTS

The generally fragmented agricultural industry, lack of coordination among market stakeholders, and inadequate enforcement of regulatory laws and supporting infrastructure in developing countries are expected to hamper Food and Agriculture Technology and Products market growth. The fragmented agricultural industry also disrupts markets for agricultural and food products and technology. High capital investment and energy demand are key factors that can slow the growth of markets for agricultural and food products and technology. Furthermore, strict regulations regarding the use of cannabis and parasites in many countries are another factor that is expected to hinder the growth of Food and Agriculture Technology and Products markets to some extent.

MARKET OPPORTUNITIES

Rising demand for farm produce across South-East Asia (SEA) provides potential prospects for the expansion of the food and agriculture technology and products market. ASEAN, comprising ten countries in SEA, stands out as one of the rapidly augmenting markets. Like, the exports of Australian farm products and solutions to ASEAN have grown considerably over the years. With the growth of these nations comes an increasing demand for products from across the globe. According to data released by the Department of Agriculture, Fisheries and Forestry of the Australian Government, in 2021-22, Australia exported 22 percent of its agricultural products to ASEAN, with this share increasing to 27 percent in the months of July through September 2022. The ASEAN region comprises several of the world’s rapidly expanding economies. From 2011 to 2021, the total GDP of ASEAN rose by 43 percent, compared to a 30 percent jump in global GDP. Additionally, from 2028 to 2022, the imports of farm and food products and solutions by this group of nations from international markets surged to 168 billion US dollars in 2022 from 120 billion US dollars. The progress can be attributed to drivers, including enhanced income levels, which contribute to the formation of an affluent and urbanized middle class across the ASEAN region. This results in a transition in customer preferences and escalating demand for distinctive, high-worth and premium-quality farm goods like wine, seafood, and meat. Another factor behind this is that the food and fiber processing industries are becoming larger and using more inputs. Therefore, South-East Asia presents an alluring opportunity for all types of brands and companies operating in this market.

MARKET CHALLENGES

A decrease in farming land while food consumption increases is one of the major challenges before the food and agriculture technology and products market. This includes land degradation, conversion, and climate change. Land use pressures are becoming among the key environmental issues of this era. As competition for fertile and ecologically important soil grows, along with the services and resources it provides, conflict over land is anticipated to heighten in the coming decades. This is fuelled by rising demands for arable ground, climate change initiatives, and other vital uses, resulting in a deepening ‘land crunch’.

Moreover, today’s food system has been shaped with a limited emphasis on satisfying escalating consumption by boosting productivity, ultimately hurting the market growth rate. The approach implemented post-Second World War is regarded as an uncritical way and has resulted in a series of worsening negative outcomes, impacting the expansion of this market. Initially, it led to lower diversity in agriculture, which in turn is less supportive of both human health and the well-being of the planet. Policy and finance assistance has predominantly favored a select few crops cultivated in key agricultural regions. As a consequence, the nine crops (potatoes, cassava, barley, sugar, palm, soybeans, rice, wheat, and rice) now account for around 75 percent of total farm calories produced. Further, the progress of the market is also hindered by other outcomes of this approach. These outcomes include greater greenhouse discharge, eroding the landscape’s natural capital, affordable food that encourages wastage and overconsumption, etc.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.12% |

|

Segments Covered |

By Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Evonik, ADM, DSM, Deere & Company, AKVA Group, United Technologies, Daikin, SGS SA, Signify Holdings, Zoetis, Pentair, GEA, Intertek, Neogen, Genus, Mosa Meat and Others |

SEGMENTAL ANALYSIS

By Industry Insights

The cold chain segment is expected to occupy the largest share during the outlook period. Cold chain technology occupied a significant size in the agricultural and food products and technology markets in 2018. It prolongs shelf life by limiting microbial growth and reducing spoilage of perishable foods by refrigeration or freezing. Networked business relationships in all countries are increasing, consumer demand for perishable food through online shopping is increasing, and the flexibility to ship perishable food in a timely manner in developed countries is driving the market growth of the cold chain.

In addition, the agriculture industry is expected to be the second fastest-growing sector during the outlook period. This is because this equipment can be widely used in almost all types of agricultural crops. The growing demand for food due to population growth and limited natural resources has led to the development of agricultural products and technologies. Growing consumer demand for pesticide and herbicide-free food and the need to reduce the carbon footprint of traditional farming practices are also expected to lead the agricultural sector.

Moreover, the cold chain sector is expected to dominate the market because it is important to transport industries, goods, equipment and products from one food to another in the food and agricultural technology and product markets. Globally, the refrigeration industry is growing by increasing the shelf life of food without compromising nutritional value. Since this market covers all industries, it is expected to grow at a moderate rate during the forecast period.

REGIONAL ANALYSIS

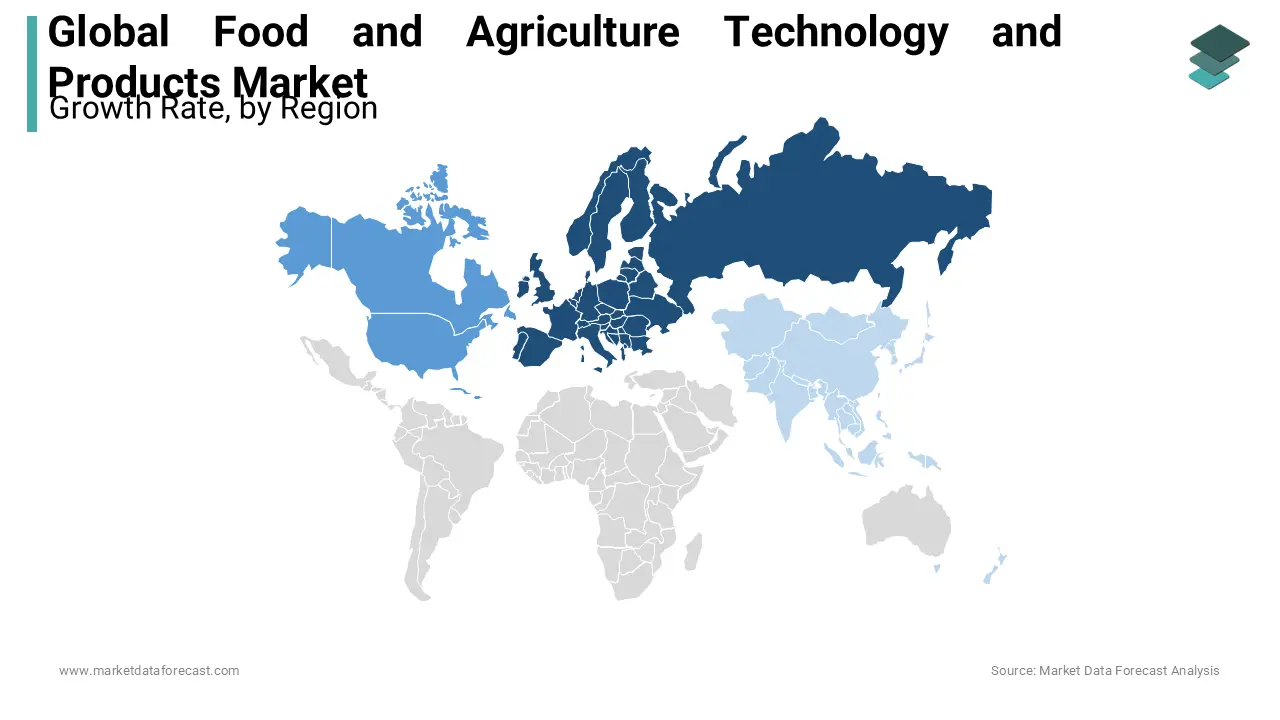

Europe was the leading regional market for Food and Agriculture Technology and Products in 2023, followed by North America. The growth of the European agricultural technology market can be attributed to increased startup activity in agricultural and food innovations, high adoption rates of agricultural technology, and crowdfunding for various indoor agricultural initiatives.

The North American market is expected to record significant growth in terms of sales in world markets for agricultural and food products and technology in the coming years. This can be credited to the surge in the need for packaged foods, organic fruits and vegetables, and rising development skills related to cloud computing and big data analytics in agricultural operations. The Asia Pacific food products and technology market is likely to expand with a considerable growth rate in the following years, owing to the rising call for processed foods and developments in the agricultural sector.

The Asia Pacific market is expected to rapidly advance in the next decade. In addition, population growth, disposable income, and the deployment of various technologies in the agri-food industries are other factors that are anticipated to drive growth in the Asia Pacific Food and Agriculture Technology and Products market. These aspects will create favorable growth prospects for all the markets in the APAC area. Moreover, agriculturalists, ranchers, and peasants in India are struggling with growingly uncertain and exceptional weather events, considerably affecting the farming and associated sectors. This presents a potential opportunity for market players to offer unique and tailored solutions for the nation’s problems. As the population of developing nations in South Asia increases by 1.18 percent each year, the threat of food insecurity becomes increasingly significant. In the coming years, it is vital for agricultural practices to evolve, becoming less vulnerable to climate fluctuations and more focused on leveraging innovative technologies for sustainable food production.

KEY MARKET PARTICIPANTS

Evonik, ADM, DSM, Deere & Company, AKVA Group, United Technologies, Daikin, SGS SA, Signify Holdings, Zoetis, Pentair, GEA, Intertek, Neogen, Genus and Mosa Meat are a few of the notable companies in the global food and agriculture technology and products market.

RECENT HAPPENINGS IN THE MARKET

-

In July 2024, Cropin Technology, a Bengaluru-headquartered company that is an AI platform for agriculture and food, reported the introduction of Sage, which is the foremost real-time agri-intelligence solution in the world and is driven by Google Gemini.

MARKET SEGMENTATION

This research report on the global food and agriculture technology and products market has been segmented and sub-segmented based on industry and region.

By Industry

- Animal

- Agriculture

- Cold Chain

- Food & Beverage

- Cannabis

By Region

- North America

- Europe

- Asia and Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the current trends in the food and agriculture technology and products market?

Current trends include the adoption of precision agriculture, the integration of Internet of Things (IoT) and smart farming technologies, advancements in biotechnology, increasing use of drones and robotics, and the development of sustainable and organic farming practices.

2. What is the future outlook for the food and agriculture technology market?

The future outlook is promising with continuous advancements in technology, increasing investment in agri-tech startups, and growing awareness of sustainable farming practices. The market is expected to see significant growth, driven by the need to feed a growing global population efficiently and sustainably.

3. How is climate change influencing trends in agriculture technology?

Climate change is prompting the development and adoption of technologies that enhance resilience to extreme weather conditions. This includes drought-resistant crop varieties, advanced irrigation systems, and climate-smart agricultural practices that mitigate the impact of climate variability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com