Global Flour Market Size, Share, Trends & Growth Forecast Report Segmented By Raw Material (Wheat, Maize, Rice, Other Raw Materials), Application, Technology, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Flour Market Size

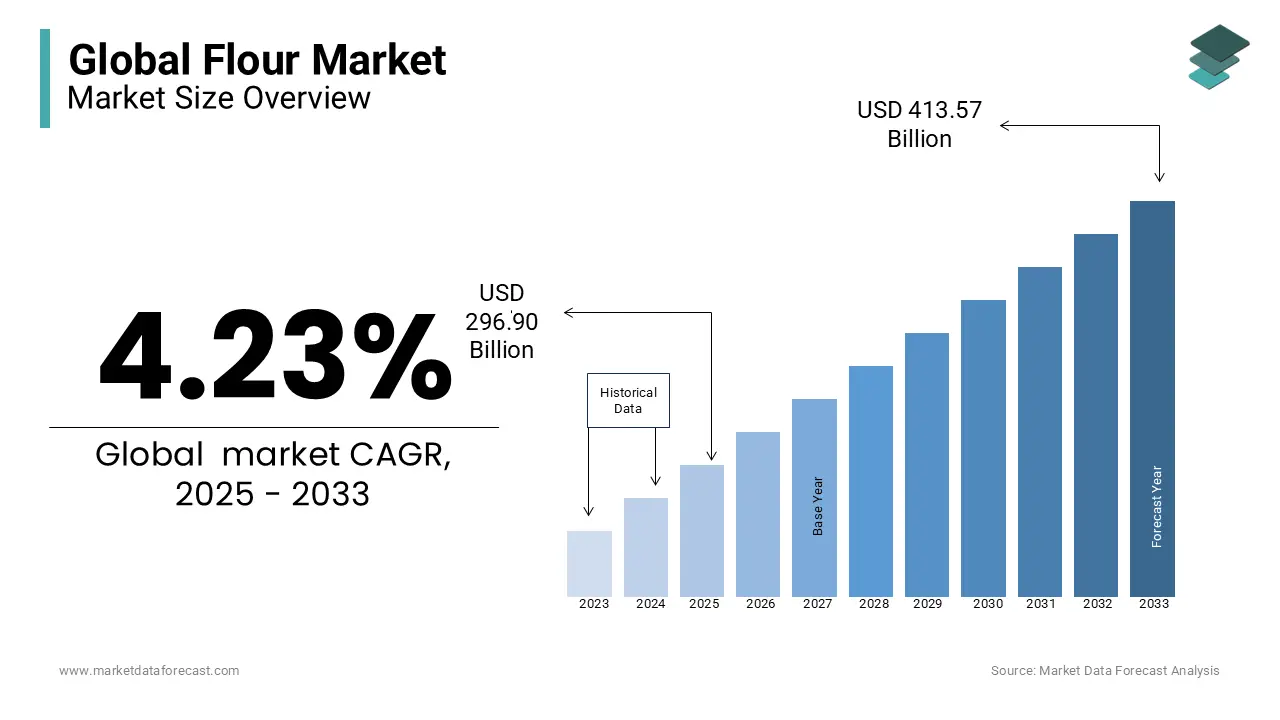

The global flour market size was calculated to be USD 284.85 billion in 2024 and is anticipated to be worth USD 413.57 billion by 2033 from USD 296.90 billion In 2025, growing at a CAGR of 4.23% during the forecast period.

Flour is a vital ingredient in the global food supply and contributes significantly to human caloric intake. According to the Food and Agriculture Organization (FAO), wheat-based products provide approximately 20% of the world’s dietary energy supply and are a cornerstone of global nutrition. On average, a person consumes about 66 kilograms of flour annually. This figure varies depending on cultural and regional diets. In some developing nations, cereals such as wheat and other flour-based staples account for over 50% of daily caloric intake with their role in food security. The production of flour, especially from wheat, is resource intensive. The Water Footprint Network estimates that producing one kilogram of wheat flour requires around 2,700 Liters of water. Alternative flours like chickpea and almond offer additional nutritional advantages. For instance, chickpea flour contains about 22 grams of protein per 100 grams, making it an excellent option for enhancing dietary protein levels.

MARKET DRIVERS

Global Food Security and Dietary Dependence on Cereals

Cereals, especially wheat play a vital role in food security by providing over 20% of the global dietary energy supply according to the Food and Agriculture Organization (FAO). In developing nations, cereals contribute more than 50% of daily caloric intake. This highlights their significance in ensuring nutrition for billions of people. Wheat flour is a staple ingredient used in bread, pasta and various foods consumed worldwide. In 2022 as per FAO data, global wheat production reached 776 million metric tons and henceforth meeting the caloric needs of the growing population. Increasing population and the affordability of cereal-based diets are key factors driving the demand for flour.

Flour Fortification and Nutritional Interventions

Flour fortification combats malnutrition by enriching flour with essential vitamins and minerals like iron, folic acid, and zinc. According to the World Health Organization, more than 80 countries mandate wheat flour fortification programs. These efforts have significantly reduced anemia rates by 34% and prevented millions of neural tube defect cases. Fortification ensures that essential nutrients reach low-income populations who rely on flour-based staples. Such initiatives drive demand for fortified flour, making it a vital tool in addressing global nutritional deficiencies and supporting public health efforts aimed at eradicating malnutrition.

MARKET RESTRAINTS

Climate Change and Environmental Impact

Climate change is a significant threat to wheat production, which is a primary source of flour. The Food and Agriculture Organization (FAO) reports that extreme weather events such as excessive rainfall and droughts have caused poor harvests in recent years. In 2024, England experienced its second-worst wheat harvest on record due to heavy rains, resulting in a 21% decline in production, as reported by The Guardian. The FAO’s Food Outlook further indicates a projected decline in global wheat production in 2023, emphasizing the vulnerability of wheat yields to climate variability. These challenges highlight the urgent need for sustainable farming practices and innovations to reduce the impact of climate change on flour production.

Supply Chain Disruptions and Market Volatility

Supply chain disruptions continue to affect the stability of the flour market. In November 2024, wheat farmers in exporting countries held back their crops due to low prices, creating a supply crunch for flour millers, as reported by Reuters. This situation left millers with lower stockpiles, increasing their exposure to price fluctuations. Geopolitical tensions, including the ongoing conflict in Ukraine, have further disrupted grain exports, worsening global supply challenges. According to the FAO, such disruptions contribute to market volatility, impacting both the availability and prices of flour worldwide. Strengthening supply chain resilience and implementing effective risk management strategies are crucial to address these issues.

MARKET OPPORTUNITIES

Import Substitution with Cassava Flour

Cassava flour is a viable alternative to wheat flour in regions heavily reliant on wheat imports. The Food and Agriculture Organization (FAO) highlights that substituting 10% of wheat imports with domestically produced cassava flour could increase local cassava demand by 13% in Asia and 11% in Latin America. This strategy reduces dependency on imported wheat while promoting local cassava production, boosting regional agricultural economies and enhancing food security. It supports a shift toward sustainable and self-sufficient food systems in countries with high cassava cultivation potential.

Expansion of Cassava-Based Products

The growth of cassava-based products offers significant opportunities for cassava-producing nations. The FAO projects a 3.1% annual increase in global cassava starch demand, with regional growth rates reaching 4.2% in Asia, 3.4% in Latin America, and 2.3% in Africa. This rising demand stems from cassava starch's versatility in industries such as food, textiles, and paper. Additionally, the increased popularity of cassava chips and pellets in non-producing countries signals strong market potential. Capitalizing on this demand can enhance cassava value chains will support economic development and improve global food security.

MARKET CHALLENGES

Declining Flour Consumption Trends

In recent years, flour consumption has declined in some regions. For example, the United States has experienced a drop in per capita flour usage. According to the U.S. Department of Agriculture (USDA), flour production decreased from 480 million hundredweight in 2020 to 474 million hundredweight in 2021. This decline is attributed to changing dietary preferences with consumers shifting towards low-carbohydrate and gluten-free diets. Such evolving consumption patterns create hurdles for the flour industry in maintaining consistent demand and adapting to alternative consumer needs.

Trade Restrictions and Export Limitations

Trade restrictions and export limitations have a significant impact on the global flour market by disrupting supply chains and affecting market stability. In April 2022, Kazakhstan, one of the largest wheat producers, imposed export restrictions on wheat and wheat flour. The restrictions capped exports at 1.0 million metric tons (MMT) of wheat and 300,000 metric tons (MT) of wheat flour until June 15, 2022. These measures were later extended to September 30, 2022, with increased quotas of 1.55 MMT for wheat and 670,000 MT for wheat flour. These policies aimed to balance exports with domestic food security concerns. However, the restrictions created operational challenges for flour millers who faced limited access to raw materials.

Addressing these challenges is vital to ensure the stability and sustainability of the global flour market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.23% |

|

Segments Covered |

By Raw Material, Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Wudeli Flour Mill Group, Ardent Mills LLC, Grain Craft, GoodMills Group GmbH, Conagra Brands, Inc., Cargill, Incorporated, Archer Daniels Midland Company (ADM), Gruma, S.A.B. de C.V., ITC Limited, The King Milling Company |

SEGMENTAL ANALYSIS

By Raw Material Insights

The wheat flour segment is the largest segment in the global flour market currently and accounted for 44.2% of the global market share in 2023. According to the Food and Agriculture Organization (FAO), global wheat utilization for the 2024-2025 period is forecasted to reach 796 million tonnes. This highlights its dominance in the flour industry. Wheat flour's leadership is attributed to its versatility and extensive use in staple foods like bread, pasta, and pastries, which are integral to diets in various cultures. Additionally, the global cultivation of wheat ensures widespread availability and affordability making its position as the market leader.

On the other hand, the rice flour segment is growing rapidly and is estimated to showcase a CAGR of 3.88% over the forecast period. The FAO projects global rice utilization to reach 536.7 million tonnes in 2024-2025 with a 2.0 percent increase from the previous year and achieving a record high. This rapid growth is fueled by rising demand in Asia where rice is a staple food and the increasing adoption of rice flour in gluten-free products globally. Its versatility in cooking and suitability for individuals with gluten intolerance make rice flour a preferred choice for various culinary and dietary needs which is driving its swift market expansion.

By Application Insights

The bread & bakery products segment is the most dominating segment in the global market and occupied 34.9% of global flour market share in 2024. The dominance is due to its role as a staple in many diets worldwide. For instance, flour constitutes over 70% of the cost in staple bread products like pan de sal with its significance in bakery items in the Philippines, according to USDA Foreign Agricultural Service.

The noodles & pasta segment is swiftly growing and is estimated to progress at a CAGR of 3.5% during the forecast period. This surge is driven by increasing consumer demand for convenient and diverse food options. The FAO notes a rising trend in wheat consumption for processed foods, including noodles and pasta in urban areas where lifestyle changes favor quick meal solutions.

By Technology Insights

The dry milling segment held 55.9% of global flour market share in 2024. It comprises grinding grains without adding water that produces flour with a longer shelf life while preserving its natural nutrients. This method is predominantly used for processing wheat into flour and a key ingredient in products like bread and pasta. According to the United States Department of Agriculture (USDA), U.S. flour mills processed approximately 913 million bushels of wheat in 2021 which resulted in 421 million hundredweight of flour. This highlights the efficiency and widespread use of dry milling with the dominant technology in the flour market due to its cost-effectiveness and suitability for large-scale production.

The wet milling segment is expected to register a CAGR of 4.2% over the forecast period. It involves soaking grains in water before grinding to separate the grain into components like starch, protein, and fiber. This process is commonly used for grains such as corn and rice. Research from the Agricultural Resource Information System indicates that wet-milled rice flour has higher swelling power and lower solubility compared to dry-milled flour by making it ideal for specific food applications such as confectionery and specialty products. Wet milling is less prevalent due to its higher operational costs and the complexities of managing wastewater. However, its applications in high-value products keep it relevant in niche markets.

REGIONAL ANALYSIS

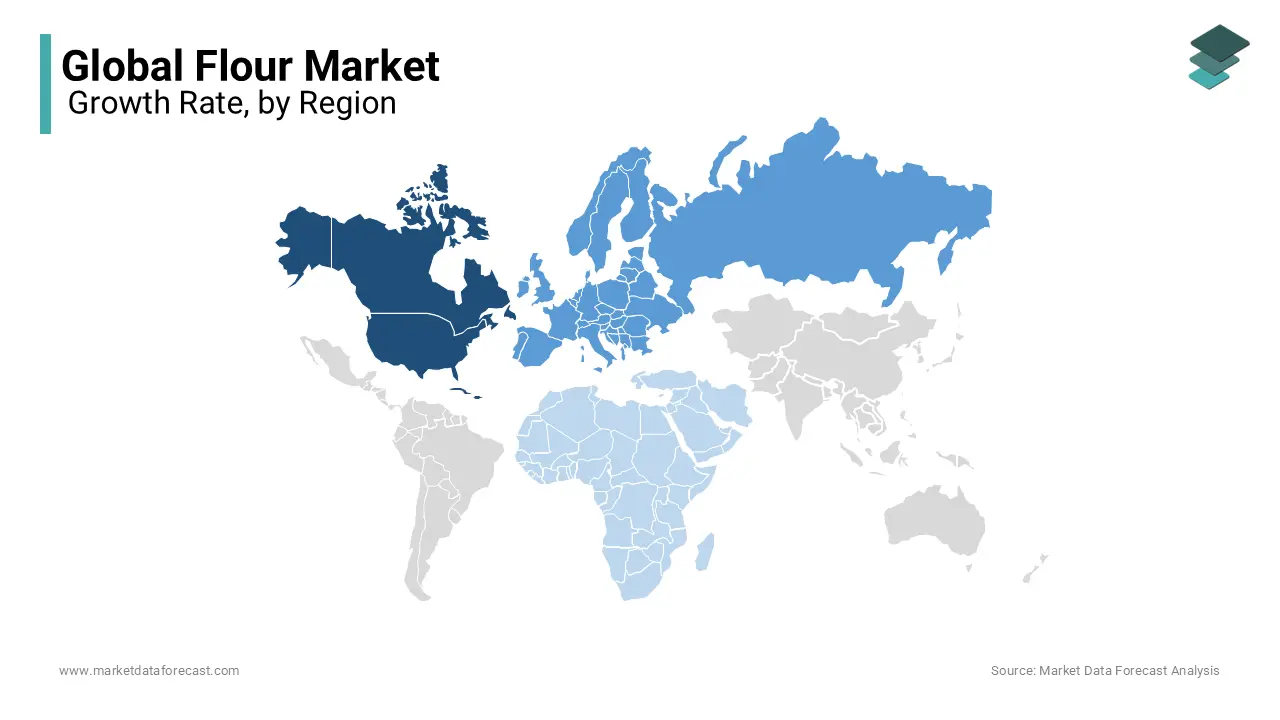

The North American region led the flour market worldwide and captured 40.4% of the global market share in 2024. In the United States, flour production has experienced minor fluctuations. The U.S. Department of Agriculture (USDA) recorded a production volume of 474 million hundredweight in 2021, down from 480 million hundredweight in 2020. This decrease reflects shifts in consumer preferences and market conditions. Additionally, per capita wheat flour availability remained steady at 132.9 pounds in 2022 with stable consumption trends. In Canada, Statistics Canada reported that millers processed 3,156,301 tonnes of wheat in 2021 with a mark of 3.0% decline from 2020. This drop coincided with a significant 38.4% reduction in Canadian wheat production during the 2021 harvest due to severe droughts in Western Canada.

Europe did well in 2024 and is predicted to have a promising CAGR during the forecast period. According to the USDA Foreign Agricultural Service (FAS), the EU contributed 17% of global wheat production during the 2023-2024 marketing year with an output of 135.1 million metric tons. This robust production supports strong domestic consumption and export activities is reinforcing the EU's global standing in the flour industry.

The Asia-Pacific is predicted to be the most lucrative regional market for flour globally and is projected to register a CAGR of 6.6% throughout the forecast period. The APAC region exhibits strong flour market performance with the presence of leading producers like China and India. The USDA FAS reported that in the 2023-2024 marketing year, China produced 136.59 million metric tons of wheat which accounted for 17% of global production whereas India produced 110.55 million metric tons with 14% of global output. These figures highlight the region's crucial role in meeting global flour demand.

The Latin American market is likely to account for a considerable share of the worldwide market over the forecast period. The flour market in region benefits from major contributors like Argentina and Brazil. Although precise production figures are unavailable, the region is known for its agricultural strength which supports both domestic consumption and export markets. Factors such as economic conditions, trade policies, and climate variations significantly shape the region's flour market dynamics.

The market in Middle East and Africa is inclined to grow with a CAGR of 3.7% over the forecast period. The MEA present a diverse flour market landscape, with varying levels of production and reliance on wheat imports. Several countries in the region depend on imports to fulfill domestic demand. Market performance is shaped by factors such as political stability, economic growth, and food security policies. Despite limited data, the region's importance in the global market is evident due to its growing population and food requirements.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global flour market include Wudeli Flour Mill Group, Ardent Mills LLC, Grain Craft, GoodMills Group GmbH, Conagra Brands, Inc., Cargill, Incorporated, Archer Daniels Midland Company (ADM), Gruma, S.A.B. de C.V., ITC Limited, The King Milling Company

The global flour market is highly competitive and marked by the presence of numerous regional and international players striving to increase their market share. The competition is influenced by factors such as pricing strategies, product innovation, raw material sourcing, and geographic coverage. Major players like General Mills, Archer Daniels Midland Company (ADM), Ardent Mills, and Conagra Brands dominate the market due to their large production capacities, efficient supply chains, and widespread distribution networks.

Regional companies also play a crucial role in the market by catering to local tastes, preferences, and cultural dietary needs. For example, companies in the Asia-Pacific region primarily focus on producing rice and wheat flours, while businesses in Latin America emphasize corn-based flours, which align with regional cuisines and consumption patterns. Innovation and product diversification are key to staying competitive. The rising demand for specialty flours, including gluten-free, organic, and alternative flours like almond and chickpea, has pushed companies to expand their product offerings. Sustainability is also becoming an important factor as companies adopt eco-friendly practices to minimize their environmental impact. Challenges such as fluctuating raw material prices, trade regulations, and supply chain disruptions force market players to implement efficient strategies and technologies to maintain competitiveness and meet changing consumer demands.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, Grain Craft acquired Central Milling, Inc., a prominent supplier of organic flour in the United States. This acquisition aims to enhance both companies' capabilities in the organic flour market.

- In April 2024, King Milling Co. completed a $47 million expansion at its Lowell, Michigan facility, introducing a new six-floor mill capable of producing 800,000 pounds of flour daily. This expansion brings the company's total daily production to over 2.5 million pounds, bolstering its capacity to meet growing demand.

MARKET SEGMENTATION

This research report on the global flour market has been segmented and sub-segmented based on raw material, application, technology, and region.

By Raw Material

- Wheat (Including Durum Flour)

- Maize (Including Corn Flour)

- Rice

- Other Raw Materials (Including Oat and Rye)

By Application

- Noodles & Pasta

- Bread & Bakery Products

- Animal Feed (Including Pet Food)

- Wafers, Crackers, & Biscuits

- Animal Feed (Including Pet Food)

- Non-Food Application (Including Bio-Plastics, Biomaterials, And Glue)

- Others (Including Roux & Baby Food)

By Technology

- Wet Technology

- Dry Technology

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which factors are driving the growth of the global flour market?

Key factors include rising demand for processed and convenience foods, increasing health-conscious consumers opting for gluten-free and organic flour, and advancements in flour milling technology.

2. Who are the major consumers of flour in the food industry?

Bakeries, restaurants, food manufacturers, and households are the primary consumers. The increasing trend of home baking and processed food consumption has also expanded the consumer base.

3. How does the demand for gluten-free flour impact the market?

The rising awareness of gluten intolerance and celiac disease has led to a surge in demand for alternative flours like almond, coconut, and rice flour, influencing product innovation and market expansion.

4. What are the key challenges faced by flour manufacturers?

Challenges include fluctuating raw material prices, supply chain disruptions, government regulations, and the growing competition from alternative grain-based products.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]